|

|

市場調査レポート

商品コード

1715229

欧州の炭酸飲料市場の予測 (2031年まで) - 地域別分析 (フレーバーの種類別、カテゴリー別、包装の種類別、エンドユーザー別)Europe Carbonated Soft Drinks Market Forecast to 2031 - Regional Analysis - by Flavor Type (Cola, Orange, Lemonade, Ginger, and Others), Category (Sugar-free and Conventional), Packaging Type (Bottles and Cans), and End User (On-Trade and Off-Trade) |

||||||

|

|||||||

| 欧州の炭酸飲料市場の予測 (2031年まで) - 地域別分析 (フレーバーの種類別、カテゴリー別、包装の種類別、エンドユーザー別) |

|

出版日: 2025年02月11日

発行: The Insight Partners

ページ情報: 英文 109 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の炭酸飲料市場は、2023年に671億2,378万米ドルと評価され、2031年には991億2,867万米ドルに達すると予測され、2023年から2031年までのCAGRは5.0%と推定されます。

主要企業による戦略的イニシアチブの高まりが、欧州の炭酸飲料市場を牽引

飲料メーカーは、消費者の需要の変化に対応するため、製品の多様化と技術革新に多額の投資を行っています。これには、幅広い消費者にアピールするための新しいフレーバー、配合、包装オプションの導入が含まれます。健康志向の消費者に対応するために低糖質やゼロカロリーの商品を発売したり、冒険好きな味覚蕾の興味を引くためにエキゾチックでユニークなフレーバーを導入したりと、戦略的な製品イニシアティブが市場の拡大と差別化を促進しています。さらに、魅力的な物語を創り出し、複数のプラットフォームで消費者を惹きつけるマーケティング戦略やブランディング戦略も重視されるようになっています。飲料メーカーは、ソーシャルメディア、インフルエンサーとのパートナーシップ、体験型マーケティング・キャンペーンを活用して、ブランド認知を高め、消費者のロイヤルティを育み、製品採用を促進しています。ターゲット層と共鳴する、本物で親近感のあるブランドストーリーを構築することで、企業は市場での地位を強化し、長期的な持続的成長を促進することができます。さらに、戦略的イニシアチブは、製品やマーケティング努力にとどまらず、持続可能性や企業責任に関するイニシアチブをも含んでいます。環境問題に対する消費者の意識と関心が高まる中、飲料メーカーは、包装の革新、節水への取り組み、カーボンフットプリントの削減戦略など、サプライチェーン全体で持続可能性を実践しています。こうした取り組みは消費者の価値観に合致しており、マーケットプレースにおけるブランドの差別化と競合優位性に貢献しています。

戦略的パートナーシップやコラボレーションも、炭酸飲料市場の革新と拡大を促進しています。飲料会社は、他のブランド、テクノロジー企業、新興企業と提携し、補完的な専門知識を活用し、新しいエンドユーザーにアクセスし、革新的な製品を共同開発しています。例えば、2022年2月、コカ・コーラは新しい世界・イノベーション・プラットフォーム「コカ・コーラ・クリエーションズ」と初の限定商品「コカ・コーラ・スターライト」を発売しました。さらに、2024年4月、マイクロソフト・コーポレーションとザコカ・コーラカンパニーは、コカ・コーラのコア・テクノロジー戦略をシステム全体で整合させ、最先端テクノロジーの導入を可能にし、イノベーションと生産性を世界に促進するための5年間の戦略的パートナーシップを発表しました。このパートナーシップの一環として、コカ・コーラは、マイクロソフトのクラウドとそのジェネレーティブ人工知能(AI)機能に11億米ドルのコミットメントを行いました。この提携は、コカ・コーラが世界に推奨する戦略的クラウドおよびAIプラットフォームとしてのマイクロソフト・クラウドに支えられた、コカ・コーラの継続的なテクノロジー変革を強調するものです。有名インフルエンサーとのコラボレーションによる限定フレーバーの発売、先進技術の統合、飲料宅配サービスとの提携など、提携は市場の成長を促進し、収益創出の新たな機会を引き出しています。

欧州の炭酸飲料市場の概要

欧州の炭酸飲料市場は、多様な製品と消費者の嗜好の変化を特徴としています。消費者の健康意識が高まっているにもかかわらず、炭酸飲料は依然として欧州の文化や消費習慣に深く根付いています。多くの欧州諸国では、特に社交の場、食事、祝賀の際に炭酸飲料を楽しむ伝統が長年続いています。最も多く飲まれているブランドはコカ・コーラとペプシで、定番のソーダ、レモンライム、オレンジなど、さまざまなフレーバーを提供しています。さらに、コカ・コーラなどの主要ブランドは、ダイエット飲料や糖分ゼロ飲料の種類を増やすことで、欧州の消費者に対応しています。このような多様性は、欧州大陸のさまざまな嗜好にアピールし、需要の持続に寄与しています。さらに、オランダ統計局(CBS)によると、アイルランド、デンマーク、オランダ、オーストリア、ベルギーといった国々は、一人当たりの所得が最も高いです。所得が上がると、消費者はプレミアム飲料に使える可処分所得が増えることが多いです。この購買力の増加により、消費者は炭酸飲料をより頻繁に楽しむことができるようになり、販売量の増加に貢献します。

可処分所得の増加は、ライフスタイルや消費習慣の変化につながります。消費者は、レストランで外食したり、炭酸飲料が手軽に手に入るコンビニエンスストアで飲料を購入したりする傾向が強まるかもしれません。このような簡便消費へのシフトは、これらの飲料の需要をさらに押し上げます。同地域の企業は、消費者のニーズや嗜好の変化に対応するために絶えず技術革新を行っており、市場の活力と競争力を維持しています。

欧州の炭酸飲料市場の収益と2031年までの予測(金額)

欧州の炭酸飲料市場のセグメンテーション

欧州の炭酸飲料市場は、フレーバーの種類、カテゴリー、包装の種類、エンドユーザー、国に分類されます。

フレーバーの種類別では、欧州の炭酸飲料市場はコーラ、オレンジ、レモネード、ジンジャー、その他に区分されます。コーラセグメントは2023年に欧州の炭酸飲料市場で最大のシェアを占めました。

カテゴリー別では、欧州の炭酸飲料市場は無糖と従来型に二分されます。従来型セグメントが2023年に欧州の炭酸飲料市場でより大きなシェアを占めました。

包装の種類別では、欧州の炭酸飲料市場はボトルと缶に二分されます。2023年の欧州の炭酸飲料市場は、ボトル市場がより大きなシェアを占めています。

エンドユーザー別では、欧州の炭酸飲料市場はオントレードとオフトレードに分類されます。2023年の欧州の炭酸飲料市場シェアはオントレード部門が大きいです。

国別では、欧州の炭酸飲料市場はドイツ、フランス、イタリア、英国、スペイン、スウェーデン、オランダ、その他欧州に分類されます。その他欧州は、2023年の欧州の炭酸飲料市場シェアを独占しました。

Three Cents Co、The Coca-Cola Co、PepsiCo Inc、Red Bull、Fevertree Drinks Plc、Monster Beverage Corp、Britvic Plc、Keurig Dr Pepper Inc、Refresco Group、Asahi Group Holdings Ltdは、欧州の炭酸飲料市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 欧州の炭酸飲料市場の情勢

- 概観

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 欧州の炭酸飲料市場:主な市場力学

- 市場促進要因

- ミレニアル世代とZ世代における炭酸飲料消費の増加

- 主要企業による戦略的イニシアチブの高まり

- 市場抑制要因

- 炭酸飲料の健康への悪影響

- 市場機会

- 無糖・ゼロカロリー炭酸飲料への嗜好の高まり

- 今後の動向

- プレミアム炭酸飲料への需要の高まり

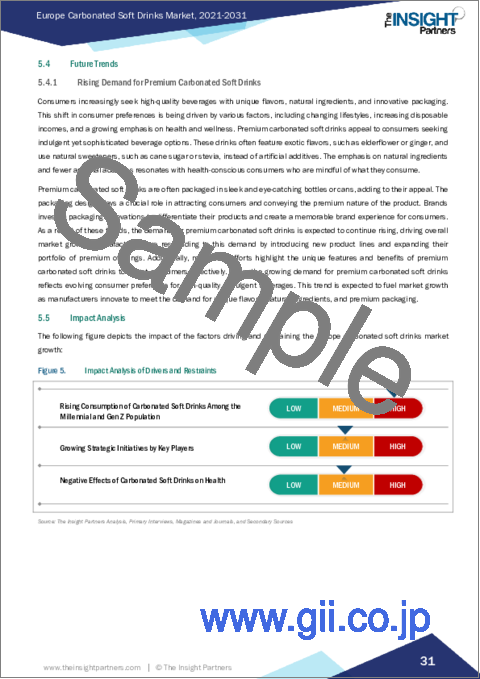

- 影響分析

第6章 炭酸飲料:欧州市場の分析

- 欧州の炭酸飲料市場の収益 (2021~2031年)

- 欧州の炭酸飲料市場の予測・分析

第7章 欧州の炭酸飲料市場の分析:フレーバーの種類別

- コーラ

- オレンジ

- レモネード

- ジンジャー

- その他

第8章 欧州の炭酸飲料市場の分析:カテゴリー別

- 無糖

- 従来型

第9章 欧州の炭酸飲料市場の分析:包装の種類別

- ボトル

- 缶

第10章 欧州の炭酸飲料市場の分析:エンドユーザー別

- オントレード

- オフトレード

第11章 欧州の炭酸飲料市場:国別分析

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- スウェーデン

- オランダ

- その他欧州

第12章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第13章 業界情勢

- 概要

- 市場イニシアティブ

- 企業合併・買収 (M&A)

第14章 企業プロファイル

- Three Cents Co

- The Coca-Cola Co

- PepsiCo Inc

- Red Bull

- Fevertree Drinks Plc

- Monster Beverage Corp

- Britvic Plc

- Keurig Dr Pepper Inc

- Refresco Group

- Asahi Group Holdings Ltd

第15章 企業概要・付録

List Of Tables

- Table 1. Europe Carbonated Soft Drinks Market Segmentation

- Table 2. List of Vendors

- Table 3. Europe Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Table 4. Europe Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by Flavor Type

- Table 5. Europe Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by Category

- Table 6. Europe Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by Packaging Type

- Table 7. Europe Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

- Table 8. Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by Country

- Table 9. Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 10. Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 11. Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 12. Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 13. France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by Flavor Type

- Table 14. France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 15. France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 16. France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

- Table 17. Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 18. Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 19. Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 20. Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 21. UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 22. UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 23. UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 24. UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 25. Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 26. Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 27. Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 28. Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 29. Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 30. Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 31. Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 32. Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 33. Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 34. Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 35. Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 36. Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

- Table 37. Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Flavor Type

- Table 38. Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Category

- Table 39. Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by Packaging Type

- Table 40. Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion) - by End User

List Of Figures

- Figure 1. Europe Carbonated Soft Drinks Market Segmentation, by Country

- Figure 2. Carbonated Soft Drinks Market-Porter's Analysis

- Figure 3. Ecosystem: Europe Carbonated Soft Drinks Market

- Figure 4. Europe Carbonated Soft Drinks Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Europe Carbonated Soft Drinks Market Revenue (US$ Billion), 2021-2031

- Figure 7. Europe Carbonated Soft Drinks Market Share (%) - by Flavor Type (2023 and 2031)

- Figure 8. Cola: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 9. Orange: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 10. Lemonade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 11. Ginger: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 12. Others: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 13. Europe Carbonated Soft Drinks Market Share (%) - by Category (2023 and 2031)

- Figure 14. Sugar-free: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 15. Conventional: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 16. Europe Carbonated Soft Drinks Market Share (%) - by Packaging Type (2023 and 2031)

- Figure 17. Bottles: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 18. Cans: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 19. Europe Carbonated Soft Drinks Market Share (%) - by End User (2023 and 2031)

- Figure 20. On-Trade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 21. Off-Trade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 22. Europe: Carbonated Soft Drinks Market Revenue, by Key Countries, (2023) (US$ Bn)

- Figure 23. Europe: Carbonated Soft Drinks Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 24. Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 25. France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 26. Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 27. UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 28. Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 29. Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 30. Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 31. Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031(US$ Billion)

- Figure 32. Heat Map Analysis by Key Players

- Figure 33. Company Positioning & Concentration

The Europe carbonated soft drinks market was valued at US$ 67,123.78 million in 2023 and is expected to reach US$ 99,128.67 million by 2031; it is estimated to register a CAGR of 5.0% from 2023 to 2031.

Growing Strategic Initiatives by Key Players Drive Europe Carbonated Soft Drinks Market

Beverage companies are investing heavily in product diversification and innovation to meet the changing demands of consumers. This includes introducing new flavors, formulations, and packaging options to appeal to a broader audience. Whether it's launching low-sugar or zero-calorie variants to cater to health-conscious consumers or introducing exotic and unique flavors to capture the interest of adventurous taste buds, strategic product initiatives are driving market expansion and differentiation. In addition, there is a growing emphasis on marketing and branding strategies to create compelling narratives and engage consumers on multiple platforms. Beverage companies leverage social media, influencer partnerships, and experiential marketing campaigns to build brand awareness, foster consumer loyalty, and drive product adoption. By crafting authentic and relatable brand stories that resonate with target demographics, companies can strengthen their market position and drive sustained growth over the long term. Moreover, strategic initiatives extend beyond product and marketing efforts to include sustainability and corporate responsibility initiatives. With increasing consumer awareness and concern about environmental issues, beverage companies are implementing sustainability practices throughout their supply chains, including packaging innovations, water conservation efforts, and carbon footprint reduction strategies. These initiatives align with consumer values and contribute to brand differentiation and competitive advantage in the marketplace.

Strategic partnerships and collaborations are also driving innovation and expansion within the carbonated soft drinks market. Beverage companies are partnering with other brands, technology firms, and startups to leverage complementary expertise, access new end users, and co-create innovative products. For instance, in February 2022, Coca-Cola launched its new global innovation platform, Coca-Cola Creations, along with its first limited-edition product, Coca-Cola Starlight. In addition, in April 2024, Microsoft Corp and The Coca-Cola Company announced a five-year strategic partnership to align Coca-Cola's core technology strategy systemwide, enable the adoption of leading-edge technology, and foster innovation and productivity globally. As part of the partnership, Coca-Cola has made a US$ 1.1 billion commitment to the Microsoft Cloud and its generative artificial intelligence (AI) capabilities. The collaboration underscores Coca-Cola's ongoing technology transformation, underpinned by the Microsoft Cloud as Coca-Cola's globally preferred and strategic cloud and AI platform. Whether it's collaborating with celebrity influencers to launch limited-edition flavors, advanced technology integration, or partnering with beverage delivery services, alliances are driving market growth and unlocking new opportunities for revenue generation.

Europe Carbonated Soft Drinks Market Overview

The carbonated soft drinks market in Europe is characterized by a diverse range of products and shifting consumer preferences. Despite increasing health consciousness among consumers, carbonated soft drinks remain deeply ingrained in European culture and consumption habits. Many European countries have long-standing traditions of enjoying fizzy beverages, particularly during social gatherings, meals, and celebrations. Among the most extensively consumed brands are Coca-Cola and Pepsi, which offer a range of flavors, including classic soda, lemon-lime, and orange. Furthermore, major brands such as Coca-Cola cater to European consumers by offering a wider range of diet and zero-sugar drinks. This variety appeals to different tastes and preferences across the continent, contributing to sustained demand. In addition, according to the Statistics Netherlands (CBS), countries such as Ireland, Denmark, the Netherlands, Austria, and Belgium have the highest per capita income. As income rises, consumers often have more disposable income to spend on premium beverages. This increased purchasing power allows consumers to indulge in carbonated soft drinks more frequently, contributing to higher sales volumes.

Higher disposable incomes can lead to changes in lifestyle and consumption habits. Consumers may be more inclined to dine out at restaurants or purchase beverages from convenience stores, where carbonated soft drinks are often readily available. This shift toward convenience consumption further boosts demand for these beverages. Companies in the region are continuously innovating to meet the changing needs and preferences of consumers, ensuring the market remains dynamic and competitive.

Europe Carbonated Soft Drinks Market Revenue and Forecast to 2031 (US$ Million)

Europe Carbonated Soft Drinks Market Segmentation

The Europe carbonated soft drinks market is categorized into flavor type, category, packaging type, end user, and country.

Based on flavor type, the Europe carbonated soft drinks market is segmented into cola, orange, lemonade, ginger, and others. The cola segment held the largest Europe carbonated soft drinks market share in 2023.

In terms of category, the Europe carbonated soft drinks market is bifurcated into sugar-free and conventional. The conventional segment held a larger Europe carbonated soft drinks market share in 2023.

By packaging type, the Europe carbonated soft drinks market is bifurcated into bottles and cans. The bottles segment held a larger Europe carbonated soft drinks market share in 2023.

Based on end user, the Europe carbonated soft drinks market is categorized into on-trade and off-trade. The on-trade segment held a larger Europe carbonated soft drinks market share in 2023.

Based on country, the Europe carbonated soft drinks market is categorized into Germany, France, Italy, the UK, Spain, Sweden, the Netherlands, and the Rest of Europe. The Rest of Europe dominated the Europe carbonated soft drinks market share in 2023.

Three Cents Co, The Coca-Cola Co, PepsiCo Inc, Red Bull, Fevertree Drinks Plc, Monster Beverage Corp, Britvic Plc, Keurig Dr Pepper Inc, Refresco Group, and Asahi Group Holdings Ltd are some of the leading companies operating in the Europe carbonated soft drinks market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Europe Carbonated Soft Drinks Market Landscape

- 4.1 Overview

- 4.2 Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. Europe Carbonated Soft Drinks Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Consumption of Carbonated Soft Drinks Among the Millennial and Gen Z Population

- 5.1.2 Growing Strategic Initiatives by Key Players

- 5.2 Market Restraints

- 5.2.1 Negative Effects of Carbonated Soft Drinks on Health

- 5.3 Market Opportunities

- 5.3.1 Increasing Preference for Sugar-Free and Zero-Calorie Carbonated Soft Drinks

- 5.4 Future Trends

- 5.4.1 Rising Demand for Premium Carbonated Soft Drinks

- 5.5 Impact Analysis

6. Carbonated Soft Drinks Market - Europe Market Analysis

- 6.1 Europe Carbonated Soft Drinks Market Revenue (US$ Billion), 2021-2031

- 6.2 Europe Carbonated Soft Drinks Market Forecast Analysis

7. Europe Carbonated Soft Drinks Market Analysis - by Flavor Type

- 7.1 Cola

- 7.1.1 Overview

- 7.1.2 Cola: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.2 Orange

- 7.2.1 Overview

- 7.2.2 Orange: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.3 Lemonade

- 7.3.1 Overview

- 7.3.2 Lemonade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.4 Ginger

- 7.4.1 Overview

- 7.4.2 Ginger: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

8. Europe Carbonated Soft Drinks Market Analysis - by Category

- 8.1 Sugar-free

- 8.1.1 Overview

- 8.1.2 Sugar-free: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 8.2 Conventional

- 8.2.1 Overview

- 8.2.2 Conventional: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

9. Europe Carbonated Soft Drinks Market Analysis - by Packaging Type

- 9.1 Bottles

- 9.1.1 Overview

- 9.1.2 Bottles: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 9.2 Cans

- 9.2.1 Overview

- 9.2.2 Cans: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

10. Europe Carbonated Soft Drinks Market Analysis - by End User

- 10.1 On-Trade

- 10.1.1 Overview

- 10.1.2 On-Trade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.2 Off-Trade

- 10.2.1 Overview

- 10.2.2 Off-Trade: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

11. Europe Carbonated Soft Drinks Market - Country Analysis

- 11.1 Europe

- 11.1.1 Europe: Carbonated Soft Drinks Market Breakdown, by Key Countries, 2023 and 2031 (%)

- 11.1.1.1 Europe: Carbonated Soft Drinks Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 Germany: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.2.1 Germany: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.2.2 Germany: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.2.3 Germany: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.2.4 Germany: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.3 France: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.3.1 France: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.3.2 France: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.3.3 France: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.3.4 France: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.4 Italy: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.4.1 Italy: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.4.2 Italy: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.4.3 Italy: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.4.4 Italy: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.5 UK: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.5.1 UK: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.5.2 UK: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.5.3 UK: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.5.4 UK: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.6 Spain: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.6.1 Spain: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.6.2 Spain: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.6.3 Spain: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.6.4 Spain: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.7 Sweden: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.7.1 Sweden: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.7.2 Sweden: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.7.3 Sweden: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.7.4 Sweden: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.8 Netherlands: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.8.1 Netherlands: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.8.2 Netherlands: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.8.3 Netherlands: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.8.4 Netherlands: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1.9 Rest of Europe: Carbonated Soft Drinks Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.9.1 Rest of Europe: Carbonated Soft Drinks Market Breakdown, by Flavor Type

- 11.1.1.9.2 Rest of Europe: Carbonated Soft Drinks Market Breakdown, by Category

- 11.1.1.9.3 Rest of Europe: Carbonated Soft Drinks Market Breakdown, by Packaging Type

- 11.1.1.9.4 Rest of Europe: Carbonated Soft Drinks Market Breakdown, by End User

- 11.1.1 Europe: Carbonated Soft Drinks Market Breakdown, by Key Countries, 2023 and 2031 (%)

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Merger and Acquisition

14. Company Profiles

- 14.1 Three Cents Co

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 The Coca-Cola Co

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 PepsiCo Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Red Bull

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Fevertree Drinks Plc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Monster Beverage Corp

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Britvic Plc

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Keurig Dr Pepper Inc

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Refresco Group

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Asahi Group Holdings Ltd

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners