|

市場調査レポート

商品コード

1851633

艦艇MRO:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Naval Vessel MRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 艦艇MRO:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月31日

発行: Mordor Intelligence

ページ情報: 英文 188 Pages

納期: 2~3営業日

|

概要

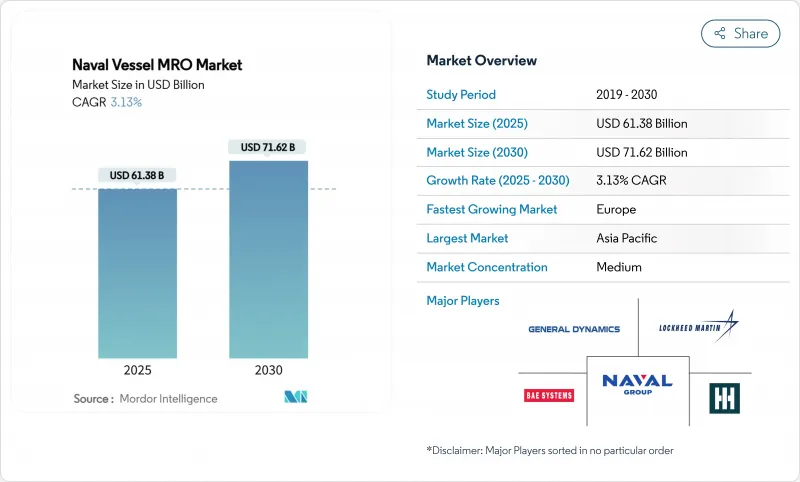

艦艇MRO市場規模は2025年に613億8,000万米ドル。

2030年にはCAGR 3.13%で716億2,000万米ドルに達すると予測されており、商業的な原動力よりも政府の防衛上の優先事項が着実な成長をもたらしています。

持続的な近代化計画、紛争水域でのより高い運用テンポ、成果ベースのロジスティクス(PBL)契約への移行が、引き続き需要を支えています。原子力艦船の維持管理と乾ドックのオーバーホールは、専門的なインフラと深い技術的専門知識を必要とするため、最も有利なニッチ分野であることに変わりはなく、割高な価格設定となっています。アジア太平洋地域は、中国の急速な船隊拡大と同盟国の対抗措置に後押しされ、最大の投資額を占めているが、欧州はNATOの新たなコミットメントを背景に最も急速に加速しています。サプライチェーンの脆弱性と熟練労働者の不足が大きな逆風となっているが、デジタルツイン・アナリティクスと積層造形はダウンタイムを軽減し、さらなるコスト削減を可能にします。

世界の艦艇MRO市場動向と洞察

車両近代化プログラム

各国政府は、単に車両数を拡大するのではなく、能力を拡張することを目指しているため、国を挙げてのアップグレード計画が艦艇MRO市場の需要を再構築しています。フィリピンの350億米ドルを投じた近代化計画やトルコの3年計画による艦隊強化計画では、整備インフラやプラットフォームのアップグレードに多額の予算を割いています。デンマークとオーストラリアにおける同様の戦略は、中堅海軍が改装、オーバーホール、モジュール式アップグレードに資金を提供することで、不釣り合いな能力向上を確保できることを示しています。潜水艦の船体寿命延長は、新造コストのほぼ4分の1で10~15年の耐用年数を追加し、耐久性のあるMRO収入を生み出します。段階的な作業パッケージにより、請負業者は労働力と在庫を事前に十分に計画できるため、予測可能性が向上し、スケジュールの遅れを縮めることができます。

レガシー船隊の延命

次世代船体の到着が遅れるにつれ、旧式船を戦闘可能な状態に維持することは、倹約から必要性へと移行しています。米国海軍の巡洋艦のオーバーホール・プログラムや英国海軍の23型フリゲート艦の寿命延長の取り組みは、海軍がいかにして最新の能力の70~80%を、代替コストのわずか15~25%で獲得しているかを示しています。強化されたコーティング、構造健全性モニタリング、および耐用年数半ばの戦闘システムの交換は、疲労と陳腐化に取り組む一方で、予測分析によって点検間隔を厳格化します。レガシー船への依存度の高まりは、独立系ヤードでは容易に再現できないデポレベルの改装需要を安定させ、既存コントラクターのプレミアム価格設定を強化します。

ドライドック枠の超過とコスト

施設の老朽化とプロジェクトの急進化により、オーバーホールの予算は計画を大幅に上回る。真珠湾のドライドック近代化は61億米ドルから160億米ドルに膨れ上がり、ポーツマス海軍造船所のコストは4倍に膨れ上がり、他の緊急工事のためのキャパシティを妨げています。造船所インフラ最適化プログラムは210億米ドルを投入するが、潜水艦の改装を12~18カ月遅らせるような短期的なギャップを解消することはできないです。民間造船所は、オーバーランが収益性を危うくするため、海軍との契約を断ることが多く、ボトルネックをさらに深刻にしています。

セグメント分析

潜水艦は2024年の艦艇MRO市場の33.88%を占め、その核推進の複雑さと抑止力の価値を反映して、複数年のサービス契約を支えています。高い規制障壁が競争を制限し、割高なレートを支えています。フリゲート艦は、分散水上作戦における役割と、すぐに維持段階に入る比較的早い建造サイクルにより、CAGR 5.26%で最も急成長しています。駆逐艦とコルベットは中位に位置し、前者はイージスシステムの保守から恩恵を受け、後者は予算に見合った哨戒艦を求める新興の沿岸海軍を惹きつけています。

潜水プラットフォームは、大規模な原子炉燃料補給、音響シグネチャーのチェック、船体圧力テスト、およびデポレベルの作業負荷をロックインする必要があります。フリゲート艦のプログラムでは、モジュール式の戦闘システム・ブロックを活用することで、耐用年数の半ばでのアップグレードを簡素化し、新しい船体の代わりに段階的な能力向上への投資を行うよう海軍を誘惑しています。スペインのISOPRENEプロジェクトによるデジタルツインパイロットは、両艦クラスで予定外のダウンタイムを15~20%削減することを実証しており、予測期間中に広範な採用が進むことを示唆しています。

ドライドック作業は、2024年の艦艇MRO市場の39.22%を占めました。これは、ドッキングを義務付ける法定船体検査、シャフトラインの交換、推進システムのオーバーホールによるものです。この分野は、義務的な定期点検が複数年のマスタースケジュールを支えているため、安定した認知度を享受しています。改造とアップグレード・サービスは、海軍が新造船を待つよりもむしろセンサー、武器、電子戦スイートを改修するため、毎年3.71%成長しています。

アディティブ・マニュファクチャリングは、部品修理の経済性を再構築しています。USS Bataanの金属3Dプリンタは、すでに海上で認証されたスペアを製造し、ロジスティクスの遅れを削減し、より重い作業のためにドックスペースを解放しています。PBLフレームワークは、部品ターンアラウンドの高速化が契約パフォーマンス指標を高めるため、サプライヤーがこの能力にさらに投資するインセンティブを与えます。

地域分析

アジア太平洋地域は、2024年の艦艇MRO市場支出の37.59%を占め、2030年までに435隻に増加する中国の船隊と、水上部隊を倍増させるというオーストラリアの計画のような同盟国の対抗策に支えられています。造船大国である韓国と日本は、オーバーフロー・ドックの能力を提供しています。ハンファ・オーシャンは、米国海軍の補修工事を獲得した最初の韓国ヤードとなり、同盟国の協力関係の深化を強調しました。

欧州は、NATO加盟国が国防支出をGDPの2%以上に引き上げる中、CAGR4.00%で最も急成長している地域です。デンマークの大規模な艦隊拡張、フランスのトゥールヴィル潜水艦就役、ギリシャの270億米ドルの再軍備により、新たな船体が維持パイプラインに注入されます。トルコの3億5,000万ユーロを投じたアクサズ海軍基地の改修は、地中海の安全保障に対する広範な懸念を反映し、この地域のメンテナンスの選択肢をさらに広げるものです。

北米は、米国海軍が近代化と老朽化施設の制約とのバランスを取りながら、堅調ながらも安定した需要を維持しています。潜水艦労働のための57億米ドルの緊急補填と、年間造船予算401億米ドルは、財政的コミットメントを強調するが、予測兵力レベルは2027年までに283隻に低下し、その後2054年までに381隻に再建されます。南米と中東・アフリカは、14億ZAR(7,890万米ドル)の潜水艦改修のようなプログラムは、漸進的な上昇を指し示しているが、貢献は依然として小さいです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- フリート近代化プログラム

- レガシー・フリートの延命

- 海洋安全保障における緊張の高まり

- PBL契約の採用

- デジタルツインベースの予測型MRO

- 積層造形によるスペア部品

- 市場抑制要因

- ドライドック枠のオーバーランとコスト

- 熟練労働者の不足

- コネクテッド造船所のサイバーリスク

- グリーン対応廃棄物処理コスト

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 船舶タイプ別

- 航空母艦

- 駆逐

- フリゲート

- コルベット

- 潜水艦

- その他の船舶タイプ(支援・補助船舶、無人水上船舶、水中船舶)

- MROタイプ別

- エンジンMRO

- ドライドックMRO

- コンポーネントMRO

- 改造とアップグレード

- メンテナンスレベル別

- 組織/運営

- 中級/フィールド

- デポ

- 推進タイプ別

- 原子力船

- 従来型(ディーゼル/ガスタービン)

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- エジプト

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- General Dynamics Corporation

- Huntington Ingalls Industries, Inc.

- Lockheed Martin Corporation

- NAVANTIA, S.A., SME

- thyssenkrupp AG

- BAE Systems plc

- Naval Group

- Rolls-Royce plc

- Rhoads Industries, Inc.

- Abu Dhabi Ship Building Company PJSC

- Larsen & Toubro Limited

- Damen Shipyards Group

- Singapore Technologies Engineering Ltd.

- FINCANTIERI S.p.A.

- HD Hyundai Heavy Industries Co., Ltd.

- Saab AB

- Austal Limited

- Mitsubishi Heavy Industries, Ltd.

- Kongsberg Gruppen ASA