|

市場調査レポート

商品コード

1404534

ロケーションベースVR:市場シェア分析、産業動向・統計、成長予測、2024年~2029年Location-Based VR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ロケーションベースVR:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

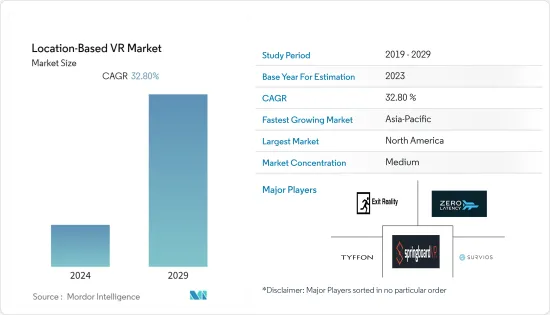

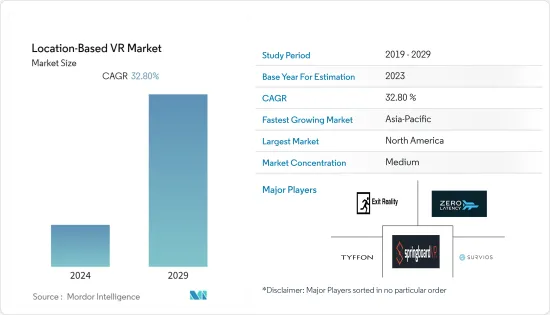

ロケーションベースVR市場は、今年度15億8,000万米ドルと評価され、CAGR 32.8%を記録し、5年後には87億3,000万米ドルに達すると予測されます。

主なハイライト

- VR技術は、ユーザーをデジタルの世界に誘う没入体験を提供し、年々飛躍的に進化しています。この進化の重要な側面は、ロケーションベースVR(LBVR)市場の出現です。LBVRは家庭やオフィスの枠を超えたVR体験を提供し、ユーザーは専用の物理的スペースでインタラクティブな仮想世界を探索することができます。ロケーションベースVRセンターは、高品質の没入型VR体験を消費者に提供します。これらのセンターは、先進的なハードウェアモーショントラッキングシステムと様々なインタラクティブコンテンツを備え、ユーザーに比類のない共有体験を提供します。LBVRのコンセプトは、ユーザーがVRを楽しむための社会的で共同的な環境を作り出し、ユニークな体験を育むことを目的としています。

- LBVR市場は、その創設以来、没入型体験に対する需要の急増とVR技術の進歩により、著しい成長を遂げています。The VOID、Dreamscape Immersive、Zero Latencyなどのプレーヤーは、イノベーションを生み出すことでこの成長を先導してきました。例えば前年、DreamscapeとMajid Al Futtaimはサウジアラビアで没入型VRデスティネーションを立ち上げました。さらに、Dreamscapeの革命は、ハリウッドの魅惑的なストーリーとテーマパークの乗り物の爽快なスリルを組み合わせたもので、全身を追跡する技術を搭載したこれらの心臓が高鳴るようなダイナミックな冒険は、前例のないレベルの没入感を提供し、訪問者を内臓に訴えかけるような体験に引き込みます。

