|

|

市場調査レポート

商品コード

1856921

バッテリーエネルギー貯蔵システムの世界市場:バッテリータイプ別、接続タイプ別、所有権別、エネルギー容量別、用途別、地域別 - 2030年までの予測Battery Energy Storage System Market by Type, Capacity, Connection Type - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バッテリーエネルギー貯蔵システムの世界市場:バッテリータイプ別、接続タイプ別、所有権別、エネルギー容量別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月08日

発行: MarketsandMarkets

ページ情報: 英文 316 Pages

納期: 即納可能

|

概要

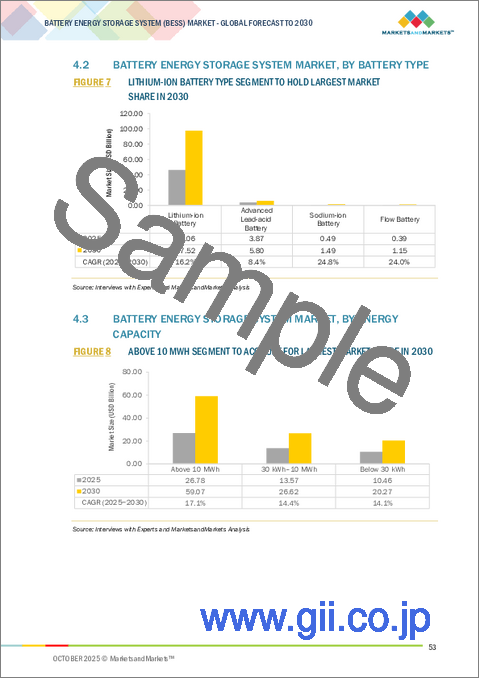

世界のバッテリーエネルギー貯蔵システムの市場規模は、15.8%のCAGRで拡大し、2025年の508億1,000万米ドルから2030年には1,059億6,000万米ドルに成長すると予測されています。

世界のバッテリーエネルギー貯蔵システム(BESS)市場は、複数の要因によって力強い成長を遂げています。太陽光や風力などの再生可能エネルギー源の統合が進むにつれ、系統変動のバランスを取るための信頼性の高い蓄電ソリューションに対する需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | バッテリータイプ別、接続タイプ別、所有権別、エネルギー容量別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

住宅、商業、産業部門における電力消費の増加が、柔軟なエネルギー管理の必要性をさらに高めています。リチウムイオンや他の先端電池技術のコスト低下により、BESSソリューションは経済的に実行可能性が高くなり、また政府の政策、インセンティブ、規制の枠組みが支持され、展開が加速しています。さらに、送電網の近代化、停電に対する回復力、低炭素エネルギー生態系への移行への注目の高まりは、市場の拡大を強化します。これらの要因の総体として、BESSは、持続可能で、効率的で、信頼性の高いエネルギー・インフラを世界中で実現するための重要なイネーブラーとして位置づけられています。

高容量BESSは耐用年数が長く、ピークカット、谷間充填、将来の世界的なエネルギー相互接続におけるグリッド安定化などの大規模用途に特に適しています。これらのシステムは、ピーク負荷期間中のエネルギー需要を効率的に管理し、再生可能エネルギーの統合をサポートし、大規模な風力発電や太陽光発電による変動を緩和することができます。変動する再生可能エネルギー出力のバランスをとることで、大容量貯蔵はよりスムーズなエネルギー供給を保証し、送電網の信頼性を高め、リアルタイムの運転安全性を強化します。さらに、これらの大規模BESSは、地域や国の送電網全体でクリーンエネルギーの効率的な貯蔵と分配を可能にすることで、低炭素エネルギー・エコシステムへの移行を促進し、エネルギー・インフラストラクチャの将来性を確保する上で重要な役割を果たします。

ユーティリティ用途分野は、予測期間中、バッテリーエネルギー貯蔵システム(BESS)市場で最大のシェアを確保すると予測されています。ユーティリティ用途には、電力網との統合が含まれ、発電所で発電された電力は、停電や機器の損傷につながる可能性のある電圧や周波数の偏差を防ぐために、消費量とのバランスを注意深くとる必要があります。BESSは、電圧と周波数を安定させ、信頼できるグリッド運用を確保することによって、この課題に対処します。これらのシステムは、変電所や送配電(T&D)ネットワークに費用対効果の高いソリューションを提供し、増大するピーク需要を効率的に管理することを可能にします。さらに、ユーティリティ・スケールのBESSは、再生可能エネルギー源の統合をサポートし、グリッドの回復力を高め、より柔軟で低炭素なエネルギー・インフラへの移行を促進します。

同地域の成長の原動力は、再生可能エネルギー・プロジェクトの導入拡大、住宅・商業・公共部門にわたる電力需要の増加、送電網の信頼性と回復力の強化への注力です。支持的な規制枠組み、クリーンエネルギー導入へのインセンティブ、グリッド近代化とスマートエネルギー技術への投資が、BESSの統合をさらに加速させています。大規模なエネルギー貯蔵プロジェクトは、ピーク負荷を管理し、電圧と周波数を安定させ、太陽光や風力などの断続的な再生可能エネルギー源の統合を促進するために実施されています。さらに、バッテリー技術の進歩は、脱炭素化に対する企業や電力会社のコミットメントの増加と相まって、ユーティリティ・スケールおよび分散型ストレージ・ソリューションの革新と採用を促進しています。これらの要因により、北米は大規模で信頼性が高く、持続可能なエネルギー貯蔵インフラの主要市場となっています。

当レポートでは、世界のバッテリーエネルギー貯蔵システム市場について調査し、バッテリータイプ別、接続タイプ別、所有権別、エネルギー容量別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 価格分析

- AI/生成AIがバッテリーエネルギー貯蔵システム市場に与える影響

- 2025年の米国関税が蓄電池エネルギー貯蔵システム市場に与える影響

第6章 主要なBESSコンポーネントと関連技術の進歩の概要

- イントロダクション

- バッテリーエネルギー貯蔵システムの主要コンポーネント

- BESSコンポーネントの技術情勢とイノベーション

第7章 BESSに関連する主要な入力エネルギー源

- イントロダクション

- 入力エネルギー源

- ソーラーパネル

- 風力タービン

- グリッドパワー

- ディーゼル発電機

- その他

第8章 BESSの実装タイプとバッテリー技術の比較分析

- イントロダクション

- バッテリーエネルギー貯蔵システムの主な実装タイプ

- バッテリー技術の比較分析

- エネルギー貯蔵システムの比較分析

第9章 主要なBESSビジネスモデル

- イントロダクション

- 直接所有モデル

- サードパーティ所有モデル

- ハイブリッド所有権モデル

- エネルギー貯蔵サービス(ESAAS)モデル

- 集約と仮想発電所(VPP)モデル

- ユーティリティ契約および補助サービスモデル

- コミュニティと協同組合の所有権モデル

第10章 バッテリーエネルギー貯蔵システム市場(バッテリータイプ別)

- イントロダクション

- リチウムイオンバッテリー

- 先進の鉛蓄電池

- フローバッテリー

- ナトリウムイオンバッテリー

第11章 バッテリーエネルギー貯蔵システム市場(接続タイプ別)

- イントロダクション

- オングリッド

- オフグリッド

第12章 バッテリーエネルギー貯蔵システム市場(所有権別)

- イントロダクション

- 顧客所有

- サードパーティ所有

- 公益事業所有

第13章 蓄電池エネルギー貯蔵システム市場(エネルギー容量別)

- イントロダクション

- 30KWH未満

- 10KWH~10MWH

- 10MWH以上

第14章 バッテリーエネルギー貯蔵システム市場(用途別)

- イントロダクション

- 住宅

- 商業および工業

- ユーティリティ

第15章 地域別蓄電池エネルギー貯蔵システム市場

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- オーストラリア

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第17章 企業プロファイル

- 主要参入企業

- TESLA

- SUNGROW

- BYD COMPANY LTD.

- LG ENERGY SOLUTION

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

- SAMSUNG SDI

- ABB

- AB VOLVO

- DELTA ELECTRONICS, INC.

- GE VERNOVA

- GOTION

- HONEYWELL INTERNATIONAL INC.

- NGK INSULATORS, LTD.

- PANASONIC CORPORATION

- SIEMENS ENERGY

- TOSHIBA CORPORATION

- その他の企業

- THE AES CORPORATION

- TRINASOLAR

- AEG

- EAST PENN MANUFACTURING COMPANY

- ESS TECH, INC.

- FARADION

- KORE POWER INC.

- PRIMUS POWER SOLUTIONS

- SAFT

- VRB ENERGY