|

|

市場調査レポート

商品コード

1642031

世界の風力発電-市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Global Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界の風力発電-市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

概要

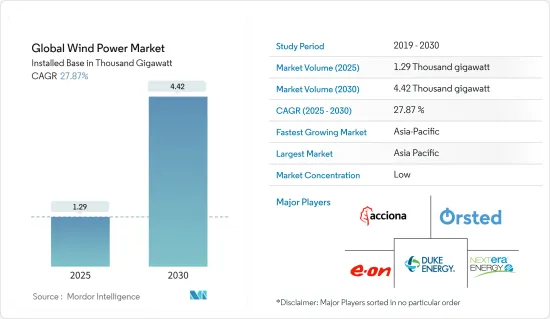

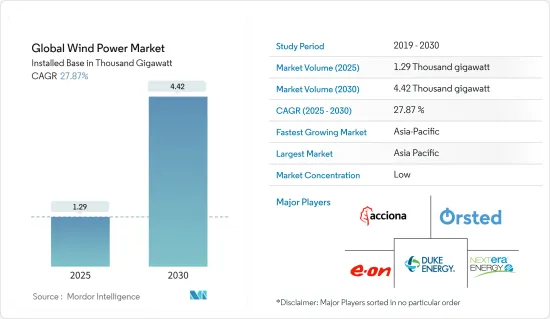

風力発電の世界市場規模は、2025年の1,290ギガワットから2030年には4,420ギガワットに拡大し、予測期間(2025~2030年)のCAGRは27.87%になると予測されます。

主要ハイライト

- 中期的には、有利な政府施策、今後の風力発電プロジェクトに対する投資の増加、風力エネルギーのコスト削減といった要因が風力エネルギー導入の増加につながり、2024~2029年にかけて市場を牽引すると予想されます。

- ガスベースや太陽光発電などの代替エネルギー源の採用が増加していることが、市場の成長を妨げると予想されます。

- 洋上風力タービンの効率性と生産コストの低減における技術的進歩は、世界市場に十分な機会を創出すると予想されます。

- アジア太平洋は、エネルギー需要の増加により最も急成長している市場です。この成長は、インド、中国、オーストラリアを含むこの地域の国々における政府の支援施策と相まって、投資が増加していることに起因しています。

世界の風力発電市場動向

洋上風力発電部門は大幅な成長が見込まれる

- 欧州は洋上風力発電の主要大陸であり、世界で最も大規模な洋上風力発電所が稼働しています。同地域の洋上風力発電容量は、欧州の電力需要を満たすのに十分な規模であり、今後も増加の一途をたどると考えられます。

- 洋上風力は陸上風力よりもはるかに速いため、洋上への風力発電所の設置は有利な市場になりつつあります。また、洋上風力発電所は陸上風力発電所よりも風速が速く、陸地の障害物が少ないため、利便性が高いです。

- 洋上風力発電は、この5年間で世界的に大幅に増加しています。国際再生可能エネルギー機関(IRENA)によると、2023年の洋上風力エネルギーは72.66GWで、2019年に比べて1.57倍に増加しました。今後、多くの風力発電プロジェクトが稼動することが予想されるため、予測期間中に大幅に増加することが予想されます。

- 2024年3月、英国政府は再生可能エネルギープロジェクトに10億英ポンド(12億5,000万米ドル)という最も重要な予算を発表したが、その中には洋上風力発電に8億英ポンド(10億米ドル)、浮体式洋上風力発電と地熱技術に1億500万英ポンド(1億3,100万米ドル)が含まれています。

- 同様に、英国政府は2023年9月、95の新しい再生可能エネルギーイニシアチブに差金決済契約(CFD)を配分し、370万kWのクリーンエネルギー容量を確保すると発表しました。これらのプロジェクトには、陸上風力、太陽光、潮力エネルギー開発が含まれます。さらに、英国を拠点とするOctopus Energyは、2030年までに洋上風力発電に世界全体で200億米ドルを投資する計画です。Octopus Energy Groupの子会社である同社は、この投資によって年間12ギガトン(GW)の再生可能エネルギー発電が行われ、これは1,000万世帯分の電力に相当すると述べています。

- さらに2024年4月、米国エネルギー省の風力エネルギー技術局(WETO)は、洋上風力プラットフォームの研究開発強化を含む、洋上風力への4,800万米ドルの投資を発表しました。このようなプロジェクトにより、2024~2029年の間に世界中で風力発電が加速すると予想されます。

- したがって、このようなシナリオにより、洋上風力発電市場は2024~2029年にかけて大きく成長すると予想されます。

アジア太平洋が市場を独占する見込み

- アジア太平洋は世界で最も重要な風力発電市場であり、中国、インド、オーストラリアなどがそのトップ市場です。2024~2029年にかけては、特に中国での成長が目覚ましく、アジア太平洋が首位の座に躍り出る可能性が高いです。

- 国際再生可能エネルギー機関(IRENA)によると、2023年のアジア全体の風力エネルギーは508.45GWで、2019年と比較して97.32%増加しました。2023年の風力発電量は中国が441.89GWで首位となり、インドが44.74GWで続きました。今後数年間で多くの風力発電プロジェクトが稼働すると予想されるため、この数字は2024~2029年にかけて大幅に増加すると予想されます。

- この地域全体の政府は、エネルギー生産を促進するために、複数の再生可能エネルギープロジェクトを主要な組織に提供しています。例えば、2023年12月、Apraava Energyは、インドのカルナータカ州に300MWの風力発電所を建設するため、Energy Corporation of India(SECI)が実施する州間送電(ISTS)の1,200MWオークション容量プロジェクトを受注しました。プロジェクトの建設は電力購入契約(PPA)によるもので、25年間、INR 3.24/kWhの競合料金で行われます。

- さらに、再生可能エネルギーの需要はここ数年、アジア太平洋全域で急激に高まっており、企業はアジア太平洋全域で大規模な投資を行っています。例えば、英国に本社を置くOctopus Energyは2023年5月、アジア太平洋全域の風力発電プロジェクトを含む再生可能エネルギープロジェクトに18億米ドルを投資すると発表しました。同社は2027年までに風力、太陽光、その他のクリーンエネルギープロジェクトに投資するようです。この投資はまた、2030年までに洋上風力発電容量を150GW増加させるという日本の風力エネルギー目標にも焦点を当てています。こうした目標や投資はすべて、2024~2029年にかけて市場を牽引する可能性が高いです。

- したがって、大規模風力発電の設置、今後のプロジェクト、洋上風力セグメントの拡大計画は、2024~2029年にかけてアジア太平洋市場を牽引すると予想されます。

世界の風力発電産業概要

風力発電市場は細分化されています。この市場の主要企業としては、Acciona Energia SA、Duke Energy Corporation、Electricite de France(EDF)SA、Orsted AS、NextEra Energy Inc.、E.ON SEなどが挙げられます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 再生可能エネルギーミックス(2023年)

- 2029年までの風力発電設備容量と予測(単位:GW)

- 最近の動向と開発

- 市場力学

- 促進要因

- 洋上風力発電プロジェクトへの投資の増加

- 政府の支援施策

- 抑制要因

- 代替クリーンエネルギー源(例:太陽光、水力)の採用増加

- 促進要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 立地

- 陸上

- 洋上

- 2029年までの市場規模と需要予測(地域別)

- 北米

- 米国

- カナダ

- その他の北米

- 欧州

- 英国

- フランス

- ノルウェー

- ドイツ

- スペイン

- トルコ

- ロシア

- ノルディック

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他のアジア太平洋

- 中東・アフリカ

- アラブ首長国連邦

- エジプト

- サウジアラビア

- ナイジェリア

- カタール

- その他の中東・アフリカ

- 南米

- ブラジル

- チリ

- アルゼンチン

- コロンビア

- その他の南米

- 北米

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア分析-風力タービンサプライヤー

- 主要企業の戦略

- 企業プロファイル

- Wind Farm Operators

- Acciona Energia SA

- Duke Energy Corporation

- EDF SA

- Orsted AS

- NextEra Energy Inc.

- E.ON SE

- 機器サプライヤー

- Aerodyn Energiesysteme GmbH

- Envision Energy

- General Electric Company

- Xinjiang Goldwind Science & Technology Co. Ltd(Goldwind)

- Siemens Gamesa Renewable Energy SA

- Suzlon Energy Limited

- Vestas Wind Systems AS

- Dongfang Electric Corporation

- Wind Farm Operators

- 市場シェア/ランキング分析

第7章 市場機会と今後の動向

- 洋上風力タービンの効率化と製造コストの技術的進歩

目次

Product Code: 66176

The Global Wind Power Market size in terms of installed base is expected to grow from 1.29 thousand gigawatt in 2025 to 4.42 thousand gigawatt by 2030, at a CAGR of 27.87% during the forecast period (2025-2030).

Key Highlights

- In the medium term, factors such as favorable government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy have led to increased adoption of wind energy and are expected to drive the market between 2024 and 2029.

- The increasing adoption of alternative energy sources, such as gas-based and solar power, is expected to hinder the growth of the market.

- Nevertheless, technological advancements in efficiency and decreased production costs of offshore wind turbines are expected to create ample opportunity for the global market.

- Asia-Pacific is the fastest-growing market due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Global Wind Power Market Trends

The Offshore Wind Power Sector is Expected to Witness Significant Growth

- Europe is the leading continent in offshore wind and is home to the most significant operational wind farms globally. The region's offshore wind capacity is large enough to meet Europe's electricity needs, which will only continue to grow in the upcoming years.

- Installing wind farms in offshore areas is becoming a lucrative market because offshore winds are much faster than onshore winds. Also, offshore wind farms are more convenient than onshore wind farms, given that offshore areas have more wind speed and less land obstruction.

- Offshore wind energy has increased significantly over the last five years worldwide. According to the International Renewable Energy Agency (IRENA), in 2023, offshore wind energy was 72.66 GW, an increase of 1.57 times compared to 2019. The number is expected to rise significantly during the forecast period as many wind projects are expected to be operational in the upcoming years.

- In March 2024, the government of the United Kingdom announced the most significant budget of GBP 1 billion (USD 1.25 billion) for renewable energy projects, which includes GBP 800 million (USD 1 billion) for offshore wind and GBP 105 million (USD 131 million) for floating offshore wind and geothermal technologies.

- Similarly, in September 2023, the United Kingdom's Government announced the distribution of Contract for Difference (CFDs) to 95 new renewable energy initiatives, ensuring 3.7 GW of clean energy capacity. These projects include onshore wind, solar, and tidal energy developments. Furthermore, Octopus Energy, based in the United Kingdom, plans to invest USD 20 billion globally in offshore wind by 2030. The company, which is a subsidiary of Octopus Energy Group, stated that the investment will generate 12 gigatonnes (GW) of renewable electricity per year, enough to power 10 million homes.

- Furthermore, in April 2024, the United States Department of Energy's Wind Energy Technologies Office (WETO) announced an investment of USD 48 million in offshore wind, including enhancing the research and development of offshore wind platforms. These types of projects are expected to accelerate wind energy generation across the world between 2024 and 2029.

- Hence, with such a scenario, the offshore wind power market is expected to grow significantly from 2024 to 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the world's most significant wind power market, with top markets including China, India, and Australia. Encouraging growth, particularly in China, is likely to propel it to the top spot between 2024 and 2029.

- According to the International Renewable Energy Agency (IRENA), in 2023, wind energy across Asia was 508.45 GW, an increase of 97.32% compared to 2019. China generated 441.89 GW of wind energy in 2023 and became the leader, followed by India, which generated 44.74 GW. The number is expected to rise significantly between 2024 and 2029 as many wind projects are expected to be operational in the upcoming years.

- The government across the region offers multiple renewable energy projects to the leading organizations to boost energy production. For instance, in December 2023, Apraava Energy received the 1200 MW auction capacity project of the Inter-State Transmission System (ISTS) conducted by the Energy Corporation of India (SECI) to construct a 300 MW Wind farm in Karnataka, India. The project's construction is as per the Power Purchase Agreement (PPA), which is for 25 years at a competitive tariff of INR 3.24/kWh.

- Furthermore, the demand for renewable energy has been rising exponentially across the region for the past few years, and companies are investing significantly across Asia-Pacific. For instance, in May 2023, octopus Energy, a United Kingdom-based company, announced an investment of USD 1.8 billion for renewable energy projects, including wind energy projects across Asia-Pacific. The company is likely to invest in wind, solar, and other clean energy projects by 2027. The investment also focused on Japan's wind energy target to increase offshore wind energy capacity by 150 GW by 2030. All these types of targets and investments are likely to drive the market between 2024 and 2029.

- Therefore, large-scale wind power installations, upcoming projects, and plans to expand the offshore wind segment are expected to drive the Asia-Pacific market between 2024 and 2029.

Global Wind Power Industry Overview

The wind power market is fragmented. Some of the key players in this market are Acciona Energia SA, Duke Energy Corporation, Electricite de France (EDF) SA, Orsted AS, NextEra Energy Inc., and E.ON SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2023

- 4.3 Wind Power Installed Capacity and Forecast in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in Offshore Wind Power Projects

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar, Hydro)

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Norway

- 5.2.2.4 Germany

- 5.2.2.5 Spain

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 NORDIC

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Malaysia

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Vietnam

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Egypt

- 5.2.4.3 Saudi Arabia

- 5.2.4.4 Nigeria

- 5.2.4.5 Qatar

- 5.2.4.6 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Chile

- 5.2.5.3 Argentina

- 5.2.5.4 Colombia

- 5.2.5.5 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis - Wind Turbine Suppliers

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Wind Farm Operators

- 6.4.1.1 Acciona Energia SA

- 6.4.1.2 Duke Energy Corporation

- 6.4.1.3 EDF SA

- 6.4.1.4 Orsted AS

- 6.4.1.5 NextEra Energy Inc.

- 6.4.1.6 E.ON SE

- 6.4.2 Equipment Suppliers

- 6.4.2.1 Aerodyn Energiesysteme GmbH

- 6.4.2.2 Envision Energy

- 6.4.2.3 General Electric Company

- 6.4.2.4 Xinjiang Goldwind Science & Technology Co. Ltd (Goldwind)

- 6.4.2.5 Siemens Gamesa Renewable Energy SA

- 6.4.2.6 Suzlon Energy Limited

- 6.4.2.7 Vestas Wind Systems AS

- 6.4.2.8 Dongfang Electric Corporation

- 6.4.1 Wind Farm Operators

- 6.5 Market Share/Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in Efficiency and Decrease in the Production Cost of Offshore Wind Turbines