|

|

市場調査レポート

商品コード

1481945

飼料種子の北米市場:地域別分析 - タイプ別、カテゴリー別、家畜別、予測(~2030年)North America Forage Seeds Market Forecast to 2030 - Regional Analysis - by Type, Category (Organic and Conventional), and Livestock (Ruminants, Poultry, Swine, and Others) |

||||||

|

|||||||

| 飼料種子の北米市場:地域別分析 - タイプ別、カテゴリー別、家畜別、予測(~2030年) |

|

出版日: 2024年03月04日

発行: The Insight Partners

ページ情報: 英文 98 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の飼料種子の市場規模は、2022年に56億7,304万米ドルに達し、2022~2030年にかけてCAGR 5.0%で成長し、2030年には84億1,187万米ドルに達すると予測されています。

家畜生産の増加が北米の飼料種子市場を牽引

工業的畜産は大きな変貌を遂げ、肉に基づく製品や乳製品の需要が増加しています。畜産物は、人間の食事に含まれるエネルギーの16%とタンパク質の34%を占めています。また、畜産は食料生産額の19%、世界の農業額の30%を占めています。畜産物の需要は、ライフスタイルや食の嗜好の変化、都市化の進展、所得の増加、世界人口の急増によって牽引されています。家畜需要の急増に伴い、タンパク質が豊富な肉製品の消費が急増しています。国連食糧農業機関(FAO)によると、世界の肉タンパク質消費量は2030年までに14%増加すると予測されています。さらに、経済協力開発機構(OECD)とFAOの報告書によれば、世界の牛乳生産量は2020~2029年にかけて毎年1.6%増加し、2029年には9億9,700万トンに達すると予想されています。このように、食肉などの畜産物の消費量の増加や生乳生産量の増加は、メーカーが家畜の餌となる良質な飼料作物の供給に注力するよう促しています。畜産量の増加は、より良い飼料作物への需要を生み出す可能性が高いです。飼料作物に対する需要の増加は、より質の高い飼料種子によってのみ支えられます。家畜の栄養不足は、家畜の成長速度、健康、幸福を維持する飼料を与えることで解決できます。人々の健康に対する意識が高まっているため、農薬を含まない有機食品が好まれるようになっています。このように、需要の急増に伴い、北米全域で健康な家畜の生産が増加しており、飼料種子市場をさらに牽引しています。

北米の飼料種子市場の概要

北米は、飼料としての飼料需要の増加、食肉消費量、気象条件、価格上昇にもかかわらず畜産物の消費量の増加、確立された動物飼料、農業産業のため、飼料種子の重要な市場の一つです。米国、カナダ、メキシコでは、タンパク質が豊富で健康的な製品を選ぶ個人の増加、可処分所得の増加、ライフスタイルの変化、食事パターンが、タンパク質が豊富な食肉需要の急増に寄与しています。このように、肉製品の消費の増加に伴い、家畜飼料の需要が増加し、飼料種子市場をさらに牽引しています。この地域は、地域全体で最大の動物飼料生産者の1つを占めています。Alltech Globalレポートによると、2020年、この地域は2億5,400万トン以上の動物飼料製品を生産しました。北米における動物飼料の大量生産と、特に食肉や乳製品に関する食品安全への懸念の高まりが、同地域におけるフォレージなどの栄養価の高い動物飼料の消費の増加につながっています。

北米の飼料種子市場の収益と2030年までの予測(100万米ドル)

北米の飼料種子市場のセグメンテーション

北米の飼料種子市場は、タイプ、カテゴリー、家畜、国によって区分されます。タイプ別では、北米の飼料用種子市場は、アルファルファ、クローバー、ライグラス、ティモシー、ソルガム、ブローム、バーズフットトレフォイル、ササゲ、メドウフェスク、その他に区分されます。

カテゴリーに基づいて、有機と従来型に二分されます。2022年の市場シェアは従来型区分の方が大きいです。

家畜に基づくと、北米の飼料種子市場は反芻動物、家禽、豚、その他に区分されます。反芻動物セグメントが2022年に最大の市場シェアを占めました。

国別では、北米の飼料種子市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米の飼料種子市場シェアを独占しました。

UPL Ltd、DLF Seeds AS、Corteva Inc、S&W Seed Co、MAS Seeds SA、Syngenta AG、Deutsche Saatveredelung AG、Allied Seeds LLC.は、北米の飼料種子市場で事業を展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

- 制限と前提条件

第4章 北米の飼料種子の市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- 流通業者または供給業者

- エンドユーザー

第5章 北米の飼料種子市場:主要市場力学

- 市場促進要因

- 家畜生産の増加

- 戦略的開発イニシアティブ

- 市場抑制要因

- 新興国市場の未組織化

- 市場機会

- 種子遺伝学の技術改良

- 今後の動向

- 有機飼料への嗜好の高まり

- 促進要因と抑制要因の影響分析

第6章 飼料種子市場:北米の市場分析

- 飼料種子市場の収益

- 飼料種子市場の予測と分析(2020~2030年)

第7章 北米の飼料種子市場の収益分析:タイプ別

- アルファルファ

- クローバー

- ライグラス

- ティモシー

- ソルガム

- ブローム

- バーズフットトレフォイル

- ササゲ

- メドウフェスク

第8章 北米の飼料種子市場の収益分析:カテゴリー別

- 有機

- 従来型

第9章 北米の飼料種子市場の収益分析:家畜別

- 反芻家畜

- 家禽

- 豚

- その他

第10章 北米の飼料種子市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 産業情勢

- 合併と買収

- パートナーシップ

第12章 競合情勢

- 主要プレーヤー別ヒートマップ分析

- 企業のポジショニングと集中度

第13章 企業プロファイル

- UPL Ltd

- DLF Seeds AS

- Corteva Inc

- S&W Seed Co

- MAS Seeds SA

- Syngenta AG

- Deutsche Saatveredelung AG

- Allied Seed LLC

第14章 付録

List Of Tables

- Table 1. North America Forage Seeds Market Segmentation

- Table 2. North America Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- Table 3. US Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 4. US Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Category

- Table 5. US Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 6. Canada Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 7. Canada Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Category

- Table 8. Canada Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 9. Mexico Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 10. Mexico Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Category

- Table 11. Mexico Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

List Of Figures

- Figure 1. North America Forage Seeds Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis: Forage Seeds Market

- Figure 3. Ecosystem: North America Forage Seeds Market

- Figure 4. North America Forage Seeds Market - Key Industry Dynamics

- Figure 5. Global Meat Production by Livestock Type (2001-2021)

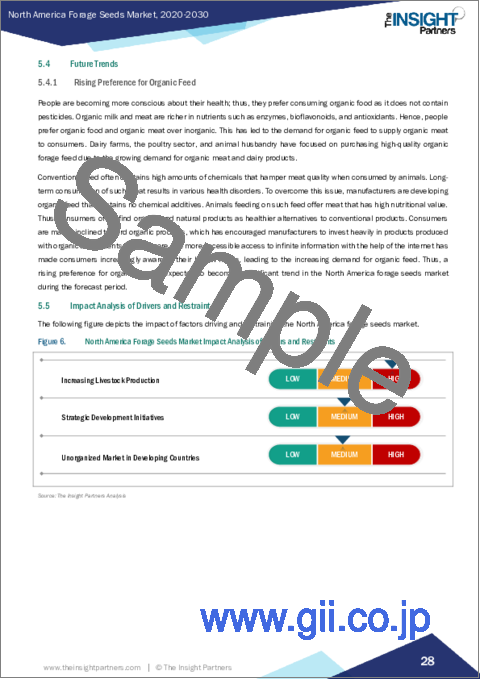

- Figure 6. North America Forage Seeds Market Impact Analysis of Drivers and Restraints

- Figure 7. North America Forage Seeds Market Revenue (US$ Million), 2020 - 2030

- Figure 8. North America Forage Seeds Market Share (%) - Type, 2022 and 2030

- Figure 9. Alfalfa: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Clover: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 11. White: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Red: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Hybrid: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Other Clovers: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Annual Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Perennial Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Italian Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Hybrid Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Timothy: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Sorghum: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Brome: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Birdsfoot Trefoil: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Cowpea: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Meadow Fescue: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Others: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 27. North America Forage Seeds Market Revenue Share, By Category (2022 and 2030)

- Figure 28. Organic: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Conventional: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 30. North America Forage Seeds Market Revenue Share, By Livestock (2022 and 2030)

- Figure 31. Ruminants: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Poultry: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Swine: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 34. Others: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- Figure 35. North America Forage Seeds Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 36. North America Forage Seeds Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 37. US Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 38. Canada Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 39. Mexico Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 40. Company Positioning & Concentration

- Figure 41. Heat Map Analysis by Key Players

The North America forage seeds market was valued at US$ 5,673.04 million in 2022 and is expected to reach US$ 8,411.87 million by 2030; it is estimated to grow at a CAGR of 5.0% from 2022 to 2030.

Increasing Livestock Production Fuel the North America Forage Seeds Market

Industrial livestock production has undergone a significant transformation, increasing demand for meat-based products and dairy products. Livestock products account for 16% of energy and 34% of the protein in human diets. Livestock production also accounts for ~19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. With burgeoning livestock demand, the consumption of protein-rich meat products is surging. According to the Food and Agriculture Organization (FAO), worldwide meat protein consumption is predicted to increase by 14% by 2030. Additionally, world milk production is expected to rise by 1.6% annually between 2020 and 2029 and reach 997 million metric tons in 2029, according to a report by the Organization for Economic Co-operation and Development (OECD) and FAO. Thus, the increasing consumption of livestock products such as meat and increasing milk production has encouraged manufacturers to focus on providing good quality forage crops for feeding livestock. The growth in livestock production is likely to create a demand for better forage crops, as people are highly concerned about the quality of meat they consume. The growth in the demand for forage crops can only be supported with better-quality forage seeds. Nutrient deficiencies in livestock can be resolved by providing them with forage feed that maintains the growth rate of livestock, their health, and well-being. People are becoming more conscious about their health, and thus, preference is given to organic food, as it does not contain pesticides. Thus, with surging demand, the production of healthy livestock is increasing across the North America, further driving the forage seeds market.

North America Forage Seeds Market Overview

North America is one of the significant markets for forage seeds due to the increased demand for forage as feed, meat consumption, and weather conditions, as well as rising consumption of livestock products despite the rising prices, well-established animal feed, and agriculture industry. An increasing number of individuals opting for protein-rich and healthier products, growing disposable income, lifestyle changes, and eating patterns contribute to a surge in demand for protein-rich meat in the US, Canada, and Mexico. Thus, with the rising consumption of meat products, the demand for animal feed increases and further drives the market for forage seeds. The region accounts for one of the largest animal feed producers across the region. As per the report of Alltech Global, in 2020, the region produced more than 254 million metric tons of animal feed products. The mass production of animal feed in North America and the rising food safety concerns, especially about meat and dairy products, have led to the increased consumption of nutritional animal feed such as forages in the region.

North America Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

North America Forage Seeds Market Segmentation

The North America forage seeds market is segmented based on type, category, livestock, and country. Based on type, the North America forage seeds market is segmented into alfalfa, clover, ryegrass, timothy, sorghum, brome, birdsfoot trefoil, cowpea, meadow fescue, and others. The alfalfa segment held the largest market share in 2022. The clover segment is further subsegmented into white, red, hybrid, and others. Additionally, the ryegrass segment is categorized into annual ryegrass, perennial ryegrass, Italian ryegrass, and hybrid ryegrass.

Based on category, the North America forage seeds market is bifurcated into organic and conventional. The conventional segment held a larger market share in 2022.

Based on livestock, the North America forage seeds market is segmented into ruminants, poultry, swine, and others. The ruminants segment held the largest market share in 2022.

Based on country, the North America forage seeds market is segmented into the US, Canada, and Mexico. The US dominated the North America forage seeds market share in 2022.

UPL Ltd, DLF Seeds AS, Corteva Inc, S&W Seed Co, MAS Seeds SA, Syngenta AG, Deutsche Saatveredelung AG, and Allied Seeds LLC. are some of the leading companies operating in the North America forage seeds market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

- 3.4 Limitations and Assumptions:

4. North America Forage Seeds Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.2.1 Pre-Planting Activities

- 4.3.2.2 Post-planting activities

- 4.3.3 Distributors or Suppliers

- 4.3.4 End User

5. North America Forage Seeds Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Livestock Production

- 5.1.2 Strategic Development Initiatives

- 5.2 Market Restraints

- 5.2.1 Unorganized Market in Developing Countries

- 5.3 Market Opportunities

- 5.3.1 Technological Improvement for Seed Genetics

- 5.4 Future Trends

- 5.4.1 Rising Preference for Organic Feed

- 5.5 Impact Analysis of Drivers and Restraint

6. Forage Seeds Market - North America Market Analysis

- 6.1 Forage Seeds Market Revenue (US$ Million)

- 6.2 Forage Seeds Market Forecast and Analysis (2020-2030)

7. North America Forage Seeds Market Analysis - Type

- 7.1 Alfalfa

- 7.1.1 Overview

- 7.1.2 Alfalfa: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Clover

- 7.2.1 Overview

- 7.2.2 Clover: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 White

- 7.2.3.1 Overview

- 7.2.3.2 White: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.4 Red

- 7.2.4.1 Overview

- 7.2.4.2 Red: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.5 Hybrid

- 7.2.5.1 Overview

- 7.2.5.2 Hybrid: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.6 Other Clovers

- 7.2.6.1 Overview

- 7.2.6.2 Other Clovers: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Ryegrass

- 7.3.1 Overview

- 7.3.2 Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.3 Annual Ryegrass

- 7.3.3.1 Overview

- 7.3.3.2 Annual Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.4 Perennial Ryegrass

- 7.3.4.1 Overview

- 7.3.4.2 Perennial Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.5 Italian Ryegrass

- 7.3.5.1 Overview

- 7.3.5.2 Italian Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.6 Hybrid Ryegrass

- 7.3.6.1 Overview

- 7.3.6.2 Hybrid Ryegrass: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Timothy

- 7.4.1 Overview

- 7.4.2 Timothy: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Sorghum

- 7.5.1 Overview

- 7.5.2 Sorghum: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.6 Brome

- 7.6.1 Overview

- 7.6.2 Brome: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.7 Birdsfoot Trefoil

- 7.7.1 Overview

- 7.7.2 Birdsfoot Trefoil: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.8 Cowpea

- 7.8.1 Overview

- 7.8.2 Cowpea: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.9 Meadow Fescue

- 7.9.1 Overview

- 7.9.2 Meadow Fescue: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 7.10 Others

- 7.10.1 Overview

- 7.10.2 Others: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

8. North America Forage Seeds Market Revenue Analysis - By Category

- 8.1 Overview

- 8.2 Organic

- 8.2.1 Overview

- 8.2.2 Organic: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 8.3 Conventional

- 8.3.1 Overview

- 8.3.2 Conventional: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

9. North America Forage Seeds Market Revenue Analysis - By Livestock

- 9.1 Overview

- 9.2 Ruminants

- 9.2.1 Overview

- 9.2.2 Ruminants: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Poultry

- 9.3.1 Overview

- 9.3.2 Poultry: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Swine

- 9.4.1 Overview

- 9.4.2 Swine: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: Forage Seeds Market Revenue and Forecast to 2030 (US$ Million)

10. North America Forage Seeds Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Forage Seeds Market Overview

- 10.1.2 North America Forage Seeds Market Revenue and Forecasts and Analysis - By Countries

- 10.1.2.1 North America Forage Seeds Market Breakdown by Country

- 10.1.2.2 US Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.2.1 US Forage Seeds Market Breakdown by Type

- 10.1.2.2.2 US Forage Seeds Market Breakdown by Category

- 10.1.2.2.3 US Forage Seeds Market Breakdown by Livestock

- 10.1.2.3 Canada Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.3.1 Canada Forage Seeds Market Breakdown by Type

- 10.1.2.3.2 Canada Forage Seeds Market Breakdown by Category

- 10.1.2.3.3 Canada Forage Seeds Market Breakdown by Livestock

- 10.1.2.4 Mexico Forage Seeds Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.2.4.1 Mexico Forage Seeds Market Breakdown by Type

- 10.1.2.4.2 Mexico Forage Seeds Market Breakdown by Category

- 10.1.2.4.3 Mexico Forage Seeds Market Breakdown by Livestock

11. Industry Landscape

- 11.1 Overview

- 11.2 Merger and Acquisition

- 11.3 Partnerships

12. Competitive Landscape

- 12.1 Heat Map Analysis By Key Players

- 12.2 Company Positioning & Concentration

13. Company Profiles

- 13.1 UPL Ltd

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 DLF Seeds AS

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Corteva Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 S&W Seed Co

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 MAS Seeds SA

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Syngenta AG

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Deutsche Saatveredelung AG

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Allied Seed LLC

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments