|

|

市場調査レポート

商品コード

1415549

産業用センサーの世界市場 (~2029年):センサータイプ (レベルセンサー・温度センサー・ガスセンサー・圧力センサー・位置センサー・湿度&水分センサー)・タイプ (接触センサー・非接触センサー)・エンドユーザー産業・地域別Industrial Sensors Market by Sensor Type (Level Sensor, Temperature Sensor, Gas Sensor, Pressure Sensor, Position Sensor, and Humidity & Moisture Sensor), Type (Contact & non-contact sensors), End-User Industry and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 産業用センサーの世界市場 (~2029年):センサータイプ (レベルセンサー・温度センサー・ガスセンサー・圧力センサー・位置センサー・湿度&水分センサー)・タイプ (接触センサー・非接触センサー)・エンドユーザー産業・地域別 |

|

出版日: 2024年01月19日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | センサータイプ・タイプ・エンドユーザー産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

産業用センサーの市場規模は、2024年の279億米ドルから、予測期間中は8.5%のCAGRで推移し、2029年には421億米ドルの規模に成長すると予測されています。

産業用センサーの技術的進歩の拡大、センサー産業における小型化とMEMS技術の浸透の拡大により、製造、石油・ガス、鉱業、医薬品、エネルギー・電力、化学などの用途で産業用センサーの用途が広がっています。

タイプ別では、非接触センサーの部門が予測期間中に最も高い成長率を示す見通しです。同部門の成長は、遠隔モニタリングやワイヤレスセンサー技術の普及が進んでいることに起因しています。非接触センサーは測定対象物に物理的に接触する必要がないため、定期的なメンテナンスや校正が不要であり、ダウンタイムや関連コストが削減されます。

北米地域では米国が最大の市場規模を維持する見込みです。2023年の北米の産業用センサー市場では米国が最大のシェアを占めており、予測期間中も同様の動向が予想されています。自動車産業は、米国の産業用センサー市場の成長に大きく貢献している産業の1つです。自動運転車やADAS (先進運転支援システム) の開発は、障害物検知、ナビゲーション、安全運転においてセンサーに大きく依存しています。これらのセンサーは、周辺環境の3Dマップを生成し、あらゆる天候条件で物体を検出し、環境に関する視覚情報を提供し、近距離の物体を検出して、車両の安全かつ自律的な走行を可能にします。

当レポートでは、世界の産業用センサーの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 技術分析

- 貿易分析

- 料金分析

- 特許分析

- 規制状況と基準

- 主な会議とイベント

- 価格分析

第6章 産業用センサーに統合された技術

- 産業用センサーに使用されるパッケージング技術

- システムインパッケージ (SIP)

- システムオンチップ (SOC)

- MEMS技術

- VLSI

- NEMS

- CMOS技術

- 光センシング技術

- その他の技術

- 光学分光法

- マイクロシステム技術

- 統合型産業用センサー・ハイブリッドセンサー

- IC互換3D微細構造

- ASIC

第7章 産業用センサー市場:センサータイプ別

- レベルセンサー

- 温度センサー

- フローセンサー

- ガスセンサー

- 位置センサー

- 圧力センサー

- 力センサー

- 湿度および湿度センサー

- イメージセンサー

第8章 産業用センサー市場:タイプ別

- 接触センサー

- 非接触センサー

第9章 産業用センサー市場:エンドユーザー産業別

- 製造

- 石油・ガス

- 化学薬品

- 医薬品

- エネルギー・電力

- 鉱業

第10章 産業用センサー市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要企業の戦略

- 市場シェア分析

- 収益分析

- 企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- ROCKWELL AUTOMATION

- HONEYWELL INTERNATIONAL INC.

- TEXAS INSTRUMENTS INCORPORATED

- PANASONIC CORPORATION

- STMICROELECTRONICS

- TE CONNECTIVITY

- SIEMENS

- AMPHENOL CORPORATION

- DWYER INSTRUMENTS, LLC.

- BOSCH SENSORTEC GMBH

- その他の企業

- OMEGA ENGINEERING, INC.

