|

市場調査レポート

商品コード

1787830

学習管理システム(LMS)の世界市場(~2035年):コンポーネントタイプ別、展開別、デリバリー方式別、サービス別、産業別、技術別、価格設定モデル別、エンドユーザー別、ビジネスモデル別、主要地域別、産業動向、予測Learning Management Systems Market, Till 2035: Distribution by Type of Component, Deployment, Mode of Delivery, Service, Industry, Technology, Pricing Model, End-user, Business Model and Key Geographical Regions: Industry Trends and Global Forecasts: |

||||||

カスタマイズ可能

|

|||||||

| 学習管理システム(LMS)の世界市場(~2035年):コンポーネントタイプ別、展開別、デリバリー方式別、サービス別、産業別、技術別、価格設定モデル別、エンドユーザー別、ビジネスモデル別、主要地域別、産業動向、予測 |

|

出版日: 2025年08月11日

発行: Roots Analysis

ページ情報: 英文 201 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

学習管理システム(LMS)市場の概要

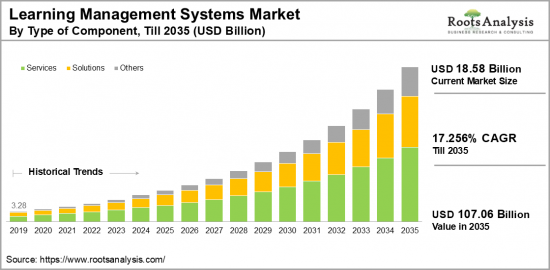

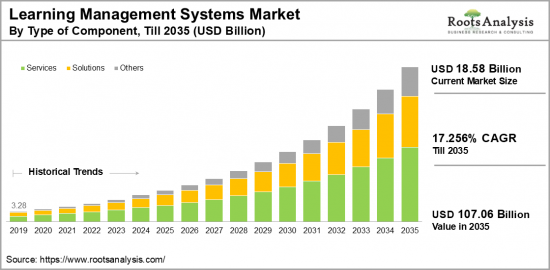

世界の学習管理システム(LMS)の市場規模は、現在の185億8,000万米ドルから2035年までに1,070億6,000万米ドルに達すると予測され、2035年までの予測期間にCAGRで17.256%の成長が見込まれます。

学習管理システム(LMS)市場:成長と動向

デジタル教育の台頭により、学習管理システム(LMS)の開発が進んでいます。LMSは、仮想学習体験を強化する技術を通じて革新的なeラーニング戦略を提供することで、重要な役割を果たしています。バーチャルクラスルーム、ラップトップ、クラウドサービス、その他のツールを活用することで、各人が自宅に居ながらにして最大限の学習を行うことができます。COVID-19パンデミック中、教育機関が閉鎖されたため、10億人を超える学生が学習の中断に直面しました。オンライン教育は孤立した状態での学習の継続を可能にし、その結果、従来の学校からデジタル教室への大きな移行が起こり、学習管理システム(LMS)市場の成長を加速させました。

近年の技術革新は、IoTやAIの導入とともに、eラーニングの有効性を大幅に高めています。さまざまな補助ツールがデータ収集能力を向上させ、モバイル学習アプローチを促進しています。さらに、デジタルクラスルームモデルを採用する教育機関も増えています。さらに、スマートフォンやタブレットの普及も、オンライン教育の受け入れに大きく寄与しています。さらに、多くの組織が学習体験を向上させるためにBYOD(Bring Your Own Device)政策を支持しています。これらの組織は、この移行を促進するために、教師や講師にスマートデバイスを身につけさせています。

さらに、5G技術の導入により、学習プロセス全体が合理化され、時間的な効率が大幅に向上しています。以上の要因から、学習管理システム(LMS)市場は予測期間に大きく成長する見込みです。

当レポートでは、世界の学習管理システム(LMS)市場について調査し、市場規模の推計と機会の分析、競合情勢、企業プロファイルなどの情報を提供しています。

目次

第1章 序文

第2章 調査手法

第3章 経済的考慮事項、その他のプロジェクト特有の考慮事項

第4章 マクロ経済指標

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 競合情勢

第8章 企業プロファイル

- 章の概要

- Absorb LMS Software

- Adobe LMS

- Docebo

- Oracle

- LearnUpon

- Instructure

- IBM

- Braincert

- Epignosis

- Callidus Software

第9章 バリューチェーン分析

第10章 SWOT分析

第11章 世界の学習管理システム(LMS)市場

第12章 市場機会:コンポーネントタイプ別

第13章 市場機会:展開タイプ別

第14章 市場機会:デリバリー方式別

第15章 市場機会:サービスタイプ別

第16章 市場機会:産業別

第17章 市場機会:技術別

第18章 市場機会:価格設定モデル別

第19章 市場機会:エンドユーザー別

第20章 市場機会:企業規模別

第21章 市場機会:ビジネスモデル別

第22章 北米のLMS市場の機会

第23章 欧州のLMS市場の機会

第24章 アジアのLMS市場の機会

第25章 中東・北アフリカ(MENA)のLMS市場の機会

第26章 ラテンアメリカのLMS市場の機会

第27章 その他の地域のLMS市場の機会

第28章 表形式データ

第29章 企業・団体のリスト

第30章 カスタマイズの機会

第31章 Rootsのサブスクリプションサービス

第32章 著者詳細

Learning Management Systems Market Overview

As per Roots Analysis, the global learning management systems market size is estimated to grow from USD 18.58 billion in the current year to USD 107.06 billion by 2035, at a CAGR of 17.256% during the forecast period, till 2035.

The opportunity for learning management systems market has been distributed across the following segments:

Type of Component

- Solutions

- Software

- Services

Type of Deployment

- Cloud-based

- On Premise

- Web-based

Mode of Delivery

- Blended Training

- Distance Learning

- Instructor-led Training

Type of Service

- Administration

- Content Management

- Communication & Collaboration

- Learner Management

- Performance Management

Type of Industry

- Banking and Finance and insurance (BFSI)

- Government and Defense

- Healthcare

- Manufacturing

- Retail

- Software and Technology

- Telecommunication

- Others

Type of Technology

- Analytics and Reporting

- Artificial Intelligence (AI) Integration

- Mobile Learning

- Gamification

Pricing Model

- Freemium

- One-time License

- Subscription-based

End User

- Academic

- Administrators and Managers

- Content Creators

- Corporate

- Government

- Individual Learners

- Instructors and Educators

- Others

Company Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

LEARNING MANAGEMENT SYSTEMS MARKET: GROWTH AND TRENDS

The emergence of digital education has led to the development of learning management systems (LMS). LMS plays a crucial role by offering innovative e-learning strategies through technologies that enhance virtual learning experiences. By utilizing virtual classrooms, laptops, cloud services, and other tools, individuals can maximize their learning from the comfort of their own homes. During the COVID-19 pandemic, when educational institutions were closed, over 1 billion students faced interruptions in their learning. Online education enabled continued learning in isolation, resulting in a significant transition from traditional schools to digital classrooms, which accelerated the growth of the learning management system market.

Recent innovations, along with the introduction of the Internet of Things (IoT) and artificial intelligence (AI), have significantly enhanced the efficacy of e-learning. Various supplemental tools have improved the capability for data collection and have facilitated mobile learning approaches. Additionally, more educational institutions are adopting the digital classroom model. Moreover, the increased prevalence of smartphones and tablets has greatly contributed to the acceptance of online education. Additionally, many organizations are endorsing bring your own device (BYOD) policy to enhance the learning experience. These organizations are equipping teachers and instructors with smart devices to facilitate this transition.

Furthermore, the implementation of 5G technology has streamlined the entire learning process, significantly improving efficiency in terms of time. Owing to the above mentioned factors, the learning management systems market is expected to experience significant growth during the forecast period.

LEARNING MANAGEMENT SYSTEMS MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global learning management systems market is segmented into solutions, software, and services. According to our estimates, currently, the services sector captures the majority share of the market. This can be attributed to the rising number of installations and a strong need for technical services.

Major players in the digital learning sector are providing comprehensive educational services, encompassing consultancy, implementation, and additional support to enhance curriculum development and improve performance.

Market Share by Type of Deployment

Based on type of deployment, the learning management systems market is segmented into cloud based, on-premises, and web-based. According to our estimates, currently, cloud-based segment captures the majority of the market. This can be attributed to its adaptable pricing models and the user-friendly maintenance and software upgrade processes.

LMS providers support, host, and develop the solutions. Almost everything one might need is available in LMS, including the ability to upload new courses, guide new learning paths, and access completion statistics.

Market Share by Mode of Delivery

Based on mode of delivery, the learning management systems market is segmented into distance learning, blended training and instructor-led training. According to our estimates, currently, online instructor-led training, which involves real-time interaction between learners and educators captures the majority share of the market. This can be attributed to the fact that it allows participants to engage with instructors from the comfort of their homes.

Blended training ranks second in market share, as it combines elements of both online and traditional classroom instruction. However, distance learning segment is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Service

Based on type of service, the learning management systems market is segmented into administration, content management, communication & collaboration, learner management, and performance management. The market size for these various service types within the learning and development sector can fluctuate due to factors like industry trends, demand, and revenue from businesses that provide these services.

The leading industry in this market is not fixed and shifts depending on the companies involved. In every segment, different companies focus on delivering a specific set of specialized services; for example, notable leaders such as Cornerstone OnDemand, SAP Litmos, and Docebo excel in offering comprehensive administration solutions for managing educational programs, monitoring progress, and creating reports.

Other key factors that contribute to the market size and growth of these segments include a range of significant players who are dedicated to enhancing the overall experience, leading to substantial expansion in the market.

Market Share by Type of Industry

Based on type of industry, the learning management systems market is segmented into software and technology, retail, banking and finance and insurance (BFSI), manufacturing, telecommunication, government and defense, and healthcare. Within the LMS market share, the corporate sector accounts for the majority of this segment. Organizations from diverse fields, including finance, healthcare, retail, and technology, utilize LMS platforms to optimize training procedures and boost employee productivity, indicating a significant market growth potential over the next decade.

Additionally, the market share by industry type includes education, governmental, and non-profit entities, which represent a considerable portion of this segment. Educational institutions extensively rely on LMS for online education, course management, and student evaluations. With the growing demand for effective, scalable, and adaptable training solutions, the market is rapidly evolving and is projected to experience substantial growth in the future.

Market Share by Type of Technology

Based on type of technology, the global learning management systems market is segmented across various technologies. According to our estimates, currently, artificial intelligence (AI) integration segment captures the majority share of the market. This can be attributed to the ongoing advancements in AI. Additionally, there are segments focused on analytics and reporting, which play a key role in monitoring student performance, engagement, and progress within learning management systems. However, the market for obile learning and gamification segment is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Type of Pricing Model

Based on type of pricing model, the global learning management systems market is segmented into freemium, one-time license, and subscription-based models. According to our estimates, currently, subscription-based pricing model captures the majority share of the market. This can be attributed to its various benefits compared to the other options.

This model focuses heavily on both affordability and efficiency. Additionally, it allows users the flexibility to pay a recurring fee (monthly, quarterly, or annually) depending on the number of users or specific features utilized. This model is currently employed by leading market players, significantly contributing to the overall growth of the market.

Market Share by End User

Based on end user, the global learning management systems market is segmented into academic, administrators and managers, content creators, corporate, government, individual learners, instructors and educators, and others. According to our estimates, currently, the academic sector captures the majority share of the market.

This can be attributed to its early embrace of LMS technologies to improve operations such as fraud detection, student assessment, and providing a tailored customer experience. By utilizing LMS technologies, the academic sector aims to meet its needs for decision-making and automation.

However, the market for corporate and content creators segment is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Company Size

Based on company size, the global learning management systems market is segmented into large size companies and small and mid-size companies. According to our estimates, currently, large companies captures the majority share of the market. This can be attributed to their ability to allocate significant resources towards LMS solutions to facilitate extensive employee training, compliance initiatives, and ongoing professional development. They generally favor cloud-based LMS solutions due to their flexibility and straightforward management.

However, the market for medium and small enterprises is expected to grow at a relatively higher CAGR during the forecast period, owing to the fact that these options are cost-effective and user-friendly, allowing for quick implementation to meet basic training requirements.

Market Share by Business Model

Based on business model, the global learning management systems market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B segment captures the majority share of the market. This can be attributed to the rising use of LMS technology across various business sectors, including education, manufacturing, healthcare, finance, and more.

However, the market for B2C model is expected to grow at a relatively higher CAGR during the forecast period, owing to the fact that this model is user-friendly and consumers increasingly seek personalized applications, smartphone integration, and enhanced user experience.

Market Share by Geographical Regions

Based on geographical regions, the learning management systems market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to various factors, including the early embrace of advanced technology, the presence of key industry players, their collaborations and partnerships with other stakeholders, and substantial investment in research and development for innovative solutions. However, the market in Asia is expected to grow at a higher CAGR during the forecast period, due to the growing adoption of AI-driven technologies across various sectors.

