|

|

市場調査レポート

商品コード

1355046

HRテクノロジーの世界市場の評価:展開別、タイプ別、組織規模別、エンドユーザー別、地域別、機会、予測(2016年~2030年)HR Technology Market Assessment, By Deployment, By Type, By Organization Size, By End-user, By Region, Opportunities and Forecast, 2016-2030F |

||||||

カスタマイズ可能

|

|||||||

| HRテクノロジーの世界市場の評価:展開別、タイプ別、組織規模別、エンドユーザー別、地域別、機会、予測(2016年~2030年) |

|

出版日: 2023年10月03日

発行: Markets & Data

ページ情報: 英文 127 Pages

納期: 3~5営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のHRテクノロジー市場は近年著しい成長を示しており、今後も力強い拡大ペースを維持すると予測されます。2022年の収益は約308億米ドルで、2030年までに618億米ドルに達し、2023年~2030年にCAGRで9.1%の成長が予測されています。

業務を効率化するHRプロセスの自動化

デジタルトランスフォーメーションは、手動の時間のかかるHRプロセスの自動化を促します。HRの自動化は採用プロセスから始まります。ATSソフトウェアは、求人情報の掲載、候補者のスクリーニング、面接の日程調整、応募者とのコミュニケーションを自動化します。HRチームが大量の応募をより効率的に管理するのに役立ちます。HRIS(HR情報システム)やHCM(人的資本管理)ソフトウェアなどのHRテクノロジーソリューションは、給与計算、福利厚生管理、時間追跡などの業務を自動化します。管理業務の負担を軽減し、ミスを最小限に抑え、HR担当者は戦略的な活動に専念できるようになります。

例えば、Oracleは2023年6月、Oracle Fusion Cloud Human Capital Management(HCM)プラットフォームに、AIを活用した生成機能を統合することを発表しました。Oracle Cloud Infrastructure(OCI)のジェネレーティブAIサービスは、新たに導入されたこれらの機能を下支えし、現在のHR業務にシームレスに組み込まれています。この統合は、ビジネスの利益を加速し、効率を高め、候補者や従業員との対話の質を高め、HRの手続きを簡素化することを目的としています。

HR計画におけるデータ主導の意思決定に向けたアナリティクスの採用

デジタルHRソリューションは、さまざまなHR指標や従業員のパフォーマンスに関する豊富なデータへのアクセスを提供します。アナリティクスとレポーティングツールを活用することで、組織は人材獲得、パフォーマンス管理、人員計画、コンプライアンス、リスク管理に関するデータ主導の意思決定を行うことができます。アナリティクスは、HR戦略を最適化し、ビジネス目標と整合させるのに役立ちます。これとは別に、HRアナリティクスは組織内のダイバーシティとインクルージョンの取り組みに関する知見を提供します。組織は、人口統計データ、従業員エンゲージメントの調査、その他の関連情報を検討することで、多様で包括的な職場づくりの進捗を評価します。多様性への取り組みを指導する情報は、より包括的な企業文化の醸成に役立ちます。

例えば、2022年3月、VisierはPeople CloudとPeople Cloud Custom Servicesを発表しました。Visier People Cloudは、同社の人材分析プラットフォームに基づいて構築されています。同社が述べているように、People Cloudは、HRチームや組織の人材分析戦略の潜在能力をフルに発揮することをしばしば妨げるラストマイルの問題を解決することを目的としています。

北米が最大の市場シェアを占める

北米には技術とイノベーションを受け入れる文化があります。企業も従業員も新しいHRテクノロジーをいち早く採用することが多く、市場の成長に貢献しています。北米、特に米国は、世界最大級の多様な労働力を有しています。この多様性により、人材獲得からパフォーマンス管理まで、さまざまなHRプロセスを管理する先進のHRソリューションが必要とされています。さらに、この地域では、クラウドベースのHRテクノロジーが広く採用されています。クラウドソリューションは拡張性、費用対効果、アクセス性を提供し、あらゆる規模の組織にとって非常に魅力的なものとなっています。

例えば、2023年9月、HiBobとPapaya Globalは戦略的提携を発表し、特に多国籍企業向けに、HRと統合された包括的でコンプライアンスに準拠した給与計算ソリューションの需要に応えます。これにより、企業はHR、有給休暇(PTO)、報酬データをシームレスに統合できるようになりました。リアルタイムのデータ同期により、多国籍企業はHRと給与業務を合理化し、強化することができます。

当レポートでは、世界のHRテクノロジー市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 調査手法

第2章 プロジェクトの範囲と定義

第3章 世界のHRテクノロジー市場に対するCOVID-19の影響

第4章 エグゼクティブサマリー

第5章 HRテクノロジー市場の見通し(2016年~2030年)

- 市場規模と予測

- 金額

- 展開別

- オンプレミス

- クラウド

- タイプ別

- 従業員管理

- 採用

- 給与管理

- パフォーマンス管理

- その他

- 組織規模別

- 大企業

- 中小企業

- エンドユーザー別

- IT・通信

- BFSI

- 小売

- 医療

- その他

- 地域別

- 北米

- 欧州

- 南米

- アジア太平洋

- 中東・アフリカ

- 市場シェア:企業別(2022年)

第6章 世界のHRテクノロジー市場の見通し:地域別(2016年~2030年)

- 北米

- 市場規模と予測

- 展開別

- タイプ別

- 組織規模別

- エンドユーザー別

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

- 南米

- ブラジル

- アルゼンチン

- アジア太平洋

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第7章 市場マッピング(2022年)

- 展開別

- タイプ別

- 組織規模別

- エンドユーザー別

- 地域別

第8章 マクロ環境と産業構造

- PESTEL分析

- ポーターのファイブフォース分析

第9章 市場力学

- 成長促進要因

- 成長抑制要因(課題、抑制要因)

第10章 主要企業情勢

- マーケットリーダー上位5社の競合マトリクス

- マーケットリーダー上位5社市場の収益分析(2022年)

- 合併と買収/合弁事業(該当する場合)

- SWOT分析(市場参入企業5社向け)

- 特許分析(該当する場合)

第11章 ケーススタディ(該当する場合)

第12章 主要企業の見通し

- SAP SE

- Oracle Corporation

- Automatic Data processing Inc.

- Cornerstone OnDemand Inc

- Ceridian HCM, Inc.

- Workday Inc.

- Infor Inc.

- Cegid Group

- Hi Bob, Inc.

- The Access Group

第13章 戦略的推奨事項

第14章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 2. Global HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 3. Global HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 4. Global HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 5. Global HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 6. Global HR Technology Market Share, By Region, In USD Billion, 2016-2030F

- Figure 7. North America HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 8. North America HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 9. North America HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 10. North America HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 11. North America HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 12. North America HR Technology Market Share, By Country, In USD Billion, 2016-2030F

- Figure 13. United States HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 14. United States HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 15. United States HR Technology Market Share, By Type, In USD Billion, 2016-2030F

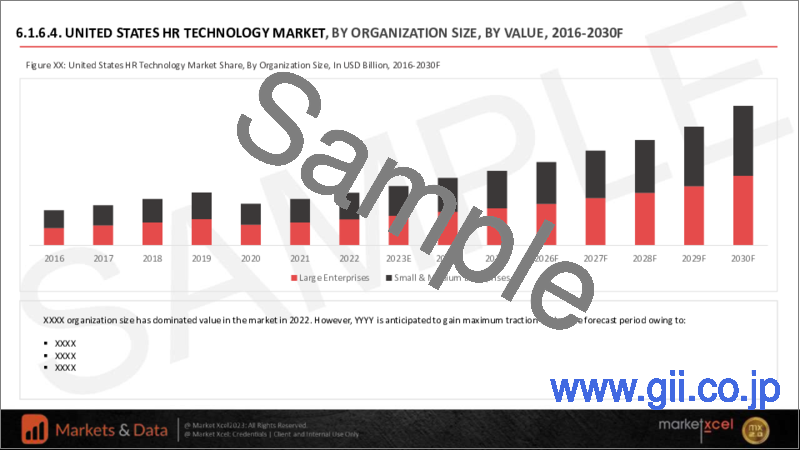

- Figure 16. United States HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 17. United States HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 18. Canada HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 19. Canada HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 20. Canada HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 21. Canada HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 22. Canada HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 23. Mexico HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 24. Mexico HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 25. Mexico HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 26. Mexico HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 27. Mexico HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 28. Europe HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 29. Europe HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 30. Europe HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 31. Europe HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 32. Europe HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 33. Europe HR Technology Market Share, By Country, In USD Billion, 2016-2030F

- Figure 34. Germany HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 35. Germany HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 36. Germany HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 37. Germany HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 38. Germany HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 39. France HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 40. France HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 41. France HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 42. France HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 43. France HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 44. Italy HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 45. Italy HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 46. Italy HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 47. Italy HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 48. Italy HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 49. United Kingdom HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 50. United Kingdom HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 51. United Kingdom HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 52. United Kingdom HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 53. United Kingdom HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 54. Russia HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 55. Russia HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 56. Russia HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 57. Russia HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 58. Russia HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 59. Netherlands HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 60. Netherlands HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 61. Netherlands HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 62. Netherlands HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 63. Netherlands HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 64. Spain HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 65. Spain HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 66. Spain HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 67. Spain HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 68. Spain HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 69. Turkey HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 70. Turkey HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 71. Turkey HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 72. Turkey HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 73. Turkey HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 74. Poland HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 75. Poland HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 76. Poland HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 77. Poland HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 78. Poland HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 79. South America HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 80. South America HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 81. South America HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 82. South America HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 83. South America HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 84. South America HR Technology Market Share, By Country, In USD Billion, 2016-2030F

- Figure 85. Brazil HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 86. Brazil HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 87. Brazil HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 88. Brazil HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 89. Brazil HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 90. Argentina HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 91. Argentina HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 92. Argentina HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 93. Argentina HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 94. Argentina HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 95. Asia-Pacific HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 96. Asia-Pacific HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 97. Asia-Pacific HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 98. Asia-Pacific HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 99. Asia- Pacific Cream Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 100. Asia-Pacific HR Technology Market Share, By Country, In USD Billion, 2016-2030F

- Figure 101. India HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 102. India HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 103. India HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 104. India HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 105. India HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 106. China HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 107. China HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 108. China HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 109. China HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 110. China HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 111. Japan HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 112. Japan HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 113. Japan HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 114. Japan HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 115. Japan HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 116. Australia HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 117. Australia HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 118. Australia HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 119. Australia HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 120. Australia HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 121. Vietnam HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 122. Vietnam HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 123. Vietnam HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 124. Vietnam HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 125. Vietnam HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 126. South Korea HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 127. South Korea HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 128. South Korea HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 129. South Korea HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 130. South Korea HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 131. Indonesia HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 132. Indonesia HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 133. Indonesia HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 134. Indonesia HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 135. Indonesia HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 136. Philippines HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 137. Philippines HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 138. Philippines HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 139. Philippines HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 140. Philippines HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 141. Middle East & Africa HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 142. Middle East & Africa HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 143. Middle East & Africa HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 144. Middle East & Africa HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 145. Middle East & Africa HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 146. Middle East & Africa HR Technology Market Share, By Country, In USD Billion, 2016-2030F

- Figure 147. Saudi Arabia HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 148. Saudi Arabia HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 149. Saudi Arabia HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 150. Saudi Arabia HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 151. Saudi Arabia HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 152. UAE HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 153. UAE HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 154. UAE HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 155. UAE HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 156. UAE HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 157. South Africa HR Technology Market, By Value, In USD Billion, 2016-2030F

- Figure 158. South Africa HR Technology Market Share, By Deployment, In USD Billion, 2016-2030F

- Figure 159. South Africa HR Technology Market Share, By Type, In USD Billion, 2016-2030F

- Figure 160. South Africa HR Technology Market Share, By Organization Size, In USD Billion, 2016-2030F

- Figure 161. South Africa HR Technology Market Share, By End-user Industry, In USD Billion, 2016-2030F

- Figure 162. By Deployment Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 163. By Type Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 164. By Organization Size Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 165. By End-user Industry Map-Market Size (USD Billion) & Growth Rate (%), 2022

- Figure 166. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2022

The global HR Technology Market has experienced significant growth in recent years and is expected to maintain a strong pace of expansion in the coming years. With projected revenue of approximately USD 30.8 billion in 2022, the market is forecasted to reach a value of USD 61.8 billion by 2030, displaying a robust CAGR of 9.1% from 2023 to 2030.

The HR technology market is a rapidly growing industry that provides software and services to help HR departments streamline their operations and improve their employee experience. The market is experiencing substantial growth due to increased recognition of the strategic importance of HR in organizations. Companies are investing in HR tech solutions to improve HR processes, increase efficiency, and attract and retain top talent. Core HR systems, including human resource information systems (HRIS) and human capital management (HCM) software, are forming the foundation of HR technology. These systems help manage employee data, payroll, benefits administration, and compliance. However, data security remains an ongoing concern for both systems and software. Companies consistently enhance their cybersecurity protocols to manage confidential information within their client organizations. In December 2021, a data breach impacted UKG, affecting employees' payroll and related data from 2,000 organizations utilizing their software. Instances like these, underscores the importance of companies maintaining stringent data security measures.

HR Processes Automation to Streamline Operations

Digital transformation encourages the automation of manual and time-consuming HR processes. HR automation begins with the recruitment process. ATS software automates job postings, candidate screening, interview scheduling, and applicant communication. It helps HR teams manage a high volume of applications more effectively. HR technology solutions, such as HRIS (Human Resource Information Systems) and HCM (Human Capital Management) software, enable organizations to automate payroll processing, benefits administration, and time-tracking tasks. It reduces administrative burdens, minimizes errors, and allows HR professionals to focus on strategic activities.

For example, in June 2023, Oracle unveiled the integration of generative AI-driven features into its Oracle Fusion Cloud Human Capital Management (HCM) platform. The Oracle Cloud Infrastructure (OCI) generative AI service underpinned these newly introduced capabilities and have been seamlessly incorporated into current HR operations. This integration aims to accelerate business benefits, boost efficiency, elevate the quality of interactions with candidates and employees, and simplify HR procedures.

Adoption of Analytics Towards Data-Driven Decision-Making in HR Planning

Digital HR solutions provide access to a wealth of data on various HR metrics and employee performance. By leveraging analytics and reporting tools, organizations can make data-driven decisions related to talent acquisition, performance management, workforce planning, compliance, and risk management. It helps in optimizing HR strategies and aligning them with business objectives. Apart from this, HR analytics provides insights into diversity and inclusion efforts within an organization. Organizations assess their progress in creating a diverse and inclusive workplace by examining demographic data, employee engagement surveys, and other relevant information. The information guide diversity initiatives help foster a more inclusive corporate culture.

For example, in March 2022, Visier introduced its People Cloud and People Cloud Custom Services. The Visier People Cloud is constructed upon the company's people analytics platform. As stated by the company, the people cloud aims to solve last mile problems that often obstruct the full potential of HR team or people analytics strategies of organizations.

North America to Witness Largest Market Share

North America has a culture which embraces technology and innovation. Both, businesses and employees are often early adopters of new HR technologies, contributing to the growth of the market. North America, especially the United States, has one of the world's largest and most diverse workforces. This diversity necessitates sophisticated HR solutions to manage different HR processes, from talent acquisition to performance management. Moreover, the region has witnessed widespread adoption of cloud-based HR technology. Cloud solutions offer scalability, cost-effectiveness, and accessibility, making them highly attractive to organizations of all sizes.

For example, in September 2023, HiBob and Papaya Global announced a strategic partnership to meet the demand for comprehensive and compliant payroll solutions integrated with HR, particularly for multinational enterprises. Now organizations integrate HR, paid time off (PTO), and compensation data seamlessly. The real-time data synchronization empowers multinational corporations to streamline and enhance their HR and payroll operations.

Government Initiatives

Government initiatives play a significant role in shaping the HR technology market. Governments around the world are implementing data privacy regulations such as GDPR (General Data Protection Regulation) in the European Union and CCPA (California Consumer Privacy Act) in the United States. These regulations impose strict rules on how organizations handle personal data, including HR. HR technology providers need to comply with these regulations, which can lead to the development of privacy-focused HR tech solutions. Government agencies are increasingly concerned about data breaches and cyber threats. HR technology solutions must adhere to government guidelines for cybersecurity and data protection, which may lead to advancements in security features.

Impact of COVID-19

The COVID-19 pandemic had a significant impact on the HR technology market. It accelerated pre-existing trends and created new challenges and opportunities for HR technology providers and organizations alike. The sudden shift to remote work, forced organizations to invest in HR technology solutions, such as virtual onboarding tools, collaboration platforms, and employee engagement apps. With remote work becoming the norm, HR technology providers focused on solutions for employee engagement, communication, and feedback. Digital channels, chatbots, and virtual town halls became popular for maintaining employee connections. Video conferencing and communication tools saw a surge in demand. COVID-19 accelerated digital transformation initiatives, including the adoption of cloud-based HR technology. Organizations recognized the need for digital HR solutions to manage remote teams, streamline processes, and maintain HR operations.

Future Market Scenario

The future of the HR technology market is likely to be characterized by a growing emphasis on AI, cloud-based solutions, employee experience, and data and analytics. Organizations that are looking to improve their HR operations should consider investing in HR technology solutions that align with these trends. AI and ML are being used to develop HR technology solutions that can automate tasks, provide insights, and make predictions. For example, AI-powered chatbots are used to provide employees with self-service support, and ML is used to identify and predict employee turnover. Overall, HR technology is becoming increasingly sophisticated and affordable, playing a vital role in helping organizations manage their workforce effectively.

Key Players Landscape and Outlook

The HR technology market is witnessing a swift growth trajectory due to the increasing emphasis placed by companies worldwide on establishing advanced automation software infrastructure. Furthermore, the market expansion is greatly facilitated by the establishment of proper cloud infrastructure, along with significant investments made by companies to enhance research and development resources, engage in collaboration projects, and bolster marketing efforts. These factors collectively contribute to the rapid expansion of the market.

In September 2023, Tenet Healthcare Corporation opted for Oracle Fusion Cloud Human Capital Management (HCM) to modernize and streamline its HR and payroll procedures. By integrating its systems with Oracle Cloud HCM, Tenet enhance and automate its processes, thereby improving its ability to serve employees, HR, and payroll professionals across the organization.

Table of Contents

1. Research Methodology

2. Project Scope & Definitions

3. Impact of COVID-19 on the Global HR Technology Market

4. Executive Summary

5. HR Technology Market Outlook, 2016-2030F

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. By Deployment

- 5.2.1. On-premises

- 5.2.2. Cloud

- 5.3. By Type

- 5.3.1. Workforce management

- 5.3.2. Recruitment

- 5.3.3. Payroll Management

- 5.3.4. Performance Management

- 5.3.5. Others

- 5.4. By Organization Size

- 5.4.1. Large Enterprises

- 5.4.2. Small & Medium Enterprises

- 5.5. By End-user

- 5.5.1. IT & Telecom

- 5.5.2. BFSI

- 5.5.3. Retail

- 5.5.4. Healthcare

- 5.5.5. Others

- 5.6. By Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. South America

- 5.6.4. Asia-Pacific

- 5.6.5. Middle East and Africa

- 5.7. By Company Market Share (%), 2022

6. Global HR Technology Market Outlook, By Region, 2016-2030F

- 6.1. North America*

- 6.1.1. Market Size & Forecast

- 6.1.1.1. By Value

- 6.1.2. By Deployment

- 6.1.2.1. On-premises

- 6.1.2.2. Cloud

- 6.1.3. By Type

- 6.1.3.1. Workforce management

- 6.1.3.2. Recruitment

- 6.1.3.3. Payroll Management

- 6.1.3.4. Performance Management

- 6.1.3.5. Others

- 6.1.4. By Organization Size

- 6.1.4.1. Large Enterprises

- 6.1.4.2. Small & Medium Enterprises

- 6.1.5. By End-user

- 6.1.5.1. IT & Telecom

- 6.1.5.2. BFSI

- 6.1.5.3. Retail

- 6.1.5.4. Healthcare

- 6.1.5.5. Others

- 6.1.6. United States*

- 6.1.6.1. Market Size & Forecast

- 6.1.6.1.1. By Value

- 6.1.6.2. By Deployment

- 6.1.6.2.1. On-premises

- 6.1.6.2.2. Cloud

- 6.1.6.3. By Type

- 6.1.6.3.1. Workforce management

- 6.1.6.3.2. Recruitment

- 6.1.6.3.3. Payroll Management

- 6.1.6.3.4. Performance Management

- 6.1.6.3.5. Others

- 6.1.6.4. By Organization Size

- 6.1.6.4.1. Large Enterprises

- 6.1.6.4.2. Small & Medium Enterprises

- 6.1.6.5. By End-user

- 6.1.6.5.1. IT & Telecom

- 6.1.6.5.2. BFSI

- 6.1.6.5.3. Retail

- 6.1.6.5.4. Healthcare

- 6.1.6.5.5. Others

- 6.1.7. Canada

- 6.1.8. Mexico

- 6.1.1. Market Size & Forecast

All segments will be provided for all regions and countries covered

- 6.2. Europe

- 6.2.1. Germany

- 6.2.2. France

- 6.2.3. Italy

- 6.2.4. United Kingdom

- 6.2.5. Russia

- 6.2.6. Netherlands

- 6.2.7. Spain

- 6.2.8. Turkey

- 6.2.9. Poland

- 6.3. South America

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.4. Asia-Pacific

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Vietnam

- 6.4.6. South Korea

- 6.4.7. Indonesia

- 6.4.8. Philippines

- 6.5. Middle East & Africa

- 6.5.1. Saudi Arabia

- 6.5.2. UAE

- 6.5.3. South Africa

7. Market Mapping, 2022

- 7.1. By Deployment

- 7.2. By Type

- 7.3. By Organization Size

- 7.4. By End-user

- 7.5. By Region

8. Macro Environment and Industry Structure

- 8.1. PESTEL Analysis

- 8.1.1. Political Factors

- 8.1.2. Economic System

- 8.1.3. Social Implications

- 8.1.4. Technological Advancements

- 8.1.5. Environmental Impacts

- 8.1.6. Legal Compliances and Regulatory Policies (Statutory Bodies Included)

- 8.2. Porter's Five Forces Analysis

- 8.2.1. Supplier Power

- 8.2.2. Buyer Power

- 8.2.3. Substitution Threat

- 8.2.4. Threat from New Entrant

- 8.2.5. Competitive Rivalry

9. Market Dynamics

- 9.1. Growth Drivers

- 9.2. Growth Inhibitors (Challenges, Restraints)

10. Key Players Landscape

- 10.1. Competition Matrix of Top Five Market Leaders

- 10.2. Market Revenue Analysis of Top Five Market Leaders (in %, 2022)

- 10.3. Mergers and Acquisitions/Joint Ventures (If Applicable)

- 10.4. SWOT Analysis (For Five Market Players)

- 10.5. Patent Analysis (If Applicable)

11. Case Studies (If applicable)

12. Key Players Outlook

- 12.1. SAP SE

- 12.1.1. Company Details

- 12.1.2. Key Management Personnel

- 12.1.3. Products & Services

- 12.1.4. Financials (As reported)

- 12.1.5. Key Market Focus & Geographical Presence

- 12.1.6. Recent Developments

- 12.2. Oracle Corporation

- 12.3. Automatic Data processing Inc.

- 12.4. Cornerstone OnDemand Inc

- 12.5. Ceridian HCM, Inc.

- 12.6. Workday Inc.

- 12.7. Infor Inc.

- 12.8. Cegid Group

- 12.9. Hi Bob, Inc.

- 12.10. The Access Group

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work