|

|

市場調査レポート

商品コード

1804893

コントラクトロジスティクス:市場規模と予測(2021年~2031年)、世界・地域シェア、動向、成長機会分析レポート、タイプ別、サービスタイプ別、エンドユーザー別、地域別Contract Logistics Market Size and Forecast 2021 - 2031, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type, Service Type, End-Users, and Geography |

||||||

|

|||||||

| コントラクトロジスティクス:市場規模と予測(2021年~2031年)、世界・地域シェア、動向、成長機会分析レポート、タイプ別、サービスタイプ別、エンドユーザー別、地域別 |

|

出版日: 2025年08月07日

発行: The Insight Partners

ページ情報: 英文 213 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

コントラクトロジスティクスの市場規模は2024年に3,270億8,000万米ドルと評価され、2031年までには5,252億9,000万米ドルに達すると予測され、2025年から2031年の間に7.2%のCAGRで成長すると期待されています。

アウトソーシングは、コントラクトロジスティクス市場において重要なセグメントです。コントラクトロジスティクスにおけるアウトソーシングとは、企業がサプライチェーンやロジスティクス業務(倉庫保管、輸送、在庫管理、注文処理など)をサードパーティーロジスティクス(3PL)プロバイダーに委託することを指します。このモデルにより、企業はロジスティクスの専門知識、先進技術、拡張可能なインフラを活用しながら、コアコンピタンスに集中することができます。例えば、Unileverは2024年、サービス効率の向上と排出量削減のため、欧州の物流ネットワークの一部を大手物流業者にアウトソーシングしました。同様に、Walmartもeコマースの成長とラストワンマイルデリバリーのプレッシャーに対応するため、フルフィルメントセンターのアウトソーシング利用を拡大しています。アウトソーシングは、ジャスト・イン・タイム配送が重要な自動車産業などでも普及しています。特にオムニチャネル環境では、消費者の要求の急速な変化に対応するため、アウトソーシングを行うファッションブランドや小売ブランドが増えています。最近の地域サプライチェーンや持続可能性の目標へのシフトは、3PLへの依存をさらに加速させ、アウトソーシングを競争力のある強靭なロジスティクス業務の戦略的ツールとして位置づけています。

米国は、世界最大かつ最先端のロジスティクス受託市場を誇っています。高度に発達した輸送インフラ、堅調なeコマースの成長、小売、自動車、ヘルスケア、テクノロジーなどの分野からの旺盛な需要により、米国はロジスティクスプロバイダーにとって成熟しつつも進化する状況を提供しています。サードパーティロジスティクス(3PL)プロバイダーは、サプライチェーンの管理、倉庫管理、ラストワンマイル配送において極めて重要な役割を果たしています。ロジスティクス業務のアウトソーシングへの依存を高めることで、企業は効率性を高め、コアコンピタンスに集中することができます。2023年半ばには、APL CEVA Government Logistics(バージニア州)、Crowley Government Service(フロリダ州)、Intrepid Eagle Logistics(メリーランド州)などがそれぞれ、世界中の米国戦闘司令部に商業港湾業務とターミナルロジスティクスサービスを提供するため、総額7億1,000万米ドルの無期限・数量契約を獲得しました。さらに、技術の進歩、自動化、持続可能性への取り組みが、米国契約物流市場の革新と競争力に貢献しています。

ドイツは、その高度なインフラ、中心的な立地、強力な産業基盤により、欧州におけるコントラクトロジスティクスの主要拠点となっています。このセクターは効率的な道路、鉄道、港湾ネットワークの恩恵を受けており、自動車、製造、小売、eコマース業界向けの合理化されたサプライチェーンを支えています。DHL、DB Schenker、Kuehne+Nagelといった主要企業がこの市場で幅広く事業を展開しています。倉庫管理、梱包、在庫管理といった付加価値サービスへの高い需要が成長を支えています。技術的進歩、自動化、持続可能性への取り組みが、市場の様相を変えつつあります。安定した経済、規制の枠組み、熟練した労働力を持つドイツは、欧州におけるコントラクトロジスティクス事業の戦略的な選択肢となっています。Deutsche Bahn(DB)は2023年12月、中核となる鉄道インフラに集中し、負債を削減することを目的に、ロジスティクス部門であるDB Schenkerの売却に向けた正式なプロセスを開始しました。入札候補者は2024年1月中旬までに募集されました。英国のロジスティクス情勢は、技術革新、顧客サービス、統合されたテクノロジー主導のソリューションに重点を置き、依然として回復力を維持しています。2023年6月、運輸省は「ジェネレーションロジスティクス」キャンペーンに30万ポンド(38万7,000米ドル)を追加投資しました(政府投資総額は2年間で64万5,000ポンド(83万2,000米ドル))。このイニシアティブは、学校やカレッジでロジスティクスのキャリアに対する認識を高め、290万件のソーシャルメディアエンゲージメントを確保し、約280人のロジスティクスアンバサダーのネットワークを確立しました。

Deutsche Post AG、FedEx Corp、GXO Logistics Inc.、United Parcel Service Inc.、Nippon Express Co Ltd.、GEODIS SA、Ryder System Inc.、CMA CGM SA、DSV AS.は、この市場調査で紹介されている主要企業です。

コントラクトロジスティクス市場全体の規模は、一次情報と二次情報の両方を用いて導き出されています。徹底的な二次調査は、コントラクトロジスティクス市場規模に関連する質的・量的情報を得るために、社内外の情報源を用いて実施されました。このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのにも役立ちます。また、データを検証し、分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、コントラクトロジスティクス市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力分析

第3章 調査手法

- 2次調査

- 1次調査

- 市場推定アプローチ

- 供給サイド分析

- 需要サイド分析

- マクロ・ミクロ経済指標

- 調査の前提条件と制限

第4章 コントラクトロジスティクス市場情勢

- バリューチェーン分析

- サプライチェーン分析

- PEST分析

- 規制の枠組み

第5章 コントラクトロジスティクス市場:主要市場力学

- 主要市場促進要因

- 主な市場抑制要因

- 主な市場機会

- 今後の動向

- 促進要因と抑制要因の影響分析

第6章 コントラクトロジスティクス市場:世界市場分析

- コントラクトロジスティクス-世界市場概要

- コントラクトロジスティクス-世界市場と2031年までの予測

第7章 コントラクトロジスティクス市場-収益分析:タイプ別、2021年~2031年

- アウトソーシング

- インソーシング

第8章 コントラクトロジスティクス市場-収益分析:サービスタイプ別、2021年~2031年

- 倉庫管理・配送

- 輸送管理

- アフターマーケットロジスティクス

- その他

第9章 コントラクトロジスティクス市場-収益分析:エンドユーザー別、2021年~2031年

- 小売・eコマース

- 自動車

- 工業・製造業

- 医薬品・ヘルスケア

- 消費財・エレクトロニクス

- 航空宇宙・防衛

- その他

第10章 コントラクトロジスティクス市場-収益分析、2021年~2031年:地域別市場分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- ポーランド

- その他欧州

- アジア太平洋

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東・アフリカ

- 中南米

- ブラジル

- アルゼンチン

- その他中南米

第11章 主要企業の戦略的取り組み

- 合併と買収

- 契約、提携、合弁事業

- 新製品の上市

- 事業拡大とその他の戦略的開発

第12章 競合情勢

- 主要企業の企業ベンチマーキング

- タイプ別

- サービスタイプ別

- エンドユーザー別

- 企業シェア分析、2024年

- 市場集中度

第13章 コントラクトロジスティクス市場-主要企業プロファイル

- Deutsche Post AG

- FedEx Corp

- GXO Logistics Inc

- United Parcel Service Inc

- Nippon Express Co Ltd

- GEODIS SA

- Ryder System Inc

- CMA CGM SA

- DSV AS

- Kuehne + Nagel International AG

第14章 付録

List Of Tables

- Table 1. Contract Logistics Market Segmentation 26

- Table 2. List of Vendors 35

- Table 3. Contract Logistics Market - Revenue, 2021-2024 (US$ Million) 41

- Table 4. Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) 41

- Table 5. Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 43

- Table 6. Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 43

- Table 7. Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 46

- Table 8. Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 47

- Table 9. Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 52

- Table 10. Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 53

- Table 11. North America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 65

- Table 12. North America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 65

- Table 13. North America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 66

- Table 14. North America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 66

- Table 15. North America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 67

- Table 16. North America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 68

- Table 17. North America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Country 69

- Table 18. North America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country 69

- Table 19. United States: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 70

- Table 20. United States: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 71

- Table 21. United States: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 71

- Table 22. United States: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 71

- Table 23. United States: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 72

- Table 24. United States: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 72

- Table 25. Canada: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 73

- Table 26. Canada: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 74

- Table 27. Canada: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 74

- Table 28. Canada: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 74

- Table 29. Canada: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 75

- Table 30. Canada: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 75

- Table 31. Mexico: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 76

- Table 32. Mexico: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 77

- Table 33. Mexico: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 77

- Table 34. Mexico: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 77

- Table 35. Mexico: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 78

- Table 36. Mexico: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 78

- Table 37. Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 81

- Table 38. Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 81

- Table 39. Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 82

- Table 40. Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 83

- Table 41. Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 84

- Table 42. Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 84

- Table 43. Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Country 85

- Table 44. Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country 86

- Table 45. Germany: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 87

- Table 46. Germany: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 87

- Table 47. Germany: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 88

- Table 48. Germany: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 88

- Table 49. Germany: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 89

- Table 50. Germany: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 89

- Table 51. France: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 90

- Table 52. France: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 91

- Table 53. France: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 91

- Table 54. France: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 91

- Table 55. France: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 92

- Table 56. France: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 92

- Table 57. Italy: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 93

- Table 58. Italy: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 94

- Table 59. Italy: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 94

- Table 60. Italy: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 94

- Table 61. Italy: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 95

- Table 62. Italy: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 95

- Table 63. United Kingdom: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 97

- Table 64. United Kingdom: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 97

- Table 65. United Kingdom: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 97

- Table 66. United Kingdom: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 98

- Table 67. United Kingdom: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 98

- Table 68. United Kingdom: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 99

- Table 69. Russia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 100

- Table 70. Russia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 100

- Table 71. Russia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 101

- Table 72. Russia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 101

- Table 73. Russia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 102

- Table 74. Russia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 102

- Table 75. Poland: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 103

- Table 76. Poland: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 104

- Table 77. Poland: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 104

- Table 78. Poland: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 104

- Table 79. Poland: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 105

- Table 80. Poland: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 105

- Table 81. Rest of Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 106

- Table 82. Rest of Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 107

- Table 83. Rest of Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 107

- Table 84. Rest of Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 107

- Table 85. Rest of Europe: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 108

- Table 86. Rest of Europe: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 108

- Table 87. Asia Pacific: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 111

- Table 88. Asia Pacific: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 111

- Table 89. Asia Pacific: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 112

- Table 90. Asia Pacific: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 113

- Table 91. Asia Pacific: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 114

- Table 92. Asia Pacific: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 114

- Table 93. Asia Pacific: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Country 115

- Table 94. Asia Pacific: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country 116

- Table 95. China: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 117

- Table 96. China: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 117

- Table 97. China: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 117

- Table 98. China: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 118

- Table 99. China: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 118

- Table 100. China: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 119

- Table 101. Japan: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 120

- Table 102. Japan: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 120

- Table 103. Japan: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 121

- Table 104. Japan: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 121

- Table 105. Japan: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 122

- Table 106. Japan: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 122

- Table 107. India: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 123

- Table 108. India: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 124

- Table 109. India: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 124

- Table 110. India: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 124

- Table 111. India: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 125

- Table 112. India: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 125

- Table 113. South Korea: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 127

- Table 114. South Korea: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 127

- Table 115. South Korea: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 127

- Table 116. South Korea: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 128

- Table 117. South Korea: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 128

- Table 118. South Korea: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 129

- Table 119. Australia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 130

- Table 120. Australia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 130

- Table 121. Australia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 131

- Table 122. Australia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 131

- Table 123. Australia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 132

- Table 124. Australia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 132

- Table 125. Rest of APAC: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 133

- Table 126. Rest of APAC: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 134

- Table 127. Rest of APAC: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 134

- Table 128. Rest of APAC: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 134

- Table 129. Rest of APAC: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 135

- Table 130. Rest of APAC: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 135

- Table 131. Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 138

- Table 132. Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 138

- Table 133. Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 139

- Table 134. Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 140

- Table 135. Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 141

- Table 136. Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 141

- Table 137. Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Country 142

- Table 138. Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country 143

- Table 139. Saudi Arabia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 144

- Table 140. Saudi Arabia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 144

- Table 141. Saudi Arabia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 144

- Table 142. Saudi Arabia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 145

- Table 143. Saudi Arabia: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 145

- Table 144. Saudi Arabia: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 146

- Table 145. United Arab Emirates: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 147

- Table 146. United Arab Emirates: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 147

- Table 147. United Arab Emirates: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 147

- Table 148. United Arab Emirates: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 148

- Table 149. United Arab Emirates: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 148

- Table 150. United Arab Emirates: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 149

- Table 151. South Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 150

- Table 152. South Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 150

- Table 153. South Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 151

- Table 154. South Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 151

- Table 155. South Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 152

- Table 156. South Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 152

- Table 157. Rest of Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 153

- Table 158. Rest of Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 154

- Table 159. Rest of Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 154

- Table 160. Rest of Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 154

- Table 161. Rest of Middle East and Africa: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 155

- Table 162. Rest of Middle East and Africa: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 155

- Table 163. South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 158

- Table 164. South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 158

- Table 165. South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 159

- Table 166. South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 160

- Table 167. South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 161

- Table 168. South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 161

- Table 169. South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Country 162

- Table 170. South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country 163

- Table 171. Brazil: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 164

- Table 172. Brazil: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 164

- Table 173. Brazil: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 164

- Table 174. Brazil: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 165

- Table 175. Brazil: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 165

- Table 176. Brazil: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 166

- Table 177. Argentina: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 167

- Table 178. Argentina: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 167

- Table 179. Argentina: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 168

- Table 180. Argentina: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 168

- Table 181. Argentina: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 169

- Table 182. Argentina: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 169

- Table 183. Rest of South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Type 170

- Table 184. Rest of South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Type 171

- Table 185. Rest of South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Service Type 171

- Table 186. Rest of South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Service Type 171

- Table 187. Rest of South and Central America: Contract Logistics Market - Revenue, 2021-2024 (US$ Million) - by Industry Vertical 172

- Table 188. Rest of South and Central America: Contract Logistics Market - Revenue Forecast, 2025-2031 (US$ Million) - by Industry Vertical 172

- Table 189. Heat Map Analysis by Key Players 174

- Table 190. List of Abbreviation 226

List Of Figures

- Figure 1. Contract Logistics Market Segmentation, by Geography 29

- Figure 2. PEST Analysis 36

- Figure 3. Impact Analysis of Drivers and Restraints 43

- Figure 4. Contract Logistics Market Revenue (US$ Million), 2021-2031 44

- Figure 5. Contract Logistics Market Share (%) - by Type (2024 and 2031) 46

- Figure 6. Outsourcing: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 47

- Figure 7. Insourcing: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 48

- Figure 8. Contract Logistics Market Share (%) - by Service Type (2024 and 2031) 49

- Figure 9. Warehousing and Distribution: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 51

- Figure 10. Transportation Management: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 52

- Figure 11. Aftermarket Logistics: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 53

- Figure 12. Others: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 54

- Figure 13. Contract Logistics Market Share (%) - by Industry Vertical (2024 and 2031) 55

- Figure 14. Retail and E-commerce: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 57

- Figure 15. Automotive: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 58

- Figure 16. Industrial and Manufacturing: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 59

- Figure 17. Pharma and Healthcare: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 60

- Figure 18. Consumer Goods and Electronics: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 61

- Figure 19. Aerospace and Defense: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 62

- Figure 20. Others: Contract Logistics Market - Revenue and Forecast to 2031 (US$ Million) 63

- Figure 21. Contract Logistics Market Breakdown by Region, 2024 and 2031 (%) 64

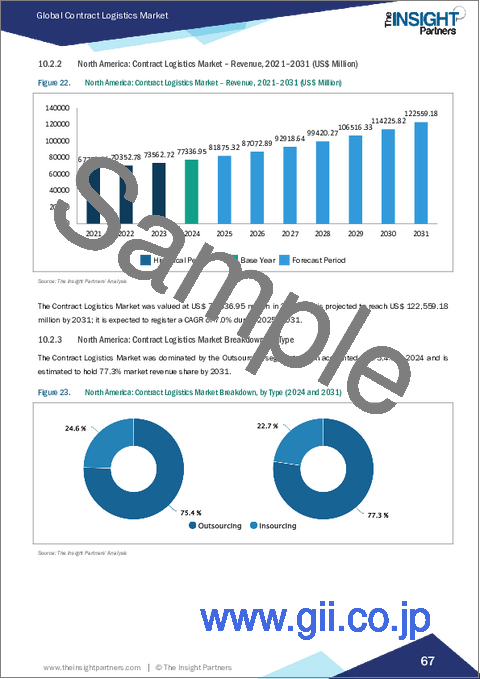

- Figure 22. North America: Contract Logistics Market - Revenue, 2021-2031 (US$ Million) 67

- Figure 23. North America: Contract Logistics Market Breakdown, by Type (2024 and 2031) 67

- Figure 24. North America: Contract Logistics Market Breakdown, by Service Type (2024 and 2031) 68

- Figure 25. North America: Contract Logistics Market Breakdown, by Industry Vertical (2024 and 2031) 70

- Figure 26. North America: Contract Logistics Market Breakdown, by Key Countries, 2024 and 2031 (%) 71

- Figure 27. United States: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 73

- Figure 28. Canada: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 76

- Figure 29. Mexico: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 79

- Figure 30. Europe: Contract Logistics Market - Revenue, 2021-2031 (US$ Million) 83

- Figure 31. Europe: Contract Logistics Market Breakdown, by Type (2024 and 2031) 84

- Figure 32. Europe: Contract Logistics Market Breakdown, by Service Type (2024 and 2031) 85

- Figure 33. Europe: Contract Logistics Market Breakdown, by Industry Vertical (2024 and 2031) 86

- Figure 34. Europe: Contract Logistics Market Breakdown, by Key Countries, 2024 and 2031 (%) 88

- Figure 35. Germany: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 89

- Figure 36. France: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 93

- Figure 37. Italy: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 96

- Figure 38. United Kingdom: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 99

- Figure 39. Russia: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 102

- Figure 40. Poland: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 106

- Figure 41. Rest of Europe: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 109

- Figure 42. Asia Pacific: Contract Logistics Market - Revenue, 2021-2031 (US$ Million) 113

- Figure 43. Asia Pacific: Contract Logistics Market Breakdown, by Type (2024 and 2031) 114

- Figure 44. Asia Pacific: Contract Logistics Market Breakdown, by Service Type (2024 and 2031) 115

- Figure 45. Asia Pacific: Contract Logistics Market Breakdown, by Industry Vertical (2024 and 2031) 116

- Figure 46. Asia Pacific: Contract Logistics Market Breakdown, by Key Countries, 2024 and 2031 (%) 118

- Figure 47. China: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 119

- Figure 48. Japan: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 122

- Figure 49. India: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 126

- Figure 50. South Korea: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 129

- Figure 51. Australia: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 132

- Figure 52. Rest of APAC: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 136

- Figure 53. Middle East and Africa: Contract Logistics Market - Revenue, 2021-2031 (US$ Million) 140

- Figure 54. Middle East and Africa: Contract Logistics Market Breakdown, by Type (2024 and 2031) 141

- Figure 55. Middle East and Africa: Contract Logistics Market Breakdown, by Service Type (2024 and 2031) 142

- Figure 56. Middle East and Africa: Contract Logistics Market Breakdown, by Industry Vertical (2024 and 2031) 143

- Figure 57. Middle East and Africa: Contract Logistics Market Breakdown, by Key Countries, 2024 and 2031 (%) 145

- Figure 58. Saudi Arabia: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 146

- Figure 59. United Arab Emirates: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 149

- Figure 60. South Africa: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 152

- Figure 61. Rest of Middle East and Africa: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 156

- Figure 62. South and Central America: Contract Logistics Market - Revenue, 2021-2031 (US$ Million) 160

- Figure 63. South and Central America: Contract Logistics Market Breakdown, by Type (2024 and 2031) 161

- Figure 64. South and Central America: Contract Logistics Market Breakdown, by Service Type (2024 and 2031) 162

- Figure 65. South and Central America: Contract Logistics Market Breakdown, by Industry Vertical (2024 and 2031) 163

- Figure 66. South and Central America: Contract Logistics Market Breakdown, by Key Countries, 2024 and 2031 (%) 165

- Figure 67. Brazil: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 166

- Figure 68. Argentina: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 169

- Figure 69. Rest of South and Central America: Contract Logistics Market - Revenue and Forecast, 2021-2031 (US$ Million) 173

- Figure 70. Company Positioning & Concentration 177

The contract logistics market size was valued at US$ 327.08 billion in 2024 and is projected to reach US$ 525.29 billion by 2031; it is expected to grow at a CAGR of 7.2% during 2025-2031.

The outsourcing is a critical segment within the contract logistics market. Outsourcing in contract logistics refers to companies delegating their supply chain and logistics operations-such as warehousing, transportation, inventory management, and order fulfillment-to third-party logistics (3PL) providers. This model allows businesses to focus on core competencies while leveraging specialized logistics expertise, advanced technologies, and scalable infrastructure. For instance, in 2024, Unilever outsourced parts of its European distribution network to a major logistics provider to enhance service efficiency and reduce emissions. Similarly, Walmart has expanded its use of outsourced fulfillment centers to handle e-commerce growth and last-mile delivery pressures. Outsourcing is also prevalent in industries like automotive, where Just-In-Time delivery is critical. A growing number of fashion and retail brands are outsourcing to meet fast-changing consumer demands, particularly in omnichannel environments. Recent shifts toward regional supply chains and sustainability goals have further accelerated the reliance on 3PLs, positioning outsourcing as a strategic tool for competitive and resilient logistics operations.

The US boasts one of the largest and most advanced contract logistics markets globally. With a highly developed transportation infrastructure, robust e-commerce growth, and strong demand from sectors such as retail, automotive, healthcare, and technology, the US offers a mature yet evolving landscape for logistics providers. Third-party logistics (3PL) providers play a pivotal role in managing supply chains, warehousing, and last-mile delivery. Increasing reliance on outsourcing logistics operations enables companies to enhance efficiency and focus on core competencies. In mid-2023, APL CEVA Government Logistics (VA), Crowley Government Services (FL), Intrepid Eagle Logistics (MD), and others were each awarded indefinite-delivery/quantity contracts totaling ~ US$ 710 million to provide commercial port operations and terminal logistics services across US combatant commands worldwide. Further, the technological advancements, automation, and sustainability efforts contribute to innovation and competitiveness in the US contract logistics market.

Germany is a leading hub for contract logistics in Europe, driven by its advanced infrastructure, central location, and strong industrial base. The sector benefits from efficient road, rail, and port networks, supporting streamlined supply chains for automotive, manufacturing, retail, and e-commerce industries. Key players like DHL, DB Schenker, and Kuehne + Nagel operate extensively in the market. High demand for value-added services such as warehousing, packaging, and inventory management supports growth. Technological advancements, automation, and sustainability initiatives are reshaping the landscape. Germany's stable economy, regulatory framework, and skilled workforce make it a strategic choice for contract logistics operations in Europe. In December 2023, Deutsche Bahn (DB) initiated a formal process to divest its logistics arm DB Schenker, aiming to concentrate on core railway infrastructure and reduce debt. Potential bidders were invited by mid-January 2024. The UK logistics landscape remains resilient, with a strong emphasis on innovation, customer service, and integrated technology-driven solutions. In June 2023, the Department for Transport invested an additional £300,000 ( US$ 0.387 million) into its Generation Logistics campaign (total government investment £645k ( US$ 0.832 million) over two years. This initiative raised awareness of logistics careers across schools and colleges, securing 2.9 M social media engagements and establishing a network of ~280 logistics ambassadors.

Deutsche Post AG, FedEx Corp, GXO Logistics Inc., United Parcel Service Inc., Nippon Express Co Ltd., GEODIS SA, Ryder System Inc., CMA CGM SA, and DSV AS. are among the key contract logistics market players that are profiled in this market study.

The overall contract logistics market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the contract logistics market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the contract logistics market.

Table Of Contents

1. Introduction

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.2.1 Currency Conversion

- 1.2.2 Study Period - Historic Year, Base Year, and Forecast Year

- 1.3 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness Analysis

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.3 Market Estimation Approach

- 3.3.1 Supply Side Analysis

- 3.3.2 Demand Side Analysis

- 3.4 Macro and Micro-economic Indicators

- 3.5 Research Assumptions and Limitations

4. Contract Logistics Market Landscape

- 4.1 Overview

- 4.2 Value Chain Analysis

- 4.3 Supply Chain Analysis

- 4.4 PEST Analysis

- 4.5 Regulatory Framework

5. Contract Logistics Market - Key Market Dynamics

- 5.1 Key Market Drivers

- 5.2 Key Market Restraints

- 5.3 Key Market Opportunities

- 5.4 Future Trends

- 5.5 Impact Analysis of Drivers and Restraints

6. Contract Logistics Market - Global Market Analysis

- 6.1 Contract Logistics - Global Market Overview

- 6.2 Contract Logistics - Global Market and Forecast to 2031

7. Contract Logistics Market - Revenue Analysis (USD Million) - By Type, 2021-2031

- 7.1 Overview

- 7.2 Outsourcing

- 7.3 Insourcing

8. Contract Logistics Market - Revenue Analysis (USD Million) - By Service Type, 2021-2031

- 8.1 Overview

- 8.2 Warehousing and Distribution

- 8.3 Transportation Management

- 8.4 Aftermarket Logistics

- 8.5 Others

9. Contract Logistics Market - Revenue Analysis (USD Million) - By End-Users, 2021-2031

- 9.1 Overview

- 9.2 Retail and E-commerce

- 9.3 Automotive

- 9.4 Industrial and Manufacturing

- 9.5 Pharma and Healthcare

- 9.6 Consumer Goods and Electronics

- 9.7 Aerospace and Defense

- 9.8 Others

10. Contract Logistics Market - Revenue Analysis (USD Million), 2021-2031 - Geographical Analysis

- 10.1 North America

- 10.1.1 North America Contract Logistics Market Overview

- 10.1.2 North America Contract Logistics Market Revenue and Forecasts to 2031

- 10.1.3 North America Contract Logistics Market Revenue and Forecasts and Analysis - By Type

- 10.1.4 North America Contract Logistics Market Revenue and Forecasts and Analysis - By Service Type

- 10.1.5 North America Contract Logistics Market Revenue and Forecasts and Analysis - By End-Users

- 10.1.6 North America Contract Logistics Market Revenue and Forecasts and Analysis - By Countries

- 10.1.6.1 United States Contract Logistics Market

- 10.1.6.1.1 United States Contract Logistics Market, by Type

- 10.1.6.1.2 United States Contract Logistics Market, by Service Type

- 10.1.6.1.3 United States Contract Logistics Market, by End-Users

- 10.1.6.2 Canada Contract Logistics Market

- 10.1.6.2.1 Canada Contract Logistics Market, by Type

- 10.1.6.2.2 Canada Contract Logistics Market, by Service Type

- 10.1.6.2.3 Canada Contract Logistics Market, by End-Users

- 10.1.6.3 Mexico Contract Logistics Market

- 10.1.6.3.1 Mexico Contract Logistics Market, by Type

- 10.1.6.3.2 Mexico Contract Logistics Market, by Service Type

- 10.1.6.3.3 Mexico Contract Logistics Market, by End-Users

- 10.1.6.1 United States Contract Logistics Market

- 10.2 Europe

- 10.2.1 Germany

- 10.2.2 France

- 10.2.3 Italy

- 10.2.4 United Kingdom

- 10.2.5 Russia

- 10.2.6 Poland

- 10.2.7 Rest of Europe

- 10.3 Asia-Pacific

- 10.3.1 Australia

- 10.3.2 China

- 10.3.3 India

- 10.3.4 Japan

- 10.3.5 South Korea

- 10.3.6 Rest of Asia-Pacific

- 10.4 Middle East and Africa

- 10.4.1 South Africa

- 10.4.2 Saudi Arabia

- 10.4.3 U.A.E

- 10.4.4 Rest of Middle East and Africa

- 10.5 South and Central America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Rest of South and Central America

11. Strategic Initiatives by Key Players

- 11.1 Mergers and Acquisitions

- 11.2 Agreements, Collaborations, Joint Ventures

- 11.3 New Product Launches

- 11.4 Expansions and Other Strategic Developments

12. Competitive Landscape

- 12.1 Company Benchmarking of Key Players

- 12.1.1 By Type

- 12.1.2 By Service Type

- 12.1.3 By End-Users

- 12.2 Company Market Share Analysis, 2024

- 12.3 Market Concentration

13. Contract Logistics Market - Key Company Profiles

- 13.1 Deutsche Post AG

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Market Initiatives/Developments

- 13.2 FedEx Corp

- 13.3 GXO Logistics Inc

- 13.4 United Parcel Service Inc

- 13.5 Nippon Express Co Ltd

- 13.6 GEODIS SA

- 13.7 Ryder System Inc

- 13.8 CMA CGM SA

- 13.9 DSV AS

- 13.10 Kuehne + Nagel International AG

14. Appendix

- 14.1 Glossary

- 14.2 About The Insight Partners

- 14.3 Market Intelligence Cloud