Example Players in Learning Management Systems Market

- Absorb LMS Software

- Adobe LMS

- Articulate 360

- Blackboard

- Braincert

- Callidus Software

- Cornerstone OnDemand

- D2L

- Docebo

- Epignosis

- eFront

- IBM

- Infor

- Instructure

- JZero Solutions

- John Wiley & Sons

- LearnUpon

- Learning Technologies Group

- McGraw Hill

- MindScroll

- Oracle

- Paradiso Solutions

- Pearson plc

- PowerSchool

- SABA Software

- SAP Litmos

- SAP SE

- Schoology

- SkyPrep

- SumTotal

- Talent Cards

- Thinkific

- Xerox

LEARNING MANAGEMENT SYSTEMS MARKET: RESEARCH COVERAGE

The report on the learning management systems market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the learning management systems market, focusing on key market segments, including [A] type of component, [B] type of deployment, [C] mode of delivery, [D] type of service, [E] type of industry, [F] type of technology, [G] pricing model, [H] end-user, [I] company size, [J] business model and [K] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the Learning management systems market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the Learning management systems market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] Learning management systems portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the Learning management systems market.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in learning management systems market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Learning Management Systems

- 6.2.1. Key Characteristics of LMS

- 6.2.2. Type of Component

- 6.2.3. Mode of Delivery

- 6.2.4. Type of Service

- 6.2.5. Type of Industry

- 6.2.6. Type of Technology

- 6.2.7. Type of Pricing Model

- 6.2.8. Type of End User

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Learning Management Systems: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Absorb LMS Software*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- Similar detail is presented for other below mentioned companies based on information in the public domain

- 8.3. Adobe LMS

- 8.4. Docebo

- 8.5. Oracle

- 8.6. LearnUpon

- 8.7. Instructure

- 8.8. IBM

- 8.9. Braincert

- 8.10. Epignosis

- 8.11. Callidus Software

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL LEARNING MANAGEMENT SYSTEMS MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Learning Management Systems Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. LMS Market for Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. LMS Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. LMS Market for Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYEMENT

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. LMS Market for Cloud-based Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. LMS Market for On Premise Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. LMS Market for Web-based Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON MODE OF DELIVERY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. LMS Market for Distance Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. LMS Market for Blended Training: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. LMS Market for Instructor-led Training: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF SERVICE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. LMS Market for Administration: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. LMS Market for Content Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. LMS Market for Communication and Collaboration: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. LMS Market for Learner Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. LMS Market for Performance Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.11. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF INDUSTRY

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. LMS Market for Banking and Finance and Insurance (BFSI): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. LMS Market for Government and Defense: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. LMS Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. LMS Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.10. LMS Market for Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.11. LMS Market for Software and Technology: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.12. LMS Market for Telecommunication: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.13. LMS Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.14. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TECHNOLOGY

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. LMS Market for Analytics and Reporting: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. LMS Market for AI Integration: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. LMS Market for Mobile Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. LMS Market for Gamification: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON PRICING MODEL

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. LMS Market for Freemium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. LMS Market for One time License: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. LMS Market for Subscription based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. LMS Market for Academic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. LMS Market for Administrator and Managers: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. LMS Market for Content Creators: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. LMS Market for Corporate: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. LMS Market for Government: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. LMS Market for Individual Learners: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.12. LMS Market for Instructors and Educators: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.13. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. LMS Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. LMS Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. LMS Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. LMS Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. LMS Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR LMS IN NORTH AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. LMS Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. LMS Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. LMS Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. LMS Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. LMS Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR LMS IN EUROPE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. LMS Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. LMS Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. LMS Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. LMS Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. LMS Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. LMS Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. LMS Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. LMS Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. LMS Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.9. LMS Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.10. LMS Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.11. LMS Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.12. LMS Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.13. LMS Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till-2035)

- 23.6.14. LMS Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.15. LMS Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR LMS IN ASIA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. LMS Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. LMS Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. LMS Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. LMS Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. LMS Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. LMS Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. LMS Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR LMS IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. LMS Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. LMS Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 25.6.2. LMS Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. LMS Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. LMS Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. LMS Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. LMS Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. LMS Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. LMS Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR LMS IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. LMS Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. LMS Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. LMS Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. LMS Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. LMS Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. LMS Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. LMS Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR LMS IN REST OF THE WORLD

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. LMS Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. LMS Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. LMS Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. LMS Market in Other Countries

- 27.7. Data Triangulation and Validation