|

市場調査レポート

商品コード

1687087

商用航空機キャビンシーティング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Commercial Aircraft Cabin Seating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 商用航空機キャビンシーティング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 193 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

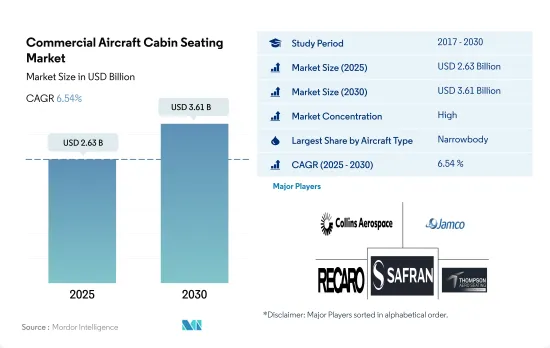

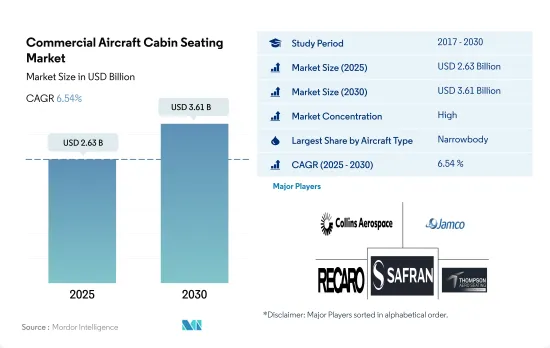

商用航空機キャビンシーティング市場規模は2025年に26億3,000万米ドルと推定・予測され、予測期間中(2025-2030年)にCAGR 6.54%で成長し、2030年には36億1,000万米ドルに達すると予測されます。

世界の機体拡大戦略により、ナローボディ機とワイドボディ機の取得が促進され、予測期間中に商用航空機の座席拡大が促進されると予想されます。

- 旅行者の嗜好の高まりにより、エコノミークラスよりも広いスペースを備えた座席構造の充実が不可欠になりつつあります。ナローボディ機が納入数を独占し、2017~2022年の全体の納入数の83%を占めました。客室クラス別では、2022年に納入された航空機の座席全体に占めるエコノミークラスとプレミアムエコノミークラスの座席の割合は、ナローボディ機が93%、ワイドボディ機が86%でした。

- ナローボディ機とワイドボディ機を含む旅客機カテゴリー全体では、2020年に30%の減少が見られ、これが世界の航空機シート需要に影響を与えました。ナローボディ機セグメントでは、2022年のエコノミーおよびプレミアムエコノミー席の世界シェアは94%であったが、ワイドボディ機では86%でした。ほとんどの座席がエコノミークラスに属しているエコノミー座席カテゴリーには、リージョナル航空の急増が追い風となっています。

- 航空会社は長距離路線でナローボディ機を頻繁に使用するようになり、人間工学に基づいたシートの市場導入が促進されています。例えば、アシアナ航空と大韓航空は、人間工学に基づいたデザイン、個別に調整可能なカーフレスト、プライバシー機能の導入により、フライト中の快適性と全体的な体験のレベル向上に取り組んでいます。

- 世界中の航空会社やOEMは、人間工学を導入することで軽量化を図り、座席の快適性を向上させる取り組みを強化しています。世界の航空会社の長距離路線ではナローボディ機の採用が増加しており、ナローボディ機への航空機用シートの配備を後押ししています。2023年から2030年にかけて、約13,358機の航空機が納入される見込みです。同地域の航空機増備計画は、ナローボディ機とワイドボディ機の両方の調達を促進すると予想されます。

予測期間中、アジア太平洋が最も活気のある市場になると予想される一方、北米市場は引き続き世界最大の市場になると予測されます。

- 航空会社にとって顧客体験は常に最優先事項です。乗客は旅行でポジティブな体験をしなければならないです。そのため、最高の体験を提供するために、世界の航空会社は乗客が快適に過ごせるような客室シートの近代化に力を入れています。

