|

|

市場調査レポート

商品コード

1754817

BNPL(後払い決済)の世界市場:2034年までの機会と戦略Buy Now Pay Later Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| BNPL(後払い決済)の世界市場:2034年までの機会と戦略 |

|

出版日: 2025年06月16日

発行: The Business Research Company

ページ情報: 英文 332 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のBNPL(後払い決済)市場は2019年に340億4,528万米ドルと評価され、2024年まで46.00%以上のCAGRで成長しました。

政府主導の成長

政府のイニシアチブの成長は、歴史的な期間におけるBNPL(後払い決済)市場の成長に貢献しました。政府の政策は、消費者のクレジット・アクセスを向上させ、金融包摂を後押しすることで、BNPLセクターの成長を刺激する重要な役割を果たしてきました。各国政府は規制や支援策を実施することで、BNPLプラットフォームの透明性と消費者保護を向上させてきました。こうした取り組みは、BNPLサービスの利用を増加させただけでなく、市場全体の成長にも大きく寄与しています。例えば、2024年5月、米国を拠点とする金融分野の消費者保護を担当する独立機関である消費者金融保護局(CFPB)は、BNPLサービスを利用する消費者を保護するための連邦規則の拡大を発表し、BNPL貸金業者に対してクレジットカード利用者と同様の保護を提供することを義務付けた。これには、請求に異議を唱える権利、返品された商品の返金を受ける権利、定期的に請求明細書を受け取る権利などが含まれます。60日後に施行される新規制は、成長するBNPL市場において一貫性と公平性を確保することを目的としています。従って、政府のイニシアチブの高まりが、BNPL(後払い決済)市場の成長を後押ししました。

目次

第1章 エグゼクティブサマリー

- BNPL(後払い決済)-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- BNPL(後払い決済)市場定義とセグメンテーション

- 市場セグメンテーション:チャネル別

- オンライン

- POS

- 市場セグメンテーション:企業規模別

- 大企業

- 中小企業

- 市場セグメンテーション:最終用途別

- コンシューマーエレクトロニクス

- ファッションと衣料

- ヘルスケア

- レジャーとエンターテイメント

- 小売り

- その他の用途

第7章 主要な市場動向

- AIを活用したBNPLサービスを活用したユーザーフレンドリーな体験の提供

- 今すぐ購入・後払いサービスの未来を再定義するコラボレーション

- 柔軟な分割払いソリューションでB2B決済を革新

- クラウドベースの決済ソリューションとの統合による業務効率の向上

- 新たな戦略的パートナーシップにより、多国籍企業向けBNPLの提供が強化されます

第8章 世界のBNPL(後払い決済)の成長分析と戦略分析フレームワーク

- 世界のBNPL(後払い決済)のPESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- 最終用途産業(B2C)の分析

- 世界のBNPL(後払い決済)市場:成長率分析

- 市場成長実績, 2019-2024

- 市場促進要因2019年~2024年

- 市場抑制要因2019-2024年

- 市場成長予測, 2024-2029, 2034F

- 市場促進要因2024年~2029年

- 市場抑制要因2024年~2029年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界のBNPL(後払い決済)市場規模(TAM)

第9章 世界のBNPL(後払い決済)市場:セグメンテーション

- 世界のBNPL(後払い決済)市場:チャネル別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のBNPL(後払い決済)市場:企業規模別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のBNPL(後払い決済)市場:用途別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のBNPL(後払い決済)市場、オンラインのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のBNPL(後払い決済)市場、POSのサブセグメンテーション、タイプ別、実績と予測, 2019-2024, 2029F, 2034F

第10章 BNPL(後払い決済)市場:地域・国別分析

- 世界のBNPL(後払い決済)市場:地域別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のBNPL(後払い決済)市場:国別、実績と予測, 2019-2024, 2029F, 2034F

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Block, Inc

- Affirm Holdings Inc

- PayPal Holdings Inc

- Klarna Bank AB

- MasterCard Inc.

第19章 その他の大手企業と革新的企業

- PayU

- Shop Pay Installments(Shopify Inc.)

- Sezzle

- Latitude Group Holdings Limited

- Visa Inc.

- Amazon.com, Inc

- Laybuy Group Holdings Limited

- Perpay Inc

- Payl8r(Social Money Ltd.)

- Tamara

- Tabby

- RecargaPay

- Swappa

- Addi

- Payflex

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- Super.money Acquired BharatX

- DMI Finance Acquired ZestMoney

- Upgrade Acquired Uplift

- Zip Acquired Sezzle

- Block Inc. Acquired Afterpay Limited

第23章 最近の動向BNPL(後払い決済)市場

第24章 機会と戦略

- 世界のBNPL(後払い決済)市場2029:新たな機会を提供する国

- 世界のBNPL(後払い決済)市場2029:新たな機会を提供するセグメント

- 世界のBNPL(後払い決済)市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 BNPL(後払い決済)市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々

第26章 付録

BNPL is a payment method allowing consumers to purchase goods or services and pay for them over time, usually through interest-free installments. When using BNPL, customers select this option at checkout, either online or in-store and typically pay a fraction of the total cost upfront. The remaining balance is then divided into equal payments, spread over a set period, such as weeks or months. BNPL providers facilitate the transaction, often charging merchants a fee, while offering consumers a flexible alternative to traditional credit.

The global buy now pay later market was valued at $34,045.28 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 46.00%.

Growth In Government Initiative

A growth in government initiatives contributed to the growth of the buy now pay later market in the historic period. Government policies have played a critical role in stimulating the growth of the BNPL sector by increasing consumer access to credit and boosting financial inclusion. Governments have improved transparency and consumer protection on BNPL platforms by implementing regulations and supportive measures. These initiatives have not only increased the use of BNPL services but have also considerably aided the market's overall growth. For example, in May 2024, the Consumer Financial Protection Bureau (CFPB), a US-based independent agency responsible for consumer protection in the financial sector, announced expanded federal rules to protect consumers using BNPL services, requiring BNPL lenders to offer protections similar to those for credit card users. These include the right to dispute charges, receive refunds for returned products and receive periodic billing statements. The new regulations, set to take effect in 60 days, aim to ensure consistency and fairness in the growing BNPL market. Therefore, the growth in government initiatives drove the growth of the buy now pay later market.

Use Of AI-Powered BNPL Services For Providing User-Friendly Experience

Major companies operating in the buy now pay later market are focusing on artificial intelligence (AI) to bring intelligence, efficiency and personalization to BNPL services. The use of AI technology not only facilitates seamless transactions but also contributes to risk management, fraud prevention and the creation of a tailored and user-friendly experience for consumers. For instance, in March 2024, Klarna, a Swedish fintech company that offers BNPL services, launched an AI tool that significantly boosts its customer service operations, handling the workload of 700 full-time agents. This AI technology is vital for enhancing consumer satisfaction and loyalty in a competitive market. The AI assistant efficiently manages a variety of customer inquiries related to Klarna's BNPL services, such as refunds, payment schedules and dispute resolutions. By automating these processes, Klarna delivers faster and more efficient service, essential for users who depend on BNPL options for their purchases.

The global buy now pay later market is highly fragmented, with a large number of small players in the market. The top ten competitors in the market made up to 4.41% of the total market in 2023.

Buy Now Pay Later Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global buy now pay later market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for buy now pay later? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The buy now pay later market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider buy now pay later market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by channel, by enterprise size and by end-use.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework- Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth- Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by channel, by enterprise size and by end-use in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth- Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers And Acquisitions- Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.

- Recent Developments- Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for buy now pay later providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Channel: Online; POS

- 2) By Enterprise Size: Large Enterprise; Small and Medium Enterprise

- 3) By End-User: Consumer Electronics; Fashion and Garments; Healthcare; Leisure And Entertainment; Retail; Other End-Uses

- Companies Mentioned: Block Inc; Affirm Holdings Inc; PayPal Holdings Inc; Klarna Bank AB; Mastercard Incorporated

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; buy now pay later indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Buy Now Pay Later - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Buy Now Pay Later Market Definition And Segmentations

- 6.4 Market Segmentation By Channel

- 6.4.1 Online

- 6.4.2 POS

- 6.5 Market Segmentation By Enterprise Size

- 6.5.1 Large Enterprises

- 6.5.2 Small And Medium Enterprises

- 6.6 Market Segmentation By End-Use

- 6.6.1 Consumer Electronics

- 6.6.2 Fashion And Garments

- 6.6.3 Healthcare

- 6.6.4 Leisure And Entertainment

- 6.6.5 Retail

- 6.6.6 Other End-Uses

7 Major Market Trends

- 7.1 Use Of AI-Powered BNPL Services For Providing User-Friendly Experience

- 7.2 Collaborations Redefining the Future of Buy Now Pay Later Services

- 7.3 Revolutionizing B2B Payments with Flexible Installment Solutions

- 7.4 Integration With Cloud Based Payment Solutions to Improve Operational Efficiency

- 7.5 New Strategic Partnership Enhances BNPL Offerings for Multinational Corporations

8 Global Buy Now Pay Later Growth Analysis And Strategic Analysis Framework

- 8.1 Global Buy Now Pay Later PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End Use Industries (B2C)

- 8.3 Global Buy Now Pay Later Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019- 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Buy Now Pay Later Total Addressable Market (TAM)

9 Global Buy Now Pay Later Market Segmentation

- 9.1 Global Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Buy Now Pay Later Market, Sub-Segmentation Of Online, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Buy Now Pay Later Market, Sub-Segmentation Of POS, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Buy Now Pay Later Market, Regional and Country Analysis

- 10.1 Global Buy Now Pay Later Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Buy Now Pay Later Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

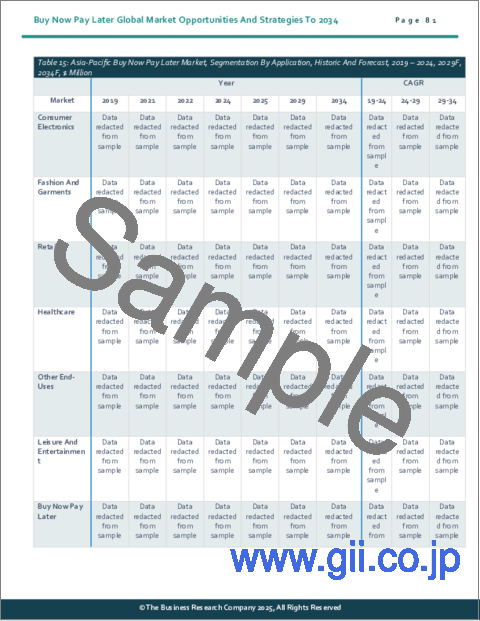

- 11.5 Asia-Pacific Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 China Market

- 11.7 Summary

- 11.8 Market Overview

- 11.8.1 Country Information

- 11.8.2 Market Information

- 11.8.3 Background Information

- 11.8.4 Government Initiatives

- 11.8.5 Regulations

- 11.8.6 Regulatory Bodies

- 11.8.7 Major Associations

- 11.8.8 Taxes Levied

- 11.8.9 Corporate Tax Structure

- 11.8.10 Investments

- 11.8.11 Major Companies

- 11.9 China Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.10 China Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 India Market

- 11.13 India Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.14 India Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 Japan Market

- 11.17 Summary

- 11.18 Market Overview

- 11.18.1 Country Information

- 11.18.2 Market Information

- 11.18.3 Background Information

- 11.18.4 Government Initiatives

- 11.18.5 Regulations

- 11.18.6 Regulatory Bodies

- 11.18.7 Major Associations

- 11.18.8 Taxes Levied

- 11.18.9 Corporate Tax Structure

- 11.18.10 Investments

- 11.18.11 Major Companies

- 11.19 Japan Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.20 Japan Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Australia Market

- 11.23 Australia Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.24 Australia Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.25 Australia Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.26 Indonesia Market

- 11.27 Indonesia Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.28 Indonesia Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Indonesia Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.30 South Korea Market

- 11.31 Summary

- 11.32 Market Overview

- 11.32.1 Country Information

- 11.32.2 Market Information

- 11.32.3 Background Information

- 11.32.4 Government Initiatives

- 11.32.5 Regulations

- 11.32.6 Regulatory Bodies

- 11.32.7 Major Associations

- 11.32.8 Taxes Levied

- 11.32.9 Corporate Tax Structure

- 11.32.10 Investments

- 11.32.11 Major Companies

- 11.33 South Korea Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.34 South Korea Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 South Korea Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Buy Now Pay Later Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major companies

- 13.3 Eastern Europe Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Russia Market

- 13.7 Russia Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.8 Russia Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Buy Now Pay Later Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investments

- 14.15.11 Major Companies

- 14.16 Canada Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.6 Regulatory Bodies

- 15.2.7 Major Associations

- 15.2.8 Taxes Levied

- 15.2.9 Corporate Tax Structure

- 15.2.10 Investments

- 15.2.11 Major Companies

- 15.3 South America Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 Brazil Market

- 15.7 Brazil Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.8 Brazil Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Buy Now Pay Later Market, Segmentation By Channel, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Buy Now Pay Later Market, Segmentation By Enterprise Size, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Buy Now Pay Later Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape and Company Profiles

- 18.1 Company Profiles

- 18.2 Block, Inc

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial performance

- 18.3 Affirm Holdings Inc

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Performance

- 18.4 PayPal Holdings Inc

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Business Strategy

- 18.4.4 Financial Performance

- 18.5 Klarna Bank AB

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Business Strategy

- 18.5.4 Financial Performance

- 18.6 MasterCard Inc.

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial performance

19 Other Major And Innovative Companies

- 19.1 PayU

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 Shop Pay Installments (Shopify Inc.)

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 Sezzle

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Latitude Group Holdings Limited

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 Visa Inc.

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 Amazon.com, Inc

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Laybuy Group Holdings Limited

- 19.7.1 Company Overview

- 19.7.2 Products And Services

- 19.8 Perpay Inc

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Payl8r (Social Money Ltd.)

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Tamara

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Tabby

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 RecargaPay

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Swappa

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Addi

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 Payflex

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 Super.money Acquired BharatX

- 22.2 DMI Finance Acquired ZestMoney

- 22.3 Upgrade Acquired Uplift

- 22.4 Zip Acquired Sezzle

- 22.5 Block Inc. Acquired Afterpay Limited

23 Recent Developments In The Buy Now Pay Later Market

- 23.1 Transforming In-Store Transactions With Interest-Free Payments

- 23.2 Empowering Banks & FinTechs With Flexible BNPL Solutions

- 23.3 Innovative Pre-Purchase Loans Solution For BNPL To Strengthen Financial Portfolios

24 Opportunities And Strategies

- 24.1 Global Buy Now Pay Later Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Buy Now Pay Later Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Buy Now Pay Later Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Buy Now Pay Later Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer