|

|

市場調査レポート

商品コード

1667082

炭素クレジット市場の機会、成長促進要因、産業動向分析、2025~2034年の予測Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| 炭素クレジット市場の機会、成長促進要因、産業動向分析、2025~2034年の予測 |

|

出版日: 2024年12月26日

発行: Global Market Insights Inc.

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

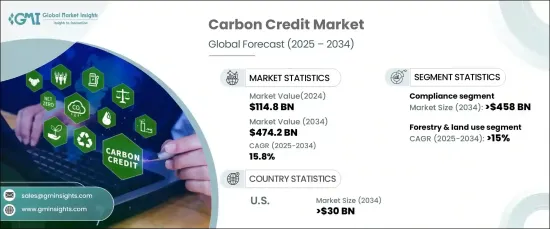

世界の炭素クレジット市場は、2024年に1,148億米ドルと評価され、2025年から2034年にかけて15.8%のCAGRで顕著に拡大すると予測されています。

炭素クレジットは、持続可能性を推進しながら排出量を相殺するメカニズムを企業や政府に提供し、気候変動問題への取り組みの要となっています。このダイナミックな市場の背景には、規制の強化やカーボンニュートラルに対する企業のコミットメントに加え、環境・社会・ガバナンス(ESG)目標の達成の重要性が高まっていることがあります。産業界が環境への説明責任をますます優先するようになるにつれ、炭素クレジットの需要が急増し、取引プラットフォームやカーボン・オフセット・イニシアチブの革新が促進されています。炭素クレジットと再生可能エネルギー証書や生物多様性クレジットの統合は、総合的な環境ソリューションへのシフトを明確にし、市場の成長をさらに後押ししています。

コンプライアンス炭素クレジット分野は、規制された炭素市場への世界の取り組みの拡大を反映し、2034年までに4,580億米ドルを創出すると予想されます。科学的根拠に基づく取り組みと世界の協力関係によって強化され、統一された基準と手法を確立するために100を超えるプロジェクトが進行中です。こうした取り組みが市場の拡大を促し、コンプライアンス市場とより広範な環境戦略との整合性を促進しています。炭素クレジット取引所が他の環境市場と連携することで、包括的な持続可能性ソリューションへの道筋がより明確になり、企業が二酸化炭素排出量を効果的に削減する機会を提供しています。

| 市場範囲 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 開始金額 | 1,148億米ドル |

| 予測金額 | 4,742億米ドル |

| CAGR | 15.8% |

林業と土地利用の取り組みは、炭素クレジット市場において重要性を増しており、この分野は2034年までCAGR 15%で成長すると予測されています。森林再生と植林の取り組みは、気候変動に対処しながら炭素クレジットを創出する上で極めて重要です。これらのプロジェクトは、しばしば「自然気候ソリューション」と呼ばれ、炭素隔離、生態系の回復、生物多様性の保全といった重要な環境利益をもたらします。さらに、コミュニティーの参加を促進し、気候変動緩和戦略の重要な一翼を担っています。企業や政府がこうした自然ベースの解決策をますます採用するようになるにつれ、排出量を相殺し、世界の持続可能性目標を達成する上で、その役割はますます大きくなっています。

米国の炭素クレジット市場は、2034年までに300億米ドルを創出すると予測されており、これは企業の持続可能性への注力と自発的なカーボン・オフセット・プログラムに後押しされています。企業は、高品質の検証済み炭素クレジットを活用して、野心的なネットゼロ排出目標を達成しようとしています。人工知能やブロックチェーンを含む技術の進歩は、炭素クレジット取引の透明性と効率性を高め、プロセスをより利用しやすく信頼できるものにしています。コミュニティ開発や生物多様性保全など、コベネフィットが重視されるようになったことも、需要を後押ししています。企業が持続可能性計画にこうしたその他の特典を組み込むにつれ、米国市場は世界の炭素クレジット情勢における革新と成長の拠点となりつつあります。

目次

第1章 調査手法と調査範囲

- 市場範囲と定義

- 市場推計・予測パラメータ

- 予測計算

- データソース

- 1次データ

- 2次データ

- 有料

- 公的

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- 規制状況

- 業界への影響要因

- 促進要因

- 業界の潜在的リスク&課題

- 成長可能性分析

- ポーターの分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 戦略的展望

- イノベーションと持続可能性の展望

第5章 市場規模・予測:タイプ別、2021年~2034年

- 主要動向

- ボランタリー

- コンプライアンス

第6章 市場規模・予測:最終用途別、2021年~2034年

- 主要動向

- 農業

- 炭素回収・貯留

- 化学プロセス

- エネルギー効率

- 工業

- 林業・土地利用

- 再生可能エネルギー

- 輸送

- 廃棄物管理

- その他

第7章 市場規模・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第8章 企業プロファイル

- 3Degrees

- Allcot

- Atmosfair

- Carbon Clear

- Carbon Collective

- Carbon Trust

- Climeco

- Climate Impact Partners

- EcoAct

- Ecosecurities

- Green Mountain Energy

- Shell

- South Pole

- Sterling Planet

- Terrapass

- Verra

- WGL Holdings

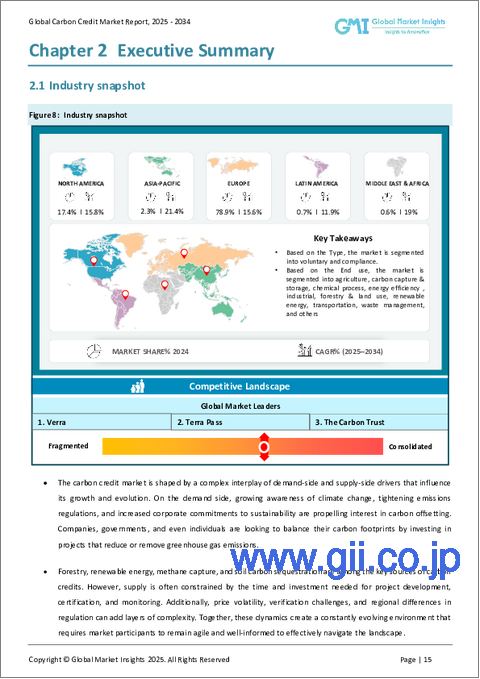

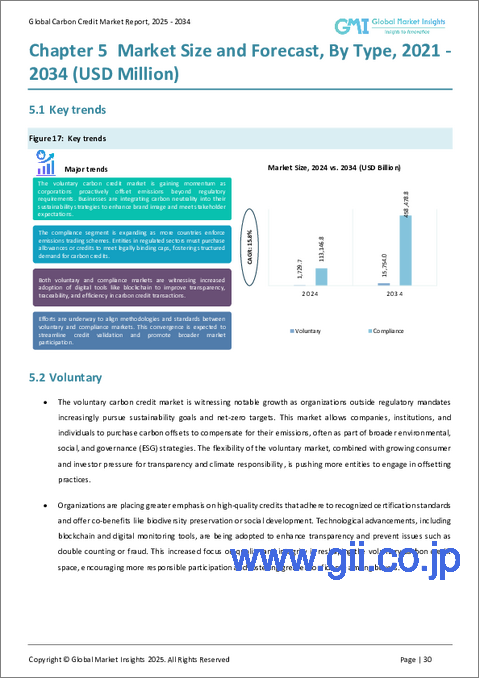

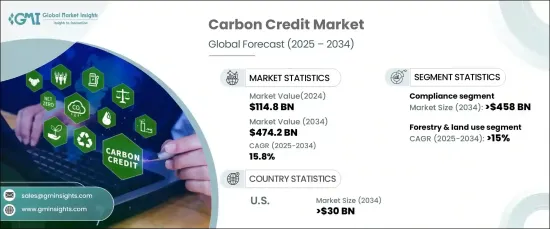

The Global Carbon Credit Market, valued at USD 114.8 billion in 2024, is projected to expand at a remarkable CAGR of 15.8% between 2025 and 2034. Carbon credits have become a cornerstone in tackling climate challenges, offering businesses and governments a mechanism to offset emissions while advancing sustainability. This dynamic market is driven by the growing importance of meeting Environmental, Social, and Governance (ESG) goals, alongside stricter regulations and corporate commitments to carbon neutrality. As industries increasingly prioritize environmental accountability, demand for carbon credits has surged, catalyzing innovation in trading platforms and carbon offset initiatives. The integration of carbon credits with renewable energy certificates and biodiversity credits underscores a shift toward holistic environmental solutions, further fueling market growth.

The compliance carbon credit segment is expected to generate USD 458 billion by 2034, reflecting the expanding global commitment to regulated carbon markets. Enhanced by science-based initiatives and global collaboration, over a hundred projects are underway to establish uniform standards and methodologies. These initiatives are driving market expansion and facilitating the alignment of compliance markets with broader environmental strategies. As carbon credit exchanges link with other environmental markets, the path to comprehensive sustainability solutions is becoming more defined, offering opportunities for businesses to reduce their carbon footprints effectively.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $114.8 Billion |

| Forecast Value | $474.2 Billion |

| CAGR | 15.8% |

Forestry and land-use initiatives are gaining prominence in the carbon credit market, with this segment projected to grow at a CAGR of 15% through 2034. Reforestation and afforestation efforts are pivotal in generating carbon credits while addressing climate change. These projects, often referred to as "natural climate solutions," deliver critical environmental benefits, such as carbon sequestration, ecosystem restoration, and biodiversity preservation. Additionally, they foster community engagement, making them a vital part of climate mitigation strategies. As corporations and governments increasingly adopt these nature-based solutions, their role in offsetting emissions and achieving global sustainability goals continues to grow.

The US carbon credit market is forecasted to generate USD 30 billion by 2034, bolstered by corporations' focus on sustainability and voluntary carbon offset programs. Companies are leveraging high-quality, verified carbon credits to meet ambitious net-zero emission targets. Technological advancements, including artificial intelligence and blockchain, are enhancing transparency and efficiency in carbon credit trading, making the process more accessible and trustworthy. The rising emphasis on co-benefits, such as community development and biodiversity conservation, is also driving demand. As businesses incorporate these additional benefits into their sustainability plans, the US market is becoming a hub for innovation and growth in the global carbon credit landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Carbon capture & storage

- 6.4 Chemical process

- 6.5 Energy efficiency

- 6.6 Industrial

- 6.7 Forestry & land use

- 6.8 Renewable energy

- 6.9 Transportation

- 6.10 Waste management

- 6.11 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.3 Europe

- 7.4 Asia Pacific

- 7.5 Middle East & Africa

- 7.6 Latin America

Chapter 8 Company Profiles

- 8.1 3Degrees

- 8.2 Allcot

- 8.3 Atmosfair

- 8.4 Carbon Clear

- 8.5 Carbon Collective

- 8.6 Carbon Trust

- 8.7 Climeco

- 8.8 Climate Impact Partners

- 8.9 EcoAct

- 8.10 Ecosecurities

- 8.11 Green Mountain Energy

- 8.12 Shell

- 8.13 South Pole

- 8.14 Sterling Planet

- 8.15 Terrapass

- 8.16 Verra

- 8.17 WGL Holdings