|

|

市場調査レポート

商品コード

1614875

発酵用化学品の世界市場規模、シェア、成長分析:タイプ別、用途別、地域別 - 産業予測(2024年~2031年)Fermentation Chemicals Market Size, Share, Growth Analysis, By Type (Amino Acids, Industrial Enzymes), By Application (Food & Beverage, Plastics & Fibers), By Region - Industry Forecast 2024-2031 |

||||||

|

|||||||

| 発酵用化学品の世界市場規模、シェア、成長分析:タイプ別、用途別、地域別 - 産業予測(2024年~2031年) |

|

出版日: 2024年12月15日

発行: SkyQuest

ページ情報: 英文 157 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

世界の発酵用化学品の市場規模は、2022年に707億米ドルと評価され、2023年の756億米ドルから2031年には1,300億米ドルに成長し、予測期間(2024年~2031年)のCAGRは7%で成長する見通しです。

世界の発酵用化学品市場は、飲食品、医薬品、バイオ燃料などの産業にわたって重要であり、主に持続可能な代替品に対する需要の高まりが原動力となっています。発酵プロセスは、再生可能な原料を利用してアルコール、抗生物質、バイオポリマーなど様々な必須製品を生産するもので、環境持続可能性とカーボンフットプリント削減を重視する世界の流れに沿ったものです。しかし市場には、原料価格の変動や、中小企業にとってはコンプライアンスを複雑にする厳しい規制要件などの課題があります。さらに、先端バイオテクノロジーとの競合も脅威となっています。こうした障害にもかかわらず、発酵法の技術革新とバイオベース製品に対する需要の増加によって、市場の着実な成長が見込まれています。業界各社は、このダイナミックな市場情勢における新たな機会を活用するため、研究、戦略的パートナーシップ、事業拡大に積極的に取り組んでいます。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次・一次情報源

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析と影響

- 競争企業間の敵対関係

- 代替品の脅威

- 買い手の交渉力

- 新規参入業者の脅威

- 供給企業の交渉力

主な市場の考察

- 重要成功要因

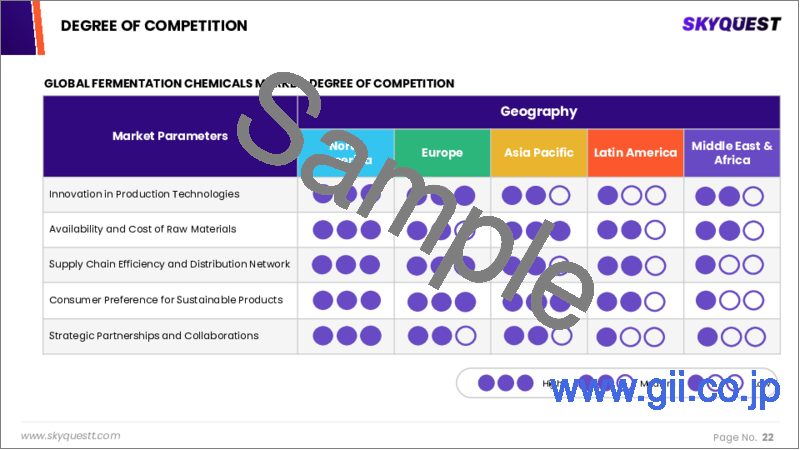

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2023年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- 技術の進歩

- 規制情勢

- ケーススタディ

- 特許分析

発酵用化学品市場規模:タイプ別、CAGR(2024年~2031年)

- 市場概要

- アルコールとケトン

- アミノ酸

- 工業用酵素

- 有機酸

- その他

発酵用化学品市場規模:用途別、CAGR(2024年~2031年)

- 市場概要

- 飲食品

- プラスチックと繊維

- 栄養および医薬品

- 工業用途

- 化粧品・トイレタリー

- その他

発酵用化学品市場規模、CAGR(2024年~2031年)

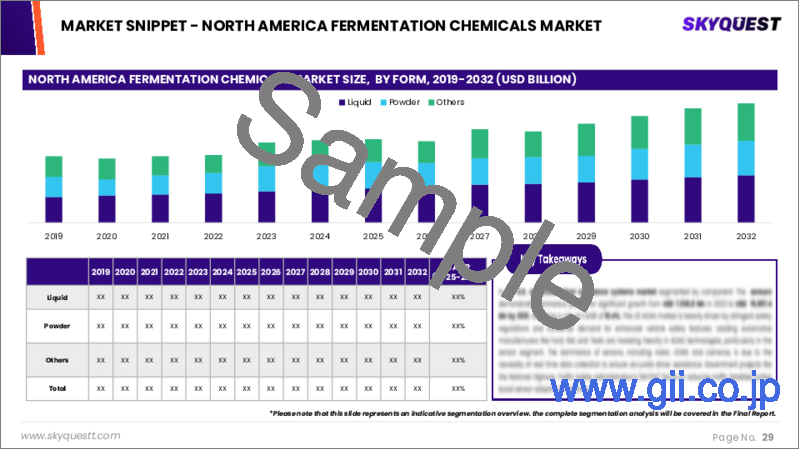

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2023年)

- 主な市場企業が採用した戦略

- 市場の最近の動向

- 企業の市場シェア分析(2023年)

- 主要企業プロファイル

- 会社概要

- 製品ポートフォリオ分析

- セグメント別シェア分析

- 収益の前年比の比較(2021年~2023年)

主要企業プロファイル

- BASF SE(Germany)

- DSM(Netherlands)

- Evonik Industries AG(Germany)

- Novozymes(Denmark)

- Cargill, Incorporated(United States)

- Ajinomoto Co., Inc.(Japan)

- Chr. Hansen Holding A/S(Denmark)

- Lonza(Switzerland)

- AB Enzymes(Germany)

- Biocon(India)

- BioVectra(Canada)

- MicroBiopharm Japan Co., Ltd.(Japan)

- Novasep(France)

- Teva Pharmaceutical Industries Ltd.(Israel)

結論と推奨事項

Global Fermentation Chemicals Market size was valued at USD 70.7 billion in 2022 and is poised to grow from USD 75.6 billion in 2023 to USD 130 billion by 2031, growing at a CAGR of 7% during the forecast period (2024-2031).

The global fermentation chemicals market is vital across industries such as food and beverages, pharmaceuticals, and biofuels, primarily driven by the rising demand for sustainable alternatives. Fermentation processes utilize renewable feedstocks to produce various essential products, including alcohol, antibiotics, and biopolymers, aligning with the global emphasis on environmental sustainability and carbon footprint reduction. However, the market encounters challenges, including fluctuating raw material prices and stringent regulatory requirements that can complicate compliance for smaller firms. Additionally, competition from advanced biotechnologies poses a threat. Despite these obstacles, steady market growth is anticipated, fueled by innovations in fermentation methods and increased demand for bio-based products. Industry players are actively engaging in research, strategic partnerships, and expansions to leverage emerging opportunities in this dynamic market landscape.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Fermentation Chemicals market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Fermentation Chemicals Market Segmental Analysis

Global Fermentation Chemicals Market is segmented by Type, Application and Region. Based on Type, the market is segmented into Alcohols and Ketones, Amino Acids, Industrial Enzymes, Organic Acids, Others. Based on Application, the market is segmented into Food and Beverage, Plastics and Fibers, Nutritional and Pharmaceuticals, Industrial Application, Cosmetic and Toiletry, Others. Based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Global Fermentation Chemicals Market

The Global Fermentation Chemicals market is primarily driven by the rising demand for sustainable and eco-friendly products, as businesses and consumers alike place greater emphasis on environmental stewardship. This heightened awareness has led to a growing preference for fermentation chemicals, which provide a greener alternative to conventional chemical synthesis techniques. As various industries align themselves with sustainability goals, the adoption of fermentation-based solutions is on the rise, further propelling their demand across a multitude of applications. Consequently, this trend not only reflects a shift towards environmentally responsible practices but also underscores the pivotal role of fermentation chemicals in promoting a sustainable future.

Restraints in the Global Fermentation Chemicals Market

The global fermentation chemicals market faces significant challenges due to a stringent regulatory landscape. The production and application of these chemicals must adhere to rigorous safety and quality standards, which are essential to ensure their efficacy and protect public health. Navigating this regulatory framework can be complicated and expensive for manufacturers, potentially hindering their ability to innovate and expand operations. These compliance requirements create obstacles that can restrict market growth by increasing operational costs and deterring new entrants. As such, the intricate nature of regulatory compliance presents a notable restraint within the fermentation chemicals sector.

Market Trends of the Global Fermentation Chemicals Market

The Global Fermentation Chemicals market is witnessing a robust trend driven by expanding applications in the pharmaceutical and healthcare sectors. As the demand for healthcare products surges, prompted by a rising global focus on health and wellness, fermentation chemicals have become essential for producing critical pharmaceutical ingredients such as antibiotics, enzymes, and vitamins. Furthermore, the ongoing advancements in personalized medicine and biotechnology are significantly bolstering the use of fermentation processes to create tailored therapeutic solutions. This convergence of increased healthcare demand and innovative drug development is set to fuel sustained growth in the fermentation chemicals market over the coming years.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Driver & Opportunities

- Restraints & Challenges

- Porters Analysis & Impact

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2023

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Technological Advancement

- Regulatory Landscape

- Case Studies

- Patent Analysis

Fermentation Chemicals Market Size by Type & CAGR (2024-2031)

- Market Overview

- Alcohols and Ketones

- Amino Acids

- Industrial Enzymes

- Organic Acids

- Others

Fermentation Chemicals Market Size by Application & CAGR (2024-2031)

- Market Overview

- Food and Beverages

- Plastics and Fibers

- Nutritional and Pharmaceuticals

- Industrial Application

- Cosmetics and Toiletries

- Others

Fermentation Chemicals Market Size & CAGR (2024-2031)

- North America, (Type, Application)

- US

- Canada

- Europe, (Type, Application)

- UK

- Germany

- Spain

- France

- Italy

- Rest of Europe

- Asia-Pacific, (Type, Application)

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America, (Type, Application)

- Brazil

- Rest of Latin America

- Middle East & Africa (Type, Application)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2023

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2023

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2021-2023)

Key Company Profiles

- BASF SE (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- DSM (Netherlands)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Evonik Industries AG (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Novozymes (Denmark)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Cargill, Incorporated (United States)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Ajinomoto Co., Inc. (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Chr. Hansen Holding A/S (Denmark)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Lonza (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- AB Enzymes (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Biocon (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- BioVectra (Canada)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- MicroBiopharm Japan Co., Ltd. (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Novasep (France)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Teva Pharmaceutical Industries Ltd. (Israel)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments