|

市場調査レポート

商品コード

1687812

半導体組立・テストのアウトソーシング(OSAT)-市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Outsourced Semiconductor Assembly and Test (OSAT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体組立・テストのアウトソーシング(OSAT)-市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 187 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

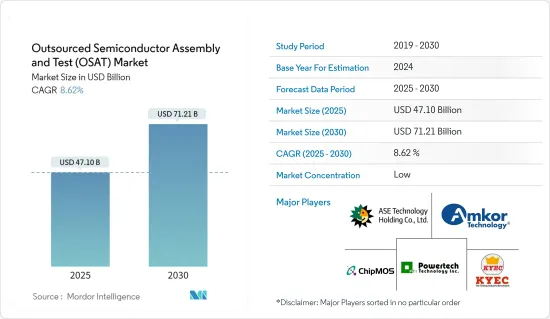

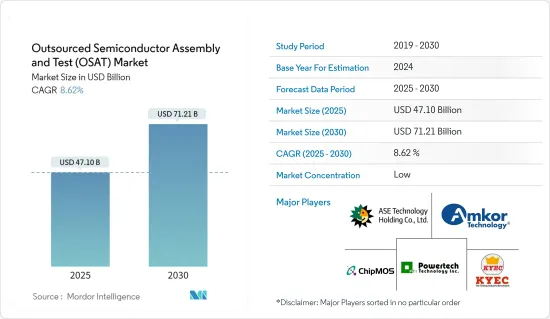

半導体組立・テストのアウトソーシング市場規模は、2025年に471億米ドルと推定・予測され、予測期間中(2025年~2030年)のCAGRは8.62%で、2030年には712億1,000万米ドルに達すると予測されます。

半導体産業は、小型化と効率化に注力しながら成長を続けています。半導体は、あらゆる現代技術の構成要素として台頭してきています。この分野の進歩や革新は、川下のあらゆる技術に直接影響を与えます。人工知能(AI)やクラウドコンピューティングを含むエレクトロニクス技術の急速な開発は、高速、低消費電力、高集積の集積回路(IC)への高い需要によって補完され、大きな売上につながっています。

主なハイライト

- 半導体産業ではアウトソーシングも重要な要素です。設計以上に、半導体製品開発の製造面は、サードパーティーベンダーが提供するサービスに依存しています。ファブ(ピュアプレイ鋳造)とOSATは、半導体アウトソーシングの2つの顕著な例です。

- OSAT半導体企業は、サードパーティICパッケージングとテストサービスを提供し、ファウンドリーが製造した半導体デバイスを市場に出荷する前にパッケージングとテストを行う。このような企業は、電子機器内でより少ないスペースで、より速い処理速度、より高い性能、機能性を実現する革新的で費用対効果の高いソリューションを提供しています。

- インテル、AMD、Nvidiaなどの半導体設計企業は、OSAT企業と契約し、企業の設計を実行させています。例えば、インテルはチップ設計会社であり、ファウンドリー(ウエハー供給会社)でもあります。チップを顧客に出荷する前に、インテルはチップのパッケージングを別のOSATに委託し、組み立てとテストサービスを受ける。

- 主要半導体メーカーのパッケージング事業への垂直統合は、世界のOSAT市場にとって大きな脅威です。米国と中国の貿易戦争のような様々な要因が、半導体業界におけるサプライチェーンのギャップを引き起こしています。

- OSATのサプライヤーは、半導体集積回路のアセンブリ、パッケージング、テストサービスを提供するサードパーティです。COVID後、半導体業界は、チップメーカーがより小さく、より速く、より効率的な半導体の生産に焦点を当てているため、成長を示しています。

半導体組立・テストのアウトソーシング(OSAT)市場動向

通信が最大のアプリケーション・セグメントに

- 通信のバリューチェーンではパッケージングがまだ初期段階にあるため、半導体市場の成長はOSAT市場の開拓に直接影響します。鋳造工場は、自社でパッケージングを行うか、外注することができます。例えば、半導体と通信機器のメーカーであるクアルコムは、OSATと契約してパッケージング・ニーズを処理しています。

- 通信アプリケーションは、主に通信業界の通信チップで構成されています。パワーアンプ(PA)、フロントエンドモジュール(FEM)、その他のRF機器やコネクティビティ機器などの機器は、OSATやOEMの主な需要源です。半導体産業協会によると、製造される全半導体の約31%は、ネットワーク機器やスマートフォン無線などの通信用に使用されています。

- 通信用アプリケーションは過酷な環境条件下で展開されることが多いため、信頼性の高いパッケージング・ソリューションが必要とされます。特に大規模通信アプリケーションでは、多くの場合、システム・イン・パッケージ(SiP)が多種多様な通信機器に好まれています。

- スマートフォン市場はここ数年、ハードウェア、ソフトウェアともに大きく成長しています。COVID-19期間中、スマートフォンの世界出荷台数は減少したもの、中国を含む多くの市場で高い普及率が見られました。バイオセンサー、5Gスマートフォン、AI機能などの動向により、新型スマートフォンの販売は再び勢いを取り戻すと予想されます。

- GSMAによると、アジア太平洋地域のスマートフォン普及率は2025年までに83%に上昇すると予想されています。同時に、モバイル加入者の普及率は同年までに62%に達すると予想されています。また、5Gスマートフォンの普及により、コネクテッドデバイス密度、無線データ通信帯域幅、遅延が大幅に改善されると予想されています。

- 多くの半導体メーカーは、シリコン含有率の高い5Gスマートフォンが世界中で広く採用されると予想しています。5Gスマートフォンには、より高い電力効率、より高速な通信速度、より複雑な機能が求められるため、デバイスあたりの半導体部品の使用量は増加します。それに伴い、家電業界では半導体パッケージング・ソリューションの需要が大幅に増加すると予想されます。

- GSMAレポートによると、2025年までに世界人口の約3分の1が5Gネットワークにアクセスできるようになると推定されています。また、同レポートによると、その時点で5G接続数は4億を超え、全モバイル接続数の約14%を占めるといいます。

- 5Gの普及率は2023年末までに17%に達し、2030年には54%(53億接続に相当)まで増加すると予測されました。この技術進歩は、世界経済に1兆米ドル近く貢献すると予想されています。その結果、半導体の需要は市場の成長を高めると思われます。

市場の大幅な成長が期待される韓国

- 韓国は、世界のOSATベンダーにとって有望な市場のひとつです。同国には、サムスンやSKハイニックスなど、コンシューマー・エレクトロニクス・セグメント向けの著名なチップ・メーカーがあり、半導体デバイスの技術革新にとって有利な拠点となっています。

- 韓国政府はスマート・マニュファクチャリングに力を入れており、2025年までに完全自動化された製造企業を3万社に増やす計画です。政府は、最新の自動化、データ交換、IoT技術を取り入れることでこれを達成することを目指しており、これらは同国におけるOSATサービスの重要な推進力になると期待されています。

- 同国の半導体テスト部門は、サムスン電子のシステム半導体事業の成長とともに大きく成長しました。NEPES Ark、LB Semicon、Tesna、Hana Micronといった国内の半導体試験会社は、必要な施設や設備に多額の投資を行うことで、システム半導体の供給増に対応しています。

- SK Hynixは120兆ウォン(約900億円)を投資し、龍仁市元山(ウォンサム)地域に次世代メモリー生産基地を建設中です。SKハイニックスは2025年にメモリ製造施設の建設を開始する予定です。SK HynixはHBM3の製造業者でもあります。同社は利川DRAM製造施設にTSVパッケージ製造ラインを設置する予定です。HBMの競争力を高めるため、サムスンとSKハイニックスはパッケージング生産ラインの増設を検討しています。

- サムスンは、TSMCが提供する2.5Dインターポーザー統合サービスの置き換えに取り組んでいます。TSV(シリコン貫通電極)パッケージング方式の製造コストを下げようとしています。SKハイニックスに比べ、サムスンはHBM(高帯域幅メモリー)市場の後発組です。それでも、サムスンはHBM容量への投資を増やしていると主張し、2023年までに新たなHBM製品を投入する意向を表明しており、HBMのパッケージング容量拡大の可能性が広がっています。

- 5G分野の開発は、チップの先進パッケージングの成長にもつながっています。科学ICT省によると、2023年2月時点で国内の5G加入者数は2,913万人で、2021年2月の1,366万人と比べて113%増加しています。

半導体組立・テストのアウトソーシング(OSAT)市場概要

半導体組立・テストのアウトソーシング(OSAT)市場は細分化されており、ASE Technology Holding、Amkor Technology Inc.、Powertech Technology Inc.、ChipMOS Technologies Inc.、King Yuan Electronicsなどの主要企業が存在します。同市場の企業は、イノベーション、パートナーシップ、買収などの戦略を採用し、製品提供を強化し、持続可能な競争優位性を獲得しています。

2023年12月-最近の発表では、Powertech Technology(PTI)Inc.がWinbond Electronics Corporationとの提携を明らかにしました。この提携は、2.5D(チップ・オン・ウエハ・オン・サブストレート)/3D先進パッケージングのビジネスを共同で推進することを目的としています。PTIは、WECのシリコンインターポーザ、DRAM、フラッシュを活用し、異種混載を可能にし、高帯域幅と高性能コンピューティングサービスに対する市場の需要に応えるよう、顧客を指導します。

2023年10月-ASE Technology Holdingは、共同設計ツールセットである統合設計エコシステム(IDE)を発表しました。このツールセットは、VIPackプラットフォーム全体の先進パッケージアーキテクチャを体系的に強化するように設計されています。この革新的なアプローチにより、シングルダイSoCからチップレットやメモリを含むマルチダイ分解IPブロックへのシームレスな移行が可能になります。これは、2.5Dまたは高度なファンアウト構造を使用して統合することで実現できます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 半導体産業の展望

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 業界バリューチェーン分析

- COVID-19パンデミックの市場への影響評価

第5章 市場力学

- 市場促進要因

- 自動車における半導体アプリケーションの増加

- 5Gなどの動向による半導体パッケージングの先進化

- 市場抑制要因

- 業界統合はOSAT企業の重大な懸念事項の一つです。

第6章 市場セグメンテーション

- サービスタイプ別

- パッケージング

- 試験

- パッケージングタイプ別

- ボールグリッドアレイ(BGA)パッケージング

- チップスケールパッケージング(CSP)

- スタックダイパッケージング

- マルチチップパッケージング

- クワッドフラットおよびデュアルインラインパッケージング

- 用途別

- 通信機器

- コンシューマー・エレクトロニクス

- 自動車

- コンピューティング&ネットワーキング

- 産業用

- その他の用途

- 地域別

- 米国

- 中国

- 台湾

- 韓国

- マレーシア

- シンガポール

- 日本

第7章 競合情勢

- 企業プロファイル

- ASE Technology Holding Co. Ltd

- Amkor Technology Inc.

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- King Yuan Electronics Co. Ltd

- Formosa Advanced Technologies Co. Ltd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- UTAC Holdings Ltd

- Lingsen Precision Industries Ltd

- Tongfu Microelectronics Co.

- Chipbond Technology Corporation

- Hana Micron Inc.

- Integrated Micro-electronics Inc.

- Tianshui Huatian Technology Co. Ltd

- Vendor Share Analysis

第8章 投資分析

第9章 市場機会と今後の動向

The Outsourced Semiconductor Assembly and Test Market size is estimated at USD 47.10 billion in 2025, and is expected to reach USD 71.21 billion by 2030, at a CAGR of 8.62% during the forecast period (2025-2030).

The semiconductor industry has been growing, focusing on miniaturization and efficiency. Semiconductors are emerging as building blocks of all modern technology. The advancements and innovations in this field directly impact all downstream technologies. The rapid development of electronics technology, including artificial intelligence (AI) and cloud computing, is complemented by a high demand for integrated circuits (ICs) with high speed, low power consumption, and high integration, leading to its significant sales.

Key Highlights

- Outsourcing is also a significant factor in the semiconductor industry. More than just design, the manufacturing aspect of semiconductor product development is dependent on the services provided by third-party vendors. Fabs (Pure-Play Foundries) and OSATs are two prominent examples of semiconductor outsourcing.

- OSAT semiconductor firms provide third-party IC packaging and testing services package and test semiconductor devices made by foundries before shipping them to the market. Such companies in the market provide innovative and cost-effective solutions that deliver faster processing speeds, higher performance, and functionality while taking up less space in an electronic device.

- Semiconductor design companies, such as Intel, AMD, and Nvidia, contract OSAT companies to execute the companies' designs. For instance, Intel is a chip designer and a foundry (wafer provider) because they own and operate their fabs or foundries. Before shipping the chips to customers, Intel outsources its chip packaging to different OSATs for assembly and test services.

- Vertical integration of key semiconductor manufacturers into packaging operations is a significant threat to the global OSAT market. Various factors, such as the US-China trade war, have caused a supply chain gap in the semiconductor industry.

- The suppliers of as OSAT are third parties that provide the assembly, packaging and testing services for a semiconductor integrated circuit. Post COVID, semiconductor industry has been witnessing the growth due to chipmakers are focused on producing smaller, faster and more efficient semiconductors and where which increased the growth of OSAT as its has playes an essential part in the by filling the gap between IC design and availability.

Outsourced Semiconductor Assembly and Test (OSAT) Market Trends

Communication to be the Largest Application Segment

- The semiconductor market's growth directly influences the OSAT market's development because the packaging is still at an early stage in the telecommunications value chain. The foundries can either handle the packaging themselves or contract it out. For instance, Qualcomm, a manufacturer of semiconductors and telecom equipment, contracts OSATs to handle its packaging needs.

- The communication applications primarily consist of communication chips in the telecommunication industry. Equipment such as power amplifiers (PAs), front-end modules (FEMs), and other RF and connectivity devices are major sources of demand for OSATs and OEMs. According to the Semiconductor Industry Association, about 31% of all semiconductors manufactured are used for communications, including networking equipment and smartphone radios.

- Communication applications require highly reliable packaging solutions as they are often deployed in harsh environmental conditions. In many cases, a system in package (SiP) is preferred for a large variety of communication equipment, especially in large-scale telecommunication applications.

- The smartphone market has grown significantly in hardware and software over the past few years. Despite declining global smartphone unit shipments during COVID-19, there was high penetration in many markets, including China. Sales of new smartphones are expected to regain momentum, driven by trends like biosensors, 5G smartphones, and AI features.

- The smartphone adoption rate in Asia-Pacific is expected to rise to 83% by 2025, according to GSMA. Concurrently, the mobile subscriber penetration rate is expected to reach 62% by the same year. The proliferation of 5G smartphones is also expected to significantly improve connected device density, wireless data communication bandwidth, and latency.

- Many semiconductor producers anticipate that 5G smartphones with higher silicon contents will be widely adopted worldwide. The use of semiconductor components per device will rise due to the need for 5G smartphones to have higher power efficiency, faster speeds, and more complex functionalities. In turn, the consumer electronics industry is anticipated to experience a significant increase in demand for semiconductor packaging solutions.

- According to the GSMA Report, around one-third of the global population is estimated to have access to 5G networks by 2025. The report also states that there will be more than 400 million 5G connections at that time, accounting for approximately 14% of all mobile connections.

- The adoption of 5G was projected to reach 17% by the end of 2023 and increase to 54% (equivalent to 5.3 billion connections) by 2030. This technological advancement is anticipated to contribute nearly USD 1 trillion to the global economy. As a result, the demand for semiconductors will enhance the market's growth.

South Korea Expected to Register Significant Growth in the Market

- South Korea is one of the promising markets for global OSAT vendors. The country is also home to some prominent chip makers for the consumer electronics segment, such as Samsung and SK Hynix, making it a lucrative hub for innovation in semiconductor devices.

- The South Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies, which are expected to be significant drivers for OSAT services in the country.

- The country's semiconductor testing sector has grown significantly with the growth of Samsung Electronics' system semiconductor business. The semiconductor testing companies in the country, such as NEPES Ark, LB Semicon, Tesna, and Hana Micron, have been dealing with increased supplies of system semiconductors by making significant investments in necessary facilities and equipment.

- SK Hynix is constructing a base for manufacturing next-generation memory in the Wonsam town region of Yongin by investing KRW 120 trillion ( USD 90 billion). The chipmaker anticipates breaking construction on the memory manufacturing facility in 2025. SK Hynix is also the manufacturer of HBM3. The company plans to install TSV packaging production lines at its Icheon DRAM manufacturing facility. To improve its HBM competitiveness, Samsung and SK Hynix are considering adding more packaging production lines.

- Samsung has been working on replacing the 2.5D interposer integration service offered by TSMC. It seeks to lower the cost of manufacturing the through-silicon via (TSV) packaging method. Compared to SK Hynix, Samsung is a latecomer to the HBM (high bandwidth memory) market. Still, the business claims it is increasing investments in its HBM capacity and declared intentions to introduce new HBM products by 2023, opening possibilities for expanding HBMs' packaging capacity.

- The developments in the 5G space have also led to the growth of advanced packaging of chips. According to the Ministry of Science and ICT, as of February 2023, the country had 29.13 million 5G Subscribers, an increase of 113% compared to 13.66 million 5G subscribers in February 2021.

Outsourced Semiconductor Assembly and Test (OSAT) Market Overview

The outsourced semiconductor assembly and test services (OSAT) market is fragmented, with the presence of major players like ASE Technology Holding Co. Ltd, Amkor Technology Inc., Powertech Technology Inc., ChipMOS Technologies Inc., and King Yuan Electronics Co. Ltd. Players in the market are adopting strategies such as innovations, partnerships, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

December 2023 - In a recent announcement, Powertech Technology (PTI) Inc. revealed its partnership with Winbond Electronics Corporation by signing a letter of intent. This collaboration aims to jointly advance the business of 2.5D (Chip on Wafer on Substrate)/3D advanced packaging. PTI will guide its customers to leverage WEC's silicon Interposer, DRAM, and Flash to enable heterogeneous integration and cater to the market's demand for high-bandwidth and high-performance computing services.

October 2023 - ASE Technology Holding Co. Ltd launched its Integrated Design Ecosystem (IDE), a collaborative design toolset. This toolset is designed to enhance advanced package architecture across the VIPack platform systematically. This innovative approach enables a seamless transition from single-die SoC to multi-die disaggregated IP blocks, including chiplets and memory. It can be achieved by integrating them using 2.5D or advanced fanout structures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Semiconductor Industry Outlook

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Applications of Semiconductors in Automotive

- 5.1.2 Advancement in Semiconductor Packaging Due to Trends like 5G

- 5.2 Market Restraints

- 5.2.1 Vertical Integration is One of the Significant Concerns of OSAT Players

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Packaging

- 6.1.2 Testing

- 6.2 By Type of Packaging

- 6.2.1 Ball Grid Array (BGA) Packaging

- 6.2.2 Chip Scale Packaging (CSP)

- 6.2.3 Stacked Die Packaging

- 6.2.4 Multi Chip Packaging

- 6.2.5 Quad Flat and Dual-inline Packaging

- 6.3 By Application

- 6.3.1 Communication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Computing and Networking

- 6.3.5 Industrial

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 United States

- 6.4.2 China

- 6.4.3 Taiwan

- 6.4.4 South Korea

- 6.4.5 Malaysia

- 6.4.6 Singapore

- 6.4.7 Japan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Technology Holding Co. Ltd

- 7.1.2 Amkor Technology Inc.

- 7.1.3 Powertech Technology Inc.

- 7.1.4 ChipMOS Technologies Inc.

- 7.1.5 King Yuan Electronics Co. Ltd

- 7.1.6 Formosa Advanced Technologies Co. Ltd

- 7.1.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 7.1.8 UTAC Holdings Ltd

- 7.1.9 Lingsen Precision Industries Ltd

- 7.1.10 Tongfu Microelectronics Co.

- 7.1.11 Chipbond Technology Corporation

- 7.1.12 Hana Micron Inc.

- 7.1.13 Integrated Micro-electronics Inc.

- 7.1.14 Tianshui Huatian Technology Co. Ltd

- 7.2 Vendor Share Analysis