|

市場調査レポート

商品コード

1906889

プログラマブルロジックコントローラ(PLC):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Programmable Logic Controller (PLC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| プログラマブルロジックコントローラ(PLC):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 161 Pages

納期: 2~3営業日

|

概要

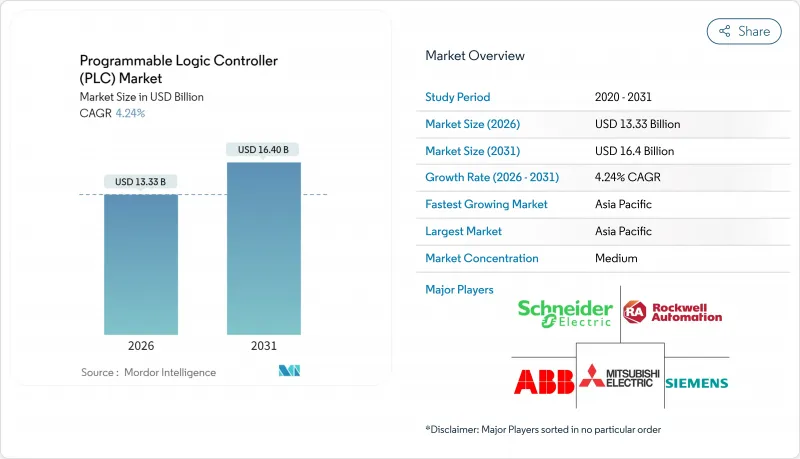

プログラマブルロジックコントローラ(PLC)市場は、2025年の127億9,000万米ドルから2026年には133億3,000万米ドルへ成長し、2026年から2031年にかけてCAGR 4.24%で推移し、2031年には164億米ドルに達すると予測されております。

この着実な拡大は、工場現場の継続的な近代化、サイバーセキュリティを背景とした回帰(リショアリング)の増加、固定ハードウェアからソフトウェア定義の自動化への段階的な移行を反映しています。アジア太平洋地域は規模と勢いの両面で主導的立場にあり、中国とインドにおける補助金支援による生産能力の増強が、コンパクトコントローラーの基盤需要を押し上げています。大規模プラントではモジュラーアーキテクチャが基盤であり続けていますが、ユーザーが標準産業用PC上での柔軟な導入を求める中、仮想化ソリューションが市場シェアを拡大しています。電力会社、自動車の電動化、グリッドエッジプロジェクトが短期的な購入を支える一方、予知保全イニシアチブが収益源をサービス分野へ拡大しています。サプライチェーンのデュアルソーシングと強化されたサイバーセキュリティ要件が切り替えコストを上昇させ、部品不足が緩和される中でも確立されたブランドが価格を維持することを可能にしています。

世界のプログラマブルロジックコントローラ(PLC)市場の動向と洞察

製造業におけるインダストリー4.0導入の加速

工場は生産性向上のためにデジタル化を進めており、PLCは機械と企業ソフトウェアを接続するローカルデータハブとして機能します。ドイツ連邦経済省の報告によれば、インダストリー4.0の導入率は2023年の65%から2024年には78%へ急上昇し、コントローラー更新の勢いを裏付けています。中国とインドにおける補助金制度は中小生産者向けの自動化コストをさらに低減させています。一方、アウディ社の仮想PLC導入は試運転時間を23%短縮し、リアルタイム最適化を向上させ、ソフトウェア中心制御への移行を実証しました。ISO 9001トレーサビリティ要件の強化により、製造業者はレガシーハードウェアを、詳細なデータ記録とシームレスなERP統合をサポートする最新コントローラに置き換えることが義務付けられています。離散産業およびプロセス産業全体において、サイバーセキュリティプロトコルを損なうことなくフィードバックループを短縮する、エッジ分析機能を内蔵したPLCへの需要が高まっています。

IIoTとクラウド統合による予知保全の実現

エッジ対応PLCは振動・温度・電力メトリクスをローカルで分析し、精緻化された知見のみをクラウドダッシュボードへ送信することで、設備全体の健全性監視を実現します。シュナイダーエレクトリックのEcoStruxureプラットフォームは、オンプレミスロジックとクラウドアルゴリズムを融合したハイブリッドモデルの好例であり、継続的な最適化を可能にします。5G接続とデジタルツインソフトウェアにより分散型PLCノードがリアルタイムで連携し、自律的なプロセス調整を支援することで予期せぬダウンタイムを抑制します。予知保全を導入した公益事業や金属プラントでは、OEE(総合設備効率)の顕著な向上と予備部品在庫の削減が報告されており、サイバーセキュリティ上の懸念が残る中でも投資効果は実証されています。

中小製造業者における初期資本コストの高さ

平均15,000~5万米ドルのプロジェクト費用は、特に統合・研修・ダウンタイムを考慮すると、多くの小規模企業にとって依然として障壁となります。限られた資金力から、初心者購買担当者がリスク回避のため「万能型」の考え方で過剰仕様を選択するケースが少なくありません。融資スキームやベンダーリースは負担軽減に寄与しますが、保守的な投資文化を完全に解消することはできません。サブスクリプション型仮想PLCは低コスト導入を可能にしますが、サービスが未成熟なため普及は地域によってばらつきがあり、特にインターネット環境が不安定な地域では導入が進みません。

セグメント分析

2025年にはモジュラー構成がプログラマブルロジックコントローラ(PLC)市場の41.56%を占め、プラントのアップグレードに伴いI/Oや演算能力を拡張できる特性を反映しています。このアーキテクチャにより、エンジニアはフォークリフト交換なしでモーション、安全、AIカードを追加でき、自動車や民生電子機器における混合モデルラインをサポートします。ソフトPLCは依然としてニッチ市場ですが、ハイパーバイザーが確定的な性能を提供し、ベンダーが強化されたカーネルを組み込むことで、7.22%のCAGRで進展しています。

離散産業とプロセス産業の両分野において、機械レベルでの異常検知を目的としたエッジ分析機能をホストするコントローラーへの需要が高まっています。コンパクトPLCはスタンドアロン機械向けに引き続き需要があり、分散型PLCは大規模な製油所や発電所向けに、耐障害性と地理的に分散したノードを重視する用途で採用されています。OPC-UA over TSNの成熟に伴い、ユーザーはシームレスな相互運用性を期待しており、これによりハードウェアのコモディティ化がさらに進み、差別化要因はソフトウェアツールチェーンとサポートエコシステムへと移行しています。

2025年時点でプログラマブルロジックコントローラ(PLC)市場規模の84.67%をハードウェアとソフトウェアが占めていますが、ユーザーが設備投資(CapEx)から運用コスト(OpEx)モデルへ移行する中、サービス収益はCAGR7.76%で拡大しています。IIoT接続の各層で統合の複雑性が増すにつれ、ベンダー主導のコンサルティングやアプリケーションエンジニアリングへの需要が高まっています。

予知保全パッケージは遠隔監視、ファームウェア管理、AI駆動型診断を統合し、複数年にわたる継続契約を生み出しています。ベンダーは新興国でトレーニングアカデミーを拡充し、スキルギャップ解消とブランド認知の定着を図っています。クラウド型サポートポータルは出張コストを削減し、拡張現実ガイドは現地修理サイクルを短縮。これにより、ハードウェア中心の交換プロジェクトにおいてもサービス需要が強化されています。

地域別分析

アジア太平洋地域の製造業復興が規模と速度の両方を支え、2025年には収益の35.10%、2031年までのCAGR6.12%を占めます。中国のパンデミック後の景気刺激策は自動車・電子機器分野のコントローラー更新を補助し、インドの産業回廊建設はPLCの初回導入を促進しています。日本の「品質4.0」イニシアチブにより、電子部品実装機向けナノ秒レベルの確定的制御装置への需要は高水準を維持。韓国の造船所や半導体工場では、ミッションクリティカルな稼働時間を確保するため冗長PLCクラスターが指定され、高利益率の受注を支えています。

欧州では持続可能性推進により、エネルギー管理と循環型経済対応を軸としたコントローラ購入が進行中です。2024年EUサイバーレジリエンス法はOEMメーカーに対し設計段階からのセキュリティ認証を義務付け、暗号化通信と異常検知機能を内蔵した製品需要を喚起しています。ドイツ自動車メーカーはソフトウェア定義型PLCサンドボックスの試験運用を開始し、フランスとイタリアでは航空宇宙複合材ラインにフェイルセーフロジックを自動導入しています。

北米のユーザーは、安全なサプライチェーンと国内半導体部品の使用を優先しています。インフラ投資・雇用法により、負荷分散と故障隔離のための最新コントローラを組み込んだ変電所の改修が資金援助されています。メキシコのニアショアブームにより自動車用ハーネス生産が拡大し、コンパクトPLCの迅速な導入が求められています。カナダの鉱業・林業セクターでは、拡張温度定格を備えた堅牢な機器が好まれています。全体として、地域のバイヤーは入札評価においてサイバーセキュリティ認証と国内修理サポートを重視しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 製造業におけるインダストリー4.0導入の加速

- 中小企業におけるコンパクトオートメーションの需要拡大

- IIoTとクラウド統合による予知保全の実現

- ソフトウェア定義PLCワークステーションへの移行

- オープン産業プロトコル(TSN上のOPC-UA)の採用

- サイバーセキュリティ対策に基づく国内調達義務化

- 市場抑制要因

- 中小メーカーにおける初期資本コストの高さ

- 接続されたPLCに対するサイバーセキュリティ脅威の増大

- 産業用PCおよびソフトPLCによる代替リスク

- 半導体供給の不安定化によるリードタイムの長期化

- 業界バリューチェーン分析

- マクロ経済要因の影響

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 製品タイプ別

- コンパクトPLC

- モジュラーPLC

- 分散型PLC

- ソフトPLC

- その他の製品

- コンポーネント別

- ハードウェアとソフトウェア

- サービス

- 設置および統合

- トレーニングとサポート

- メンテナンス

- 製品サイズ別

- ナノPLC

- マイクロPLC

- 小規模PLC

- 中規模PLC

- 大規模PLC

- エンドユーザー業界別

- 自動車

- 食品・飲料

- 化学・石油化学

- 石油・ガス

- エネルギー・公益事業

- 上水道・下水処理

- 医薬品

- パルプ・製紙

- 金属・鉱業

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Siemens AG

- Rockwell Automation Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- ABB Ltd.

- Omron Corporation

- Emerson Electric Co.

- Honeywell International Inc.

- Beckhoff Automation GmbH & Co. KG

- Delta Electronics Inc.

- Bosch Rexroth AG

- Panasonic Holdings Corporation

- Fuji Electric Co. Ltd.

- Hitachi Ltd.

- IDEC Corporation

- Keyence Corporation

- Toshiba Corporation

- General Electric Company

- Parker Hannifin Corporation

- Eaton Corporation plc

- Yokogawa Electric Corporation

- Inovance Technology Co. Ltd.

- Hollysys Automation Technologies Ltd.

- WAGO Kontakttechnik GmbH & Co. KG

- B&R Industrial Automation GmbH