|

市場調査レポート

商品コード

1851754

ITサービス管理(ITSM):市場シェア分析、産業動向、統計、成長予測(2025年~2030年)ITSM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ITサービス管理(ITSM):市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月06日

発行: Mordor Intelligence

ページ情報: 英文 152 Pages

納期: 2~3営業日

|

概要

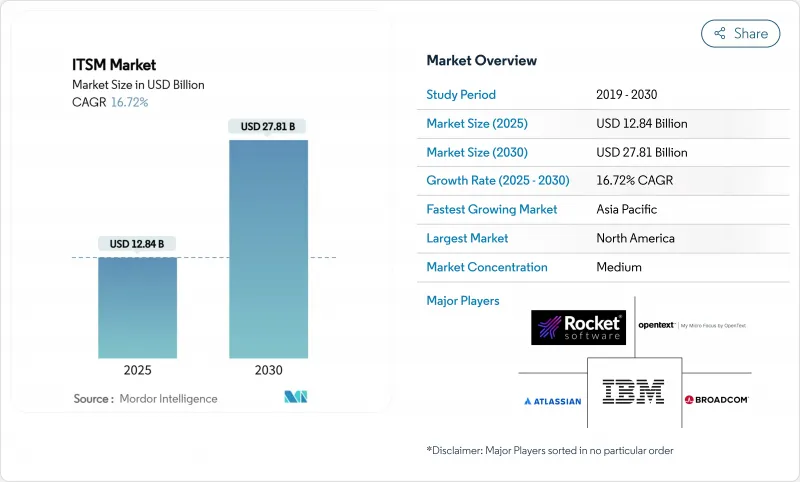

ITサービス管理(ITSM)市場の2025年の市場規模は128億4,000万米ドルで、2030年にはCAGR 16.72%を反映して278億1,000万米ドルに成長すると予測されています。

この加速は、AIを活用した自動化の急速な企業導入、クラウドネイティブアーキテクチャへの移行、ハイブリッドクラウドとマルチクラウドの統合管理の必要性という3つの力から生じています。企業はまた、スキル不足を補うためにローコード・オーケストレーションを採用する一方、FinOpsとGreenOpsのレポートでは、持続可能性とコスト管理の指標をITワークフローに直接組み込んでいます。エッジコンピューティングと5Gの導入は、分散デバイスがリアルタイムのサポートを必要とするため、ITサービス管理市場の範囲をさらに拡大します。

世界のITSM市場の動向と洞察

クラウドネイティブITSMプラットフォームへのシフト

クラウドネイティブの採用により、レガシーシステムに関連する年間4万米ドルのメンテナンス負担がなくなり、イノベーションのための予算が確保されます。ハイパースケーラーとの戦略的提携により、AI機能のための弾力的なコンピューティングが可能になり、2025年第1四半期のサブスクリプションは前年同期比19%増となりました。移行したメーカーはサポート時間を30分から6分に短縮し、生産性の向上を強調。早期導入企業はコストとスピードで優位に立ち、クラウドネイティブ機能がITサービス管理市場全体の基本要件となります。

AI主導のサービス自動化とAIOpsの統合

ServiceNowは、前四半期比150%のAI案件の伸びを記録し、2025年のServiceNowにおけるAI顧客数が1,000社を突破しました。AIOpsは平均解決時間を最大60%短縮し、チケットのバックログを削減します。IBMのジェネレーティブAIの売上は2025年に60億米ドルに達し、自律的なオペレーションに対する企業の意欲を浮き彫りにしています。会話型インターフェースを組み込むベンダーは、アクセスの民主化をさらに進め、買い手の期待を変え、競合他社との差別化を鮮明にしています。

レガシーマイグレーションの複雑さと高いスイッチングコスト

セキュリティの脆弱性がリスクを高めているが、データを保護する段階的な移行は、移行後に最大277%のROIを実現します。費用は障壁となり、既存ベンダーの地位は維持されるが、近代化した組織は大幅な効率向上を享受できます。

セグメント分析

クラウド導入は2024年にITサービス管理市場の64.8%を占め、2030年までのCAGRは18.3%で成長すると予測されています。企業は、資本支出なしにAI機能にアクセスし、グローバルなオペレーションを管理するためにクラウドを選択します。オンプレミスは、防衛のようなデータを重視する環境では依然として不可欠です。マイクロソフトが社内のServiceNowインスタンスをAzureに移行するなどの実例は、イノベーションの拡大におけるクラウドの役割を示しています。

クラウドはまた、あらかじめ構築された統合を提供するため、マルチクラウドの現実とも合致します。ServiceNowとAWSの戦略的コラボレーションは、多様な業界にわたるAI搭載アプリケーションをカバーし、その勢いを示しています。その結果、クラウドは最新のITサービス管理市場機能への既定の道となりつつあります。

サービスデスクとインシデント管理は、ITサポートの基盤となるゲートウェイとして、2024年に35.3%のシェアを維持した。構成管理および資産管理は、資産ディスカバリーのニーズに後押しされ、CAGR 17.9%で拡大します。ディスカバリー、依存関係マッピング、インシデント・ワークフローを統合したプラットフォーム・アプローチは、予算の優先順位を変えます。構成・資産管理のITサービス管理市場規模は、2025年から2030年の間に倍増すると予測されます。

AIがあらゆるアプリケーションをさらに進化させるServiceNowのAI Agent Orchestratorは、複数の自律的エージェントがチケット解決に協力することで、手作業を削減することを示しています。変更管理、リリース管理、ネットワーク管理、データベース管理の各分野は、DevOpsとハイブリッドアーキテクチャが統合された可視性を要求しているため、堅調な伸びを示しています。

地域分析

北米は2024年の売上高の37.2%を占め、企業や公共部門に定着したインストールベースで首位を維持。最近の連邦政府との契約はそれぞれ100万米ドルを超えており、プラットフォームのアップグレードが続いていることを裏付けています。地域の焦点は、初回導入から高度なAIやクロスドメインの観測可能性へとシフトしています。

アジア太平洋地域が最も急成長しています。企業が俊敏性を維持するためにITSMをアウトソースしているため、マネージドサービスの需要は2025年に32%急増しました。中国の製造業や銀行が大規模なデジタル化を進める一方、日本の三菱UFJ銀行は2025年のServiceNow導入で年間2,200時間を節約しました。インドの内需は、世界的なアウトソーシングのリーダーシップとともに強化されています。

欧州、南米、中東・アフリカは、多様なビジネスチャンスを示しています。欧州の企業は、厳格なデータ保護法と今後のAIガバナンスの枠組みを尊重するITSMソリューションを必要としています。持続可能性報告により、FinOpsとGreenOpsモジュールの見通しが明るくなります。中南米ではクラウドの導入が加速し、GCC諸国はスマートシティ構想のためにITSMに投資します。アフリカの通信事業者と政府部門は、手頃な価格のクラウドベース・プラットフォームの初期段階だが有望な舞台を形成しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- クラウドネイティブITSMプラットフォームへのシフト

- AIによるサービス自動化とAIOpsの統合

- ハイブリッド/マルチクラウドエステートの統合管理

- シチズンITSMを可能にするローコード/ノーコード・オーケストレーション

- ITSMに組み込まれたFinOpsとGreenOpsレポート

- エッジコンピューティングと5G運用のITSMへのオンボーディング

- 市場抑制要因

- レガシーマイグレーションの複雑さと高いスイッチングコスト

- 熟練したITSMおよびITOM専門家の不足

- 新たなAIガバナンスとデータ居住規制

- 観測可能なデータコストの上昇がツールの乱立を引き起こす

- サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- 展開別

- クラウド

- オンプレミス

- 用途別

- サービスデスクおよびインシデント管理

- 構成および資産管理

- 変更およびリリース管理

- ネットワークおよびデータベース管理

- その他

- エンドユーザー業界別

- BFSI

- 製造業

- 政府と教育

- IT・通信

- 小売とeコマース

- ヘルスケア

- 旅行とホスピタリティ

- その他の業界

- 企業規模別

- 大企業

- 中小企業(SME)

- サービスタイプ別

- ソリューション(プラットフォーム/ソフトウェア)

- サービス(インプリメンテーション、マネージド、トレーニング)

- 地域別

- 北米

- 米国

- カナダ

- 南米

- ブラジル

- アルゼンチン

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 東南アジア

- その他アジア太平洋地域

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- ServiceNow Inc.

- IBM Corporation

- BMC Software Inc.

- Atlassian Corporation PLC

- Broadcom Inc.(CA Technologies)

- Micro Focus International PLC

- Ivanti Inc.

- Freshworks Inc.

- ASG Technologies Group Inc.

- Axios Systems

- ManageEngine(Zoho Corp.)

- SolarWinds Corp.

- EasyVista SA

- USU Software AG

- SysAid Technologies Ltd.

- Cherwell(Ivanti)

- TOPdesk BV

- Hornbill Service Management Ltd.

- SymphonyAI Summit

- 4me Inc.