|

市場調査レポート

商品コード

1723657

ヘルスケアにおける非代替性トークン(NFT)市場:使用ブロックチェーン別、応用分野別、最終用途別、地域別:2035年までの業界動向と世界の予測Non-fungible Tokens (NFT) in Healthcare Market by Blockchain Used, Application Area, End-user and Geographical Regions: Industry Trends and Global Forecasts, till 2035 |

||||||

カスタマイズ可能

|

|||||||

| ヘルスケアにおける非代替性トークン(NFT)市場:使用ブロックチェーン別、応用分野別、最終用途別、地域別:2035年までの業界動向と世界の予測 |

|

出版日: 2025年05月09日

発行: Roots Analysis

ページ情報: 英文 210 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

ヘルスケアにおける非代替性トークン(NFT)市場

世界のヘルスケアにおけるNFTの市場規模は、2021年に1億5,400万米ドル、2025年には2億810万米ドルになるとみられ、2035年には1兆1,168億米ドルに達すると予測されており、予測期間中のCAGRは18.3%と見込まれています。

ヘルスケア市場におけるNFTの機会は、以下のセグメントに分散しています:

使用されるブロックチェーン

- イーサリアム

- ハイパーレジャー

- ポリゴン

- その他

応用分野

- 医療記録管理

- サプライチェーン管理

- ゲノム研究

- 健康とウェルネス

- 臨床試験同意書

- その他

エンドユーザー

- ヘルスケア関係者

- 患者

- 製薬会社

- 学術機関/政府機関

- 保険会社

- その他

地域

- 北米(米国、カナダ)

- 欧州(ドイツ、英国、スペイン、その他)

- アジア太平洋地域(中国、韓国、インド、その他)

- 中東・北アフリカ(サウジアラビア、UAE、その他)

- ラテンアメリカ(ブラジル、アルゼンチン、その他)

ヘルスケアにおけるNFT市場:成長と動向

NFT市場は急速に発展している分野であり、分散型ブロックチェーン技術を統合することで複数の業界に変革をもたらしつつあります。ブロックチェーン技術を取り入れることで、さまざまな業界が中央集権型システムから分散型ネットワークへの移行を促し、取引速度の向上、コストの削減、データの整合性の向上など、いくつかの利点がもたらされています。NFTはブロックチェーン上に保存され、トークン化されるため、(前述の)いくつかの利点があることは注目に値します。このような利点が、近年NFTの導入が拡大している一因となっています。実際、2021年にNFT市場はNFTの取引により400億米ドル以上の収益を生み出しました。この主な要因は、NFTの歴史に大きなブレークスルーをもたらしたアートワーク業界における重要な出来事(デジタルアーティストのBeepleが6,900万米ドル相当の作品を売却)にあります。

NFTは、ブロックチェーン技術によってトークン化されたアート作品、医療データ、ビデオクリップなどの資産をデジタルで表現したものです。トークン化された情報には第三者がアクセスできないため、NFTは可分性がなく、不変であり、高いセキュリティとプライバシーを提供するという特長があります。上記の特徴から、NFTはアート、サプライチェーン、ファッション、ゲーム、ヘルスケア、不動産など、さまざまな分野で利用されています。さらに、NFTは暗号通貨やブロックチェーン市場に携わる投資家や利害関係者から大きな関心を集めており、導入拡大に寄与しています。

ヘルスケアでは、サプライチェーンの追跡、健康記録の管理、ゲノム研究、献血、臨床試験同意、ヘルスケア、ウェルネスプログラムなど、複数の用途でNFTが利用されています。特に、医療記録用のNFTはヘルスケア業界で最も一般的に使用されており、患者が自分の健康関連データを管理し、製薬会社や研究機関と取引することを可能にしています。さらに、ヘルスケア分野におけるNFTの可能性を十分に引き出すため、NFTソリューションを提供する様々な企業が、データの安全かつ透明性の高い保存と共有を可能にする革新的なプラットフォームの開発も進めています。

ブロックチェーンや関連先端技術に対する認識が高まり、導入が進んでいることから、ヘルスケア業界におけるNFTソリューションの需要は安定したペースで増加しています。さらに、著名人によるデジタル資産の推奨や、ヘルスケアデータの取り扱いが急務となっていることから、ヘルスケアにおけるNFT市場は今後数年間で安定した成長が見込まれます。

ヘルスケアにおけるNFT市場:主要インサイト

当レポートでは、ヘルスケア分野におけるNFT市場の現状を調査し、潜在的な成長機会を特定しています。主な調査結果は以下の通りです:

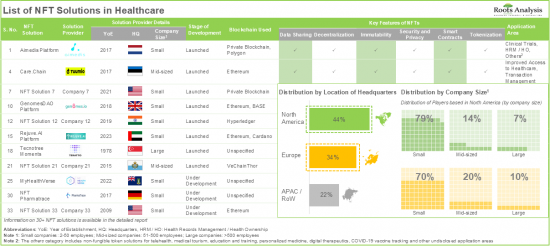

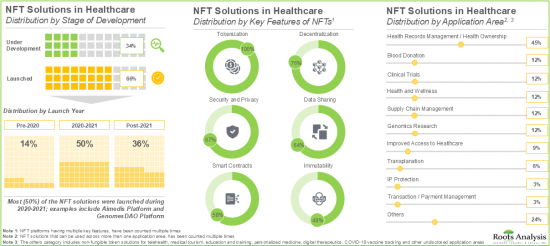

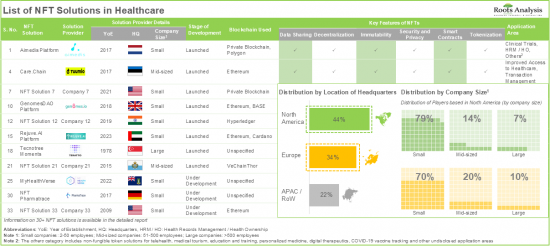

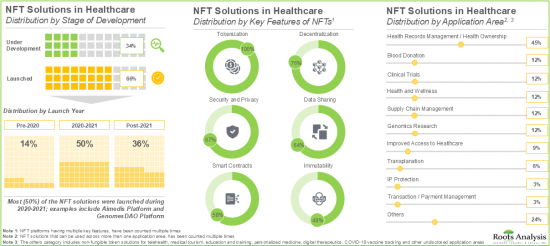

- 様々なヘルスケアにおけるセキュリティと信頼性のニーズに後押しされ、30を超えるNFTソリューションが上市/開発されています。

- 現在、65%以上のNFTプラットフォームが市場で利用可能であり、そのうち30%はデータ共有、スマートコントラクト、分散化、トークン化、不変性、セキュリティといった主要機能をすべて備えています。

- この分野で締結された取引の約45%は、医療データ管理とアクセシビリティを向上させるNFTソリューションの強化に焦点を当てたもので、大陸間取引の大半は北米を拠点とする参入企業により締結されました。

- 過去数年間、ヘルスケア分野のNFTソリューション・プロバイダーは、さまざまな資金調達ラウンドを通じて9,000万米ドル以上を調達しています。

- 暗号通貨の普及と患者の収益化機会の増加は、ヘルスケアにおける非代替性トークン市場を牽引し、当面は安定した成長が見込まれます。

- NFTが提供する比類のないデータセキュリティと相まって、非中央集権化などの原則に関する意識が高まっていることから、同市場は2035年まで年率18.3%(CAGR)で成長すると予測されています。

ヘルスケアにおけるNFT市場:主要セグメント

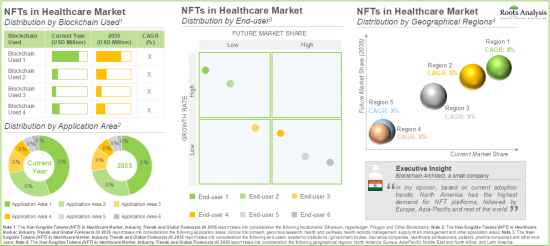

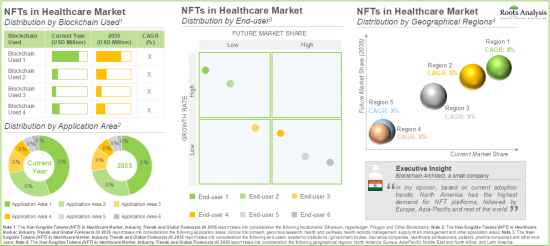

使用ブロックチェーン別では、世界のヘルスケアにおけるNFT市場は、イーサリアム、ハイパーレジャー、ポリゴンおよびその他のブロックチェーンにセグメント化されます。現在、ヘルスケアにおけるNFT市場の大半のシェアを獲得しているのは、イーサリアム・ブロックチェーン・ネットワークを利用したNFTソリューションです。これは、イーサリアム・ブロックチェーンがセキュリティとプライバシーを強化し(スマートコントラクトを実装した最初のブロックチェーンであるため)、第三者による検証を必要としないという事実に起因しています。他のブロックチェーンを活用したNFTソリューションは、今後数年間で大きなペースで成長する可能性が高いことは特筆に値します。

応用分野別では、ヘルスケアにおける世界のNFT市場は、医療記録管理、サプライチェーン管理、ゲノム研究、健康とウェルネス、臨床試験同意、その他のアプリケーション分野に分散しています。NFTは電子カルテの追跡を効率的に行い、正確な診断と治療をサポートするため、現在のところ、カルテ管理分野が市場全体を支配する可能性が高いです。特に、この動向は予測期間中も変わりそうにありません。

世界のNFT市場はエンドユーザー別では、医療従事者、患者、製薬会社、学術機関/政府機関、保険会社、その他のエンドユーザーに区分されます。注目すべきは、現在の市場は医療従事者が利用するNFTソリューションが支配的であろうということです。しかし、今後数年間は、患者のニーズに応えるNFTソリューションが大幅な成長を遂げることが予想されます。

地域別に見ると、市場は北米、欧州、アジア太平洋、中東・北アフリカ、ラテンアメリカに区分されます。現在のシナリオでは、北米がヘルスケアにおけるNFT市場を独占する可能性が高いです。しかし、研究開発活動の活発化、認知度の向上、NFTソリューションの採用増加により、アジア太平洋のヘルスケアにおけるNFT市場は予測期間中により高いCAGRで成長すると予想されます。

当レポートでお答えする主な質問

- 現在、この市場に参入している企業は何社あるか

- この市場における主要企業

- この市場の進化に影響を与えそうな要因

- 現在と将来の市場規模

- この市場のCAGR

- 現在および将来の市場機会は、主要市場セグメントにどのように分配されそうか

- 業界利害関係者が一般的に採用しているパートナーシップモデルの種類

- この市場で進行中の投資動向

当レポートを購入する理由

- 当レポートは包括的な市場分析を提供し、市場全体と特定のサブセグメントに関する詳細な収益予測を提供します。この情報は、すでに市場をリードしている企業にとっても、新規参入企業にとっても貴重なものです。

- 利害関係者は、市場内の競争力学をより深く理解するためにレポートを活用することができます。競合情勢を分析することで、企業は、市場でのポジショニングを最適化し、効果的な市場参入戦略を開発するために、情報に基づいた意思決定を行うことができます。

- 当レポートは、主要促進要因・市場抑制要因・課題など、市場の包括的な概要を利害関係者に提供します。この情報は、利害関係者が市場動向を常に把握し、成長の見込みを活用するためのデータ主導の意思決定を行うための力となります。

その他の特典

- PPTインサイトパック

- レポート内の全分析モジュールの無料エクセルデータパック

- 10%の無料コンテンツカスタマイズ

- 調査チームによる詳細レポートのウォークスルーセッション

- レポートが6-12ヶ月以上前の場合、無料更新レポート

当レポートでは、世界のヘルスケアにおける非代替性トークン(NFT)市場について調査し、市場の概要とともに、使用ブロックチェーン別、応用分野別、最終用途別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

セクションI:レポートの概要

第1章 背景

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクションII:定性的な洞察

第5章 エグゼクティブサマリー

第6章 イントロダクション

- 非代替性トークン(NFT)の概要

- ブロックチェーンプロセス

- NFTの主な特徴

- NFTのユースケース

- ヘルスケアにおけるNFTの応用

- ヘルスケア分野におけるNFTの課題

- 将来の展望

セクションIII:市場概要

第7章 競合情勢

- 調査手法と主要なパラメータ

- ヘルスケアにおけるNFTソリューション:市場情勢

- ヘルスケアにおけるNFTソリューションプロバイダー:市場情勢

第8章 企業競争力分析

- 調査手法と主要なパラメータ

- 採点基準

- ピアグループ

- ヘルスケアソリューションプロバイダーにおけるNFT:企業競争力分析

- ヘルスケアソリューションプロバイダーにおけるNFT:ベンチマーク分析

セクションIV:企業プロファイル

第9章 企業プロファイル

セクションV:市場動向

第10章 パートナーシップとコラボレーション

- パートナーシップモデル

- ヘルスケアにおける非代替性トークン:パートナーシップとコラボレーション

第11章 資金調達と投資

- 資金調達モデル

- ヘルスケアにおける非代替性トークン:資金調達と投資

- サマリーと重要なポイント

第12章 ヘルスケアにおける非代替性トークン:ユースケース

- NFTユースケースの概要

- NFTの潜在的な使用例

セクションVI:市場予測と機会分析

第13章 市場影響分析:促進要因、抑制要因、機会、課題

- 章の概要

- 市場の促進要因

- 市場の抑制要因

- 市場の機会

- 市場の課題

- 結論

第14章 ヘルスケア市場における世界な非代替性トークン

- 主要な前提と調査手法

- ヘルスケア市場における世界の非代替性トークン、歴史的動向(2021年以降)と予測推定(2035年まで)

- 主要な市場セグメンテーション

第15章 ヘルスケア市場における非代替トークン市場(使用ブロックチェーン別)

第16章 ヘルスケアにおける非代替性トークン市場(応用分野別)

第17章 ヘルスケアにおける非代替性トークン市場(エンドユーザー別)

第18章 ヘルスケアにおける非代替性トークン市場(地域別)

セクションVII:地理的地域における市場機会分析

第19章 市場機会分析:北米

第20章 市場機会分析:欧州

第21章 市場機会分析:アジア太平洋

第22章 市場機会分析:中東および北アフリカ

第23章 市場機会分析:ラテンアメリカ

セクションVIII:戦略ツール

第24章 ポーターのファイブフォース分析

セクションIX:その他の独占的洞察

第25章 結論

第26章 1次調査からの洞察

セクションX:付録

第27章 表形式データ

第28章 企業・団体一覧

List of Tables

- Table 7.1 NFT Solutions in Healthcare: Information on Solution Provider, Stage of Development, Launch Year, Blockchain Used and Key Features

- Table 7.2 NFT Solutions in Healthcare: Information on Application Area

- Table 7.3 NFT Solutions in Healthcare: Information on End-user

- Table 7.4 NFT Solution Providers in Healthcare: Information on Year of Establishment, Headquarter and Company Size

- Table 10.1 Non-fungible Tokens in Healthcare: List of Partnerships and Collaborations, since 2020

- Table 11.1 Non-fungible Tokens in Healthcare: List of Funding and Investments, since 2018

- Table 19.1 Non-fungible Tokens in Healthcare Market in North America: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 19.2 Non-fungible Tokens in Healthcare Market in North America: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 19.3 Non-fungible Tokens in Healthcare Market in North America: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.1 Non-fungible Tokens in Healthcare Market in Europe: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.2 Non-fungible Tokens in Healthcare Market in Europe: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 20.3 Non-fungible Tokens in Healthcare Market in Europe: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.1 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.2 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 21.3 Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.1 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.2 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 22.3 Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.1 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Blockchain Used, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.2 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Application Area, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- Table 23.3 Non-fungible Tokens in Healthcare Market in Latin America: Distribution by End-user, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035) (USD Million)

- *Detailed information on Tables 19.1-23.3 is available in the Excel Data Packs shared along with the report

- Table 27.1 NFT Solutions in Healthcare: Distribution by Stage of Development

- Table 27.2 NFT Solutions in Healthcare: Distribution by Key Features of NFTs

- Table 27.3 NFT Solutions in Healthcare: Distribution by Application Area

- Table 27.4 NFT Solutions in Healthcare: Distribution by End-user

- Table 27.5 NFT Solution Providers: Distribution by Year of Establishment

- Table 27.6 NFT Solution Providers: Distribution by Company Size

- Table 27.7 NFT Solution Providers: Distribution by Location of Headquarters

- Table 27.8 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 27.9 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 27.10 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 27.11 Partnerships and Collaborations: Distribution by Type of Partner

- Table 27.12 Partnerships and Collaborations: Distribution by Application Area

- Table 27.13 Partnerships and Collaborations: Distribution by Geographical Activity

- Table 27.14 Most Active Players: Distribution by Number of Partnerships

- Table 27.15 Funding and Investments: Cumulative Year-wise Trend of Fundings and Investments

- Table 27.16 Funding and Investments: Distribution of Funding Instances by Type of Funding

- Table 27.17 Funding and Investments: Year-wise Distribution of Funding Instances by Type of Funding

- Table 27.18 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Table 27.19 Funding and Investments: Distribution of Funding Instances by Country

- Table 27.20 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 27.21 Funding and Investments: Summary

- Table 27.22 Global Non-fungible Tokens in Healthcare Market, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.23 Non-fungible Tokens in Healthcare Market: Distribution by Blockchain Used

- Table 27.24 Non-fungible Tokens in Healthcare Market for Ethereum Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.25 Non-fungible Tokens in Healthcare Market for Hyperledger Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.26 Non-fungible Tokens in Healthcare Market for Polygon Blockchain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.27 Non-fungible Tokens in Healthcare Market for Other Blockchains, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.28 Non-fungible Tokens in Healthcare Market: Distribution by Application Area

- Table 27.29 Non-fungible Tokens in Healthcare Market for Health Records Management, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.30 Non-fungible Tokens in Healthcare Market for Supply Chain Management, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.31 Non-fungible Tokens in Healthcare Market for Genomics Research, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.32 Non-fungible Tokens in Healthcare Market for Health and Wellness, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.33 Non-fungible Tokens in Healthcare Market for Clinical Trial Consent, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.34 Non-fungible Tokens in Healthcare Market for Other Application Areas, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.35 Non-fungible Tokens in Healthcare Market: Distribution by End-user

- Table 27.36 Non-fungible Tokens in Healthcare Market for Healthcare Professionals, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.37 Non-fungible Tokens in Healthcare Market for Patients, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.38 Non-fungible Tokens in Healthcare Market for Pharmaceutical Companies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.39 Non-fungible Tokens in Healthcare Market for Academic Institutions / Government Bodies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.40 Non-fungible Tokens in Healthcare Market for Insurance Companies, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.41 Non-fungible Tokens in Healthcare Market for Other End-users, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.42 Non-fungible Tokens in Healthcare Market: Distribution by Geographical Regions

- Table 27.43 Non-fungible Tokens in Healthcare Market in North America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.44 Non-fungible Tokens in Healthcare Market in the US, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.45 Non-fungible Tokens in Healthcare Market in Canada, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.46 Non-fungible Tokens in Healthcare Market in Europe, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.47 Non-fungible Tokens in Healthcare Market in Germany, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.48 Non-fungible Tokens in Healthcare Market in the UK, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.49 Non-fungible Tokens in Healthcare Market in Spain, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.50 Non-fungible Tokens in Healthcare Market in Rest of the Europe, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.51 Non-fungible Tokens in Healthcare Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.52 Non-fungible Tokens in Healthcare Market in China, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.53 Non-fungible Tokens in Healthcare Market in South Korea, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.54 Non-fungible Tokens in Healthcare Market in India, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.55 Non-fungible Tokens in Healthcare Market in Rest of the Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.56 Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.57 Non-fungible Tokens in Healthcare Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.58 Non-fungible Tokens in Healthcare Market in UAE, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.59 Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.60 Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.61 Non-fungible Tokens in Healthcare Market in Brazil, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.62 Non-fungible Tokens in Healthcare Market in Argentina, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

- Table 27.63 Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (since 2021) and Forecasted Estimated (till 2035): Conservative, Base and Optimistic Scenario (USD Million)

NON-FUNGIBLE TOKENS (NFT) IN HEALTHCARE MARKET

As per Roots Analysis, the global NFT in healthcare market, valued at USD 154.0 million in 2021, is projected to reach USD 208.1 million in 2025 and USD 1,116.8 billion by 2035, representing a CAGR of 18.3% during the forecast period.

The opportunity for NFT in the healthcare market has been distributed across the following segments:

Blockchain Used

- Ethereum

- HyperLedger

- Polygon

- Other Blockchains

Application Area

- Health Records Management

- Supply Chain Management

- Genomics Research

- Health and Wellness

- Clinical Trial Consent

- Other Application Areas

End-user

- Healthcare Professionals

- Patients

- Pharmaceutical Companies

- Academic Institutions / Government Bodies

- Insurance Companies

- Other End-users

Geographical Regions

- North America (US and Canada)

- Europe (Germany, UK, Spain and Rest of the Europe)

- Asia-Pacific (China, South Korea, India and Rest of the Asia-Pacific)

- Middle East and North Africa (Saudi Arabia, UAE and Rest of the Middle East and North Africa)

- Latin America (Brazil, Argentina and Rest of the Latin America)

NFT IN HEALTHCARE MARKET: GROWTH AND TRENDS

The NFT market is a rapidly evolving sector that is transforming several industries by integrating decentralized blockchain technology. The incorporation of blockchain technology has prompted various industries to shift from centralized systems to decentralized networks, offering several advantages, such as enhanced transaction speeds, reduced costs, and improved data integrity. It is worth highlighting that NFTs are stored and tokenized on blockchain and therefore offer several advantages (mentioned above). These advantages have further contributed to the increased adoption of NFTs in recent years. In fact, in 2021, the NFT market generated more than USD 40 billion in revenues by trading NFTs; primarily attributed to an important event in the artwork industry (wherein Beeple, a digital artist, sold a piece of his artwork worth USD 69 million) that marked a significant breakthrough in the history of NFTs.

NFTs are distinct digital representations of assets, such as artwork, medical data, and video clips that have been tokenized through blockchain technology. It is worth noting that NFTs are non-divisible, immutable, and provide high security and privacy, since third parties cannot access the tokenized information. Owing to the abovementioned features, NFTs are being used across multiple disciplines, such as art, supply chain, fashion, gaming, healthcare, and real estate. Further, NFTs have gained significant interest from investors and stakeholders engaged in the cryptocurrency and blockchain market, contributing to their increased adoption.

In healthcare, NFTs are being used for several applications, including tracking supply chain, managing health records, genomics research, blood donation, clinical trial consent, healthcare and wellness programs. Notably, the NFTs for medical records are most commonly used in the healthcare industry, which allows patients to control their health-related data and trade it with pharmaceutical firms and research institutions. Moreover, to fully realize the potential of NFTs in the healthcare sector, various companies providing NFT solutions are also developing innovative platforms that enable secure and transparent storage and sharing of data.

Given the rising awareness and increased adoption of blockchain and related advanced technologies, the demand for NFT solutions in the healthcare industry is increasing at a steady pace. Moreover, the celebrity endorsements of digital assets and the urgent need to handle healthcare data, the NFT in healthcare market is expected to witness steady growth in the forthcoming years.

NFT IN HEALTHCARE MARKET: KEY INSIGHTS

The report delves into the current state of the NFT in healthcare market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Driven by the need for security and reliability across various healthcare applications, over 30 NFT solutions have been launched / under development; notably, the market landscape primarily features the presence of new entrants.

- Presently, more than 65% of the NFT platforms are available in the market; of these, 30% of the platforms have all the key features, namely data sharing, smart contracts, decentralization, tokenization, immutability and security.

- Around 45% of the deals inked in this domain were focused on enhancing NFT solutions to improve health data management and accessibility; the majority of the intercontinental deals were signed by players based in North America.

- Over the past few years, more than USD 90 million has been raised across various funding rounds by NFT solution providers in healthcare; of which, 80% of the total amount was raised by players based in Europe.

- The rise in adoption of cryptocurrencies coupled with monetization opportunities for patients drives the non-fungible tokens in healthcare market, positioning it for steady growth in the foreseeable future.

- Given the rising awareness regarding principles such as decentralization coupled with unmatched data security offered by NFTs, the market is anticipated to grow at an annualized rate (CAGR) of 18.3% till 2035.

NFT IN HEALTHCARE MARKET: KEY SEGMENTS

NFT Solutions Utilizing Ethereum Blockchain Network is Likely to Dominate the NFT in Healthcare Market During the Forecast Period

Based on the blockchain used, the global NFT in healthcare market is segmented into Ethereum, HyperLedger, Polygon and other blockchains. Currently, the majority share of the NFT in healthcare market is captured by NFT solutions utilizing Ethereum blockchain network. This can be attributed to the fact that Ethereum blockchain offers enhanced security and privacy (as this was the first blockchain to implement smart contracts) and does not require third-party verification. It is worth mentioning that the NFT solutions utilizing other blockchains are likely to grow at a significant pace in the coming years.

Health Records Management Segment is Likely to Hold the Largest Share of the NFT in Healthcare Market During the Forecast Period

Based on the application area, the global NFT in healthcare market is distributed across health records management, supply chain management, genomics research, health and wellness, clinical trial consent and other application areas. Currently, the health records management segment is likely to dominate the overall market, as NFTs enable the tracking of electronic health records effectively, which supports accurate diagnosis and treatment. Notably, this trend is unlikely to change during the forecast period.

Currently, NFT Solutions Catering to Healthcare Professionals Hold the Largest Share of the NFT in Healthcare Market

Based on the end-user, the global NFT in healthcare market is segmented into healthcare professionals, patients, pharmaceutical companies, academic institutions / government bodies, insurance companies and other end-users. It is worth noting that the current market is likely to be dominated by NFT solutions being utilized by healthcare professionals. However, in the coming years, the NFT solutions catering to patient needs are expected to witness substantial growth.

North America Accounts for the Largest Share of the Market

Based on geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, and Latin America. In the current scenario, North America is likely to dominate the NFT in healthcare market. However, owing to the increasing research and development activity, rising awareness and increased adoption of NFT solutions, the NFT in healthcare market in Asia-Pacific is expected to grow at a higher CAGR during the forecast period.

Example Players in the NFT in Healthcare Market

- Aimedis

- BurstIQ

- ChainCode Consulting

- DeHealth

- Epillo Health

- GenoBank.io

- Genomes.io

- IVIRSE

- Molecule

- Rejuve.AI

- TuumIO

- Universal Health Token

NFT IN HEALTHCARE MARKET: RESEARCH COVERAGE

The report on NFT in healthcare market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of NFT in healthcare market, focusing on key market segments, including [A] blockchain used, [B] application area, [C] end-user, and [D] geographical regions.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- NFT Solutions Market Landscape: An insightful analysis of various NFT solutions based on several relevant parameters, such as [A] stage of development, [B] key features, [C] application area, and [D] end-user. Additionally, this section also features analyses of the companies engaged in this domain, based on [A] company size, [B] location of headquarters, and [C] year of establishment.

- Company Competitiveness Analysis: An insightful competitiveness analysis of NFT solution providers based on various relevant parameters, such as [A] supplier strength, [B] portfolio strength, and [C] portfolio diversity.

- Company Profiles: Elaborate profiles of leading players developing NFT solutions across various geographies, including North America, Europe, Asia-Pacific and rest of the world, providing details on [A] company overview, [B] NFT solution overview, [C] recent developments and [D] an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders engaged in NFT in healthcare industry, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] application area, [E] most active players and [F] geographical distribution of partnership activity.

- Funding and Investment Analysis: An in-depth analysis of funding and investments made in the NFT in healthcare domain, based on relevant parameters, such as [A] year of funding, [B] type of funding, [C] amount invested (USD million), [D] geography, and [E] most active players.

- Case Study: A detailed assessment of the existing and potential use cases of non-fungible tokens across several healthcare applications, highlighting their capacity to revolutionize health data management and enhancing patient care.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the NFT in healthcare industry, including threats of new entrants, bargaining power of buyers, bargaining power of NFT in healthcare solution providers, threats of substitute products and rivalry among existing competitors.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What types of partnership models are commonly adopted by industry stakeholders?

- What is the ongoing investment trend in this market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Overview of Non-fungible Tokens (NFTs)

- 6.2. Blockchain Process

- 6.3. Key Features of NFTs

- 6.4. NFTs Use Cases

- 6.5. Applications of NFTs in Healthcare

- 6.6. Challenges Associated with NFTs in Healthcare Domain

- 6.7. Future Perspectives

SECTION III: MARKET OVERVIEW

7. COMPETITIVE LANDSCAPE

- 7.1. Methodology and Key Parameters

- 7.2. NFT Solutions in Healthcare: Overall Market Landscape

- 7.2.1. Analysis by Stage of Development

- 7.2.2. Analysis by Key Features of NFTs

- 7.2.3. Analysis by Application Area

- 7.2.4. Analysis by End-user

- 7.3. NFT Solution Providers in Healthcare: Overall Market Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Methodology and Key Parameters

- 8.2. Scoring Criteria

- 8.3. Peer Groups

- 8.3.1. Overview of Peer Groups

- 8.4. NFT in Healthcare Solution Providers: Company Competitiveness Analysis

- 8.4.1. NFT Solution Providers in North America: Peer Group I

- 8.4.1.1. Leading Players in Peer Group I

- 8.4.2. NFT Solution Providers in Europe: Peer Group II

- 8.4.2.1. Leading Players in Peer Group II

- 8.4.3. NFT Solution Providers in Asia-Pacific and Rest of the World: Peer Group III

- 8.4.3.1. Leading Players in Peer Group III

- 8.4.1. NFT Solution Providers in North America: Peer Group I

- 8.5. NFT in Healthcare Solution Providers: Benchmarking Analysis

- 8.5.1. Benchmarking of Supplier Strength Score

- 8.5.2. Benchmarking of Portfolio Strength Score

- 8.5.3. Benchmarking of Portfolio Diversity Score

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES

- 9.1. Overview

- 9.2. Leading Non-fungible Token Solution Providers in Healthcare

- 9.2.1. Aimedis

- 9.2.1.1. Company Overview

- 9.2.1.2. Company Mission

- 9.2.1.3. Management Team

- 9.2.1.4. Contact Details

- 9.2.1.5. NFT Solution Overview

- 9.2.1.6. Recent Initiatives

- 9.2.2. BurstIQ

- 9.2.3. DeHealth

- 9.2.4. GenoBank.io

- 9.2.5. Tuumio

- 9.2.1. Aimedis

- 9.3. Other Prominent Non-fungible Token Solution Providers in Healthcare

- 9.3.1. ChainCode Consulting

- 9.3.1.1. Company Mission

- 9.3.1.2. Management Team

- 9.3.1.3. NFT Solution Overview

- 9.3.1.4. Recent Initiatives

- 9.3.2. Epillo Health

- 9.3.3. Genomes.io

- 9.3.4. IVIRSE

- 9.3.5. Molecule

- 9.3.6. Rejuve.AI

- 9.3.7. Universal Health Token

- 9.3.1. ChainCode Consulting

SECTION V: MARKET TRENDS

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Partnership Models

- 10.2. Non-fungible Tokens in Healthcare: Partnerships and Collaborations

- 10.2.1. Analysis by Year of Partnership

- 10.2.2. Analysis by Type of Partnership

- 10.2.3. Analysis by Year and Type of Partnership

- 10.2.4. Analysis by Type of Partner

- 10.2.5. Analysis by Application Area

- 10.2.6. Analysis by Geographical Activity

- 10.2.7. Most Active Players: Analysis by Number of Partnerships

11. FUNDING AND INVESTMENTS

- 11.1. Funding Models

- 11.2. Non-fungible Tokens in Healthcare: Funding and Investments

- 11.2.1. Analysis by Year of Funding

- 11.2.2. Analysis of Funding Instances by Type of Funding

- 11.2.3. Analysis of Funding Instances by Year and Type of Funding

- 11.2.4. Analysis of Amount Invested by Type of Funding

- 11.2.5. Analysis of Funding Instances by Country

- 11.2.6. Most Active Players: Analysis by Amount Raised

- 11.3. Summary and Key Takeaways

12. NON-FUNGIBLE TOKENS IN HEALTHCARE: USE CASES

- 12.1. Overview of NFT Use Cases

- 12.1.1. Use Case 1: Auctioning Genomic Data

- 12.1.2. Use Case 2: DNA Kits

- 12.1.3. Use Case 3: Blood Donation

- 12.1.4. Use Case 4: Stem Cell Research

- 12.1.5. Use Case 5: Digital Health Clinics

- 12.1.6. Use Case 6: Charitable Health NFTs

- 12.1.7. Use Case 7: Marketing NFTs

- 12.1.8. Use Case 8: Supply Chain Traceability

- 12.2. Potential NFT Use Cases

SECTION VI: MARKET FORECAST AND OPPORTUNITY ANALYSIS

13. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 13.1. Chapter Overview

- 13.2. Market Drivers

- 13.3. Market Restraints

- 13.4. Market Opportunities

- 13.5. Market Challenges

- 13.6. Conclusion

14. GLOBAL Non-fungible TOKENS in healthcare MARKET

- 14.1. Key Assumptions and Methodology

- 14.2. Global Non-fungible Tokens in Healthcare Market, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 14.2.1. Multivariate Scenario Analysis

- 14.2.1.1. Conservative Scenario

- 14.2.1.2. Optimistic Scenario

- 14.2.1. Multivariate Scenario Analysis

- 14.3. Key Market Segmentations

15. Non-fungible TOKENS in healthcare MARKET, BY Blockchain Used

- 15.1. Key Assumptions and Methodology

- 15.2. Non-fungible Tokens in Healthcare Market: Distribution by Blockchain Used

- 15.2.1. Non-fungible Tokens in Healthcare Market for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.2. Non-fungible Tokens in Healthcare Market for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.3. Non-fungible Tokens in Healthcare Market for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.2.4. Non-fungible Tokens in Healthcare Market for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 15.3. Data Triangulation and Validation

- 15.3.1. Secondary Sources

- 15.3.2. Primary Sources

16. Non-fungible TOKENS in Healthcare MARKET, BY APPLICATION AREA

- 16.1. Key Assumptions and Methodology

- 16.2. Non-fungible Tokens in Healthcare Market: Distribution by Application Area

- 16.2.1. Non-fungible Tokens in Healthcare Market for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.2. Non-fungible Tokens in Healthcare Market for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.3. Non-fungible Tokens in Healthcare Market for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.4. Non-fungible Tokens in Healthcare Market for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.5. Non-fungible Tokens in Healthcare Market for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.2.6. Non-fungible Tokens in Healthcare Market for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 16.3. Data Triangulation and Validation

- 16.3.1. Secondary Sources

- 16.3.2. Primary Sources

17. Non-fungible TOKENS in healthcare MARKET, BY End-user

- 17.1. Key Assumptions and Methodology

- 17.2. Non-fungible Tokens in Healthcare Market: Distribution by End-user

- 17.2.1. Non-fungible Tokens in Healthcare Market for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.2. Non-fungible Tokens in Healthcare Market for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.3. Non-fungible Tokens in Healthcare Market for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.4. Non-fungible Tokens in Healthcare Market for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.5. Non-fungible Tokens in Healthcare Market for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.2.6. Non-fungible Tokens in Healthcare Market for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 17.3. Data Triangulation and Validation

- 17.3.1. Secondary Sources

- 17.3.2. Primary Sources

18. Non-fungible TOKENS in healthcare MARKET, BY Geographical Regions

- 18.1. Key Assumptions and Methodology

- 18.2. Non-fungible Tokens in Healthcare Market: Distribution by Geographical Regions

- 18.2.1. Non-fungible Tokens in Healthcare Market in North America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1.1. Non-fungible Tokens in Healthcare Market in the US, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1.2. Non-fungible Tokens in Healthcare Market in Canada, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2. Non-fungible Tokens in Healthcare Market in Europe, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.1. Non-fungible Tokens in Healthcare Market in Germany, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.2. Non-fungible Tokens in Healthcare Market in the UK, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.3. Non-fungible Tokens in Healthcare Market in Spain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.2.4. Non-fungible Tokens in Healthcare Market in Rest of the Europe, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.1. Non-fungible Tokens in Healthcare Market in China, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.2. Non-fungible Tokens in Healthcare Market in the South Korea, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.3. Non-fungible Tokens in Healthcare Market in India, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.3.4. Non-fungible Tokens in Healthcare Market in Rest of the Asia-Pacific, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.1. Non-fungible Tokens in Healthcare Market in Saudi Arabia, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.2. Non-fungible Tokens in Healthcare Market in UAE, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.4.3. Non-fungible Tokens in Healthcare Market in Rest of the Middle East and North Africa, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5. Non-fungible Tokens in Healthcare Market in Latin America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.1. Non-fungible Tokens in Healthcare Market in Brazil, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.2. Non-fungible Tokens in Healthcare Market in Argentina, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.5.3. Non-fungible Tokens in Healthcare Market in Rest of the Latin America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.2.1. Non-fungible Tokens in Healthcare Market in North America, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 18.3 Non-fungible Tokens in Healthcare Market, By Geographical Regions: Market Dynamics Assessment

- 18.3.1. Penetration-Growth (P-G) Matrix

- 18.3.2. Market Movement Analysis

- 18.4. Data Triangulation and Validation

- 18.4.1. Secondary Sources

- 18.4.2. Primary Sources

SECTION VII: MARKET OPPORTUNITY ANALYSIS WITHIN GEOGRAPHICAL REGIONS**

19. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 19.1. Non-fungible Tokens in Healthcare Market in North America: Distribution by Blockchain Used

- 19.1.1. Non-fungible Tokens in Healthcare Market in North America for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.2. Non-fungible Tokens in Healthcare Market in North America for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.3. Non-fungible Tokens in Healthcare Market in North America for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.1.4. Non-fungible Tokens in Healthcare Market in North America for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2. Non-fungible Tokens in Healthcare Market in North America: Distribution by Application Area

- 19.2.1. Non-fungible Tokens in Healthcare Market in North America for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.2. Non-fungible Tokens in Healthcare Market in North America for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.3. Non-fungible Tokens in Healthcare Market in North America for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.4. Non-fungible Tokens in Healthcare Market in North America for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.5. Non-fungible Tokens in Healthcare Market in North America for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.2.6. Non-fungible Tokens in Healthcare Market in North America for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3. Non-fungible Tokens in Healthcare Market in North America: Distribution by End-user

- 19.3.1. Non-fungible Tokens in Healthcare Market in North America for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.2. Non-fungible Tokens in Healthcare Market in North America for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.3. Non-fungible Tokens in Healthcare Market in North America for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.4. Non-fungible Tokens in Healthcare Market in North America for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.5. Non-fungible Tokens in Healthcare Market in North America for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 19.3.6. Non-fungible Tokens in Healthcare Market in North America for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

20. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 20.1. Non-fungible Tokens in Healthcare Market in Europe: Distribution by Blockchain Used

- 20.1.1. Non-fungible Tokens in Healthcare Market in Europe for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.2. Non-fungible Tokens in Healthcare Market in Europe for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.3. Non-fungible Tokens in Healthcare Market in Europe for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.1.4. Non-fungible Tokens in Healthcare Market in Europe for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2. Non-fungible Tokens in Healthcare Market in Europe: Distribution by Application Area

- 20.2.1. Non-fungible Tokens in Healthcare Market in Europe for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.2. Non-fungible Tokens in Healthcare Market in Europe for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.3. Non-fungible Tokens in Healthcare Market in Europe for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.4. Non-fungible Tokens in Healthcare Market in Europe for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.5. Non-fungible Tokens in Healthcare Market in Europe for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.2.6. Non-fungible Tokens in Healthcare Market in Europe for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3. Non-fungible Tokens in Healthcare Market in Europe: Distribution by End-user

- 20.3.1. Non-fungible Tokens in Healthcare Market in Europe for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.2. Non-fungible Tokens in Healthcare Market in Europe for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.3. Non-fungible Tokens in Healthcare Market in Europe for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.4. Non-fungible Tokens in Healthcare Market in Europe for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.5. Non-fungible Tokens in Healthcare Market in Europe for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 20.3.6. Non-fungible Tokens in Healthcare Market in Europe for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

21. MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 21.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Blockchain Used

- 21.1.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.1.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by Application Area

- 21.2.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.5. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.2.6. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific: Distribution by End-user

- 21.3.1. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.2. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.3. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.4. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.5. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 21.3.6. Non-fungible Tokens in Healthcare Market in Asia-Pacific for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

22. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 22.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Blockchain Used

- 22.1.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.1.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by Application Area

- 22.2.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.5. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.2.6. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa: Distribution by End-user

- 22.3.1. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.2. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.3. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.4. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.5. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 22.3.6. Non-fungible Tokens in Healthcare Market in Middle East and North Africa for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

23. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 23.1. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Blockchain Used

- 23.1.1. Non-fungible Tokens in Healthcare Market in Latin America for Ethereum Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.2. Non-fungible Tokens in Healthcare Market in Latin America for Hyperledger Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.3. Non-fungible Tokens in Healthcare Market in Latin America for Polygon Blockchain, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.1.4. Non-fungible Tokens in Healthcare Market in Latin America for Other Blockchains, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by Application Area

- 23.2.1. Non-fungible Tokens in Healthcare Market in Latin America for Health Records Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.2. Non-fungible Tokens in Healthcare Market in Latin America for Supply Chain Management, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.3. Non-fungible Tokens in Healthcare Market in Latin America for Genomics Research, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.4. Non-fungible Tokens in Healthcare Market in Latin America for Health and Wellness, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.5. Non-fungible Tokens in Healthcare Market in Latin America for Clinical Trial Consent, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.2.6. Non-fungible Tokens in Healthcare Market in Latin America for Other Application Areas, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3. Non-fungible Tokens in Healthcare Market in Latin America: Distribution by End-user

- 23.3.1. Non-fungible Tokens in Healthcare Market in Latin America for Healthcare Professionals, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.2. Non-fungible Tokens in Healthcare Market in Latin America for Patients, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.3. Non-fungible Tokens in Healthcare Market in Latin America for Pharmaceutical Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.4. Non-fungible Tokens in Healthcare Market in Latin America for Academic Institutions / Government Bodies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.5. Non-fungible Tokens in Healthcare Market in Latin America for Insurance Companies, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 23.3.6. Non-fungible Tokens in Healthcare Market in Latin America for Other End-users, Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- *Detailed information on Section VII is available in the Excel Data Packs shared along with the report**

SECTION VIII: STRATEGIC TOOLS

24. PORTER'S FIVE FORCES ANALYSIS

- 24.1. Overview

- 24.2. Significance of Porter's Five Forces Analysis

- 24.3. Methodology

- 24.4. Porter's Five Forces

- 24.4.1. Threats of New Entrants

- 24.4.2. Bargaining Power of Buyers

- 24.4.3. Bargaining Power of NFT Solution Providers

- 24.4.4. Threats of Substitute Products

- 24.4.5. Rivalry Among Existing Competitors

- 24.5. Concluding Remarks