|

市場調査レポート

商品コード

1851134

メディアとエンターテインメント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Media And Entertainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| メディアとエンターテインメント:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月21日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

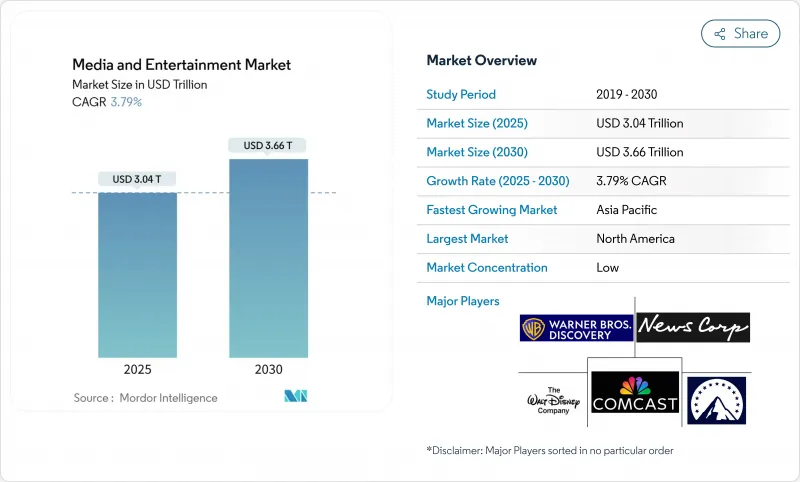

メディアとエンターテインメント市場規模は、2025年に3兆400億米ドルと推計され、2030年には3兆6,600億米ドルに達すると予測され、2025年から2030年までのCAGRは3.79%と堅調に推移します。

モバイル広告、ライブストリーミング、サブスクリプション・ビデオを合わせると、現在の収益のほぼ2分の1を占めています。一方、従来の放送、映画、印刷物はシェアを減らし続けているが、利益率の高いライセンス契約につながるライブラリー・コンテンツには貢献しています。サブスクリプションの更新は、広告の先行カレンダーに縛られた従来の山と谷を滑らかにするため、キャッシュフローは季節的でなくなりつつあります。消費者への直接配信と独自の広告スタックを組み合わせる企業は、より強い信用見通しを示し、より低い借入コストでより長い制作パイプラインの資金調達に役立っています。ソーシャルフィードでの短編視聴は5Gの普及率が高い地域で急拡大し、長編サービスは破壊的ではなくネイティブ感のあるミッドロール広告を挿入することで視聴時間を維持しています。

世界のメディアとエンターテインメント市場の動向と洞察

アジアにおける5G対応モバイル動画消費の急増

韓国のモバイル動画トラフィックは、全国的な5G対応が一般化した後、2025年第1四半期に前年同期比で58%急増しました。平均セッション時間は22分から35分に増加し、プラットフォームはプレロールとミッドロールの在庫を増やしました。圧縮に特化したアプリはデータ料金を下げ、節約分をプレミアム・ショートフォームの権利に振り向け、権利者との交渉力を強化しました。6秒のコマースクリップをテストした広告主は、デスクトップディスプレイと同等のカートコンバージョンを報告し、スマートフォンがブランド構築とチェックアウトの両方の機能を果たせることを証明しました。したがって、メディアとエンターテインメント市場は、視聴時間1分あたりのマネタイズレバーが豊富であることから恩恵を受け、スタジオがモバイルファーストのフランチャイズにより多くの予算を割り当てることを促しています。

米国小売ブランドによるコネクテッドTV広告費の急増

米国のある大手小売企業は、2025年4月までの12ヶ月間でコネクテッドTV(CTV)広告費を2倍以上に増やした(corporate.walmart.com)。ロイヤルティカードのデータをCTVの露出にリンクさせることで、ターゲット世帯はコントロールグループよりも食料品バスケット1つあたり6.80米ドル多く消費していることが確認されました。スマートTVのショッパブル・オーバーレイは、並行して行われたeコマース・キャンペーンでクリックスルー率を約30%上昇させ、ブランドが予算をリニアTVからストリーミングに移行する動機付けとなりました。現在ではデバイスメーカーがアドエクスチェンジを運営しているため、充填率を安定させるために複数年のボリューム保証を交渉しています。その結果、メディアとエンターテインメント市場は小売メディア予算において高いシェアを獲得しています。

ターゲティングデジタル広告に対するEUの監視強化

より厳格な同意ルールが2024年に施行された後、あるソーシャルプラットフォームは、2025年第1四半期に欧州のCPMが17%減少したと報告しました。ブランドは、強力なファーストパーティデータを持つプレミアムパブリッシャーのコンテクスチュアルプレースメントに支出をシフトすることで対応し、不足分を部分的に相殺しました。報道機関へのプログラマティック需要は増加し、規制がコンテンツ所有者にパワーをバランスさせる可能性を示唆しています。小規模なアドテク・ベンダーは、並行する同意ワークフローのコストに苦戦し、大手企業による買収を模索しています。広告利回りの低下により、エコシステム参入企業が準拠したターゲティング手法を改良するまで、メディアとエンターテインメント市場の収益成長が抑制されます。

セグメント分析

2024年のメディアとエンターテインメント市場シェアはデジタルフォーマットが45%を占め、メディアとエンターテインメント市場規模の1兆3,300億米ドルを占める。ストリーミング・プラットフォームは、ビンジワルなシリーズとイベント番組をミックスしているため、加入者獲得スパイクはシーズン最終回後に崩れることはなくなりました。短編動画は2024年後半にチップジャー機能を追加し、マイクロトランザクション収入を創出し、広告利回りの停滞を緩和。広告主が正確な読者層を求めているB2Bのニッチ分野では印刷物が存続し、専門誌は収益の減少を1桁台に抑え、専門家向けコンテンツの耐久性を強調しています。

クロスプラットフォームのエコシステムは、フランチャイズのライフサイクルを長くします。同じ四半期にファンタジーシリーズがモバイルゲームを生み出した場合、新規プレイヤーの15%がその後少なくとも1エピソードを視聴しています。仮想現実と拡張現実の収益は、絶対額では小さいが、企業の試験運用のおかげで急成長しています。ある建築会社は、遠隔デザインレビューにヘッドセットを使用し、2025年にプロジェクトサイクルを12%短縮しました。安定した企業需要はヘッドセットメーカーのキャッシュフローを安定させ、将来の家庭への普及の種となる消費者向けラウンジに補助金を出すことを可能にします。これらの力学が収束するにつれ、メディアとエンターテインメント市場は、コンシューマーとプロフェッショナルの両方の使用事例において、デジタルフォーマットをさらに深く埋め込むことになります。

メディアとエンターテインメント市場は、タイプ別(印刷メディア[新聞、雑誌、その他]、デジタルメディア[テレビ、音楽、ラジオ、その他]、ストリーミングメディア[OTTストリーミング、ライブストリーミング]、その他)、収益モデル別(広告、サブスクリプション、その他)、デバイスプラットフォーム別(スマートフォン、タブレット、スマートテレビ、セットトップボックス、その他)、地域別に分類されています。市場予測は金額(米ドル)で提供されます。

地域分析

2024年のメディアとエンターテインメント市場シェアは北米が35%を占め、1兆300億米ドル。ライブスポーツとインタラクティブなベッティングオーバーレイの組み合わせは、セッション時間を延長することで効果的な広告在庫を増加させる。テレコム・ストリーマー・バンドルは、高騰するコンテンツ・コストをより大きな顧客基盤に分配し、平均獲得コストを引き下げます。地域のケーブル事業者は2025年半ばにこのモデルを再現し、従来の家庭に一時停止画面のショッピング・ウィジェットを導入し、ダイナミック・プライシングを支えるデータ・フィードバック・ループを充実させました。

アジア太平洋は2030年までの予測CAGRが6%で成長をリードしており、中国の活気あるショートビデオエコシステムとインドのオリジナル番組の急増がそれを後押ししています。インドの月間平均モバイルデータ使用量は2024年に1ユーザーあたり27GBを超え、地域タイトルの高い完成率を支えます。制作新興企業は、初日から少なくとも2つの言語トラックを予算化し、吹き替え版の市場投入までの時間を短縮しています。日本と韓国は、東南アジア全域に輸出される5つのGネイティブコンテンツフォーマットを育成し、メディアとエンターテインメント市場のフットプリントをさらに広げています。

欧州は、豊かな創造的遺産と厳格な個人情報保護規則のバランスをとっています。FASTチャンネルは、リニアの視聴率が低迷する中、放送局に新たな収益をもたらし、コンテクスト広告技術は、パーソナライズされたターゲティングの利回りの低下を相殺するのに役立っています。ラテンアメリカは、ARPUを圧迫する為替変動と格闘しているが、ストリーミングの視聴時間は伸び続けており、マクロ環境が安定すれば潜在的な上昇余地があることを示唆しています。中東・北アフリカのプラットフォームはAIによるダビングでカタログを急速に拡大し、あるサービスでは2024年にアラビア語のライブラリを70%以上増加させました。インフラやローカライズのコストが低下するにつれ、新たな視聴者がオンライン化し、メディアとエンターテインメント市場の世界的な拡大が強化されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- アジアにおける5G対応モバイル動画消費の普及

- 米国小売・CPGブランドによるコネクテッドTV広告費の急増

- 欧州におけるFAST(無料広告付きテレビ)チャンネルの急速な普及

- ジェネレーティブAIベースの現地語吹き替えがMENAでOTTリーチを拡大

- 市場抑制要因

- ターゲティングデジタル広告に対するEU規制の強化

- 著作権侵害と違法再ストリーミングがAPACのプレミアムOTT ARPUを抑制

- 規制の見通し

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資と資金動向

第5章 市場規模と成長予測

- タイプ別

- 印刷メディア

- 新聞

- 雑誌

- ビルボード

- バナー、リーフレット、チラシ

- その他の印刷メディア

- デジタルメディア

- テレビ

- 音楽とラジオ

- 電子看板

- モバイル広告

- ポッドキャスト

- その他のデジタルメディア

- ストリーミングメディア

- OTTストリーミング

- ライブストリーミング

- ビデオゲームとeスポーツ

- 仮想現実/拡張現実コンテンツ

- 印刷メディア

- 収益モデル別

- 広告

- サブスクリプション

- ペイ・パー・ビュー/ トランザクション

- ライセンシングおよびマーチャンダイジング

- デバイスプラットフォーム別

- スマートフォンおよびタブレット

- スマートTVとセットトップボックス

- PCおよびノートPC

- ゲーム機

- VR/ARヘッドセット

- 地域別

- 北米

- 米国

- カナダ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- その他ラテンアメリカ地域

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- ニュージーランド

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- Strategic Developments

- Vendor Positioning Analysis

- 企業プロファイル

- News Corporation

- Comcast Corporation

- Walt Disney Company

- Warner Bros. Discovery, Inc.

- Paramount Global

- Netflix, Inc.

- Amazon.com, Inc.(Prime Video)

- Alphabet Inc.(YouTube)

- Apple Inc.

- Sony Group Corporation

- Tencent Holdings Ltd.

- Bertelsmann SE and Co. KGaA

- ByteDance

- Axel Springer SE

- Reliance Industries

- Roku, Inc.

- WPP plc

- Omnicom Group Inc.

- Publicis Groupe

- Spotify Technology S.A.

- Electronic Arts Inc.

- Nintendo Co. Ltd.

- Activision Blizzard, Inc.