|

市場調査レポート

商品コード

1432886

小麦種子処理:世界市場シェア分析、産業動向、統計データ、成長予測(2024~2029年)Global Wheat Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 小麦種子処理:世界市場シェア分析、産業動向、統計データ、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

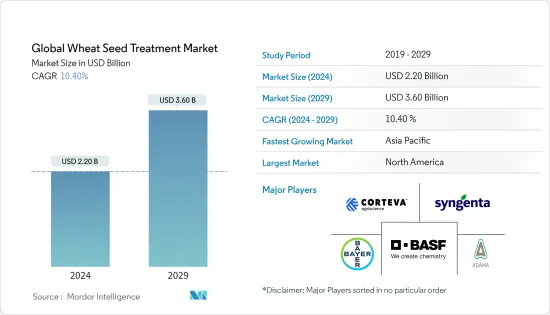

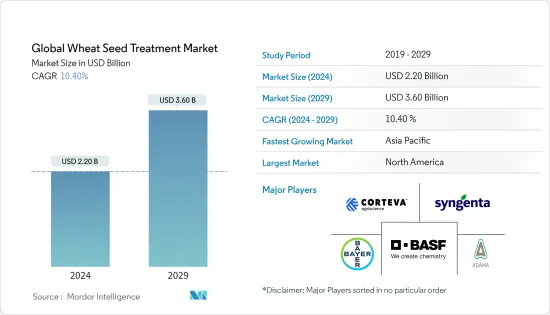

世界の小麦種子処理市場規模は、2024年に22億米ドルと推定され、2029年までに36億米ドルに達すると予測されており、予測期間(2024年から2029年)中に10.40%のCAGRで成長します。

小麦の貿易の増加、その根底にある需要の増加、および害虫や病気の出現により、小麦の収量を改善する必要があり、これにより小麦種子に対する種子処理の使用が強化され、種子の生産が促進されています。治療市場。

小麦種子処理市場は北米が独占していますが、アジア太平洋と南米は急速な市場成長を示しています。米国農務省(USDA)の2019年の報告書によると、世界の小麦供給量は2017年と比較して490万トン増加し、2018年の世界生産量は330万トンに増加しました。 2018年のインドの生産量は1億120万トン、欧州連合(EU)の生産量は1億5,380万トンでした。生産量の増加は、気候から種子を保護する上で費用対効果が高く効率的であるため、小麦種子処理製品の需要が高まっていることを示しています。逆境。

COVID-19感染症のパンデミックは、農家にとって重要な中間投入物の入手可能性に影響を与えました。新型コロナウイルスが作付けシーズンの直前にカナダに到達したため、種子や農薬製品の配送に混乱が生じる可能性について懸念が集中しました。したがって、農薬などの投入物の入手可能性の低さおよび/または価格の高さは、結果として種子処理市場にも同様に収量に重しを与える可能性があります。

小麦種子処理市場動向

種子処理の増加につながる不利な生産要因

小麦の生育には理想的な気温と降水量が範囲内になければならないため、作物の生産性は主に気候条件によって決まります。気候条件に加えて、害虫や病気の蔓延の増加により、小麦栽培地域では深刻な作物の損失が発生しました。したがって、高品質の種子にかかる高額なコストを考慮して、農家は作物を不利な条件から守るために種子処理を実践することが増えています。これは、世界的に小麦種子処理市場の成長を推進しています。中国は2020年に主要な作物害虫や病気の発生により作物損失に見舞われ、2019年よりも大きかった。具体的には小麦黒星病が大量に発生する可能性があります。

さらに、干ばつと気候変動は、ロシア、ウクライナ、カザフスタン(RUK)地域の穀物生産と世界の食糧安全保障に対する重大な脅威となっています。深刻な干ばつは、これらの地域の小麦生産に大きな影響を与えています。世界の需要に対応するため、小麦生産者は生産成果と収益の両方で小麦の収量を高めることに重点を置いています。種子処理は、土壌媒介害虫や病原菌と戦うための最も重要な手段の1つであり、小麦種子処理の世界市場には将来の市場成長の機会があり、種子処理製品の需要が高まると予想されています。最適な作物生産量を確保します。

北米-小麦種子処理の最大の市場

北米は小麦種子処理化学物質の採用率が高いため、最大の小麦種子処理市場になると予想されており、予測期間中に堅調な成長率を記録しています。小麦種子処理市場の需要は、世界の需要によって牽引されています。小麦は、作付面積、生産量、農業総収入において、米国の畑作物の中でトウモロコシと大豆に次いで第3位にランクされています。 USDAの報告書によると、2019年の小麦の総生産量は、4,780万エーカーの農地で冬小麦、春小麦、デュラム小麦合わせて18億8,400万ブッシェルでした。この地域では、小麦さび病、フザリウム属、線虫による毎年の被害が大きな懸念となっています。作物の経済的重要性を考慮して、多くの企業や政府団体は、新しい種子処理技術の革新のための研究開発への資金提供に資金を支出しています。 2017年、シンジェンタは種子処理技術の研究開発を行うため、ミネソタ州スタントンに北米種子管理研究所を開設しました。シンジェンタはこの研究所を通じて、顧客の特定のニーズと農場や土壌の状態に適した最新技術に基づいてカスタマイズされたソリューションを顧客に提供します。

小麦種子処理業界の概要

小麦種子処理市場は、主に新たな開発が行われている欧州および北米に企業が集中しているため、大手小麦種子処理化学会社間で統合されています。さらに、すべての大手企業は、アジア太平洋、南米、アフリカの新興市場の獲得にも注力しています。たとえば、BASFは2017年に、スタミナ F4シリアル殺菌剤種子処理と名付けられた新しい小麦種子処理を発売し、より一貫した継続的な病気の管理を実現しました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 産業の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 用途

- 化学

- バイオ

- 機能

- 種子保護

- 種子強化

- その他の機能

- 用途技術

- 種子コーティング

- 種子ペレット化

- 種子ドレッシング

- その他の用途技術

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他北米地域

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- その他のアフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- Adama Agricultural Solutions Ltd

- Advanced Biological Marketing Inc

- BASF SE

- Bayer Cropscience AG

- Bioworks Inc.

- Corteva Agriscience

- Germains Seed Technology

- Incotec Group BV

- Nufarm Ltd

- Syngenta International AG

- Valent Biosciences Corp.

- Verdesian Life Sciences

第7章 市場機会と今後の動向

第8章 COVID-19が市場に与える影響

The Global Wheat Seed Treatment Market size is estimated at USD 2.20 billion in 2024, and is expected to reach USD 3.60 billion by 2029, growing at a CAGR of 10.40% during the forecast period (2024-2029).

Owing to the increasing trade of wheat, because of the underlying rise in demand, and the emergence of pests and diseases, there is a need to improve wheat yields, which is driving an enhanced usage of seed treatment on wheat seeds, thus driving the seed treatment market.

North America dominates the wheat seed treatment market, however, Asia-Pacific and South America are showing a rapid pace of market growth. As per the United States Department of Agriculture (USDA) report 2019, global wheat supplies have increased by 4.9 million metric ton and global production increased to 3.3 million metric ton in the year 2018, compared to 2017. In addition, the report estimates the wheat production for India was recorded at 101.2 million metric ton and for European Union (EU) at 153.8 million metric ton in 2018. The increasing production indicates a higher demand for wheat seed treatment products as it is cost-effective and efficient in protecting seeds against climatic adversities.

The COVID-19 pandemic affected the availability of key intermediate inputs for farmers. With COVID reaching Canada just before planting season, concerns were centered on possible disruptions of seeds and crop protection product delivery. Therefore, low availability and/or high prices of inputs such as pesticides could weigh on yields consequently, seed treatment market as well.

Wheat Seed Treatment Market Trends

Unfavorable Production Factors Leading to Increased Practice of Seed Treatment

Crop productivity is primarily determined by climatic conditions because ideal temperatures and precipitation must be in range for wheat growth. In addition to climatic conditions, increasing pest and disease infestation resulted in severe crop loss in wheat-growing regions. Therefore, taking into consideration of high cost involved in quality seeds, farmers are increasingly practicing seed treatment to protect crops against unfavorable conditions. This is driving the growth of the wheat seed treatment market, globally. China has suffered crop loss due to the occurrence of major crop pests and diseases in 2020, heavier than that of 2019. Specifically, wheat scab, which is likely to occur heavily.

Furthermore, droughts and climate change are the significant threats to grain production in the Russia, Ukraine, and Kazakhstan (RUK) region and for global food security. Severe droughts have been significantly affecting wheat production in these regions. To maintain pace with global demand, wheat producers focus on enhancing the wheat yield both in production outcome and revenue. Seed treatment, being one of the most important means of combating soil-borne pests and pathogens, it is anticipated that the global market for wheat seed treatment is anticipated to have the opportunity for future market growth, enhancing demand for seed treatment products, in order to ensure optimal crop output.

North America-Largest Market for Wheat Seed Treatment

North America is anticipated to be the largest wheat seed treatment market, owing to the higher adoption rate of seed treatment chemicals for wheat, recording a robust growth rate during the forecasted period. The demand for the wheat seed treatment market is driven by its global demand . Wheat ranks third among U.S. field crops in planted acreage, production, and gross farm receipts, behind corn and soybeans. As per the USDA report, in 2019 the total production of wheat was 1.884 billion bushels of winter, spring, and durum wheat on 47.8 million acres of cropland. Annual losses due to wheat rust, Fusarium spp, and nematode are a major concern in the region. Taking into account the economic importance of the crop, many companies and government associations are spending funds towards the funding of research and development for innovation of new seed treatment technology. In 2017, Syngenta opened a North American Seedcare Institute in Stanton, Minnesota for doing research and development on seed treatment technology. Through this institute, Syngenta provides customized solutions to customers based on their specific needs and the latest technology suited to the farm and soil condition.

Wheat Seed Treatment Industry Overview

The wheat seed treatment market is consolidated among the major wheat seed treatment chemical companies, owing to a high concentration of companies mainly in Europe and North America, where new developments are taking place. Additionally, all major companies are also focused on capturing the new emerging markets of Asia-Pacific, South America, and Africa. For instance, in 2017, BASF launched a new wheat seed treatment, named, Stamina F4 Cereals fungicide seed treatment, providing more consistent and continuous disease control.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Chemical

- 5.1.2 Biological

- 5.2 Function

- 5.2.1 Seed Protection

- 5.2.2 Seed Enhancement

- 5.2.3 Other Functions

- 5.3 Application Technique

- 5.3.1 Seed Coating

- 5.3.2 Seed Pelleting

- 5.3.3 Seed Dressing

- 5.3.4 Other Application Techniques

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Adama Agricultural Solutions Ltd

- 6.3.2 Advanced Biological Marketing Inc

- 6.3.3 BASF SE

- 6.3.4 Bayer Cropscience AG

- 6.3.5 Bioworks Inc.

- 6.3.6 Corteva Agriscience

- 6.3.7 Germains Seed Technology

- 6.3.8 Incotec Group BV

- 6.3.9 Nufarm Ltd

- 6.3.10 Syngenta International AG

- 6.3.11 Valent Biosciences Corp.

- 6.3.12 Verdesian Life Sciences