|

|

市場調査レポート

商品コード

1532310

ターミナルトラクター市場- 世界および地域別分析:用途別、タイプ別、トン数別、推進力別、バッテリー化学別、地域別 - 分析と予測(2024年~2034年)Terminal Tractor Market - A Global and Regional Analysis: Focus on Application, Type, Tonnage, Propulsion, Battery Chemistry, and Region - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| ターミナルトラクター市場- 世界および地域別分析:用途別、タイプ別、トン数別、推進力別、バッテリー化学別、地域別 - 分析と予測(2024年~2034年) |

|

出版日: 2024年08月13日

発行: BIS Research

ページ情報: 英文 100 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

ターミナルトラクターの市場規模は、いくつかの重要な要因によって大幅な成長を遂げています。

楽観的シナリオでは、2024年の市場規模は14億8,000万米ドルで、さらにCAGR 6.31%で拡大し、2034年には27億3,000万米ドルに達すると予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 14億8,000万米ドル |

| 2034年の予測 | 27億3,000万米ドル |

| CAGR | 6.31% |

この成長の主な促進要因は、効率的なロジスティクスと港湾運営に対する需要の高まりです。ターミナルトラクターは、大量の貨物を扱い、業務効率を高めるために不可欠です。世界の貿易とeコマースが増加し続ける中、先進的なターミナルトラクターの必要性はより重要になっています。

さらに、厳しい環境規制と持続可能性の推進が、電気およびハイブリッド式ターミナルトラクターの採用を促進しています。これらのトラクターは、排出ガスと運用コストを削減し、世界の持続可能性の目標に合致します。自動化やテレマティクスといった技術の進歩は、ターミナルトラクターの効率性と安全性をさらに高め、オペレーターにとってより魅力的なものとなっています。

スマートポートやデジタルインフラの急速な開拓も市場を後押ししています。高度なテレマティクスと自動化機能を備えたターミナルトラクターは、港湾管理システムとシームレスに統合し、オペレーションを最適化してダウンタイムを削減します。

さらに、安全性と積極的なリスク軽減への関心の高まりが、ターミナルトラクターへのハイテク安全システムの採用につながっています。衝突回避、360度カメラ、自動緊急ブレーキなどの機能により、多忙なターミナル環境における貨物の安全な取り扱いが保証されます。

全体として、ターミナルトラクター市場は、効率的で持続可能なターミナルオペレーションに対する需要の増加に牽引され、トラクターの設計と機能性における技術の進歩と革新に支えられて、力強い成長を示しています。

当レポートでは、世界のターミナルトラクター市場について調査し、市場の概要とともに、用途別、タイプ別、トン数別、推進力別、バッテリー化学別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界の展望

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- R&Dレビュー

- 規制状況

- ステークホルダー分析

- 主要な世界的イベントの影響分析

- 市場力学の概要

第2章 ターミナルトラクター市場(用途別)

- 用途のセグメンテーション

- 用途の概要

- ターミナルトラクター市場(用途別)

第3章 ターミナルトラクター市場(製品別)

- 製品セグメンテーション

- 製品概要

- ターミナルトラクター市場(タイプ別)

- ターミナルトラクター市場(トン数別)

- ターミナルトラクター市場(推進力別)

- ターミナルトラクター市場(バッテリー化学別)

第4章 ターミナルトラクター市場(地域別)

- ターミナルトラクター市場- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 企業プロファイル

- 今後の見通し

- 地理的評価

- Kalmar Corporation

- Terberg Special Vehicles

- Capacity Trucks

- MAFI Transport-Systeme GmbH

- TICO Tractors

- Konecranes

- Sany Group

- Autocar India

- BYD Australia Pty. Ltd.

- Hyster-Yale Materials Handling, Inc.

- CVS ferrari S.P.A.

- Textron Specialized Vehicles

- URSUS S.A

- Liebherr Group

- Mol

第6章 調査手法

Introduction to the Terminal Tractor Market

The terminal tractor market is experiencing substantial growth, driven by several key factors. In an optimistic scenario, the market is expected to be valued at $1.48 billion in 2024 and is further projected to expand at a CAGR of 6.31%, reaching $2.73 billion by 2034.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $1.48 Billion |

| 2034 Forecast | $2.73 Billion |

| CAGR | 6.31% |

A primary driver for this growth has been the increasing demand for efficient logistics and port operations. Terminal tractors are essential for handling high volumes of goods, enhancing operational efficiency. As global trade and e-commerce continue to rise, the need for advanced terminal tractors becomes more critical.

Additionally, stringent environmental regulations and the push for sustainability are driving the adoption of electric and hybrid terminal tractors. These tractors reduce emissions and operational costs, aligning with global sustainability goals. Technological advancements, such as automation and telematics, are further enhancing the efficiency and safety of terminal tractors, making them more attractive to operators.

The rapid development of smart ports and digital infrastructure also propels the market. Terminal tractors equipped with advanced telematics and automation capabilities integrate seamlessly with port management systems, optimizing operations and reducing downtime.

Moreover, the growing focus on safety and proactive risk mitigation is leading to the adoption of high-tech safety systems in terminal tractors. Features like collision avoidance, 360-degree cameras, and automated emergency braking ensure safer handling of goods in busy terminal environments.

Overall, the terminal tractor market is witnessing robust growth, driven by the increasing demand for efficient and sustainable terminal operations, supported by technological advancements and innovations in tractor design and functionality.

Market Segmentation:

Segmentation 1: by Application

- Marine

- Airport

- Oil and Gas

- Warehouse and Logistics

- Food and Beverages

- Others

Segmentation 2: by Type

- Manual

- Automated

Segmentation 3: by Tonnage

- <50 Ton

- 50-100 Ton

- >100 Ton

Segmentation 4: by Propulsion

- Diesel

- Electric

- CNG/LNG

Segmentation 5: by Battery Chemistry

- Lithium Magnesium Phosphate (LMP)

- Nickel Manganese Cobalt (NMC)

- Others

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

How can this report add value to an organization?

Product/Innovation Strategy: The global terminal tractor market has been extensively segmented based on various categories, such as application, type, tonnage, propulsion, and battery chemistry. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Competitive Strategy: A detailed competitive benchmarking of the players operating in the global terminal tractor market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

Some of the prominent companies in this market are:

- Kalmar Corporation

- Terberg Special Vehicles

- Capacity Trucks

- MAFI Transport-Systeme GmbH

- TICO Tractors

- Konecranes

- Sany Group

- CVS ferrari S.P.A.

Key Questions Answered in this Report:

- What are the main factors driving the demand for the terminal tractor market?

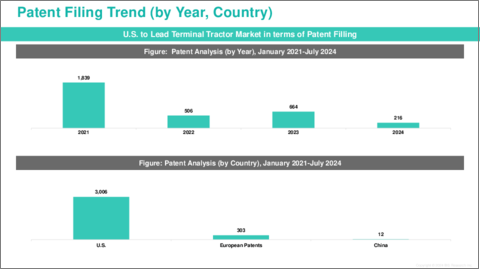

- What are the major patents filed by the companies active in the terminal tractor market?

- Who are the key players in the terminal tractor market, and what are their respective market shares?

- What partnerships or collaborations have been prominent among stakeholders in the terminal tractor market?

- What strategies have the key companies adopted to gain a competitive edge in the terminal tractor market?

- What is the futuristic outlook for the terminal tractor market in terms of growth potential?

- What is the current estimation of the terminal tractor market, and what growth trajectory is projected from 2024 to 2034?

- Which application and product segment is expected to lead the market over the forecast period 2024-2034?

- Which regions demonstrate the highest adoption rates for the terminal tractor market, and what factors contribute to their leadership?

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Growth of Smart Ports and Digital Infrastructure

- 1.1.2 Modular Design for Customization

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.5.1 Use Case

- 1.5.2 End User and Buying Criteria

- 1.6 Impact Analysis for Key Global Events

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.2 Market Restraints

- 1.7.3 Market Opportunities

2. Terminal Tractor Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Terminal Tractor Market (by Application)

- 2.3.1 Marine

- 2.3.2 Airport

- 2.3.3 Oil & Gas

- 2.3.4 Warehouse and Logistics

- 2.3.5 Food and Beverages

- 2.3.6 Others

3. Terminal Tractor Market (by Products)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Terminal Tractor Market (by Type)

- 3.3.1 Manual

- 3.3.2 Automated

- 3.4 Terminal Tractor Market (by Tonnage)

- 3.4.1 <50 Ton

- 3.4.2 50-100 Ton

- 3.4.3 >100 Ton

- 3.5 Terminal Tractor Market (by Propulsion)

- 3.5.1 Diesel

- 3.5.2 Electric

- 3.5.3 CNG/LNG

- 3.6 Terminal Tractor Market (by Battery Chemistry)

- 3.6.1 Lithium Manganese Phosphate (LMP)

- 3.6.2 Nickel Manganese Cobalt (NMC)

- 3.6.3 Others

4. Terminal Tractor Market (by Region)

- 4.1 Terminal Tractor Market- by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 U.S.

- 4.2.6.1 Market by Application

- 4.2.6.2 Market by Product

- 4.2.7 Canada

- 4.2.7.1 Market by Application

- 4.2.7.2 Market by Product

- 4.2.8 Mexico

- 4.2.8.1 Market by Application

- 4.2.8.2 Market by Product

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Germany

- 4.3.6.1 Market by Application

- 4.3.6.2 Market by Product

- 4.3.7 France

- 4.3.7.1 Market by Application

- 4.3.7.2 Market by Product

- 4.3.8 U.K.

- 4.3.8.1 Market by Application

- 4.3.8.2 Market by Product

- 4.3.9 Italy

- 4.3.9.1 Market by Application

- 4.3.9.2 Market by Product

- 4.3.10 Rest-of-Europe

- 4.3.10.1 Market by Application

- 4.3.10.2 Market by Product

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 China

- 4.4.6.1 Market by Application

- 4.4.6.2 Market by Product

- 4.4.7 Japan

- 4.4.7.1 Market by Application

- 4.4.7.2 Market by Product

- 4.4.8 India

- 4.4.8.1 Market by Application

- 4.4.8.2 Market by Product

- 4.4.9 South Korea

- 4.4.9.1 Market by Application

- 4.4.9.2 Market by Product

- 4.4.10 Rest-of-Asia-Pacific

- 4.4.10.1 Market by Application

- 4.4.10.2 Market by Product

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 South America

- 4.5.6.1 Market by Application

- 4.5.6.2 Market by Product

- 4.5.7 Middle East and Africa

- 4.5.7.1 Market by Application

- 4.5.7.2 Market by Product

5. Companies Profiled

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Kalmar Corporation

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Key Personnel

- 5.2.1.6 Analyst View

- 5.2.1.7 Market Share

- 5.2.2 Terberg Special Vehicles

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share

- 5.2.3 Capacity Trucks

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share

- 5.2.4 MAFI Transport-Systeme GmbH

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share

- 5.2.5 TICO Tractors

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share

- 5.2.6 Konecranes

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share

- 5.2.7 Sany Group

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share

- 5.2.8 Autocar India

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share

- 5.2.9 BYD Australia Pty. Ltd.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Key Personnel

- 5.2.9.6 Analyst View

- 5.2.9.7 Market Share

- 5.2.10 Hyster-Yale Materials Handling, Inc.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share

- 5.2.11 CVS ferrari S.P.A.

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share

- 5.2.12 Textron Specialized Vehicles

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share

- 5.2.13 URSUS S.A

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share

- 5.2.14 Liebherr Group

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share

- 5.2.15 Mol

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share

- 5.2.1 Kalmar Corporation