|

市場調査レポート

商品コード

1910481

軍用航空機整備・修理・オーバーホール(MRO):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Military Aviation Maintenance, Repair, And Overhaul - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 軍用航空機整備・修理・オーバーホール(MRO):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

概要

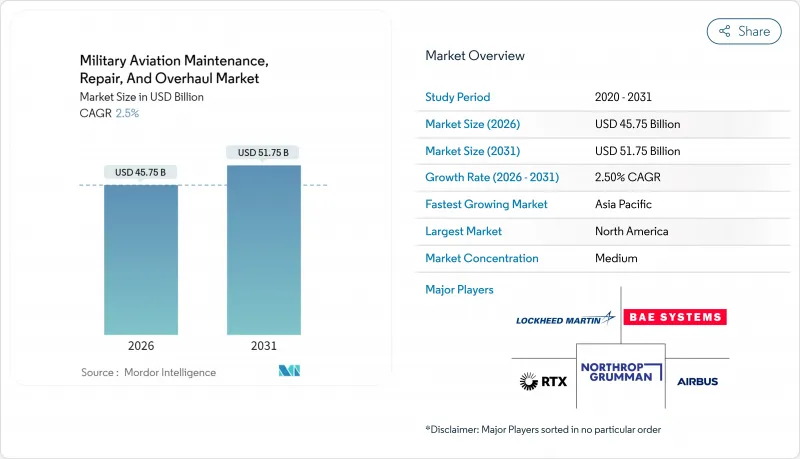

2026年の軍用航空機MRO市場規模は457億5,000万米ドルと推定され、2025年の446億3,000万米ドルから成長を続けております。

2031年までの予測では517億5,000万米ドルに達し、2026年から2031年にかけてCAGR2.5%で拡大が見込まれております。

この着実な拡大は、機体老朽化、機体寿命延長施策、地政学的緊張の高まりによって再構築された、成熟しつつも不可欠な分野を反映しています。旧式航空機の近代化プログラムの加速、デジタルツイン技術への持続的な投資、無人プラットフォームの普及が、整備要件を変え、新たなサービス提供者の収益機会を開いています。一方、持続的なサプライチェーンの脆弱性と迫り来る熟練労働者不足が供給能力を制約する恐れがあり、運用者は予測保全や性能ベースロジスティクス(PBL)を採用し、低コストで運用準備態勢を維持するよう迫られています。こうした構造的変化がアウトソーシングサービスへの漸進的な移行を支え、防衛省が安全保障を損なわずにコスト効率を追求する中で、独立系プロバイダーの存在感が高まっています。これらの動向が相まって、2030年代末まで軍用航空機MRO市場の安定した見通しを強化しています。

世界の軍用航空機整備・修理・オーバーホール(MRO)市場の動向と洞察

艦隊寿命延長プログラムの増加がMRO需要を持続的に牽引

艦隊寿命延長イニシアチブは現在、世界中の旧式爆撃機、給油機、戦闘機の維持計画の中核を成しており、財政的慎重さと即応性確保を融合した現実的な戦略を反映しています。運用者は、B-52やKC-135などのプラットフォーム向け近代化契約を、新規航空機開発に内在する予算・スケジュールリスクに対するヘッジと見なしています。2050年までの運用延長に伴い、整備工場では構造物の大規模な修復、腐食対策、ミッションシステムのアップグレードが実施され、これらはしばしば製造時の公差を超える作業となります。作業範囲には、低可視性性能を維持するための完全な配線交換、複合材パネルの交換、レーダー波吸収材の更新などが日常的に含まれます。こうした労働集約的なプロジェクトは熟練技術者を数か月間拘束し、調達需要が低迷する時期でも整備工場を稼働させ続けます。近代化が世界中の艦隊に波及する中、陳腐化管理、部品回収、デジタル記録統合を管理できる専門プロバイダーは、予測可能な複数年にわたる収益源を確保し、MRO(整備・修理・オーバーホール)全体の成長を支えています。

多国間防衛協定が相互運用性要件を拡大

同盟国の戦備体制では、標準化された整備手順、技術文書、共有在庫の整備が義務付けられ、維持管理は単独国家の任務から集団安全保障の前提条件へと位置付けが再構築されています。オーストラリアと欧州に地域拠点を置くF-35世界の支援ソリューションは、重整備作業を集約することで飛行時間当たりのコストを削減しつつ、危機時の緊急対応能力を保証する手法を示しています。共通の工具規格と認証基準を確立することで、技術者は重複訓練なしに国境を越えて活動でき、連合軍飛行隊の整備期間を短縮します。ただし、厳格な技術移転規則により、プロバイダーは情報公開と機密データの保護のバランスを保つ必要があります。認証機関はソフトウェア検証手順を調和させ、一国でリリースされたアップグレードがパートナー艦隊全体で航空適性を維持できるようにする必要があります。独立系MRO事業者にとって、サイバーセキュリティ、輸出管理コンプライアンス、主権的なサプライチェーンの優先事項を整合させることは、競合上の差別化要因となりつつあります。その結果、複数の管轄区域にわたる信頼、透明性、実績に基づくパフォーマンスに依存する、より大規模で安定した作業パッケージが形成されます。

サプライチェーンの脆弱性がMRO能力を制約

単一供給源と老朽化した工具は脆弱な供給網を生み、些細な混乱が数ヶ月に及ぶ航空機の地上待機事故へと連鎖します。レガシーエンジン向け重要鍛造部品は、認定ベンダーが1社のみの場合があり、その予期せぬ操業停止で全機隊が停止する恐れがあります。長いリードタイムにより運航会社は回転部品の備蓄を余儀なくされますが、倉庫拡張は間接費と在庫に縛られた資本を膨らませます。輸出許可の遅延は多国籍プログラムに不確実性を加え、特に地政学的緊張が高まるとライセンシング審査が厳格化されます。デポでは非飛行重要部品への積層造形技術導入でリスク軽減を図っていますが、認証のハードルは依然として高い状況です。サプライヤーの健全性を監視し、生産能力不足の早期兆候を検知するデジタルトレーサビリティプラットフォームが導入されつつあります。調達先の多様化、高度な需要予測、積層造形ソリューションの普及が進むまでは、サプライチェーンの脆弱性がMROの処理能力と収益実現に対する最も差し迫った制約要因であり続けるでしょう。

セグメント分析

固定翼機は、定期的な重整備やアビオニクス更新を必要とする戦闘機・輸送機の膨大な保有数により、2025年の軍事航空MRO市場規模の59.72%を占めました。一方、無人航空機(UAV)は6.58%のCAGRで最も急成長しているセグメントであり、米国防総省の「レプリケーター」構想に基づく群自律飛行技術への戦略的投資を反映しています。

固定翼プラットフォームが最大の整備作業量を維持する一方、UAVの成長により、プロバイダーはデポレベルオーバーホールとは異なる、高ボリュームかつ迅速なターンアラウンドプロセスへの適応を迫られています。回転翼機の需要は安定しており、特に特殊作戦仕様のUH-60およびMH-47のバリエーションは、機密扱いのハンガーアクセスと加速されたターンアラウンドを必要とします。こうした機体構成の変化に対応するため、サービスプロバイダーは柔軟なキャパシティ計画を策定し、既存機体のサポートを損なうことなく増加するUAV需要を取り込む必要があります。これにより、軍事航空MRO市場全体でバランスの取れた拡大が持続されます。

エンジンオーバーホールは2025年収益の42.12%を占め、推進システムが最大の整備費項目であり、厳格な性能・認証基準を課されていることを示しています。コンポーネント修理・オーバーホールは、検査コスト削減と特定部品交換を可能にするデジタルツイン技術を活用した診断により、CAGR3.39%で業界を牽引すると予測されます。

機体整備需要は安定しており、耐用年数延長に伴い構造補強、腐食対策、複合材修理が求められています。この変化によりライン整備の成長と軍用航空機MRO市場への浸透は状態ベースのスケジュール管理に限定されますが、前方展開時の即応態勢維持には依然として不可欠です。性能ベース契約は複数のサービス種別を統合し続けることで、プロバイダーが各整備部門の効率性を活用し、軍用航空機MRO市場への浸透を深めることを可能にしております。

地域別分析

北米の37.35%というシェアは、米国が保有する13,000機以上の軍用機を基盤としており、ボーイング社の23億米ドル規模のC-17維持契約などの大型契約がこれを支えています。しかしながら、慢性的な部品不足と迫り来る技術者の退職ラッシュが生産性の低下を招く恐れがあり、各軍種はデジタルツインの導入加速と人材育成への投資を迫られています。カナダがL3Harris社と提携しF-35整備基地を設立した事例は、同盟国間の協力が大陸全体の戦備態勢を強化する好例です。

アジア太平洋地域は最も活況を呈する領域であり、地域大国が地政学的リスクの高まりに対応する中、CAGR4.32%で拡大しています。日本は2024年度防衛予算を21%増の553億米ドルに拡大し、インドの23億4,000万米ドル規模のMiG-29改修事業は、国産維持能力への意図的な転換を示しています。中国は3,140億米ドルの安定的な予算配分を維持しており、欧米企業の直接的な市場参入がなくても、重要な基盤的推進力となっています。これらの要因が相まって、予測期間において同地域は軍用航空機MRO市場にとって重要性を増す見込みです。

欧州は成熟しつつも機会に富んだ環境を維持しています。「欧州再軍備計画」では8,000億ユーロ(9,385億7,000万米ドル)の防衛予算が計上されていますが、その実施は政治的な合意形成と供給能力に依存しています。スロバキアにおけるF-16のMRO能力拡充など、最近の動向はNATO内での維持管理の分散化が徐々に進んでいることを示しています。環境規制もまた、欧州の運用者にエンジンの改修キャンペーンに着手させ、中期運用プラットフォームの寿命を延ばすと同時に排出削減目標の達成を推進しています。こうした進展により、欧州は進化する軍用航空機MRO市場において存在感を維持していますが、実際の成長は公表されている資金調達約束額を下回る可能性があります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 機体寿命延長プログラムの増加

- 多国籍準備態勢協定の拡大

- 新興アジア太平洋諸国の防衛支出の増加

- OEMデジタルツイン対応サービスパッケージ

- 特殊作戦における回転翼機の使用増加

- 持続可能性の要請がエンジン改修を推進

- 市場抑制要因

- 防衛グレードのスペアパーツにおけるサプライチェーンの脆弱性

- 整備工場レベル施設における熟練労働者の不足

- 西欧における予算サイクルの不確実性

- 重要航空電子機器に対する輸出管理規制

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 用途別

- 固定翼

- 戦闘機

- 輸送機および給油機

- 特殊任務航空機

- その他

- 回転翼機

- 汎用/輸送ヘリコプター

- 攻撃ヘリコプター

- 無人航空機(UAV)

- 固定翼

- MROタイプ別

- エンジンオーバーホール

- 航空機本体整備

- コンポーネント修理・オーバーホール

- ライン整備

- サービスプロバイダー別

- OEM提携センター

- 独立系MRO事業者

- 軍内部のデポ

- エンドユーザー別

- 空軍

- 海軍航空

- 陸軍航空

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- イスラエル

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Airbus SE

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- RTX Corporation

- BAE Systems plc

- Saab AB

- Elbit Systems Ltd.

- Rolls-Royce Holdings plc

- Safran SA

- MTU Aero Engines AG

- Leonardo S.p.A.

- Israel Aerospace Industries Ltd.

- Korean Aerospace Industries, Ltd.

- AAR CORP.

- StandardAero Aviation Holdings, Inc.

- General Atomics

- Singapore Technologies Engineering Ltd.

- L3Harris Technologies, Inc.