|

市場調査レポート

商品コード

1851422

イヌリン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Inulin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| イヌリン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月08日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

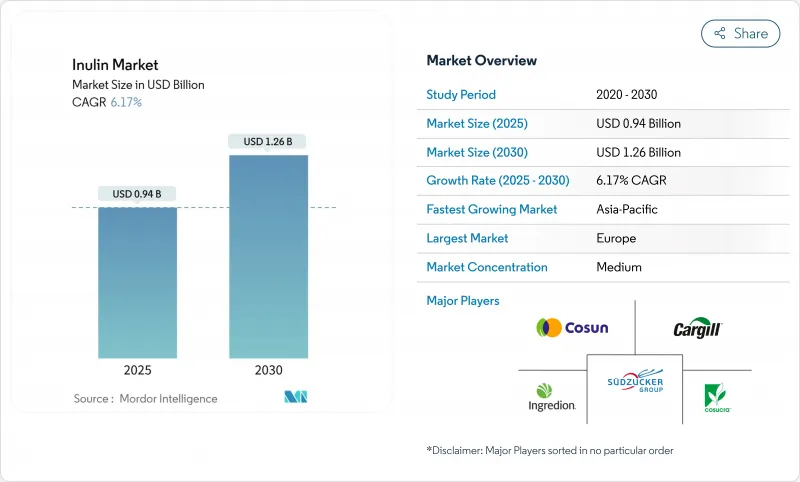

イヌリン市場は、2025年の評価額9億4,000万米ドルから2030年には12億6,000万米ドルに成長すると予測されており、イヌリン市場のCAGRは6.17%と堅調に推移すると見られています。

この成長の原動力は、消化器系の健康に対する消費者の関心の高まりと、米国FDAによる様々な植物原料のGRAS認定です。さらに、抽出技術の進歩が生産効率を高め、需要をさらに促進しています。欧州の加工業者は確立されたチコリのサプライチェーンを活用する一方、北米の拡張可能なエルサレム・アーティチョーク・プロジェクトやメキシコのリュウゼツラン統合は、調達戦略を多様化しています。こうした多様化により、原料リスクが軽減され、サプライチェーンの強靭性が強化されます。臨床調査により、脂質プロファイルの改善やカルシウム吸収の促進からマイクロバイオームの充実まで、キーワードの健康上の利点が強調されています。このような検証は、ヘルスクレームを強化するだけでなく、製品開発のイノベーションを促進します。液体のイヌリンは、工場の処理能力を向上させ、製品のテクスチャーを洗練させる迅速な可溶化により、レディ・トゥ・ドリンク飲料に好まれる選択肢となりつつあります。一方、粉末イヌリンはベーカリーや乳製品用途で重要な役割を果たし続けています。しかし、市場開拓における価格への敏感さや、酸性で熱処理された食品における安定性の懸念といった課題が立ちはだかっています。とはいえ、加工技術やカプセル化技術の進歩によってコスト効率と機能的安定性が向上し、市場の持続的成長の舞台が整いつつあります。

世界のイヌリン市場の動向と洞察

プレバイオティクス成分への需要の高まり

イヌリンは、従来のプロバイオティクスサプリメントの域を超えつつあるプレバイオティクス市場の成長において、極めて重要な成分として浮上しています。有益な腸内細菌による選択的発酵により、腸内健康を促進する重要な役割を担っています。米国FDAがイヌリンを食物繊維の摂取に寄与する水溶性食物繊維として承認したことにより、その健康強調表示(ヘルスクレーム)が有効になり、メーカーは自信を持って消費者にプレバイオティクスの利点を売り込むことができるようになりました。このような規制の明確化により、イヌリンは、ヘルスクレームの承認取得に課題を抱える他のプレバイオティクスと比較して競合優位に立つことができます。さらに、イヌリンのプレバイオティクスとしての機能性と、脂肪や糖の代替物としての機能性は、クリーンラベル製品の開発を目指す食品メーカーへの訴求力を高めています。特に短鎖のイヌリンは、長鎖のものと比べて動脈硬化予防効果が高いことが実証されており、分子構造に基づく製品の差別化の機会を提供しています。このような規制上のサポート、機能的多様性、健康上の利点の組み合わせは、プレバイオティクス市場におけるイヌリンの重要性の高まりを強調しています。

消費者のクリーンラベル原料への注目の高まり

クリーンラベルの位置づけは、マーケティング戦略からメーカーにとって不可欠な業務上の焦点へと移行しています。植物由来で最小限の加工しか必要としないイヌリンは、透明性と天然成分を求める消費者の高まりにシームレスに対応します。そのGRAS(Generally Recognized As Safe:一般に安全と認められる)ステータスと確立された安全性プロファイルにより、メーカーは製品の機能性や保存期間などの重要な側面を損なうことなく、合成添加物を置き換えることができます。欧州連合(EU)では、明確な成分表示を義務付ける厳格な規制があり、チコリ根由来のイヌリンのような認知可能な成分を含む製品は、合成の代替品とは対照的に競争上有利となります。このような規制の枠組みは、特に液体イヌリンの用途に有利であり、加工の簡便さや成分の親しみやすさが消費者の嗜好に大きく影響します。イヌリンの採用は、もはや高級品に限定されるものではなく、コスト効率を維持しながらクリーンラベルの期待に応えるため、大衆市場メーカーがますますイヌリンを採用するようになってきています。

イヌリンの高い加工コスト

米国農務省経済調査局のデータによると、特殊作物の加工には、汎用作物に比べ、生産高当たりの資本投資がかなり高いです。この高い資本要件は、新しいイヌリン生産施設にとって実質的な参入障壁となります。イヌリンの抽出工程は複雑で、熱水拡散、減圧下での濃縮、精密乾燥などの複数の段階を伴います。これらのプロセスには高度な設備と技術的専門知識が必要であり、サプライチェーンの柔軟性を制限し、運営上の課題を増大させる。さらに、国際エネルギー機関(IEA)の報告によると、エネルギーコストの上昇が食品加工業務、特に噴霧乾燥や濃縮のようなエネルギー集約型プロセスに影響を及ぼしており、これらはいずれもイヌリンの生産に不可欠です。このような技術的・財政的要件は、生産設備への多大な設備投資につながり、既存のインフラを持つ既存企業に有利となります。このような力学は、市場機会が拡大しているにもかかわらず、新規参入企業が効果的に競争することを困難にしています。

セグメント分析

チコリ根は2024年に62.64%の圧倒的な市場シェアを維持するが、これは数十年にわたる栽培技術の進歩と、欧州の生産地域全体で確立された加工インフラが整備された結果です。欧州連合(EU)の共通農業政策は、チコリ栽培に重要な農業支援を提供し続け、大規模なイヌリン生産を支える安定したサプライチェーンと予測可能な価格構造を確保しています。ベルギーとオランダは、長年にわたる農業協同組合と最先端の加工施設に支えられ、チコリ生産の世界的リーダーであり続けています。これらの施設は、数十年にわたる商業的操業の間、一貫して抽出収量を最適化し、高品質の基準を維持してきました。チコリの加工インフラは甜菜の加工インフラと同じで、根菜の取り扱いと加工における既存の専門知識を活用しながら、大幅なスケールメリットを実現し、市場での競争力をさらに強固なものにしています。

エルサレム・アーティチョークは、2030年までのCAGRが7.33%と予測され、最も急成長しているソース・セグメントとして浮上しています。この成長の原動力となっているのは、優れたイヌリン濃縮度と持続可能な栽培特性であり、環境と経済の両課題に対応しています。米国農務省の農業調査局によると、エルサレム・アーティチョークのイヌリン濃度は乾燥重量で75~80%と非常に高く、チコリの約20%をはるかに上回っています。この高いイヌリン含有率は、処理量の削減と抽出コストの削減につながり、経済的に魅力的な選択肢となる可能性があります。オハイオ州立大学エクステンションの調査は、エルサレム・アーティチョークの多様な栽培条件への適応性と、持続可能な農業慣行との整合性を強調しています。

地域分析

2024年には、欧州が市場の47.89%という圧倒的なシェアを占めているが、これは数十年にわたる規制の進化と機能性食品に関する消費者教育の賜物です。このリーダーシップは、チコリの栽培と加工のための確立されたインフラストラクチャーによって強化されています。2025年2月より、欧州食品安全機関が新規食品の評価に関するガイダンスを刷新し、承認プロセスを合理化する予定です。厳格な安全基準が確保される一方で、この動きは新たなイヌリン製品の導入を早める可能性があります。豊かな健康食品の伝統と堅実な国内生産を有するドイツとフランスが、この地域の消費の先陣を切っています。一方、英国のブレグジット後の規制調整により、欧州のサプライヤーは継続的な市場アクセスが確保されます。欧州の厳格な表示義務、特に規制1169/2011は、「クリーン・ラベル」としてのイヌリンの魅力を高め、合成食品をしのぐ優位性を与えています。

2030年までのCAGRが7.34%と予測されるアジア太平洋では、都市化と可処分所得の増加に牽引されて機能性食品の採用が急増しています。中国の規制状況、とりわけ健康食品のカテゴリーをキャンディーや飲食品にまで拡大するという提案は、欧米のより厳格なアプローチとは対照的であり、中国に市場開拓の優位性をもたらす可能性があります。日本の人口動態の高齢化は、消化器系の健康食品に対する一貫した需要を生み出しています。日本の高度な食品加工能力と相まって、イヌリンの伝統的な応用と現代的な応用の両方にとって肥沃な土壌が形成されています。インドでは、急成長する加工食品部門が健康志向の高まる都市住民と出会い、大きなチャンスをもたらしています。

北米は、規制状況や消費者の意識が明確な成熟市場であるが、新興の用途や人口動態に潜在的な成長の可能性をまだ秘めています。2024年には、ユングバンスラウアーがポートコルボーンに2億米ドルを投じてバイオガム施設を建設するカナダの投資動向が注目されます。この投資は、キサンタンガムに特化したものだが、この地域の機能性素材生産へのコミットメントを強調するものです。クリーンラベルの動向と健康食品のプレミアム化の波は、イヌリンの市場での存在感をさらに高めています。さらに、エルサレム・アーティチョークの栽培が北東部と北中部の州で盛んであることから、この地域は欧州産チコリの輸入への依存を減らし、別の調達先を見つけることができます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- プレバイオティクス原料の需要拡大

- 消費者のクリーンラベル原料への関心の高まり

- 消化器系健康製品を求める老年人口の増加

- グルテンフリー製品メーカーによる食感改善の需要

- 消費者の低カロリー食品重視の高まり

- 強化食品産業の需要拡大

- 市場抑制要因

- イヌリンの加工コストの高さ

- イヌリンの高温・低PH下での安定性問題

- 主張される利益に対する一貫性のない臨床証拠

- 先進国における厳しい表示義務

- サプライチェーン分析

- 規制の見通し

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力/消費者

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 原料別

- リュウゼツラン

- エルサレム・アーティチョーク

- チコリの根

- その他

- 形態別

- パウダー

- 液体

- 用途別

- 飲食品

- 製パン・製菓

- 乳製品

- 食肉製品

- 飲料

- その他の飲食品

- 栄養補助食品

- 医薬品

- 飲食品

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ポーランド

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- インドネシア

- 韓国

- タイ

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他南米

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

- モロッコ

- トルコ

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場ランキング分析

- 企業プロファイル

- Suedzucker AG

- Cooperative Royal Cosun UA

- Cosucra Groupe Warcoing SA

- Cargill, Incorporated

- Ingredion Incorporated

- Plamed Green Science Group

- Nutragreenlife Biotechnology Co.,Ltd

- The Green Labs LLC

- The Scoular Company

- Shaanxi Guanjie BiotechTechnology Co., Ltd.

- The Tierra Group

- Guangzhou Shiny Co.,Ltd.

- ORBE XXI(Nutriagaves)

- Ciranda, Inc.

- Intrinsic Organics

- Inner Mongolia Sinong Biotechnology

- Xi'an Healthful Biotechnology Co.,Ltd

- Hangzhou Kindherb Biotechnology Co., Ltd.

- Xi'an Victar Bio-Tech Corp

- Fuji Nihon Corporation