|

市場調査レポート

商品コード

1550531

日本のアクセスコントロール:市場シェア分析、産業動向・統計、成長予測(2024年~2029年)Japan Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本のアクセスコントロール:市場シェア分析、産業動向・統計、成長予測(2024年~2029年) |

|

出版日: 2024年09月02日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

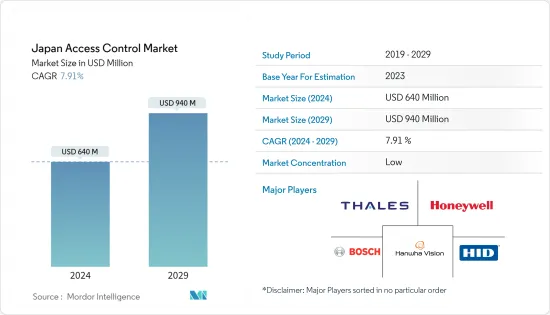

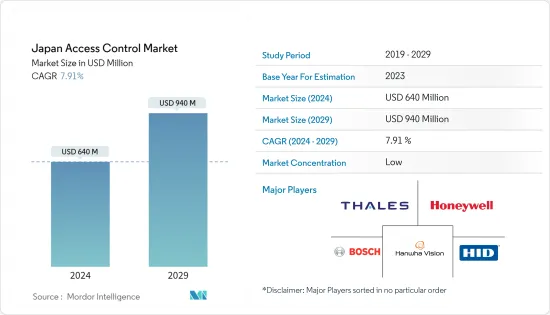

日本のアクセスコントロール市場規模は2024年に6億4,000万米ドルと推計され、2029年には9億4,000万米ドルに達すると予測され、予測期間中(2024-2029年)のCAGRは7.91%で成長すると予測されます。

アクセスコントロール市場は、技術の進歩とセキュリティへの関心の高まりにより、日本で著しい成長を遂げています。生体認証、顔認証、AIを活用したアクセスコントロールシステムの革新により、これらのソリューションはより効果的で魅力的なものとなっています。日本の強力な技術インフラは、こうした先進システムの採用を支えています。

主なハイライト

- アクセスコントロールは、アクセス・カードをクレデンシャル・リーダー(認証情報読み取り装置)に提示することで、許可された要員が制限された、管理された、または安全な空間に入ることを可能にする電子システムです。これらのシステムは、物理的セキュリティを管理するための包括的かつ柔軟なアプローチを提供します。セキュリティの強化、アカウンタビリティの向上、さまざまな用途での利便性を提供します。

- 日本が都市インフラを発展させ続ける中、商業ビル、集合住宅、公共スペースにおける高度なセキュリティ・システムの必要性が高まっています。米中央情報局(CIA)によると、日本の都市人口は前年の92%でした。さらに、国土交通省によると、建築物建設への投資額は2022年の43兆2,000億円から2023年には43兆4,000億円に増加すると予測されています。

- インフラ整備への政府投資の増加は、市場開拓に前向きな見通しをもたらしています。例えば、中央政府は2023年12月、2025年の大阪関西万博に向けた会場へのアクセスなどのインフラ整備費用全体が総額8,390億円(58億米ドル)になると発表しました。

- 全国的なデータセンターの開拓が市場成長を後押しすると予想されます。データセンターには重要かつ機密性の高い情報が保管されており、物理的な侵害の格好の標的となっています。高度なアクセスコントロールシステムは、許可された担当者のみがこれらの施設にアクセスできるようにするために不可欠です。2024年2月、Yondr Groupは日本のコングロマリットであるMarubeniと日本におけるデータセンター開発で提携しました。両社はまず西東京市にデータセンターを建設し、さらなるプロジェクトも計画しています。

- しかし、高度なアクセスコントロールシステムの導入には、ハードウェア、ソフトウェア、インストールを含め、多額の初期費用がかかります。予算が限られている中小企業にとっては、これが足かせになることもあります。さらに、新しいアクセスコントロールシステムを既存のインフラや他のセキュリティシステムと統合することは、複雑で困難な場合があります。互換性の問題や専門的な技術知識の必要性が、導入の妨げになることもあります。

- インフレ率の上昇により、アクセスコントロールシステムを含む商品やサービスのコストが上昇しています。コスト上昇は消費者や企業の購買力低下につながり、市場の成長を鈍化させます。さらに、ロシアとウクライナの戦争は世界のサプライチェーンを混乱させ、特にアクセスコントロールシステムに使用される電子部品や原材料の入手性とコストに影響を与えました。このため、生産に遅れが生じ、メーカーにとってはコスト増となりました。

日本のアクセスコントロール市場動向

スマートカードセグメントが市場で著しい成長を記録する見込み

- スマートカードは、安全なアクセスコントロールシステムの標準となりつつあります。これらのカードには、カード所有者の個人情報や、入場を許可された特定のアクセス・ポイントに関する情報がプログラムされたコンピュータ・チップが組み込まれています。これらのカードは、近接システム、磁気ストライプシステム、バイオメトリックシステムなど、さまざまなテクノロジーと統合することができ、柔軟で効果的なセキュリティソリューションを実現します。

- スマートカードは、暗号化や機密データの安全な保存といった堅牢なセキュリティ機能を備えており、安全な認証を必要とするアプリケーションに最適です。スマートカードの高度な処理能力とメモリは、認証のために高度に暗号化されたデータをクレデンシャル・リーダーに送信することを可能にし、セキュリティを大幅に強化します。

- ビルや都市におけるIoTデバイスやスマート・インフラの導入が進むにつれ、統合された安全なアクセスコントロール・システムの必要性が高まっています。スマートカードは、安全で便利なアクセスを提供することで、このエコシステムにおいて重要な役割を果たしています。さらに、クラウドベースのアクセスコントロールシステムへの移行が、スマートカードの採用に影響を与えています。クラウド・ソリューションは、拡張性、柔軟性、遠隔管理機能を提供し、スマートカードをこれらのシステムに不可欠なものにしています。

- 政府のイニシアチブは、ソサエティ5.0のコンセプトを通じて市場の需要を促進しています。このビジョンは、これまでの社会段階を基礎としている:ソサエティ1.0(狩猟採集)、ソサエティ2.0(農業)、ソサエティ3.0(工業化)、ソサエティ4.0(情報化)です。「超スマート社会」として知られるソサエティ5.0は、ビッグデータ分析、AI、IoT、ロボティクスなどのデジタル技術を活用することで、持続可能で包括的な社会経済モデルの構築を目指しています。

- 特に商業、住宅、施設の分野では、セキュリティへの関心の高まりから、アクセスコントロールにスマートカードシステムを取り入れるケースが増えています。スマートカードは、従来の鍵に比べてより高度なセキュリティを提供します。暗号化を使用し、特定のエリアへのアクセスを許可するようプログラムできるため、不正侵入のリスクを軽減できます。国土交通省の発表によると、2023年には日本で約81万9,600戸の住宅着工が開始されます。

産業部門が大きな市場シェアを占めると予想されます。

- 日本の産業部門は歴史的に日本経済の要であり、GDPと世界貿易に大きく貢献してきました。同国は、特にロボット工学、自動車、エレクトロニクスの分野における技術進歩で有名です。これらの分野における絶え間ない技術革新が成長を促し、日本を世界の産業発展の最前線に位置づけています。

- 多くの工業製造施設の主な目的は、安全性と生産性です。後者の目標は、労働者、訪問者、工場管理者、その他のリーダーにとって安全で安心できる場所を確保することに大きく依存しています。そのため、脅威を検知し、侵入を防ぎ、不測の事態が発生した場合に適切かつ迅速に対応するために、産業用製造現場における物理的セキュリティのレベルを高める必要があります。

- アクセスコントロールシステムや管理ツールなどの統合セキュリティ・ソリューションは、セキュリティの運用と報告を合理化し、強化するために、産業現場で大幅に採用されています。アクセスコントロールは、これらのソリューションをシームレスに融合させ、産業用製造施設が安全性と生産性の目標を達成するのを支援する方法です。代表的なソリューションには、バイオメトリクス、スマートセンサー、近接カードなどがあります。

- 工場管理者は、あらゆる脆弱性を減らすために、スタッフや訪問者の身元を正確に確認するツールとして、バイオメトリクスの採用を検討すべきです。バイオメトリクスのマルチスペクトル画像技術は、最新の偏光ビジョンと、皮膚の表面、表面下、皮下構造からデータを取得する際に使用されるさまざまな種類の光によって、本物の指先と偽物の指先を検出できないリスクを低減します。

- 成長する産業部門はアクセスコントロール装置の需要を生み出すと予想されます。経済産業省(日本)によると、日本のエレクトロニクス産業の総生産額は2023年に約10兆7,000億円(760億米ドル)に達しました。この産業には、民生用電子機器、産業用電子機器、電子部品・デバイスが含まれます。

日本のアクセスコントロール産業の概要

日本のアクセスコントロール市場は、国内外に多くの主要企業が存在するため競争が激しいです。市場は断片化されており、主要企業は製品革新やM&Aなどの戦略を採用しています。同市場の主要プレイヤーには、Thales Group、Bosch Security System Inc.、Idemia Group、HID Global、Axis Communicationsが含まれます。

- 2024年3月:デジタルセキュリティおよびID会社であるIdentiv Inc.は、高セキュリティ物理アクセス制御システム(PACS)ポートフォリオに画期的な追加製品であるScrambleFactorを発表しました。ScrambleFactorリーダーは、指紋バイオメトリクスと最先端のLCDタッチスクリーン・キーパッドにより、連邦市場向けのセキュアエントリーを再構築し、複数の認証方法を統合することで、比類のないセキュリティ、スピード、機能性、利便性を実現します。

- 2024年2月:Hikvisionは、第2世代のプロフェッショナル向けアクセスコントロール製品を発表しました。この新製品と機能性は、アクセス管理における大きな飛躍を意味し、ウェブ管理、柔軟な認証、プロフェッショナルアクセスアプリケーション、および統合・統一セキュリティソリューションの革新が含まれています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- COVID-19の副作用とその他のマクロ経済要因が市場に与える影響

第5章 市場力学

- 市場促進要因

- 犯罪率と脅威の増加によるアクセスコントロールシステムの採用拡大

- 技術の進歩

- 市場抑制要因

- 運用とROIへの懸念

第6章 技術スナップショット

- アクセスコントロールソリューションの進化

- RFIDとNFC技術の比較分析

- 主要技術動向

第7章 市場セグメンテーション

- タイプ別

- カードリーダーおよびアクセス制御機器

- カード式

- 近接型

- スマートカード(接触・非接触)

- バイオメトリック・リーダー

- 電子錠

- ソフトウェア

- その他のタイプ

- カードリーダーおよびアクセス制御機器

- 業界別

- 商業

- 住宅用

- 政府機関

- 産業用

- 輸送・物流

- ヘルスケア

- 軍事・防衛

- その他エンドユーザー業界別

第8章 競合情勢

- 企業プロファイル

- Hanwha Techwin Co. Ltd

- Thales Group(Gemalto NV)

- Bosch Security System Inc.

- HID Global Corporation

- Honeywell International Inc.

- Tyco International PLC(Johnson Controls)

- Allegion PLC

- ASSA ABLOY AB Group

- Schneider Electric SE

- Panasonic Corporation

- Brivo Systems, LLC

- Identiv Inc.

- Dormakaba Holding AG

- NEC Corporation

- Idemia Group

- Axis Communications AB

- Dahua Technology

- Genetec Inc.

- BioConnect Inc.

第9章 投資分析

第10章 投資分析市場の将来

The Japan Access Control Market size is estimated at USD 640 million in 2024, and is expected to reach USD 940 million by 2029, growing at a CAGR of 7.91% during the forecast period (2024-2029).

The market for access control is witnessing significant growth in Japan owing to technological advancements and increased security concerns. Innovations in biometrics, facial recognition, and AI-driven access control systems make these solutions more effective and appealing. Japan's strong technological infrastructure supports the adoption of these advanced systems.

Key Highlights

- Access control is an electronic system that allows authorized personnel to enter restricted, controlled, or secure spaces by presenting an access card to a credential reader. These systems provide a comprehensive and flexible approach to managing physical security. They offer enhanced security, improved accountability, and convenience for various applications.

- As Japan continues to develop its urban infrastructure, there is a growing need for sophisticated security systems in commercial buildings, residential complexes, and public spaces. According to the Central Intelligence Agency, Japan's urban population was 92% the previous year. Further, as per the MLIT (Japan), investment in building construction was forecasted to increase to JPY 43.4 trillion in 2023 from JPY 43.2 trillion in 2022.

- The increasing government investments in infrastructural developments are creating a positive outlook for market growth. For instance, in December 2023, the central government announced that the overall costs to develop infrastructure, such as access to venues, for the 2025 Osaka Kansai Expo would be a total of JPY 839 billion (USD 5.8 billion).

- The development of data centers across the country is expected to boost market growth. Data centers house critical and sensitive information, making them prime targets for physical breaches. Advanced access control systems are essential to ensure that only authorized personnel can access these facilities. In February 2024, Yondr Group formed a partnership with Japanese conglomerate Marubeni Corporation for the development of data centers in Japan. The two will initially build a data center in West Tokyo, with plans for further projects.

- However, the upfront cost of implementing advanced access control systems, including hardware, software, and installation, can be significant. This can be a deterrent for small and medium-sized businesses with limited budgets. Additionally, integrating new access control systems with existing infrastructure and other security systems can be complex and challenging. Compatibility issues and the need for specialized technical expertise can hinder adoption.

- The rising inflation rates have increased the cost of goods and services, including access control systems. Higher costs lead to reduced purchasing power for consumers and businesses, slowing market growth. Further, the war between Russia and Ukraine disrupted the global supply chain, particularly affecting the availability and cost of electronic components and raw materials used in access control systems. This led to delays in production and increased costs for manufacturers.

Japan Access Control Market Trends

The Smart Card Segment is Expected to Register Significant Growth in the Market

- Smartcards are increasingly becoming the standard for secure access control systems. These cards contain an embedded computer chip programmed with personal information about the cardholder and the specific access points they are permitted to enter. These cards can be integrated with various technologies, such as proximity, magnetic-stripe, and biometric systems, to create a flexible and effective security solution.

- Smartcards offer robust security features such as encryption and secure storage of sensitive data, making them ideal for applications that require secure authentication. The advanced processing capabilities and memory of smart cards allow them to transmit highly encrypted data to credential readers for authentication, significantly enhancing security.

- The increasing adoption of IoT devices and smart infrastructure in buildings and cities drives the need for integrated and secure access control systems. Smart cards play a key role in this ecosystem by providing secure and convenient access. Further, the shift toward cloud-based access control systems influences the adoption of smart cards. Cloud solutions offer greater scalability, flexibility, and remote management capabilities, making smart cards an integral part of these systems.

- Government initiatives are driving market demand through the concept of Society 5.0. This vision builds on previous societal phases: Society 1.0 (hunter-gatherer), Society 2.0 (agricultural), Society 3.0 (industrialized), and Society 4.0 (information). Known as the 'super-smart society,' Society 5.0 aims to create a sustainable, inclusive socio-economic model by leveraging digital technologies such as big data analytics, AI, IoT, and robotics.

- New constructions, particularly in commercial, residential, and institutional sectors, are increasingly incorporating smart card systems for access control due to increased security concerns. Smart cards provide a higher level of security compared to traditional keys. They use encryption and can be programmed to allow access to specific areas, reducing the risk of unauthorized entry. As per the MLIT (Japan), in 2023, approximately 819.6 thousand housing starts were initiated in Japan.

The Industrial Sector is Anticipated to Hold a Significant Market Share

- Japan's industrial sector has historically been a cornerstone of its economy, contributing significantly to its GDP and global trade presence. The country is renowned for its technological advancements, particularly in robotics, automotive, and electronics. Continuous innovation in these fields drives growth and keeps Japan at the forefront of global industrial development.

- The primary objectives of many industrial manufacturing facilities are safety and productivity. The latter goal significantly depends on ensuring a safe and secure place for workers, visitors, plant managers, and other leaders. As such, there is a need to increase the level of physical security in industrial manufacturing settings to detect threats, prevent intrusion, and respond appropriately and quickly in the case of any unwanted event.

- Integrated security solutions, such as access control systems and management tools, are significantly adopted in industrial sites to streamline and enhance security operations and reporting. Access control is a way to seamlessly fuse these solutions and help the industrial manufacturing facility reach its goals of safety and productivity. Some of the prime solutions include biometrics, smart sensors, and proximity cards.

- Plant managers should consider adopting biometrics as a tool to accurately verify the staff and visitor identity to reduce any vulnerability. Biometrics' multispectral imaging technology reduces the risk of not detecting the real fingertip from a fake one due to modern polarization vision and different types of light used in capturing the data from the surface, subsurface, and subdermal structures of the skin.

- The growing industrial sector is expected to generate demand for access control devices. According to METI (Japan), the total production value of Japan's electronics industry reached approximately JPY 10.7 trillion (USD 0.076 trillion) in 2023. This industry includes consumer electronic equipment, industrial electronic equipment, and electronic components and devices.

Japan Access Control Industry Overview

The Japanese access control market is highly competitive due to the presence of many key players within national and international boundaries. The market appears fragmented, with the key players adopting strategies like product innovation and mergers and acquisitions. Major players in the market include Thales Group, Bosch Security System Inc., Idemia Group, HID Global, and Axis Communications.

- March 2024: Identiv Inc., a digital security and identification company, introduced ScrambleFactor, a groundbreaking addition to its high-security physical access control system (PACS) portfolio. The ScrambleFactor reader reimagines secure entry for the federal market with fingerprint biometrics and a state-of-the-art LCD touchscreen keypad, integrating multiple authentication methods to deliver unparalleled security, speed, functionality, and convenience.

- Feb 2024: Hikvision launched its second-generation professional access control products. The new products and functionalities represent a significant leap forward in access management and include innovations for web management, flexible authentication, professional access applications, and converged and unified security solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Access Control Systems owing to Rising Crime Rates and Threats

- 5.1.2 Technological Advancements

- 5.2 Market Restraints

- 5.2.1 Operational and ROI Concerns

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Access Control Solutions

- 6.2 Comparative Analysis of RFID and NFC Technology

- 6.3 Key Technological Trends

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Card Reader and Access Control Devices

- 7.1.1.1 Card-based

- 7.1.1.2 Proximity

- 7.1.1.3 Smartcard (Contact and Contactless)

- 7.1.2 Biometric Readers

- 7.1.3 Electronic Locks

- 7.1.4 Software

- 7.1.5 Other Types

- 7.1.1 Card Reader and Access Control Devices

- 7.2 By End-user Vertical

- 7.2.1 Commercial

- 7.2.2 Residential

- 7.2.3 Government

- 7.2.4 Industrial

- 7.2.5 Transport and Logistics

- 7.2.6 Healthcare

- 7.2.7 Military and Defense

- 7.2.8 Other End-user Verticals

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Hanwha Techwin Co. Ltd

- 8.1.2 Thales Group (Gemalto NV)

- 8.1.3 Bosch Security System Inc.

- 8.1.4 HID Global Corporation

- 8.1.5 Honeywell International Inc.

- 8.1.6 Tyco International PLC (Johnson Controls)

- 8.1.7 Allegion PLC

- 8.1.8 ASSA ABLOY AB Group

- 8.1.9 Schneider Electric SE

- 8.1.10 Panasonic Corporation

- 8.1.11 Brivo Systems, LLC

- 8.1.12 Identiv Inc.

- 8.1.13 Dormakaba Holding AG

- 8.1.14 NEC Corporation

- 8.1.15 Idemia Group

- 8.1.16 Axis Communications AB

- 8.1.17 Dahua Technology

- 8.1.18 Genetec Inc.

- 8.1.19 BioConnect Inc.