- SENSIRION AG

- AMS-OSRAM AG

- MICROCHIP TECHNOLOGY INC.

- ABB

- NXP SEMICONDUCTORS

- ENDRESS+HAUSER GROUP SERVICES AG

- FIGARO ENGINEERING INC.

- SAFRAN COLIBRYS SA

- ANALOG DEVICES, INC.

- INFINEON TECHNOLOGIES AG

- RENESAS ELECTRONICS CORPORATION

- BREEZE TECHNOLOGIES

- ELICHENS

- EDINBURGH SENSORS

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Sensor Type, Type, End-User Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

The industrial sensors market is projected to grow from USD 27.9 billion in 2024 and is expected to reach USD 42.1 billion by 2029, growing at a CAGR of 8.5% from 2024 to 2029. The growing technological advancements in industrial sensors. The reduction in size and the growing penetration of MEMS technology in the sensors industry have created a wide horizon of applications for industrial sensors in applications such as manufacturing, oil & gas, mining, pharmaceuticals, energy & power, and chemicals.

"Non-contact sensors in the industrial sensor market to witness highest growth rate during the forecast period."

The non-contact industrial sensors market is expected to grow at a higher rate during the forecast period. The growth of the market can be attributed to the increasing penetration of remote monitoring and wireless sensor technologies. Non-contact sensors do not require physical contact with the object being measured, eliminating the need for regular maintenance and calibration. This reduces downtime and associated costs. Hence, these sensors are preferable over traditional contact sensors.

"Market for oil & gas segment in the industrial sensor market to hold the second largest market share during the forecast period."

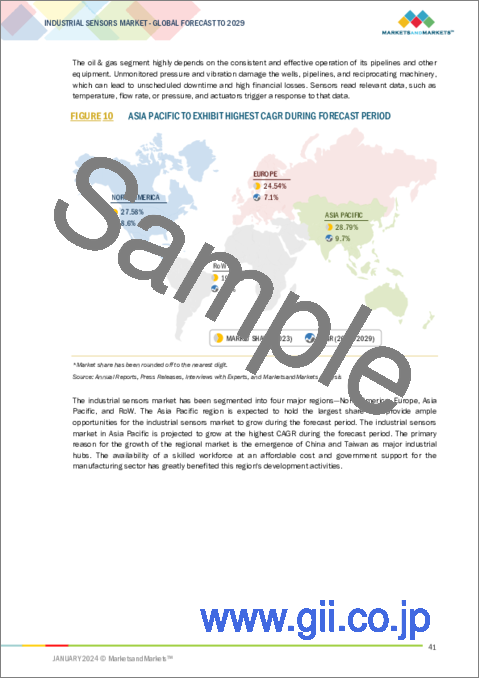

The oil & gas industry highly depends on the consistent and effective operation of its pipelines and other equipment. Unmonitored pressure and vibration damage the wells, pipelines, and reciprocating machinery, which can lead to unscheduled downtime and high financial losses. Industrial sensors read relevant data, such as temperature, flow rate, or pressure, and actuators trigger a response to that data resulting in an efficient operation in the oil & gas industries.

"The US is expected to hold the largest market size in the North American region during the forecast period."

The US accounted for the largest share of the North American industrial sensor market in 2023, and a similar trend is expected to be witnessed during the forecast period. The automotive industry is one of the significant contributors to the growth of the US industrial sensors market. The development of autonomous vehicles and Advanced Driver-Assistance Systems (ADAS) relies heavily on sensors for obstacle detection, navigation, and safe operation. These sensors generate 3D maps of the surrounding environment, detect objects in all weather conditions, provide visual information about the environment, and detect objects at close range enabling the vehicle navigate safely and autonomously.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: C-level Executives - 30%, Directors -30%, and Others - 40%

- By Region: North America -30%, Europe - 25%, Asia Pacific- 40%, and RoW - 5%

The report profiles key players in the industrial sensor market with their respective market ranking analysis. Prominent players profiled in this report include Rockwell Automation (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Panasonic (Japan), STMicroelectronics (Switzerland), TE Connectivity (Switzerland), Siemens (Germany), Amphenol Corporation (US), Dwyer Instruments, LLC. (US), and Bosch Sensortec (Germany). Apart from these, Omega Engineering Inc. (US), Sensirion AG (Switzerland), ams-OSRAM AG (Austria), Microchip Technology Inc. (US), ABB (Switzerland), NXP Semiconductors (Netherlands), Endress+Hauser Group Services AG (Switzerland), Figaro Engineering Inc. (Japan), Safran Colibrys SA (Switzerland), Analog Devices Inc. (US), Infineon Technologies AG (Germany), Renesas Electronics Corporation (Japan), Breeze Technologies (Germany), eLichens (France) and Edinburgh Sensors (UK) are among a few other key companies in the industrial sensor market.

Report Coverage

The report defines, describes, and forecasts the industrial sensor market based on sensor type, type, end user, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the industrial sensor market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall industrial sensor market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Rising adoption of Industry 4.0 and IIoT in manufacturing), restraints (Competitive pricing resulting in a decline in average selling prices), opportunities (Predictive maintenance to offer lucrative opportunities to market players), and challenges (Precise performance requirements from upcoming advanced/ technologically sensors) of the industrial sensor market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial sensor market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the industrial sensor market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial sensor market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players like Rockwell Automation (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Panasonic (Japan), and STMicroelectronics (Switzerland) among others in the industrial sensor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INDUSTRIAL SENSORS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 INDUSTRIAL SENSORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of major secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATED IN INDUSTRIAL SENSORS MARKET (SUPPLY-SIDE)

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (supply side)

- FIGURE 4 INDUSTRIAL SENSORS MARKET: BOTTOM-UP APPROACH (SUPPLY SIDE)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 5 INDUSTRIAL SENSORS MARKET: TOP-DOWN APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON INDUSTRIAL SENSORS MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 IMAGE SENSOR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 INDUSTRIAL SENSORS MARKET, BY TYPE, 2024 VS. 2029

- FIGURE 9 MANUFACTURING SEGMENT TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL SENSORS MARKET

- FIGURE 11 GROWING ADOPTION OF INDUSTRY 4.0 PRINCIPLES TO DRIVE INDUSTRIAL SENSORS MARKET

- 4.2 INDUSTRIAL SENSORS MARKET, BY TYPE

- FIGURE 12 NON-CONTACT SENSORS TO REGISTER HIGHER CAGR FROM 2024 TO 2029

- 4.3 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE

- FIGURE 13 IMAGE SENSORS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY

- FIGURE 14 MANUFACTURING INDUSTRY TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 INDUSTRIAL SENSORS MARKET IN ASIA PACIFIC, BY END-USER INDUSTRY AND COUNTRY

- FIGURE 15 MANUFACTURING SEGMENT AND CHINA DOMINATED MARKET IN 2023

- 4.6 INDUSTRIAL SENSORS MARKET, BY COUNTRY

- FIGURE 16 CHINA TO LEAD GLOBAL INDUSTRIAL SENSORS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 INDUSTRIAL SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 18 INDUSTRIAL SENSORS MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.1.1 Rising adoption of Industry 4.0 and IIoT in manufacturing

- 5.2.1.2 Growing demand for smart sensors in various industries to gain real-time insights

- 5.2.1.3 Reduced size of industrial sensors due to technological innovations

- 5.2.2 RESTRAINTS

- FIGURE 19 INDUSTRIAL SENSORS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.2.1 Shrinking profit margins for manufacturers due to reduced ASP

- 5.2.2.2 High manufacturing costs associated with developing innovative gas sensors

- 5.2.3 OPPORTUNITIES

- FIGURE 20 INDUSTRIAL SENSORS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.3.1 Implementation of AI and machine learning

- 5.2.3.2 Thriving automotive sector owing to rising investments in R&D

- 5.2.4 CHALLENGES

- FIGURE 21 INDUSTRIAL SENSORS MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.2.4.1 Varied sensing capability based on end-use application

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: MANUFACTURING AND ASSEMBLY PHASE TO ADD MAXIMUM VALUE

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 24 ECOSYSTEM OF INDUSTRIAL SENSORS MARKET

- TABLE 1 COMPANIES AND THEIR ROLES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INDUSTRIAL SENSORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 26 KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- 5.7.1 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 WIKA (US) SUPPLIES AGRICULTURAL MACHINERY MANUFACTURERS WITH PRESSURE SENSORS FOR MACHINE CONTROL

- 5.8.2 CO2METER (US) PROVIDES ISENSE ALARM (CM-0052) TO MONITOR AND CONTROL REMOTE DEPLOYMENT AND LEAK DETECTION OF CO2

- 5.8.3 TE CONNECTIVITY (SWITZERLAND) DEVELOPS SMI SO-10 PRESSURE SENSOR PACKAGE THAT PROVIDES FULLY PRESSURE-CALIBRATED AND TEMPERATURE-COMPENSATED OUTPUT

- 5.8.4 REFINERY IN NORTH AMERICA IMPROVES VACUUM TOWER LEVEL MEASUREMENT WITH SIEMENS' ROSEMOUNT 3051S ERS AND THERMAL RANGE EXPANDER

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGY

- 5.9.1.1 Seed technology

- 5.9.1.2 Electronic nose (e-nose)

- 5.9.1.3 MEMS temperature sensors

- 5.9.1.4 Miniature fiber-optic temperature sensors

- 5.9.1 KEY TECHNOLOGY

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 28 IMPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 5 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10.2 EXPORT SCENARIO

- FIGURE 29 EXPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 6 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 TARIFF ANALYSIS

- TABLE 7 TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY US, 2022

- TABLE 8 TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2022

- TABLE 9 TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 10 TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY MEXICO, 2022

- 5.12 PATENT ANALYSIS

- TABLE 11 INDUSTRIAL SENSORS MARKET: LIST OF PATENTS, 2021-2023

- FIGURE 30 INDUSTRIAL SENSORS MARKET: PATENTS GRANTED, 2012-2022

- TABLE 12 TOP PATENT OWNERS, 2012-2022

- FIGURE 31 INDUSTRIAL SENSORS MARKET: TOP 10 PATENT HOLDERS IN INDUSTRIAL SENSORS MARKET, 2012-2022

- 5.13 REGULATORY LANDSCAPE AND STANDARDS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 INTERNATIONAL ELECTROTECHNICAL COMMISSION STANDARDS (IEC)

- 5.13.2 AS4641

- 5.13.3 ISO 19891-1

- 5.13.4 RESTRICTION OF HAZARDOUS SUBSTANCES DIRECTIVE (ROHS)

- 5.13.5 ATMOSPHERE EXPLOSIBLE (ATEX)

- 5.13.6 EDISON TESTING LABORATORY (ETL)

- 5.13.7 SAFETY INTEGRITY LEVEL 1 (SIL 1)

- 5.13.8 MATERIAL SAFETY DATA SHEET (MSDS)

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 17 INDUSTRIAL SENSORS MARKET: LIST OF CONFERENCES AND EVENTS

- 5.15 PRICING ANALYSIS

- TABLE 18 AVERAGE SELLING PRICE (ASP) OF DIGITAL TEMPERATURE SENSORS OFFERED BY TWO MAJOR PLAYERS

- FIGURE 32 AVERAGE SELLING PRICE (ASP) TREND OF DIGITAL TEMPERATURE SENSORS OFFERED BY TWO MAJOR PLAYERS

- 5.15.1 AVERAGE SELLING PRICE (ASP) TREND OF INDUSTRIAL SENSORS, 2020-2029

- FIGURE 33 AVERAGE SELLING PRICE (ASP) TREND OF INDUSTRIAL SENSORS, 2020-2029

- FIGURE 34 AVERAGE SELLING PRICE (ASP) TREND OF INDUSTRIAL TEMPERATURE SENSORS, BY REGION, 2020-2029

6 TECHNOLOGIES INTEGRATED INTO INDUSTRIAL SENSORS

- 6.1 INTRODUCTION

- 6.2 PACKAGING TECHNOLOGIES USED FOR INDUSTRIAL SENSORS

- 6.2.1 INTRODUCTION

- 6.2.2 SYSTEM-IN-PACKAGE (SIP)

- 6.2.3 SYSTEM-ON-CHIP (SOC)

- TABLE 19 TECHNICAL FEATURES OF SYSTEM-IN-PACKAGE (SIP) AND SYSTEM-ON-CHIP (SOC)

- 6.3 MICROELECTROMECHANICAL SYSTEMS (MEMS) TECHNOLOGY

- 6.3.1 VERY-LARGE-SCALE INTEGRATION TECHNOLOGY (VLSI)

- 6.3.2 NANOELECTROMECHANICAL SYSTEMS (NEMS)

- 6.4 CMOS TECHNOLOGY

- 6.5 OPTICAL SENSING TECHNOLOGY

- 6.6 OTHER TECHNOLOGIES

- 6.6.1 OPTICAL SPECTROSCOPY

- 6.6.2 MICROSYSTEMS TECHNOLOGY

- 6.6.3 INTEGRATED INDUSTRIAL SENSORS-HYBRID SENSORS

- 6.6.4 IC-COMPATIBLE 3D MICROSTRUCTURING

- 6.6.5 APPLICATION-SPECIFIC INTEGRATED CIRCUITS

7 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE

- 7.1 INTRODUCTION

- FIGURE 35 IMAGE SENSOR SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 21 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 22 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (MILLION UNITS)

- TABLE 23 INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (MILLION UNITS)

- 7.2 LEVEL SENSORS

- 7.2.1 GROWING USE IN ENVIRONMENTAL APPLICATIONS TO DRIVE MARKET

- TABLE 24 INDUSTRIAL LEVEL SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 INDUSTRIAL LEVEL SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 26 INDUSTRIAL LEVEL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 27 INDUSTRIAL LEVEL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.3 TEMPERATURE SENSORS

- 7.3.1 AUTOMOTIVE AND PHARMACEUTICAL INDUSTRIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR PLAYERS

- FIGURE 36 NON-CONTACT SENSOR SEGMENT TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- TABLE 28 INDUSTRIAL TEMPERATURE SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 29 INDUSTRIAL TEMPERATURE SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 30 INDUSTRIAL TEMPERATURE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 31 INDUSTRIAL TEMPERATURE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.4 FLOW SENSORS

- 7.4.1 INTRODUCTION OF FLOW SENSOR-INTEGRATED TWO-WAY COMMUNICATION AND SELF-DIAGNOSIS SYSTEMS TO FOSTER SEGMENTAL GROWTH

- TABLE 32 INDUSTRIAL FLOW SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 33 INDUSTRIAL FLOW SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 34 INDUSTRIAL FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 35 INDUSTRIAL FLOW SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.5 GAS SENSORS

- 7.5.1 RISING AIR POLLUTION LEVELS TO BOOST DEMAND

- TABLE 36 INDUSTRIAL GAS SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 37 INDUSTRIAL GAS SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 38 INDUSTRIAL GAS SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 39 INDUSTRIAL GAS SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.6 POSITION SENSORS

- 7.6.1 MAJOR TYPES OF POSITION SENSORS

- 7.6.1.1 Linear position sensors

- 7.6.1.1.1 Rising applications in automated machinery and robotics to drive market

- 7.6.1.2 Rotary position sensors

- 7.6.1.2.1 Increasing deployment in medical devices and test and measurement equipment to foster segmental growth

- 7.6.1.1 Linear position sensors

- TABLE 40 INDUSTRIAL POSITION SENSORS MARKET, BY POSITION SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 41 INDUSTRIAL POSITION SENSORS MARKET, BY POSITION SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 42 INDUSTRIAL POSITION SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 43 INDUSTRIAL POSITION SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 44 INDUSTRIAL POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 45 INDUSTRIAL POSITION SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.6.1 MAJOR TYPES OF POSITION SENSORS

- 7.7 PRESSURE SENSORS

- 7.7.1 SURGING ADOPTION BY AUTOMOBILE MANUFACTURERS TO DRIVE MARKET

- FIGURE 37 OIL & GAS INDUSTRY TO HOLD LARGEST MARKET SHARE IN INDUSTRIAL PRESSURE SENSORS MARKET DURING FORECAST PERIOD

- TABLE 46 INDUSTRIAL PRESSURE SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 47 INDUSTRIAL PRESSURE SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 48 INDUSTRIAL PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 49 INDUSTRIAL PRESSURE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.8 FORCE SENSORS

- 7.8.1 GROWING DEPLOYMENT IN AUTOMATED ROBOTS TO ACCELERATE DEMAND

- TABLE 50 INDUSTRIAL FORCE SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 51 INDUSTRIAL FORCE SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 52 INDUSTRIAL FORCE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 53 INDUSTRIAL FORCE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.9 HUMIDITY AND MOISTURE SENSORS

- 7.9.1 TYPES OF HUMIDITY SENSORS

- 7.9.1.1 Capacitive

- 7.9.1.1.1 Ability to endure effects of condensation and high temperatures to boost demand

- 7.9.1.2 Resistive

- 7.9.1.2.1 Increasing demand in food processing industry to drive market

- 7.9.1.1 Capacitive

- TABLE 54 INDUSTRIAL HUMIDITY & MOISTURE SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 55 INDUSTRIAL HUMIDITY & MOISTURE SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 56 INDUSTRIAL HUMIDITY & MOISTURE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 57 INDUSTRIAL HUMIDITY & MOISTURE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.9.1 TYPES OF HUMIDITY SENSORS

- 7.10 IMAGE SENSORS

- 7.10.1 PHARMACEUTICALS AND ENERGY & POWER INDUSTRIES TO GENERATE SIGNIFICANT DEMAND

- TABLE 58 INDUSTRIAL IMAGE SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 59 INDUSTRIAL IMAGE SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 60 INDUSTRIAL IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 61 INDUSTRIAL IMAGE SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

8 INDUSTRIAL SENSORS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 38 NON-CONTACT SENSORS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 62 INDUSTRIAL SENSORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 63 INDUSTRIAL SENSORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2 CONTACT SENSORS

- 8.2.1 GROWING DEMAND IN OIL & GAS AND ENERGY & POWER INDUSTRIES TO FOSTER SEGMENTAL GROWTH

- TABLE 64 CONTACT INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 65 CONTACT INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- 8.3 NON-CONTACT SENSORS

- 8.3.1 FOOD & BEVERAGES AND MINING SECTORS TO GENERATE SIGNIFICANT DEMAND

- TABLE 66 NON-CONTACT INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 67 NON-CONTACT INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

9 INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 39 MANUFACTURING INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2024 TO 2029

- TABLE 68 INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 9.2 MANUFACTURING

- 9.2.1 GROWING ADOPTION OF IIOT IN AUTOMOTIVE AND PROCESS INDUSTRIES TO DRIVE MARKET

- TABLE 70 MANUFACTURING: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 71 MANUFACTURING: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 72 MANUFACTURING: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 MANUFACTURING: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 OIL & GAS

- 9.3.1 NEED TO ENHANCE SAFETY AND IMPROVE PRODUCTION YIELDS TO BOOST DEMAND

- FIGURE 40 NORTH AMERICA TO EXHIBIT HIGHEST CAGR IN INDUSTRIAL SENSORS MARKET FOR OIL & GAS INDUSTRY DURING FORECAST PERIOD

- TABLE 74 OIL & GAS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 75 OIL & GAS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 76 OIL & GAS: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 OIL & GAS: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 CHEMICALS

- 9.4.1 ABILITY TO OFFER REAL-TIME MONITORING AND RECORD RANGE OF GASES EMITTED FROM STACKS TO DRIVE MARKET

- TABLE 78 CHEMICALS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 79 CHEMICALS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 80 CHEMICALS: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 CHEMICALS: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 PHARMACEUTICALS

- 9.5.1 OPERATIONAL ACCURACY AND SAFETY TO BOOST DEMAND

- TABLE 82 PHARMACEUTICALS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 83 PHARMACEUTICALS: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 84 PHARMACEUTICALS: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 PHARMACEUTICALS: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 ENERGY & POWER

- 9.6.1 GROWING RELIANCE ON RENEWABLE RESOURCES FOR POWER GENERATION TO DRIVE MARKET

- FIGURE 41 FORCE SENSORS TO CLAIM LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 86 ENERGY & POWER: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 87 ENERGY & POWER: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 88 ENERGY & POWER: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 89 ENERGY & POWER: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 MINING

- 9.7.1 INCREASING USE OF MINERALS AND NATURAL RESOURCES IN MINING ACTIVITIES TO FUEL MARKET GROWTH

- TABLE 90 MINING: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2020-2023 (USD MILLION)

- TABLE 91 MINING: INDUSTRIAL SENSORS MARKET, BY SENSOR TYPE, 2024-2029 (USD MILLION)

- TABLE 92 MINING: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 MINING: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

10 INDUSTRIAL SENSORS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC TO DISPLAY HIGHEST CAGR IN GLOBAL INDUSTRIAL SENSORS MARKET DURING FORECAST PERIOD

- TABLE 94 INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 95 INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- FIGURE 43 NORTH AMERICA: INDUSTRIAL SENSORS MARKET SNAPSHOT

- TABLE 96 NORTH AMERICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 NORTH AMERICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Growing demand for automation in various industries to drive market

- TABLE 100 US: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 101 US: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Mining, automotive, and oil & gas industries to offer lucrative growth opportunities to players

- TABLE 102 CANADA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 103 CANADA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Rapid industrialization and urbanization to boost demand

- TABLE 104 MEXICO: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 105 MEXICO: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 44 EUROPE: INDUSTRIAL SENSORS MARKET SNAPSHOT

- TABLE 106 EUROPE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 107 EUROPE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Thriving food & beverages industry to boost demand

- TABLE 110 UK: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 111 UK: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Technological advancements in automotive sector to drive market

- TABLE 112 GERMANY: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 113 GERMANY: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Expanding mining sector to offer lucrative opportunities to players

- TABLE 114 FRANCE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 FRANCE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 116 REST OF EUROPE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 117 REST OF EUROPE: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: INDUSTRIAL SENSORS MARKET SNAPSHOT

- TABLE 118 ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 119 ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Increasing demand from energy & power sector to boost demand

- TABLE 122 CHINA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 123 CHINA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Growing demand for sensor-equipped medical devices due to rising aging population to drive market

- TABLE 124 JAPAN: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 125 JAPAN: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Developing automotive and consumer electronics industries to boost demand

- TABLE 126 SOUTH KOREA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 127 SOUTH KOREA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Growing petrochemicals industry to drive market

- TABLE 128 INDIA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 129 INDIA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 130 REST OF ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.5 ROW

- 10.5.1 RECESSION IMPACT ON MARKET IN ROW

- TABLE 132 ROW: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 133 ROW: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 134 ROW: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 ROW: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: INDUSTRIAL SENSORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: INDUSTRIAL SENSORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5.2 GCC

- 10.5.2.1 Established oil & gas industry to accelerate demand

- TABLE 138 GCC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 139 GCC: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Technological advancements in automotive and manufacturing sectors to boost demand

- TABLE 140 SOUTH AMERICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 141 SOUTH AMERICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.4.1 Increasing adoption of IoT and smart technologies to boost demand

- TABLE 142 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL SENSORS MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY MAJOR PLAYERS, 2020-2023

- TABLE 144 INDUSTRIAL SENSORS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 11.3 MARKET SHARE ANALYSIS, 2022

- FIGURE 46 INDUSTRIAL SENSORS MARKET SHARE ANALYSIS, 2022

- TABLE 145 INDUSTRIAL SENSORS MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 47 INDUSTRIAL SENSORS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 11.5 COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 48 INDUSTRIAL SENSORS MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 146 OVERALL COMPANY FOOTPRINT (25)

- TABLE 147 SENSOR TYPE FOOTPRINT (25)

- TABLE 148 END-USER INDUSTRY FOOTPRINT (25)

- TABLE 149 REGION FOOTPRINT (25)

- 11.7 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- TABLE 150 START-UPS/SMES IN INDUSTRIAL SENSORS MARKET

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 49 INDUSTRIAL SENSORS MARKET, START-UPS/SMES EVALUATION MATRIX, 2022

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 151 INDUSTRIAL SENSORS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 152 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 153 INDUSTRIAL SENSORS MARKET: PRODUCT LAUNCHES, 2020-2023

- 11.8.2 DEALS

- TABLE 154 INDUSTRIAL SENSORS MARKET: DEALS, 2020-2023

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.1 KEY COMPANIES

- 12.1.1 ROCKWELL AUTOMATION

- TABLE 155 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 50 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 156 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 ROCKWELL AUTOMATION: DEALS

- 12.1.2 HONEYWELL INTERNATIONAL INC.

- TABLE 158 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 159 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 161 HONEYWELL INTERNATIONAL INC.: DEALS

- 12.1.3 TEXAS INSTRUMENTS INCORPORATED

- TABLE 162 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 52 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 163 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- 12.1.4 PANASONIC CORPORATION

- TABLE 165 PANASONIC CORPORATION: COMPANY OVERVIEW

- FIGURE 53 PANASONIC CORPORATION: COMPANY SNAPSHOT

- TABLE 166 PANASONIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 168 PANASONIC CORPORATION: DEALS

- 12.1.5 STMICROELECTRONICS

- TABLE 169 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 54 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 170 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 172 STMICROELECTRONICS: DEALS

- 12.1.6 TE CONNECTIVITY

- TABLE 173 TE CONNECTIVITY: COMPANY OVERVIEW

- FIGURE 55 TE CONNECTIVITY: COMPANY SNAPSHOT

- TABLE 174 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 TE CONNECTIVITY: DEALS

- 12.1.7 SIEMENS

- TABLE 176 SIEMENS: COMPANY OVERVIEW

- FIGURE 56 SIEMENS: COMPANY SNAPSHOT

- TABLE 177 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SIEMENS: PRODUCT LAUNCHES

- 12.1.8 AMPHENOL CORPORATION

- TABLE 179 AMPHENOL CORPORATION: COMPANY OVERVIEW

- FIGURE 57 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 180 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 AMPHENOL CORPORATION: PRODUCT LAUNCHES

- TABLE 182 AMPHENOL CORPORATION: DEALS

- 12.1.9 DWYER INSTRUMENTS, LLC.

- TABLE 183 DWYER INSTRUMENTS, LLC.: COMPANY OVERVIEW

- TABLE 184 DWYER INSTRUMENTS, LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 DWYER INSTRUMENTS, LLC.: PRODUCT LAUNCHES

- 12.1.10 BOSCH SENSORTEC GMBH

- TABLE 186 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 187 BOSCH SENSORTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 OMEGA ENGINEERING, INC.

- 12.2.2 SENSIRION AG

- 12.2.3 AMS-OSRAM AG

- 12.2.4 MICROCHIP TECHNOLOGY INC.

- 12.2.5 ABB

- 12.2.6 NXP SEMICONDUCTORS

- 12.2.7 ENDRESS+HAUSER GROUP SERVICES AG

- 12.2.8 FIGARO ENGINEERING INC.

- 12.2.9 SAFRAN COLIBRYS SA

- 12.2.10 ANALOG DEVICES, INC.

- 12.2.11 INFINEON TECHNOLOGIES AG

- 12.2.12 RENESAS ELECTRONICS CORPORATION

- 12.2.13 BREEZE TECHNOLOGIES

- 12.2.14 ELICHENS

- 12.2.15 EDINBURGH SENSORS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS