|

市場調査レポート

商品コード

1667110

ゼロエミッション航空機の市場機会、成長促進要因、産業動向分析、2025年~2034年予測Zero Emission Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| ゼロエミッション航空機の市場機会、成長促進要因、産業動向分析、2025年~2034年予測 |

|

出版日: 2024年12月04日

発行: Global Market Insights Inc.

ページ情報: 英文 220 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

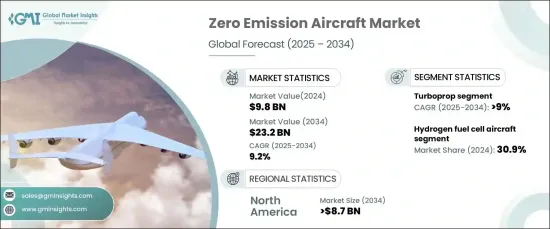

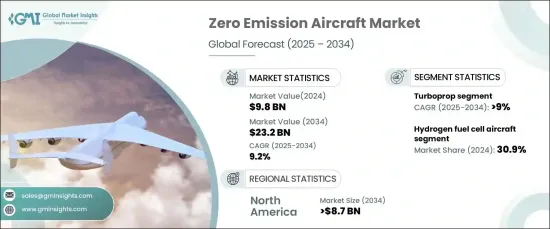

世界のゼロエミッション航空機市場は2024年に98億米ドルに達し、2025年から2034年にかけてCAGR9.2%の堅調な成長が予測されています。

環境に対する懸念が高まり、持続可能な旅行オプションに対する消費者の需要が急増する中、環境に優しい航空ソリューションに対するニーズはかつてないほど高まっています。旅行者がより環境に優しい選択肢を求める傾向が強まる中、航空会社は持続可能性の目標に沿うため、ゼロエミッション航空機を優先しています。企業もまた、社会的責任目標を達成するためにこうした環境に配慮したソリューションを採用する一方、投資家は環境・社会・ガバナンス(ESG)基準の遵守を推進し、よりクリーンな技術の採用を加速させています。

市場は航空機タイプ別に、バッテリー電気航空機、水素燃料電池航空機、ハイブリッド電気航空機、ソーラー電気航空機に区分されます。2024年には、水素燃料電池分野が30.9%のシェアで市場をリードしました。水素燃料電池航空機は燃料電池を利用して発電し、従来のジェット燃料に代わる持続可能な代替燃料を提供します。この技術は特に短距離から中距離のフライトに適しており、運航中の排出はゼロです。燃料電池システムにおける継続的な技術革新により、その効率は向上しており、水素は航空における二酸化炭素排出量を大幅に削減する重要なソリューションとなっています。

| 市場範囲 | |

|---|---|

| 開始年 | 2024年 |

| 予測年 | 2025年~2034年 |

| 開始金額 | 98億米ドル |

| 予測金額 | 232億米ドル |

| CAGR | 9.2% |

航空機タイプ別でも、市場はターボプロップ、ターボファン、混合翼機(BWB)、完全電動コンセプトに分けられます。このうち、ターボプロップ分野は2025年から2034年のCAGRが9%で、最も急成長しています。燃料効率と短い滑走路への適合性で知られるターボプロップ機は、電気推進と持続可能な燃料を取り入れることで革命を起こしつつあります。こうした技術の進歩により、ターボプロップ機はリージョナル路線や短距離路線に理想的なものとなっています。ハイブリッド電気技術とバッテリー技術の統合は、航空機がこれらの用途に必要な性能を維持できるようにしながら、排出量をさらに削減します。

北米のゼロエミッション航空機市場は、航空関連の二酸化炭素排出量削減を目的とした多額の投資と政府の取り組みに後押しされ、2034年までに87億米ドルを生み出すと予想されています。この地域は、電気および水素を動力源とする航空機の開発をリードしており、既存のメーカーと革新的な新興企業の両方が大きく貢献しています。こうした進歩は、地域の航空旅行の持続可能性を支えているだけでなく、業界全体によりクリーンな技術を広く採用することにも貢献しています。この分野における北米のリーダーシップは、世界の航空基準を形成し、世界の排出削減目標を達成する上で重要な役割を果たしています。

目次

第1章 調査手法と調査範囲

- 市場範囲と定義

- 基本推定と計算

- 予測計算

- データソース

- 一次

- 二次

- 有料ソース

- 公的ソース

第2章 エグゼクティブサマリー

第3章 業界洞察

- 業界エコシステム分析

- バリューチェーンに影響を与える要因

- 利益率分析

- 変革

- 将来の展望

- メーカー

- 流通業者

- サプライヤーの状況

- 利益率分析

- 主要ニュースと取り組み

- 規制状況

- 影響要因

- 成長促進要因

- クリーンな航空技術に対する政府支援の増加

- 持続可能で環境に優しい航空ソリューションに対する需要の高まり

- バッテリーと燃料電池システムの技術的進歩

- 航空会社に対する二酸化炭素排出量削減への圧力の高まり

- グリーン航空インフラと充電ネットワークの拡大

- 業界の潜在的リスク・課題

- ゼロエミッション航空機の開発・製造コストの高さ

- 現在のバッテリー技術での航続距離とエネルギー密度の限界

- 成長促進要因

- 成長可能性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業市場シェア分析

- 競合のポジショニングマトリックス

- 戦略展望マトリックス

第5章 市場推計・予測:航空機タイプ別、2021年~2034年

- 主要動向

- バッテリー電気航空機

- 水素燃料電池航空機

- ハイブリッド電気航空機

- ソーラー電気航空機

第6章 市場推計・予測:タイプ別、2021年~2034年

- 主要動向

- ターボプロップ

- ターボファンシステム

- 混合翼機(BWB)

- 完全電動コンセプト

第7章 市場推計・予測:容量別、2021年~2034年

- 主要動向

- 9~30

- 31~60

- 61~100

- 101~150

- 150以上

第8章 市場推計・予測:最終用途別、2021年~2034年

- 主要動向

- 商業

- 軍事

- 一般

第9章 市場推計・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第10章 企業プロファイル

- Ampaire Inc.

- Aurora Flight Sciences(The Boeing Company)

- BETA Technologies, Inc.

- Bye Aerospace

- Equator Aircraft AS

- Evektor, spol. s r. o.

- Eviation

- Heart Aerospace

- Joby Aero, Inc.

- Lilium GmbH

- PIPISTREL d.o.o.

- Rolls-Royce plc

- Wright Electric

- ZeroAvia, Inc.

The Global Zero Emission Aircraft Market reached USD 9.8 billion in 2024 and is projected to grow at a robust CAGR of 9.2% from 2025 to 2034. With rising environmental concerns and a surge in consumer demand for sustainable travel options, the need for eco-friendly aviation solutions is higher than ever. As travelers increasingly seek greener alternatives, airlines prioritize zero-emission aircraft to align with sustainability goals. Corporations are also embracing these eco-conscious solutions to meet their social responsibility targets, while investors are pushing for adherence to environmental, social, and governance (ESG) standards, accelerating the adoption of cleaner technologies.

The market is segmented by aircraft type into battery electric, hydrogen fuel cell, hybrid electric, and solar electric aircraft. In 2024, the hydrogen fuel cell segment leads the market with a 30.9% share. Hydrogen-powered aircraft utilize fuel cells to generate electricity, providing a sustainable alternative to traditional jet fuels. This technology is especially suitable for short- to medium-haul flights, producing zero emissions during operation. Ongoing innovations in fuel cell systems are improving their efficiency, establishing hydrogen as a key solution to drastically reduce carbon footprints in aviation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 billion |

| Forecast Value | $23.2 billion |

| CAGR | 9.2% |

By aircraft type, the market is also divided into turboprop, turbofan, blended-wing body (BWB), and fully electric concepts. Among these, the turboprop segment is the fastest-growing, with a CAGR of 9% during 2025-2034. Known for its fuel efficiency and compatibility with shorter runways, the turboprop aircraft is being revolutionized through the incorporation of electric propulsion and sustainable fuels. These technological advancements are making turboprops ideal for regional and short-haul routes. The integration of hybrid-electric and battery technologies further reduces emissions while ensuring the aircraft maintains the performance required for these applications.

North America zero emission aircraft market is expected to generate USD 8.7 billion by 2034, fueled by significant investments and government initiatives aimed at reducing aviation-related carbon emissions. The region is leading the way in the development of electric and hydrogen-powered aircraft, with strong contributions from both established manufacturers and innovative startups. These advancements are not only supporting regional air travel sustainability but also contributing to the wider adoption of cleaner technologies across the industry. North America's leadership in this space is instrumental in shaping global aviation standards and achieving global emission reduction goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing government support for clean aviation technologies

- 3.6.1.2 Rising demand for sustainable and eco-friendly aviation solutions

- 3.6.1.3 Technological advancements in battery and fuel cell systems

- 3.6.1.4 Growing pressure for airlines to reduce carbon emissions

- 3.6.1.5 Expansion of green aviation infrastructure and charging networks

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development and production costs of zero-emission aircraft

- 3.6.2.2 Limited range and energy density of current battery technology

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Aircraft Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Battery electric aircraft

- 5.3 Hydrogen fuel cell aircraft

- 5.4 Hybrid electric aircraft

- 5.5 Solar electric aircraft

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Turboprop

- 6.3 Turbofan system

- 6.4 Blended-Wing Body (BWB)

- 6.5 Fully electrical concept

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 9 to 30

- 7.3 31 to 60

- 7.4 61 to 100

- 7.5 101 to 150

- 7.6 More than 150

Chapter 8 Market Estimates & Forecast, By End-use, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Military

- 8.4 General

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ampaire Inc.

- 10.2 Aurora Flight Sciences (The Boeing Company)

- 10.3 BETA Technologies, Inc.

- 10.4 Bye Aerospace

- 10.5 Equator Aircraft AS

- 10.6 Evektor, spol. s r. o.

- 10.7 Eviation

- 10.8 Heart Aerospace

- 10.9 Joby Aero, Inc.

- 10.10 Lilium GmbH

- 10.11 PIPISTREL d.o.o.

- 10.12 Rolls-Royce plc

- 10.13 Wright Electric

- 10.14 ZeroAvia, Inc.