|

|

市場調査レポート

商品コード

1289786

ミートスナックの世界市場-2023-2030Global Meat Snacks Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ミートスナックの世界市場-2023-2030 |

|

出版日: 2023年06月12日

発行: DataM Intelligence

ページ情報: 英文 123 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

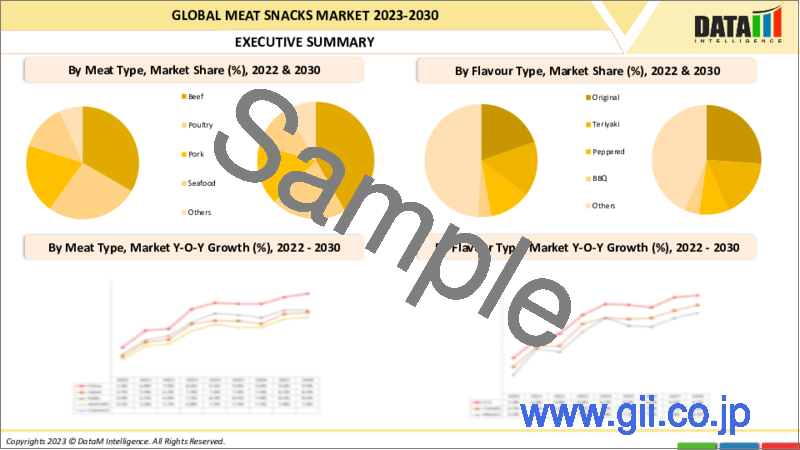

世界のミートスナック市場規模は2022年に135億米ドルに達し、2030年には最大220億米ドルに達することで有利な成長を遂げると予測されます。予測期間2023-2030年のCAGRは6.3%で成長しています。

便利で健康的なスナッキングオプションの需要は増加傾向にあり、消費者の間ではタンパク質を多く含む食事が人気で、これらの要因が業界の急成長の主な要因となっています。高タンパク質で風味が良いため、牛肉は最も頻繁に使用される肉であり、ミートスナック市場の大半を占めています。

ミートスナック業界では、大小いくつかの企業が市場競争を繰り広げており、非常に競争が激しいです。顧客を引きつけ、競争力をつけるために、ミートスナック業界の主要企業は、製品の革新、新しいフレーバー、パッケージデザインに注力しています。

市場力学

消費者の間で高まるタンパク質豊富な食生活の人気が市場成長を促進

消費者の間でタンパク質が豊富な食事が流行っていることは、ミートスナック市場の重要な促進要因となっています。また、ミートスナックの需要は、その利便性と携帯性によって牽引されています。また、低炭水化物やケトジェニックダイエットの人気が高まっていることも、ミートスナック市場の成長に寄与しています。

ミートスナックは、チップスやキャンディーといった従来のスナックに代わる健康的なものとして認識されていることが多いです。ミートスナックの世界の需要増に対応するため、メーカーは生産能力を高めています。

例えば、2022年4月、米国で最も有名なミートスナック企業の1つであるジャック・リンクスは、ジョージア州の新しい製造施設の建設に4億5,000万米ドルを投じました。

新たな技術の進歩が市場成長を牽引

ミートスナックの消費量は世界的に多いです。米国では成人の3分の2が食間にスナック菓子を食べていると言われており、消費者の需要拡大に対応するため、ミートスナック菓子の製造には数多くの最先端技術が採用されています。技術開拓により、生産時間の短縮や生産率の向上が図られ、ミートスナック市場の拡大に寄与しています。

COVID-19の影響分析

COVID-19は消費者行動に変化をもたらし、家にいて食事を作る人が増えました。そのため、一から食事を作る人が増え、ミートスナックを含むコンビニエンスフードの需要は減少しています。しかし、ミートスナックを含む包装・加工食品に対する需要の増加は、この減少を部分的に相殺しました。

人工知能の影響分析

人工知能(AI)は、メーカーのプロセスの最適化を支援することで、ミートスナックの生産に大きな影響を与えることができます。機械学習アルゴリズムは、センサーやその他のソースからのデータを分析してパターンを特定し、生産パラメータを最適化することができます。これにより、効率の向上、廃棄物の削減、品質管理の向上が期待できます。また、AIは欠陥や不整合をリアルタイムで検出することで、ミートスナックの品質管理を向上させることができます。

目次

第1章 調査手法とスコープ

- 調査手法

- 調査目的および調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 便利で健康的なスナッキングオプションへの需要の高まりが市場成長を牽引

- 抑制要因

- 過剰な肉食に対する意識の高まりが市場成長の妨げとなる

- 機会

- 肉類を食べる傾向の高まりが、市場成長を促進します

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 法規制の分析

第6章 COVID-19の分析

第7章 肉類タイプ別

- 牛肉

- 家禽

- 豚肉

- シーフード

- その他

第8章 フレーバータイプ別

- オリジナル

- テリヤキ

- ペッパー

- バーベキュー

- その他

第9章 製品タイプ別

- ジャーキー

- ステーキ&ストリップ

- バーベキュー

- スティック

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A(合併・買収)分析

第12章 企業プロファイル

- Meat Snacks Group

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展状況

- Jack Link's Beef Jerky

- Conagra Brands

- Hormel foods

- Oberto

- Old Trapper

- Tyson Foods, Inc.

- Bridgford Foods

- Klement's Sausage

- Country Archer

第13章 付録

Market Overview

The Global Meat Snacks Market size reached US$ 13.5 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 22 billion by 2030. The market is growing at a CAGR of 6.3% during the forecast period 2023-2030.

The demand for convenient and wholesome snacking options is on the rise, as is the popularity of diets high in protein among consumers and these factors are primarily responsible for the industry's rapid growth. Due to its high protein content and delicious flavour, beef is the most frequently used meat, making up the majority of the meat snack market.

Several big and little companies are competing for market share in the meat snacks industry, which is very competitive. To draw customers and gain a competitive edge, major players in the meat snacks industry are concentrating on product innovation, new flavours and packaging designs.

Market Dynamics

The Rising Popularity of Protein-rich Diets Among Consumers Drives the Market Growth

The popularity of protein-rich diets among consumers is a significant driver of the meat snacks market. The demand for meat snacks is also driven by their convenience and portability. The increasing popularity of low-carb and ketogenic diets has also contributed to the growth of the meat snacks market.

Meat snacks are often perceived as a healthier alternative to traditional snacks such as chips and candy. To meet the rising global demand for meat snacks, manufacturers are increasing their production capacity.

For instance, in April 2022, Jack Link's, one of the most well-known meat snack companies in the U.S., committed U.S.$ 450 million to the construction of a new manufacturing facility in Georgia.

New Technological Advances Drive the Market Growth

There is a large global consumption of meat snacks. In the U.S., two-thirds of adults admit to regularly eating between-meal snacks, and numerous cutting-edge methods are employed in the production of meat snacks to meet the growing consumer demand. Technology development contributes to a decrease in the amount of time needed to produce snacks and an increase in production rate, which fuels the meat snacks market's expansion.

COVID-19 Impact Analysis

COVID-19 has led to changes in consumer behaviour, with more people staying at home and cooking their meals. This has led to a decline in demand for convenience foods, including meat snacks, as people are increasingly cooking their meals from scratch. However, the increased demand for packaged and processed foods, including meat snacks, has partially offset this decline.

Artificial Intelligence Impact Analysis

Artificial Intelligence (AI) can have a significant impact on the production of meat snacks by helping manufacturers optimize their processes. Machine learning algorithms can analyze data from sensors and other sources to identify patterns and optimize production parameters. This can result in higher efficiency, reduced waste and better quality control. AI can also improve the quality control of meat snacks by detecting defects and inconsistencies in real-time.

Segment Analysis

The global meat snacks market is segmented based on meat type, flavour type, product type and region.

Increased Demand for High Protein and Easy Accessibility Meat Products

The beef segment dominated the meat snacks market in 2022. Beef jerky is the most widely used product on the market. Due to its high protein content and inclusion of essential components, it has grown in popularity in the meat snack market. To meet the rising global demand for beef snacks, manufacturers are increasing their production capacity and launching new products.

For instance, on 20 April 2023, Aleph Farms, a provider of food technology, unveiled the Aleph Cuts brand's first item, the Petite Steak. The non-modified Angus cow cells used to create the cultured meat were approved by the appropriate authorities and it is expected to be introduced in Singapore and Israel this year. In addition to ribeye steaks and collagen, the company also offers petite steaks as part of its cultivated product line.

Ggeographical Analysis

Increased Consumption of Meat Products

The preference of consumers for the portability, convenience and indulgence that savoury snacks offer led to the North American region dominating the global market for meat snacks in 2021. The U.S. produces more beef and poultry than any other country.

An increase in the production of meat snacks hastens the market's expansion. According to the U.S. Department of Agriculture (USDA), 20% of the world's beef production takes place in the U.S. In the U.S., Canada and Mexico, beef jerkies are produced on a large scale.

Competitive Landscape

The major global meat snacks market players include: Meat Snacks Group, Jack Link's Beef Jerky, Conagra Brands, Hormel Foods, Oberto, Old Trapper, Tyson Foods, Inc., Bridgford Foods, Klement's Sausage and Country Archer.

Why Purchase the Report?

- To visualize the global meat snacks market segmentation based on meat type, flavour type, product type and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of meat snacks market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Meat Snacks Market Report Would Provide Approximately 61 Tables, 62 Figures and 123 pages.

Target Audience 2023

- Manufacturers / Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Meal Type

- 3.2. Snippet by Flavour Type

- 3.3. Snippet by Product Type

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing demand for convenient and healthy snacking options drives the market growth

- 4.1.2. Restraints

- 4.1.2.1. Increasing awareness of excessive meat consumption hampers the market growth

- 4.1.3. Opportunity

- 4.1.3.1. Increasing trends in eating meat snacks drive the market growth

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Post COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers' Strategic Initiatives

- 6.6. Conclusion

7. By Meat Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 7.1.2. Market Attractiveness Index, By Meat Type

- 7.2. Beef*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Poultry

- 7.4. Pork

- 7.5. Seafood

- 7.6. Others

8. By Flavour Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 8.1.2. Market Attractiveness Index, By Flavour Type

- 8.2. Original*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Teriyaki

- 8.4. Peppered

- 8.5. BBQ

- 8.6. Others

9. By Product Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 9.1.2. Market Attractiveness Index, By Product Type

- 9.2. Jerky*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Steaks and Strips

- 9.4. Bars

- 9.5. Sticks

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. The U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. The UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Meat Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Flavour Type

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Meat Snacks Group*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Jack Link's Beef Jerky

- 12.3. Conagra Brands

- 12.4. Hormel foods

- 12.5. Oberto

- 12.6. Old Trapper

- 12.7. Tyson Foods, Inc.

- 12.8. Bridgford Foods

- 12.9. Klement's Sausage

- 12.10. Country Archer

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us