|

市場調査レポート

商品コード

1851479

IoTセキュリティ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| IoTセキュリティ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月08日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

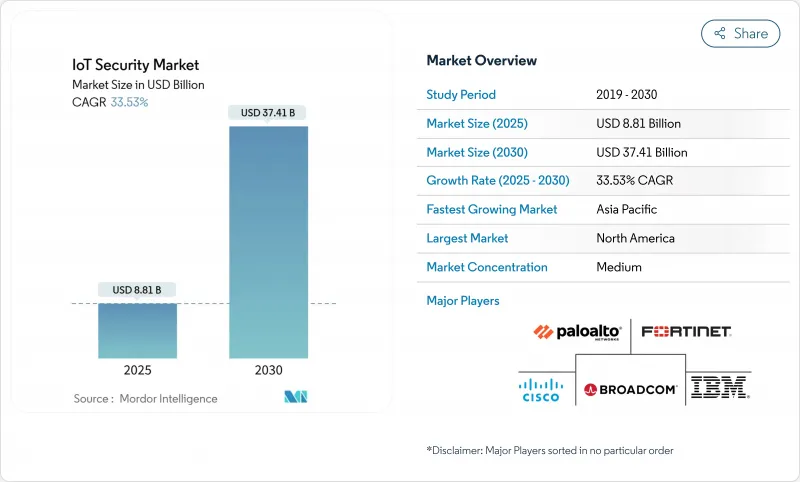

IoTセキュリティ市場規模は2025年に88億1,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは33.53%で、2030年には374億1,000万米ドルに達すると予測されます。

企業が出費を加速させているのは、規制当局があらゆるコネクテッド製品のセキュリティ・バイ・デザインを義務付けていること、運用技術がITネットワークに統合されつつあること、AIアナリティクスが膨大なデバイス群にわたってリアルタイムの検知を実現していることなどが背景にあります。英国の製品セキュリティおよび通信インフラ法(Product Security and Telecommunications Infrastructure Act)と欧州連合のサイバーレジリエンス法(Cyber Resilience Act)は、セキュリティをベストプラクティスから法的要件へと変化させ、予算を裁量プロジェクトから強制的なコンプライアンスへと転換させました。何百万もの管理されていないエンドポイントによって攻撃対象が拡大する中、境界中心の防御が優先され続けているが、クラウド配信による制御への移行によって、調達基準が再構築されつつあります。ベンダーの差別化は、工場フロアからリモートのエッジノードまで拡張可能な、標準に準拠した自動化された防御の証明によってますます左右されるようになっています。

世界のIoTセキュリティ市場の動向と洞察

データ侵害を主導する規制当局の精査

規制当局は、自主的なガイドラインから、EU域内に流入する非準拠デバイスに1,500万ユーロの罰金を科すことができるEUサイバーレジリエンス法に代表される懲罰的な執行へと移行しました。英国のPSTI法は、2024年4月発効で、デフォルト・パスワードを禁止し、定義された更新ウィンドウを義務付け、メーカーにファームウェア・パイプラインの再設計を強いています。米国連邦通信委員会が2024年に導入する消費者向けラベルにより、購入者はセキュリティの成熟度を比較できるようになり、競争優位は準拠ベンダーに移る。2025年3月、イェール・ニュー・ヘブン・ヘルスの患者記録550万件が流出したサイバー攻撃のような有名事件は、規制の緊急性を示し、監視を強化します。一流組立メーカーは現在、コンポーネント・サプライヤーに第三者認証の保有を義務付けており、文書化された安全な開発プロセスを持たない企業の参入障壁を高めています。

OT+ITセキュリティ・スタックの融合

かつては孤立していた運用技術のネットワークが、今では企業のクラウドに接続し、予知保全や分析をサポートするようになっています。IT-OTインタフェースを標的とするランサムウェアは、2025年第1四半期に北米のプラントで84%急増し、調達文書に統合された可視性の義務付けを促しました。ModbusやDNP3のようなレガシーな産業用プロトコルは、決定論的なトラフィックと厳格なレイテンシしきい値を理解するセキュリティ・ツールを必要とし、ベンダーは工場環境に合わせたディープ・パケット・インスペクションの統合を推進しています。シスコの2025年度第2四半期決算では、顧客のネットワーキングとセキュリティの統合プラットフォームへの集約に伴い、セキュリティの売上が2倍以上に増加しました。導入の複雑さが、ダウンタイムを長引かせることなくブラウンフィールド工場を移行できるプロフェッショナル・サービスへの需要を引き起こしました。コンバージド・デプロイメントが成熟するにつれ、最高情報セキュリティ責任者は、単一のコンソールからプロセス・コントローラ、企業ラップトップ、リモート・メンテナンス・リンクの異常を相関させるソリューションを求めています。

断片化されたファームウェア・アップデートのエコシステム

一般的なマイクロコントローラの53,000のファームウェア・イメージを分析したところ、99.43%が平文で保存されており、攻撃者にブート・ローダと秘密情報への直接アクセスを提供していました。自動化された無線アップデートのパイプラインを維持しているベンダーはわずか3分の1にすぎず、古いコンポーネントは平均1.34年間パッチが適用されないまま放置されています。EUの規則では、自動アップデートを強制しており、リモートフラッシュプロセスの再設計を余儀なくされています。アップデートのためのダウンタイムは1時間あたり数十万米ドルのコストがかかるため、産業事業者は躊躇し、重要なインフラ内部でパッチ未適用の資産が存続します。その結果、セキュリティ債務が拡大し、高度な認証フレームワークの採用が遅れることになります。

セグメント分析

ネットワーク・セキュリティは、2024年のIoTセキュリティ市場売上高の42%を占め、ネットワーク・エッジを唯一統一的に制御可能な実施ポイントとして扱う企業に牽引されています。ファイアウォール、マイクロセグメンテーション、セキュアなSD-WANポリシーは、しばしばチップレベルのセーフガードを持たない異種エンドポイント間の東西トラフィックを制限します。生産ラインがレガシーなプログラマブルロジックコントローラを分析クラウドに接続するにつれて、検査エンジンは標準IPと並んで産業用プロトコルを解析するようになり、特殊な脅威情報フィードが要求されるようになりました。また、クラウド対応の更新経路を説明することをベンダーに義務付けるFCC規則も、パッチのステータスを検証するためにファイアウォールとプロキシの遠隔測定を統合するプロバイダーへの買い手を誘導しています。

クラウド/仮想セキュリティは、プラットフォームがセキュリティ・アズ・ア・サービスに移行するのに伴い、2030年までのCAGRが35.45%になると予測されます。柔軟なキャパシティは、大規模なファームウェア・アップデートのプッシュやビデオ・センサーからのバックホールによるバーストと整合します。企業は、デバイスの近くで実施する一方で、相関性のある異常検知のために集中的にホストされた分析にログを転送することで、待ち時間のバランスをとる。LEAのような軽量暗号スイートは、AES-128よりも消費電力が30%少なく、コイン電池で動くタグでもリアルタイムの暗号化が可能です。クラウド・ポリシー・エンジンとローカル・エンフォースメント・エージェントを融合させるベンダーは、5G RedCapによって工場フロアの帯域幅が拡大すれば、さらなるIoTセキュリティ市場シェアを獲得する態勢を整えています。

2024年のIoTセキュリティ市場規模では、暗号化ライブラリ、IDプラットフォーム、デバイスSDKにパッケージされたランタイム異常検知エージェントなどのソリューションが58%のシェアを占めています。事前認証されたスタックは、ETSI EN 303 645やISO 27400に基づくコンプライアンス監査を短縮するため、バイヤーは依然として規制チェックリストを満たすソフトウェアライセンスに予算を割り当てています。しかし、サービス、特に管理された検知と対応は、人材不足により事業者が24時間365日の監視をアウトソーシングするようになるため、CAGR 36.08%で増加します。

EUが2025年1月にサイバーレジリエンス法の段階的施行を開始し、メーカーが製品発売前にサプライチェーンのリスク評価を文書化することを余儀なくされたため、専門家によるコンサルティング需要が増加しました。マネージド・セキュリティ・サービス・プロバイダーは、ツールを一元化し、顧客間で脅威情報を共有することで、かつてはグローバル・ブランドだけに許されていた機能を中堅公益企業が利用できるようになりました。SOCチームがアラートをトリアージするAIコパイロットを統合することで、人員は横ばいでもサービスマージンは拡大し、製品販売から経常収益モデルへの構造シフトが強化されます。

モノのインターネット(IoT)セキュリティ市場レポートは、セキュリティタイプ(ネットワークセキュリティ、エンドポイント/デバイスセキュリティ、アプリケーションセキュリティ、クラウド/仮想セキュリティ)、コンポーネント(ソリューションとサービス)、エンドユーザー産業(スマート製造、コネクテッドヘルスケア、自動車とモビリティ、エネルギーと公益事業、その他)、展開モード(オンプレミス、クラウド/SECaaS、ハイブリッドエッジ)、地域別に分類されています。

地域分析

北米は、セキュアアップデートの仕組みを文書化するベンダーを優遇するFCCラベリングスキームなどの連邦政府のイニシアチブに支えられ、2024年の世界売上高の35%を維持した。企業は早くからAI対応アナリティクスを採用し、広範なクラウドインフラと成熟したSOCスタッフを活用しています。国土安全保障省は、重要インフラへの外国からの侵入を最重要リスクと位置づけ、水道施設やパイプラインの監視試験に対する連邦政府の助成金を後押ししています。カナダは米国のアプローチを踏襲しており、メキシコのニアショアリング・ブームでは、国境を越えた物流ハブ全体の統合セキュリティが必要とされています。シリコンバレーとオースティンを中心に新興企業が集積し、特許取得済みのファームウェア・インテグリティとポスト量子暗号ソリューションをフォーチュン500社のサプライチェーンに送り込んでいます。

アジア太平洋地域は、スマートシティの積極的な展開と消費者向けIoTの大量導入に後押しされ、CAGR 35.49%の急成長が予測される地域です。中国では、2024年8月までに25億7,000万台の接続端末が報告されており、トラフィックを認証しボットネット活動をブロックするための地元通信事業者の能力が伸びています。日本の総務省は2024年に安全なスマートシティ・ガイドラインを発表し、ゼロトラストを最初から組み込んだ自治体調達を促進します。韓国の6G調査には、IoTエンドポイント向けの量子耐性鍵交換が含まれており、標準が安定すれば国内ベンダーは輸出契約を獲得できます。インドネシアとベトナムの政府は現在、サイバー衛生監査を製造業のインセンティブに組み込んでおり、外国人投資家に認定セキュリティ・プラットフォームの購入を促しています。

欧州では、生の量よりも規制の力を活用しています。サイバー・レジリエンス法(Cyber Resilience Act)は、欧州圏で販売されるすべてのコネクテッド製品に対し、脅威のモデル化、脆弱性の開示、生涯にわたる更新方針を文書化することを義務付けています。欧州以外のメーカーは市場からの排除を避けるためにこれを遵守しており、規制の影響力を世界中に輸出しています。英国のPSTI法は、家電製品の棚からデフォルトのパスワードを削除し、基本的な回復力を強化します。ドイツのIndustrie 4.0プロジェクトは、IEC 62443制御によって保護された決定論的ネットワーキングを重視し、フランスのメトロポリタンデータプラットフォームは、エッジゲートウェイと集中分析間のエンドツーエンドの暗号化を要求しています。EUのデジタル・欧州・プログラム(Digital Europe Programme)は、中小企業による認証済みセキュリティ・スタックの採用を助成しており、マネージド・サービス・プロバイダーにとって対応可能な市場を拡大しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- データ漏洩が導く規制当局の監視

- OT+ITセキュリティ・スタックの融合

- シフト・レフトの製品設計義務

- AIを活用した適応型脅威分析

- 遠隔資産における衛星ベースのNB-IoT展開

- 重要産業におけるセキュアなIoTへの需要の高まり

- 市場抑制要因

- 細分化されたファームウェア・アップデートのエコシステム

- レガシー・ブラウンフィールド・デバイスのリフレッシュの遅れ

- IoTに特化したサイバー人材の不足

- 暗号化のためのエッジ計算能力の限界

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- セキュリティ・タイプ別

- ネットワーク・セキュリティ

- エンドポイント/デバイス・セキュリティ

- アプリケーション・セキュリティ

- クラウド/仮想セキュリティ

- コンポーネント別

- ソリューション

- IAMとPKI

- DDoSプロテクション

- IDS/IPS

- 暗号化とトークン化

- サービス

- プロフェッショナル・サービス

- マネージド・セキュリティ・サービス

- ソリューション

- エンドユーザー業界別

- スマート・マニュファクチャリング

- コネクテッド・ヘルスケア

- 自動車およびモビリティ

- エネルギーおよび公益事業

- BFSI

- 政府とスマートシティ

- 小売・物流

- 展開モード別

- オンプレミス

- クラウド/SECaaS

- ハイブリッド・エッジ

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Cisco Systems

- IBM

- Broadcom(Symantec)

- Palo Alto Networks

- Check Point

- Fortinet

- Microsoft

- Trend Micro

- Armis

- Infineon Technologies

- ATandT Cybersecurity

- Darktrace

- SecureWorks

- Rapid7

- Trustwave

- Thales

- RSA Security

- Qualys

- Kaspersky

- Zscaler