|

市場調査レポート

商品コード

1851260

分子診断薬:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 分子診断薬:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月02日

発行: Mordor Intelligence

ページ情報: 英文 233 Pages

納期: 2~3営業日

|

概要

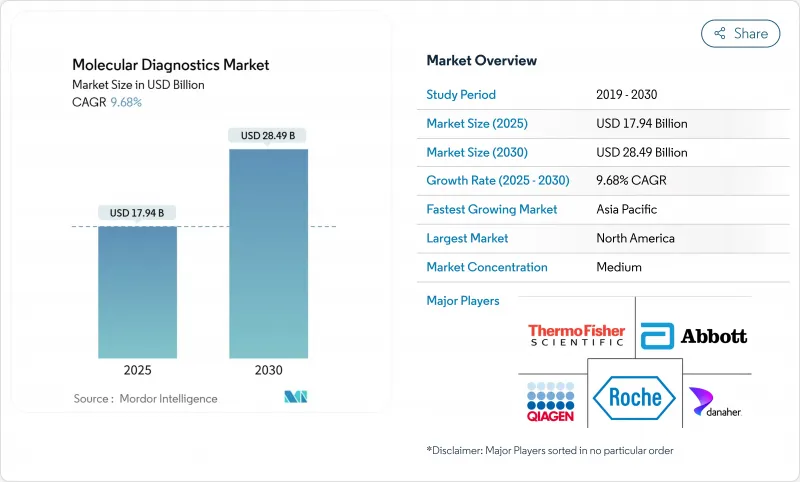

分子診断薬市場の2025年の市場規模は179億4,000万米ドルで、2030年には284億9,000万米ドルに達すると予測され、期間を通じて9.68%のCAGRで進展します。

成長を支えるのは、救急や外来での迅速マルチプレックス検査の幅広い採用、精密腫瘍学検査に対する償還の強化、参照データベースを改善する国家ゲノム構想への持続的投資です。一方、アジア太平洋地域は、意欲的な集団ゲノミクス・プロジェクトと検査施設インフラの拡大を背景に、最も急速に売上を伸ばしています。技術サプライヤーは、PCR、アイソサーマル、シーケンシングベースのワークフローを組み合わせた統合プラットフォームを優先しています。同時に、小売業者やプライマリーケアネットワークは、消費者の最初の接点で分子検査を可能にするCLIA規則の合理化を活用し、従来の検査室から検査量をシフトさせています。

世界の分子診断薬市場の動向と洞察

ポイントオブケアPCRの需要を加速するシンドロミック呼吸器パネル

マルチプレックス呼吸器パネルは複数の病原体を同時に検出し、現在では45~90分で結果を提供します。臨床での採用により、不必要な抗生物質の処方が20-30%減少し、スチュワードシップの取り組みが強化されています。これらの検査は、呼吸器症例のおよそ20%に見られる同時感染症も発見するため、単一病原体検査にありがちな診断の盲点を減らすことができます。病院ネットワークは、感染制御プロトコルの中でパネルの使用を成文化し、季節的なピークではなく年間を通しての使用量を確保しています。その結果、カートリッジ式システムのサプライヤーは試薬需要の持続性を報告しており、この動向は経常収益を押し上げ、分子診断薬市場が分散化を重視していることを裏付けています。

CLIA免除分子デバイスの小売薬局への進出

2024年12月発効の米国CLIA規則改正により、人員要件と料金体系が簡素化され、薬局が中程度の複雑さの分子アッセイを実施できるようになりました。CVSヘルスは1,600店舗でインフルエンザA/BとCOVID-19のスリーインワンPCRを導入し、一度の来店で検査と処方相談ができるようにしました。Kroger社は2,100店舗でコレステロールとグルコースの分子検査を行い、スクリーニング時間を90秒に短縮しました。この動きは、薬局を第一線の診断ハブとして位置づけ直し、十分なサービスを受けていない地域社会へのアクセスを広げ、サンプルの流れを中央検査室から遠ざけるものです。ポータブル・プラットフォームのメーカーは、より高い検査頻度と消費者の視認性から恩恵を受け、分子診断薬市場における長期的な収益源を支えます。

酵素サプライチェーンの制約によるコスト高騰

医療機器メーカーは、地政学的緊張がトレードレーンを混乱させる中、物流費や原材料費が売上高の20%近くまで上昇するのを目の当たりにしています。高純度酵素は特に影響を受けており、PTFEの不足により受託製造業者は能力の外注を余儀なくされています。小規模のアッセイ開発企業は、バッファー成分や安定剤の確保に苦労しており、製造の遅れ、定価の上昇、新規市場への参入の遅れなどを招いています。価格に敏感な新興国では、単価の高騰が検査の普及を阻害し、分子診断薬市場の短期的な拡大に歯止めをかけています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- シンドロミック呼吸器パネルの採用が北米のPoC PCR需要を加速する

- CLIA免除の分子デバイスが小売薬局に進出、アクセスが拡大

- EMAが承認したコンパニオン診断薬が欧州のがん領域の検査数を押し上げる

- ポピュレーション・ゲノミクスへの取り組みがAPAC全体でのNGS検査普及を促進

- AIを活用したバイオインフォマティクス・パイプラインがハイスループット研究所の結果ターンアラウンドを短縮する

- 全国的な抗菌薬耐性サーベイランスプログラムが病院でのマルチプレックスPCRパネル調達を促進

- 市場抑制要因

- PCRキットのコスト高騰を引き起こす酵素サプライチェーンの制約

- 新規アッセイの商業化を遅らせるEU IVDRのバックログ

- 包括的NGSパネルの償還範囲は限定的

- 厳しいデータプライバシー規制がクラウドベースの結果配信を妨げる

- 規制または技術的展望

- ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 技術別

- PCR

- 次世代シーケンサー(NGS)

- インサイチュ・ハイブリダイゼーション

- チップ&マイクロアレイ

- 質量分析

- その他のテクノロジー

- 用途別

- 感染症

- 腫瘍学

- ファーマコゲノミクス

- 微生物学

- 遺伝子疾患スクリーニング

- ヒト白血球抗原タイピング

- 血液スクリーニング

- 製品別

- 試薬&キット

- インストルメンツ&システム

- ソフトウェア&サービス

- サンプルタイプ別

- 血液、血清、血漿

- 尿

- その他のサンプルタイプ(唾液、組織、綿棒)

- エンドユーザー別

- 病院

- 診断&レファレンス・ラボラトリーズ

- 学術・研究機関

- その他のエンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Danaher

- Hologic Inc.

- Illumina Inc.

- Qiagen N.V.

- Becton, Dickinson and Company

- bioMrieux SA

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Siemens Healthineers AG

- DiaSorin S.p.A.

- Seegene Inc.

- Guardant Health

- Labcorp

- Exact Sciences Corporation

- 10x Genomics

- DNA Genotek, Inc.

- PathoNostics B.V.