|

市場調査レポート

商品コード

1686659

パッケージ検査:市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Package Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パッケージ検査:市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

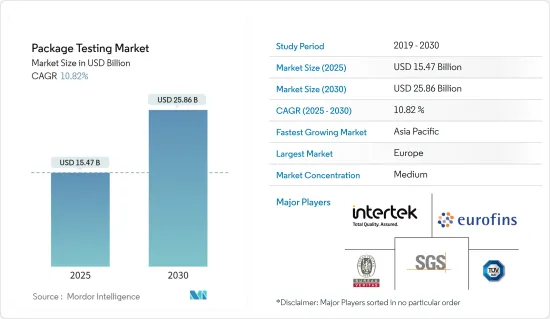

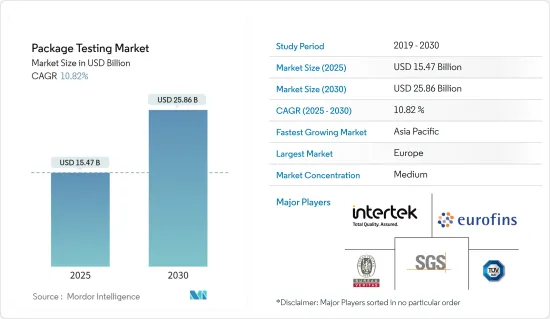

パッケージ検査市場規模は2025年に154億7,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは10.82%で、2030年には258億6,000万米ドルに達すると予測されます。

パッケージ検査は、ほぼすべてのサプライチェーンで重要な役割を果たしています。パッケージテストは、ビジネスのパッケージングが仕様に適合していることを保証し、コストのかかる製品の損傷、法的状況、劣悪なユーザー体験を回避します。パッケージ試験は、包装コストの節約、現実的な環境条件や輸送シナリオにおける包装材料の性能、品質管理に関する洞察、包装の拡張性など、いくつかの分野における機会を特定します。また、認証、仕様、規制などのコンプライアンス問題も含まれます。

主なハイライト

- 貿易自由化、輸送インフラと通信技術の改善、食品小売セクターにおける多国籍企業の成長により、世界化が進みました。その結果、乳製品、果物、野菜などの生鮮食品の国際取引が活発化しました。

- 破損した製品は小売業者や製造業者のコストを増大させ、顧客の不満足につながるため、パッケージ検査の重要性はさらに高まりました。パッケージの信頼性は、米国材料試験協会(ASTM)や国際種子試験協会(ISTA)などの標準機関が指示する落下試験、振動試験、衝撃試験など数多くの試験を実施することで検証されます。

- しかし、包装試験に関連するコストはかなり高く、小規模の製造業者や産業がこのプロセスに投資することを難しくし、それによってこの市場の成長を妨げています。

- さらに、世界経済や地域経済の健全性は、包装製品の需要を大きく左右するため、包装試験の必要性に拍車をかけています。消費者の消費シフトと購買習慣は、包装の量と複雑さを直接変化させ、包装試験の状況を形成します。

- 包装試験セクターの運命は、飲食品、消費財、医薬品、エレクトロニクスなどの主要産業と複雑に関連しています。工業生産高や製造業の変動は、包装検査サービスに対する意欲を直接揺さぶる。

パッケージ検査市場の動向

食品・飲料が市場の大きなシェアを占める

- インテリジェントパッケージング、アクティブパッケージング、スマートパッケージング、ガス置換包装などの先進パッケージング手法が従来の手法に取って代わりつつあり、これらのパッケージング製品を効果的に試験する必要性が高まっています。

- 製品は包装された状態で顧客の手元に届くため、その安全性は重要な関心事です。有毒な汚染物質や有害な汚染物質があれば、製品そのものに影響を及ぼす可能性があり、市場におけるパッケージ検査の重要性が強調されています。

- 包装食品の成長は、米国やスペイン、フランス、ロシアなどの新興経済諸国において顕著です。この強調が、市場における効果的なパッケージ検査に対する旺盛な需要を生み出しました。

- 米国の包装食品消費者は、利便性、時間の節約、簡単な下ごしらえにより消費量を増やし、その主な理由として無駄の少なさが指摘されています。国勢調査(Census.gov)の報告によると、無店舗小売業者は前年から6.8%(+1.4%)増加しました。これに対し、飲食サービス業は2023年5月より3.8%(+2.3%)増加しました。

- 紙ベースの包装ソリューションなど、環境に優しい食品包装に対する意識の高まりを受けて、包装の完全性が損なわれていないことを確認するための包装検査の必要性が高まりました。包装・加工された食品や飲料の人気はますます高まっています。包装された食品や消費財がより広く消費されるようになるにつれ、この分野は成長すると予想されます。

- オーガニック・トレード・アソシエーション(Organic Trade Association)によると、米国におけるパッケージ入りオーガニック食品の消費は、2021年の212億6,000万米ドルから2025年には250億米ドル以上に増加すると予測されています。パッケージ検査に対する需要は、パッケージ入り有機食品の消費の伸びと連動して拡大すると思われます。オーガニック食品は、その完全性を保持し、オーガニックであることを保証するために、厳しい規則や規制を遵守する必要が頻繁にあります。パッケージ検査は、パッケージの構成要素やレイアウトが、汚染の回避、鮮度の保持、賞味期限の延長といったニーズに適合していることを保証します。包装された有機食品に対する需要の高まりにより、強力なパッケージ検査技術が必要とされるであろう。

欧州が大きな市場シェアを占めると予想される

- 欧州は、過去数十年にわたってパッケージ検査分野が大きく成長してきた主要地域のひとつです。包装企業の意識の高まり、厳しい業界規則、包装製品消費の増加が、包装検査セクターの成長の主な原動力となっています。

- 例えば、EU包装・包装廃棄物指令の主な目標は、EU域内市場の適切な運営を支援し、包装の環境性能を継続的に向上させることです。加盟国はこの法律を施行するために国内法を作り、事業者が包装材料や商品を認証、試験、証明できるようにしました。

- 包装は、特定の要件に従って回収または再利用できるように製造されなければならないです。梱包された製品と消費者の衛生、安全、受け入れを維持するため、焼却や埋め立てによる排出の観点から、梱包内部の有害物質の数を最小限に抑えなければならないです。国際標準化機構(ISO)や国際安全輸送協会(ISTA)が定めたような、いくつかの分野別の包装規格に従うことが義務付けられているため、複数の業種にわたる包装試験の採用がさらに促進されています。

- さまざまなエンドユーザー分野のベンダーが新製品のリリース頻度を高めるにつれて、包装および関連試験ソリューションのニーズはさらに高まると予想されます。例えば、Nestle International Travel Retail(NITR)は、2024年3月にBreaks for Good KitKatの発売を控えています。この革新的な商品は、ネスレの新しいインカム・アクセラレーター・プログラムで旅行者と農家を結びつけるだけでなく、このバーに使用されているカカオの持続可能性を強調します。特筆すべきは、このプログラムに参加している農家からのみ調達したカカオ豆で作られたKitKatのデビューとなることです。

パッケージ検査業界の概要

パッケージ検査市場は、企業集中率が中程度であるため半固定的であり、今後数年間で統合が進むと予想されます。競争企業間の敵対関係はさらに高まると予想されます。市場競争には、Intertek Group PLC、Eurofins Scientific SE、SGS SA、Bureau Veritas SAといった老舗企業が参入しており、革新的なパッケージ検査ソリューションサービスを提供することで市場優位性を維持し、市場競争を激化させると予想されます。

- 2023年9月ユーロフィンズ・メディカル・デバイス・テスティングは、新しいパッケージ試験ラボを立ち上げました。2023年にフィンランドで業務を開始しました。ユーロフィンズ・メディカル・デバイス・テスティングは、製品の上市とライフサイクル管理を最適化するための科学的サービスを提供するラボのネットワークです。

- 2023年8月SGSがセンチュリオンに新しい微生物試験所を開設。これにより、南アフリカにおける食品安全試験能力が向上し、ケープタウンのメイトランドにあるSGSの既存の農業・食品研究所(AFL)が提供するサービスが補完されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査想定と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 技術スナップショット

- パッケージ完全性試験

- 包装強度試験

- パッケージ賞味期限試験

- パッケージバリデーション

- 市場のマクロ経済要因の評価

- 業界政策

- ASTM規格

- ISO規格

- STA規格

第5章 市場力学

- 市場促進要因

- 厳格な管理規制と管理・資格要求

- 様々な条件下での製品の長期保存に対する要求と、包装された持続可能な製品に対する需要の高まり

- 市場抑制要因

- パッケージ検査に伴う高コスト

第6章 市場セグメンテーション

- 一次材料別

- ガラス

- 紙

- プラスチック

- 金属

- タイプ別

- 落下試験

- 振動試験

- 衝撃試験

- 温度試験

- その他のタイプ(圧縮試験、賞味期限試験、大気温度試験)

- エンドユーザー産業別

- 食品・飲料

- 工業用

- ヘルスケア

- 家庭用およびパーソナルケア製品

- その他エンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- Intertek Group PLC

- Eurofins Scientific SE

- SGS SA

- Bureau Veritas SA

- TUV SUD AG

- Campden BRI

- IFP Institute for Product Quality GmbH

- DDL Inc.(Integreon Global)

- Turner Packaging Limited

- Nefab Group

第8章 投資分析

第9章 市場の将来

The Package Testing Market size is estimated at USD 15.47 billion in 2025, and is expected to reach USD 25.86 billion by 2030, at a CAGR of 10.82% during the forecast period (2025-2030).

Package testing plays a prominent role in almost every supply chain. Package testing ensures the business's packaging meets specifications and avoids costly product damage, legal situations, and poor user experiences. Package testing identifies opportunities in several areas, such as savings on packaging costs, the performance of packaging materials in realistic environmental conditions and transportation scenarios, quality control insights, and scalability of packaging. It also includes compliance issues like certifications, specifications, and regulations.

Key Highlights

- Globalization increased owing to trade liberalization, improvements in transport infrastructure and communication technologies, and the growth of multinational companies in the food retail sector. It boosted international trade in perishable foods like dairy, fruits, and vegetables.

- It made package testing even more important, as damaged products increase costs for retailers and manufacturers and lead to customer dissatisfaction. The reliability of the package is tested by performing numerous tests, such as drop, vibration, and shock tests, directed by standard institutions, such as the American Society for Testing and Materials (ASTM) and the International Seed Testing Association (ISTA).

- However, the costs associated with packaging testing are quite high, making it harder for small-scale manufacturers and industries to invest in this process, thereby hindering the growth of this market.

- Moreover, global and regional economic health significantly shapes the demand for packaged products, thereby fueling the necessity for packaging testing. Consumer spending shifts and buying habits directly alter the volume and intricacy of packaging, molding the packaging testing landscape.

- The packaging testing sector's fortunes are intricately linked to key industries like food and beverage, consumer goods, pharmaceuticals, and electronics. Swings in industrial output and manufacturing directly sway the appetite for packaging testing services.

Package Testing Market Trends

Food and Beverage Accounts for a Significant Share of the Market

- Advanced packaging methods, such as intelligent packaging, active, smart packaging, and modified atmosphere packaging, are replacing traditional methods, driving the need to test these packaged goods effectively.

- Products' safety is an important concern as they reach customers in the packaged form. Any toxic or damaging contaminant could affect the product itself, emphasizing the importance of package testing in the market.

- Packaged food's growth is more prominent in the developed economies of the United States and major European countries like Spain, France, and Russia. This emphasis created a robust demand for effective package testing in the market.

- Packaged food consumers in the United States increased their consumption due to convenience, saved time, and easy prep, with minimal wastage indicated as the primary reason. Nonstore retailers saw a 6.8% (+-1.4%) increase from the previous year, as reported by Census.gov. In comparison, food services and drinking establishments experienced a 3.8% (+-2.3%) uptick from May 2023.

- The need for package testing to ensure that the integrity of the package is not compromised increased in response to the growing awareness of environmentally friendly food packaging, such as paper-based packaging solutions. Foods and drinks that are packaged and processed are becoming increasingly popular. The sector is anticipated to grow as packaged food and consumer items are consumed more widely.

- According to the Organic Trade Association, the consumption of packaged organic food in the United States is anticipated to increase to over USD 25 billion by 2025 from USD 21.26 billion in 2021. The demand for package testing will expand in tandem with the growth in the consumption of packaged organic food. Organic food items frequently need to adhere to strict rules and regulations to retain their integrity and guarantee that they stay organic. Package testing ensures that the packaging's components and layout adhere to needs like avoiding contamination, preserving freshness, and prolonging shelf life. Strong package testing techniques will be required due to the rising demand for packaged organic foods.

Europe is Expected to Hold a Significant Market Share

- Europe is one of the key locations where the package testing sector has grown significantly over the previous few decades. The increased awareness among packaging firms, strict industry rules, and rising packaged product consumption are the main drivers of the package testing sector's growth.

- For instance, the EU Packaging and Packaging Waste Directive's main goals are to support the proper operation of the EU internal market and continuously enhance the environmental performance of packaging. Member states created national laws to execute the act, allowing businesses to certify, test, and certify the packaging materials and commodities.

- The packaging must be manufactured to allow recovery or reuse following specific requirements. The number of hazardous materials inside the packaging must be kept to a minimum in terms of emissions from incineration or landfills to maintain hygiene, safety, and acceptance for the packed product and the consumer. The requirement to follow several sector-specific packaging standards, such as those set out by the International Organisation for Standardisation (ISO) and the International Safe Transit Association (ISTA), further encourages the adoption of package testing across multiple business verticals.

- The need for packaging and related testing solutions is anticipated to increase further as vendors across various end-user sectors increase the frequency of new product releases. For instance, in March 2024, Nestle International Travel Retail (NITR) is gearing up to introduce the Breaks for Good KitKat. This innovative offering not only links travelers with farmers in Nestle's new Income Accelerator Program but also highlights the sustainability of the cocoa utilized in these bars. Notably, this will mark the debut of a KitKat crafted from cocoa beans exclusively sourced from farmers participating in the program.

Package Testing Industry Overview

The packaging testing market is semi-consolidated as the firm concentration ratio is moderate, and consolidation is expected over the next few years. The competitive rivalry is expected to increase further. The presence of longstanding companies in the market studied, such as Intertek Group PLC, Eurofins Scientific SE, SGS SA, and Bureau Veritas SA, is expected to maintain their market dominance by offering innovative package testing solutions services to intensify the market competition.

- September 2023: Eurofins Medical Device Testing launched a new Package Testing Lab. The operation started operations in Finland in 2023. Eurofins Medical Device Testing is a network of laboratories providing scientific services to ensure optimized product launch and lifecycle management.

- August 2023: SGS opens a new microbiological testing laboratory in Centurion. This increases food safety testing capabilities in South Africa, complementing the services provided by SGS's existing agriculture and food laboratory (AFL) in Maitland, Cape Town.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Package Integrity Testing

- 4.3.2 Package Strength Testing

- 4.3.3 Package Shelf-Life Studies

- 4.3.4 Package Validation

- 4.4 Assessment of Macroeconomic Factors on the Market

- 4.5 Industry Policies

- 4.5.1 ASTM Standards

- 4.5.2 ISO Standards

- 4.5.3 STA Standards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rigorous Control Regulations and Administration and Qualification Demands

- 5.1.2 Demand for Longer Shelf Life of Products Under Varying Conditions and Growing Demand for Packaged and Sustainable Products

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Package Testing

6 MARKET SEGMENTATION

- 6.1 By Primary Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Plastic

- 6.1.4 Metal

- 6.2 By Type

- 6.2.1 Drop Test

- 6.2.2 Vibration Test

- 6.2.3 Shock Test

- 6.2.4 Temperature Testing

- 6.2.5 Other Types (Compression Testing, Shelf Life Testing, Atmospheric Temperature Testing)

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Industrial

- 6.3.3 Healthcare

- 6.3.4 Household and Personal Care Products

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intertek Group PLC

- 7.1.2 Eurofins Scientific SE

- 7.1.3 SGS SA

- 7.1.4 Bureau Veritas SA

- 7.1.5 TUV SUD AG

- 7.1.6 Campden BRI

- 7.1.7 IFP Institute for Product Quality GmbH

- 7.1.8 DDL Inc. (Integreon Global)

- 7.1.9 Turner Packaging Limited

- 7.1.10 Nefab Group