|

|

市場調査レポート

商品コード

1222205

炭素クレジット取引プラットフォームの市場規模とシェア分析:タイプ別、システムタイプ別、最終用途別 - 世界の産業需要予測(2030年まで)Carbon Credit Trading Platform Market Size and Share Analysis by Type (Voluntary, Regulated), System Type (Cap and Trade, Baseline and Credit), End Use (Industrial, Utilities, Energy, Petrochemical, Aviation) - Global Industry Demand Forecast to 2030 |

||||||

| 炭素クレジット取引プラットフォームの市場規模とシェア分析:タイプ別、システムタイプ別、最終用途別 - 世界の産業需要予測(2030年まで) |

|

出版日: 2023年02月01日

発行: Prescient & Strategic Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の炭素クレジット取引プラットフォームの市場規模は、2022年の1億300万米ドルから、2030年までに4億7,900万米ドルに達し、今後数年間でCAGRで21.20%の成長が予測されています。

当レポートでは、世界の炭素クレジット取引プラットフォーム市場について調査分析し、市場力学、セグメント別・地域別の市場分析、競合情勢、主要企業プロファイルなどの情報を提供しています。

目次

第1章 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 業界の専門家/KOLの声

第5章 市場指標

第6章 業界の見通し

- 市場力学

- 動向

- 促進要因

- 抑制要因/課題

- 促進要因/抑制要因の影響分析

- COVID-19の影響

- ポーターのファイブフォース分析

第7章 世界市場

- 概要

- 市場収益:タイプ別(2017年~2030年)

- 市場収益:システムタイプ別(2017年~2030年)

- 市場収益:最終用途別(2017年~2030年)

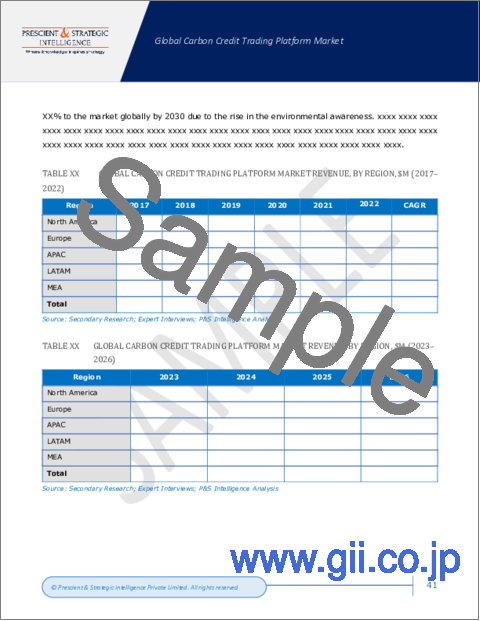

- 市場収益:地域別(2017年~2030年)

第8章 北米市場

第9章 欧州市場

第10章 アジア太平洋市場

第11章 ラテンアメリカ市場

第12章 中東・アフリカ市場

第13章 競合情勢

- 市場企業とその製品のリスト

- 主要企業の競合ベンチマーキング

- 主要企業の製品ベンチマーキング

- 最近の戦略的展開

第14章 企業プロファイル

- Nasdaq Inc.

- European Energy Exchange AG

- Carbon Trade Exchange

- Xpansiv Data Systems Inc.

- CME Group Inc.

- Climate Impact X

- Carbonplace

- Likvidi Technologies Ltd.

- BetaCarbon Pty Ltd.

- Carbonex Ltd.

- Intercontinental Exchange Inc.

- AirCarbon Pte Ltd.

- Planetly

- Toucan

第15章 付録

LIST OF TABLES

- TABLE 1 ANALYSIS PERIOD OF THE STUDY

- TABLE 2 DRIVERS FOR THE MARKET: IMPACT ANALYSIS

- TABLE 3 RESTRAINTS FOR THE MARKET: IMPACT ANALYSIS

- TABLE 4 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 5 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 6 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 7 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 8 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 9 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 10 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 11 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 12 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 13 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY REGION, $M (2017-2022)

- TABLE 14 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY REGION, $M (2023-2026)

- TABLE 15 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY REGION, $M (2027-2030)

- TABLE 16 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 17 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 18 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 19 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 20 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 21 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 22 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 23 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 24 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 25 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2022)

- TABLE 26 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2023-2026)

- TABLE 27 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2027-2030)

- TABLE 28 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 29 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 30 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 31 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 32 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 33 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 34 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 35 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 36 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 37 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2022)

- TABLE 38 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2023-2026)

- TABLE 39 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2027-2030)

- TABLE 40 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 41 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 42 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 43 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 44 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 45 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 46 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 47 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 48 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 49 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2022)

- TABLE 50 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2023-2026)

- TABLE 51 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2027-2030)

- TABLE 52 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 53 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 54 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 55 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 56 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 57 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 58 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 59 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 60 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 61 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2022)

- TABLE 62 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2023-2026)

- TABLE 63 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2027-2030)

- TABLE 64 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2022)

- TABLE 65 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2023-2026)

- TABLE 66 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2027-2030)

- TABLE 67 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2022)

- TABLE 68 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2023-2026)

- TABLE 69 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2027-2030)

- TABLE 70 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2022)

- TABLE 71 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2023-2026)

- TABLE 72 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2027-2030)

- TABLE 73 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2022)

- TABLE 74 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2023-2026)

- TABLE 75 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2027-2030)

- TABLE 76 NASDAQ INC. - AT A GLANCE

- TABLE 77 NASDAQ INC. - KEY FINANCIAL SUMMARY

- TABLE 78 EUROPEAN ENERGY EXCHANGE AG - AT A GLANCE

- TABLE 79 EUROPEAN ENERGY EXCHANGE AG - KEY FINANCIAL SUMMARY

- TABLE 80 CARBON TRADE EXCHANGE - AT A GLANCE

- TABLE 81 XPANSIV DATA SYSTEMS INC.- AT A GLANCE

- TABLE 82 CME GROUP INC. - AT A GLANCE

- TABLE 83 CME GROUP INC. - KEY FINANCIAL SUMMARY

- TABLE 84 CLIMATE IMPACT X - AT A GLANCE

- TABLE 85 CARBONPLACE - AT A GLANCE

- TABLE 86 LIKVIDI TECHNOLOGIES LTD. - AT A GLANCE

- TABLE 87 BETACARBON PTY LTD. - AT A GLANCE

- TABLE 88 CARBONEX LTD. - AT A GLANCE

- TABLE 89 INTERCONTINENTAL EXCHANGE INC. - AT A GLANCE

- TABLE 90 INTERCONTINENTAL EXCHANGE INC. - KEY FINANCIAL SUMMARY

- TABLE 91 AIRCARBON PTE LTD - AT A GLANCE

- TABLE 92 PLANETLY - AT A GLANCE

- TABLE 93 TOUCAN - AT A GLANCE

LIST OF FIGURES

- FIG 1 MARKET SIZE BREAKDOWN BY SEGMENT

- FIG 2 RESEARCH METHODOLOGY

- FIG 3 BREAKDOWN OF PRIMARY RESEARCH, BY REGION

- FIG 4 BREAKDOWN OF PRIMARY RESEARCH, BY DESIGNATION

- FIG 5 BREAKDOWN OF PRIMARY RESEARCH, BY COMPANY TYPE

- FIG 6 DATA TRIANGULATION APPROACH

- FIG 7 CURRENCY CONVERSION RATES FOR USD (2022)

- FIG 8 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SUMMARY

- FIG 9 BARGAINING POWER OF BUYERS

- FIG 10 BARGAINING POWER OF SUPPLIERS

- FIG 11 INTENSITY OF RIVALRY

- FIG 12 THREAT OF NEW ENTRANTS

- FIG 13 THREAT OF SUBSTITUTES

- FIG 14 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 15 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 16 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 17 GLOBAL CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 18 MAJOR WORLDWIDE MARKETS FOR CARBON CREDIT TRADING PLATFORM MARKET SOLUTIONS, $M

- FIG 19 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 20 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 21 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 22 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 23 NORTH AMERICA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2030)

- FIG 24 EUROPE CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 25 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 26 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 27 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 28 EUROPE CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2030)

- FIG 29 APAC CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 30 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 31 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 32 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 33 APAC CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2030)

- FIG 34 LATAM CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 35 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 36 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 37 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 38 LATAM CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2030)

- FIG 39 MEA CARBON CREDIT TRADING PLATFORM MARKET SNAPSHOT

- FIG 40 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY TYPE, $M (2017-2030)

- FIG 41 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY SYSTEM TYPE, $M (2017-2030)

- FIG 42 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY END USE, $M (2017-2030)

- FIG 43 MEA CARBON CREDIT TRADING PLATFORM MARKET REVENUE, BY COUNTRY, $M (2017-2030)

- FIG 44 NASDAQ INC. - REVENUE SPLIT BY SEGMENT AND GEOGRAPHY (2022)

- FIG 45 EUROPEAN ENERGY EXCHANGE AG - REVENUE SPLIT BY SEGMENT AND GEOGRAPHY (2022)

- FIG 46 CME GROUP INC. - REVENUE SPLIT BY SOURCE AND GEOGRAPHY (2022)

- FIG 47 INTERCONTINENTAL EXCHANGE INC. - REVENUE SPLIT BY SEGMENT AND GEOGRAPHY (2022)

The worth of the carbon credit trading platform market was USD 103 million in 2022, which is predicted to touch USD 479 million by 2030, powering at a CAGR of 21.20% in the years to come, as stated by a market research report by P&S Intelligence.

Cap-and-Trade System Is Extensively Accepted

Cap-and-trade was the larger category in the past. It is a system establishing a limit on the maximum volume of permissible emissions, for reducing the collective emissions from a group of entities.

Furthermore, it is a market-based approach for lowering the total emissions and promoting corporate investments in alternative sources of electricity and energy efficiency measures.

Moreover, numerous UN members have accepted the cap-and-trade system under the Kyoto Protocol for the reduction of GHG emissions.

For decreasing the concentration of the pollutants responsible for the depletion of the ozone layer, the Montreal Protocol has also formulated a cap-and-trade system, as has the EU.

Utilities Sector Accounts for 30% of Carbon Credit Sales

The utilities category dominates the industry with a share of about 30%. This is because power corporations are concentrating on innovative methods for reducing carbon emissions, such as smart electrical grids.

Fossil fuels are burned for producing most of the heat and powering the majority of the steam turbines, thus resulting in CO2 emissions. As a result, the power sector is responsible for about 40% of all the emissions worldwide.

Moreover, the voluntary type was the larger, with an over 60% share, in the past. This can be attributed to the increasing focus of corporations on their CSR, which is why many are taking steps to reduce their emissions.

Voluntary Carbon Credit Purchases Are Favored

A market supporting businesses' efforts of reducing their emissions is evolving, as big corporates make commitments for reducing emissions. This is the voluntary carbon credits market. The use of voluntary carbon credits has helped direct private funding toward climate change mitigation projects that would have failed to commence otherwise.

Sold Carbon Credits Have Second-Highest Worth in APAC

Europe dominated the industry, with a 32% share, in the recent past. The EU Emissions Trading System is the mainstay of the EU's strategy for climate change mitigation and for decreasing the emissions of greenhouse gases in a cost-effective and efficient manner. Moreover, Europe was the first substantial carbon market globally and also the largest.

Moreover, APAC follows Europe because of the pledges made by the regional countries at the COP26 to achieve their net-zero targets. On its efforts of achieving this target by 2050, Singapore aims at increasing its carbon purchase rates in 2024.

Table of Contents

Chapter 1. Research Scope

- 1.1. Research Objectives

- 1.2. Market Definition

- 1.3. Analysis Period

- 1.4. Market Size Breakdown by Segment

- 1.4.1. Market size breakdown, by type

- 1.4.2. Market size breakdown, by system type

- 1.4.3. Market size breakdown, by end use

- 1.4.4. Market size breakdown, by region

- 1.5. Market Data Reporting Unit

- 1.5.1. Value

- 1.6. Key Stakeholders

Chapter 2. Research Methodology

- 2.1. Secondary Research

- 2.1.1. Paid

- 2.1.2. Unpaid

- 2.1.3. P&S Intelligence database

- 2.2. Primary Research

- 2.3. Market Size Estimation

- 2.4. Data Triangulation

- 2.5. Currency Conversion Rates

- 2.6. Assumptions for the Study

- 2.7. Notes and Caveats

Chapter 3. Executive Summary

Chapter 4. Voice of Industry Experts/KOLs

Chapter 5. Market Indicators

Chapter 6. Industry Outlook

- 6.1. Market Dynamics

- 6.1.1. Trends

- 6.1.2. Drivers

- 6.1.3. Restraints/challenges

- 6.1.4. Impact analysis of drivers/restraints

- 6.2. Impact of COVID-19

- 6.3. Porter's Five Forces Analysis

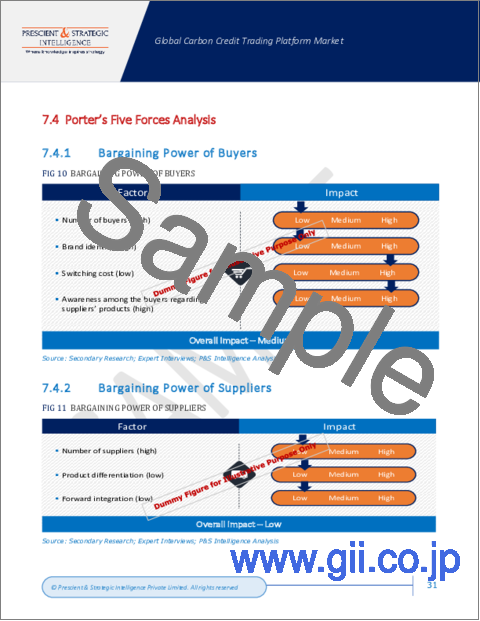

- 6.3.1. Bargaining power of buyers

- 6.3.2. Bargaining power of suppliers

- 6.3.3. Threat of new entrants

- 6.3.4. Intensity of rivalry

- 6.3.5. Threat of substitutes

Chapter 7. Global Market

- 7.1. Overview

- 7.2. Market Revenue, by Type (2017-2030)

- 7.3. Market Revenue, by System Type (2017-2030)

- 7.4. Market Revenue, by End Use (2017-2030)

- 7.5. Market Revenue, by Region (2017-2030)

Chapter 8. North America Market

- 8.1. Overview

- 8.2. Market Revenue, by Type (2017-2030)

- 8.3. Market Revenue, by System Type (2017-2030)

- 8.4. Market Revenue, by End Use (2017-2030)

- 8.5. Market Revenue, by Country (2017-2030)

Chapter 9. Europe Market

- 9.1. Overview

- 9.2. Market Revenue, by Type (2017-2030)

- 9.3. Market Revenue, by System Type (2017-2030)

- 9.4. Market Revenue, by End Use (2017-2030)

- 9.5. Market Revenue, by Country (2017-2030)

Chapter 10. APAC Market

- 10.1. Overview

- 10.2. Market Revenue, by Type (2017-2030)

- 10.3. Market Revenue, by System Type (2017-2030)

- 10.4. Market Revenue, by End Use (2017-2030)

- 10.5. Market Revenue, by Country (2017-2030)

Chapter 11. LATAM Market

- 11.1. Overview

- 11.2. Market Revenue, by Type (2017-2030)

- 11.3. Market Revenue, by System Type (2017-2030)

- 11.4. Market Revenue, by End Use (2017-2030)

- 11.5. Market Revenue, by Country (2017-2030)

Chapter 12. MEA Market

- 12.1. Overview

- 12.2. Market Revenue, by Type (2017-2030)

- 12.3. Market Revenue, by System Type (2017-2030)

- 12.4. Market Revenue, by End Use (2017-2030)

- 12.5. Market Revenue, by Country (2017-2030)

Chapter 13. Competitive Landscape

- 13.1. List of Market Players and Their Offerings

- 13.2. Competitive Benchmarking of Key Players

- 13.3. Product Benchmarking of Key Players

- 13.4. Recent Strategic Developments

Chapter 14. Company Profiles

- 14.1. Nasdaq Inc.

- 14.1.1. Business overview

- 14.1.2. Product and service offerings

- 14.1.3. Key financial summary

- 14.2. European Energy Exchange AG

- 14.2.1. Business overview

- 14.2.2. Product and service offerings

- 14.2.3. Key financial summary

- 14.3. Carbon Trade Exchange

- 14.3.1. Business overview

- 14.3.2. Product and service offerings

- 14.4. Xpansiv Data Systems Inc.

- 14.4.1. Business overview

- 14.4.2. Product and service offerings

- 14.5. CME Group Inc.

- 14.5.1. Business overview

- 14.5.2. Product and service offerings

- 14.5.3. Key financial summary

- 14.6. Climate Impact X

- 14.6.1. Business overview

- 14.6.2. Product and service offerings

- 14.7. Carbonplace

- 14.7.1. Business overview

- 14.7.2. Product and service offerings

- 14.8. Likvidi Technologies Ltd.

- 14.8.1. Business overview

- 14.8.2. Product and service offerings

- 14.9. BetaCarbon Pty Ltd.

- 14.9.1. Business overview

- 14.9.2. Product and service offerings

- 14.10. Carbonex Ltd.

- 14.10.1. Business overview

- 14.10.2. Product and service offerings

- 14.11. Intercontinental Exchange Inc.

- 14.11.1. Business overview

- 14.11.2. Product and service offerings

- 14.11.3. Key financial summary

- 14.12. AirCarbon Pte Ltd.

- 14.12.1. Business overview

- 14.12.2. Product and service offerings

- 14.13. Planetly

- 14.13.1. Business overview

- 14.13.2. Product and service offerings

- 14.14. Toucan

- 14.14.1. Business overview

- 14.14.2. Product and service offerings

Chapter 15. Appendix

- 15.1. Abbreviations

- 15.2. Sources and References

- 15.3. Related Reports