|

|

市場調査レポート

商品コード

1394958

ヘッドマウントディスプレイ (HMD) の世界市場:タイプ別、技術別、用途別、製品タイプ別、コンポーネント別、コネクティビティ別、地域別- 2029 年までの世界予測Head Mounted Display (HMD) Market by Type, Technology (AR, VR), Application (Consumer, Commercial, Enterprise & Industry, Aerospace & Defense), Product Type (Head-mounted, eyewear), Component, Connectivity and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ヘッドマウントディスプレイ (HMD) の世界市場:タイプ別、技術別、用途別、製品タイプ別、コンポーネント別、コネクティビティ別、地域別- 2029 年までの世界予測 |

|

出版日: 2023年12月08日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | タイプ・技術・コンポーネント・製品タイプ・コネクティビティ・用途 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

ヘッドマウントディスプレイ (HMD) の市場規模は、2024年の75億米ドルから、予測期間中に28.8%のCAGRで推移し、2029年には264億米ドルの規模に成長すると予測されています。

HMD市場の成長を促進する主な要因は、主要企業によるHMD開発への投資の拡大、低価格のHMDのアベイラビリティ、AR・VRの需要の拡大、技術の進歩とデジタル化の進展、手頃なマイクロディスプレイの価格などです。さらに、ゲーム用途でのHMD採用の増加、軽量HMDとポータブルデバイスの需要の拡大、消費者による採用の拡大などの要因も参入事業者に新たな成長機会をもたらすと期待されています。

コネクティビティ別で見ると、有線接続 (テザー型HMD) の部門が予測期間中に最も高いCAGRを記録する見通しです。有線接続 (テザーHMD) は、手頃な価格と性能という2つの主な理由により、HMD市場の中で最も高いCAGRを記録すると予想されています。有線HMDは一般的に無線HMDよりも手頃な価格で、より安定したパフォーマンスを提供できます。さらに、無線HMDよりも汎用性が高く、使いやすく、より幅広いデバイスで使用でき、一般的にセットアップや使用も簡単です。これらの要因により、有線HMDは当面HMD市場を独占し続けると予想されています。

地域別では、アジア太平洋地域が予測期間中に最も高いCAGRを記録する見通しです。同地域は、没入型技術の採用の増加により、HMD市場の成長をリードすると予測されています。中国のレLenovoやPico Interactive、日本のSony、韓国のSamsungなど、同地域の主要企業がHMDの開発と製造に大きく貢献しています。これらの企業は最先端のHMD技術を生産する最前線にあり、AR・VR体験に対する需要の高まりに対応しています。また、同地域の強固なエコシステムと、デジタル化に対する政府の支援も、重要な促進要因となっています。

当レポートでは、世界のヘッドマウントディスプレイ (HMD) の市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ヘッドマウントディスプレイ市場のエコシステム

- 主要技術の動向

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ

- 貿易データ

- 関税と規制

- 顧客の事業に影響を与える動向/ディスラプション

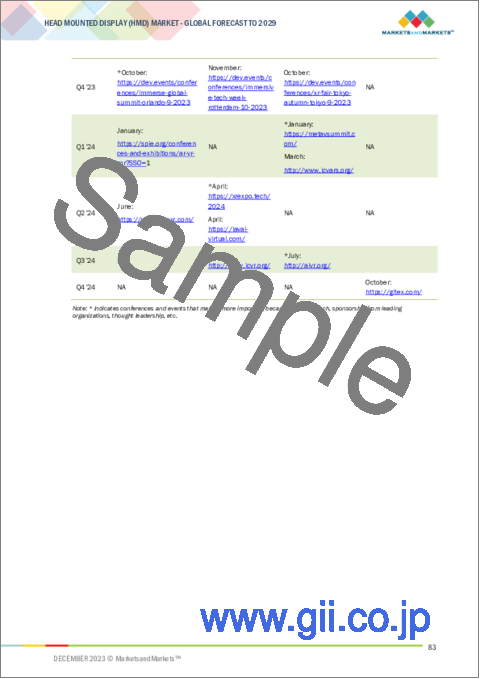

- 主な会議とイベント

第6章 ヘッドマウントディスプレイ (HMD) 市場:技術別

- AR

- VR

第7章 ヘッドマウントディスプレイ (HMD) 市場:コンポーネント別

- プロセッサー&メモリー

- コントローラー

- センサー

- 磁力計

- 加速度計

- ジャイロスコープ

- 近接センサー

- カメラ

- ディスプレイ

- レンズ

- ケース&コネクター

- その他

第8章 ヘッドマウントディスプレイ (HMD) 市場:製品タイプ別

- ヘッドマウント型

- メガネ

第9章 ヘッドマウントディスプレイ (HMD) 市場:コネクティビティ別

- テザードHMD (有線)

- スタンドアロンHMD (無線)

第10章 ヘッドマウントディスプレイ (HMD) 市場:用途別

- 消費者

- ゲーム

- スポーツ&エンターテイメント

- 航空宇宙・防衛

- ヘルスケア

- トレーニング

- 治療・手術

- 患者ケア管理

- エンタープライズ・産業用

- バーチャルインタビュー

- バーチャル会議

- 倉庫

- 緊急対応

- 操作・組み立て

- 保守点検サービス

- 現場修理サービス

- 貨物の積み込み・輸送

- 商業

- 広告・マーケティング・ブランディング

- 小売

- 観光

- エネルギー

- 自動車・その他

- 自動車

- その他

第11章 ヘッドマウントディスプレイ (HMD) 市場:地域別

- 南北アメリカ

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 市場評価の枠組み

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- META

- MICROSOFT

- SONY GROUP CORPORATION

- MAGIC LEAP, INC.

- SEIKO EPSON CORPORATION

- SAMSUNG

- HTC

- BYTEDANCE (PICO TECHNOLOGY CO. LTD.)

- DPVR

- VUZIX

- その他の企業

- LENOVO

- BAE SYSTEMS

- HP DEVELOPMENT COMPANY, L.P.

- VARJO

- VALVE CORPORATION

- REALWEAR, INC.

- THALES

- PANASONIC HOLDINGS CORPORATION

- PIMAX INC.

- GOOVIS

- ZEBRA TECHNOLOGIES CORP.

- LYNX MIXED REALITY

- MERGE LABS, INC.

- REALMAX INC.

- NIMO PLANET

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Technology, Component, Product Type, Connectivity, Application |

| Regions covered | North America, Europe, Asia Pacific, RoW |

The Head-mounted Display (HMD) market is projected to reach USD 26.4 billion by 2029 from USD 7.5 billion in 2024 at a CAGR of 28.8% during the forecast period. The major factors driving the growth of Head-mounted Display (HMD) market are growing investments by significant key players in the development of HMD, availability of low-cost HMDs, growing demand for AR and VR, technological advancements and growing digitalization, and Affordable microdisplay prices. Moreover, increasing adoption of HMDs in gaming applications, growing demand for lightweight HMDs and portable devices, and growing consumer adoption are expected to carve out new growth opportunities for market players.

"Wired (Tethered HMD) to register the highest CAGR during the forecast period."

Wired connectivity (Tethered HMD) is expected to register the highest CAGR of the HMD market due to two main reasons: affordability and performance. Wired HMDs are generally more affordable than wireless HMDs and can deliver a more consistent and stable performance. In addition, wired HMDs are more versatile and easier to use than wireless HMDs. They can be used with a wider range of devices and are generally easier to set up and use. As a result of these factors, wired HMDs are expected to continue to dominate the HMD market for the foreseeable future.

"VR Standalone HMD to register the largest share during the forecast period."

Standalone Virtual Reality (VR) Head-Mounted Displays (HMDs) are poised to secure the largest share of the HMD market, driven by recent launches and evolving consumer preferences. With a wireless and portable design, these HMDs offer unparalleled convenience, eliminating the need for external devices. The recent surge in popularity can be attributed to the ease of use, cost efficiency, and versatility of standalone VR HMDs. Notable launches from major manufacturers, such as Oculus Quest 2 and other innovative models, showcase advancements in processing power, graphics capabilities, and enhanced sensors, contributing to a more immersive virtual experience. The appeal of standalone devices to a mass market is underscored by their broad applications, spanning gaming, entertainment, education, and training.

"Asia Pacific region to register the highest CAGR during the forecast period."

The Asia-Pacific region is anticipated to lead the Head-Mounted Display (HMD) market's growth, driven by increased adoption of immersive technologies. Notable companies in the region, such as Lenovo and Pico Interactive in China, Sony in Japan, and Samsung in South Korea, contribute significantly to HMD development and manufacturing. These companies are at the forefront of producing cutting-edge HMD technologies, meeting the rising demand for virtual and augmented reality experiences. The region's robust ecosystem, coupled with government support for digitalization, positions Asia-Pacific as a key driver in shaping the global HMD market landscape.

The break-up of the profile of primary participants in the Head-mounted Display (HMD) market-

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: Americas - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The major players in the Head-mounted Display (HMD) market with a significant global presence include Meta (US), Sony (Japan), Microsoft (US), Samsung (South Korea), Magic Leap, Inc. (US) and others.

Research Coverage

The report segments the Head-mounted Display (HMD) market and forecasts its size by type, technology, component, product type, connectivity, application, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall Head-mounted Display (HMD) market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing investments by significant key players in the development of HMD, availability of low-cost HMDs, growing demand for AR and VR, technological advancements and growing digitalization, and Affordable microdisplay prices), restraints lack of design standardization for HMD design, rise in health issues related to low resolution and absence of movement, and government regulations and standards), opportunities (increasing adoption of hands in gaming application, growing demand for lightweight HMDs and portable devices, and growing consumer adoption), and challenges (lack of awareness, and usability challenges are some of the major challenges faced by market players)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Head-mounted Display (HMD) market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Head-mounted Display (HMD) market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Head-mounted hopping (HMD) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Meta (US), Sony (Japan), Microsoft (US), Samsung (South Korea), Magic Leap, Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

- 1.2.2 INCLUSIONS AND EXCLUSIONS AT TECHNOLOGY LEVEL

- 1.2.3 INCLUSIONS AND EXCLUSIONS AT CONNECTIVITY LEVEL

- 1.2.4 INCLUSIONS AND EXCLUSIONS AT COMPONENT LEVEL

- 1.2.5 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

- 1.2.6 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

- 1.3 STUDY SCOPE

- FIGURE 1 HEAD-MOUNTED DISPLAY MARKET SEGMENTATION

- 1.3.1 HEAD-MOUNTED DISPLAY MARKET: REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 HEAD-MOUNTED DISPLAY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3.3 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 RECESSION IMPACT

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: HEAD-MOUNTED DISPLAY MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 HEAD-MOUNTED DISPLAYS MARKET SIZE, 2020-2029

- FIGURE 9 STANDALONE HMD SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 10 DISPLAYS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 CONSUMER SEGMENT TO LEAD HEAD-MOUNTED DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 12 VR SEGMENT TO HOLD MAJOR SHARE OF HEAD-MOUNTED DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 13 AMERICAS TO DOMINATE HEAD-MOUNTED DISPLAY MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR HEAD-MOUNTED DISPLAY MARKET PLAYERS

- FIGURE 14 PRESENCE OF ESTABLISHED TECHNOLOGY PLAYERS IN AMERICAS TO DRIVE MARKET GROWTH

- 4.2 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY

- FIGURE 15 STANDALONE HMD SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- 4.3 HEAD-MOUNTED DISPLAY MARKET, BY COMPONENT

- FIGURE 16 DISPLAYS SEGMENT TO DOMINATE HMD MARKET DURING FORECAST PERIOD

- 4.4 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION

- FIGURE 17 CONSUMER SEGMENT TO LEAD HMD MARKET DURING FORECAST PERIOD

- 4.5 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION

- FIGURE 18 VR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 AMERICAS: HMD MARKET, BY APPLICATION AND COUNTRY, 2023

- FIGURE 19 CONSUMER APPLICATIONS AND US HELD LARGEST MARKET SHARE IN AMERICAS IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 HEAD-MOUNTED DISPLAY MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing investments by key players in development of HMD

- 5.2.1.2 Increasing availability of low-cost HMDs

- 5.2.1.3 Growing demand for AR and VR

- 5.2.1.4 Technological advancements and growing digitalization

- 5.2.1.5 Affordable microdisplay prices

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of HMD design standardization

- 5.2.2.2 Health issues related to low resolution and absence of movement

- 5.2.2.3 Government regulations and standards

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of HMDs in gaming

- 5.2.3.2 Growing demand for lightweight HMDs and portable devices

- 5.2.3.3 Growing consumer adoption

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness of AR and VR HMDs

- 5.2.4.2 Usability challenges

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: HEAD-MOUNTED DISPLAY MARKET

- TABLE 3 HMD MARKET: VALUE CHAIN ANALYSIS

- 5.4 HEAD-MOUNTED DISPLAY MARKET ECOSYSTEM

- FIGURE 26 DISPLAY MARKET ECOSYSTEM

- FIGURE 27 AR/VR ECOSYSTEM AND TECHNOLOGIES USED IN HMD

- 5.5 KEY TECHNOLOGY TRENDS

- 5.5.1 RELATED TECHNOLOGIES

- 5.5.1.1 OLED on Silicon

- 5.5.1.2 Eye-tracking and Foveated Rendering

- 5.5.2 UPCOMING TECHNOLOGIES

- 5.5.2.1 LiDAR

- 5.5.2.2 Wearable Health Monitoring

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Haptic Feedback Integration

- 5.5.3.2 Artificial Intelligence (AI) and Machine Learning (ML)

- 5.5.1 RELATED TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY CONNECTIVITY

- TABLE 4 AVERAGE SELLING PRICE OF HMDS, BY CONNECTIVITY TYPE (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND, BY REGION (USD)

- TABLE 6 HISTORICAL AVERAGE SELLING PRICE OF HMD BY KEY PLAYERS (USD)

- FIGURE 28 HISTORICAL AVERAGE SELLING PRICE OF HMD, BY KEY PLAYER (USD)

- 5.7 PATENT ANALYSIS

- TABLE 7 PATENTS FILED DURING REVIEW PERIOD

- FIGURE 29 NUMBER OF PATENTS FOR HMD

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (2013-2022)

- TABLE 8 TOP 20 PATENT OWNERS DURING REVIEW PERIOD

- TABLE 9 KEY PATENTS RELATED TO HMD

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 HEAD-MOUNTED DISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS - 2023

- FIGURE 32 IMPACT OF PORTER'S FIVE FORCES ON MARKET, 2023

- TABLE 10 HEAD-MOUNTED DISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS, 2023

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HMDS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN HMD MARKET (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS OF HMD

- TABLE 12 KEY BUYING CRITERIA FOR HMD

- 5.10 CASE STUDIES

- 5.10.1 OPTIMIZED MAINTENANCE WORKFLOWS AND QUALITY WITH HOLOLENS MIXED REALITY GLASSES (US)

- TABLE 13 HOLOLENS: MIXED REALITY GLASSES HELP OPTIMIZE MAINTENANCE WORKFLOWS AND ENSURE QUALITY

- 5.10.2 PRECISE AND HANDS-FREE VISUALIZATION OF PATIENT ANATOMY (US)

- TABLE 14 HOLOLENS: ASSISTS IN PROVIDING PRECISE AND HANDS-FREE PATIENT ANATOMY VISUALS

- 5.10.3 SIMULATION OF DANGEROUS SCENARIOS WITH META OCULUS QUEST (US)

- TABLE 15 META: OCULUS QUEST HELPS SIMULATE DANGEROUS SCENARIOS EFFECTIVELY

- 5.10.4 CREATION OF VIRTUAL ELECTRICAL SAFETY RECERTIFICATION COURSE WITH HTC VIVE (US)

- TABLE 16 HTC: VIVE VUFORIA ASSISTS IN CREATING VIRTUAL ELECTRICAL SAFETY RECERTIFICATION COURSE

- 5.11 TRADE DATA

- TABLE 17 HS CODE: 900490, EXPORT VALUES FOR MAJOR COUNTRIES, 2018-2022 (USD MILLION)

- FIGURE 35 HS CODE: 8537, EXPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- TABLE 18 HS CODE: 900490, IMPORT VALUES FOR MAJOR COUNTRIES, 2018-2022 (USD MILLION)

- FIGURE 36 HS CODE: 8537, IMPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- 5.12 TARIFF AND REGULATIONS

- 5.12.1 TARIFFS

- TABLE 19 MFN TARIFFS FOR PRODUCTS INCLUDED UNDER HS CODE: 900490 EXPORTED BY CHINA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2.1 North America

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.3 STANDARDS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 37 REVENUE SHIFT FOR HEAD-MOUNTED DISPLAY MARKET

- 5.14 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 20 HEAD-MOUNTED DISPLAY MARKET: CONFERENCES AND EVENTS

6 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 21 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 38 AR HMD SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 22 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 23 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (MILLION UNITS)

- FIGURE 39 VR HMDS EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 24 HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (MILLION UNITS)

- 6.2 AUGMENTED REALITY

- 6.2.1 ENHANCED USER PERCEPTION WITH AR-ENABLED DEVICES TO DRIVE SEGMENT

- TABLE 25 AR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- FIGURE 40 STANDALONE AR HMD EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 26 AR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 27 AR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (THOUSAND UNITS)

- TABLE 28 AR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (THOUSAND UNITS)

- TABLE 29 AR: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- FIGURE 41 COMMERCIAL APPLICATION TO REGISTER HIGHEST CAGR IN AR HMD MARKET

- TABLE 30 AR: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 31 CONSUMER: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 CONSUMER: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 AEROSPACE & DEFENSE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 AEROSPACE & DEFENSE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 HEALTHCARE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 HEALTHCARE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 ENTERPRISE & INDUSTRIAL: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 ENTERPRISE & INDUSTRIAL: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 COMMERCIAL: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 COMMERCIAL: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 AUTOMOTIVE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 AUTOMOTIVE: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 ENERGY: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 ENERGY: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 OTHER APPLICATIONS: AR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 AR: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 AR: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 6.3 VIRTUAL REALITY

- 6.3.1 INCREASED DEMAND FROM CONSUMER APPLICATIONS EXPECTED TO DRIVE SEGMENT

- TABLE 49 VR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- FIGURE 42 TETHERED VR HMD TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 50 VR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 51 VR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (MILLION UNITS)

- TABLE 52 VR: HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (MILLION UNITS)

- TABLE 53 VR: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- FIGURE 43 CONSUMER APPLICATION TO DOMINATE VR HMD MARKET DURING FORECAST PERIOD

- TABLE 54 VR: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 55 CONSUMER: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 CONSUMER: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 COMMERCIAL: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 COMMERCIAL: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 ENTERPRISE & INDUSTRIAL: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 ENTERPRISE & INDUSTRIAL: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 HEALTHCARE: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 HEALTHCARE: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 AEROSPACE & DEFENSE: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 AEROSPACE & DEFENSE: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 OTHER APPLICATIONS: VR HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 VR: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 VR: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

7 HEAD-MOUNTED DISPLAY MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- TABLE 69 HEAD-MOUNTED DISPLAY MARKET, BY COMPONENT, 2020-2023 (USD MILLION)

- FIGURE 44 DISPLAYS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 70 HEAD-MOUNTED DISPLAY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- 7.2 PROCESSORS & MEMORY

- 7.2.1 NEED FOR LARGER MEMORY CAPACITIES TO STORE AND MANAGE HIGH-RESOLUTION DATA BOOSTS GROWTH

- 7.3 CONTROLLERS

- 7.3.1 DEMAND FOR FASTER, MORE PRECISE, AND INTUITIVE INTERACTION WITH VIRTUAL ENVIRONMENTS FUELS GROWTH

- 7.4 SENSORS

- 7.4.1 GROWING DEMAND FOR MOTION DETECTION DRIVES SEGMENT GROWTH

- 7.4.2 MAGNETOMETERS

- 7.4.3 ACCELEROMETERS

- 7.4.4 GYROSCOPES

- 7.4.5 PROXIMITY SENSORS

- 7.5 CAMERAS

- 7.5.1 USE IN DEPTH MEASUREMENT AND OBJECT AMPLITUDE FUELS SEGMENT GROWTH

- 7.6 DISPLAYS

- 7.6.1 DEMAND FOR IMMERSIVE EXPERIENCES DRIVES GROWTH

- 7.7 LENSES

- 7.7.1 NEED FOR WIDER FIELD OF VIEW BOOSTS GROWTH OF SEGMENT

- 7.8 CASES & CONNECTORS

- 7.8.1 ENHANCED PROTECTION AND USER COMFORT DRIVE MARKET GROWTH

- 7.9 OTHERS

- 7.9.1 DEMAND FOR IMMERSIVE EXPERIENCES PROPELS HMD INNOVATION

8 HEAD-MOUNTED DISPLAY MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 HEAD-MOUNTED

- 8.3 EYEWEAR

9 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY

- 9.1 INTRODUCTION

- TABLE 71 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- FIGURE 45 STANDALONE HMD (WIRELESS) TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 72 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 73 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2020-2023 (MILLION UNITS)

- TABLE 74 HEAD-MOUNTED DISPLAY MARKET, BY CONNECTIVITY, 2024-2029 (MILLION UNITS)

- 9.2 TETHERED HMD (WIRED)

- 9.2.1 INCREASING NEED TO PROCESS HIGH POWER AND GRAPHICS CAPABILITIES TO FUEL SEGMENT GROWTH

- TABLE 75 TETHERED HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 76 TETHERED HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 77 TETHERED HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 78 TETHERED HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (THOUSAND UNITS)

- 9.3 STANDALONE HMD (WIRELESS)

- 9.3.1 GROWING DEMAND FOR USER-FRIENDLY VR AND AR LANDSCAPE SOLUTIONS TO DRIVE GROWTH

- TABLE 79 STANDALONE HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 46 AR IN STANDALONE HMD (WIRELESS) MARKET EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD

- TABLE 80 STANDALONE HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 81 STANDALONE HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (MILLION UNITS)

- TABLE 82 STANDALONE HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (MILLION UNITS)

10 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- TABLE 83 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- FIGURE 47 CONSUMER APPLICATION TO ACCOUNT FOR LARGEST HMD MARKET SIZE BY 2029

- TABLE 84 HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.2 CONSUMER

- TABLE 85 CONSUMER: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 48 VR TO DOMINATE CONSUMER APPLICATIONS IN HMD MARKET

- TABLE 86 CONSUMER: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 87 CONSUMER: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 CONSUMER: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2.1 GAMING

- 10.2.1.1 Adoption of HMDs in competitive gaming to drive segment growth

- 10.2.2 SPORTS & ENTERTAINMENT

- 10.2.2.1 Growing adoption of AR and VR HMDs for training and viewing in sports

- 10.3 AEROSPACE & DEFENSE

- 10.3.1 NEED FOR SIMULATION TRAINING AND ACCESS TO REAL-TIME INFORMATION FUELS SEGMENT

- TABLE 89 AEROSPACE & DEFENSE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 49 VR TO DOMINATE AEROSPACE & DEFENSE APPLICATIONS IN HMD MARKET

- TABLE 90 AEROSPACE & DEFENSE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 AEROSPACE & DEFENSE: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 AEROSPACE & DEFENSE: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 HEALTHCARE

- TABLE 93 HEALTHCARE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 50 AR TO REGISTER HIGHER CAGR IN HEALTHCARE APPLICATIONS

- TABLE 94 HEALTHCARE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 95 HEALTHCARE: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 HEALTHCARE: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4.1 TRAINING

- 10.4.1.1 High demand for enhanced training solutions in healthcare

- 10.4.2 TREATMENT AND SURGERY

- 10.4.2.1 Surgical precision enhancement made possible with HMDs

- 10.4.3 PATIENT CARE MANAGEMENT

- 10.4.3.1 Growing demand for smart glasses and VR

- 10.5 ENTERPRISE & INDUSTRIAL

- TABLE 97 ENTERPRISE & INDUSTRIAL: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 98 ENTERPRISE & INDUSTRIAL: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 99 ENTERPRISE & INDUSTRIAL: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 ENTERPRISE & INDUSTRIAL: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5.1 VIRTUAL INTERVIEWS

- 10.5.1.1 Growing demand for conducting interviews in virtual conference rooms

- 10.5.2 VIRTUAL MEETINGS

- 10.5.2.1 Increased shift toward virtual meetings

- 10.5.3 WAREHOUSES

- 10.5.3.1 Growing use of HMDs for order picking

- 10.5.4 EMERGENCY RESPONSE

- 10.5.4.1 HMDs used by emergency response professionals for coordination in critical tasks

- 10.5.5 OPERATION AND ASSEMBLY

- 10.5.5.1 Wide-scale adoption of HMDs for training and instruction

- 10.5.6 MAINTENANCE AND INSPECTION SERVICES

- 10.5.6.1 Provision of important information in visual fields

- 10.5.7 FIELD REPAIR SERVICES

- 10.5.7.1 Growing demand for collaboration at remote workplaces

- 10.5.8 FREIGHT LOADING AND TRANSPORTATION

- 10.5.8.1 Growing use of HMDs to access real-time information

- 10.6 COMMERCIAL

- TABLE 101 COMMERCIAL: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 COMMERCIAL: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 103 COMMERCIAL: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 COMMERCIAL: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6.1 ADVERTISING, MARKETING, AND BRANDING

- 10.6.1.1 Increasing adoption of HMDs for product demonstration

- 10.6.2 RETAIL

- 10.6.2.1 Increasing use of HMDs for virtual try-on products

- 10.6.3 TOURISM

- 10.6.3.1 HMDs used widely for virtual tours

- 10.7 ENERGY

- 10.7.1 NEED FOR ENHANCED TRAINING PROGRAMS TO PRACTICE COMPLEX SCENARIOS TO BOOST APPLICATION

- TABLE 105 ENERGY: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION) ENERGY

- TABLE 106 ENERGY: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 107 ENERGY: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION) ENERGY

- TABLE 108 ENERGY: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 AUTOMOTIVE & OTHERS

- TABLE 109 AUTOMOTIVE & OTHERS: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 110 AUTOMOTIVE & OTHERS: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 111 AUTOMOTIVE & OTHERS: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 112 AUTOMOTIVE & OTHERS: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8.1 AUTOMOTIVE

- 10.8.1.1 Need to view and manipulate 3D models in real time to drive segment

- 10.8.2 OTHERS

11 HEAD-MOUNTED DISPLAY MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 51 MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 113 HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 AMERICAS

- FIGURE 52 AMERICAS: HEAD-MOUNTED DISPLAY MARKET SNAPSHOT

- TABLE 115 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 116 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 118 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 119 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 120 AMERICAS: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 11.2.1 AMERICAS: RECESSION IMPACT

- 11.2.2 NORTH AMERICA

- TABLE 121 NORTH AMERICA: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.2.1 US

- 11.2.2.1.1 Growing adoption of HMDs in enterprise and healthcare applications to drive market growth

- 11.2.2.2 Canada

- 11.2.2.2.1 Increasing investment by government to foster growth of AR/VR HMDs

- 11.2.2.3 Mexico

- 11.2.2.3.1 Increasing use of HMDs in healthcare applications to drive market growth

- 11.2.2.1 US

- 11.2.3 SOUTH AMERICA

- 11.2.3.1 Growing consumer market to drive growth

- TABLE 123 SOUTH AMERICA: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 124 SOUTH AMERICA: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- FIGURE 53 EUROPE: HEAD-MOUNTED DISPLAY MARKET SNAPSHOT

- TABLE 125 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 126 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 130 EUROPE: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 11.3.1 EUROPE: RECESSION IMPACT

- 11.3.2 UK

- 11.3.2.1 Increasing focus on digitization to drive market growth

- 11.3.3 GERMANY

- 11.3.3.1 Growing adoption of AR/VR HMDs in automotive sector to drive market growth

- 11.3.4 FRANCE

- 11.3.4.1 Surging adoption of HMDs in retail sector to enhance market growth

- 11.3.5 ITALY

- 11.3.5.1 Potential for HMD use in tourism and engineering fuel market growth

- 11.3.6 REST OF EUROPE

- 11.3.6.1 Inflow of products and technologies from UK, Germany, and France to propel market growth

- 11.4 ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET SNAPSHOT

- TABLE 131 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 134 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 135 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT

- 11.4.2 CHINA

- 11.4.2.1 Large number of local HMD players to drive market growth

- 11.4.3 JAPAN

- 11.4.3.1 Increasing adoption of HMDs in healthcare sector to fuel market growth

- 11.4.4 INDIA

- 11.4.4.1 Increasing awareness about advanced technologies to play a crucial role in market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing demand in entertainment applications to fuel HMD market growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing adoption of HMDs in enterprise and industrial applications to drive market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.7.1 Growing consumer spending to boost HMD market

- 11.5 REST OF THE WORLD

- TABLE 137 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 138 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 139 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 140 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 141 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 142 REST OF THE WORLD: HEAD-MOUNTED DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 11.5.1 REST OF THE WORLD: RECESSION IMPACT

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Growing adoption of HMDs in energy sector to drive market growth

- TABLE 143 MIDDLE EAST: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 144 MIDDLE EAST: HEAD-MOUNTED DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.5.3 AFRICA

- 11.5.3.1 Increasing focus on technological advancements to fuel growth of HMD market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET EVALUATION FRAMEWORK

- TABLE 145 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 55 COMPANIES ADOPTED PARTNERSHIPS AS KEY GROWTH STRATEGY FROM 2019-2023

- 12.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 12.2.2 PRODUCT PORTFOLIO

- 12.2.3 GEOGRAPHIC PRESENCE

- 12.2.4 MANUFACTURING AND DISTRIBUTION FOOTPRINT

- 12.3 MARKET SHARE ANALYSIS, 2023

- TABLE 146 HEAD-MOUNTED DISPLAY MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- FIGURE 56 HEAD-MOUNTED DISPLAY MARKET: COMPANY EVALUATION MATRIX, 2023

- 12.4.5 COMPANY FOOTPRINT

- TABLE 147 HEAD-MOUNTED DISPLAY MARKET: COMPANY FOOTPRINT

- TABLE 148 HEAD-MOUNTED DISPLAY MARKET: COMPANY APPLICATION FOOTPRINT

- TABLE 149 HEAD-MOUNTED DISPLAY MARKET: COMPANY TECHNOLOGY FOOTPRINT

- TABLE 150 HEAD-MOUNTED DISPLAY MARKET: COMPANY REGION FOOTPRINT

- 12.5 STARTUP/SME EVALUATION MATRIX

- 12.5.1 COMPETITIVE BENCHMARKING

- TABLE 151 HEAD-MOUNTED DISPLAY MARKET: KEY STARTUP/SMES

- TABLE 152 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: TECHNOLOGY

- TABLE 153 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: APPLICATION

- TABLE 154 COMPETITIVE BENCHMARKING OF STARTUPS/SMES: REGION

- 12.5.2 PROGRESSIVE COMPANIES

- 12.5.3 RESPONSIVE COMPANIES

- 12.5.4 DYNAMIC COMPANIES

- 12.5.5 STARTING BLOCKS

- FIGURE 57 HEAD-MOUNTED DISPLAY MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 PRODUCT LAUNCHES

- TABLE 155 HEAD-MOUNTED DISPLAY MARKET, PRODUCT LAUNCHES, 2019-2023

- 12.6.2 DEALS

- TABLE 156 HEAD-MOUNTED DISPLAY MARKET, DEALS, 2019-2023

- 12.6.3 OTHERS

- TABLE 157 HEAD-MOUNTED DISPLAY MARKET, OTHER STRATEGIES, 2019-2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- (Business overview, Products/solutions/services Offered, Recent developments & MnM View)**

- 13.2 KEY PLAYERS

- 13.2.1 META

- TABLE 158 META: COMPANY OVERVIEW

- FIGURE 58 META: COMPANY SNAPSHOT

- TABLE 159 META: PRODUCT LAUNCHES

- 13.2.2 MICROSOFT

- TABLE 160 MICROSOFT: COMPANY OVERVIEW

- FIGURE 59 MICROSOFT: COMPANY SNAPSHOT

- TABLE 161 MICROSOFT: PRODUCT LAUNCHES

- TABLE 162 MICROSOFT: DEALS

- 13.2.3 SONY GROUP CORPORATION

- TABLE 163 SONY GROUP CORPORATION: COMPANY OVERVIEW

- FIGURE 60 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- TABLE 164 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- 13.2.4 MAGIC LEAP, INC.

- TABLE 165 MAGIC LEAP, INC.: COMPANY OVERVIEW

- TABLE 166 MAGIC LEAP, INC.: PRODUCT LAUNCHES

- TABLE 167 MAGIC LEAP, INC.: DEALS

- 13.2.5 SEIKO EPSON CORPORATION

- TABLE 168 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- FIGURE 61 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- TABLE 169 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 170 SEIKO EPSON CORPORATION: DEALS

- 13.2.6 SAMSUNG

- TABLE 171 SAMSUNG: COMPANY OVERVIEW

- FIGURE 62 SAMSUNG: COMPANY SNAPSHOT

- 13.2.7 HTC

- TABLE 172 HTC: COMPANY OVERVIEW

- FIGURE 63 HTC: COMPANY SNAPSHOT

- TABLE 173 HTC: PRODUCT LAUNCHES

- TABLE 174 HTC: DEALS

- TABLE 175 HTC: OTHERS

- 13.2.8 BYTEDANCE (PICO TECHNOLOGY CO. LTD.)

- TABLE 176 BYTEDANCE (PICO TECHNOLOGY CO. LTD.): COMPANY OVERVIEW

- TABLE 177 BYTEDANCE (PICO TECHNOLOGY CO. LTD.): PRODUCT LAUNCHES

- 13.2.9 DPVR

- TABLE 178 DPVR: COMPANY OVERVIEW

- TABLE 179 DPVR: PRODUCT LAUNCHES

- TABLE 180 DPVR: DEALS

- TABLE 181 DPVR: OTHERS

- 13.2.10 VUZIX

- TABLE 182 VUZIX: COMPANY OVERVIEW

- FIGURE 64 VUZIX: COMPANY SNAPSHOT

- TABLE 183 VUZIX: PRODUCT LAUNCHES

- TABLE 184 VUZIX: DEALS

- TABLE 185 VUZIX: OTHERS

- *Details on Business overview, Products/solutions/services Offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 LENOVO

- 13.3.2 BAE SYSTEMS

- 13.3.3 HP DEVELOPMENT COMPANY, L.P.

- 13.3.4 VARJO

- 13.3.5 VALVE CORPORATION

- 13.3.6 REALWEAR, INC.

- 13.3.7 THALES

- 13.3.8 PANASONIC HOLDINGS CORPORATION

- 13.3.9 PIMAX INC.

- 13.3.10 GOOVIS

- 13.3.11 ZEBRA TECHNOLOGIES CORP.

- 13.3.12 LYNX MIXED REALITY

- 13.3.13 MERGE LABS, INC.

- 13.3.14 REALMAX INC.

- 13.3.15 NIMO PLANET

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS