|

|

市場調査レポート

商品コード

1427124

パームシュガーの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 性質別、形態別、エンドユーザー別、流通チャネル別、地域別Palm Sugar Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| パームシュガーの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 性質別、形態別、エンドユーザー別、流通チャネル別、地域別 |

|

出版日: 2024年02月07日

発行: Fairfield Market Research

ページ情報: 英文 198 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界のパームシュガーの市場規模は大きな成長を遂げようとしています。同市場は、2031年までに21億米ドルから約27億米ドルへと大幅な増収が見込まれています。

北米全域において、食品業界では天然甘味料への顕著なシフトが進行中です。消費者は、精製された白砂糖に代わる健康的な甘味料として、黒砂糖や精製されていない砂糖を選ぶ傾向が強まっています。この動向に拍車をかけているのは、合成食品に伴う潜在的な健康被害に対する意識の高まりです。調査によると、パームシュガーは抗酸化レベルが高く、肥満や糖尿病などの代謝性疾患のリスクが低いなど、固有の栄養的利点を備えており、健康志向の消費者の間で支持を集めています。

世界的に、人工甘味料から天然甘味料への転換が顕著になっています。これは、合成食品による健康への悪影響を強調する広範な調査に裏打ちされています。パーム糖が有望な選択肢として浮上し、飲食品メーカーがその栄養プロファイルを強化することを目的とした研究開発への投資を促しています。特にアジア太平洋地域では、パームシュガーが文化的に重要な意味を持ち、その健康上の利点が尊ばれているため、消費者の嗜好が市場成長の原動力となっています。

需要が急増しているにもかかわらず、サプライチェーンインフラには課題が残っており、パームシュガー製品の品質とタイムリーな供給を妨げています。製造、倉庫、輸送施設が不十分なため、保管の問題やサプライチェーンの非効率性が生じています。これはパーム糖の入手性に影響を与えるだけでなく、食品インフレを引き起こし、需要を減退させる。さらに、発展途上地域には近代的な貿易施設がないため、流通経路がさらに複雑になり、製品の品質と消費者の信頼に影響を及ぼしています。

当レポートでは、世界のパームシュガー市場について調査し、市場の概要とともに、性質別、形態別、エンドユーザー別、流通チャネル別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナとロシアの紛争の影響

- 経済概要

- PESTLE分析

第3章 生産高と貿易統計、2018年~2023年

第4章 価格分析、2018年~2023年

第5章 世界のパームシュガー市場の見通し、2018年~2031年

- 世界のパームシュガー市場の見通し、性質別、金額(10億米ドル)、数量(トン)2018年~2031年

- 世界のパームシュガー市場の見通し、形態別、金額(10億米ドル)、数量(トン)、2018年~2031年

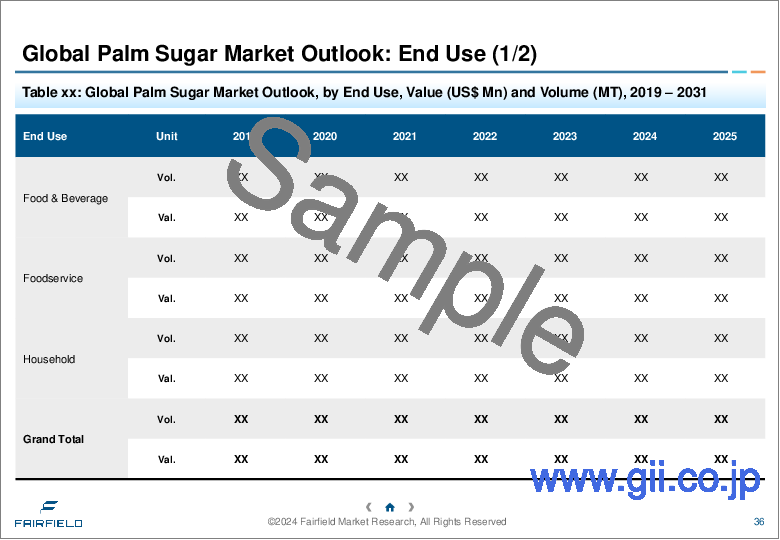

- 世界のパームシュガー市場の見通し、エンドユーザー別、金額(10億米ドル)、数量(トン)、2018年~2031年

- 世界のパームシュガー市場の見通し、流通チャネル別、金額(10億米ドル)、数量(トン)、2018年~2031年

- 世界のパームシュガー市場の見通し、地域別、金額(米国米ドル)、数量(トン)、2018年~2031年

第6章 北米のパームシュガー市場の見通し、2018年~2031年

第7章 欧州のパームシュガー市場の見通し、2018年~2031年

第8章 アジア太平洋のパームシュガー市場の見通し、2018年~2031年

第9章 ラテンアメリカのパームシュガー市場の見通し、2018年~2031年

第10章 中東・アフリカのパームシュガー市場の見通し、2018年~2031年

第11章 競合情勢

- 製品と適応症のヒートマップ

- 企業の市場シェア分析、2022年

- 競合ダッシュボード

- 企業プロファイル

- Real Raw Food

- Phalada Pure & Sure

- Future Organics

- Bionova

- Betterbody Foods & Nutrition LLC

- Wholesome Sweeteners Inc

- Windmill Organics Ltd.

- Navitas Organics

- Big Tree Farms

- Taj Agro Products

第12章 付録

Global Palm Sugar Market Sees Upward Trajectory, Fueled by Shift Towards Natural Sweeteners

The global palm sugar market is poised for significant growth, according to the latest market analysis spanning from 2024 to 2031. The market is expected to witness a substantial increase in revenue from US$ 2.1 billion to approximately US$ 2.7 billion by 2031.

Key Trends Driving Palm Sugar Market Growth

Demand for Natural Ingredients on the Rise

Across North America, a notable shift towards natural sweeteners is underway within the food industry. Increasingly, consumers are opting for brown and unrefined sugar variants, perceiving them as healthier alternatives to white, refined sugar. This trend is fueled by growing awareness regarding the potential health hazards associated with synthetic food products. Research indicates that palm sugar, with its inherent nutritional benefits such as elevated antioxidant levels and lower risks of metabolic diseases like obesity and diabetes, is gaining favor among health-conscious consumers.

Increasing Demand for Natural Ingredients and Innovative Products

Globally, there is a discernible pivot from artificial to natural sweeteners, backed by extensive research highlighting the adverse effects of synthetic food products on human health. Palm sugar emerges as a promising option, prompting food and beverage manufacturers to invest in research and development endeavors aimed at enhancing its nutritional profile. Particularly in the Asia Pacific region, where palm sugar holds cultural significance and is revered for its health benefits, consumer preference is driving market growth.

Challenges in Supply Chain Infrastructure

Despite burgeoning demand, challenges persist within the supply chain infrastructure, hindering the quality and timely delivery of palm sugar products. Inadequate manufacturing, warehousing, and transportation facilities contribute to storage issues and supply chain inefficiencies. This not only impacts the availability of palm sugar but also leads to food inflation, thereby dampening demand. Additionally, the absence of modern trade establishments in developing regions further complicates distribution channels, affecting product quality and consumer trust.

Global Forecast Insights:

In the palm sugar market, Asia Pacific is anticipated to emerge as the dominant region, with a significant value share by 2031. It is expected to witness steady growth in terms of value over the forecast period.

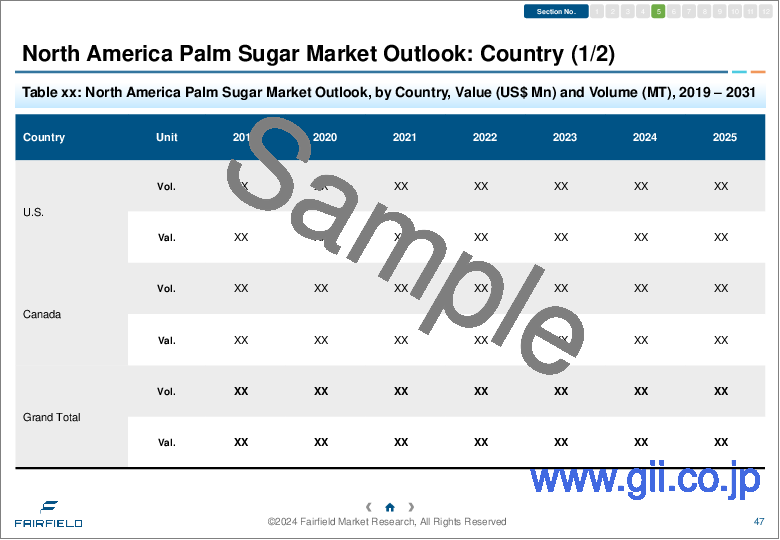

On the other hand, while North America is projected to have a smaller market share by 2031, it is forecasted to experience relatively higher growth in terms of value compared to other regions.

Latin American Palm Sugar Market Form Segment Outlook:

Among palm sugar forms, powder is expected to be the preferred choice throughout the forecast period, holding a substantial market share by 2031. It is anticipated to demonstrate steady growth in terms of value.

Meanwhile, the liquid segment is likely to have a smaller market share in 2024, with moderate growth expected in terms of value over the forecast period.

Segment Analysis:

The Household segment is expected to lead in the palm sugar market, with steady growth projected throughout the forecast period. Meanwhile, the Food & Beverages segment is also anticipated to see growth, albeit at a slightly faster rate compared to Household.

Regarding the Nature segment, Organic palm sugar is forecasted to dominate the market due to its perceived health benefits and environmental considerations. It is expected to maintain a strong market share and exhibit consistent growth over the forecast period, while the Conventional segment is also expected to see growth, albeit at a slower pace compared to Organic.

Competitive Analysis

The global palm sugar market is characterized by a diverse mix of local, regional, and multinational players. Local manufacturers, particularly in Indonesia, hold significant sway over pricing dynamics, with approximately 70-75% market share attributed to local players. While multinational players maintain a relatively lower market share, around 5-10%, their presence is notable in regions with a burgeoning demand for organic and healthy food products.

Key companies profiled

- Real Raw Food

- Phalada Pure & Sure

- Future Organics

- Bionova

- Betterbody Foods & Nutrition LLC

- Wholesome Sweeteners Inc.

- Windmill Organics Ltd.

- Navitas Organics

- Big Tree Farms

- Taj Agro Products

Palm Sugar Industry Research by Category

By Nature:

- Organic

- Conventional

By Form:

- Powder

- Liquid

- Crystal

By End Use:

- Food and Beverage Industry

- Bakery & Confectionery

- Smoothies & Shakes

- Others

- Foodservice Industry

- Household/Retail

By Distribution Channel:

- Business to Business

- Business to Consumer

- Hypermarkets/Supermarket

- Convenience Stores

- Specialty Stores

- Online Retail

By Region:

- North America

- Latin America

- Europe

- South Asia & Pacific

- East Asia

- Middle East & Africa

Table of Contents

1. Executive Summary

- 1.1. Global Palm Sugar Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value and Volume, 2023

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2018 - 2023

- 3.1. Global Palm Sugar Market Production Output, by Region, Value (US$ Bn) and Volume (Tons), 2018 - 2023

- 3.1.1. North America

- 3.1.2. Europe

- 3.1.3. Asia Pacific

- 3.1.4. Latin America

- 3.1.5. Middle East and Africa

4. Price Analysis, 2018 - 2023

- 4.1. Global Average Price Analysis, by Nature, US$ Per Tons, 2018 - 2023

- 4.2. Prominent Factor Affecting Palm Sugar Prices

- 4.3. Global Average Price Analysis, by Region, US$ Per Tons

5. Global Palm Sugar Market Outlook, 2018 - 2031

- 5.1. Global Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Organic

- 5.1.1.2. Conventional

- 5.1.1. Key Highlights

- 5.2. Global Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Powder

- 5.2.1.2. Liquid

- 5.2.1.3. Crystal

- 5.2.1. Key Highlights

- 5.3. Global Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. Food and Beverage Industry

- 5.3.1.1.1. Bakery & Confectionery

- 5.3.1.1.2. Smoothies & Shakes

- 5.3.1.1.3. Others

- 5.3.1.2. Foodservice Industry

- 5.3.1.3. Household/Retail

- 5.3.1.1. Food and Beverage Industry

- 5.3.1. Key Highlights

- 5.4. Global Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.4.1. Key Highlights

- 5.4.1.1. Business to Business

- 5.4.1.2. Business to Consumer

- 5.4.1.3. Hypermarkets/Supermarket

- 5.4.1.3.1. Convenience Stores

- 5.4.1.3.2. Specialty Stores

- 5.4.1.3.3. Online Retail

- 5.4.1. Key Highlights

- 5.5. Global Palm Sugar Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.5.1. Key Highlights

- 5.5.1.1. North America

- 5.5.1.2. Europe

- 5.5.1.3. Asia Pacific

- 5.5.1.4. Latin America

- 5.5.1.5. Middle East & Africa

- 5.5.1. Key Highlights

6. North America Palm Sugar Market Outlook, 2018 - 2031

- 6.1. North America Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Organic

- 6.1.1.2. Conventional

- 6.1.1. Key Highlights

- 6.2. North America Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Powder

- 6.2.1.2. Liquid

- 6.2.1.3. Crystal

- 6.2.1. Key Highlights

- 6.3. North America Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. Food and Beverage Industry

- 6.3.1.1.1. Bakery & Confectionery

- 6.3.1.1.2. Smoothies & Shakes

- 6.3.1.1.3. Others

- 6.3.1.2. Foodservice Industry

- 6.3.1.3. Household/Retail

- 6.3.1.1. Food and Beverage Industry

- 6.3.1. Key Highlights

- 6.4. North America Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.4.1. Key Highlights

- 6.4.1.1. Business to Business

- 6.4.1.2. Business to Consumer

- 6.4.1.3. Hypermarkets/Supermarket

- 6.4.1.3.1. Convenience Stores

- 6.4.1.3.2. Specialty Stores

- 6.4.1.4. Online Retail

- 6.4.1. Key Highlights

- 6.5. North America Palm Sugar Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1. Key Highlights

- 6.5.1.1. U.S. Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.2. U.S. Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.3. U.S. Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.4. U.S. Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.5. Canada Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.6. Canada Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.7. Canada Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.1.8. Canada Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.5.2. BPS Analysis/Market Attractiveness Analysis

- 6.5.1. Key Highlights

7. Europe Palm Sugar Market Outlook, 2018 - 2031

- 7.1. Europe Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Organic

- 7.1.1.2. Conventional

- 7.1.1. Key Highlights

- 7.2. Europe Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.2.1. Key Highlights

- 7.2.1.1. Powder

- 7.2.1.2. Liquid

- 7.2.1.3. Crystal

- 7.2.1. Key Highlights

- 7.3. Europe Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Food and Beverage Industry

- 7.3.1.1.1. Bakery & Confectionery

- 7.3.1.1.2. Smoothies & Shakes

- 7.3.1.1.3. Others

- 7.3.1.2. Foodservice Industry

- 7.3.1.3. Household/Retail

- 7.3.1.1. Food and Beverage Industry

- 7.3.1. Key Highlights

- 7.4. Europe Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.4.1. Key Highlights

- 7.4.1.1. Business to Business

- 7.4.1.2. Business to Consumer

- 7.4.1.3. Hypermarkets/Supermarket

- 7.4.1.3.1. Convenience Stores

- 7.4.1.3.2. Specialty Stores

- 7.4.1.4. Online Retail

- 7.4.1. Key Highlights

- 7.5. Europe Palm Sugar Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1. Key Highlights

- 7.5.1.1. Germany Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.2. Germany Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.3. Germany Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.4. Germany Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.5. U.K. Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.6. U.K. Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.7. U.K. Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.8. U.K. Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.9. France Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.10. France Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.11. France Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.12. France Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.13. Italy Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.14. Italy Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.15. Italy Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.16. Italy Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.17. Turkey Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.18. Turkey Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.19. Turkey Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.20. Turkey Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.21. Russia Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.22. Russia Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.23. Russia Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.24. Russia Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.25. Rest of Europe Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.26. Rest of Europe Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.27. Rest of Europe Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.1.28. Rest of Europe Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.5.2. BPS Analysis/Market Attractiveness Analysis

- 7.5.1. Key Highlights

8. Asia Pacific Palm Sugar Market Outlook, 2018 - 2031

- 8.1. Asia Pacific Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Organic

- 8.1.1.2. Conventional

- 8.1.1. Key Highlights

- 8.2. Asia Pacific Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Powder

- 8.2.1.2. Liquid

- 8.2.1.3. Crystal

- 8.2.1. Key Highlights

- 8.3. Asia Pacific Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. Food and Beverage Industry

- 8.3.1.1.1. Bakery & Confectionery

- 8.3.1.1.2. Smoothies & Shakes

- 8.3.1.1.3. Others

- 8.3.1.2. Foodservice Industry

- 8.3.1.3. Household/Retail

- 8.3.1.1. Food and Beverage Industry

- 8.3.1. Key Highlights

- 8.4. Asia Pacific Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.4.1. Key Highlights

- 8.4.1.1. Business to Business

- 8.4.1.2. Business to Consumer

- 8.4.1.3. Hypermarkets/Supermarket

- 8.4.1.3.1. Convenience Stores

- 8.4.1.3.2. Specialty Stores

- 8.4.1.4. Online Retail

- 8.4.1. Key Highlights

- 8.5. Asia Pacific Palm Sugar Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1. Key Highlights

- 8.5.1.1. China Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.2. China Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.3. China Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.4. China Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.5. Japan Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.6. Japan Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.7. Japan Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.8. Japan Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.9. South Korea Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.10. South Korea Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.11. South Korea Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.12. South Korea Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.13. India Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.14. India Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.15. India Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.16. India Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.17. Southeast Asia Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.18. Southeast Asia Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.19. Southeast Asia Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.20. Southeast Asia Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.21. Rest of Asia Pacific Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.22. Rest of Asia Pacific Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.23. Rest of Asia Pacific Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.1.24. Rest of Asia Pacific Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.5.2. BPS Analysis/Market Attractiveness Analysis

- 8.5.1. Key Highlights

9. Latin America Palm Sugar Market Outlook, 2018 - 2031

- 9.1. Latin America Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.1.1. Key Highlights

- 9.1.1.1. Organic

- 9.1.1.2. Conventional

- 9.1.1. Key Highlights

- 9.2. Latin America Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.2.1. Key Highlights

- 9.2.1.1. Powder

- 9.2.1.2. Liquid

- 9.2.1.3. Crystal

- 9.2.1. Key Highlights

- 9.3. Latin America Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.3.1. Key Highlights

- 9.3.1.1. Food and Beverage Industry

- 9.3.1.1.1. Bakery & Confectionery

- 9.3.1.1.2. Smoothies & Shakes

- 9.3.1.1.3. Others

- 9.3.1.2. Foodservice Industry

- 9.3.1.3. Household/Retail

- 9.3.1.1. Food and Beverage Industry

- 9.3.1. Key Highlights

- 9.4. Latin America Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.4.1. Key Highlights

- 9.4.1.1. Business to Business

- 9.4.1.2. Business to Consumer

- 9.4.1.3. Hypermarkets/Supermarket

- 9.4.1.3.1. Convenience Stores

- 9.4.1.3.2. Specialty Stores

- 9.4.1.4. Online Retail

- 9.4.1. Key Highlights

- 9.5. Latin America Palm Sugar Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1. Key Highlights

- 9.5.1.1. Brazil Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.2. Brazil Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.3. Brazil Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.4. Brazil Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.5. Mexico Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.6. Mexico Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.7. Mexico Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.8. Mexico Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.9. Argentina Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.10. Argentina Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.11. Argentina Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.12. Argentina Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.13. Rest of Latin America Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.14. Rest of Latin America Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.15. Rest of Latin America Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.1.16. Rest of Latin America Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 9.5.2. BPS Analysis/Market Attractiveness Analysis

- 9.5.1. Key Highlights

10. Middle East & Africa Palm Sugar Market Outlook, 2018 - 2031

- 10.1. Middle East & Africa Palm Sugar Market Outlook, by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.1.1. Key Highlights

- 10.1.1.1. Organic

- 10.1.1.2. Conventional

- 10.1.1. Key Highlights

- 10.2. Middle East & Africa Palm Sugar Market Outlook, by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.2.1. Key Highlights

- 10.2.1.1. Powder

- 10.2.1.2. Liquid

- 10.2.1.3. Crystal

- 10.2.1. Key Highlights

- 10.3. Middle East & Africa Palm Sugar Market Outlook, by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.3.1. Key Highlights

- 10.3.1.1. Food and Beverage Industry

- 10.3.1.1.1. Bakery & Confectionery

- 10.3.1.1.2. Smoothies & Shakes

- 10.3.1.1.3. Others

- 10.3.1.2. Foodservice Industry

- 10.3.1.3. Household/Retail

- 10.3.1.1. Food and Beverage Industry

- 10.3.1. Key Highlights

- 10.4. Middle East & Africa Palm Sugar Market Outlook, by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.4.1. Key Highlights

- 10.4.1.1. Business to Business

- 10.4.1.2. Business to Consumer

- 10.4.1.3. Hypermarkets/Supermarket

- 10.4.1.3.1. Convenience Stores

- 10.4.1.3.2. Specialty Stores

- 10.4.1.4. Online Retail

- 10.4.1. Key Highlights

- 10.5. Middle East & Africa Palm Sugar Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1. Key Highlights

- 10.5.1.1. GCC Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.2. GCC Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.3. GCC Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.4. GCC Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.5. South Africa Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.6. South Africa Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.7. South Africa Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.8. South Africa Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.9. Egypt Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.10. Egypt Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.11. Egypt Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.12. Egypt Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.13. Nigeria Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.14. Nigeria Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.15. Nigeria Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.16. Nigeria Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.17. Rest of Middle East & Africa Palm Sugar Market by Nature, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.18. Rest of Middle East & Africa Palm Sugar Market by Form, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.19. Rest of Middle East & Africa Palm Sugar Market by End User, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.1.20. Rest of Middle East & Africa Palm Sugar Market by Distribution Channel, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 10.5.2. BPS Analysis/Market Attractiveness Analysis

- 10.5.1. Key Highlights

11. Competitive Landscape

- 11.1. Product vs Indication Heatmap

- 11.2. Company Market Share Analysis, 2022

- 11.3. Competitive Dashboard

- 11.4. Company Profiles

- 11.4.1. Real Raw Food

- 11.4.1.1. Company Overview

- 11.4.1.2. Product Portfolio

- 11.4.1.3. Financial Overview

- 11.4.1.4. Business Strategies and Development

- 11.4.2. Phalada Pure & Sure

- 11.4.2.1. Company Overview

- 11.4.2.2. Product Portfolio

- 11.4.2.3. Financial Overview

- 11.4.2.4. Business Strategies and Development

- 11.4.3. Future Organics

- 11.4.3.1. Company Overview

- 11.4.3.2. Product Portfolio

- 11.4.3.3. Financial Overview

- 11.4.3.4. Business Strategies and Development

- 11.4.4. Bionova

- 11.4.4.1. Company Overview

- 11.4.4.2. Product Portfolio

- 11.4.4.3. Financial Overview

- 11.4.4.4. Business Strategies and Development

- 11.4.5. Betterbody Foods & Nutrition LLC

- 11.4.5.1. Company Overview

- 11.4.5.2. Product Portfolio

- 11.4.5.3. Financial Overview

- 11.4.5.4. Business Strategies and Development

- 11.4.6. Wholesome Sweeteners Inc

- 11.4.6.1. Company Overview

- 11.4.6.2. Product Portfolio

- 11.4.6.3. Financial Overview

- 11.4.6.4. Business Strategies and Development

- 11.4.7. Windmill Organics Ltd.

- 11.4.7.1. Company Overview

- 11.4.7.2. Product Portfolio

- 11.4.7.3. Financial Overview

- 11.4.7.4. Business Strategies and Development

- 11.4.8. Navitas Organics

- 11.4.8.1. Company Overview

- 11.4.8.2. Product Portfolio

- 11.4.8.3. Financial Overview

- 11.4.8.4. Business Strategies and Development

- 11.4.9. Big Tree Farms

- 11.4.9.1. Company Overview

- 11.4.9.2. Product Portfolio

- 11.4.9.3. Financial Overview

- 11.4.9.4. Business Strategies and Development

- 11.4.10. Taj Agro Products

- 11.4.10.1. Company Overview

- 11.4.10.2. Product Portfolio

- 11.4.10.3. Financial Overview

- 11.4.10.4. Business Strategies and Development

- 11.4.1. Real Raw Food

12. Appendix

- 12.1. Research Methodology

- 12.2. Report Assumptions

- 12.3. Acronyms and Abbreviations