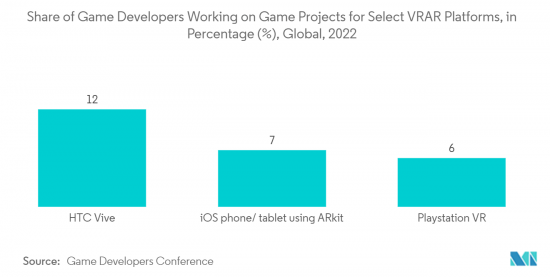

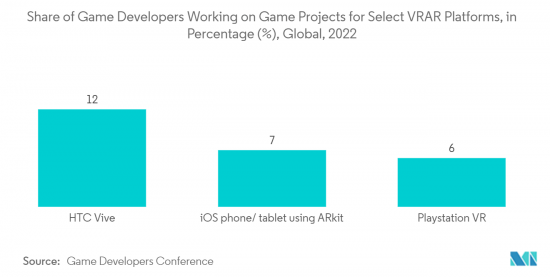

- さらに、改良されたヘッドセット、モーションコントローラー、トラッキングシステムなどの高品質なVR技術は、ユーザーがより自然で魅力的な仮想環境とインタラクションできるようにするために不可欠です。ハードウェアの必要性は、物理的な空間に仮想的な特徴を重ね合わせるロケーションベースVRでより明確になります。HTC Vive Cosmos Elite、Meta Questシリーズ、Sony PlayStation VRなど、高解像度ディスプレイと正確なモーショントラッキングシステムを備えたプレミアムVRヘッドセットは、参加者が仮想世界を流動的に移動し、LBVRエンターテインメントセンターの物理的領域で物事と相互作用することを可能にし、エスケープルーム体験を提供します。その結果、VRハードウェアの絶え間ない開拓は、ロケーションベースVRを受け入れる顧客を引き付け、市場成長を促進し、イノベーションを推進する上で不可欠です。

- 小売アーケードは、企業がアーケードフランチャイズに幅広く投資しているため、最も成長率の高い消費者です。東部の温州市に拠点を置くSeekers VRは、中国全土の70以上の都市に200のアーケードのフランチャイズチェーンを所有しています。世界市場が大きく成長する中、各社は影響力のある高精細な360度コンテンツの制作に強く力を注いでおり、一度に多くの人が少ない観客で1つのイベントを管理する必要があるため、顧客にとっての1分あたりの単価を下げています。

- LBVRの市場はまだ初期段階にあります。VR体験をよりリアルなものにすることが、市場導入と普及には欠かせないです。VR技術の導入の増加、VR技術への投資の増加、360度コンテンツの人気の高まりは、LBVR市場の成長に影響を与える他の重要な要因です。この業界では、高品質のコンテンツが重要な役割を果たしています。幅広い層に訴求する魅力的で高品質なコンテンツが市場に参入することで、市場の成長が見込まれます。

- 前年には、プラチナセラーとなったVRシューティングゲーム「Arizona Sunshine」で知られるマルチプラットフォームVRパブリッシャー兼デベロッパーのVertigo Gamesが、VR会場管理ソフトウェアのリーディングプロバイダーであり、ロケーションベースエンターテイメント(LBE)のための最も広範なコンテンツマーケットプレースであるSpringboardVRの買収を非公開の金額で完了したと発表しました。

- COVID-19危機はほとんどのVR技術企業に影響を与えました。パンデミックの初期数ヶ月間、いくつかのVRゲームセンターが自宅待機の注文のために閉鎖されました。サプライチェーンの混乱、店舗の閉鎖、企業導入の遅れが、近年の短期的な見通しに影を落としました。しかし、遠隔作業要件、拡張された会議場、非接触型ビジネス・プロセス、仮想的な社会的一体感は、パンデミック中およびパンデミック後にVR技術を可能にする需要を増加させると予想されます。

ロケーションベースVR市場の動向

360度コンテンツの人気の高まり

- VR市場は急速に拡大しており、ロケーションベースVRもそれに追随しています。3D、4D、5D、没入型VRコンテンツ、特に360度動画などの先進技術は、世界のゲームコンテンツの重要な動向になりつつあります。これらのカメラシステムは360度の全景を記録し、ユーザーに没入感を提供します。

- トロント大学オイセ校が前年に実施した調査によると、360度体験はVRで活用されており、ユーザーはVRヘッドセット内でコンテンツを視聴できます。同時に、センサーが頭の動きを追跡し、説得力のある代替現実を作り出します。しかし、ユーザーは完全に没入しなければならず、周囲を見渡すだけで前に進むことはできないです。

- エンターテインメント分野は、これらの技術で顕著な進歩を遂げており、没入型環境に対する需要が高まるにつれて成長する見込みです。先進的なカメラシステムは、位置情報ベースのVRの人気と受容を押し上げる可能性が高く、予測期間におけるVRの大きな可能性を提示します。

- エミレーツ航空やエティハド航空などの大手消費者ブランドは、360度VR体験を採用しています。例えば、Jumeirah VRアプリでは、ゲストはGoogle Cardboardゴーグルとスマートフォンを使って施設のAR/VRツアーに参加できます。

- 360度動画は商業的にも一般的にも人気を博しているが、その効果、没入感の向上、臨場感、動画評価などについて、より包括的な研究が必要です。しかし、VRヘッドセットで動画を見る消費者は、キュレーションされたコンテンツにより注意を払う傾向があります。360度コンテンツへの需要の高まりは、この市場が時間とともに飛躍的な成長を遂げることを示唆しています。

- さらに、VRの拡大、特に360度コンテンツと高度なVR技術の台頭は、没入型体験とエンターテインメントソリューションに対する需要の高まりを活用するビジネスチャンスをもたらしています。

アジア太平洋地域が大きな成長を遂げる見込み

- アジア太平洋地域は、大規模かついくつかの新興経済国の存在と、同地域におけるVRデバイスの受け入れの高まりにより、大きなシェアを占めると予想されます。このことは、業界プレイヤーの同地域への投資を促すと予想されます。

- 中国は、VR技術の採用が増加していることから、この地域で大きなシェアを占めると予想されます。同国では、VRの新興企業が続々と誕生しています。中国で期待される超高速5Gネットワークの広範な採用は、VR開発をさらに後押しし、教育やトレーニングなどの分野での成長を促進すると予想されます。

- さらに、韓国はこの産業でVR、AR、AI技術を最初に導入した国のひとつです。さらに、韓国のICT省は前年、同国のデジタルコンテンツ産業の繁栄を支援するため、VR技術と機器に1億8,180万米ドルを投資する計画を発表しました。

- 昨年、ドイツのダイムラー・トラックAGの子会社であるダイムラー・インディア商用車(DICV)は、インドのチェンナイ工場にVRセンター(VRC)を設立しました。オペレーターは、VRセンターで、ナビゲーショナル・ジョイスティックと3Dゴーグルを使ってアクセスできるデジタルモデルを使い、アクセシビリティと整備性のチェックを現実的に実施することができます。

ロケーションベースVR産業の概要

ロケーションベースVR市場は、多くの地域および世界プレーヤーが存在し、競争は中程度です。技術革新の増加に伴い、市場の主要企業は、市場シェアと収益性を高めるために戦略的な共同イニシアチブを活用することで、海外にわたる顧客基盤の拡大に注力しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の成果 と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響

第5章 市場力学

- 市場促進要因

- アーケードベースVRソリューションの導入増加

- 360度コンテンツの人気の高まり

- 市場抑制要因

- VRコンテンツ開発コストの高さ

第6章 市場セグメンテーション

- タイプ別

- ハードウェア

- ヘッドマウントディスプレイ

- ヘッドアップディスプレイ

- メガネ

- センサー

- カメラ

- ソフトウェア

- ハードウェア

- アプリケーション別

- VRアーケード

- VRテーマパーク

- VR映画館

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 競合情勢

- 企業プロファイル

- EXIT VR

- Springboard VR(Vertigo Games)

- SpaceVR Inc.

- Survios Inc.

- Hologate GmbH

- Zero Latency PTY Ltd.

- Oculus VR LLC(Facebook Inc.)

- HTC Vine(HTC Corporation)

- Tyffon Inc.

- Neurogaming Ltd

第8章 投資分析

第9章 市場の将来

The Location-Based Virtual Reality (VR) Market was valued at USD 1.58 billion in the current year and is expected to register a CAGR of 32.8%, reaching USD 8.73 billion in five years.

Key Highlights

- Virtual Reality (VR) technology has evolved by leaps and bounds over the years, offering immersive experiences that transport users to a digital realm. A significant aspect of this evolution is the emergence of the location-based virtual reality (LBVR) market. LBVR takes VR experiences beyond the confines of homes and offices, allowing users to explore interactive virtual worlds in dedicated physical spaces. Location-based VR centers provide high-quality immersive VR experiences to consumers. These centers have advanced hardware motion-tracking systems and various interactive content, giving users an unparalleled and shared experience. The LBVR concept aims to create a social and communal environment for users to enjoy VR, fostering a unique experience.

- Since its inception, the LBVR market has witnessed remarkable growth, driven by a surge in demand for immersive experiences and advancements in VR technology. Players like The VOID, Dreamscape Immersive, Zero Latency, and others have spearheaded this growth by creating innovations. For instance, the previous year, Dreamscape and Majid Al Futtaim launched an immersive virtual reality (VR) destination in Saudi Arabia. Moreover, Dreamscape's revolution combines the captivating storyline of Hollywood with the exhilarating thrill of theme park rides; powered by full-body tracking technology, these heart-pumping dynamic adventures offer an unprecedented level of immersion, engaging visitors in a visceral experience.

- Furthermore, high-quality VR technology, such as improved headsets, motion controllers, and tracking systems, is critical in allowing users to interact with virtual surroundings more naturally and engagingly. The need for hardware becomes more apparent in location-based VR, where virtual features are superimposed on physical spaces. Premium VR headsets with high-resolution displays and accurate motion tracking systems, such as HTC Vive Cosmos Elite, Meta Quest series, Sony PlayStation VR, etc., allow participants to fluidly navigate the virtual world and interact with things in the physical area of the LBVR entertainment center, giving an escape room experience. As a result, constant developments in VR hardware are essential in attracting customers to embrace location-based VR, propelling market growth and driving innovation.

- Retail arcades are the highest growing consumers, as companies invest extensively in arcade franchises. Seekers VR, based in the eastern city of Wenzhou, owns a franchised chain of 200 arcades in more than 70 cities across China. With the significant growth in the global market, companies are strongly focusing on creating influential high-definition 360-degree content and reducing the price per minute for the customers, as many people are required to manage single events with fewer audiences at a time.

- The market for LBVR is still in a nascent stage. Making the VR experience more real is critical for market adoption and penetration. Increasing the implementation of VR technology, increasing investments in VR technology, and the growing popularity of 360-degree content are other significant factors influencing the growth of the LBVR market. High-quality content plays a crucial role in this industry. The market is expected to grow as more compelling, high-quality content that appeals to a wide demographic enters the market.

- In the previous year, Vertigo Games, the multi-platform VR publisher and developer best known for the platinum-selling VR shooter 'Arizona Sunshine,' announced that it had completed the acquisition of SpringboardVR, a leading provider of VR venue management software and the most extensive content marketplace for location-based entertainment (LBE), for an undisclosed amount.

- The COVID-19 crisis impacted most VR tech companies. Several VR gaming centers were closed due to stay-at-home orders during the initial months of the pandemic. Supply-chain disruptions, store closures, and delayed enterprise implementations cast shadows on the short-term outlook in the recent year. However, remote working requirements, augmented meeting places, contactless business processes, and virtual social togetherness are expected to increase the demand for enabling VR technologies during and after the pandemic.

Location-Based Virtual Reality Market Trends

Growing Popularity of 360-degree Content

- The virtual reality market is experiencing rapid expansion, with location-based VR following suit. Advanced technologies like 3D0, 4D,5D, and immersive VR content, particularly 360-degree videos, are becoming significant trends in global gaming content. These camera systems record complete 360-degree views, providing users with an immersive experience.

- According to a survey conducted by the University of Toronto Oise in the previous year, 360-degree experiences are utilized in VR, allowing users to view content within a VR headset. At the same time, sensors track head movements to create a convincing alternative reality. However, users must be fully immersed, only looking around but not moving forward.

- The entertainment sector has made notable advancements with these technologies and is set to grow as demand for immersive environments increases. Advanced camera systems will likely boost the popularity and acceptance of location-based VR, presenting significant potential for VR in the forecast period.

- Major consumer brands, including Emirates and Etihad, have embraced the 360 VR experience; for instance, the Jumeirah VR app enables guests to take an AR/VR tour of facilities using Google Cardboard goggles and smartphones.

- Although 360-degree videos are gaining commercial and public popularity, there need to be more comprehensive studies on their effectiveness, improved immersion, presence, and video evaluation. However, consumers who view videos on virtual reality headsets tend to pay more attention to the curated content. The growing demand for 360-degree content suggests that the market will experience exponential growth over time.

- Furthermore, the expansion of virtual reality, particularly with the rise of 360-degree content and advanced VR technologies, presents opportunities for businesses to capitalize on the growing demand for immersive experiences and entertainment solutions.

Asia-Pacific Region Expected to Witness Significant Growth

- Asia-Pacific is expected to hold a significant share, owing to the presence of large and several emerging economies and the rising acceptance of virtual reality devices in the region. This is, in turn, expected to encourage industry players to invest in the region.

- China is expected to account for a significant share in the region, owing to the rising adoption of VR technology. Many startups in virtual reality are on the rise in the country. The expected wide-scale adoption of ultra-fast 5G networks in China is anticipated to boost VR development further and foster growth in areas such as education and training.

- Further, South Korea is one of the first countries to implement virtual reality, augmented reality, and artificial intelligence technologies in this industry. Moreover, South Korea's ICT Ministry announced plans to invest USD 181.8 million in virtual reality (VR) technology and devices in the previous year to help the country's digital content industry flourish.

- Rapid advancements in retail technology are transforming consumer behaviors and transactions in key global markets. Virtual Reality (VR) films created in Taiwan have become frequent at international film festivals. Also, a Taiwanese virtual reality (VR) film won an award at an extended reality (XR) art festival in Paris last year. According to industry proponents, this development confirms Taiwan's status as a leading player in comprehensive reality (XR) content, including Virtual Reality (VR) and other types of computer-altered reality.

- In the previous year, Daimler India Commercial Vehicles (DICV), a subsidiary of the German Daimler Truck AG., established its Virtual Reality Centre (VRC) at its Chennai, India facility. Operators can realistically execute accessibility and serviceability checks using a digital model accessed via navigational joysticks and 3D goggles at the virtual reality center.

- Last year, XRSpace, a company pioneering the next generation of social reality through XR in the metaverse, introduced a new virtual reality platform that promotes social engagement and features the first VR mobile headset. This development, with hand tracking as the primary control method and advanced connectivity and optical systems, is expected to drive further growth in the market.

Location-Based Virtual Reality Industry Overview

The location-based VR Market is moderately competitive with many regional and global players. With increasing technological innovations, the significant players in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability.

In June 2022, Vertigo Games, a video game developer in New York, announced the Upload of virtual reality (VR) and published two new VR games in their 2022 line-up. Moreover, Vertigo Games also brought Mixed Realms' rogue-like first-person combat game Hellsweeper VR to Meta Quest 2 and published DevilCow's VR puzzle game PathCraft.

In March 2022, HTC VIVE unveiled VIVERSE, 5G and location-based entertainment improvements, and the Holoride in-car VR at Mobile World Congress 2022. HTC VIVE showcased innovations to give consumers a probable understanding as they investigated the Viverse. Viverse provides seamless reviews that may be accessed from any device, anywhere. This is made feasible via virtual reality, augmented reality, excessive connectivity Speed, Artificial Intelligence, and Blockchain technology HTC has invested in for numerous years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Implementation for Arcade-based VR Solutions

- 5.1.2 Increasing Popularity of 360-Degree Content

- 5.2 Market Restraints

- 5.2.1 High Cost of VR Content Development

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Head Mounted Display

- 6.1.1.2 Head-up Displays

- 6.1.1.3 Glasses

- 6.1.1.4 Sensor

- 6.1.1.5 Camera

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Application

- 6.2.1 VR Arcades

- 6.2.2 VR Theme Parks

- 6.2.3 VR Cinemas

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EXIT VR

- 7.1.2 Springboard VR (Vertigo Games)

- 7.1.3 SpaceVR Inc.

- 7.1.4 Survios Inc.

- 7.1.5 Hologate GmbH

- 7.1.6 Zero Latency PTY Ltd.

- 7.1.7 Oculus VR LLC (Facebook Inc.)

- 7.1.8 HTC Vine (HTC Corporation)

- 7.1.9 Tyffon Inc.

- 7.1.10 Neurogaming Ltd