|

市場調査レポート

商品コード

1332528

メスカルの市場規模・シェア分析- 成長動向と予測(2023年~2028年)Mezcal Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| メスカルの市場規模・シェア分析- 成長動向と予測(2023年~2028年) |

|

出版日: 2023年08月08日

発行: Mordor Intelligence

ページ情報: 英文 170 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

メスカルの市場規模は2023年の1,056万リットルから2028年には1,810万リットルに成長し、予測期間(2023年~2028年)のCAGRは11.38%と予測されます。

主なハイライト

- 熱帯産のリュウゼツランを原料とする酒類であるメスカルの需要はここ数年で大幅に増加しており、予測期間中もさらに増加すると予想されます。特にミレニアル世代におけるアルコール飲料需要の増加と、プレミアム/スーパープレミアム商品に対する世界の消費者の欲求の高まりが、メスカル市場の主な促進要因となっています。

- 同様に、メスカル人気も天文学的に上昇しています。その一因は、カクテルへの組み入れが増えたことで、アメリカの飲酒家が最初にこのスピリッツに出会うことが多いです。

- さらに、世界中の消費者は、様々なフレーバーを利用できることから、他のテキーラ製品よりもメスカルを好みます。メスカルは50種類のリュウゼツランから作られるが、テキーラは1種類のリュウゼツランからしか作られません。メスカルの特徴であるスモーキーフレーバーは、リュウゼツランを地中の穴で調理することから生まれ、テキーラにはない深みとスモーキーさをもたらしています。メスカルのこうした特徴は、洗練された嗜好を持ち、革新的な風味を試してみたいという欲求を持つ、より多くのアルコール消費者を惹きつけています。

- また、近年はプレミアム化の流れから、消費者は量より質を求める傾向にあります。消費者が洗練されたものへとシフトするにつれ、メスカルのようなプレミアム飲料の需要が誘発されます。このため、メーカーは需要の増加に対応するため、より多くのメスカル製品を発売し、市場シェアを拡大しています。

- 例えば、2021年11月、英国の飲料ブランド、デンジャラス・ドンはメスカルシリーズ「デンジャラス・ドン・エスパダツーン」を全国のM&S50店舗で発売しました。さらに、様々なフレーバーを消費する働き盛りの若年層の増加が、メスカル市場の成長を支える大きな要因となっています。

メスカル市場の動向

リュウゼツランベースのプレミアム飲料への需要の高まり

- ライフスタイルの変化に伴い、消費者は健康志向からプレミアム製品やオーガニック製品を重視するようになっています。そのため、多くのアルコールユーザーが他のアルコール製品の代用品としてメスカル飲料を好んで飲んでいます。メスカル飲料は多肉植物のリュウゼツランからできています。リュウゼツランは製品にもよるが、グリセミック指数(GI値)が10%~15%と低いため、糖分の少ないリュウゼツランベースのメスカルを好む消費者が多く、リュウゼツランベースの製品に対する需要が年々高まっています。

- さらに、メスカルの味と様々なフレーバーの入手可能性が、より多くの新しい消費者を引き付けており、これが売上を牽引しています。メスカルの味はテキーラとは異なり、メスカルを製造するためにピナスを大きなピットで3~4日間燻製するため、最終的に消費者にプレミアム品質と異なる味を提供し、それによって有機製品からより良い味とプレミアム品質を提供します。

- さらに、所得が高いため、ミレニアル世代の間で高級飲料の人気が高まっており、中国やインドなどの発展途上国ではカクテル文化の人気が高まっていることから、メスカルなどの高級蒸留酒の取引外販売が促進されると予想されます。このような各国でのメスカル需要の急増に伴い、メーカーは主要市場シェアを獲得するため、事業、生産、製品ポートフォリオの拡大に注力しています。

- さらに、裕福な消費者、特に米国やカナダなどの新興経済諸国の消費者の間では、興味深く斬新なプレミアム製品を求め、生産価値の高いニッチな種類の飲料に買い換える傾向が高まっています。その結果、プレミアムスピリッツの需要と販売量はここ数年、特にスタンダードスピリッツに比べて大幅に増加しています。メスカル規制協議会によると、2020年にはメキシコからのメスカル輸出量は2018年の342万リットルから480万リットルに増加します。

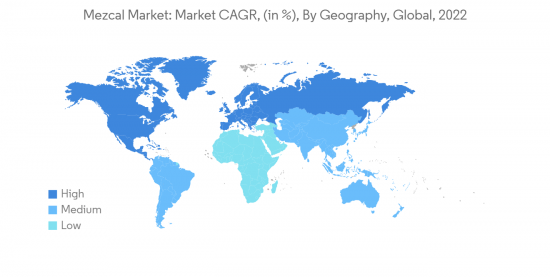

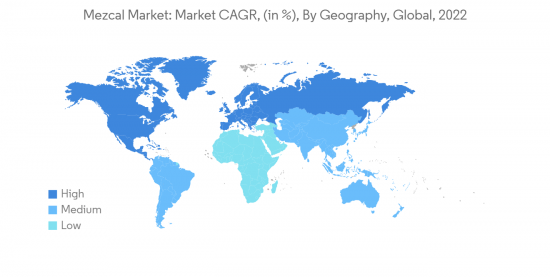

北米が最大の市場

- メキシコはメスカルの原産地であり、北米地域はメスカル市場で最大の生産国となっています。これはメキシコや米国といった国々がメスカル生産に重要な役割を果たしているためです。同様に、消費者がメスカルのようなリュウゼツランベースの飲料に関心を持ち、伝統的で贅沢な飲料に傾倒しているため、メスカルの消費量はこの地域のプレミアムアルコール市場で大きなシェアを占めています。

- 例えば、米国蒸留酒協会(DISCUS)によると、2022年、テキーラ/メスカルは米国の蒸留酒の中で第4位の消費シェアを占め、ほぼ9.79%でした。

- さらに、米国を中心とするこの地域におけるカクテル文化の台頭と、消費者により多くのアクセスと選択肢を提供することでマーケットプレースを近代化しようとするメーカーの施策が相まって、この地域における市場の成長を支え、牽引すると予想されます。さらに、新たな需要の高まりを受けて、このセグメントの主要企業は、消費者の嗜好の変化に対応するため、様々な革新的なフレーバーを消費者に提供することで、大幅な収益の増加を占めています。

- 例えば、様々なメスカル製品を提供するこの地域の主要企業の1つであり、最大の売上を誇るペルノ・リカールのデルマゲイは、2021年の売上高が4.45%増の88億ユーロ(104億9,200万米ドル)に達しました。同様に、2022年の売上高は107億ユーロ(127億3,300万米ドル)と大幅に伸びた。この成長により、メーカーは事業とメスカル製品の提供を拡大し、予測期間中に同地域と全世界での市場成長を押し上げると予想されます。

メスカル産業の概要

世界のメスカル市場は競争が激しく、国内外の様々なプレーヤーが存在します。市場の主要企業としては、Pernod Ricard、Ilegal Mezcal、Diageo PLC、Rey Campero、El Silencio Holdings INC.などが挙げられます。

主なプレーヤーはメスカル市場の小規模プレーヤーの買収に投資しており、特に高級蒸留酒セグメントを活用し、製品ポートフォリオを開発しています。プレミアム化を維持するため、味と品質にバラエティを持たせることで消費者のニーズに応えるべく、製品開発とイノベーションに注力しています。また、M&Aを主要戦略としている大手企業もあります。メスカル市場の大手メーカーはまた、アジア太平洋などの新興市場がもたらす機会を活用し、事業を拡大することに注力しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- カクテル消費動向の高まり

- プレミアムスピリッツの需要増加

- 市場抑制要因

- 製品の手頃さが市場の成長を抑制している

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 製品タイプ

- メスカル・ホベン

- メスカル・レポサド

- メスカル・アネホ

- その他の製品タイプ

- 販売チャネル

- オフライン小売店

- オンライン小売店

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- その他欧州

- 世界のその他の地域

- 北米

第6章 競合情勢

- 主要企業の戦略

- 市場シェア分析

- 企業プロファイル

- Pernod Ricard SA

- Ilegal Mezcal SA

- William Grant & Sons Ltd.

- Rey Campero

- Diageo PLC

- El Silencio Holdings INC

- Mezcal Vago

- Lagrimas de Dolores

- Fidencio Mezcal

- IZO Spirits

- Compania Tequilera de Arandas S.A. de C.V.(Lobos)

第7章 市場機会と今後の動向

The Mezcal Market size is expected to grow from 10.56 million liters in 2023 to 18.10 million Liters by 2028, at a CAGR of 11.38% during the forecast period (2023-2028).

Key Highlights

- The demand for mezcal, a tropical agave plant-based liquor, increased significantly over the past few years and is expected to increase further over the forecast period. The increased demand for alcoholic beverages, especially among millennials, as well as the rising global consumer desire for premium/super-premium goods, are the main drivers of the mezcal market.

- Similarly, its popularity has risen astronomically, partly due to its increased incorporation into cocktails, which is often how American imbibers first encounter the spirit; it's used frequently as a substitute for other spirits in drinks like a smoky margarita or a mezcal mule.

- Moreover, consumers worldwide prefer mezcal over other tequila products due to the availability of various flavors. Mezcal is made from 50 different varieties of agave, but only one type of agave plant (blue agave) makes tequila. Mezcal's signature smoky flavor comes from cooking the agave in pits in the ground, bringing a depth and smokiness not found in tequila. These features of mezcal are attracting more alcohol consumers who have sophisticated tastes and the desire to try out innovative flavors.

- Moreover, owing to the premiumization trend, consumers have been inclined toward quality over quantity in recent years. As consumers shift toward sophistication, it triggers the demand for premium beverages like mezcal. This has led manufacturers to launch more mezcal products to address the rising demand and thus gain a larger market share.

- For instance, in November 2021, the United Kingdom's drinks brand Dangerous Don launched its mezcal range, Dangerous Don Espadan, in 50 M&S stores nationwide. Furthermore, the increase in the working younger population that consumes a variety of flavors has been a major supporting factor behind the growth of the mezcal market.

Mezcal Market Trends

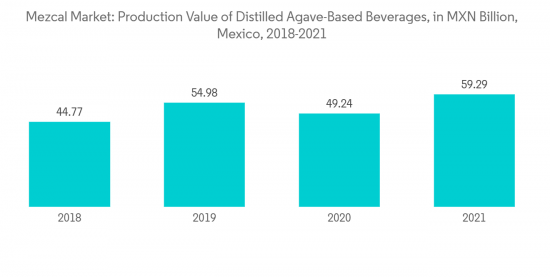

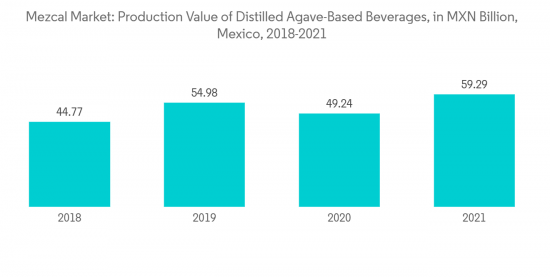

Increasing Demand for Premium Distilled Agave-Based Beverages

- As lifestyle is changing, consumers are more focused on premium and organic products because of health consciousness. Therefore, many alcohol users prefer mezcal drinks as a substitute for other alcoholic products. The mezcal drink is made up of succulent agave plants. As agave has a lower glycemic index (GI) of 10%-15% depending upon the product, many consumers prefer agave-based mezcal due to its less sugary effects, which have raised the demand for agave-based products over the years.

- Additionally, the taste and availability of various flavors in mezcal are attracting more new consumers, which is driving its sales. The taste of mezcal differs from the tequila as pinas (agave heart) are smoked for 3-4 days in large pits for manufacturing mezcal which eventually provides premium quality and a different taste to consumers, thereby providing a premium quality with better taste from the organic product.

- Moreover, owing to the higher incomes, the popularity of high-end drinks among the millennial population is growing, and the growing popularity of the cocktail culture in developing nations, such as China and India, is expected to promote the off-trade sales of premium spirits like mezcal. With this surge in demand for mezcal in different nations, manufacturers focus on expanding their businesses, productions, and product portfolios to gain major market shares.

- Furthermore, there is a rising trend amongst wealthier consumers, especially those in developed economies such as the United States and Canada, to seek out interesting and novel premium products and trade up to drinks of a niche variety with high production value. As a result, the demand for and volume of premium spirits has increased greatly over the past few years, especially compared to standard spirits. According to Mezcal Regulatory Council, in 2020, exports of mezcal from Mexico increased to 4.8 million liters from 3.42 million liters in 2018.

North America is the Largest Market

- Mexico is the origin of mezcal, making the North American region the largest producer in the mezcal market. This is due to the presence of the countries such as Mexico and the United States, as they play a significant role in the production of mezcal. Similarly, owing to the consumer's interest in different agave-based drinks like mezcal and their inclination towards traditional and luxury drinks, the consumption of mezcal has been accounting for a significant share in the premium alcohol market of the region.

- For instance, according to Distilled Spirits Council of the United States (DISCUS), in 2022, tequila/mezcal accounted for the 4th largest consumption share among distilled spirits in the United States, with almost 9.79%.

- Moreover, the rise of the cocktail culture in the region, majorly in the United States, coupled with the measures taken by manufacturers to modernize the marketplace by providing spirits to consumers with greater access and more choices, is expected to support and drive the market's growth in the region. Furthermore, due to the emerging demands, the key players in the segment are accounting for significant increases in their revenues by offering various innovative flavors to consumers to meet their changing preferences.

- For instance, Pernod Ricard's Del Maguey, one of the top players in the region that offers various mezcal products and the largest selling brand's net sales in 2021 saw a growth of 4.45% in sales to EUR 8.8 billion (USD 10.492 billion). Similarly, its sales grew substantially in 2022 to EUR 10.7 billion (USD 12.733 billion). With this growth, manufacturers are expected to expand their businesses and mezcal product offerings, thus boosting the market's growth in the region and throughout the globe during the forecast period.

Mezcal Industry Overview

The global mezcal market is highly competitive, with the presence of various international and domestic players. Some of the key players in the market are Pernod Ricard, Ilegal Mezcal, Diageo PLC, Rey Campero, and El Silencio Holdings INC.

Key players have been investing in acquiring small players in the mezcal market, especially to leverage the luxury spirits segment and to develop the product portfolio. They are focusing on product development and innovation to meet the consumer's needs by offering a variety in taste and product quality to maintain premiumization. Also, some major players use mergers and acquisitions as their key strategy. The leading manufacturers in the mezcal market have also been focused on leveraging opportunities posed by emerging markets in regions such as Asia-Pacific to expand their business operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Trend of Consuming Cocktails

- 4.1.2 Rising Demand for Premium Spirits

- 4.2 Market Restraints

- 4.2.1 Affordability of the Product is Restraining the Market's Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Mezcal Joven

- 5.1.2 Mezcal Reposado

- 5.1.3 Mezcal Anejo

- 5.1.4 Other Product Types

- 5.2 Distribution Channel

- 5.2.1 Offline Retail stores

- 5.2.2 Online Retail stores

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Pernod Ricard SA

- 6.3.2 Ilegal Mezcal SA

- 6.3.3 William Grant & Sons Ltd.

- 6.3.4 Rey Campero

- 6.3.5 Diageo PLC

- 6.3.6 El Silencio Holdings INC

- 6.3.7 Mezcal Vago

- 6.3.8 Lagrimas de Dolores

- 6.3.9 Fidencio Mezcal

- 6.3.10 IZO Spirits

- 6.3.11 Compania Tequilera de Arandas S.A. de C.V. (Lobos)