|

|

市場調査レポート

商品コード

1761498

ターミナルトラクターの世界市場:タイプ別、用途別、駆動装置別、推進力別、トン数別、業界別、モーター出力別、バッテリー化学別、地域別 - 2032年までの予測Terminal Tractor Market by Type, Drive, Tonnage, Application, Battery Chemistry, Logistics, Propulsion, Motor Power Output, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| ターミナルトラクターの世界市場:タイプ別、用途別、駆動装置別、推進力別、トン数別、業界別、モーター出力別、バッテリー化学別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月27日

発行: MarketsandMarkets

ページ情報: 英文 314 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ターミナルトラクターの市場規模は、5.5%のCAGRで拡大し、2025年の15億5,000万米ドルから2032年には22億5,000万米ドルに成長すると予測されています。

世界のターミナルトラクター市場は近年、いくつかの重要な要因によって著しい成長を遂げています。これには、コンテナ輸送量の増加、さまざまな産業にわたる国際貿易の拡大、輸出入活動の活発化、倉庫・物流・鉄道貨物部門からの需要増加などが含まれます。さらに、港湾交通量の増加により、効率的な貨物処理ソリューションの必要性が生じています。ターミナルトラクターは、重い荷物を扱うための燃費効率が良く、費用対効果の高いソリューションを提供することで、港湾やターミナルの運営効率を高める上で重要な役割を担っています。世界の貿易活動の拡大に伴い、信頼性が高く高性能なターミナルトラクターへの需要が高まることが予想されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 検討単位 | 金額、数量(台) |

| セグメント別 | タイプ別、用途別、駆動装置別、推進力別、トン数別、業界別、モーター出力別、バッテリー化学別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、その他の地域 |

250 kW超セグメントは予測期間中に最も高い成長を達成すると予測されています。このセグメントの成長は、これらのトラクターが大型物流、港湾作業、産業用途に使用されることに起因しています。これらの高出力電動ターミナルトラクターは、大型コンテナ・ハンドリング、高密度貨物移動、マルチトレーラー構成、厳しい環境下での特殊プロジェクト貨物ハンドリングなど、連続的な高負荷作業用に設計されています。250 kWを超える出力により、これらの電動トラクターはディーゼル・ターミナルトラクターの性能に匹敵するか、それ以上の性能を発揮し、瞬時にトルクを供給することができます。これらのターミナルトラクターの需要は、大規模な港湾業務、大量のマテリアルハンドリング、および海港や倉庫での効率的なロジスティクスの必要性から、北米で最も高くなっています。SANYやMAFIなどのOEMは、250kW以上のモーター出力を持つターミナルトラクターを提供しています。MAFI T230eは、最大出力300kW、リチウムイオンバッテリー、容量~40トンです。同様に、SANY SM4256電動ターミナルトラクターは、最大出力280 kWの電気モーターを搭載した4x2駆動を提供します。

駆動装置別では、4x2セグメントが予測期間中最大のシェアを占めると予測されています。このセグメントの成長は、費用対効果、運用効率、幅広い物流用途に適したトラクターカテゴリーに起因しています。アジア太平洋、MEA、RoWでは、2024年時点でターミナルトラクターの80%以上が4x2アクスルタイプです。大手企業は、多様な運用ニーズを満たすために4x2トラクターのモデルを開発してきました。例えば、KalmarのOttawa 4x2 DOT/EPA Yard Truckは、40トンの第5輪容量を備えており、倉庫・配送センター、軽工業用途、コンテナ・複合一貫輸送に適しています。TerbergのYT203-EVもまた、4x2駆動による世界な業務に適した高度な電気駆動システムを特徴とする、著名なモデルです。中国、インド、マレーシアのような国々は、欧州や北米への主要輸出国です。これらの地域は、アジア太平洋の港を経由する貨物量を多くしています。この増加する貿易を効率的に管理するため、多くの地域港湾は、港湾施設内の短距離トレーラー移動のための費用対効果の高いソリューションを提供する4x2ターミナルトラクターを採用しています。ドライブトレインがシンプルなため、取得コストとメンテナンスコストが削減され、多忙な輸出ハブ港での高頻度オペレーションに最適です。同様に、欧州と北米では、平坦な地形に適していること、総所有コストが低いこと、極端な牽引力を必要としない物流センターや複合一貫輸送ターミナルで広く使用されていることから、4x2構成が主流となっています。

米国は予測期間中、北米のターミナルトラクターの最大市場になると予測されています。米国市場を牽引する要因は、強力な国内製造基盤、確立された港湾インフラ、充実した貿易能力、効率的な物流ソリューションに対する需要の高まりです。同国ではeコマース産業が急速に拡大し、物流インフラに多額の投資が行われています。米国国勢調査局によると、eコマースの売上高は2025年第1四半期に3,002億米ドルに達し、2024年の同時期から6.1%増加しました。このような成長には、効率的な倉庫作業とトレーラーの移動が必要であり、ターミナルトラクターは運用面で大きなメリットを提供します。アマゾンのような大手小売企業は、カリフォルニア州ヘスペリアにある250万平方フィートの倉庫に1億6,190万米ドルの投資を計画するなど、物流能力の拡大に注力しています。同様に、eBay、Costco、Walmartといった他の著名な小売業者も店舗数を拡大しており、倉庫や配送センターにおけるターミナルトラクターの新たな需要をさらに支えています。さらに、米国の製造業者は自動化をますます採用しており、物流ハブ、倉庫、港湾にわたるマテリアルハンドリングのためのターミナルトラクター用途における米国の優位性を際立たせています。

当レポートでは、世界のターミナルトラクター市場について調査し、タイプ別、用途別、駆動装置別、推進力別、トン数別、業界別、モーター出力別、バッテリー化学別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- AI/生成AIの影響

- 貿易分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 特許分析

- サプライチェーン分析

- エコシステム分析

- 規制状況

- 価格分析

- 技術動向

- 投資と資金調達のシナリオ

- 主要な会議とイベント

- OEM分析

第6章 ターミナルトラクター市場(タイプ別)

- イントロダクション

- 手動

- 自動

- 主要な洞察

第7章 ターミナルトラクター市場(用途別)

- イントロダクション

- 空港

- 海港

- 石油・ガス

- 倉庫・物流

- 主要な洞察

第8章 ターミナルトラクター市場(駆動装置別)

- イントロダクション

- 4X2

- 4X4

- 6X4

- 主要な洞察

第9章 ターミナルトラクター市場(推進力別)

- イントロダクション

- ディーゼル

- 電気

- CNG/LNG

- 水素

- 主要な洞察

第10章 ターミナルトラクター市場(トン数別)

- イントロダクション

- 50トン未満

- 50~100トン

- 100トン以上

- 主要な洞察

第11章 ターミナルトラクター市場(業界別)

- イントロダクション

- 小売

- 食品・飲料

- 内陸水路および海上サービス

- 鉄道物流

- ロールオン/ロールオフ(RORO)

- 主要な洞察

第12章 電動ターミナルトラクター市場(モーター出力別)

- イントロダクション

- 150kW未満

- 150~250kW

- 250kW以上

- 主要な洞察

第13章 電動ターミナルトラクター市場(バッテリー化学別)

- イントロダクション

- リン酸鉄リチウム(LFP)

- ニッケルマンガンコバルト(NMC)

- その他

- 主要な洞察

第14章 ターミナルトラクター市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- 欧州

- マクロ経済見通し

- ドイツ

- フランス

- 英国

- スペイン

- ロシア

- その他

- 中東・アフリカ

- マクロ経済見通し

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他

- 北米

- マクロ経済見通し

- 米国

- メキシコ

- カナダ

- その他の地域

- マクロ経済見通し

- ブラジル

- チリ

- アルゼンチン

- その他

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年1月~2025年5月

- 市場シェア分析、2024年

- 収益分析、2021年~2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価

- 財務指標

- ブランド/製品比較

- 競合シナリオ

第16章 企業プロファイル

- 主要参入企業

- KALMAR

- KONECRANES

- TERBERG SPECIAL VEHICLES

- LINDE MATERIAL HANDLING

- CAPACITY TRUCKS

- MAFI TRANSPORT-SYSTEME GMBH

- AUTOCAR, LLC

- MOL(MOL CY NV)

- TICO TRACTORS

- GAUSSIN

- その他の企業

- SANY GROUP

- HOIST MATERIAL HANDLING, INC.

- BLYYD

- ORANGE EV

- DAYSWORTH INTERNATIONAL

- CHINA SINOTRUK INTERNATIONAL CO., LIMITED

- BYD

- AB VOLVO

- HYSTER-YALE MATERIALS HANDLING, INC.

- DONGFENG MOTOR COMPANY

- TRANSPORTER INDUSTRY INTERNATIONAL GMBH

- HANMA TECHNOLOGY GROUP CO., LTD.

第17章 市場における提言

第18章 付録

List of Tables

- TABLE 1 TERMINAL TRACTOR MARKET DEFINITION, BY PROPULSION

- TABLE 2 TERMINAL TRACTOR MARKET DEFINITION, BY DRIVE

- TABLE 3 TERMINAL TRACTOR MARKET DEFINITION, BY TYPE

- TABLE 4 USD CURRENCY EXCHANGE RATES, 2021-2024

- TABLE 5 US: IMPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 UAE: IMPORT SHARE, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 FRANCE: IMPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 NETHERLANDS: IMPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 GERMANY: IMPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 US: EXPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 SAUDI ARABIA: EXPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 FRANCE: EXPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 NETHERLANDS: EXPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 GERMANY: EXPORT SHARE, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 DRIVES (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP 2 PROPULSIONS

- TABLE 17 TERMINAL TRACTOR MARKET: KEY PATENTS, JANUARY 2019-MAY 2025

- TABLE 18 TERMINAL TRACTOR MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 19 SAFETY STANDARDS FOR TERMINAL TRACTORS, BY COUNTRY/REGION

- TABLE 20 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY PROPULSION, 2021 VS. 2023 VS. 2025 (USD)

- TABLE 24 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY TYPE, 2021 VS. 2023 VS. 2025 (USD)

- TABLE 25 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY REGION, 2021-2025 (USD)

- TABLE 26 FUNDING BY KEY PLAYERS, 2023-2024

- TABLE 27 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 28 TERMINAL TRACTOR MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 29 TERMINAL TRACTOR MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 30 TERMINAL TRACTOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 TERMINAL TRACTOR MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 32 MANUAL TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 33 MANUAL TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 34 MANUAL TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 MANUAL TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 36 AUTOMATED TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 37 AUTOMATED TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 38 AUTOMATED TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 AUTOMATED TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 41 TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 42 TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 44 AIRPORT TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 45 AIRPORT TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 46 AIRPORT TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 AIRPORT TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 48 MARINE PORT TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 49 MARINE PORT TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 50 MARINE PORT TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 MARINE PORT TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

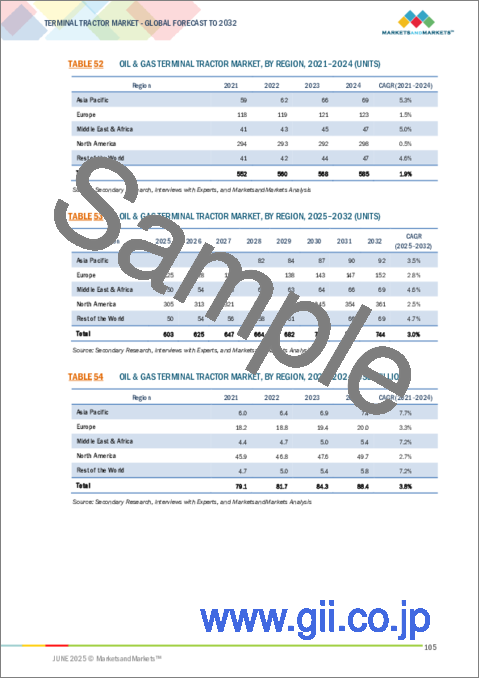

- TABLE 52 OIL & GAS TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 53 OIL & GAS TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 54 OIL & GAS TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 OIL & GAS TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 WAREHOUSE & LOGISTICS TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 57 WAREHOUSE & LOGISTICS TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 58 WAREHOUSE & LOGISTICS TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 WAREHOUSE & LOGISTICS TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 TERMINAL TRACTOR MARKET, BY DRIVE, 2021-2024 (UNITS)

- TABLE 61 TERMINAL TRACTOR MARKET, BY DRIVE, 2025-2032 (UNITS)

- TABLE 62 TERMINAL TRACTOR MARKET, BY DRIVE, 2021-2024 (USD MILLION)

- TABLE 63 TERMINAL TRACTOR MARKET, BY DRIVE, 2025-2032 (USD MILLION)

- TABLE 64 4X2 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 65 4X2 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 66 4X2 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 4X2 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 4X4 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 69 4X4 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 70 4X4 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 4X4 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 6X4 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 73 6X4 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 74 6X4 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 6X4 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 TERMINAL TRACTOR MARKET, BY PROPULSION, 2021-2024 (UNITS)

- TABLE 77 TERMINAL TRACTOR MARKET, BY PROPULSION, 2025-2032 (UNITS)

- TABLE 78 TERMINAL TRACTOR MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 79 TERMINAL TRACTOR MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 80 DIESEL TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 81 DIESEL TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 82 DIESEL TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 DIESEL TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 84 ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 85 ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 86 ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 CNG/LNG TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 89 CNG/LNG TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 90 CNG/LNG TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 CNG/LNG TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 TERMINAL TRACTOR MARKET, BY TONNAGE, 2021-2024 (UNITS)

- TABLE 93 TERMINAL TRACTOR MARKET, BY TONNAGE, 2025-2032 (UNITS)

- TABLE 94 TERMINAL TRACTOR MARKET, BY TONNAGE, 2021-2024 (USD MILLION)

- TABLE 95 TERMINAL TRACTOR MARKET, BY TONNAGE, 2025-2032 (USD MILLION)

- TABLE 96 <50-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 97 <50-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 98 <50-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 <50-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 50-100-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 101 50-100-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 102 50-100-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 50-100-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 >100-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 105 >100-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 106 >100-TON TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 >100-TON TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 108 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY, 2021-2024 (UNITS)

- TABLE 109 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY, 2025-2032 (UNITS)

- TABLE 110 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 111 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 112 GLOBAL TOP CONTAINER PORTS (MILLION TEU)

- TABLE 113 TERMINAL TRACTOR MARKET FOR RETAIL INDUSTRY, BY REGION, 2021-2024 (UNITS)

- TABLE 114 TERMINAL TRACTOR MARKET FOR RETAIL INDUSTRY, BY REGION, 2025-2032 (UNITS)

- TABLE 115 TERMINAL TRACTOR MARKET FOR RETAIL INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 TERMINAL TRACTOR MARKET FOR RETAIL INDUSTRY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 TERMINAL TRACTOR MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2021-2024 (UNITS)

- TABLE 118 TERMINAL TRACTOR MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2025-2032 (UNITS)

- TABLE 119 TERMINAL TRACTOR MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 TERMINAL TRACTOR MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 TERMINAL TRACTOR MARKET FOR INLAND WATERWAYS & MARINE SERVICE INDUSTRY, BY REGION, 2021-2024 (UNITS)

- TABLE 122 TERMINAL TRACTOR MARKET FOR INLAND WATERWAYS & MARINE SERVICE INDUSTRY, BY REGION, 2025-2032 (UNITS)

- TABLE 123 TERMINAL TRACTOR MARKET FOR INLAND WATERWAYS & MARINE SERVICE INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 TERMINAL TRACTOR MARKET FOR INLAND WATERWAYS & MARINE SERVICE INDUSTRY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 TERMINAL TRACTOR MARKET FOR RAIL LOGISTICS INDUSTRY, BY REGION, 2021-2024 (UNITS)

- TABLE 126 TERMINAL TRACTOR MARKET FOR RAIL LOGISTICS INDUSTRY, BY REGION, 2025-2032 (UNITS)

- TABLE 127 TERMINAL TRACTOR MARKET FOR RAIL LOGISTICS INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 TERMINAL TRACTOR MARKET FOR RAIL LOGISTICS INDUSTRY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 TERMINAL TRACTOR MARKET FOR RORO INDUSTRY, BY REGION, 2021-2024 (UNITS)

- TABLE 130 TERMINAL TRACTOR MARKET FOR RORO INDUSTRY, BY REGION, 2025-2032 (UNITS)

- TABLE 131 TERMINAL TRACTOR MARKET FOR RORO INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 TERMINAL TRACTOR MARKET FOR RORO INDUSTRY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 133 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT, 2021-2024 (UNITS)

- TABLE 134 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT, 2025-2032 (UNITS)

- TABLE 135 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT, 2021-2024 (USD MILLION)

- TABLE 136 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT, 2025-2032 (USD MILLION)

- TABLE 137 <150-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 138 <150-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 139 <150-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 <150-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 141 150-250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 142 150-250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 143 150-250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 144 150-250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 145 >250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 146 >250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 147 >250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 >250-KW ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 149 TERMINAL TRACTOR MODELS, BY BATTERY CHEMISTRY

- TABLE 150 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY, 2021-2024 (UNITS)

- TABLE 151 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025-2032 (UNITS)

- TABLE 152 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY, 2021-2024 (USD MILLION)

- TABLE 153 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025-2032 (USD MILLION)

- TABLE 154 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 155 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 156 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 157 LITHIUM IRON PHOSPHATE (LFP): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 158 NICKEL MANGANESE COBALT (NMC): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 159 NICKEL MANGANESE COBALT (NMC): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 160 NICKEL MANGANESE COBALT (NMC): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 161 NICKEL MANGANESE COBALT (NMC): ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 162 OTHERS: ELECTRIC TERMINAL TRACTOR MARKET, BY REGION 2021-2024 (UNITS)

- TABLE 163 OTHERS: ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 164 OTHERS: ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 OTHERS: ELECTRIC TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 166 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 167 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 168 TERMINAL TRACTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 TERMINAL TRACTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 170 ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 171 ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 172 ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 174 CHINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 175 CHINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 176 CHINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 CHINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 178 JAPAN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 179 JAPAN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 180 JAPAN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 JAPAN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 182 SOUTH KOREA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 183 SOUTH KOREA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 184 SOUTH KOREA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH KOREA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 186 INDIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 187 INDIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 188 INDIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 INDIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 191 REST OF ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 192 REST OF ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 194 EUROPE: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 195 EUROPE: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 196 EUROPE: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 197 EUROPE: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 198 GERMANY: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 199 GERMANY: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 200 GERMANY: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 GERMANY: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 202 FRANCE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 203 FRANCE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 204 FRANCE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 205 FRANCE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 206 UK: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 207 UK: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 208 UK: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 209 UK: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 210 SPAIN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 211 SPAIN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 212 SPAIN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 213 SPAIN: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 214 RUSSIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 215 RUSSIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 216 RUSSIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 217 RUSSIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 218 REST OF EUROPE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 219 REST OF EUROPE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 220 REST OF EUROPE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 221 REST OF EUROPE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 223 MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 224 MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 226 UAE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 227 UAE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 228 UAE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 229 UAE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 230 SAUDI ARABIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 231 SAUDI ARABIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 232 SAUDI ARABIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 233 SAUDI ARABIA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 234 SOUTH AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 235 SOUTH AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 236 SOUTH AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 237 SOUTH AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 238 REST OF MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 239 REST OF MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 240 REST OF MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 242 NORTH AMERICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 243 NORTH AMERICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 244 NORTH AMERICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 245 NORTH AMERICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 246 US: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 247 US: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 248 US: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 249 US: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 250 MEXICO: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 251 MEXICO: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 252 MEXICO: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 253 MEXICO: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 254 CANADA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 255 CANADA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 256 CANADA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 257 CANADA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 258 REST OF THE WORLD: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 259 REST OF THE WORLD: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 260 REST OF THE WORLD: TERMINAL TRACTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 261 REST OF THE WORLD: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 262 BRAZIL: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 263 BRAZIL: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 264 BRAZIL: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 265 BRAZIL: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 266 CHILE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 267 CHILE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 268 CHILE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 269 CHILE: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 270 ARGENTINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 271 ARGENTINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 272 ARGENTINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 273 ARGENTINA: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 274 OTHERS: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (UNITS)

- TABLE 275 OTHERS: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (UNITS)

- TABLE 276 OTHERS: TERMINAL TRACTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 277 OTHERS: TERMINAL TRACTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 278 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-MAY 2025

- TABLE 279 TERMINAL TRACTOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 280 TERMINAL TRACTOR MARKET: REGION FOOTPRINT, 2024

- TABLE 281 TERMINAL TRACTOR MARKET: PROPULSION FOOTPRINT, 2024

- TABLE 282 TERMINAL TRACTOR MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 283 TERMINAL TRACTOR MARKET: LIST OF STARTUPS/SMES

- TABLE 284 TERMINAL TRACTOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 285 TERMINAL TRACTOR MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, DECEMBER 2022-MAY 2024

- TABLE 286 TERMINAL TRACTOR MARKET: DEALS, JUNE 2022-DECEMBER 2024

- TABLE 287 TERMINAL TRACTOR MARKET: EXPANSIONS, AUGUST 2023-MAY 2025

- TABLE 288 TERMINAL TRACTOR MARKET: OTHER DEVELOPMENTS, AUGUST 2022-MARCH 2025

- TABLE 289 KALMAR: COMPANY OVERVIEW

- TABLE 290 KALMAR: PRODUCTS OFFERED

- TABLE 291 KALMAR: DEALS

- TABLE 292 KALMAR: OTHER DEVELOPMENTS

- TABLE 293 KONECRANES: COMPANY OVERVIEW

- TABLE 294 KONECRANES: PRODUCTS OFFERED

- TABLE 295 KONECRANES: DEALS

- TABLE 296 KONECRANES: OTHER DEVELOPMENTS

- TABLE 297 TERBERG SPECIAL VEHICLES: COMPANY OVERVIEW

- TABLE 298 TERBERG SPECIAL VEHICLES: PRODUCTS OFFERED

- TABLE 299 TERBERG SPECIAL VEHICLES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 300 TERBERG SPECIAL VEHICLES: DEALS

- TABLE 301 TERBERG SPECIAL VEHICLES: EXPANSIONS

- TABLE 302 TERBERG SPECIAL VEHICLES: OTHER DEVELOPMENTS

- TABLE 303 LINDE MATERIAL HANDLING: COMPANY OVERVIEW

- TABLE 304 LINDE MATERIAL HANDLING: PRODUCTS OFFERED

- TABLE 305 LINDE MATERIAL HANDLING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 306 LINDE MATERIAL HANDLING: DEALS

- TABLE 307 LINDE MATERIAL HANDLING: EXPANSIONS

- TABLE 308 CAPACITY TRUCKS: COMPANY OVERVIEW

- TABLE 309 CAPACITY TRUCKS: PRODUCTS OFFERED

- TABLE 310 CAPACITY TRUCKS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 311 CAPACITY TRUCKS: DEALS

- TABLE 312 MAFI TRANSPORT-SYSTEME GMBH: COMPANY OVERVIEW

- TABLE 313 MAFI TRANSPORT-SYSTEME GMBH: PRODUCTS OFFERED

- TABLE 314 MAFI TRANSPORT-SYSTEME GMBH: PRODUCT LAUNCHES

- TABLE 315 MAFI TRANSPORT-SYSTEME GMBH: DEALS

- TABLE 316 AUTOCAR, LLC: COMPANY OVERVIEW

- TABLE 317 AUTOCAR, LLC: PRODUCTS OFFERED

- TABLE 318 AUTOCAR, LLC: DEALS

- TABLE 319 AUTOCAR, LLC: OTHER DEVELOPMENTS

- TABLE 320 MOL (MOL CY NV): COMPANY OVERVIEW

- TABLE 321 MOL (MOL CY NV): PRODUCTS OFFERED

- TABLE 322 TICO TRACTORS: COMPANY OVERVIEW

- TABLE 323 TICO TRACTORS: PRODUCTS OFFERED

- TABLE 324 TICO TRACTORS: PRODUCT LAUNCHES

- TABLE 325 TICO TRACTORS: DEALS

- TABLE 326 TICO TRACTORS: EXPANSIONS

- TABLE 327 GAUSSIN: COMPANY OVERVIEW

- TABLE 328 GAUSSIN: PRODUCTS OFFERED

- TABLE 329 GAUSSIN: DEALS

- TABLE 330 GAUSSIN: EXPANSIONS

- TABLE 331 GAUSSIN: OTHER DEVELOPMENTS

- TABLE 332 SANY GROUP: COMPANY OVERVIEW

- TABLE 333 HOIST MATERIAL HANDLING, INC.: COMPANY OVERVIEW

- TABLE 334 BLYYD: COMPANY OVERVIEW

- TABLE 335 ORANGE EV: COMPANY OVERVIEW

- TABLE 336 DAYSWORTH INTERNATIONAL: COMPANY OVERVIEW

- TABLE 337 CHINA SINOTRUK INTERNATIONAL CO., LIMITED: COMPANY OVERVIEW

- TABLE 338 BYD: COMPANY OVERVIEW

- TABLE 339 AB VOLVO: COMPANY OVERVIEW

- TABLE 340 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY OVERVIEW

- TABLE 341 DONGFENG MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 342 TRANSPORTER INDUSTRY INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 343 HANMA TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 TERMINAL TRACTOR MARKET: RESEARCH DESIGN

- FIGURE 2 RESEARCH METHODOLOGY MODEL

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 TERMINAL TRACTOR MARKET SIZE: BOTTOM-UP APPROACH (APPLICATION AND REGION)

- FIGURE 6 TERMINAL TRACTOR MARKET SIZE: TOP-DOWN APPROACH (BY PROPULSION)

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 TERMINAL TRACTOR MARKET OVERVIEW

- FIGURE 9 TERMINAL TRACTOR MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 10 TERMINAL TRACTOR MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 11 INCREASING PORT AND LOGISTICS INFRASTRUCTURE, GROWTH OF E-COMMERCE, AND RISE IN GLOBAL TRADE TO DRIVE MARKET

- FIGURE 12 MANUAL TO BE DOMINANT SEGMENT IN 2032

- FIGURE 13 50-100 TONS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 14 NICKEL MANGANESE COBALT (NMC) TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 15 DIESEL TO SURPASS OTHER SEGMENTS IN 2032

- FIGURE 16 4X2 TO BE DOMINANT SEGMENT IN 2032

- FIGURE 17 > 250 KW TO BE LARGEST SEGMENT IN 2032

- FIGURE 18 WAREHOUSE & LOGISTICS TO BE LARGEST SEGMENT IN 2032

- FIGURE 19 RETAIL INDUSTRY TO BE LARGEST SEGMENT IN 2032

- FIGURE 20 NORTH AMERICA TO LEAD TERMINAL TRACTOR MARKET IN 2025

- FIGURE 21 TERMINAL TRACTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 WORLD SEABORNE TRADE BY TYPE OF CARGO, ANNUAL, 2021-2023 (METRIC TONS IN THOUSANDS)

- FIGURE 23 RETAIL E-COMMERCE SALES WORLDWIDE, 2021-2027 (USD TRILLION)

- FIGURE 24 ELECTRIC VS. DIESEL TERMINAL TRACTORS

- FIGURE 25 TERMINAL TRACTOR MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 DRIVES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP 2 PROPULSIONS

- FIGURE 28 PATENT PUBLICATION TRENDS, JANUARY 2014-MAY 2025

- FIGURE 29 TERMINAL TRACTOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 TERMINAL TRACTOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 NON-ROAD MOBILE MACHINERY EMISSION REGULATION OUTLOOK, OFF-HIGHWAY VEHICLES, 2019-2030

- FIGURE 32 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY PROPULSION, 2021 VS. 2023 VS. 2025 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY TYPE, 2021 VS. 2023 VS. 2025 (USD)

- FIGURE 34 AVERAGE SELLING PRICE TREND OF TERMINAL TRACTORS, BY REGION, 2021-2025 (USD)

- FIGURE 35 INVESTMENT SCENARIO, 2022-2025

- FIGURE 36 DRIVE TYPE VS. OEMS

- FIGURE 37 OEM VS. MOTOR POWER OUTPUT

- FIGURE 38 TERMINAL TRACTOR MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 39 TERMINAL TRACTOR MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 40 TERMINAL TRACTOR MARKET, BY DRIVE, 2025 VS. 2032 (USD MILLION)

- FIGURE 41 TERMINAL TRACTOR MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 TERMINAL TRACTOR MARKET, BY TONNAGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 44 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 46 TERMINAL TRACTOR MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 48 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 49 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 50 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 51 ASIA PACIFIC: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 52 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 53 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 55 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 56 EUROPE: TERMINAL TRACTOR MARKET SNAPSHOT

- FIGURE 57 MIDDLE EAST & AFRICA: GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 58 MIDDLE EAST & AFRICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 59 MIDDLE EAST & AFRICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 60 MIDDLE EAST & AFRICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 61 MIDDLE EAST & AFRICA: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 62 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 63 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 64 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 65 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 66 NORTH AMERICA: TERMINAL TRACTOR MARKET SNAPSHOT

- FIGURE 67 REST OF THE WORLD: GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 68 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 69 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 70 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 71 REST OF THE WORLD: TERMINAL TRACTOR MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 72 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 73 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- FIGURE 74 TERMINAL TRACTOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 75 TERMINAL TRACTOR MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 76 TERMINAL TRACTOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 77 TERMINAL TRACTOR MARKET: COMPANY VALUATION

- FIGURE 78 TERMINAL TRACTOR MARKET: FINANCIAL METRICS

- FIGURE 79 BRAND/PRODUCT COMPARISON

- FIGURE 80 KALMAR: COMPANY SNAPSHOT

- FIGURE 81 KONECRANES: COMPANY SNAPSHOT

- FIGURE 82 LINDE MATERIAL HANDLING: COMPANY SNAPSHOT

The terminal tractor market is projected to grow from USD 1.55 billion in 2025 to USD 2.25 billion by 2032 at a CAGR of 5.5%. The global terminal tractor market has witnessed significant growth in recent years, driven by several key factors. These include the rising volume of containerized transportation, expanding international trade across various industries, growing import and export activities, and increasing demand from the warehousing, logistics, and rail freight sectors. Additionally, the rise in port traffic has created a need for efficient cargo-handling solutions. Terminal tractors are critical in enhancing operational efficiency at ports and terminals by offering fuel-efficient and cost-effective solutions for handling heavy loads. As global trade activities expand, the demand for reliable and high-performance terminal tractors is expected to rise.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value, Volume (Units) |

| Segments | Tonnage, Propulsion, Drive, Logistics by Industry, Type, Application, Electric Terminal Tractor by Battery Chemistry, and Electric Terminal Tractor by Motor Power Output |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and Rest of the World |

"The > 250 kW segment is projected to be the fastest-growing segment in the global terminal tractor market during the forecast period."

The > 250 kW segment is projected to achieve the highest growth during the forecast period. The segment's growth is attributed to the use of these tractors for heavy-duty logistics, port operations, and industrial applications. These high-power electric terminal tractors are engineered for continuous heavy-duty operations, including oversized container handling, dense cargo movements, multi-trailer configurations, and specialized project cargo handling under challenging environments. The > 250 kW power output enables these electric tractors to match or exceed the performance of diesel terminal tractors while providing instant torque delivery. The demand for these terminal tractors is the highest in North America due to the region's large-scale port operations, high material handling volumes, and the need for efficient logistics in marine ports and warehouses. OEMs such as SANY and MAFI offer terminal tractors with motor power above 250 kW. MAFI T230e has a maximum power output of 300 kW, lithium-ion batteries, and a capacity of ~40 tons. Similarly, the SANY SM4256 Electric Terminal Tractor offers a 4x2 drive with a maximum 280 kW electric motor power output.

"The 4x2 segment is projected to account for the largest share of the terminal tractor segment during the forecast period."

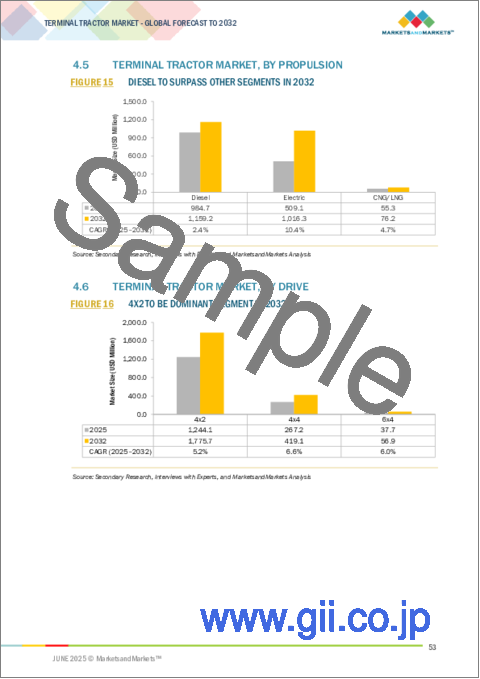

By drive, the 4x2 segment is projected to account for the largest share during the forecast period. The growth of the segment can be attributed to the cost-effectiveness, operational efficiency, and suitability of these category of tractors for a broad range of logistics applications. In Asia Pacific, MEA, and RoW, ~ more than 80% of terminal tractors are of 4x2 axle type as of 2024. Leading players have developed 4x2 terminal tractor models to meet diverse operational needs. For instance, Kalmar's Ottawa 4x2 DOT/EPA Yard Truck comes with a fifth wheel capacity of 40 tons, which is suitable for warehousing and distribution centers, light industrial applications, and container & intermodal handling. Terberg's YT203-EV is another prominent model, featuring advanced electric drive systems suitable for global operations with 4x2 drive. Countries like China, India, and Malaysia are key exporters to Europe and North America. These regions are driving high cargo volumes through Asia Pacific ports. To efficiently manage this growing trade, many regional ports are adopting 4x2 terminal tractors, which offer a cost-effective solution for short-distance trailer movement within port facilities. Their simpler drivetrain reduces acquisition and maintenance costs, making them ideal for high-frequency operations in busy export hubs. Similarly, in Europe and North America, the 4x2 configuration dominates due to its suitability for flat terrain, lower total cost of ownership, and widespread use in logistics centers and intermodal terminals where extreme traction is not required.

"The US is projected to be the largest market for North America during the forecast period."

The US is projected to be the largest market for terminal tractors in the North American region during the forecast period. The factors driving the US market are a strong domestic manufacturing base, established port infrastructure, substantial trade capabilities, and higher demand for efficient logistic solutions. The country has experienced rapid expansion in the e-commerce industry and substantial investments in logistics infrastructure. According to the US Census Bureau, e-commerce sales reached USD 300.2 billion in Q1 2025, a 6.1% increase from the same period in 2024. This growth demands efficient warehouse operations and trailer movements, where terminal tractors offer significant operational advantages. Major retailers like Amazon are focusing on the expansion of logistics capabilities, as the company planned an investment of USD 161.9 million in a 2.5-million-square-foot warehouse in Hesperia, California. Likewise, other prominent retailers like eBay, Costco, and Walmart are expanding their store counts, further supporting the new demand for terminal tractors at their warehouses and distribution centers. Additionally, manufacturers in the US are increasingly adopting automation, highlighting the country's dominance in terminal tractor application for material handling across logistics hubs, warehouses, and ports.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the terminal tractor market.

The break-up of primaries is as follows:

- By Company Type: Terminal Tractor OEMs-75%, End User Organizations -25%

- By Designation: C-Levels-35%, Director Levels-40%, and Others-25%

- By Region: North America-25%, Europe-35%, Asia Pacific-25%, and Rest of the World-15%

The terminal tractor market comprises major players, such as Kalmar (Finland), Konecranes (Finland), Terberg Special Vehicles (Netherlands), Linde Material Handling (Germany), and Capacity Trucks (US).

Research Coverage

This research report categorizes the study segments of the terminal tractor market. It forecasts the market size by application (warehouse & logistics, marine port, airport, and oil & gas), drive (4x2, 4x4, and 6x4), type (manual and automated), tonnage (< 50 tons, 50-100 tons, and > 100 tons), propulsion (diesel, electric, CNG/LNG, and hydrogen), logistics by industry (retail, food & beverages, inland waterways & marine service, rail logistics, and RoRo), electric terminal tractor by battery chemistry (LFP, NMC, Others), electric terminal tractor by motor power output (< 150 kW, 150-250 kW, > 250 kW), and region (Asia Pacific, North America, Middle East & Africa [MEA], Europe, and the Rest of the World [RoW]).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the terminal tractor market. A thorough analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, mergers, and acquisitions; and recent developments associated with the terminal tractor market. This report also covers competitive analysis of SMEs/startups in the terminal tractor market ecosystem, supplier analysis, and development by key suppliers.

Reasons to Buy this Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall terminal tractor market and the subsegments. The report includes a comprehensive market share analysis, supply chain analysis, extensive lists and insights into component manufacturers, chapter segmentation based on materials, a thorough supply chain analysis, and a competitive landscape. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The report further provides insights on the following aspects of a market:

- Analysis of key drivers (Increase in port traffic, increase in rail freight transportation, growing demand from the e-commerce and logistics industries), restraints (High initial investment costs, limited charging infrastructure for electric terminal tractors), opportunities (Strong inclination towards electric terminal tractors, development in automated terminal tractor technology), and challenges (Lack of synchronization with other port equipment)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the terminal tractor market

- Market Development: Comprehensive information about lucrative markets across regions

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the terminal tractor market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Kalmar (Finland), Terberg Special Vehicles (Netherlands), Capacity Trucks (US), MAFI Transport-Systeme GmbH (Germany), and TICO Tractors (US) in the terminal tractor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources to estimate terminal tractor market

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TERMINAL TRACTOR MARKET

- 4.2 TERMINAL TRACTOR MARKET, BY TYPE

- 4.3 TERMINAL TRACTOR MARKET, BY TONNAGE CAPACITY

- 4.4 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY

- 4.5 TERMINAL TRACTOR MARKET, BY PROPULSION

- 4.6 TERMINAL TRACTOR MARKET, BY DRIVE

- 4.7 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT

- 4.8 TERMINAL TRACTOR MARKET, BY APPLICATION

- 4.9 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY

- 4.10 TERMINAL TRACTOR MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in port traffic

- 5.2.1.2 Increase in rail freight transportation

- 5.2.1.3 Growing demand from e-commerce and logistics industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment costs

- 5.2.2.2 Limited charging infrastructure for electric terminal tractors

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Strong inclination toward electric terminal tractors

- 5.2.3.1.1 Low maintenance cost of battery electric terminal tractors

- 5.2.3.1.2 Growing demand for low-emission terminal tractors

- 5.2.3.2 Developments in automated terminal tractor technology

- 5.2.3.1 Strong inclination toward electric terminal tractors

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of synchronization with other port equipment

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 IMPACT OF AI/GEN AI

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA

- 5.5.2 EXPORT DATA

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 PORT OF LOS ANGELES ADVANCED YARD TRACTOR DEPLOYMENT AND ECO-FRATIS DRAYAGE TRUCK EFFICIENCY PROJECT

- 5.7.2 DEPLOYMENT OF AUTONOMOUS ELECTRIC TERMINAL TRACTORS AT THE PORT OF FELIXSTOWE

- 5.7.3 GROOT INDUSTRIES' ADOPTION OF ORANGE EV ELECTRIC TERMINAL TRUCK

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.10 ECOSYSTEM ANALYSIS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 EMISSION REGULATIONS

- 5.11.2 SAFETY STANDARDS FOR TERMINAL TRACTORS

- 5.11.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 BY PROPULSION

- 5.12.2 BY TYPE

- 5.12.3 BY REGION

- 5.13 TECHNOLOGY TRENDS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Terminal tractor automation

- 5.13.1.2 New energy solutions for terminal tractors

- 5.13.1.3 IoT for automated material handling

- 5.13.2 ADJACENT TECHNOLOGIES

- 5.13.2.1 Telematics for terminal tractors

- 5.13.3 COMPLEMENTARY TECHNOLOGIES

- 5.13.3.1 Electronic stability control

- 5.13.1 KEY TECHNOLOGIES

- 5.14 INVESTMENT AND FUNDING SCENARIO

- 5.15 KEY CONFERENCES AND EVENTS

- 5.16 OEM ANALYSIS

6 TERMINAL TRACTOR MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 MANUAL

- 6.2.1 EASE OF MAINTENANCE AND REPAIR TO DRIVE DEMAND

- 6.3 AUTOMATED

- 6.3.1 ADVANCEMENT IN PORT AND TERMINAL OPERATIONS TO DRIVE DEMAND

- 6.4 KEY PRIMARY INSIGHTS

7 TERMINAL TRACTOR MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 AIRPORT

- 7.2.1 RISING GLOBAL AIR TRAFFIC AND CARGO DEMAND TO DRIVE SEGMENTAL GROWTH

- 7.3 MARINE PORT

- 7.3.1 SIGNIFICANT INVESTMENTS IN MARINE PORT DEVELOPMENT AND MODERNIZATION TO DRIVE SEGMENTAL GROWTH

- 7.4 OIL & GAS

- 7.4.1 RISING OIL DEMAND TO DRIVE SEGMENTAL GROWTH

- 7.5 WAREHOUSE & LOGISTICS

- 7.5.1 ROBUST GROWTH OF LOGISTICS INDUSTRY TO DRIVE SEGMENTAL GROWTH

- 7.6 KEY PRIMARY INSIGHTS

8 TERMINAL TRACTOR MARKET, BY DRIVE

- 8.1 INTRODUCTION

- 8.2 4X2

- 8.2.1 RISING DEMAND FOR EFFICIENT TERMINAL OPERATIONS TO DRIVE MARKET

- 8.3 4X4

- 8.3.1 INCREASE IN CARGO VOLUMES IN DEVELOPED ECONOMIES TO DRIVE MARKET

- 8.4 6X4

- 8.4.1 INCREASING ADOPTION OF HIGHER LOAD CAPACITY TERMINAL TRUCKS TO DRIVE MARKET

- 8.5 KEY PRIMARY INSIGHTS

9 TERMINAL TRACTOR MARKET, BY PROPULSION

- 9.1 INTRODUCTION

- 9.2 DIESEL

- 9.2.1 REQUIREMENT FOR HIGH POWER AND COST-EFFECTIVE TERMINAL TRACTORS FOR DEMANDING APPLICATIONS TO DRIVE MARKET

- 9.3 ELECTRIC

- 9.3.1 STRINGENT GLOBAL EMISSION REGULATIONS TO DRIVE MARKET

- 9.4 CNG/LNG

- 9.4.1 ENVIRONMENTAL BENEFITS TO DRIVE MARKET

- 9.5 HYDROGEN

- 9.5.1 OEM INNOVATIONS AND COLLABORATIONS TO DRIVE MARKET

- 9.6 KEY PRIMARY INSIGHTS

10 TERMINAL TRACTOR MARKET, BY TONNAGE

- 10.1 INTRODUCTION

- 10.2 <50 TONS

- 10.2.1 GROWTH IN SEABORNE TRADE TO DRIVE DEMAND

- 10.3 50-100 TONS

- 10.3.1 GROWING EXPORTS AND IMPORTS WORLDWIDE TO DRIVE MARKET

- 10.4 >100 TONS

- 10.4.1 HIGH IMPORT AND EXPORT ACTIVITIES FOR HANDLING OVERSIZED AND HEAVY CARGO TO DRIVE MARKET

- 10.5 KEY PRIMARY INSIGHTS

11 TERMINAL TRACTOR MARKET, LOGISTICS BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 RETAIL

- 11.2.1 GROWTH OF RETAIL INDUSTRY DRIVEN BY E-COMMERCE IN EMERGING ECONOMIES TO DRIVE MARKET

- 11.3 FOOD & BEVERAGES

- 11.3.1 GROWTH OF JUST-IN-TIME DELIVERY MODELS TO DRIVE MARKET

- 11.4 INLAND WATERWAYS & MARINE SERVICE

- 11.4.1 INCREASING WATERBORNE FREIGHT ACTIVITIES TO DRIVE MARKET

- 11.5 RAIL LOGISTICS

- 11.5.1 RISING DEMAND FOR SUSTAINABLE FREIGHT TRANSPORTATION SOLUTIONS TO DRIVE MARKET

- 11.6 ROLL-ON/ROLL-OFF (RORO)

- 11.6.1 EXPANSION OF AUTOMOTIVE AND HEAVY MACHINERY EXPORTS TO DRIVE MARKET

- 11.7 KEY PRIMARY INSIGHTS

12 ELECTRIC TERMINAL TRACTOR MARKET, BY MOTOR POWER OUTPUT

- 12.1 INTRODUCTION

- 12.2 <150 KW

- 12.2.1 EASIER TO INTEGRATE INTO SMALLER-SCALE ELECTRIC FLEETS

- 12.3 150-250 KW

- 12.3.1 SUITABLE FOR STANDARD PORT LOGISTICS

- 12.4 >250 KW

- 12.4.1 DESIGNED TO MEET DEMANDING REQUIREMENTS OF HEAVY-DUTY LOGISTICS

- 12.5 KEY PRIMARY INSIGHTS

13 ELECTRIC TERMINAL TRACTOR MARKET, BY BATTERY CHEMISTRY

- 13.1 INTRODUCTION

- 13.2 LITHIUM IRON PHOSPHATE (LFP)

- 13.2.1 SHIFT TOWARD SAFER, COST-EFFECTIVE, AND SUSTAINABLE OPERATIONS TO DRIVE MARKET

- 13.3 NICKEL MANGANESE COBALT (NMC)

- 13.3.1 HIGH ENERGY AND POWER DENSITIES TO DRIVE MARKET

- 13.4 OTHERS

- 13.5 KEY PRIMARY INSIGHTS

14 TERMINAL TRACTOR MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 MACROECONOMIC OUTLOOK

- 14.2.2 CHINA

- 14.2.2.1 Increasing cargo through sea routes and growth in e-commerce sector to drive market

- 14.2.3 JAPAN

- 14.2.3.1 Increase in trade through major marine ports to drive market

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Growing semiconductor exports to drive market

- 14.2.5 INDIA

- 14.2.5.1 Government initiatives to boost economic growth to drive market

- 14.2.6 REST OF ASIA PACIFIC

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK

- 14.3.2 GERMANY

- 14.3.2.1 Booming logistics sector to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Presence of advanced industrial sector to drive market

- 14.3.4 UK

- 14.3.4.1 Maximum trade through seaports to drive market

- 14.3.5 SPAIN

- 14.3.5.1 Growth of logistics sector to drive market

- 14.3.6 RUSSIA

- 14.3.6.1 Investments in port modernization to impact market

- 14.3.7 REST OF EUROPE

- 14.4 MIDDLE EAST & AFRICA

- 14.4.1 MACROECONOMIC OUTLOOK

- 14.4.2 UAE

- 14.4.2.1 Increasing port expansion and automation activities to drive market

- 14.4.3 SAUDI ARABIA

- 14.4.3.1 Increasing maritime trade volumes to drive market

- 14.4.4 SOUTH AFRICA

- 14.4.4.1 Revival of maritime transport sector to drive market

- 14.4.5 REST OF MIDDLE EAST & AFRICA

- 14.5 NORTH AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK

- 14.5.2 US

- 14.5.2.1 Growth of e-commerce sector to drive market

- 14.5.3 MEXICO

- 14.5.3.1 Increasing marine port activities to drive market

- 14.5.4 CANADA

- 14.5.4.1 Increase in import and export activities to boost market

- 14.6 REST OF THE WORLD

- 14.6.1 MACROECONOMIC OUTLOOK

- 14.6.2 BRAZIL

- 14.6.2.1 Unprecedented growth of e-commerce sector to drive market

- 14.6.3 CHILE

- 14.6.3.1 Growth of freight and logistics market to drive growth

- 14.6.4 ARGENTINA

- 14.6.4.1 Rapid growth of e-commerce sales to drive market

- 14.6.5 OTHERS

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-MAY 2025

- 15.3 MARKET SHARE ANALYSIS, 2024

- 15.4 REVENUE ANALYSIS, 2021-2024

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT

- 15.5.6 TERMINAL TRACTOR MARKET: REGION FOOTPRINT, 2024

- 15.5.7 TERMINAL TRACTOR MARKET: PROPULSION FOOTPRINT, 2024

- 15.5.8 TERMINAL TRACTOR MARKET APPLICATION FOOTPRINT, 2024

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING

- 15.6.5.1 List of startups/SMEs

- 15.6.5.2 Competitive benchmarking of startups/SMEs

- 15.7 COMPANY VALUATION

- 15.8 FINANCIAL METRICS

- 15.9 BRAND/PRODUCT COMPARISON

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

- 15.10.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 KALMAR

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.3.2 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 KONECRANES

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.3.2 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 TERBERG SPECIAL VEHICLES

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches/developments

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.3.4 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 LINDE MATERIAL HANDLING

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches/developments

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 CAPACITY TRUCKS

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches/developments

- 16.1.5.3.2 Deals

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 MAFI TRANSPORT-SYSTEME GMBH

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.7 AUTOCAR, LLC

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.3.2 Other developments

- 16.1.8 MOL (MOL CY NV)

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 TICO TRACTORS

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.9.3.3 Expansions

- 16.1.10 GAUSSIN

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.10.3.2 Expansions

- 16.1.10.3.3 Other developments

- 16.1.1 KALMAR

- 16.2 OTHER PLAYERS

- 16.2.1 SANY GROUP

- 16.2.2 HOIST MATERIAL HANDLING, INC.

- 16.2.3 BLYYD

- 16.2.4 ORANGE EV

- 16.2.5 DAYSWORTH INTERNATIONAL

- 16.2.6 CHINA SINOTRUK INTERNATIONAL CO., LIMITED

- 16.2.7 BYD

- 16.2.8 AB VOLVO

- 16.2.9 HYSTER-YALE MATERIALS HANDLING, INC.

- 16.2.10 DONGFENG MOTOR COMPANY

- 16.2.11 TRANSPORTER INDUSTRY INTERNATIONAL GMBH

- 16.2.12 HANMA TECHNOLOGY GROUP CO., LTD.

17 RECOMMENDATIONS BY MARKETSANDMARKETS

- 17.1 NORTH AMERICA TO DOMINATE TERMINAL TRACTOR MARKET

- 17.2 ELECTRIC TERMINAL TRACTOR MARKET AS KEY FOCUS AREA

- 17.3 CONCLUSION

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 TERMINAL TRACTOR MARKET, BY PROPULSION AND COUNTRY

- 18.4.2 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS