|

|

市場調査レポート

商品コード

1446519

日本のアニメマーチャンダイジング市場規模、シェア、動向分析レポート:商品別、流通チャネル別、セグメント予測、2024年~2030年Japan Anime Merchandising Market Size, Share & Trends Analysis Report By Product (Figurine, Clothing, Books), By Distribution Channel (Online, Offline), And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 日本のアニメマーチャンダイジング市場規模、シェア、動向分析レポート:商品別、流通チャネル別、セグメント予測、2024年~2030年 |

|

出版日: 2024年02月16日

発行: Grand View Research

ページ情報: 英文 80 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

日本のアニメマーチャンダイジング市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、日本のアニメマーチャンダイジング市場規模は2024年から2030年にかけてCAGR 8.1%を記録し、2030年には93億6,000万米ドルに達すると予測されています。

若者の心理的ストレスの増加により、日本の視聴者の間でアニメコンテンツや関連商品コレクションの消費が拡大しています。アニメは若者のストレスレベルを下げることで、若者の精神的健康にプラスの影響を与えています。アニメやマンガは日本で広く受け入れられている娯楽形態であり、あらゆる年齢層の人々が楽しんでいます。アニメやマンガにまつわるスティグマ(汚名)はかなり薄れ、アニメのファンであることを公然と表明する中高年が増えています。その結果、視聴者の裾野が広がり、高年齢層におけるアニメグッズの全体的な需要を押し上げています。

中高年のアニメファンは、古典的なシリーズから新しいタイトルまで、多様な趣味や嗜好を持っており、市場の多様性と成長に大きく貢献しています。政府は、アニメの芸術形式や文化輸出としての文化的重要性を認識し、アニメ関連の芸術品、美術品、史跡を保存・保護する取り組みを支援しています。これには、日本のアニメ遺産を後世に残すことを目的とした博物館、資料館、保存プロジェクトへの資金援助も含まれます。アニメやマンガのコンテンツに対する政府の見方は、単なる芸術的資料と見なされることから、日本の産業や国民にとっての文化的資料と指定されることへと変化しています。

文化庁はマンガの流出を防ぎ、マンガ文化を保存し、海外から日本のファンを呼び込む観光資源として活用することを目指しています。COVID-19の大流行は市場の成長にマイナスの影響を与えました。新しいアニメコンテンツの公開スケジュールが乱れ、アニメのシーズン、エピソード、映画の制作と公開の遅れにつながった。そのため、業界はタイムリーなプロモーションの機会を利用することが難しくなった。さらに、アニメコンベンションやイベントが安全上の懸念から中止または延期されたため、全体的な商品売上が減少し、ファンが参加する機会が奪われました。

日本アニメマーチャンダイジング市場レポートハイライト:

- アニメ文化の人気の高まりにより、フィギュア分野が市場を独占し、2023年には38.0%のシェアを占めました。

- オンライン流通チャネルが市場を独占し、2024年から2030年にかけて最も速いCAGR 9.5%で成長すると予測されます。

- この市場の成長は、政府による強力な文化振興、知的財産権保護、産業支援、観光、国際協力、デジタル配信、商品輸出促進などの要因によってもたらされます。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 日本のアニメマーチャンダイジング市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

- 関連/付随市場の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 日本のアニメマーチャンダイジング市場分析ツール

- 業界分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 日本のアニメマーチャンダイジング市場:製品推定・動向分析

- 製品市場シェア、2023年と2030年

- セグメントダッシュボード

- 商品別日本アニメグッズ市場展望

- 市場規模、予測および動向分析、2018年から2030年まで

- フィギュア

- 服

- 本

- ボードゲーム・トイ

- ポスター

- その他

第5章 日本のアニメマーチャンダイジング市場:流通チャネルの推定・動向分析

- 流通チャネル市場シェア、2023年と2030年

- セグメントダッシュボード

- 流通チャネル別の日本のアニメマーチャンダイジング市場の見通し

- 市場規模、予測および動向分析、2018年から2030年まで

- オンライン

- オフライン

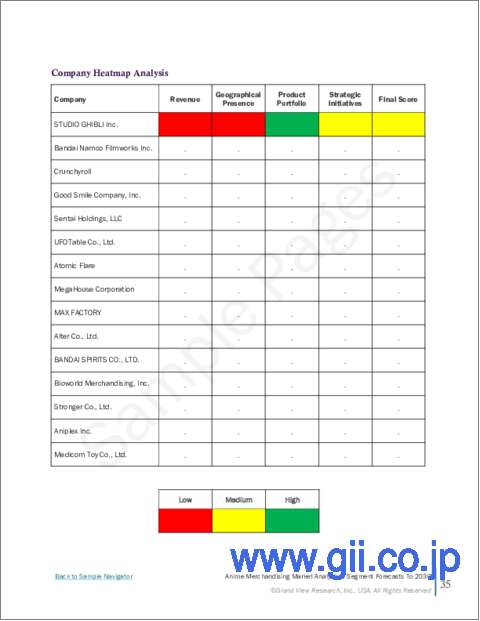

第6章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 会社/競合の分類

- ベンダー情勢

- List of key distributors and channel partners

- Key customers

- 企業プロファイル

- Bandai Namco

- Good Smile Company, Inc.

- Kodansha LTD.

- Kotobukiya Co., Ltd.

- Kyoto Animation Co., Ltd.

- PAWORKS Co.,Ltd

- Pierrot Co.,Ltd.

- Production IG

- Studio Ghibli, Inc.

- TOEI ANIMATION Co., Ltd.

- Ufotable Co., Ltd.

- VIZ Media, LLC.

List of Tables

- Table 1 List of abbreviations

- Table 2 Japan anime merchandising market, by product, 2018 - 2030 (USD Million)

- Table 3 Japan anime merchandising market, by distribution channel, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Japan anime merchandising market segmentation

- Fig. 3 Japan anime merchandising technology landscape

- Fig. 4 Information procurement

- Fig. 5 Data analysis models

- Fig. 6 Market formulation and validation

- Fig. 7 Data validating & publishing

- Fig. 8 Market snapshot

- Fig. 9 Segment snapshot (1/2)

- Fig. 10 Segment snapshot (2/2)

- Fig. 11 Competitive landscape snapshot

- Fig. 12 Japan anime merchandising market Size and growth prospects (USD Billion)

- Fig. 13 Japan anime merchandising market: Industry value chain analysis

- Fig. 14 Japan anime merchandising market: Market dynamics

- Fig. 15 Japan anime merchandising market: PORTER's analysis

- Fig. 16 Japan anime merchandising market: PESTEL analysis

- Fig. 17 Japan anime merchandising market: Product movement analysis

- Fig. 18 Japan anime merchandising market: Product outlook and key takeaways

- Fig. 19 Figurine market estimates and forecast, 2018 - 2030

- Fig. 20 Clothing estimates and forecast, 2018 - 2030

- Fig. 21 Books estimates and forecast, 2018 - 2030

- Fig. 22 Board games and toys estimates and forecast, 2018 - 2030

- Fig. 23 Posters estimates and forecast, 2018 - 2030

- Fig. 24 Others estimates and forecast, 2018 - 2030

- Fig. 25 Japan anime merchandising market: Distribution channel movement analysis

- Fig. 26 Japan anime merchandising market: Distribution channel outlook and key takeaways

- Fig. 27 Online market estimates and forecasts, 2018 - 2030

- Fig. 28 Offline market estimates and forecasts, 2018 - 2030

- Fig. 29 Key company categorization

- Fig. 30 Company market positioning

- Fig. 31 Key company market share analysis, 2023

- Fig. 32 Strategic framework

Japan Anime Merchandising Market Growth & Trends:

The Japan anime merchandising market size is anticipated to reach USD 9.36 billion by 2030, registering a CAGR of 8.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. The increasing psychological stress level among young people led to a growing consumption of anime content and related merchandise collections among Japanese viewers. Animation has positively impacted young people's mental health by reducing their stress levels. Anime and manga are widely accepted forms of entertainment in Japan, enjoyed by people of all ages. The stigma surrounding anime and manga has diminished considerably, leading to more middle-aged individuals openly expressing their fandom for anime. It has resulted in a broader audience base and boosted the overall demand for anime merchandise among older demographics.

Middle-aged anime fans have diverse tastes and preferences, ranging from classic series to newer titles, contributing significantly to market's diversity and growth. Recognizing the cultural significance of anime as an art form and cultural export, the government supports efforts to preserve and conserve anime-related artifacts, artwork, and historical sites. It includes funding museums, archives, and preservation projects dedicated to preserving Japan's anime heritage for future generations. The government's perspective on anime and manga content has shifted from being viewed as mere artistic materials to being designated as cultural materials for the Japanese industry and people.

The Agency for Cultural Affairs aims to prevent manga outflow, preserve manga culture, and use it as a tourism resource to attract Japanese fans from overseas. The COVID-19 pandemic negatively impacted the market growth. The release schedules of new anime content had been disrupted, leading to delays in the production and release of anime seasons, episodes, and movies. It made it difficult for the industry to take advantage of timely promotional opportunities. Moreover, anime conventions and events had been canceled or postponed due to safety concerns, reducing overall merchandise sales and depriving fans of engagement opportunities.

Japan Anime Merchandising Market Report Highlights:

- The figurine segment dominated the market and accounted for a share of 38.0% in 2023 owing to the growing popularity of anime culture

- The online distribution channel segment dominated the market and is expected to grow at the fastest CAGR of 9.5% from 2024 to 2030

- The growth of this market is driven by factors, such as strong cultural promotion by the government, intellectual property protection, industry support, tourism, international collaboration, digital distribution, and merchandise export promotion

- In November 2023, COVER Corporation announced the release of new Hololive Meet 2023 Ambassadors merchandise in an official partnership with Tokyo Otaku Mode Inc.

- The released merchandise includes stickers, badges, handwritten postcards, trading cards, phone tabs, strap sets, and acrylic stands

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Segment Definitions

- 1.2.1. Product

- 1.2.2. Distribution channel

- 1.2.3. Estimates and forecasts timeline

- 1.3. Research Methodology

- 1.4. Information Procurement

- 1.4.1. Purchased database

- 1.4.2. GVR's internal database

- 1.4.3. Secondary sources

- 1.4.4. Primary research

- 1.4.5. Details of primary research

- 1.4.5.1. Data for primary interviews in Asia Pacific

- 1.5. Information or Data Analysis

- 1.5.1. Data analysis models

- 1.6. Market Formulation & Validation

- 1.7. Model Details

- 1.7.1. Commodity flow analysis (Model 1)

- 1.7.2. Approach 1: Commodity flow approach

- 1.7.3. Volume price analysis (Model 2)

- 1.7.4. Approach 2: Volume price analysis

- 1.8. List of Secondary Sources

- 1.9. List of Primary Sources

- 1.10. Objectives

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Product outlook

- 2.2.2. Distribution channel outlook

- 2.3. Competitive Insights

Chapter 3. Japan Anime Merchandising Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.1.2. Related/ancillary market outlook

- 3.2. Market Dynamics

- 3.2.1. Market driver analysis

- 3.2.1.1. Growing popularity of anime content

- 3.2.1.2. Increasing use of technology and tools to craft merchandise and collaborations with brands

- 3.2.2. Market restraint analysis

- 3.2.2.1. Increasing prevalence of piracy and counterfeiting

- 3.2.2.2. Merchandise market in Japan faces saturation and intense competition

- 3.2.3. Market opportunity analysis

- 3.2.3.1. Increasing technology integration such as AR/VR, artificial intelligence tools

- 3.2.1. Market driver analysis

- 3.3. Japan Anime Merchandising Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Supplier power

- 3.3.1.2. Buyer power

- 3.3.1.3. Substitution threat

- 3.3.1.4. Threat of new entrant

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic landscape

- 3.3.2.3. Social landscape

- 3.3.2.4. Technological landscape

- 3.3.2.5. Environmental landscape

- 3.3.2.6. Legal landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. Japan Anime Merchandising Market: Product Estimates & Trend Analysis

- 4.1. Product Market Share, 2023 & 2030

- 4.2. Segment Dashboard

- 4.3. Japan Anime Merchandising Market by Product Outlook

- 4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

- 4.4.1. Figurine

- 4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.2. Clothing

- 4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.3. Books

- 4.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.4. Board Games & Toys

- 4.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.5. Posters

- 4.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.6. Others

- 4.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 4.4.1. Figurine

Chapter 5. Japan Anime Merchandising Market: Distribution Channel Estimates & Trend Analysis

- 5.1. Distribution Channel Market Share, 2023 & 2030

- 5.2. Segment Dashboard

- 5.3. Japan Anime Merchandising Market by Distribution Channel Outlook

- 5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

- 5.4.1. Online

- 5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.2. Offline

- 5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

- 5.4.1. Online

Chapter 6. Competitive Landscape

- 6.1. Recent Developments & Impact Analysis, By Key Market Participants

- 6.2. Company/Competition Categorization

- 6.3. Vendor Landscape

- 6.3.1. List of key distributors and channel partners

- 6.3.2. Key customers

- 6.4. Company Profiles

- 6.4.1. Bandai Namco

- 6.4.1.1. Company overview

- 6.4.1.2. Financial performance

- 6.4.1.3. Product benchmarking

- 6.4.1.4. Strategic initiatives

- 6.4.2. Good Smile Company, Inc.

- 6.4.2.1. Company overview

- 6.4.2.2. Financial performance

- 6.4.2.3. Product benchmarking

- 6.4.2.4. Strategic initiatives

- 6.4.3. Kodansha LTD.

- 6.4.3.1. Company overview

- 6.4.3.2. Financial performance

- 6.4.3.3. Product benchmarking

- 6.4.3.4. Strategic initiatives

- 6.4.4. Kotobukiya Co., Ltd.

- 6.4.4.1. Company overview

- 6.4.4.2. Financial performance

- 6.4.4.3. Product benchmarking

- 6.4.4.4. Strategic initiatives

- 6.4.5. Kyoto Animation Co., Ltd.

- 6.4.5.1. Company overview

- 6.4.5.2. Financial performance

- 6.4.5.3. Product benchmarking

- 6.4.5.4. Strategic initiatives

- 6.4.6. P.A.WORKS Co.,Ltd

- 6.4.6.1. Company overview

- 6.4.6.2. Financial performance

- 6.4.6.3. Product benchmarking

- 6.4.6.4. Strategic initiatives

- 6.4.7. Pierrot Co.,Ltd.

- 6.4.7.1. Company overview

- 6.4.7.2. Financial performance

- 6.4.7.3. Product benchmarking

- 6.4.7.4. Strategic initiatives

- 6.4.8. Production I.G

- 6.4.8.1. Company overview

- 6.4.8.2. Financial performance

- 6.4.8.3. Product benchmarking

- 6.4.8.4. Strategic initiatives

- 6.4.9. Studio Ghibli, Inc.

- 6.4.9.1. Company overview

- 6.4.9.2. Financial performance

- 6.4.9.3. Product benchmarking

- 6.4.9.4. Strategic initiatives

- 6.4.10. TOEI ANIMATION Co., Ltd.

- 6.4.10.1. Company overview

- 6.4.10.2. Financial performance

- 6.4.10.3. Product benchmarking

- 6.4.10.4. Strategic initiatives

- 6.4.11. Ufotable Co., Ltd.

- 6.4.11.1. Company overview

- 6.4.11.2. Financial performance

- 6.4.11.3. Product benchmarking

- 6.4.11.4. Strategic initiatives

- 6.4.12. VIZ Media, LLC.

- 6.4.12.1. Company overview

- 6.4.12.2. Financial performance

- 6.4.12.3. Product benchmarking

- 6.4.12.4. Strategic initiatives

- 6.4.1. Bandai Namco