|

市場調査レポート

商品コード

1441610

LNGバンカリング:市場シェア分析、業界動向と統計、成長予測(2024~2029年)LNG Bunkering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| LNGバンカリング:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 125 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

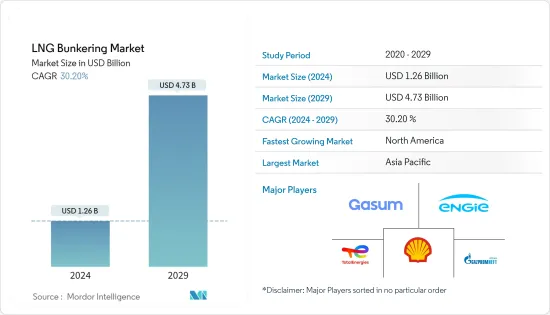

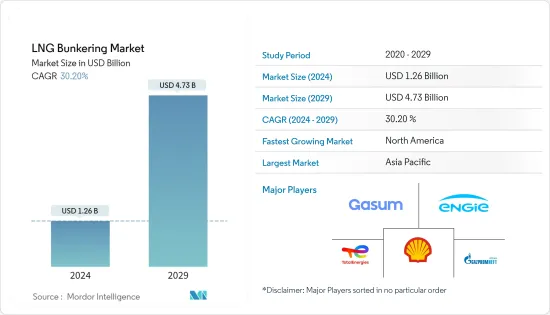

LNGバンカリング市場規模は2024年に12億6,000万米ドルと推定され、2029年までに47億3,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に30.20%のCAGRで成長します。

COVID-19感染症のパンデミック中、一時的な輸出入禁止により市場は低迷しました。しかし、海運によるバンカー燃料としてのLNGの需要の高まりにより、2021年下半期には市場は収益の減少から回復しました。市場の成長という点では、従来型燃料の硫黄含有量を制限する基準と効率の向上により、LNGバンカリングインフラストラクチャの需要が高まっています。さまざまな地域の船舶は、推進用の燃料としてLNGを徐々に採用し始めています。さらに、従来の燃料から硫黄分を減らすには高額なコストがかかり、経済性が損なわれる可能性があります。

主なハイライト

- タンカーフリートセグメントは、予測期間中に大幅な成長を遂げる可能性があります。

- バンカー燃料としてのLNGは、遵守期間の延長からGHG排出量の削減に至るまで、従来のバンカー燃料に比べて計り知れない利点をもたらします。 IMO規制の施行により、船舶は硫黄含有量の少ない燃料に切り替えることになるため、LNGは理想的な選択肢となり、バンカリング市場でのチャンスにつながります。

- 需要の大部分は米国とカナダから来ており、北米が市場を独占すると予想されています。

液化天然ガス(LNG)バンカリング市場動向

タンカーフリートが大幅な成長を示す

- タンカーフリートには、小型タンカー、中型タンカー、中距離1(MR1)、中距離2(MR2)、大型タンカー1(LR1)、大型タンカー2(LR2)、超大型原油運搬船(VLCC)、および超大型タンカーが含まれます。大型原油運搬船(ULCC)はタンカー容量によって異なります。

- タンカーフリートは、大量のガス/液体を保管または輸送するために使用されます。これらは、石油、ガス、化学物質、および植物油、淡水、ワイン、糖蜜などのその他の製品を保管および運搬するために使用されます。

- 2020年、国際海事機関は、海洋活動による温室効果ガスの排出を制限するために、燃料含有量に対する世界の硫黄含有量の新たな0.5%の上限を施行し、以前の3.5%から引き下げました。バンカー燃料としてのLNGは、NOx排出量を最大80%削減し、SOx粒子状物質を排除するなど、他の種類のバンカー燃料に比べて大きな利点をもたらし、最新のエンジン技術によりGHG排出量を最大23%削減します。競争力のある設計でLNGを使用して稼働する船舶は、従来の設計よりも長期間のコンプライアンスを保証します。これらの要因により、バンカー燃料としてのLNGの採用が増加し、タンカーによるLNG輸送が増加しています。

- 2020年末時点で、LNGタンカーの全フリートは642隻で構成され、総運用能力は9,340万立方メートルでした。 2020年には、さらに47隻の船舶がメーカーから引き渡され、40隻のタンカーが新規注文されました。発注書は2020年までに147戸、2,270万立方メートルで構成されています。

- したがって、燃料中の硫黄含有量に関する規制により、LNGは今後数年間の海洋活動に依存する燃料になると予測され、タンカーによるLNGバンカー燃料の輸送の増加につながります。

北米が市場を独占する

- 北米地域は、予測期間中にLNGバンカリング市場を独占する可能性が高く、需要のほとんどは米国とカナダからのものです。

- LNGバンカリング市場を牽引する主な要因は、海運業界における二酸化炭素排出量削減に向けたLNG需要の増加です。さらに、LNGはより優れた代替燃料であり、政府はLNG適応への取り組みを進めています。

- 2020年、国際海事機関は、海洋活動からの温室効果ガス排出を抑制するために、バンカー燃料の硫黄含有量の削減を実施しました。この要因により、IMO規制後のLNGは船舶用燃料の経済的な代替品となる可能性が高く、米国のLNGバンカリング市場は今後数年間で成長すると予想されています。

- 2022年 1月、米国の造船会社Fincantieri Bay Shipbuildingは、米国最大のLNGバンカリングバージの建造を開始しました。 LNGバンカリングバージは長さ126.8メートルの船で構成され、12,000立方メートルのLNGを収容する能力があります。プロジェクトの完成予定日は2023年です。

- さらに、2021年9月、スタビリス・ソリューションズ社はテキサス州のポート・イザベル物流オフショア・ターミナルおよびルイジアナ州のキャメロン教区ポート・ハーバー・ターミナル地区と船舶向けLNG給油サービスを開発するための覚書(MoU)を締結しました。

- 同様に、2021年4月、Wison Offshore &Marine(Wison)は、Pilot LNGのカナダのガルベストンLNGバンカー港プロジェクトのフロントエンドエンジニアリング開発(FEED)契約を受注し、2024年に操業開始予定です。

- カナダ政府は温室効果ガス排出量を大幅に削減することを約束しており、同国には天然ガスが豊富に供給されています。天然ガスを燃焼させると温室効果ガスの排出が少なくなるため、LNGはカナダの海運業界にとって優れた代替船舶燃料となっています。

- LNGベースの船舶の初期設置コストは高くなりますが、スクラバーを設置した古い船舶を運用する場合に比べて運用コストは低くなります。したがって、北米地域は、予測期間中にLNGバンカリング市場全体を支配する可能性があります。

液化天然ガス(LNG)バンカリング業界の概要

LNGバンカリング市場は適度に統合されています。主要企業には、Shell PLC、Gazprom Neft PJSC、TotalEnergies SE、Gasum Oy、Engie SAなどがあります。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査範囲

- 市場の定義

- 調査の前提条件

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 市場概要

- イントロダクション

- 2027年までの市場規模と需要予測(100万米ドル)

- 最近の動向と発展

- 政府の政策と規制

- 市場力学

- 促進要因

- 抑制要因

- サプライチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- エンドユーザー

- タンカーフリート

- コンテナフリート

- ばら積み貨物および一般貨物フリート

- フェリーとOSV

- その他のエンドユーザー

- 地域

- 北米

- 欧州

- アジア太平洋

- 中東とアフリカ

- 南米

第6章 競合情勢

- 合併と買収、合弁事業、コラボレーション、および契約

- 有力企業が採用した戦略

- 企業プロファイル

- Shell PLC

- ENN Energy Holdings Ltd

- Korea Gas Corporation

- Harvey Gulf International Marine LLC

- Gasum Oy

- Engie SA

- Gazprom Neft PJSC

- TotalEnergies SE

- Naturgy Energy Group SA

第7章 市場機会と将来の動向

The LNG Bunkering Market size is estimated at USD 1.26 billion in 2024, and is expected to reach USD 4.73 billion by 2029, growing at a CAGR of 30.20% during the forecast period (2024-2029).

During the COVID-19 pandemic, the market experienced a decline due to temporary bans on export and import. However, the market recovered from the declining revenues in the second half of 2021, owing to the rising demand for LNG as bunker fuel from maritime transport. In terms of market growth, the norms to restrict the sulfur content in conventional fuels and the increased efficiency are driving the demand for LNG bunkering infrastructure. The ships across various regions are slowly starting to adopt LNG as a fuel for propulsion. Moreover, reducing the sulfur content from conventional fuel requires high costs, which is likely to hamper its economic viability.

Key Highlights

- The tanker fleet segment is likely to witness significant growth during the forecast period.

- LNG as a bunker fuel presents immense benefits over conventional bunker fuel, ranging from increased length of compliance to reduced GHG emissions. With the IMO regulations in place, maritime vessels will be switching to less sulfur content fuel, making LNG an ideal choice and leading to opportunities in the bunkering market.

- North America is expected to dominate the market, with most of the demand coming from the United States and Canada.

Liquefied Natural Gas (LNG) Bunkering Market Trends

Tanker Fleet to Witness Significant Growth

- Tanker fleets include small tanker, intermediate tanker, medium-range 1 (MR1), medium-range 2 (MR2), large range 1 (LR1), large range 2 (LR2), very large crude carrier (VLCC), and ultra-large crude carrier (ULCC), which differ based on tanker capacity.

- Tanker fleets are used to store or transport gases/liquids in bulk amounts. These are used to store and carry oil, gas, chemicals, and other products, like vegetable oil, freshwater, wine, molasses, etc.

- In 2020, the International Maritime Organization enforced a new 0.5% global sulfur cap on fuel content, lowering from the earlier 3.5% to limit the greenhouse gas emissions from the marine activities. LNG as a bunker fuel presents significant advantages over other kinds of bunker fuels, such as reducing NOx emissions by up to 80% and eliminating SOx particulate matter, leading to a reduction in GHG emissions by up to 23% with modern engine technology. Vessels that run on LNG on a competitive design ensure longer compliance than conventional designs. These factors have led to increasing adoption of LNG as a bunker fuel and increasing transport of LNG through tankers.

- At the end of 2020, the total LNG tanker fleet consisted of 642 vessels with a total operational capacity of 93.4 million cubic meters. In 2020, 47 more vessels were delivered by the manufacturers and 40 new orders for tankers. The order book consisted of 147 units of 22.7 million cubic meters by 2020.

- Thus, with the regulations related to sulfur content in the fuel, LNG is projected to become a reliant fuel for maritime activity in the coming years, leading to the increased transportation of LNG bunker fuel through tankers.

North America to Dominate the Market

- The North American region is likely to dominate the LNG bunkering market during the forecast period, with most demand coming from the United States and Canada.

- The key factor driving the LNG bunkering market is the increased LNG demand to reduce the carbon footprint in the shipping industry. Furthermore, LNG is a better alternative fuel, and the governments have been taking initiatives for LNG adaptation.

- In 2020, the International Maritime Organization implemented the reduced sulfur content in bunker fuels to contain the GHG emission from maritime activity. Due to this factor, the US LNG bunkering market is expected to witness growth in the coming years, as LNG is likely to be an economical alternative for marine fuel after IMO's regulation.

- In January 2022, the US shipbuilder Fincantieri Bay Shipbuilding commenced the construction of the largest LNG bunkering barge in the United States. The LNG bunkering barge will consist of a 126.8 m vessel, which will have the capacity for 12,000 m3 of LNG. The expected completion date of the project is 2023.

- Furthermore, in September 2021, Stabilis Solutions Inc. signed a memorandum of understanding (MoU) with Port Isabel Logistical Offshore Terminal in Texas and Louisiana's Cameron Parish Port, Harbor & Terminal District to develop LNG refueling services for ships.

- Similarly, in April 2021, Wison Offshore & Marine (Wison) was awarded the Front-End Engineering Development (FEED) contract for Pilot LNG's Galveston LNG Bunker Port project in Canada, with operations slated to begin in 2024.

- The Canadian government made commitments to significantly reduce greenhouse gas emissions, and the country has an abundant supply of natural gas. Natural gas on combustion produces less greenhouse gas emissions, making LNG a better alternative marine fuel for the Canadian shipping industry.

- Although the initial installation cost of LNG-based vessels is high, the operational cost is lower compared to running old ships with installed scrubbers. Therefore, the North American region is likely to dominate the overall LNG bunkering market during the forecast period.

Liquefied Natural Gas (LNG) Bunkering Industry Overview

The LNG bunkering market is moderately consolidated. The major companies include Shell PLC, Gazprom Neft PJSC, TotalEnergies SE, Gasum Oy, and Engie SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End User

- 5.1.1 Tanker Fleet

- 5.1.2 Container Fleet

- 5.1.3 Bulk and General Cargo Fleet

- 5.1.4 Ferries and OSV

- 5.1.5 Other End Users

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Middle-East and Africa

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Shell PLC

- 6.3.2 ENN Energy Holdings Ltd

- 6.3.3 Korea Gas Corporation

- 6.3.4 Harvey Gulf International Marine LLC

- 6.3.5 Gasum Oy

- 6.3.6 Engie SA

- 6.3.7 Gazprom Neft PJSC

- 6.3.8 TotalEnergies SE

- 6.3.9 Naturgy Energy Group SA