|

市場調査レポート

商品コード

1907220

保険テレマティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Insurance Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 保険テレマティクス:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

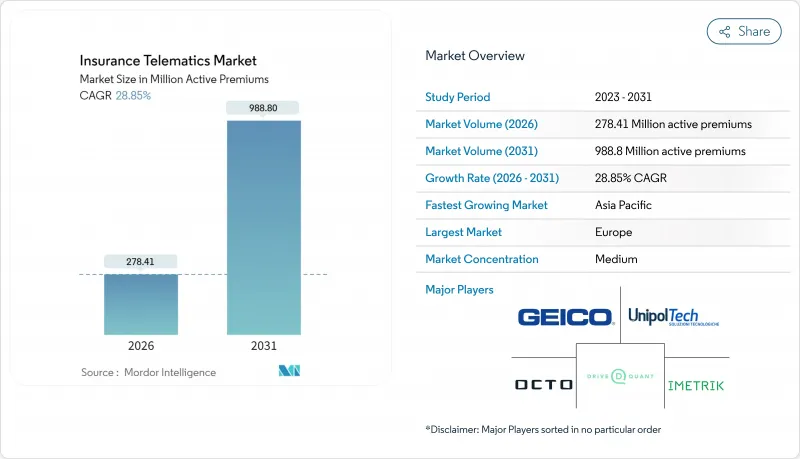

保険テレマティクス市場の規模は、2026年には2億7,841万件の有効保険料と推定されております。

これは2025年の2億1,607万件から成長した数値であり、2031年には9億8,880万件に達すると予測されております。2026年から2031年にかけてはCAGR28.85%で拡大する見込みです。

市場規模の拡大は、リアルタイム運転分析、自動車のコネクティビティ向上、AIを活用した不正検知スコアリングに依存するデータ駆動型価格設定モデルの保険会社による急速な採用を反映しています。欧州の保険会社は先行者優位性を維持していますが、アジア太平洋地域では規制要件とスマートフォン普及率の上昇を背景に、最も急激な導入曲線を示しています。競合環境は、独自の車両データを活用する技術に精通した保険会社やOEM専属プログラムに有利です。データプライバシーコンプライアンスコストやアフターマーケット用ドングルに関連するサイバーセキュリティリスクが逆風要因となっていますが、スマートフォン中心のプラットフォームが導入障壁を低減し、対象顧客層を拡大しているため、勢いは持続しています。

世界の保険テレマティクス市場の動向と洞察

保険会社の使用量ベース保険モデルへの急速な移行

ダイレクト・アシュアランス社は2024年に「YouDrive」契約を27%拡大し、顧客1人あたり平均保険料を200ユーロ(213米ドル)削減。リスク価格設定において、静的な人口統計データよりもリアルタイム行動データが優位であることを示しました。プログレッシブ社は2024年の正味書込保険料が744億米ドル(前年比21%増)と報告し、テレマティクスプログラムが主要な成長要因となっています。ケンブリッジ・モバイル・テレマティクス社が2025年に日本のドライバー100万人へ拡大した事例が示すように、競合優位性を生むのはデータの量ではなく速度です。走行距離に応じた保険料設定商品が普及する中、既存保険会社はモバイルテレマティクスを迅速に統合しなければシェア喪失のリスクに直面します。

自動車コネクティビティの革新がインフラ変革を推進

5GとeSIM技術により、車両は常時接続のデータハブへと変貌を遂げています。ドイツテレコムと共同開発したBMWのiXプラットフォームは、テレマティクスとインフォテインメント通信を分離するデュアルSIM接続を実現し、堅牢なデータストリームを確保しています。G+DのデュアルアクティブSIMアーキテクチャは、無線更新(OTA)のセキュリティを強化し、世界のローミングの継続性を保証します。エリクソンのIoTアクセラレータは、自動車メーカーが大規模なリモートSIMプロビジョニングを統合的に管理することを可能にします。組み込み型接続技術は、アフターマーケットハードウェアへの依存を解消し、データ精度を高め、事故発生時の即時通知を可能にします。これにより、保険会社の価値提案は、事後対応型の保険金支払から、事前予防型のリスク管理へと進化します。

データプライバシー規制が導入の複雑化を招く

欧州データ保護委員会は、車載データに関して明示的な同意、細分化された目的限定、ユーザーの撤回権を義務付けており、導入サイクルを延長し、コンプライアンスコストを増加させています。中国では、国境を越えた転送前に現地でのデータ保存とセキュリティ評価が義務付けられており、世界のプラットフォームを分断し、アーキテクチャ費用を膨らませています。小規模な保険会社は、継続的なプライバシー監査のためのリソースを欠いていることが多く、コンプライアンスのオーバーヘッドをより広範なポートフォリオに分散できる大手保険会社へ市場シェアがシフトする傾向にあります。

セグメント分析

運転行動管理型保険商品はCAGR31.28%で拡大しており、安全な加速・制動・コーナリングを評価する保険会社が増える中、保険テレマティクス市場の平均成長率を上回っています。インドの2025年規制では、保険会社が走行距離連動型保険を標準自動車保険オプションとして提供することが義務付けられ、UBI(使用量連動型保険)の普及を促進しています。走行距離連動型保険(PAYD)は販売数量で首位を維持していますが、市場飽和に直面しています。一方、走行距離と運転行動を組み合わせたハイブリッド型保険(MHYD)は、より精緻なリスクスコアリングを実現しています。ケンブリッジ・モバイル・テレマティクスのDriveWellプラットフォームは、フィードバックループをゲーミフィケーション化することで保険金請求頻度を20%削減し、MHYDの経済性を実証しています。

導入障壁は主にドライバーのプライバシー認識とセンサー校正にありますが、スマートフォンテレマティクスの受動的データ収集がこれらの摩擦を軽減します。規制当局がエコドライブ促進策を推進する中、MHYDは都市部排出ガス削減目標と密接に連動し、次世代モビリティ保険の基盤として位置づけられています。

OBD-IIドングルは2025年に保険契約の38.66%を占めましたが、スマートフォンアプリのCAGR32.62%に伴い減少傾向にあります。Smartcar社は、ドングルが物流コスト・改ざんリスク・精度問題を引き起こし、保険会社の投資利益率を低下させると指摘しています。一方、スマートフォンセンサーとクラウドAIを組み合わせれば、ハードウェアの追加コストなしで同等の事象解決が可能です。OEM組み込みモジュールは高級車向けにプレミアムな位置付けを確立し、セキュアブートチェーンと高レートCANデータを提供しますが、データ共有契約に依存します。法的な追跡可能性のために封印されたハードウェアを義務付ける管轄区域では、ブラックボックス型デバイスが依然として重要性を保っています。

移行の成功は、ユーザー体験を維持しつつ信頼性の高いデータを確保するためのバッテリー最適化とモーション共同処理にかかっています。ZendriveのモバイルSDKは98%の走行検知精度を示し、スマートフォンの実用性を証明しています。

保険テレマティクスレポートは、利用タイプ(PAYD、PHYD、MHYD)、技術プラットフォーム(OBD-IIドングル、OEM組み込みモジュール、スマートフォン中心、ブラックボックス/ハードワイヤード)、車両タイプ(乗用車、軽商用車、重商用車)、エンドユーザー(個人向け保険、法人向け保険など)、流通チャネル(消費者向け直接販売、ブローカー/代理店など)、地域別に分類されています。市場予測は価値(有効保険料)ベースで提供されます。

地域別分析

欧州は、GDPRに基づく消費者信頼と厳格な道路安全政策の強みにより、2025年に32.41%の市場シェアで首位を占めました。EIOPAの調査では、保険会社の17%が既にテレマティクス製品を販売しており、今後施行されるEUデータ法がデータ共有権を正式化することで導入が促進されると予想されます。ロンドンやミラノなど渋滞料金制度を導入している都市での補助金制度は、走行距離課金プログラムの普及をさらに加速させています。

アジア太平洋地域は、インドがAIS-140位置追跡装置を義務化し、中国が自動車データセキュリティを標準化する中、2031年までに32.47%のCAGRで推移すると予測されます。中国規制当局は新エネルギー車(NEV)の安全性分析にテレマティクスを推進し、EVドライバー向けの保険料割引を実現しています。日本のソルベンシー改革では、技術を活用したリスク軽減に対して資本負担軽減が適用され、保険会社がテレマティクス基盤への予算配分を促進するインセンティブとなっています。

北米では着実な成長が続いております。プログレッシブ社のテレマティクス導入率は2024年に新車保険契約の45%に達し、68%という優れたコンバインドレシオを支えました。データプライバシー規制のばらつきや訴訟リスクの高まりが成長加速を抑制する一方、高いスマートフォン普及率が勢いを維持しております。

中東・アフリカ、南米は依然として発展途上ながら有望です。政府のデジタル化政策と自動車普及率の上昇がテレマティクス導入の基盤を整え、輸入業者は差別化を図るため接続機能の組み込みに意欲的です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストサポート(3ヶ月間)

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 保険会社の使用量ベース保険(UBI)への急速な移行

- 自動車コネクティビティの革新(5G、eSIM)

- 道路安全規制およびCO2排出規制の強化

- OEM APIの収益化義務化

- 都市渋滞対策による走行距離連動型補助金

- AIを活用した不正スコアリングによる損害率の低下

- 市場抑制要因

- データプライバシーと同意に関する障壁(GDPR、CPRA)

- デバイス/データ品質の相互運用性ギャップ

- アフターマーケット向けドングルに対するCANバスサイバー攻撃の増加

- 低リスクドライバーの退出による逆選択現象

- 業界バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 用途別

- PAYD(走行距離連動型)

- PHYD(運転行動連動型)

- MHYD(運転方法管理型)

- 技術プラットフォーム別

- OBD-IIドングル

- 組み込みOEMモジュール

- スマートフォン中心

- ブラックボックス/ハードワイヤード

- 車両タイプ別

- 乗用車

- 小型商用車

- 大型商用車

- エンドユーザー別

- 個人向け保険会社

- 商業保険会社

- 自動車メーカー直営販売会社

- フリート管理サービスプロバイダー

- 流通チャネル別

- 消費者向け直接販売

- ブローカー/エージェント仲介

- OEM/ディーラー向けバンドル

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他のアジア

- 中東

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- エジプト

- その他アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Berkshire Hathaway Inc.-GEICO

- Unipol Gruppo SpA-UnipolTech

- Octo Telematics SpA

- DriveQuant SAS

- IMS(Global)Ltd.

- AXA SA

- The Floow Ltd.

- LexisNexis Risk Solutions(RELX PLC)

- Vodafone Group PLC-Vodafone Automotive SpA

- Viasat Group SpA

- Targa Telematics SpA

- Cambridge Mobile Telematics Inc.

- Allstate Corp.