|

|

市場調査レポート

商品コード

1513563

世界および中国の自動車用無線通信モジュール市場(2024年)Global and China Automotive Wireless Communication Module Market Report, 2024 |

||||||

|

|||||||

| 世界および中国の自動車用無線通信モジュール市場(2024年) |

|

出版日: 2024年06月22日

発行: ResearchInChina

ページ情報: 英文 310 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

5G自動車通信市場が爆発的に拡大、5G FWAは5G-Aへ進化

2023年、5G自動車モジュール搭載数が急増の先駆けとなっています。統計によると、中国の乗用車5Gモジュール搭載数は2023年に163万3,000台に達し、搭載率は約7.5%でした。2027年に搭載数は785万6,000台、搭載率は35.6%に増加すると予測されます。

主要モデルから見ると、5Gモジュールの標準構成を実現したZeekr、Denza、Avatr、Voyah、IM、Li Auto、NIOなど、新興OEMの新エネルギーモデルの5G搭載率が高いです。

OEMの5G搭載の促進要因

5Gインフラは徐々に改良されています。:MIITの統計によると、2024年2月の時点で、中国の5G基地局の総数は350万9,000に達し、モバイル基地局の総数の29.8%を占めています。また、中国は世界でもっとも5G基地局数が多い国であり、65%以上を占めています。

5G政策の標準は徐々に改良されています。:2023年8月、Shanghai MobileとChina Academy of Information and Communications Technologyが主導し、20を超える規格起草ユニットを組織し、「5G Network Planning, Construction and Acceptance Requirements for Supporting High-level Autonomous Driving」および「5G Network Performance Requirements for Supporting High-level Autonomous Driving」の準備に参加し、その他の2つのグループ規格が正式にリリースされ、実施され、国内外の対応規格のギャップを埋めました。2023年12月、HuaweiとChina Mobile、Unicom、Quectel、Fuzhou Internet of Things Open Laboratory、Fudan University School of Microelectronicsなどが共同で5G自動車用通信規格を開発、発表しました。5G自動車用グレードモジュール、Uu port communication certification standard 1.0を共同開発し、発表しました。

5Gは自動運転の発展に適しています。:自動運転の発展には高速・低遅延が要求され、4Gモジュールでは対応が難しいです。5Gネットワークの3大特徴は、高速伝送速度、低遅延、D2Dデバイス伝送技術であり、1msの超低遅延、20Gbpsの高ピークレート、最大100万台の車両とデバイスの超高密度を実現し、自動運転の開発に最適です。

5Gは5G-Aに向けて進化しています。:2024年は5G-A元年です。5G-Aがもたらす新機能は、車載ソフトウェアOTA、車載大画面エンターテインメント、スマート運転トレーニングなどの用途に効果的に対応でき、5G-AはAIと組み合わせることで、AI時代のネットワークニーズによりよく対応できます。現在、北京、上海、杭州などが5G-Aベースのテレマティクスの実証回線を上陸させています。

2024年3月、Shanghai MobileとHuaweiは上海浦東で初のスマートパーキング地下駐車場ネットワークの建設を完了し、7万平方メートルを超える地下スペースに5G-Aネットワークを提供しました。5G-A駐車場は500Mbps超のアップリンク容量を提供することができ、数百台の車の駐車および運転機能を同時に満たすことができるとしています。5G-Aネットワークはギガビットを超えるダウンリンク速度も達成でき、車両のOTAバージョンアップも最短30秒で完了します。

これに対し、従来の4G FWAの平均速度は約20Mbpsで、5G FWAの平均速度は約100Mbpsです。5G-Aネットワークはよりよいユーザーエクスペリエンスをもたらし、5Gモジュールの加速を促進します。

当レポートでは、世界と中国の自動車用無線通信モジュール市場について調査分析し、開発政策、業界標準、市場規模、競合情勢などの情報を提供しています。

目次

第1章 自動車用通信モジュール産業の現状

- 自動車用無線通信モジュールの分類

- 自動車用無線通信モジュールの搭載形式

- 自動車用通信モジュールの市場規模

- 自動車用通信モジュール市場の競合情勢

第2章 自動車用5Gモジュールの利用見通し

- 5G政策と標準設定の方向性

- 5Gインフラ開発の現状と動向

- OEMの5G量産

- OEMの5Gモジュール搭載ソリューション

- 5Gモジュールの開発プラットフォームとサプライヤー

- 5G生産ファウンドリ

- 5Gモジュールのコストと価格動向

第3章 自動車用インテリジェントモジュールの利用見通し

- インテリジェントモジュールの開発状況と動向

- インテリジェントモジュールの開発プラットフォームとサプライヤー

- インテリジェントモジュールチップの製造プロセスとパッケージングプロセス

第4章 その他の革新的なモジュールの利用見通し

- ニアフラッシュモジュール

- Wi-Fi 7モジュール

- C-V2Xモジュール

第5章 自動車用通信チップ(4G/5G、C-V2X)サプライヤー

- Huawei

- MediaTek

- Unisoc

- ASR Microelectronics

- Qualcomm

- Samsung

- Morningcore

- Autotalks

- u-blox

第6章 自動車用通信モジュールサプライヤー

- ZTE

- Huawei

- Quectel

- Fibocom

- GosuncnWelink

- MeiG Smart Technology

- CITIC Zhilian

- Neoway Technology

- Sunsea AIoT (Longsung + SIMCom)

- C-V2X Module: SIM8100

- TitanInvo

- Flaircomm

- Mobiletek Communication

Communication module and 5G research: 5G module installation rate reaches new high, 5G-A promotes vehicle application acceleration

5G automotive communication market has exploded, and 5G FWA is evolving towards 5G-A

In 2023, 5G vehicle module installation ushered in a surge. According to statistics, China passenger car 5G module installation hits 1.633 million units in 2023, the installation rate is about 7.5%, and it is expected that the installation in 2027 will rise to 7.856 million with installation rate of 35.6%.

From the perspective of major models, the 5G installation rate of new energy models of emerging OEMs is higher, such as Zeekr, Denza, Avatr, Voyah, IM, Li Auto and NIO, which have all achieved standard configuration of 5G module.

Factors driving 5G installation for OEMs

5G infrastructure is gradually improving: According to MIIT statistics, as of February 2024, the total number of 5G base stations in China reached 3.509 million, accounting for 29.8% of the total number of mobile base stations. And China is the country with the largest number of 5G base stations in the world, accounting for more than 65%;

5G policy standards are gradually improved: In August 2023, Shanghai Mobile and China Academy of Information and Communications Technology took the lead in organizing more than 20 standard drafting units to participate in preparation of "5G Network Planning, Construction and Acceptance Requirements for Supporting High-level Autonomous Driving" and "5G Network Performance Requirements for Supporting High-level Autonomous Driving" and other two group standards were officially released and implemented, filling the gap of corresponding standards at home and abroad; in December 2023, Huawei and China Mobile, Unicom, Quectel, Fuzhou Internet of Things Open Laboratory, Fudan University School of Microelectronics, etc. jointly developed and released 5G automotive-grade module Uu port communication certification standard 1.0;

5G is more suitable for development of autonomous driving: The development of autonomous driving requires high speed and low latency, which is difficult to meet with 4G modules. The three major characteristics of 5G network are fast transmission speed, low latency, and D2D device transmission technology, which realizes ultra-low latency of 1 ms, high peak rate of 20 Gbps, and extremely high density of up to 1,000,000 vehicles and devices, making it ideal for the development of autonomous driving.

5G is evolving towards 5G-A: 2024 is the first year of 5G-A. The new capabilities brought by 5G-A can effectively meet applications such as in-vehicle software OTA, in-car large-screen entertainment and smart driving training, and 5G-A can be combined with AI to better meet the network needs of AI era. At present, Beijing, Shanghai, Hangzhou and other places have landed 5G-A-based telematics demonstration lines.

In March 2024, Shanghai Mobile and Huawei completed the construction of the first smart parking underground parking network in Shanghai Pudong, providing 5G-A network coverage for more than 70,000 square meters of underground space. The 5G-A parking lot can provide an uplink capacity of over 500Mbps, claiming to be able to meet parking and driving functions of hundreds of cars at the same time; the 5G-A network can also achieve a downlink super gigabit rate, and the vehicle OTA version upgrade can be completed in as little as 30 seconds.

In comparison, the traditional 4G FWA average rate is about 20Mbps, and the 5G FWA average rate is about 100Mbps. 5G-A network will bring a better user experience and promote the acceleration of 5G modules.

In satellite broadband technology, MediaTek showcased a new generation of 5G-Advanced satellite test chips at MWC2024, which can provide more than 100Mbps of data throughput for automobiles and a variety of other termnal devices.

5G-Advanced (5G-A) standards are frozen, and the tide of commercialization is launched

R18 is the first 5G-A version. In February 2024, Huawei promoted 3GPP R18 standard base station energy-saving core part to reach an agreement and freeze at the 102nd meeting of RAN. The freezing of this part marks the concept of "0 Bit 0 Watt" and "Double Excellence of Experience and Energy Saving" advocated by Huawei, was officially accepted by 3GPP International Standards Organization. On June 18, 2024, 3GPP Release 18 was officially frozen, meeting the conditions for commercialization.

The milestone of 6G standardization process has arrived

In December 2023, 3GPP held RAN #102 meeting and identified the first batch of 16 RAN projects in the Rel-19 field, marking a new stage in the development of 5G-Advanced international standards. Looking to the future, 3GPP's 6G work began in 2024 during Release 19, which marked the official start of work related to "requirements" (i.e. 6G SA1 business requirements). This is an important milestone in the 6G standardization process and lays the foundation for subsequent work.

In addition, 3GPP expects the first 6G specification to be completed in Release 21 by the end of 2028. This means that in about four years, 3GPP will complete the core specification of 6G, paving the way for commercialization of 6G technology.

5G module development platform: Qualcomm dominates, and domestic platforms such as ZTE, Huawei, and MediaTek are developing rapidly

Mainstream 5G module development platforms include ZTE, Huawei, Qualcomm, MediaTek, etc. Module supplierrs such as Quectel, Fibocom, MeiG Smart Technology, ZTE Communication, Huawei, and LG provide 5G module products for OEMs based on the development platform.

ZTE 5G Development Platform

5G module ZM9300: Using 3GPP Rel-16 technology, based on self-developed car-grade 5G Modem chip platform, supports optional configuration R16 NR & LTE-V2X PC5 direct communication; built-in computing power exceeds 18K + DMIPS CPU, which can support C-V2X ITS protocol stack and applications, without external AP processor. The ZM9300 module will be mass-produced and loaded on GAC in 2024.

4G module ZM8201V: equipped with a self-developed 4G communication chip platform. It has been first mass-produced and delivered in SAIC MAXUS Xintu V80, and subsequent SAIC passenger cars will also be equipped with this module product one after another. At the same time, ZM8201V has passed AEC Q100 vehicle certification, supports overseas eCa11, and has passed network access certification test of operators in more than 70 countries around the world.

MediaTek 5G Development Platform

MediaTek MTK2735: In China, products such as Fibocom AN758 and Mobiletek Communication T800 are equipped with MediaTek MTK2735. Mobiletek Communication T800 is the first MTK 5G module in China to obtain European Union ecall certification and Huawei compatibility test certification. As early as 2022, MediaTek's automotive 5G modems have entered the supply chain of Japanese and European OEMs.

MediaTek Dimensity Auto 5G smart cockpit platform: includes four SoC products, CX-1, CY-1, CM-1 and CV-1, using 3nm/4nm advanced manufacturing process. The communication technologies supported by Dimensity Auto include: 5G Sub-6GHz carrier aggregation technology, Wi-Fi 7, GNSS, 5G NTN two-way satellite communication capability, V2X vehicle connection communication, etc.

Qualcomm 5G Development Platform

Qualcomm's 5G platform has evolved to the latest generation of SA525M/SM522M platforms, and for the latest generation of 5G platforms launched by Qualcomm, module suppliers such as Quectel, Fibocom, and MeiG Smart Technology have also made arrangements.

Quectel AG59 series: including AG59xH series based on Qualcomm SA525M platform and AG59xE series based on Qualcomm SA522M platform. At the same time, Quectel also provides a series of high-performance antenna products to match the modules of this series, which can shorten R & D cycle of customer products. Quectel's modules have been mass-produced in nearly 20 mainstream OEMs such as SAIC, Great Wall, FAW Hongqi, NIO, and Li Auto.

Fibocom AN970T: AN970 series based on Qualcomm SA525M and AN960 series based on SA522M, two series of modules P2P, support customers to switch quickly.

Among them, the AN970 series module has a CPU computing power of up to 22k DMIPS, integrates multi-constellation GNSS receivers, supports optional dual-frequency GNSS, inertial navigation (DR), RTK, C-V2X units, 3GPP Release 16, NR Sub-6, 5G independent networking (SA) and non-independent networking (NSA) architectures, with faster transmission rates, better carrying capacity, and lower network latency.

Innovative in-vehicle communication module products emerge in an endless stream, bringing a diverse experience

1) Intelligent modules: communication modules are moving towards a high degree of integration with cockpit

In the development environment of automotive domain control architecture, automotive wireless communication solutions have entered a stage of cost-effectiveness improvement, driving vehicle modules to evolve towards integrated intelligent modules. Compared with traditional communication modules, intelligent modules will further integrate operating systems, CPUs/GPUs, etc.

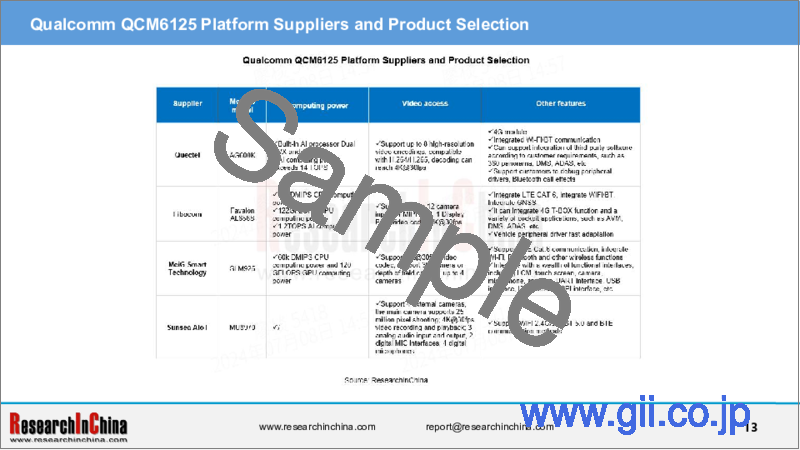

The current intelligent modules on the market are mainly developed based on Qualcomm platform. The newly released MediaTek Dimensity Auto 5G smart cockpit platform has received great attention from the market and will help MediaTek achieve high-end market breakthroughs.

