|

市場調査レポート

商品コード

1640331

小売オートメーション:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Retail Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小売オートメーション:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

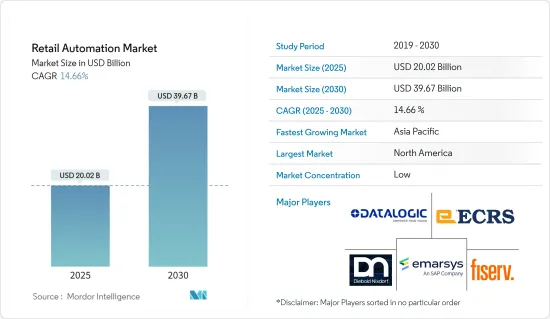

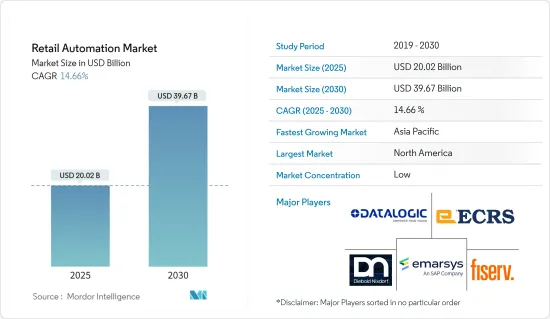

小売オートメーション市場規模は2025年に200億2,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは14.66%で、2030年には396億7,000万米ドルに達すると予測されます。

主要ハイライト

- 小売業者は最近、技術革命が注目され、大きく普及する中で課題に直面しています。このような技術やイノベーションは、消費者の行動や、販売前後の協力やコミュニケーションの方法を再構築しています。オートメーションによって提供される利便性や透明性といった特徴は、小売業者にPOSシステムの適応とアップグレードを促しています。さらに、その費用対効果の高さから、POSシステムに対する需要は小規模小売店の間で著しく高まっています。

- 小売オートメーションは、リアクションのトリガー処理、他のデジタルシステムとの相互作用、データ処理を支援します。オペレーショナルリスクの軽減、コストの削減、より良い顧客体験、生産性の向上は、このソフトウェアを使用する利点のほんの一部です。

- 記帳のような反復業務をオートメーション技術で行うことで、人の介入を最小限に抑えることができます。オートメーションは、作業の最短かつ正確な方法を判断し、そのプロセスを繰り返すことができるため、企業はスムーズかつ効率的に、一貫したオペレーションを行うことができます。小売のオートメーションにより、買い物客はタッチスクリーンのインターフェースを使って商品を閲覧することができ、取引にかかる時間も短縮されます。顧客が好きな商品を選び、クレジットカードやデビットカードで決済に進むことができるのは、小売オートメーションによって可能になります。

- この成長は、小売オートメーションに組み込まれた機械学習機能の市場にさらに影響を与えています。ロボティックプロセスオートメーション(RPA)は、人工知能(AI)を使用して、より優れたビジネス洞察とデータの完全性を記載しています。さらに、小売オートメーション市場は、都市化の進展、ライフスタイルの変化、支出の増加、消費者支出の増加から利益を得ています。

小売オートメーション市場の動向

小売産業とeコマースの成長と競合

- 店舗でのセルフレジ、ロボット工学、サプライチェーンでの人工知能(AI)の利用により、小売産業ではオートメーションの導入が進んでいます。これは主に、物価と賃金の上昇、市場競争、個人消費の減少の結果です。世界経済フォーラム(WEF)の推定によると、このセクターのオートメーション率は現在40%だが、今後3~4年の間に、この数字は60~65%に増加する可能性があります。オートメーションへの再注目は、ロジスティクス、ロボット工学、小売業に機会をもたらします。

- 近年の投資や提携といった戦略的動向の高まりは、市場成長率に大きく寄与すると分析されています。例えば、2022年10月、ナイジェリアの小売オートメーションプラットフォームであるBumpaは、Base10 Partnersをリード投資家として400万米ドルを調達しました。同社は昨年9月に20万米ドルのプレシード投資を公表しており、この資金をアフリカの新市場への進出、人材獲得、システムや体制の改善に活用するとしています。

- 2022年10月、Walmartは、独自の在庫処理技術を開発する電子食料品オートメーション企業、Alert Innovationを買収したと発表しました。プレスリリースによると、Alert InnovationのAlphabotシステムは、エレベーターやコンベアの代わりに全方向性ロボットを使用して、注文の保管、取り出し、払い出しを行っています。小売大手は、Alertと提携して「その能力を拡大する」と発表し、この技術によって顧客の集配が加速すると指摘しました。小売大手は、Alphabotの技術により、米国の人口の90%から10マイル以内に位置する4,700店舗という広大な店舗面積を保管と配達に活用できるようになると述べました。

- Microsoftは、小売業が配送ソリューションを強化し、最終的に良好な顧客体験につながるよう支援するため、小売産業のあらゆるセグメントの著名企業を結集しています。2022年1月、世界のSaaSプラットフォームであるFarEyeは、MicrosoftがMicrosoft Cloud for RetailのAmplification Partnerに選定したことを発表しました。この協業は、小売業者が商品の移動をオーケストレーション、追跡、最適化する方法を強化・変革し、企業が最終消費者のニーズを満たしながら物流コストを削減することを可能にします。

- 米国国勢調査局は、2023年末までに小売売上高が約7兆2,400億米ドルに急増し、前年から約15億米ドル増加したと報告しています。

北米が大きなシェアを占める見込み

- 北米の小売市場は最大級の規模を誇る。Wal-Mart、Costco、Kroger、Home Depot、Targetはこの地域に起源を持っています。店舗内業務におけるデータ量が急速に増加していることが、市場成長の原動力となっています。米国の小売オートメーション市場は、WalmartやAmazonなどの大手企業によるオートメーション技術の採用拡大によって牽引されると予想されます。この採用の一部は、消費者の嗜好の変化にも起因しています。

- さらに、北米は小売クラウドソリューションの需要をリードしています。この地域は、他の多くの地域と比較して、最も実験的な小売シナリオの1つです。また、この地域では専門店でのクラウドソリューションの利用が多いです。例えば、Bernhardt Furniture Company Inc.では、IBMの小売クラウドソリューションを利用してモバイル販売アプリと分析プラットフォームを構築し、わずか10週間で同社の売上を約20%押し上げました。また、同社は、幹部が販売イベント中に約205人以上の顧客と関わることができたと報告しています。

- 米国を拠点とする著名なクラウドPOSソリューションベンダーであるCitixsysTechnologiesが最近実施した調査によると、回答者の67%以上が、探している商品を見つけるのに手助けが必要だったため、手ぶらで店を出ています。このような情報はすべての小売業者にとって非常に必要であり、これがクラウドソリューションの導入につながっています。

- 小売クラウド環境では、小売企業や小売業者は、インフラリソースやビジネスアプリケーションをSaaS(Software-as-a-Service)など、クラウドのさまざまなサービスアーキテクチャに移行することで、スピードと俊敏性の面で大きな優位性を得ることができます。小売産業では、SaaSは他のサービスモデルと比較して、予測期間中に重要な位置を占めると予測されています。

小売オートメーション産業概要

小売オートメーション市場は、多数のソリューション・プロバイダーが世界に事業を展開しており、セグメント化が特徴となっています。オートメーション技術の開発が進んでいるため、市場参入企業間の競争は依然として激しいです。既存参入企業は、潜在的な参入企業による市場シェア破壊を阻止するため、研究開発に継続的に多額の投資を行っています。さらに、既存の市場シェアを最大化するための拡大戦略も模索しています。

2022年5月、北米に拠点を持つ有名なデジタルトランスフォーメーションソリューション・プロバイダーであるUSTは、SAPとの相手先商標製品製造者契約の締結を発表しました。この契約により、SAP Business Technology Platform(SAP BTP)がUSTのCogniphiAI Visionプラットフォームに統合され、今後はUST Sentry Vision AIとして販売されます。このSaaS(Software as a Service)包装ソリューションは、SAP S/4HANAとRISE with SAPとシームレスに連携し、先進的ビデオ分析を通じて、小売業や製造業の業務に予測、文脈、分析機能を組み込むことを容易にします。先進的視覚ベースの人工知能技術であるUST Sentry Vision AIは、予測可能なパターンを特定することで、業務の無駄を削減し、パフォーマンスをモニタリングし、収益漏れを検出し、複雑な業務をオートメーションすることができます。企業は、UST Sentry Vision AIを使用することで、デジタルビジョンデータとビデオ分析を活用し、競合を高めることができます。USTの人工知能ベースのビジョンプラットフォームは、SAP Business Technology PlatformとSAP Analytics Cloudと統合され、インテリジェントなデジタル企業への移行を強化・加速します。

2023年5月、ECS Industrial Computerは、インテリジェントな小売キオスク向けの広範な新製品を発表しました。これには、オートメーションインテリジェンス、情報端末、宝くじ端末向けに設計されたB760H7-M8やQ670HIS1マザーボードなどのLIVA Z5 Plus MiniPCシリーズが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場力学

- 市場促進要因

- 高品質で迅速なサービスに対する需要の高まり

- 小売産業とeコマースの成長と競合

- 市場課題

- 高いハードウェア故障率

- インターネットと接続性への大きな依存

第6章 市場セグメンテーション

- タイプ別

- ハードウェア

- POSシステム

- セルフチェックアウトシステム

- RFID・バーコードスキャナー

- その他

- ソフトウェア

- ハードウェア

- エンドユーザー別

- 食料品(スーパーマーケット、ハイパーマーケット、コンビニエンスストア(燃料あり・なし)、ドラッグストア)

- ジェネラル・マーチャンダイズ(ハードグッズ、ソフトグッズ、デパートなどの複合ジェネラル・マーチャンダイズ)

- ホスピタリティ(ホテル(カジノ、リゾート、クルーズ船などを含む)、レストラン)

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- アジア

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Datalogic S.p.A

- Diebold Nixdorf, Incorporated

- ECR Software Corporation

- Emarsys eMarketing Systems AG

- Fiserv Inc.

- Fujitsu Limited

- Honeywell International Inc.

- NCR Corporation

- RapidPricer B.V.

- Posiflex Technology Inc.

第8章 投資分析

第9章 市場の将来

The Retail Automation Market size is estimated at USD 20.02 billion in 2025, and is expected to reach USD 39.67 billion by 2030, at a CAGR of 14.66% during the forecast period (2025-2030).

Key Highlights

- Retailers have recently faced challenges as the technological revolution has gained attention and adoption significantly. Such technologies and innovations have been reshaping the behavior of consumers and their way of collaborating and communicating pre - and post-sales. Features, such as convenience and transparency, provided by automation have been pushing retailers to adapt and upgrade their PoS systems. Furthermore, due to their cost-effectiveness, the demand for PoS systems has significantly risen among small retail stores.

- Retail automation assists with handling triggering reactions, interacting with other digital systems, and handling data. Cheaper operational risk, lower costs, a better customer experience, and increased productivity are just a few advantages of using this software.

- The requirement for human intervention can be minimized by using automation technologies to carry out repetitive operations like bookkeeping. The firm operates smoothly, efficiently, and consistently owing to automation, which can determine the shortest and most precise way to do the operation and repeat the process. With retail automation, shoppers may browse products using a touchscreen interface, and transactions take less time. The ability to choose the product of customers choosing and proceed to payment with a credit or debit card is made possible by retail automation.

- The growth further influences the market for machine learning capabilities incorporated into retail automation. Robotic process automation (RPA) uses artificial intelligence (AI) to provide better business insights and data integrity. Additionally, the retail automation market benefits from rising urbanization, a shift in lifestyle, an increase in expenditures, and higher consumer spending.

Retail Automation Market Trends

Growth and Competition among Retail Industry and E -commerce

- With the usage of self-checkouts in stores, robotics, and artificial intelligence (AI) in supply chains, the retail industry has made progress in implementing automation. This is primarily a result of increased prices and wages, competitive labor markets, and decreased consumer spending. The sector is presently 40% automated, according to World Economic Forum (WEF) estimates, but over the next three to four years, this number might increase to 60-65%. The renewed focus on automation creates opportunities for logistics, robotics, and retailers.

- The growing strategic developments, such as investments and partnerships in recent years, are analyzed to contribute to the market growth rate significantly. For instance, In October 2022, Bumpa, a Nigerian retail automation platform, raised USD 4 million with Base10 Partners as the lead investor. The company disclosed a USD 200,000 pre-seed investment in September last year, saying it would utilize the money to expand into new African markets, acquire people, and improve its systems and structures.

- In October 2022, Walmart stated that it had acquired Alert Innovation, an e-grocery automation company that creates unique inventory-handling technology. According to the press release, Alert Innovation's Alphabot system uses omnidirectional robots instead of elevators or conveyors to store, retrieve, and dispense orders, freeing up space and making the technology easier to scale. The retail giant announced that it would partner with Alert to "scale their capabilities," noting that the technology will accelerate customer pickup and delivery. The retail giant said the Alphabot technology would enable it to utilize its vast store footprint for storage and fulfillment-4,700 stores located within 10 miles of 90% of the U.S. population.

- Microsoft is bringing together prominent players across all sectors of the retail space to help retailers enhance their delivery solutions to ultimately result in a positive customer experience. In January 2022, FarEye, a global SaaS platform, announced its selection by Microsoft as an Amplification Partner in Microsoft Cloud for Retail. The collaboration empowers and transforms how retailers orchestrate, track, and optimize the movement of goods, enabling enterprises to lower logistics costs while meeting the needs of end consumers.

- By the end of 2023, the US Census Bureau reported that total retail sales had surged to about USD 7.24 trillion, marking a notable increase of around USD 1.5 billion from the previous year.

North America is Expected to Hold Major Share

- The retail market in North America is one of the biggest. Wal-Mart, Costco, Kroger, Home Depot, and Target have their origins in this region. The rapidly growing data volume across in-store operations drives the market's growth. The retail automation market in the United States is expected to be driven by the growing adoption of automation technologies by major players such as Walmart and Amazon. Part of the adoption is also attributable to changing consumer preferences.

- Further, North America leads the demand for retail cloud solutions. The region has one of the most experimental retail scenarios compared to many other regions. Also, the use of cloud solutions in the region is high in specialty stores. For example, consider Bernhardt Furniture Company Inc., where the company used IBM's retail cloud solutions to create a mobile sales app and analytics platform that boosted the company's sales by approximately 20% in just ten weeks. Also, the company reported that its executives could engage around 205 more customers during sales events.

- According to the recent survey conducted by CitixsysTechnologies, the prominent vendors of cloud POS solutions (iVendRetail) based in the United States, over 67% of the respondents leave empty-handed from the store because they needed help finding the product they are looking The survey also reveals that over 51% of the respondents turn away from stores due to high waiting times at the POS (Point of service). Such info is very necessary for every retailer, and this is leading to the adoption of cloud solutions.

- In a retail cloud environment, retail businesses and retailers can move their infrastructure resources and business applications to different service architectures of the cloud, such as software as a service (SaaS), to gain a major advantage in terms of speed and agility. In the retail industry, SaaS is anticipated to hold a significant position during the forecast period compared to the other service models, as retailers have an affinity for enhancing customer-facing functionalities.

Retail Automation Industry Overview

The retail automation market is characterized by fragmentation, with numerous solution providers operating globally. Given the ongoing development of automation technology, competition among market players remains intense. Incumbent participants continuously invest heavily in research and development to deter potential entrants from disrupting their market share. Additionally, they explore expansion strategies to maximize their existing market footprint.

In May 2022, UST, a renowned digital transformation solutions provider with a presence in North America, announced the signing of an original equipment manufacturer agreement with SAP. This agreement enables the integration of the SAP Business Technology Platform (SAP BTP) into UST's CogniphiAI Vision platform, which will now be marketed as UST Sentry Vision AI. This Software as a Service (SaaS) packaged solution seamlessly interfaces with SAP S/4HANA and RISE with SAP, facilitating the incorporation of predictive, contextual, and analytical capabilities into retail and manufacturing operations through advanced video analytics. UST Sentry Vision AI, an advanced vision-based artificial intelligence technology, allows the identification of predictable patterns that can reduce operational waste, monitor performance, detect revenue leakage, and automate complex business operations. Businesses can leverage digital vision data and video analytics to gain a competitive edge with UST Sentry Vision AI. UST's artificial intelligence-based vision platform, integrated with SAP Business Technology Platform and SAP Analytics Cloud, empowers and accelerates the transition to an intelligent digital enterprise.

In May 2023, ECS Industrial Computer introduced an extensive range of new products for intelligent retail kiosks. This includes the LIVA Z5 Plus MiniPC series, such as B760H7-M8 and Q670HIS1 motherboards, designed for automation intelligence, information terminals, and lottery terminals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Quality and Fast Service

- 5.1.2 Growth and Competition among Retail Industry and E -commerce

- 5.2 Market Challenges

- 5.2.1 High Hardware Failure Rates

- 5.2.2 Huge Reliance on Internet and Connectivity

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 POS System

- 6.1.1.2 Self -checkout System

- 6.1.1.3 RFID and Barcode Scanners

- 6.1.1.4 Other Hardware Types

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By End-User

- 6.2.1 Grocery (Supermarkets, Hypermarkets, Convenience Stores (with and without Fuel), and Drugstores)

- 6.2.2 General Merchandise (Hardgoods, Softgoods, and Mixed General Merchandise, like Departmental Stores, etc.)

- 6.2.3 Hospitality (Hotels (including Casinos, Resorts, Cruise Ships, etc.) and Restaurants)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Datalogic S.p.A

- 7.1.2 Diebold Nixdorf, Incorporated

- 7.1.3 ECR Software Corporation

- 7.1.4 Emarsys eMarketing Systems AG

- 7.1.5 Fiserv Inc.

- 7.1.6 Fujitsu Limited

- 7.1.7 Honeywell International Inc.

- 7.1.8 NCR Corporation

- 7.1.9 RapidPricer B.V.

- 7.1.10 Posiflex Technology Inc.