|

|

市場調査レポート

商品コード

1423639

航空燃料市場の2030年までの予測:燃料タイプ、航空機タイプ、グレード、エンドユーザー別、地域別の世界分析Aviation Fuel Market Forecasts to 2030 - Global Analysis By Fuel Type, Aircraft Type, Grade, End User and by Geography |

||||||

カスタマイズ可能

|

|||||||

| 航空燃料市場の2030年までの予測:燃料タイプ、航空機タイプ、グレード、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の航空燃料市場は2023年に2,927億7,000万米ドルを占め、予測期間中のCAGRは16%で成長し、2030年には8,274億4,000万米ドルに達すると予想されています。

航空燃料とも呼ばれるジェット燃料は、航空機での使用を目的とした特定の種類の石油ベースの燃料です。航空運航中の最高の性能と安全性を保証するため、この高エネルギー密度の液体は厳格な仕様に従わなければならないです。ジェット燃料はいくつかの等級に分類され、最も一般的に使用されているのはジェットAおよびジェットA-1です。ケロシンをベースとするこれらの燃料は、低温と高高度で生じる過酷な状況に耐えるように設計されています。

国際航空運送協会(IATA)によると、航空業界は燃料効率と環境の持続可能性に関する課題に取り組み続けています。国際航空運送協会(IATA)によると、航空業界は燃料効率と環境の持続可能性に関する課題に取り組み続けています。同協会は、こうした懸念に対処するための業界内の協力的な取り組みと技術革新の必要性を強調し、航空輸送の未来を形作る上で、航空燃料技術と持続可能な慣行における進歩が極めて重要な役割を果たすことを強調しています。

航空産業の成長

航空燃料市場は、主に世界の航空産業の継続的な成長によって牽引されています。経済成長、可処分所得の増加、世界化などの要因により、航空旅行の需要が急増し、それに比例して航空燃料の消費量も増加しています。さらに、この拡大は特に発展途上国で顕著であり、そこでは航空産業が急速に拡大し、ジェット燃料の安定した需要を支えています。

エネルギー価格の予測不可能性

原油価格の変動は、航空燃料市場に大きな制約をもたらします。航空会社やその他の利害関係者は、地政学的な出来事、供給の途絶、経済の不確実性などの影響を受ける世界の石油市場の変動の結果、困難に直面しています。さらに、航空会社の収益性は、原油価格の急激な上昇によって影響を受ける可能性があり、その結果、運航コストの上昇や財務上の不確実性が生じることもあります。

環境に優しい航空燃料の成長

航空業界の持続可能性への関心の高まりは、持続可能な航空燃料(SAF)の使用に大きなチャンスを与えます。さらに、よりクリーンで環境に優しい代替燃料の開発と使用を助長する環境は、環境意識の高まりと二酸化炭素排出量削減のための規制支援によって作り出されています。

代替燃料のための不十分な設備

水素ベースの燃料や持続可能な航空燃料(SAF)のような代替燃料の航空業界への円滑な統合は、これらの燃料のためのインフラの不足によって脅かされています。さらに、代替燃料の選択肢の拡大は、不十分な生産施設、流通網、貯蔵能力によって妨げられる可能性があり、これは業界の持続可能性への移行を遅らせることになります。

COVID-19の影響:

COVID-19の大流行は航空燃料市場に大きな影響を及ぼしました。というのも、COVID-19の大流行により、広範囲に及ぶ渡航制限、立ち入り禁止、航空需要の急激な落ち込みが生じたからです。世界中の航空会社は、航空機の運航停止や収益の減少など、かつて経験したことのない財政難に直面し、燃料購入の延期や市場での燃料過剰を招いた。さらに、パンデミック(世界的大流行病)の破壊的な影響により、外部からの衝撃に対する市場の脆弱性が浮き彫りになり、サプライチェーンの回復力の再評価と、不測の危機に対処するための業界全体の調整の必要性につながった。

予測期間中、ジェット燃料分野が最大となる見込み

航空燃料に関しては、通常ジェット燃料が最大の市場シェアを占めています。具体的には、ジェット燃料は軍用機や民間機で使用される主な燃料です。ジェット燃料は、ジェットエンジン用に製造された特定のケロシンベースの燃料であり、広い温度範囲にわたって安定性と高いエネルギー密度を提供します。さらに、航空機との適合範囲が広く、業界標準に厳格に準拠しているため、ジェット燃料は圧倒的な市場シェアを占めています。

予測期間中にCAGRが最も高くなると予想されるのは商業用セグメントです。

航空市場では、民間航空セグメントが一貫して最も高いCAGRを示しています。世界の航空需要の高まり、航空会社の保有機材の大型化、経済成長が、航空会社が提供する旅客・貨物サービスを含む民間航空部門の拡大を後押ししています。中流階級の人口増加、新興市場の出現、効果的な輸送に対する継続的な需要はすべて、この部門の着実な成長に寄与しています。さらに、新路線、航空機技術の向上、燃費重視の傾向の高まりも、すべて民間航空の拡大に寄与しています。

最大のシェアを持つ地域

予測期間中、市場シェアが最も高かったのは欧州地域です。強力な航空会社、重要な国際空港、国内および国際便の緻密なネットワークがすべて欧州の航空産業を支えています。欧州に本社を置く大手航空サービス会社や航空機製造会社の存在により、欧州は大きな市場シェアを占めています。さらに、規制構造、技術の進歩、環境に優しい航空への取り組みが、世界の航空市場における主要プレーヤーとしての欧州の役割をさらに明確にしています。

CAGRが最も高い地域:

市場のCAGRが最も高いのはアジア太平洋地域です。急速な都市化、中産階級の拡大、中国やインドなどの新興経済圏における航空需要の高まりが、この成長を牽引する要因の一部です。アジア太平洋地域では、航空インフラへの大規模な投資、航空会社の機体拡大、空港施設の近代化にますます重点が置かれています。さらに、世界貿易・通商におけるこの地域の戦略的重要性により、航空産業は急成長を遂げています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の航空燃料市場:燃料タイプ別

- ジェットA-1

- ジェットA

- ジェットB

- JP5

- JP8

- Avgas

- バイオ燃料

- その他の燃料タイプ

第6章 世界の航空燃料市場:航空機タイプ別

- 固定翼

- 回転翼

- 無人航空機

- その他の航空機タイプ

第7章 世界の航空燃料市場:グレード別

- ジェット燃料

- 航空ガソリン

- バイオケロシン

- その他のグレード

第8章 世界の航空燃料市場:エンドユーザー別

- 商業

- 民事

- 軍隊

- 民間

- スポーツ&レクリエーション

- その他のエンドユーザー

第9章 世界の航空燃料市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイル

- Emirates National Oil Company

- Chevron Corporation

- Marathon Petroleum Corporation

- Abu Dhabi National Oil Company

- Essar Oil Limited

- Allied Aviation Services Inc

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited

- Hindustan Petroleum Corporation Limited

- World Fuel Services Corporation

- British Petroleum Fuel

- Royal Dutch Shell plc

- China Aviation Oil Corporation Ltd

- Viva Energy Group

- TotalEnergies SE

- Valero Energy Corporation

List of Tables

- Table 1 Global Aviation Fuel Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 3 Global Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 4 Global Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 5 Global Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 6 Global Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 7 Global Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 8 Global Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 9 Global Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 10 Global Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 11 Global Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 12 Global Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 13 Global Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 14 Global Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 15 Global Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 16 Global Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 17 Global Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 18 Global Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 19 Global Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 20 Global Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 21 Global Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 22 Global Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 23 Global Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 24 Global Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 25 Global Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 26 Global Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 27 Global Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 28 North America Aviation Fuel Market Outlook, By Country (2021-2030) ($MN)

- Table 29 North America Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 30 North America Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 31 North America Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 32 North America Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 33 North America Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 34 North America Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 35 North America Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 36 North America Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 37 North America Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 38 North America Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 39 North America Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 40 North America Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 41 North America Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 42 North America Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 43 North America Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 44 North America Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 45 North America Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 46 North America Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 47 North America Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 48 North America Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 49 North America Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 50 North America Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 51 North America Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 52 North America Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 53 North America Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 54 North America Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 55 Europe Aviation Fuel Market Outlook, By Country (2021-2030) ($MN)

- Table 56 Europe Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 57 Europe Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 58 Europe Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 59 Europe Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 60 Europe Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 61 Europe Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 62 Europe Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 63 Europe Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 64 Europe Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 65 Europe Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 66 Europe Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 67 Europe Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 68 Europe Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 69 Europe Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 70 Europe Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 71 Europe Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 72 Europe Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 73 Europe Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 74 Europe Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 75 Europe Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 76 Europe Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 77 Europe Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 78 Europe Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 79 Europe Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 80 Europe Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 81 Europe Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 82 Asia Pacific Aviation Fuel Market Outlook, By Country (2021-2030) ($MN)

- Table 83 Asia Pacific Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 84 Asia Pacific Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 85 Asia Pacific Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 86 Asia Pacific Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 87 Asia Pacific Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 88 Asia Pacific Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 89 Asia Pacific Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 90 Asia Pacific Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 91 Asia Pacific Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 92 Asia Pacific Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 93 Asia Pacific Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 94 Asia Pacific Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 95 Asia Pacific Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 96 Asia Pacific Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 97 Asia Pacific Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 98 Asia Pacific Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 99 Asia Pacific Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 100 Asia Pacific Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 101 Asia Pacific Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 102 Asia Pacific Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 103 Asia Pacific Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 104 Asia Pacific Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 105 Asia Pacific Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 106 Asia Pacific Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 107 Asia Pacific Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 108 Asia Pacific Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 109 South America Aviation Fuel Market Outlook, By Country (2021-2030) ($MN)

- Table 110 South America Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 111 South America Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 112 South America Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 113 South America Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 114 South America Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 115 South America Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 116 South America Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 117 South America Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 118 South America Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 119 South America Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 120 South America Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 121 South America Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 122 South America Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 123 South America Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 124 South America Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 125 South America Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 126 South America Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 127 South America Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 128 South America Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 129 South America Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 130 South America Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 131 South America Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 132 South America Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 133 South America Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 134 South America Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 135 South America Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 136 Middle East & Africa Aviation Fuel Market Outlook, By Country (2021-2030) ($MN)

- Table 137 Middle East & Africa Aviation Fuel Market Outlook, By Fuel Type (2021-2030) ($MN)

- Table 138 Middle East & Africa Aviation Fuel Market Outlook, By Jet A-1 (2021-2030) ($MN)

- Table 139 Middle East & Africa Aviation Fuel Market Outlook, By Jet A (2021-2030) ($MN)

- Table 140 Middle East & Africa Aviation Fuel Market Outlook, By Jet B (2021-2030) ($MN)

- Table 141 Middle East & Africa Aviation Fuel Market Outlook, By JP 5 (2021-2030) ($MN)

- Table 142 Middle East & Africa Aviation Fuel Market Outlook, By JP 8 (2021-2030) ($MN)

- Table 143 Middle East & Africa Aviation Fuel Market Outlook, By Avgas (2021-2030) ($MN)

- Table 144 Middle East & Africa Aviation Fuel Market Outlook, By Biofuel (2021-2030) ($MN)

- Table 145 Middle East & Africa Aviation Fuel Market Outlook, By Other Fuel Types (2021-2030) ($MN)

- Table 146 Middle East & Africa Aviation Fuel Market Outlook, By Aircraft Type (2021-2030) ($MN)

- Table 147 Middle East & Africa Aviation Fuel Market Outlook, By Fixed Wing (2021-2030) ($MN)

- Table 148 Middle East & Africa Aviation Fuel Market Outlook, By Rotary Wing (2021-2030) ($MN)

- Table 149 Middle East & Africa Aviation Fuel Market Outlook, By Unmanned Aerial Vehicle (2021-2030) ($MN)

- Table 150 Middle East & Africa Aviation Fuel Market Outlook, By Other Aircraft Types (2021-2030) ($MN)

- Table 151 Middle East & Africa Aviation Fuel Market Outlook, By Grade (2021-2030) ($MN)

- Table 152 Middle East & Africa Aviation Fuel Market Outlook, By Jet fuel (2021-2030) ($MN)

- Table 153 Middle East & Africa Aviation Fuel Market Outlook, By Aviation Gasoline (2021-2030) ($MN)

- Table 154 Middle East & Africa Aviation Fuel Market Outlook, By Biokerosene (2021-2030) ($MN)

- Table 155 Middle East & Africa Aviation Fuel Market Outlook, By Other Grades (2021-2030) ($MN)

- Table 156 Middle East & Africa Aviation Fuel Market Outlook, By End User (2021-2030) ($MN)

- Table 157 Middle East & Africa Aviation Fuel Market Outlook, By Commercial (2021-2030) ($MN)

- Table 158 Middle East & Africa Aviation Fuel Market Outlook, By Civil (2021-2030) ($MN)

- Table 159 Middle East & Africa Aviation Fuel Market Outlook, By Military (2021-2030) ($MN)

- Table 160 Middle East & Africa Aviation Fuel Market Outlook, By Private (2021-2030) ($MN)

- Table 161 Middle East & Africa Aviation Fuel Market Outlook, By Sports & Recreational (2021-2030) ($MN)

- Table 162 Middle East & Africa Aviation Fuel Market Outlook, By Other End Users (2021-2030) ($MN)

According to Stratistics MRC, the Global Aviation Fuel Market is accounted for $292.77 billion in 2023 and is expected to reach $827.44 billion by 2030 growing at a CAGR of 16% during the forecast period. Jet fuel, also referred to as aviation fuel, is a particular kind of petroleum-based fuel intended for use in aircraft. To guarantee the best possible performance and safety during aviation operations, this high-energy-density liquid is subjected to strict specifications. Jet fuel is categorized into several grades, the most commonly used being Jet A and Jet A-1 on a worldwide scale. These fuels, which are based on kerosene, are designed to endure the harsh circumstances that arise at low temperatures and high altitudes

According to the International Air Transport Association (IATA), the aviation industry continues to grapple with challenges related to fuel efficiency and environmental sustainability. The association emphasizes the need for collaborative efforts and innovation within the industry to address these concerns, highlighting the pivotal role of advancements in aviation fuel technologies and sustainable practices in shaping the future of air transportation.

Market Dynamics:

Driver:

Growth of the aviation industry

The aviation fuel market is primarily driven by the ongoing growth of the global aviation industry. Due to factors like economic growth, rising disposable income, and globalization, there is a surge in demand for air travel, which leads to a proportionate increase in the consumption of aviation fuel. Additionally, this expansion is especially noticeable in developing nations, where the aviation industry is expanding quickly and supporting a steady demand for jet fuel.

Restraint:

Unpredictability in energy prices

The volatility of oil prices poses a major constraint on the aviation fuel market. Airlines and other industry stakeholders face difficulties as a result of fluctuations in the world oil markets, which are impacted by geopolitical events, disruptions in supply, and economic uncertainty. Furthermore, the profitability of aviation companies may be impacted by sudden increases in oil prices, which can also result in higher operational costs and financial uncertainty.

Opportunity:

Growth of eco-friendly aviation fuels

The aviation industry's growing focus on sustainability offers a substantial chance for the use of sustainable aviation fuels (SAFs). Moreover, an environment that is conducive to the development and use of cleaner and greener alternative fuels is created by rising environmental consciousness and regulatory support for lowering carbon emissions.

Threat:

Inadequate facilities for alternative fuels

The smooth integration of alternative fuels, like hydrogen-based fuels or sustainable aviation fuels (SAFs), into the aviation industry is threatened by the lack of infrastructure for these fuels. Furthermore, the expansion of alternative fuel options may be hampered by inadequate production facilities, distribution networks, and storage capacities, which would slow down the industry's transition to sustainability.

Covid-19 Impact:

The COVID-19 pandemic had a major effect on the aviation fuel market because it resulted in widespread travel restrictions, lockdowns, and a sharp decline in demand for air travel. Airlines around the world encountered previously unheard-of financial difficulties, including grounded fleets and decreased revenues, which led to postponed fuel purchases and an excess of fuel in the market. Additionally, the market's susceptibility to external shocks was highlighted by the pandemic's disruptive effects, which led to a re-evaluation of supply chain resilience and the requirement for industry-wide adjustments to handle unforeseen crises.

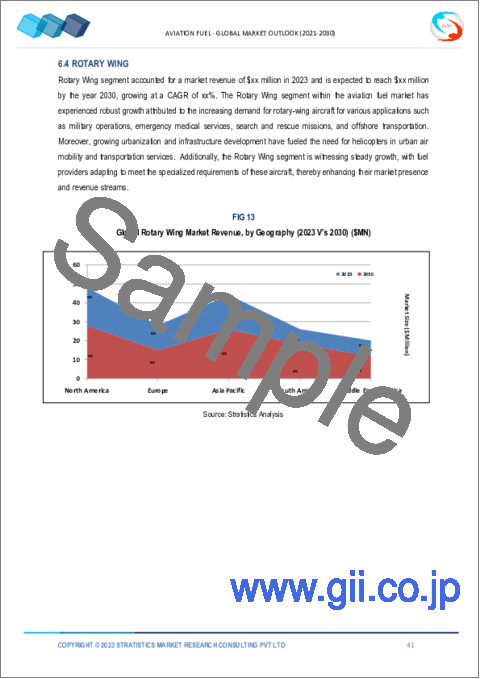

The Jet fuel segment is expected to be the largest during the forecast period

When it comes to aviation fuel, jet fuel usually has the largest market share. Specifically, jet fuel is the main fuel used in military and commercial aircraft. It is a specific kerosene-based fuel made for jet engines that provides stability and high energy density over a broad temperature range. Moreover, due to its wide range of aircraft compatibility and strict adherence to industry standards, jet fuel has a dominant market share.

The Commercial segment is expected to have the highest CAGR during the forecast period

In the aviation market, the commercial aviation segment has consistently demonstrated the highest CAGR. The demand for air travel worldwide is rising, airline fleets are getting bigger, and economic growth is driving the expansion of the commercial aviation sector, which includes the passenger and cargo services offered by airlines. Growing middle-class populations, the emergence of emerging markets, and the ongoing demand for effective transportation all contribute to the sector's steady growth. Additionally, new routes, improved aircraft technology, and a growing emphasis on fuel economy all contribute to the expansion of commercial aviation.

Region with largest share:

The Europe region had the largest market share during the forecast period. Strong airline companies, significant international airports, and a dense network of domestic and international flights all support the European aviation industry. Europe has a significant market share due to the presence of major aviation services and aircraft manufacturing companies with their headquarters there. Furthermore, regulatory structures, technological advancements, and a commitment to environmentally friendly aviation further define Europe's role as a major player in the world aviation market.

Region with highest CAGR:

The market's highest CAGR has frequently been seen in the Asia-Pacific region. Rapid urbanization, the expansion of the middle class, and the rising demand for air travel in emerging economies like China and India are some of the factors driving this growth. Significant investments in aviation infrastructure, airline fleet expansion, and an increasing emphasis on modernizing airport facilities have all occurred in the Asia-Pacific region. Additionally, the aviation industry has grown rapidly due to the region's strategic importance in world trade and commerce.

Key players in the market

Some of the key players in Aviation Fuel market include Emirates National Oil Company, Chevron Corporation, Marathon Petroleum Corporation, Abu Dhabi National Oil Company, Essar Oil Limited, Allied Aviation Services Inc, Exxon Mobil Corporation, Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited, Hindustan Petroleum Corporation Limited, World Fuel Services Corporation, British Petroleum Fuel, Royal Dutch Shell plc, China Aviation Oil Corporation Ltd, Viva Energy Group, TotalEnergies SE and Valero Energy Corporation.

Key Developments:

In December 2023, Marathon Petroleum Corporation MPC, a leading downstream energy company, secured a two-year time charter contract with Performance Shipping Inc., a prominent oil shipping company. The deal involves Performance Shipping's M/T P. Long Beach tanker transporting refined products for MPC at a rate of $37,200 per day, generating approximately $25.7 million in gross revenue for the former.

In October 2023, Chevron Corporation announced today that it has entered into a definitive agreement with Hess Corporation to acquire all of the outstanding shares of Hess in an all-stock transaction valued at $53 billion, or $171 per share based on Chevron's closing price on October 20, 2023. Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The total enterprise value, including debt, of the transaction is $60 billion.

In October 2023, Abu Dhabi National Oil Co. announced it has taken a final investment decision and awarded the build contracts for a gas project expected to produce over 1.5 billion cubic feet per day at home. The state-owned energy giant touted the Hail and Ghasha Offshore Development project in the Emirati capital as the world's first gas production project to have net-zero emissions.

Fuel Types Covered:

- Jet A-1

- Jet A

- Jet B

- JP 5

- JP 8

- Avgas

- Biofuel

- Other Fuel Types

Aircraft Types Covered:

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicle

- Other Aircraft Types

Grades Covered:

- Jet fuel

- Aviation Gasoline

- Biokerosene

- Other Grades

End Users Covered:

- Commercial

- Civil

- Military

- Private

- Sports & Recreational

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Aviation Fuel Market, By Fuel Type

- 5.1 Introduction

- 5.2 Jet A-1

- 5.3 Jet A

- 5.4 Jet B

- 5.5 JP 5

- 5.6 JP 8

- 5.7 Avgas

- 5.8 Biofuel

- 5.9 Other Fuel Types

6 Global Aviation Fuel Market, By Aircraft Type

- 6.1 Introduction

- 6.2 Fixed Wing

- 6.3 Rotary Wing

- 6.4 Unmanned Aerial Vehicle

- 6.5 Other Aircraft Types

7 Global Aviation Fuel Market, By Grade

- 7.1 Introduction

- 7.2 Jet fuel

- 7.3 Aviation Gasoline

- 7.4 Biokerosene

- 7.5 Other Grades

8 Global Aviation Fuel Market, By End User

- 8.1 Introduction

- 8.2 Commercial

- 8.3 Civil

- 8.4 Military

- 8.5 Private

- 8.6 Sports & Recreational

- 8.7 Other End Users

9 Global Aviation Fuel Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 Emirates National Oil Company

- 11.2 Chevron Corporation

- 11.3 Marathon Petroleum Corporation

- 11.4 Abu Dhabi National Oil Company

- 11.5 Essar Oil Limited

- 11.6 Allied Aviation Services Inc

- 11.7 Exxon Mobil Corporation

- 11.8 Indian Oil Corporation Limited

- 11.9 Bharat Petroleum Corporation Limited

- 11.10 Hindustan Petroleum Corporation Limited

- 11.11 World Fuel Services Corporation

- 11.12 British Petroleum Fuel

- 11.13 Royal Dutch Shell plc

- 11.14 China Aviation Oil Corporation Ltd

- 11.15 Viva Energy Group

- 11.16 TotalEnergies SE

- 11.17 Valero Energy Corporation