MeiG Smart Technology: Intelligent module SLM925 supports LTE Cat.6 communication, integrates Wi-Fi, Bluetooth, GNSS and other wireless functions, supports Android 10 operating system, supports 4K@30fps video codec, supports 3D camera or depth of field photography, supports dual-screen display, can support 8-way camera, supports 8-channel TDM, meets the requirements of vehicle temperature and width, and has obtained designation from a number of OEMs.

2) NearFlash module

NearFlash technology, as a new generation of wireless short-range communication technology, is applied in smart cars including digital car keys, head unit projection, intelligent terminal display, and wireless audio & video application solutions around the smart cockpit.

At present, based on NearFlash technology, Huawei, PATEO, Lilda, etc. have launched vehicle products.

PATEO: In April 2024, the demo product showing NearFlash smart key has characteristics of sensing the owner within 80 meters, automatically opening the lights and reflectors in 9-meter welcome area, and unlocking the vehicle within 3 meters.

3)WIFI7 Module

As the WiFi 7 standard continues to improve, chip vendors and module suppliers have deployed WiFi 7 technology, and the world's first automotive Wi-Fi 7 solution was launched by Qualcomm in early 2024, namely Qualcomm QCA6797AQ.

Qualcomm QCA6797AQ supports 320MHz channel bandwidth, 4K QAM technology enables peak throughput up to 5.8Gbps, and also introduces innovative technologies such as high-frequency concurrency and multi-link multi-radio frequency.

Global and China Automotive Wireless Communication Module Market Report, 2024 includes following contents:

Research on development policies, industry standards, market size, competition landscape, etc. of automotive wireless communication module industry;

Application of automotive 5G modules, including 5G platform selection, 5G loading applications, 5G standard vehicles, 5G technology trends, etc.

The application prospect of automotive intelligent modules, including research on development platform selection, production process, development status and trends, etc.

Research on the latest developments and manufacturer layouts of innovative modules, such as NearFlash modules, WiFi 7 modules, C-V2X modules, etc.;

Research on the product lines of major suppliers of automotive communication chips and communication modules, technology trends, and vehicle loading and mass production trends.

Table of Contents

1 Status Quo of Automotive Communication Module Industry

- 1.1 Classification of Automotive Wireless Communication Modules

- 1.1.1 Classification of Vehicle Communication Technology

- 1.1.2 Classification of Vehicle Wireless Communication Technology

- 1.1.2 Automotive Communication Module Application

- 1.1.4 Classification of Automotive Wireless Communication Module

- 1.1.5 Automotive Wireless Communication Module 1:5G Module Can Be Applied to Intelligent Cockpit/Vehicle-Road Collaboration

- 1.1.6 Automotive Wireless Communication Module 2: Comprehensive Global 4G Network Coverage

- 1.1.7 Automotive Wireless Communication Module 2: Summary of Some Models of Vehicle Level 4G Communication Module

- 1.2 Loading Form of Automotive Wireless Communication Module

- 1.2.1 Automotive Communication Module Integration Form

- 1.2.2 Form 1: T-BOX Key Components

- 1.2.3 Form 1: T-Box Cost Composition

- 1.2.4 Form 1: Integration of Communication Modules into T-Box is the mainstream Solution in the current Market

- 1.2.5 Form 1: T-BOX Demand Scale for Communication Module

- 1.2.6 Form 1: T-BOX Demand for Communication Module

- 1.2.7 Form 1: Communication Module Applied to T-Box

- 1.2.8 Form 1: T-Box Communication Module from a Single 4G Module to 5G, C-V2X and other Multi-Module Integration

- 1.2.9 Form 1: Installation Location of T-Box on the Vehicle

- 1.2.10 Form 1: Universal T-BOX

- 1.2.11 Form 1: WEY Mocha

- 1.2.12 Form 1: 2023 Volvo

- 1.2.13 Form 1: Mercedes-Benz EQC System Framework

- 1.2.14 Form 1: Mercedes-Benz EQC Internal Framework

- 1.2.15 Form 1: Mercedes-Benz EQC Disassembly Diagram

- 1.2.16 Form 1: TitanInvo LE940A9

- 1.2.17 Form 2: 5G Smart Antenna

- 1.2.18 Form 2: Advantages of Smart Antenna

- 1.2.19 Form 2: Smart Antenna is Installation Trend

- 1.2.20 Form 2: Tesla Smart Antenna

- 1.2.21 Form 2: Continental Smart Antenna

- 1.2.22 Form 2: Hongqi E-HS9 Smart Antenna

- 1.2.23 Form 2: AITO Install 5G Antenna in New M7 Max version

- 1.2.24 Form 2: Xpeng G9 5G Antenna

- 1.2.25 Form 3: Communication Module Integrated into Domain Control

- 1.2.26 Form 3: Tesla Central Computing Module HW3.0

- 1.2.27 Form 3: Tesla Central Computing Module HW4.0

- 1.2.28 Form 3: SAIC Feifan R7 Intelligent Connection Domain Control (1)

- 1.2.29 Form 3: SAIC Feifan R7 Intelligent Connected Domain Control Architecture (2)

- 1.2.30 Form 4: ST Intelligent Gateway Solution

- 1.3 Automotive Communication Module Market Size

- 1.3.1 Global Passenger Car OEM Communication Module Market Size, 2022-2027E

- 1.3.2 China Passenger Car OEM Communication Module Market Size, 2022-2027E (4G/5G/C-V2X Module)

- 1.4 Competitive Landscape of Automotive Communication Module Market

- 1.4.1 Automotive Communication Module Industry Chain

- 1.4.2 Global Automotive Communication Module Market is basically Stable

- 1.4.3 Chinese Automotive Communication Module Industry Pattern: Expanding Overseas Business through M&A

- 1.4.4 Chinese Automotive Communication Module Industry Pattern: domestic Baseband Chips Cut into Supply Chain of Mainstream Manufacturers

- 1.4.5 TimeLine of Major Suppliers Release Vehicle Grade Communication Module Product

- 1.4.6 Production Capability Comparison of Major Suppliers

- 1.4.7 Technical Strength Comparison of Major Suppliers

2 Application Prospects of Automotive 5G Modules

- 2.1 5G Policy and Standard Setting Direction

- 2.1.1 Global Promotion Policy on the second Phase of 5G Development

- 2.1.2 Policy Dynamics: MIIT Planning Telematics Dedicated Number

- 2.1.3 Policy Trends: Shanghai Promotes 5G-A Infrastructure Building

- 2.1.4 2024 Automotive 5G Communication Standard Dynamics: R18 Standard Officially Frozen

- 2.1.5 2024 Automotive 5G Communication Standard Dynamics: R19 Standard Progress

- 2.1.6 2024 Automotive 5G Communication Standard Dynamics: 6G Standardization Launch

- 2.1.7 Group Standard Landing: 5G Network Standard National Debut

- 2.1.8 Group Standard Landing: Huawei Releases 5G Vehicle standard Module Certification Standard 1.0

- 2.2 Status and Trends of 5G Infrastructure Development

- 2.2.1 Global 5G Base Station Construction

- 2.2.2 China's 5G Base Station Construction

- 2.2.3 5G Technology Evolution Stage: now in the First Stage

- 2.2.4 Evolution of 5G Vehicle Communication Technology

- 2.2.5 5G Communication Module High Performance Trend (1)

- 2.2.6 5G Communication Module High Performance Trend (2)

- 2.2.7 5G Communication Module High Performance Trends (3)

- 2.2.8 5G Communication Module High Performance Trends (4)

- 2.2.9 5G Communication Module High Performance Trends (5)

- 2.2.10 5G Communication Module High Performance Trends (6)

- 2.2.11 5G Communication Module High Performance Trends (7)

- 2.2.12 5G Communication Module Lightweight Trend (8)

- 2.2.13 5G Communication Module Lightweight Trend (9)

- 2.3 5G Mass Production of OEMs

- 2.3.1 China Passenger Car OEM 5G Module Penetration Rate

- 2.3.2 China Passenger Car 5G Module Assembly Rate by Price, 2023-2024

- 2.3.3 China Passenger Car 5G Module Assembly Rate by Brand, 2023

- 2.3.4 China 5G Assembly Volume (by Brand), 2023

- 2.3.5 5G Module Supplier Selected by OEMs

- 2.4 5G Module Instalation Solution of OEMs

- 2.4.1 Summary of 5G Communication Module Requirements for OEMs (1)

- 2.4.2 Summary of 5G Communication Module Requirements for OEMs (2)

- 2.4.3 Summary of 5G Communication Module Requirements for OEMs (3)

- 2.4.4 Summary of 5G Communication Module Requirements for OEMs (4)

- 2.4.5 5G Communication Module Technology Planning of Foreign OEMs

- 2.4.6 5G Communication Module Technology Planning of Chinese OEMs

- 2.4.7 5G Communication Module Technology Planning of Emerging OEMs

- 2.4.8 Xpeng EE Architecture is still Dominated by 4G Communication

- 2.4.9 Xpeng's latest EE Architecture can Connect to 5G Communication

- 2.4.10 Volkswagen will Adopt Xpeng's latest EE Architecture in Chinese Market: mainly 4G Communication

- 2.4.11 Li L9 5G Communication Module Integrated into Cockpit Domain Control

- 2.5 5G Module Development Platforms and Suppliers

- 2.5.1 Qualcomm SA525M 5G Platform Suppliers and Product Selection

- 2.5.2 Qualcomm SA522M 5G Platform Suppliers and Product Selection

- 2.5.3 Qualcomm SA515M 5G Platform Suppliers and Product Selection (1)

- 2.5.4 Qualcomm SA515M 5G Platform Suppliers and Product Selection (2)

- 2.5.5 ZTE, Huawei, 5G Platform Suppliers and Product Selection

- 2.5.6 MediaTek MTK2735 Platform Suppliers and Product Selection

- 2.6 5G Production Foundry

- 2.6.1 Production Mode and Capacity of Automotive Communication Module Manufacturers

- 2.6.2 Automotive Communication Module Foundry is in the Upstream of Industry Chain

- 2.6.3 Vehicle Communication Module OEM

- 2.7 5G Module Cost and Price Trend

- 2.7.1 Communication Module Price

- 2.7.2 Automotive Communication Module Price Trend (3G 4G 5G Module)

- 2.7.3 Cost Composition of Automotive Wireless Communication Module

3 Application Prospects of Automotive Intelligent Modules

- 3.1 Development Status and Trends of Intelligent Modules

- 3.1.1 Domain Control Architecture Promotes Development of Communication Modules towards Integration (1)

- 3.1.2 Intelligent Module Advantages: High Integration, Low Cost

- 3.1.3 Intelligent Module Technology Evolution

- 3.2 Intelligent Module Development Platforms and Suppliers

- 3.2.1 Qualcomm Platform Suppliers and Product Selection

- 3.2.2 Qualcomm QCM6490 Platform Supplier and Product Selection

- 3.2.3 Qualcomm QCM6125 Platform suppliers and Product selection

- 3.3 Intelligent Module Chip Manufacturing Process and Packaging Process

- 3.3.1 Difference between Automotive-grade Module SIP and SOC (1)

- 3.3.2 Difference between Automotive-grade Module SIP and SOC (2)

- 3.3.3 Advantages of SIP Technology

- 3.3.4 Application Prospects of SIP Technology in Automotive Field

4 Application Prospects of Other Innovative Modules

- 4.1 NearFlash Module

- 4.1.1 Automotive Communication Module Technology Development Trend 2: NearFlash Technology Vehicle Commercial Rhythm

- 4.1.2 Automotive Communication Module Technology Development Trend 2: NearFlash Technology System Architecture

- 4.1.3 Automotive Communication Module Technology Development Trend 1: Huawei NearFlash Key

- 4.1.4 Automotive Communication Module Technology Development Trend II: Lilda Star Flash Automotive Application Solution

- 4.1.5 Automotive Communication Module Technology Development Trend 2: PATEO NearFlash Vehicle Products

- 4.2 Wifi 7 Module

- 4.2.1 WiFi Module Evolving to WiFi 7

- 4.2.2 Qualcomm Launches World's First Automotive Wi-Fi 7 Solution

- 4.3 C-V2X Module

- 4.3.1 China Passenger Car C-V2X Module Market Size

- 4.3.2 China Passenger Car C-V2X Module Installation by Price, 2023-2024

- 4.3.3 China Passenger Car C-V2X Module Installation (TOP 10 Models), 2023-2024

- 4.3.4 China Passenger Car C-V2X Module Installation (TOP 10 OEMs), 2023-2024

- 4.3.5 C-V2X Module Models Summary

- 4.3.6 C-V2X Module Technology Evolution

- 4.3.7 C-V2X Module Development Trend

- 4.3.8 C-V2X to Realize Information Interaction of Vehicle-Road Cloud Collaboration

- 4.3.9 Vehicle-Road Cloud Collaboration Case

5 Automotive Communication Chip (4G/5G, C-V2X) Suppliers

- 5.1 Huawei

- 5.1.1 Communication Chip Product Line

- 5.1.2 Communication Chip: Balong 765

- 5.1.3 Communication Chip: Balong 5000

- 5.2 MediaTek

- 5.2.1 Automotive Communication Business

- 5.2.2 Dimensity Auto integrates 5G, WiFi and other Communication Technologies

- 5.2.3 Automotive Communication Platform Autus T10 (MT2635)

- 5.2.4 4G Cockpit Platform MT8666

- 5.3 Unisoc

- 5.3.1 Communication Chip Product Line

- 5.3.2 5G Cockpit Platform Chip: A7870

- 5.3.3 Ultra-high Computing Power 4G Intelligent Vehicle Platform: A7862 series

- 5.4 ASR Microelectronics

- 5.4.1 Baseband Chip Business

- 5.4.2 Vehicle 4G Chip: ASR1803

- 5.4.3 Vehicle 4G Chip: ASR3603-V

- 5.5 Qualcomm

- 5.5.1 Automotive Solutions Overall Strategy

- 5.5.2 Communication Chip Product Line

- 5.5.3 Automotive "Connectivity" Solutions Product Line

- 5.5.4 5G Communication Chip: Snapdragon X55

- 5.5.5 5G Communication Chip: Snapdragon X60

- 5.5.6 V2X Chipset: Platform Evolution

- 5.5.7 Qualcomm V2X Chipset: Business Strategy

- 5.5.8 V2X Chipset: SA2150P Chip internal Architecture

- 5.5.9 V2X Chipset: MDM9250 Platform Architecture

- 5.5.10 V2X Chipset: 9150 Chipset Architecture

- 5.5.11 Snapdragon 5G SOC Platform: 2nd Generation SA525M/SA522M with Integrated V2X

- 5.5.12 Snapdragon 5G SOC Platform: First Generation SA515, External 2150 V2X Chipset

- 5.5.13 Snapdragon Cockpit SOC: Qualcomm 4th Generation 8295 Integrated 5G SOC with C-V2X Support

- 5.6 Samsung

- 5.6.1 Automotive 5G Technology

- 5.6.2 Automotive 5G Chip

- 5.6.3 Automotive 5G Application

- 5.7 Morningcore

- 5.7.1 Evolution of Wireless Communication Module Related Product Lines

- 5.7.2 V2X Chip: CX1910 Features

- 5.7.3 V2X Chip: CX1860 Architecture

- 5.7.4 V2X Chip Module (Cooperative Product)

- 5.7.5 Cooperate with Mobiletek Communication on 5G + C-V2X dual-mode Reference Solution

- 5.7.6 V2X Module: CX7101 Index

- 5.7.7 V2X Module: CX7101N Integrated Nebula Interconnection C-V2X National Standard Protocol Stack CWAVE II

- 5.7.8 Advantage of Cooperation on Automotive Communication Module: Integrated Software Capability

- 5.7.9 Advantage of Telematics Solution: Excellent Performance

- 5.7.10 customer Products are widely Used in Domestic Demonstration Zone

- 5.8 Autotalks

- 5.8.1 Evolution of Wireless Communication Product Line

- 5.8.2 C-V2X Chipset: TEKTON3, SECTON3 available

- 5.8.3 C-V2X Chipset: CRATON2 Features

- 5.8.4 C-V2X Chipset Application Case: MediaTek

- 5.8.5 C-V2X Chipset Application Case: Integrating 5G Modules with V2X

- 5.9 u-blox

- 5.9.1 V2X Chip

- 5.9.2 Automotive Communication Module Products

- 5.9.3 Automotive Communication Module New Product: JODY-W4

6 Automotive Communication Module Suppliers

- 6.1 ZTE

- 6.1.1 Automotive Wireless Communication Module Product Line

- 6.1.2 5G Communication Module: ZM9300

- 6.1.3 5G Communication Module: ZM9200

- 6.1.4 4G Communication Module: ZM8201

- 6.1.5 4G Communication Module: ZM8330 Parameters

- 6.1.6 4G Communication Module: ZM8332 Parameters

- 6.1.7 4G Communication Module: ZM8200 Parameters

- 6.1.8 C-V2X Module: ZM8350 PParameters

- 6.2 Huawei

- 6.2.1 Wireless Communication Product Line Layout

- 6.2.2 5G Communication Module: MH5000

- 6.2.3 Automotive Communication Terminal: HiFin

- 6.2.4 Automotive Communication Module Product Advantage 1

- 6.2.5 Automotive Communication Module Product Advantage 2

- 6.2.6 Automotive Communication Module Product Advantage 3

- 6.2.7 Vehicle 5G Cooperation Strategy

- 6.2.8 Vehicle 5G Technology Cooperation Model

- 6.3 Quectel

- 6.3.1 Automotive Product Line Layout

- 6.3.2 Wireless Communication Module shipments

- 6.3.3 Automotive Wireless Communication Module Product Line layout (1)

- 6.3.4 Automotive Wireless Communication Module Product Line layout (2)

- 6.3.5 Vehicle grade 5G Module (based on Qualcomm SA525M): AG59X Features

- 6.3.6 Vehicle grade 5G Module: AG550Q Features

- 6.3.7 Vehicle grade 5G Module: AG56xN, AG57xQ Parameters

- 6.3.8 Vehicle grade 4G Module: AG520R Characteristics

- 6.3.9 Vehicle grade C-V2X Module: AG18 Parameters

- 6.3.10 Vehicle grade C-V2X Module: AG15 Characteristics

- 6.3.11 C-V2X AP Module: AG215S Architecture

- 6.3.12 WIFI Module: AF51Y

- 6.3.13 Intelligent Module: AG800D, AG600K Product Features (1)

- 6.3.14 Intelligent Module: AG800D, AG600K Product Features (2)

- 6.3.15 Intelligent Module: Intelligent Module AG855G

- 6.3.16 5G + C-V2X End-to-End Solution

- 6.3.17 Vehicle Module Development Software Platform: QuecOpen

- 6.3.18 Vehicle-grade Module Partners

- 6.3.19 Production Base

- 6.4 Fibocom

- 6.4.1 Wireless Communication Module Production, Sales and Price

- 6.4.2 Automotive OEM Communication Module Product Line Layout (1)

- 6.4.3 Automotive OEM Communication Module Product Line Layout (2)

- 6.4.4 Automotive Post-installed Communication Module Products

- 6.4.5 Automotive-grade 5G Module: Favalon AN758

- 6.4.6 Automotive-grade 5G Module: AN958 series Parameters

- 6.4.7 C-V2X Processor Module: Favalon AP915 Parameters

- 6.4.8 C-V2X Module: Favalon AX166

- 6.4.9 C-V2X Module: AX168-GL Parameters

- 6.4.10 4G Module: AL940/AL640 Parameters

- 6.4.11 Wifi Module: Favalon AW916

- 6.4.12 Intelligent Module: Favalon AN693S

- 6.4.13 Intelligent Module: Favalon AL656S

- 6.4.14 Intelligent Module: Favalon AN803S

- 6.4.15 Main Customers

- 6.5 GosuncnWelink

- 6.5.1 Wireless Communication Module Product Line Layout

- 6.5.2 Wireless Communication Terminal Product Evolution

- 6.5.3 5G Communication Module: RedCap Module GM870A

- 6.5.4 5G Communication Module: GM860A-C1AG Features

- 6.5.5 5G Communication Module: GM860A-C1AX Features

- 6.5.6 4G Communication Module: GM551A Features

- 6.5.7 4G Communication Module: GM551A Parameters

- 6.5.8 4G Communication Module: GM552A Features

- 6.5.9 4G Communication Module: GM552A Parameters

- 6.5.10 4G Communication Module: GM351A

- 6.5.11 Communication Terminal: T-Box Iterates towards 2.0/3, Integrating Gateway and Domain Control

- 6.5.12 Communication Terminal: Ability to Have a Communication Domain Controller Entry Threshold (1)

- 6.5.13 Communication Terminal: Ability to Have a Communication Domain Controller Entry Threshold (2)

- 6.5.14 Major Customers

- 6.6 MeiG Smart Technology

- 6.6.1 Automotive Wireless Communication Module Product Line

- 6.6.2 Automotive Intelligent Module: SLM925

- 6.6.3 Automotive Intelligent Module: SRM930

- 6.6.4 Automotive Intelligent Module: SRM930 Architecture

- 6.6.5 Automotive Intelligent Module: SRM900

- 6.6.6 4G Communication Module Products: MA800 Advantages

- 6.6.7 4G Communication Module Products: MA800 Parameters (1)

- 6.6.8 4G Communication Module Products: MA800 Parameters (2)

- 6.6.9 5G Module: MA925 Performance (1)

- 6.6.10 5G Module: MA925 Performance (2)

- 6.6.11 5G Module: MA922

- 6.6.12 Automotive Communication Terminal: Automotive AI-BOX Solution

- 6.6.13 Automotive Communication Module Application: Intelligent Cockpit

- 6.6.14 Main Customers

- 6.7 CITIC Zhilian

- 6.7.1 Evolution of Wireless Communication Module Product Line

- 6.7.2 5G Communication Module: DMM21 Module

- 6.7.3 C-V2X Module: DRA10 Frequency Compensation Module Parameters

- 6.7.4 C-V2X Module: DMD3A Parameters

- 6.7.5 Wireless Communication Vehicle Terminal

- 6.7.6 Wireless Communication Vehicle Terminal: C-V2X & ADAS Integrated Domain Control

- 6.7.7 Wireless Communication Vehicle Terminal: C-V2X & ADAS Fusion Domain Control Parameters

- 6.7.8 Automotive Communication Module Software Capability: Development Kit

- 6.7.9 Automotive Communication Module Software Capability: C-ITS Protocol Stack (gCStack)

- 6.8 Neoway Technology

- 6.8.1 Automotive Module Product Line

- 6.8.2 5G Communication Module: N725/A590b Features

- 6.8.3 5G Communication Module Product: A590

- 6.8.4 4G Communication Module: N725A

- 6.8.5 4G Communication Module: A70

- 6.8.6 "PipeLine Cloud + High Reliable Communication Module" Solution

- 6.9 Sunsea AIoT (Longsung + SIMCom)

- 6.9.1 Wireless Communication Module Product Line Evolution: Longsung Technology

- 6.9.2 Intelligent Module: MU8580

- 6.9.3 Intelligent Module: MU8970

- 6.9.4 5G Communication Module: VX610

- 6.9.5 4G Communication Module: U9507 series (1)

- 6.9.6 4G Communication Module: U9507 series (2)

- 6.9.7 C-V2X Module: VX95

- 6.9.8 Wireless Communication Module Product Line Evolution: Longsung Technology

- 6.9.9 Wireless Communication Module Product Line: SIMCom

- 6.9.10 5G Communication Module: SIM8800CE

- 6.9.11 C-V2X Module: SIM8100

- 6.9.12 SIMCom 4G Communication Module: SIM7800E Parameters

- 6.9.13 SIMCom 4G Communication Module: SIM7800CE Parameters

- 6.9.14 Application of Automotive Communication Modules: In-vehicle Entertainment System

- 6.9.15 Application of Automotive Communication Modules: T-Box

- 6.10 TitanInvo

- 6.10.1 Evolution of Wireless Communication Module Product Line

- 6.10.2 4G Module: LE940A9

- 6.10.3 4G Module: LE940B6

- 6.10.4 4G Module: LE920

- 6.10.5 C-V2X Module: VE945C1/LE944V7

- 6.11 Flaircomm

- 6.11.1 Automotive Communication Module Products

- 6.11.2 Main Customers

- 6.11.3 Sales and and Price of Communication Modules

- 6.12 Mobiletek Communication

- 6.12.1 5G Module: T800

- 6.12.2 4G Module: T100

- 6.12.3 Production Capacity