|

|

市場調査レポート

商品コード

1698616

固体電池市場:開発動向(2025年)Development Trends of Solid-State Battery Market 2025 |

||||||

|

|||||||

| 固体電池市場:開発動向(2025年) |

|

出版日: 2025年06月13日

発行: TrendForce

ページ情報: 英文 250 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

レポートの概要

固体電池(SSB)はエネルギー密度と安全性が高く、次世代のEV用電池技術として期待されています。現在、欧州、米国、日本、韓国、中国の関連企業はSSB技術を積極的にレイアウトしており、エンジニアリングの新たな進展を続けています。特に、トヨタ自動車、日産自動車、Samsung SDI などの世界の大手メーカーは、パイロット生産の段階に入り始めており、SSBの商業応用は絶えず前進しています。TrendForceは、世界の生産競争により、ASSBは2027年までにGWhレベルの量産に達すると予測しています。

調査範囲

当レポートでは、SSBの特性、主な材料と部品技術の進展、市場の現状と動向、各国の産業化の進展、主要企業の商業レイアウトなどから綿密な調査分析とサマリーを行い、SSB産業の市場開拓動向を洞察し、顧客の市場機会をより的確に把握します。

| 報告範囲 | 詳細 | |

|---|---|---|

市場セグメンテーション |

|

|

対象企業 |

| |

最近の動向:

- 2024年、日産とホンダが全固体電池(ASSB)のパイロット工場の建設を開始。同時にトヨタも、2024年9月にASSBの開発・生産計画が経済産業省から認定され、2026年から生産を開始する予定です。日本の野心は、2030年頃までにASSBの正式な商業利用を実現することです。

- Samsung SDIは、2022年にASSB生産のパイロットライン(Sライン)の開始を発表し、パイロットラインの建設を完了し、2023年に電気自動車メーカーにASSBサンプルの最初のバッチを納入しただけでなく、2024年にはSSBの供給を5つの潜在顧客に拡大した。現在、サンプルテストが進行中で、2027年に量産を達成する予定です。

- 中国政府は2024年以降、ASSBの研究開発資金を増額しました。2024年、中国は工業・情報化省およびその他の省が主導し、ASSBの研究開発を支援するために約60億人民元を投資する予定です。CATL、BYD、FAW、SAIC、WELION、Geelyの6社は、ASSBプロジェクトの基礎的な研究開発支援を政府から受ける予定です。目標は、2027年までに小規模車両搭載(数千台)を達成することです。一方、GAC、SAIC、Cheryなどの自動車メーカーは、2026年にASSB仕様の電気自動車を発売すると公言しています。

目次

第1章 サマリー:SSB業界の現状

- SSBの定義

- SSBの特性

- エネルギー密度

- 安全性

- 急速充電、サイクル寿命

- SSBの種類

- 半固体、全固体

- ポリマー、酸化物、硫化物

- SSBの製造プロセス

- バッテリーセル

- スタッキングと梱包

- SSB産業チェーンの形成

第2章 技術:SSBの主要材料とコンポーネントの技術的進歩

- カソード

- LCO

- NCA/NCM

- LFP/LMFP

- リチウムを豊富に含むマンガン系正極

- LNMO

- その他

- アノード

- グラファイト陽極

- Siベースアノード

- リチウム金属アノード

- リチウム合金陽極

- アノードフリー

- 固体電解質

- ポリマー

- 酸化物

- 硫化物

- ハロゲン化物

- その他

- セパレーター

- 集電装置

- バッテリーセルの製造

- カソード/アノード電極

- 電解液セパレーター

- セルの組立と仕上

- パック

第3章 市場:SSB業界の分析

- SSBのコスト分析

- SSBのコスト削減ルートと動向

- 市場需要予測

- 競合情勢

- 技術情勢

- 特許情勢

- SSBの市場の応用と動向

第4章 産業:SSBの工業化の現状と動向

- SSBの技術ロードマップ

- 材料

- バッテリーとその用途

- SSBの産業化の進展

- 世界

- 欧州と米国

- 日本

- 韓国

- 中国

- SSB産業化におけるボトルネック

- 材料

- 装置

- プロセス

- SSB産業チェーンの開発状況と動向

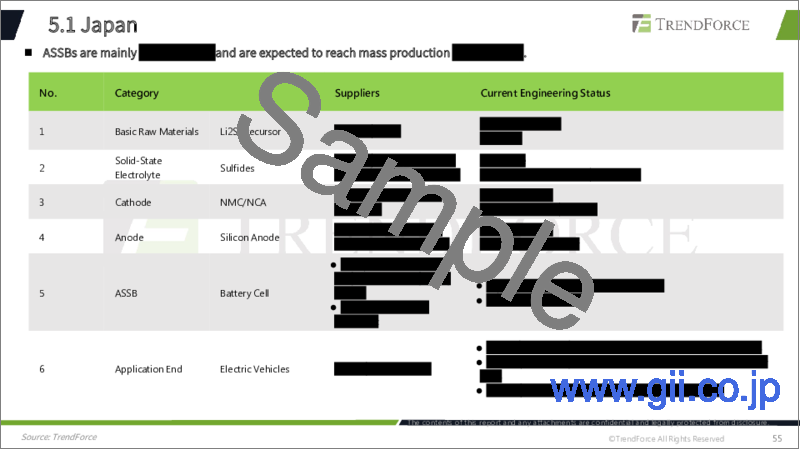

第5章 企業:主要企業における展開と商業化の分析

- 日本

- Toyota

- Nissan

- Honda

- Panasonic

- Idemitsu

- Hitachi Zosen

- Mitsui Kinzoku

- Maxell

- TDK

- 韓国

- Hyundai

- Samsung SDI

- LG Energy Solution

- SK on

- POSCO Holdings

- Solivis

- Solid Ionics

- Lotte Energy Materials

- 欧州・アメリカ

- Factorial

- Quantum Scape

- SES

- Solid Power

- Blue Solutions

- Solidion

- Ionic Storage Systems

- Basquevolt

- ilika

- 24M Technologies

- 中国

- CATL

- BYD

- Gotion

- EVE

- Svolt

- Ganfeng LiEnergy

- Welion

- Qingtao Energy

- 台湾

- ProLogium

Overview of the report:

Solid-state battery (SSB), with higher energy density and safety, is a potential next-generation EV battery technology. At present, relevant enterprises in Europe, the United States, Japan, South Korea and China are actively layout SSB technology, and continue to make new progress in engineering. In particular, the global leading manufacturers such as Toyota, Nissan and Samsung SDI have begun to enter the pilot production phase, and the commercial application of SSBs is constantly moving forward. TrendForce estimates that with the global production competition, ASSBs are expected to reach GWh level mass production by 2027.

Report Coverage:

In this report, we conduct in-depth research and analysis and summary from SSB characteristics, key materials and component technology progress, market status and trends, industrialization progress in various countries, and commercial layout of key enterprises, to gain insight into the development trend of SSB industry, and better grasp market opportunities for customers.

| Report coverage | Details | |

|---|---|---|

Market segments covered: |

|

|

Companies covered: |

|

|

Recent Developments:

- In 2024, Nissan and Honda began the construction of pilot factories of all solid-state batteries (ASSBs). Toyota, at the same time, the development and production plan of ASSBs was certified by the Ministry of Economy, Trade and Industry of Japan in September 2024, and plans to start production from 2026. Japans ambition is to realize the formal commercial application of ASSBs by around 2030;

- Samsung SDI has announced the initiation of the pilot line (S-line) for ASSB production in 2022, it has not only completed the construction of pilot line and delivered the first batch of ASSB samples to electric vehicle manufacturers in 2023, but also expanded the supply of SSBs to five potential customers in 2024. Currently, the sample test is under way and is scheduled to achieve mass production in 2027.

- Chinese government has increased R&D funding for ASSBs from 2024 onwards. In 2024, led by the Ministry of Industry and Information Technology and other ministries, China plans to invest around CNY 6 billion to support the R&D of ASSBs. Six companies-CATL, BYD, FAW, SAIC, WELION, and Geely-will receive foundational R&D support from the government for their ASSB projects. The goal is to achieve small-scale vehicle installation (thousands of vehicle units) by 2027. Meanwhile, GAC, SAIC, Chery and other auto manufacturers have publicly announced that they will launch electric models equipped with ASSB versions in 2026.

Table of Contents

1. Summary: Status of SSB Industry

- 1.1. Definition of SSBs

- 1.2. Properties of SSBs

- 1.2.1. Energy Density

- 1.2.2. Safety

- 1.2.3. Fast Charging, Cycle life

- 1.3. Types of SSBs

- 1.3.1. Semi-Solid State, All-Solid State

- 1.3.2. Polymer, Oxide, Sulfide

- 1.4. Manufacturing Processes of SSBs

- 1.4.1. Battery Cells

- 1.4.2. Stacking and Packing

- 1.5. Formation of SSB Industry Chain

2. Technology: Technical Advancement on Key Materials and Components of SSBs

- 2.1. Cathode

- 2.1.1. LCO

- 2.1.2. NCA/NCM

- 2.1.3. LFP/LMFP

- 2.1.4. Li-rich Mn-based cathode

- 2.1.5. LNMO

- 2.1.6. Others

- 2.2. Anode

- 2.2.1. Graphite Anode

- 2.2.2. Si-Based Anode

- 2.2.3. Li-Metal Anode

- 2.2.4. Lithium Alloy Anode

- 2.2.5. Anode-Free

- 2.3. Solid Electrolyte

- 2.3.1. Polymer

- 2.3.2. Oxide

- 2.3.3. Sulfide

- 2.3.4. Halide

- 2.3.5. Others

- 2.4. Separator

- 2.5. Current Collector

- 2.6. Manufacturing of Battery Cell

- 2.6.1. Cathode/Anode Electrode

- 2.6.2. Electrolyte Separator

- 2.6.3. Cell Assembly and Finishing

- 2.7. Pack

3. Market: Analysis on SSB Industry

- 3.1. Cost Analysis on SSB

- 3.1.1. Semi-SSB

- 3.1.2. Polymer-Based

- 3.1.3. Oxide-Based

- 3.1.4. Sulfide-Based

- 3.2. Cost Reduction Routes and Trends of SSB

- 3.2.1. Cathode

- 3.2.2. Anode

- 3.2.3. Electrolytes

- 3.2.4. Cells

- 3.3. Market Demand Forecast

- 3.3.1. Mid-to-long-term Outlook (~2035)

- 3.3.2. EV Market

- 3.3.3. ESS Market

- 3.3.4. Small SSB/Microbattery Market

- 3.3.5. Low-altitude Flight (eVTOL/UAM) Market

- 3.4. Competitive Landscape

- 3.4.1. Technology Landscape

- 3.4.2. Patent Landscape

- 3.5. Market Applications and Trends for SSBs

- 3.5.1. Current Applications

- 3.5.2. Application Trends

4. Industry: Current Status and Trends of Industrialization of SSB

- 4.1. Technology Roadmap of SSB

- 4.1.1. Materials

- 4.1.2. Batteries and Applications

- 4.2. Progress of Industrialization of SSB

- 4.2.1. Global

- 4.2.2. Europe & US

- 4.2.3. Japan

- 4.2.4. South Korea

- 4.2.5. China

- 4.3. Bottlenecks in SSB Industrialization

- 4.3.1. Materials

- 4.3.2. Equipment

- 4.3.3. Processes

- 4.4. Development Status and Trends of the SSB Industry Chain

5. Enterprises: Analysis on Deployment and Commercialization among Key Enterprises

- 5.1. Japan

- Toyota

- Nissan

- Honda

- Panasonic

- Idemitsu

- Hitachi Zosen

- Mitsui Kinzoku

- Maxell

- TDK

- 5.2. South Korea

- Hyundai

- Samsung SDI

- LG Energy Solution

- SK on

- POSCO Holdings

- Solivis

- Solid Ionics

- Lotte Energy Materials

- 5.3. Europe & America

- Factorial

- Quantum Scape

- SES

- Solid Power

- Blue Solutions

- Solidion

- Ionic Storage Systems

- Basquevolt

- ilika

- 24M Technologies

- 5.4. China

- CATL

- BYD

- Gotion

- EVE

- Svolt

- Ganfeng LiEnergy

- Welion

- Qingtao Energy

- 5.5. Taiwan

- ProLogium