- 旅客輸送量の増加は、最終的に新たな航空機の調達と発注を促進し、航空機座席市場を押し上げる可能性があります。2022年10月現在、エミレーツ航空、カタール航空、エティハド航空、デルタ航空、アメリカン航空、ルフトハンザドイツ航空、トルコ航空、エールフランス航空、シンガポール航空、日本航空、全日空、中国国際航空など、世界のさまざまな航空会社がボーイングとエアバスの合計534機を発注しています。

- 航空機の重量を軽減し、客室スペースの効率と利用率を向上させるため、世界のさまざまな大手航空会社が軽量シートの採用を開始しました。例えば、アジア太平洋地域、大韓航空、アシアナ航空は、人間工学に基づいたシートデザイン、個別に調整可能なカーフレスト、プライバシー機能を備えたシートを採用することで、乗客の快適性の向上に努めています。カナダの航空会社ポーター航空は、北米のリージョナル航空機に軽量シートを導入しました。欧州では、航空会社のシートメーカーがチタンやカーボンファイバー製のシートを上級クラス向けに導入し始めています。乗客の快適性とプライバシーを向上させるこのような技術革新が、今後世界の民間航空機客室座席市場を牽引していくと予想されます。

- 2023年から2030年にかけて、約13,358機の航空機が納入される見込みです。北半球は世界最大の市場になると予想され、アジア太平洋地域は予測期間中に最も有利な市場になると予想されます。

世界の商用航空機キャビンシーティング市場動向

アフリカ諸国における航空需要の高まりが、新規航空機納入の需要を促進

- 航空旅客輸送量の増加は、航空会社が様々な国内路線や国際路線からの需要に対応するために新しい航空機を調達する原動力として重要な役割を果たしています。2021年、アフリカの航空旅客数は1億400万人に達し、2020年比で191%、2019年比で3%の伸びを示しました。航空会社は増大する航空需要に対応するため機体規模の拡大を図っており、アフリカ諸国全体で新型機に対する大きな需要を生み出しています。南アフリカ、エジプト、アルジェリアなどの主要国は、この地域の総旅客輸送量の40%を占めており、アフリカの他の国々と比べて新造航空機に対する高い需要を生み出しています。

- 2017年から2022年の間にアフリカ諸国全体で合計36機の新造航空機が納入され、歴史的期間中に同地域で納入された新造ジェット機は、世界の旅客機納入総数の1%未満でした。航空旅客輸送が生み出す需要は、最終的に航空機調達の増加につながる可能性があります。アフリカの主要航空会社には、エチオピア航空、エジプト航空、ロイヤル・エア・モロッコ、エア・アルジェリー、ケニア航空などがあります。2022年9月現在、他の航空会社の中には86機以上の航空機を滞留させているところもあります。86機のうち、52機はナローボディ機となる見込みです。燃費の良い長距離機の採用が増加していることと、格安航空会社の成功が拡大していることが、ナローボディ部門を牽引する主な要因です。こうした要因は、予測期間においてアフリカの客室内装品市場を押し上げる可能性があります。

COVID-19パンデミック後の国際旅客輸送量の増加が市場需要を牽引しています。

- COVID-19パンデミック後の2022年に国境を越えた旅行が徐々に回復するにつれて、アジア太平洋の航空会社は、人々の旅行願望と2年間の隔離期間に蓄積された貯蓄の現金化に刺激されて、暴走する需要に対応するために増便を急いです。その結果、2022年には、同地域の航空旅客輸送量は他の地域よりも急速にパンデミックから回復しました。例えば、2022年のアジア太平洋全体の航空旅客数は19億人を記録し、2021年比で6%、2020年比で151%の伸びとなりました。この地域の航空会社は、主要国における航空旅客輸送量の増加に対応するため、機材の拡張計画を実施しています。中国、インド、日本、インドネシアは同地域の航空旅客輸送量全体の70%を占めており、他のアジア太平洋諸国と比較して新造航空機に対する高い需要を生み出しています。

- アジア太平洋地域の航空会社はまた、世界的に経済状況が厳しさを増しているにもかかわらず、旅行需要が成長を促進し続けたため、国際航空旅客市場の順調な回復を目の当たりにしました。例えば、2022年8月の国際線旅客数は1,310万人を記録し、140万人であった2021年8月と比較すると836%の伸びとなりました。年初来の8ヵ月間における国際線旅客数の健全な伸びは、ビジネスおよびレジャー消費者からの強い旅行需要を示しています。同地域における航空旅客輸送量の急増は、今後の航空輸送業界を牽引するものと期待されます。

商用航空機キャビンシーティング業界の概要

商用航空機キャビンシーティング市場はかなり統合されており、上位5社で82.68%を占めています。この市場の主要企業は以下の通りです。 Collins Aerospace, Jamco Corporation, Recaro Group, Safran and Thompson Aero Seating(sorted alphabetically).

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月のアナリストサポート

目次

第1章 エグゼクティブサマリーと主な調査結果

第2章 レポートのオファー

第3章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

- 調査手法

第4章 主要産業動向

- 航空旅客輸送量

- アジア太平洋

- 欧州

- 中東

- 北米

- 新規航空機納入数

- アフリカ

- アジア太平洋

- 欧州

- 中東

- 北米

- 南米

- 一人当たりGDP(現在価格)

- アジア太平洋

- 欧州

- 中東

- 北米

- 航空機メーカーの収入

- 航空機受注残

- 受注総額

- 空港建設支出(継続中)

- 航空会社の燃料費

- 規制の枠組み

- バリューチェーンと流通チャネル分析

第5章 市場セグメンテーション

- 航空機タイプ

- ナローボディ

- ワイドボディ

- 地域

- アジア太平洋

- 国別

- 中国

- インド

- インドネシア

- 日本

- シンガポール

- 韓国

- その他アジア太平洋地域

- 欧州

- 国別

- フランス

- ドイツ

- スペイン

- トルコ

- 英国

- その他欧州

- 中東

- 国別

- サウジアラビア

- アラブ首長国連邦

- その他中東

- 北米

- 国別

- カナダ

- 米国

- 北米のその他

- 世界のその他の地域

- アジア太平洋

第6章 競争情勢

- 主要な戦略動向

- 市場シェア分析

- 企業情勢

- 企業プロファイル

- Adient Aerospace

- Collins Aerospace

- Expliseat

- Jamco Corporation

- Recaro Group

- Safran

- STELIA Aerospace(Airbus Atlantic Merginac)

- Thompson Aero Seating

- ZIM Aircraft Seating GmbH

第7章 CEOへの主な戦略的質問

第8章 付録

- 世界概要

- 概要

- ファイブフォース分析フレームワーク

- 世界のバリューチェーン分析

- 市場力学(DROs)

- 情報源と参考文献

- 図表一覧

- 主要洞察

- データパック

- 用語集

The Commercial Aircraft Cabin Seating Market size is estimated at 2.63 billion USD in 2025, and is expected to reach 3.61 billion USD by 2030, growing at a CAGR of 6.54% during the forecast period (2025-2030).

Fleet expansion strategies globally are anticipated to facilitate the acquisition of narrowbody and widebody aircraft and stimulate the expansion of commercial aircraft seating during the forecast period

- An enhanced seating structure with more developed space than economy-class seats is becoming highly essential due to rising preferences from travelers. The narrowbody aircraft dominated the number of deliveries, with 83% of the overall deliveries during 2017-2022. In terms of cabin class, economy and premium economy seats accounted for 93% of the overall seats of the aircraft delivered in 2022 for narrowbody aircraft and 86% for widebody aircraft.

- The overall passenger aircraft category, including narrowbody and widebody aircraft, witnessed a decline of 30% in 2020, which affected the demand for aircraft seats globally. In the narrowbody segment, the share of economy and premium economy seats globally was 94% in 2022, while their share was 86% in widebody aircraft. The surge in regional aviation has aided the economy seating category, where most seats belong to economy class.

- Airlines are using narrowbody aircraft more frequently on longer routes, facilitating the introduction of ergonomic seats in the market. For instance, Asiana Airlines and Korean Air are working to improve the level of comfort and overall experience during the flight by implementing ergonomic design, individually adjustable calf rests, and privacy features.

- Aviation operators and OEMs across the world are stepping up their efforts to reduce weight and improve the comfort features in seats by implementing ergonomics. The adoption of narrowbody aircraft in the longer haul routes airlines worldwide has increased, thus aiding the deployment of aircraft seats in narrowbody aircraft. Around 13,358 aircraft are expected to be delivered between 2023 and 2030. The fleet expansion plans in the region are expected to aid the procurement of both narrowbody and widebody aircraft.

The North market is projected to remain the largest in the world, while Asia-Pacific is anticipated to the most lucarative market during the forecast period.

- Customer experience is always the top priority for airlines. Passengers must have a positive experience with travel. Thus, to provide the best experience, airlines worldwide focus on modernized cabin seats that comfort passengers.

- The increased passenger traffic may eventually drive new aircraft procurements and orders, thus boosting the aircraft seating market. As of October 2022, a total of 534 Boeing and Airbus planes were ordered by various airlines globally, such as Emirates, Qatar Airways, Etihad Airways, Delta Airlines, American Airlines, Lufthansa, Turkish Airlines, Air France, Singapore Airlines, Japan Airlines, ANA, and Air China.

- Various major airlines worldwide started adopting lighter seats to reduce the aircraft's weight and improve cabin space efficiency and utilization. For instance, Asia-Pacific, Korean Air, and Asiana Airlines are working to improve passenger experience by adopting ergonomic seat designs, individually adjustable calf rests, and privacy-featured seats. The Canadian airline Porter Airlines integrated lightweight seats in its regional aircraft in North America. In Europe, airline seat manufacturers have started introducing titanium and carbon fiber seats for the higher-end classes. Such innovations to improve passenger comfort and privacy are expected to drive the global commercial aircraft cabin seating market in the future.

- Around 13,358 aircraft are expected to be delivered between 2023 and 2030. The North is expected to be the largest market globally, while the Asia-Pacific region is expected to be the most lucrative market in the forecast period.

Global Commercial Aircraft Cabin Seating Market Trends

Growing demand for air travel in African countries is driving the demand for new aircraft deliveries

- Rising air passenger traffic plays a vital role in driving airlines to procure new aircraft to meet the demand from various domestic and international routes. In 2021, air passenger traffic in Africa reached 104 million, a growth of 191% compared to 2020 and 3% compared to 2019. Airlines are looking to expand their fleet sizes to cater to the growing demand for air travel, which is generating significant demand for new aircraft across African nations. Major countries, such as South Africa, Egypt, and Algeria, accounted for 40% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other countries across Africa.

- A total of 36 new aircraft were delivered across African countries between the years of 2017 and 2022, and the new jet deliveries in the region during the historic period accounted for less than 1% of the total worldwide passenger aircraft deliveries. The demand generated by air passenger traffic may eventually lead to an increase in aircraft procurements. Some of the major airlines in Africa are Ethiopian Airlines, Egyptair, Royal Air Maroc, Air Algerie, and Kenya Airways. As of September 2022, some other airlines had a backlog of over 86 aircraft. Of the 86 jets, 52 are expected to be narrowbody aircraft. The increasing adoption of fuel-efficient, long-range aircraft and the growing success of low-cost carriers are the major factors driving the narrowbody segment. Such factors may boost the African cabin interior market in the forecast period.

An increase in international passenger traffic post the COVID-19 pandemic is driving market demand

- As cross-border travel was progressively restored in 2022 post the COVID-19 pandemic, the carriers in Asia-Pacific raced to increase their flights to meet runaway demand, stimulated by people's desire to travel and cash in on savings accumulated in the two years of isolation. As a result, in 2022, the air passenger traffic in the region recovered more rapidly from the pandemic than in the other regions. For instance, in 2022, air passenger traffic in the whole of Asia-Pacific was recorded at 1.9 billion, a growth of 6% compared to 2021 and 151% compared to 2020. Airline companies in the region are implementing fleet expansion plans to cater to the growing air passenger traffic in the major countries. China, India, Japan, and Indonesia accounted for 70% of the total air passenger traffic in the region, generating higher demand for new aircraft compared to other Asia-Pacific countries.

- Airlines in Asia-Pacific also witnessed a good recovery in international air passenger markets as travel demand continued to fuel growth despite increasingly challenging global economic conditions. For instance, in August 2022, the region recorded 13.1 million international air passenger traffic, an 836% increase compared to August 2021, when it was recorded at 1.4 million. The healthy growth in international passenger traffic in the first eight months of the year showed strong travel demand from business and leisure consumers. The rapid increase in air passenger traffic in the region is expected to drive the air transport industry in the future.

Commercial Aircraft Cabin Seating Industry Overview

The Commercial Aircraft Cabin Seating Market is fairly consolidated, with the top five companies occupying 82.68%. The major players in this market are Collins Aerospace, Jamco Corporation, Recaro Group, Safran and Thompson Aero Seating (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Air Passenger Traffic

- 4.1.1 Asia-Pacific

- 4.1.2 Europe

- 4.1.3 Middle East

- 4.1.4 North America

- 4.2 New Aircraft Deliveries

- 4.2.1 Africa

- 4.2.2 Asia-Pacific

- 4.2.3 Europe

- 4.2.4 Middle East

- 4.2.5 North America

- 4.2.6 South America

- 4.3 GDP Per Capita (current Price)

- 4.3.1 Asia-Pacific

- 4.3.2 Europe

- 4.3.3 Middle East

- 4.3.4 North America

- 4.4 Revenue Of Aircraft Manufacturers

- 4.5 Aircraft Backlog

- 4.6 Gross Orders

- 4.7 Expenditure On Airport Construction Projects (ongoing)

- 4.8 Expenditure Of Airlines On Fuel

- 4.9 Regulatory Framework

- 4.10 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Aircraft Type

- 5.1.1 Narrowbody

- 5.1.2 Widebody

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.1.1 By Country

- 5.2.1.1.1 China

- 5.2.1.1.2 India

- 5.2.1.1.3 Indonesia

- 5.2.1.1.4 Japan

- 5.2.1.1.5 Singapore

- 5.2.1.1.6 South Korea

- 5.2.1.1.7 Rest of Asia-Pacific

- 5.2.2 Europe

- 5.2.2.1 By Country

- 5.2.2.1.1 France

- 5.2.2.1.2 Germany

- 5.2.2.1.3 Spain

- 5.2.2.1.4 Turkey

- 5.2.2.1.5 United Kingdom

- 5.2.2.1.6 Rest of Europe

- 5.2.3 Middle East

- 5.2.3.1 By Country

- 5.2.3.1.1 Saudi Arabia

- 5.2.3.1.2 United Arab Emirates

- 5.2.3.1.3 Rest of Middle East

- 5.2.4 North America

- 5.2.4.1 By Country

- 5.2.4.1.1 Canada

- 5.2.4.1.2 United States

- 5.2.4.1.3 Rest of North America

- 5.2.5 Rest of World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adient Aerospace

- 6.4.2 Collins Aerospace

- 6.4.3 Expliseat

- 6.4.4 Jamco Corporation

- 6.4.5 Recaro Group

- 6.4.6 Safran

- 6.4.7 STELIA Aerospace (Airbus Atlantic Merginac)

- 6.4.8 Thompson Aero Seating

- 6.4.9 ZIM Aircraft Seating GmbH

7 KEY STRATEGIC QUESTIONS FOR COMMERCIAL AIRCRAFT CABIN INTERIOR CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms