|

|

市場調査レポート

商品コード

1793321

特殊飼料添加物の世界市場:タイプ別、家畜別、由来別、形状別、機能別、製造技術別、地域別 - 2030年までの予測Specialty Feed Additives Market by Livestock, Type, Form, Source, Function, Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 特殊飼料添加物の世界市場:タイプ別、家畜別、由来別、形状別、機能別、製造技術別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月08日

発行: MarketsandMarkets

ページ情報: 英文 408 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

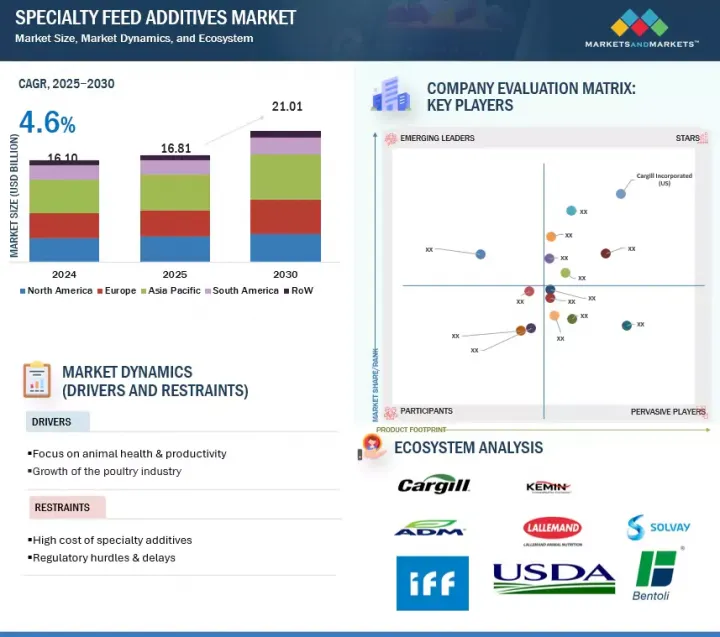

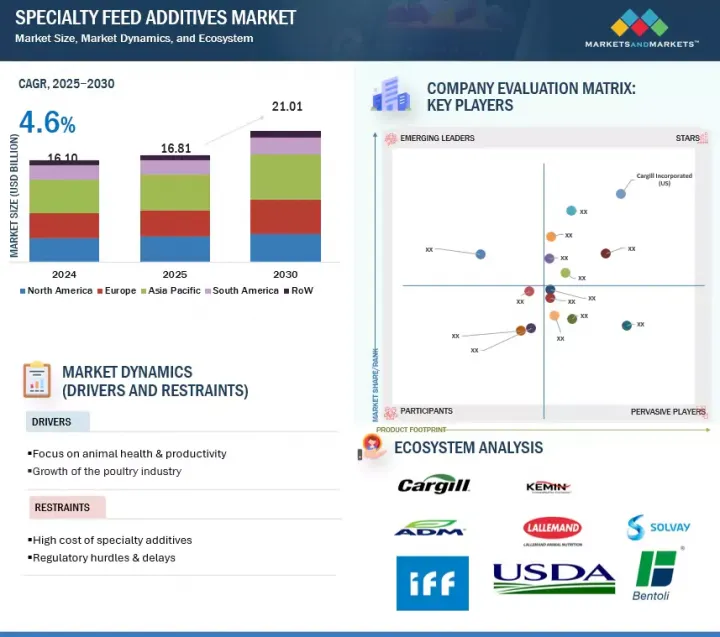

特殊飼料添加物の市場規模は、2025年に168億1,000万米ドルと推定され、4.6%のCAGRで拡大し、2030年には210億1,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(米ドル)および数量(KT) |

| セグメント別 | タイプ別、家畜別、由来別、形状別、機能別、製造技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

特殊飼料添加物市場は、高品質の動物性タンパク質に対する世界の需要の高まりと、動物の健康とパフォーマンスの重視の高まりにより、着実な成長を遂げています。アミノ酸、酵素、有機酸、フィトジェニック、マイコトキシン結合剤などを含むこれらの添加物は、飼料効率の向上、腸内環境の改善、家畜の免疫力強化において重要な役割を果たしています。抗生物質を使用しない生産へのシフト、動物福祉に対する意識の高まり、厳しい飼料安全規制が市場を牽引しています。アジア太平洋やラテンアメリカなどの地域では、畜産の工業化と急速な都市化が、性能向上添加物の採用を加速させています。しかし、業界は原料価格の変動、サプライチェーンの混乱、規制の複雑さといった課題に直面しています。

飼料全体の生産量が2023年に0.2%減少するなど、特殊飼料添加物の情勢は広範な世界的問題により厳しいです。生産量の減少は、生産コストの増加、地政学的緊張、動物飼料の供給に関する考慮の増加によって引き起こされ、これがこのセクターへの圧力となっています。主な問題としては、生産コストの上昇、地理的緊張、気候変動などがあり、これらは欧州における供給の複雑化や米国における牛のサイクルに関連したシフトの一因となっています。飼料効率は、南北アメリカを含む世界の一部で改善されつつあります。原料供給の予測不可能性に起因する問題はいくらか緩和されましたが、コストと供給可能性は、生産と価格への影響という点で、依然として世界の懸念事項です。

市場は、動物栄養学の進歩、地政学的緊張、食糧安全保障、エネルギー問題の4つの主な要因に影響されます。国家間の地政学的緊張が市場に影響を与えています。例えば、米国と中国の対立、ウクライナとロシアの対立などがあり、これによって世界のサプライ・チェーンが再編成され、生産コストと輸送コストが上昇し、消費者の嗜好が動物性タンパク質から離れています。第二に、植物性天然飼料と持続可能性の動向が、技術革新と飼料添加物の開発によって市場に影響を与えています。

ドライ特殊飼料添加物市場は、機械的なペレット化の過程で10%多くの経費を消費するペレット飼料よりも、マッシュ飼料の方がコストが低いため、支配的であると予測されます。このプロセスは飼料の損失を最小限に抑え、栄養素を消化する体の能力を高める。家禽業界では、ブロイラーにシンプルな給餌ソリューションを提供する、砕けたペレットからなる砕片飼料が好まれています。乾燥形態が畜産生産者を惹きつけるのは、液体形態に比べて保存性に優れ、劣化しにくいからです。この製品の安定した性質は、廃棄物や経費を最小限に抑え、乾燥した組成は輸送コストの削減や包装要件の軽減につながります。メーカーやユーザーにとって使いやすいのは、温度変化に強く、店頭で製品を長持ちさせる乾燥添加物によるものです。市場参入企業は主に、香料、甘味料、プロバイオティクス、酸味料、マイコトキシン結合剤、家畜の消化率や嗜好性、飼料要求率を高める酸化防止剤などのドライ製品を販売しています。

プロバイオティクス分野は、特殊飼料添加物市場の種類別セグメントの中で大きなシェアを占めています。プロバイオティクスの採用は、飼料添加物に含まれる抗生物質の規制、抗生物質不使用製品に対する消費者の嗜好、環境の持続可能性により、欧州などの地域で増加しています。2024年のペンシルベニア州立大学の研究では、枯草菌やアミロリクファシエンスなどのプロバイオティクスが、320羽のブロイラーのひなの腸の健康、栄養吸収、成長成績を改善することが分かっています。熱帯地域の家禽の健康をターゲットに、エボニックは最近インドでEcobiol Soluble Plusを発表し、Poultry India 2024でお披露目され、市場拡大をサポートすると期待されています。プロバイオティクスは、戦略的な業界提携、継続的な技術革新、世界の食肉消費量の増加、持続可能な動物栄養ソリューションに焦点を当てた研究の増加に牽引され、特殊飼料添加物市場で大きな成長が見込まれます。

2024年、米国の食肉産業は、世界のタンパク質サプライチェーンにおけるリーダーシップ、イノベーション、競合優位性を確認し、例外的な輸出実績を示しました。米国産豚肉の輸出量は歴史的最高値の303万トン(334万トン)、輸出額は86億3,000万米ドルに達し、業界はと殺頭数1頭当たり66.53米ドルのピーク輸出額を記録し、旺盛な国際需要と米国産豚肉の安定した品質を裏付けた。同様に、米国産牛肉の輸出額は104億5,000万米ドルと過去最高を記録し、1頭当たりの輸出額は415.08米ドルに上昇しました。

この好調な輸出実績を補完するように、米国はイノベーション主導の進歩に支えられ、北米の特殊飼料添加物市場で圧倒的なシェアを維持しています。2024年の特筆すべき出来事としては、Kemin Industries Inc.(米国)が、同社のアニマル・ニュートリション・アンド・ヘルス北米部門が開発した次世代豚用飼料酸性化剤「FORMYL」を発売したことが挙げられます。この製品は、ギ酸カルシウムとクエン酸の独自のカプセル化ブレンドを利用し、腸の健康を促進し、抗生物質を使用しないメカニズムで豚の生産性を向上させる。消化管に的を絞ったこの製品は、pHの低下を助け、病原体の制御をサポートします。これは、飼料技術の進歩に取り組み、特殊添加物における米国業界のリーダーシップを維持する姿勢を反映したものです。

当レポートでは、世界の特殊飼料添加物市場について調査し、タイプ別、家畜別、由来別、形状別、機能別、製造技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 生成AIが動物栄養/特殊飼料添加物に与える影響

第6章 業界動向

- イントロダクション

- 2025年の米国関税の影響- 特殊飼料添加物市場

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 購入者に影響を与える動向/混乱

- 特許分析

- 主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 投資と資金調達のシナリオ

第7章 特殊飼料添加物市場(タイプ別)

- イントロダクション

- 植物由来成分

- 有機酸

- マイコトキシン結合剤および改質剤

- 藻類由来オメガ3

- ペレットバインダー

- プロバイオティクス

- 抗酸化物質

- 水消毒剤

- 香料と甘味料

第8章 特殊飼料添加物市場(家畜別)

- イントロダクション

- 家禽

- 反芻動物

- 豚

- 水生動物

- コンパニオンアニマル

第9章 特殊飼料添加物市場(由来別)

- イントロダクション

- 合成

- 天然

第10章 特殊飼料添加物市場(形状別)

- イントロダクション

- ドライ

- 液体

第11章 特殊飼料添加物市場(機能別)

- イントロダクション

- 腸の健康と消化機能

- マイコトキシン管理

- 嗜好性向上剤

- 機能性成分の保存

- その他

第12章 特殊飼料添加物市場(製造技術別)

- イントロダクション

- 発酵

- 抽出と精製

- マイクロカプセル化/コーティング

- 造粒と乾燥

- その他の製造技術

第13章 特殊飼料添加物市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリアとニュージーランド

- 韓国

- インドネシア

- タイ

- ベトナム

- マレーシア

- フィリピン

- その他

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- コロンビア

- ベネズエラ

- その他

- その他の地域

- アフリカ

- その他

- 中東

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- CARGILL, INCORPORATED

- ARCHER DANIELS MIDLAND(ADM)COMPANY

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- EVONIK INDUSTRIES AG

- BASF SE

- NOVONESIS GROUP

- NUTRECO

- LALLEMAND INC.

- BENTOLI

- ALLTECH

- PETROLIAM NASIONAL BERHAD(PETRONAS)

- ADISSEO

- KEMIN INDUSTRIES, INC.

- LAND O'LAKES, INC.

- NOVUS INTERNATIONAL, INC.

- その他の企業

- NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

- GLOBAL NUTRITION INTERNATIONAL

- VOLAC INTERNATIONAL LTD.

- NUTREX

- IMPEXTRACO NV

- INNOVAD

- TEX BIOSCIENCES(P)LTD.

- CENTAFARM SRL

- NUQO FEED ADDITIVES

- PALITAL FEED ADDITIVES B.V.

第16章 隣接市場と関連市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 LIMITATIONS & RISK ASSESSMENT

- TABLE 5 SPECIALTY FEED ADDITIVES MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 6 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 EXPECTED IMPACT LEVEL ON TARGET INGREDIENTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 8 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: SPECIALTY FEED ADDITIVES MARKET

- TABLE 9 EXPORT VALUE OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT VALUE OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (TONS)

- TABLE 11 IMPORT VALUE OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 12 IMPORT VOLUME OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (TONS)

- TABLE 13 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR FEED ADDITIVE TYPE, 2024 (USD/TON)

- TABLE 14 SPECIALTY FEED ADDITIVES: AVERAGE SELLING PRICES (ASP), BY TYPE, 2020-2024 (USD/TON)

- TABLE 15 SPECIALTY FEED ADDITIVES: AVERAGE SELLING PRICE TREND (ASP), BY REGION, 2021-2024 (USD/TON)

- TABLE 16 SPECIALTY FEED ADDITIVES MARKET ECOSYSTEM

- TABLE 17 LIST OF MAJOR PATENTS PERTAINING TO SPECIALTY FEED ADDITIVES MARKET, 2020-2025

- TABLE 18 SPECIALTY FEED ADDITIVES MARKET: KEY DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 TARIFF FOR HS CODE: 230990

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 DEADLINES FOR SUBMISSION OF APPLICATION FOR REEVALUATION

- TABLE 25 SPECIALTY FEED ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SPECIALTY FEED ADDITIVE SOURCES

- TABLE 27 KEY BUYING CRITERIA FOR SPECIALTY FEED ADDITIVE SOURCES

- TABLE 28 SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 31 SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 32 FEED PHYTOGENICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 FEED PHYTOGENICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 FEED PHYTOGENICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 FEED PHYTOGENICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 FEED PHYTOGENICS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 37 FEED PHYTOGENICS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 38 FEED ORGANIC ACIDS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 FEED ORGANIC ACIDS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 FEED ORGANIC ACIDS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 FEED ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 FEED ORGANIC ACIDS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 43 FEED ORGANIC ACIDS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 44 FEED MYCOTOXIN DETOXIFIERS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 FEED MYCOTOXIN DETOXIFIERS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 FEED MYCOTOXIN DETOXIFIERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 FEED MYCOTOXIN DETOXIFIERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 FEED MYCOTOXIN DETOXIFIERS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 49 FEED MYCOTOXIN DETOXIFIERS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 50 FEED ALGAE OMEGA-3 MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 FEED ALGAE OMEGA-3 MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 FEED ALGAE OMEGA-3 MARKET, BY REGION, 2021-2024 (KT)

- TABLE 53 FEED ALGAE OMEGA-3 MARKET, BY REGION, 2025-2030 (KT)

- TABLE 54 FEED PELLET BINDERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 FEED PELLET BINDERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 FEED PELLET BINDERS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 57 FEED PELLET BINDERS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 58 FEED PROBIOTICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 FEED PROBIOTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 FEED PROBIOTICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 FEED PROBIOTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 FEED PROBIOTICS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 63 FEED PROBIOTICS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 64 FEED ANTIOXIDANTS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 FEED ANTIOXIDANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 66 FEED ANTIOXIDANTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 FEED ANTIOXIDANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 FEED ANTIOXIDANTS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 69 FEED ANTIOXIDANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 70 FEED WATER DISINFECTANTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 FEED WATER DISINFECTANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 FEED WATER DISINFECTANTS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 73 FEED WATER DISINFECTANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 74 FEED FLAVORS & SWEETENERS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 FEED FLAVORS & SWEETENERS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 FEED FLAVORS & SWEETENERS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 FEED FLAVORS & SWEETENERS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 FEED FLAVORS & SWEETENERS MARKET, BY REGION, 2021-2024 (KT)

- TABLE 79 FEED FLAVORS & SWEETENERS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 80 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 81 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 82 SPECIALTY POULTRY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 83 SPECIALTY POULTRY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 SPECIALTY POULTRY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 SPECIALTY POULTRY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 SPECIALTY RUMINANT FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 SPECIALTY RUMINANT FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 SPECIALTY SWINE FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 89 SPECIALTY SWINE FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 SPECIALTY SWINE FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 SPECIALTY SWINE FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 SPECIALTY AQUAFEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 SPECIALTY AQUAFEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 SPECIALTY AQUAFEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 SPECIALTY AQUAFEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 SPECIALTY COMPANION ANIMAL FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 SPECIALTY COMPANION ANIMAL FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 99 SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 100 SYNTHETIC SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 SYNTHETIC SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 NATURAL SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 NATURAL SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 105 SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 106 DRY SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 DRY SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 LIQUID SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 LIQUID SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 111 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 112 SPECIALTY FEED ADDITIVES MARKET FOR GUT HEALTH & DIGESTIVE PERFORMANCE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 SPECIALTY FEED ADDITIVES MARKET FOR GUT HEALTH & DIGESTIVE PERFORMANCE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 SPECIALTY FEED ADDITIVES MARKET FOR MYCOTOXIN MANAGEMENT, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 SPECIALTY FEED ADDITIVES MARKET FOR MYCOTOXIN MANAGEMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 SPECIALTY FEED ADDITIVES MARKET FOR PALATABILITY ENHANCERS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 SPECIALTY FEED ADDITIVES MARKET FOR PALATABILITY ENHANCERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 SPECIALTY FEED ADDITIVES MARKET FOR PRESERVATION OF FUNCTIONAL INGREDIENTS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 SPECIALTY FEED ADDITIVES MARKET FOR PRESERVATION OF FUNCTIONAL INGREDIENTS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 SPECIALTY FEED ADDITIVES MARKET FOR OTHER FUNCTIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 SPECIALTY FEED ADDITIVES MARKET FOR OTHER FUNCTIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2021-2024 (KT)

- TABLE 125 SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2025-2030 (KT)

- TABLE 126 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 129 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 130 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 133 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 134 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 142 US: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 US: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 144 US: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 145 US: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 146 CANADA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 147 CANADA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 148 CANADA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 149 CANADA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 150 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 153 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 154 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 155 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 156 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 157 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 158 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 159 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 161 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 163 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 166 GERMANY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 GERMANY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 GERMANY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 169 GERMANY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 170 UK: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 171 UK: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 172 UK: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 173 UK: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 174 FRANCE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 175 FRANCE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 176 FRANCE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 177 FRANCE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 178 ITALY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 179 ITALY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 180 ITALY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 181 ITALY: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 182 SPAIN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 183 SPAIN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 184 SPAIN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 185 SPAIN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 186 REST OF EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 187 REST OF EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 188 REST OF EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 189 REST OF EUROPE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 190 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 193 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 194 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 197 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 198 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 199 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 203 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 206 CHINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 207 CHINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 208 CHINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 209 CHINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 210 INDIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 211 INDIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 212 INDIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 213 INDIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 214 JAPAN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 215 JAPAN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 216 JAPAN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 217 JAPAN: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 218 AUSTRALIA & NEW ZEALAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 AUSTRALIA & NEW ZEALAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 220 AUSTRALIA & NEW ZEALAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 221 AUSTRALIA & NEW ZEALAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 222 SOUTH KOREA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 223 SOUTH KOREA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 224 SOUTH KOREA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 225 SOUTH KOREA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 226 INDONESIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 227 INDONESIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 228 INDONESIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 229 INDONESIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 230 THAILAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 231 THAILAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 232 THAILAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 233 THAILAND: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 234 VIETNAM: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 235 VIETNAM: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 236 VIETNAM: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 237 VIETNAM: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 238 MALAYSIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 239 MALAYSIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 240 MALAYSIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 241 MALAYSIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 242 PHILIPPINES: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 243 PHILIPPINES: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 244 PHILIPPINES: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 245 PHILIPPINES: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 246 REST OF ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 249 REST OF ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 250 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 251 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2021-2024 (KT)

- TABLE 253 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY, 2025-2030 (KT)

- TABLE 254 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 255 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 256 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 257 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 258 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 259 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 261 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 263 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 264 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 265 LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 266 BRAZIL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 267 BRAZIL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 268 BRAZIL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 269 BRAZIL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 270 ARGENTINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 271 ARGENTINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 272 ARGENTINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 273 ARGENTINA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 274 MEXICO: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 275 MEXICO: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 276 MEXICO: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 277 MEXICO: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 278 COLOMBIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 279 COLOMBIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 280 COLOMBIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 281 COLOMBIA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 282 VENEZUELA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 283 VENEZUELA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 284 VENEZUELA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 285 VENEZUELA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 286 REST OF LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 288 REST OF LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 289 REST OF LATIN AMERICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 290 ROW: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 291 ROW: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 292 ROW: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY/REGION, 2021-2024 (KT)

- TABLE 293 ROW: SPECIALTY FEED ADDITIVES MARKET, BY COUNTRY/REGION, 2025-2030 (KT)

- TABLE 294 ROW: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 295 ROW: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 296 ROW: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 297 ROW: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 298 ROW: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 299 ROW: SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 300 ROW: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 301 ROW: SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 302 ROW: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2021-2024 (USD MILLION)

- TABLE 303 ROW: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 304 ROW: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 305 ROW: SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 306 AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 307 AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 308 AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 309 AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 310 SOUTH AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 311 SOUTH AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 312 SOUTH AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 313 SOUTH AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 314 EGYPT: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 315 EGYPT: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 316 EGYPT: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 317 EGYPT: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 318 REST OF AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 319 REST OF AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 320 REST OF AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 321 REST OF AFRICA: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 322 MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 323 MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 324 MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 325 MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 326 TURKIYE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 327 TURKIYE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 328 TURKIYE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 329 TURKIYE: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 330 ISRAEL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 331 ISRAEL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 332 ISRAEL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 333 ISRAEL: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 334 IRAQ: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 335 IRAQ: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 336 IRAQ: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 337 IRAQ: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 338 REST OF MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 339 REST OF MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 340 REST OF MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2021-2024 (KT)

- TABLE 341 REST OF MIDDLE EAST: SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025-2030 (KT)

- TABLE 342 OVERVIEW OF STRATEGIES ADOPTED BY KEY FEED ADDITIVES VENDORS

- TABLE 343 SPECIALTY FEED ADDITIVES MARKET: DEGREE OF COMPETITION

- TABLE 344 SPECIALTY FEED ADDITIVES MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 345 SPECIALTY FEED ADDITIVES MARKET: TYPE FOOTPRINT, 2024

- TABLE 346 SPECIALTY FEED ADDITIVES MARKET: LIVESTOCK FOOTPRINT, 2024

- TABLE 347 SPECIALTY FEED ADDITIVES MARKET: FORM FOOTPRINT, 2024

- TABLE 348 SPECIALTY FEED ADDITIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 349 SPECIALTY FEED ADDITIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES (1/2)

- TABLE 350 SPECIALTY FEED ADDITIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES (2/2)

- TABLE 351 SPECIALTY FEED ADDITIVES MARKET: PRODUCT LAUNCHES, APRIL 2022-APRIL 2025

- TABLE 352 SPECIALTY FEED ADDITIVES MARKET: DEALS, MAY 2020-JULY 2024

- TABLE 353 SPECIALTY FEED ADDITIVES MARKET: EXPANSIONS, MARCH 2023-APRIL 2024

- TABLE 354 SPECIALTY FEED ADDITIVES MARKET: OTHER DEVELOPMENTS, JUNE 2024-AUGUST 2024

- TABLE 355 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 356 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 357 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 358 CARGILL, INCORPORATED: DEALS

- TABLE 359 ADM: COMPANY OVERVIEW

- TABLE 360 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 361 ADM: PRODUCT LAUNCHES

- TABLE 362 ADM: DEALS

- TABLE 363 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY OVERVIEW

- TABLE 364 INTERNATIONAL FLAVORS & FRAGRANCES INC: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 365 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 366 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 367 EVONIK INDUSTRIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 368 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

- TABLE 369 EVONIK INDUSTRIES AG: DEALS

- TABLE 370 EVONIK INDUSTRIES AG: EXPANSIONS

- TABLE 371 BASF SE: COMPANY OVERVIEW

- TABLE 372 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 BASF SE: DEALS

- TABLE 374 NOVONESIS GROUP: COMPANY OVERVIEW

- TABLE 375 NOVONESIS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 NOVONESIS GROUP: DEALS

- TABLE 377 NUTRECO: COMPANY OVERVIEW

- TABLE 378 NUTRECO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 NUTRECO: DEALS

- TABLE 380 NUTRECO: EXPANSIONS

- TABLE 381 LALLEMAND INC.: COMPANY OVERVIEW

- TABLE 382 LALLEMAND INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 383 LALLEMAND INC.: DEALS

- TABLE 384 BENTOLI: COMPANY OVERVIEW

- TABLE 385 BENTOLI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 386 BENTOLI: DEALS

- TABLE 387 ALLTECH: COMPANY OVERVIEW

- TABLE 388 ALLTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 ALLTECH.: DEALS

- TABLE 390 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY OVERVIEW

- TABLE 391 PETROLIAM NASIONAL BERHAD (PETRONAS): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 392 PERSTORP: PRODUCT LAUNCHES

- TABLE 393 ADISSEO: COMPANY OVERVIEW

- TABLE 394 ADISSEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 ADISSEO: EXPANSIONS

- TABLE 396 KEMIN INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 397 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 KEMIN INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 399 KEMIN INDUSTRIES, INC.: DEALS

- TABLE 400 KEMIN INDUSTRIES, INC.: EXPANSIONS

- TABLE 401 LAND O'LAKES, INC.: COMPANY OVERVIEW

- TABLE 402 LAND O'LAKES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 403 NOVUS INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 404 NOVUS INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 405 NOVUS INTERNATIONAL, INC.: PRODUCT LAUNCHES

- TABLE 406 NOVUS INTERNATIONAL, INC.: DEALS

- TABLE 407 NOVUS INTERNATIONAL, INC.: OTHER DEVELOPMENTS

- TABLE 408 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 409 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 410 GLOBAL NUTRITION INTERNATIONAL: COMPANY OVERVIEW

- TABLE 411 GLOBAL NUTRITION INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 VOLAC INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 413 VOLAC INTERNATIONAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 414 VOLAC INTERNATIONAL LTD.: EXPANSIONS

- TABLE 415 VOLAC INTERNATIONAL LTD.: OTHER DEVELOPMENTS

- TABLE 416 NUTREX: COMPANY OVERVIEW

- TABLE 417 NUTREX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 418 IMPEXTRACO NV: COMPANY OVERVIEW

- TABLE 419 IMPEXTRACO NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 420 INNOVAD: COMPANY OVERVIEW

- TABLE 421 TEX BIOSCIENCES (P) LTD.: COMPANY OVERVIEW

- TABLE 422 CENTAFARM SRL: COMPANY OVERVIEW

- TABLE 423 NUQO FEED ADDITIVES: COMPANY OVERVIEW

- TABLE 424 PALITAL FEED ADDITIVES B.V.: COMPANY OVERVIEW

- TABLE 425 ADJACENT MARKETS TO SPECIALTY FEED ADDITIVES MARKET

- TABLE 426 FEED ADDITIVES MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 427 FEED ADDITIVES MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 428 COMPOUND FEED MARKET, BY FORM, 2018-2022 (USD MILLION)

- TABLE 429 COMPOUND FEED MARKET, BY FORM, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MARKETS COVERED AND REGIONS CONSIDERED

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 SPECIALTY FEED ADDITIVES MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 SUPPLY-SIDE ANALYSIS: SOURCES OF INFORMATION AT EVERY STEP

- FIGURE 9 SPECIALTY FEED ADDITIVES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 SPECIALTY FEED ADDITIVES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 SPECIALTY FEED ADDITIVES MARKET, BY REGION, 2024

- FIGURE 16 RISE IN DEMAND FOR HIGH-QUALITY MEAT & DAIRY PRODUCTS TO DRIVE GROWTH OF SPECIALTY FEED ADDITIVES MARKET

- FIGURE 17 US TO RECORD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 CHINA AND SYNTHETIC TO LEAD RESPECTIVE SEGMENTS IN ASIA PACIFIC IN 2025

- FIGURE 19 DRY FORM SEGMENT TO DOMINATE SPECIALTY FEED ADDITIVES MARKET DURING FORECAST PERIOD IN ASIA PACIFIC REGION

- FIGURE 20 PELLET BINDERS TO DOMINATE SPECIALTY FEED ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 21 POULTRY SEGMENT TO DOMINATE SPECIALTY FEED ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 22 GUT HEALTH & DIGESTIVE PERFORMANCE SEGMENT TO DOMINATE SPECIALTY FEED ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 23 COMPOUND FEED PRODUCTION, 2018-2024 (MILLION TONS)

- FIGURE 24 SPECIALTY FEED ADDITIVES MARKET DYNAMICS

- FIGURE 25 PER CAPITA MEAT CONSUMPTION BY HIGH INCOME COUNTRIES AND MEAT TYPE (KG/PERSON/YEAR) (RETAIL WEIGHT EQUIVALENT)

- FIGURE 26 REGIONAL FEED PRODUCTION, 2024 (MILLION TONS)

- FIGURE 27 TOP 10 FEED PRODUCING COUNTRIES, 2024 (MILLION TONS)

- FIGURE 28 PERCENTAGE OF FEED MILLS, BY REGION, 2024

- FIGURE 29 ADOPTION OF GEN AI IN ANIMAL NUTRITION

- FIGURE 30 SPECIALTY FEED ADDITIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS OF SPECIALTY FEED ADDITIVES MARKET: RAW MATERIAL SOURCING AND MANUFACTURING TO BE KEY CONTRIBUTORS

- FIGURE 32 EXPORT VALUE OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 33 IMPORT VALUE OF PREPARATIONS (OF A KIND USED IN ANIMAL FEEDING) FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 34 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024 (USD/TON)

- FIGURE 35 AVERAGE SELLING PRICE TREND, BY TYPE, 2021-2024 (USD/TON)

- FIGURE 36 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/TON)

- FIGURE 37 ECOSYSTEM MAP

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING BUYERS IN SPECIALTY FEED ADDITIVES MARKET

- FIGURE 39 NUMBER OF PATENTS GRANTED FOR SPECIALTY FEED ADDITIVES MARKET, 2015-2025

- FIGURE 40 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR SPECIALTY FEED ADDITIVES, 2015-2025

- FIGURE 41 PORTER'S FIVE FORCES ANALYSIS: SPECIALTY FEED ADDITIVES MARKET

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SPECIALTY FEED ADDITIVE SOURCES

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SPECIALTY FEED ADDITIVE SOURCES

- FIGURE 44 INVESTMENT & FUNDING SCENARIO, 2020-2024 (USD MILLION)

- FIGURE 45 FEED ADDITIVES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 46 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK, 2025 VS. 2030 (USD MILLION)

- FIGURE 47 SPECIALTY FEED ADDITIVES MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 48 SPECIALTY FEED ADDITIVES MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 49 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 50 FEED PRODUCTION VOLUME SHARE, BY REGION, 2022

- FIGURE 51 SPECIALTY FEED ADDITIVES MARKET GROWTH RATES, BY KEY COUNTRY, 2025-2030

- FIGURE 52 EUROPE: SPECIALTY FEED ADDITIVES MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET SNAPSHOT

- FIGURE 54 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST THREE YEARS, 2022-2024 (USD BILLION)

- FIGURE 55 SHARE OF LEADING COMPANIES IN SPECIALTY FEED ADDITIVES MARKET, 2024

- FIGURE 56 RANKING OF TOP FIVE PLAYERS IN SPECIALTY FEED ADDITIVES MARKET, 2024

- FIGURE 57 COMPANY VALUATION OF KEY SPECIALTY FEED ADDITIVE VENDORS, 2024 (USD BILLION)

- FIGURE 58 EV/EBITDA OF KEY COMPANIES, 2024

- FIGURE 59 BRAND COMPARISON ANALYSIS, BY TYPE

- FIGURE 60 SPECIALTY FEED ADDITIVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 61 SPECIALTY FEED ADDITIVES MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 62 SPECIALTY FEED ADDITIVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 63 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 64 ADM: COMPANY SNAPSHOT

- FIGURE 65 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 66 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 67 BASF SE: COMPANY SNAPSHOT

- FIGURE 68 NOVONESIS GROUP: COMPANY SNAPSHOT

- FIGURE 69 ADISSEO: COMPANY SNAPSHOT

The specialty feed additives market is estimated at USD 16.81 billion in 2025 and is projected to reach USD 21.01 billion by 2030, at a CAGR of 4.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | By Livestock, Type, Form, Source, Function, Manufacturing Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The specialty feed additives market is experiencing steady growth due to rising global demand for high-quality animal protein and increasing emphasis on animal health and performance. These additives, including amino acids, enzymes, organic acids, phytogenics, and mycotoxin binders, play a vital role in enhancing feed efficiency, improving gut health, and boosting immunity in livestock. The market is driven by the shift toward antibiotic-free production, growing awareness about animal welfare, and stringent feed safety regulations. In regions such as Asia-Pacific and Latin America, industrialization of animal farming and rapid urbanization are accelerating the adoption of performance-enhancing additives. However, the industry faces challenges such as fluctuating raw material prices, supply chain disruptions, and regulatory complexities.

"Disruptions in the specialty feed additives market"

The landscape for specialty feed additives is difficult due to broad-based global issues, as overall feed production fell by 0.2% in 2023. The decreased production is driven by the increasing costs of production, geopolitical tensions, and increased considerations of supply for animal feed, which have created pressures on the sector. Key issues include increased costs of production, geographic tensions, and climate change, which contribute to the complications of supply in Europe and the shifts associated with the cattle cycle in the United States. Feed efficiency is improving in parts of the world, including the Americas. It has alleviated some issues caused by unpredictability in the supply of raw materials, although cost and availability are still global issues of concern for their implications on production and price.

The market is influenced by four key factors: advances in animal nutrition, geopolitical tensions, food security, and energy issues. Geopolitical tensions between nations are influencing the market. Examples include the conflict between the US and China as well as the Ukraine-Russia conflict, which has re-positioned global supply chains, increased production costs and shipping costs, and redirected consumer preferences away from animal protein. Second, plant-based natural feeds and sustainability trends are impacting the market by developing innovations and feed additives, as these trends also prominently impact operational costs and health concerns.

"The dry form is projected to be dominant in the market."

The dry specialty feed additive market is projected to be dominant because mash feed costs less than pellet feed, which consumes 10% more expenses during the mechanical pelletization process. The process minimizes feed loss and increases the body's ability to digest nutrients. The poultry industry prefers crumbling because it consists of broken pellets, which provide simple feeding solutions for broiler birds. Dry forms attract livestock producers because they offer superior storage capabilities and better resistance to degradation compared to liquid forms. The stable nature of this product minimizes waste and expenses while its dry composition results in lower transportation costs and reduced packaging requirements. The ease of use for manufacturers and users comes from dry additives that resist temperature variations and help products last longer on store shelves. Market participants predominantly distribute dry products, including flavors, sweeteners, probiotics, acidifiers, mycotoxin binders, antioxidants that enhance digestibility and palatability, and feed conversion ratios in livestock.

"The probiotics segment will hold a significant market share among the types in the specialty feed additives market."

The probiotic segment holds a significant share within the type segment of the specialty feed additives market. Probiotic adoption has increased in regions such as Europe due to restrictions on antibiotics in feed additives, consumer preferences for antibiotic-free products, and environmental sustainability. A 2024 Penn State study found that probiotics, like Bacillus subtilis and Bacillus amyloliquefaciens, improve gut health, nutrient absorption, and growth performance in 320 broiler chicks. Targeting poultry health in tropical regions, Evonik recently introduced Ecobiol Soluble Plus in India, which was unveiled at Poultry India 2024 and is expected to support market expansion. Probiotics are expected to witness significant growth in the specialty feed additives market, driven by strategic industry collaborations, continuous innovation, rising global meat consumption, and increasing research focused on sustainable animal nutrition solutions.

"The US is projected to dominate the North American specialty feed additives market during the forecast period."

In 2024, the US meat industry demonstrated exceptional export performance, affirming its leadership, innovation, and competitive advantage in the global protein supply chain. US pork exports reached a historic high of 3.03 million tonnes (3.34 million tons), valued at USD 8.63 billion, while the industry recorded a peak export value of USD 66.53 per head slaughtered, underscoring robust international demand and the consistent quality of US pork. Similarly, US beef exports delivered a record value of USD 10.45 billion, with per-head export value rising to USD 415.08, reflecting the premium positioning of US beef in overseas markets despite supply-side constraints.

Complementing this strong export performance, the US continues to hold a dominant share in the North American specialty feed additives market, supported by innovation-led advancements. A notable development in 2024 was Kemin Industries Inc.'s (US) launch of FORMYL, a next-generation swine feed acidifier developed by its Animal Nutrition and Health - North America division. The product utilizes a proprietary encapsulated blend of calcium formate and citric acid to promote gut health and enhance pig productivity via a non-antibiotic mechanism. Its targeted action in the gastrointestinal tract aids in pH reduction and supports pathogen control, reflecting the US industry's commitment to advancing feed technologies and maintaining its leadership in specialty additives.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the specialty feed additives market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXOs - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), Evonik Industries AG (Germany), BASF SE (Germany), Novonesis Group (Denmark), Adisseo (France), Solvay (Belgium), Nutreco (Netherlands), Kemin Industries, Inc. (US), and Lallemand Inc. (Canada).

Research Coverage

This research report categorizes the specialty feed additives market by type (phytogenics, organic acids, probiotics, mycotoxin binders & modifiers, algae omega 3, pellet binders, probiotics, antioxidants, water disinfectants, flavors & sweeteners), livestock (poultry, swine, ruminants, aquatic animals & companion animals), form (dry, liquid), source (natural, synthetic), functions, and manufacturing technology (qualitative), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of specialty feed additives. A thorough analysis of the key industry players has provided insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the specialty feed additives market. This report covers the competitive analysis of upcoming startups in the specialty feed additives market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report will offer market leaders/new entrants' information on the closest approximate revenue numbers for the overall specialty feed additives and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Increased demand for meat-based products drives the demand), restraints (reliance on antibiotics for growth promotion in livestock production), opportunities (evolution of precision livestock farming), and challenges (fluctuating raw material costs) influencing the growth of the specialty feed additives market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the specialty feed additives market

- Market Development: Comprehensive information about lucrative market analysis of specialty feed additives across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the specialty feed additives market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc. (US), and other players in the specialty feed additives market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SPECIALTY FEED ADDITIVES MARKET OVERVIEW

- 4.2 SPECIALTY FEED ADDITIVES MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 4.3 ASIA PACIFIC: SPECIALTY FEED ADDITIVES MARKET, BY SOURCE & COUNTRY

- 4.4 SPECIALTY FEED ADDITIVES MARKET, BY FORM FOR REGION

- 4.5 SPECIALTY FEED ADDITIVES MARKET, BY TYPE

- 4.6 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK

- 4.7 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN DEMAND FOR COMPOUND FEED

- 5.2.2 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in demand for meat-based products

- 5.3.1.2 Growth in feed production

- 5.3.1.3 Rise in awareness about feed quality

- 5.3.1.4 Increase in number of feed mills across regions

- 5.3.2 RESTRAINTS

- 5.3.2.1 Reliance on antibiotics for growth promotion in livestock production

- 5.3.2.2 Inconsistency in regulatory structure

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Evolution of precision livestock farming

- 5.3.3.2 Increase in demand for nutritional supplements for monogastric animals

- 5.3.4 CHALLENGES

- 5.3.4.1 Rising operational and raw material costs

- 5.3.4.2 Sustainability of feed and livestock chain

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON ANIMAL NUTRITION/SPECIALTY FEED ADDITIVES

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN ANIMAL NUTRITION/SPECIALTY FEED ADDITIVES

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Revolutionizing dairy nutrition through AI innovations

- 5.4.3.2 Enhancing livestock feed formulation through decision support tools

- 5.4.4 IMPACT ON SPECIALTY FEED ADDITIVES MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFF - SPECIALTY FEED ADDITIVES MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 DISRUPTION IN SPECIALTY FEED ADDITIVE PRODUCTS

- 6.2.4 PRICE IMPACT ANALYSIS

- 6.2.5 IMPACT ON COUNTRY/REGION

- 6.2.5.1 US

- 6.2.5.2 Europe

- 6.2.5.3 Asia Pacific

- 6.2.6 IMPACT ON END-USE INDUSTRIES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.4.2 RAW MATERIAL SOURCING

- 6.4.3 PRODUCTION

- 6.4.4 QUALITY CONTROL & SAFETY

- 6.4.5 DISTRIBUTION & LOGISTICS

- 6.4.6 MARKETING & SALES

- 6.4.7 END USERS

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO

- 6.5.2 IMPORT SCENARIO

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Pelletizing and extrusion

- 6.6.1.2 Coating technologies

- 6.6.2 COMPLEMENTARY TECHNOLOGY

- 6.6.2.1 Omics technologies

- 6.6.3 ADJACENT TECHNOLOGY

- 6.6.3.1 Precision livestock farming

- 6.6.1 KEY TECHNOLOGIES

- 6.7 PRICING ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS

- 6.7.3 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.7.4 AVERAGE SELLING PRICE TREND, BY REGION

- 6.8 ECOSYSTEM ANALYSIS

- 6.8.1 DEMAND SIDE

- 6.8.2 SUPPLY SIDE

- 6.9 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 6.10 PATENT ANALYSIS

- 6.10.1 LIST OF MAJOR PATENTS

- 6.11 KEY CONFERENCES AND EVENTS

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF RELATED TO FEED ADDITIVES

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS

- 6.12.3.1 Feed additives regulatory approval from European Union

- 6.12.3.2 Time duration for specialty feed additives in register

- 6.12.3.3 Registration of specialty feed additives

- 6.12.3.4 Packaging of specialty feed additives

- 6.12.3.5 Labeling of specialty feed additives

- 6.12.3.6 Manufacture and sale of specialty feed additives

- 6.12.3.7 Import of specialty feed additives

- 6.12.3.8 Revaluation of feed additives

- 6.12.4 REGULATORY FRAMEWORK, BY COUNTRY

- 6.12.4.1 US

- 6.12.4.1.1 Labeling

- 6.12.4.1.2 Association of American Feed Control Officials (AAFCO)

- 6.12.4.2 Canada

- 6.12.4.2.1 Legal authorities

- 6.12.4.3 China

- 6.12.4.4 European Union

- 6.12.4.5 Japan

- 6.12.4.6 South Africa

- 6.12.4.1 US

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT OF SUBSTITUTES

- 6.13.5 THREAT OF NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 CASE STUDIES

- 6.15.1 ENHANCING POULTRY HEALTH WITH PHYTOGENIC FEED ADDITIVES BY KEMIN INDUSTRIES

- 6.15.2 PICHIA GUILLIERMONDII IN AQUAFEED BY ADM FOR BETTER IMMUNE SUPPORT IN SHRIMP

- 6.16 INVESTMENT & FUNDING SCENARIO

7 SPECIALTY FEED ADDITIVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PHYTOGENICS

- 7.2.1 ROLE IN IMPROVEMENT OF GUT HEALTH AND HEALTHY DIGESTION IN ANIMAL FEED TO BOOST MARKET

- 7.2.2 ESSENTIAL OILS

- 7.2.3 FLAVONOIDS

- 7.2.4 SAPONINS

- 7.2.5 OLEORESINS

- 7.2.6 OTHER PHYTOGENICS

- 7.3 ORGANIC ACIDS

- 7.3.1 ROLE IN CONSISTENT FEED FORMULATIONS AND FEED PRESERVATION TO DRIVE MARKET

- 7.3.2 PROPIONIC ACID

- 7.3.3 FORMIC ACID

- 7.3.4 CITRIC ACID

- 7.3.5 LACTIC ACID

- 7.3.6 SORBIC ACID

- 7.3.7 MALIC ACID

- 7.3.8 BENZOIC ACID

- 7.3.9 OTHER ORGANIC ACIDS

- 7.4 MYCOTOXIN BINDERS & MODIFIERS

- 7.4.1 INCREASE IN AWARENESS REGARDING BENEFITS OF BINDERS TO DRIVE MARKET

- 7.4.2 BINDERS

- 7.4.3 MODIFIERS

- 7.5 ALGAE OMEGA-3

- 7.5.1 ALGAE OMEGA-3 TO GAIN TRACTION AS SUSTAINABLE FEED ADDITIVE ACROSS ANIMAL NUTRITION SECTORS

- 7.6 PELLET BINDERS

- 7.6.1 PELLET BINDERS SUPPORT NUTRITIONAL STABILITY WHILE MEETING DURABILITY DEMANDS

- 7.7 PROBIOTICS

- 7.7.1 POTENTIAL TO REPLACE ANTIBIOTIC GROWTH PROMOTERS TO DRIVE MARKET

- 7.7.2 BACTERIA

- 7.7.3 YEAST & FUNGI

- 7.8 ANTIOXIDANTS

- 7.8.1 ROLE IN PROTECTION OF FAT-SOLUBLE VITAMINS AGAINST OXIDATIVE DEGRADATION TO DRIVE MARKET

- 7.8.2 SYNTHETIC ANTIOXIDANTS

- 7.8.3 NATURAL ANTIOXIDANTS

- 7.9 WATER DISINFECTANTS

- 7.9.1 RISING THREATS FROM CONTAMINATED WATER TO BOOST DEMAND FOR EFFECTIVE DISINFECTANTS

- 7.10 FLAVORS & SWEETENERS

- 7.10.1 ROLE OF SWEETENERS TO MASK UNDESIRED TASTE OF FEED TO DRIVE MARKET

- 7.10.2 FEED FLAVORS

- 7.10.3 FEED SWEETENERS

8 SPECIALTY FEED ADDITIVES MARKET, BY LIVESTOCK

- 8.1 INTRODUCTION

- 8.2 POULTRY

- 8.2.1 RISE IN DEMAND FOR HIGH-QUALITY CHICKEN AND EGGS TO DRIVE MARKET

- 8.2.2 BROILERS

- 8.2.3 LAYERS

- 8.2.4 BREEDERS

- 8.3 RUMINANTS

- 8.3.1 INCREASE IN CONSUMPTION OF DAIRY PRODUCTS AND BEEF TO DRIVE DEMAND

- 8.3.2 DAIRY CATTLE

- 8.3.3 BEEF CATTLE

- 8.3.4 SHEEP & GOATS

- 8.4 SWINE

- 8.4.1 RISE IN PORK TRADE AND CONCERNS OVER MEAT SAFETY TO BOOST MARKET

- 8.4.2 STARTERS

- 8.4.3 GROWERS

- 8.4.4 SOWS

- 8.5 AQUATIC ANIMALS

- 8.5.1 INCREASE IN HIGH-QUALITY AQUAFEED PRODUCTION TO DRIVE MARKET

- 8.5.2 FISH

- 8.5.3 CRUSTACEANS

- 8.5.4 MOLLUSKS

- 8.5.5 OTHER AQUATIC ANIMALS

- 8.6 COMPANION ANIMALS

9 SPECIALTY FEED ADDITIVES MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 SYNTHETIC

- 9.2.1 COST-EFFECTIVENESS AND HIGH STABILITY PROPERTIES TO PROPEL GROWTH

- 9.3 NATURAL

- 9.3.1 NEED FOR ALTERNATIVES TO ANTIBIOTICS AND CHEMICAL BINDERS TO DRIVE MARKET

10 SPECIALTY FEED ADDITIVES MARKET, BY FORM

- 10.1 INTRODUCTION

- 10.2 DRY

- 10.2.1 CONVENIENCE IN STORAGE, HANDLING, AND TRANSPORTATION TO DRIVE MARKET

- 10.3 LIQUID

- 10.3.1 UNIFORM MIXING AND PRECISE DOSING OF LIQUID FEED ADDITIVES TO PROPEL MARKET

11 SPECIALTY FEED ADDITIVES MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 GUT HEALTH & DIGESTIVE PERFORMANCE

- 11.2.1 INCREASED DEMAND FOR HEALTHY GUT MICROBIOTA TO IMPROVE DIGESTION AND PREVENT GASTROINTESTINAL DISEASES

- 11.3 MYCOTOXIN MANAGEMENT

- 11.3.1 INCREASE IN CONCERNS OVER FEED SAFETY, ANIMAL HEALTH, AND PRODUCTIVITY LOSSES TO DRIVE DEMAND FOR MYCOTOXIN MANAGEMENT FUNCTIONS

- 11.4 PALATABILITY ENHANCERS

- 11.4.1 IMPROVED TASTE, SMELL, AND OVERALL APPEAL OF ANIMAL FEED TO DRIVE DEMAND

- 11.5 PRESERVATION OF FUNCTIONAL INGREDIENTS

- 11.5.1 EFFECTIVE PRESERVATION ENHANCES OVERALL FEED QUALITY, SUPPORTING BETTER ANIMAL HEALTH AND PRODUCTIVITY

- 11.6 OTHER FUNCTIONS

12 SPECIALTY FEED ADDITIVES, BY MANUFACTURING TECHNOLOGY

- 12.1 INTRODUCTION

- 12.2 FERMENTATION

- 12.3 EXTRACTION & PURIFICATION

- 12.4 MICROENCAPSULATION/COATING

- 12.5 GRANULATION & DRYING

- 12.6 OTHER MANUFACTURING TECHNOLOGIES

13 SPECIALTY FEED ADDITIVES MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Investments by companies like Kemin and IFF in innovative feed solutions reflect growing demand for specialty feed additives

- 13.2.2 CANADA

- 13.2.2.1 Increased production of poultry products to boost market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Increased production of animal-based food while strengthening biosecurity to fuel demand

- 13.3.2 UK

- 13.3.2.1 Rise in horse-riding to require targeted nutritional additives for efficiency

- 13.3.3 FRANCE

- 13.3.3.1 Increase in investments in livestock sector to fuel market growth

- 13.3.4 ITALY

- 13.3.4.1 Focus on improving animal health and nutrition to drive market

- 13.3.5 SPAIN

- 13.3.5.1 Growth in caged poultry sector to boost demand for nutritious feed additives

- 13.3.6 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Strategic partnerships between key players in market to show rising demand

- 13.4.2 INDIA

- 13.4.2.1 Rising dairy & poultry supported by key players' initiatives to support market growth

- 13.4.3 JAPAN

- 13.4.3.1 Increasing consumer demand for premium animal-based products to drive market

- 13.4.4 AUSTRALIA & NEW ZEALAND

- 13.4.4.1 Rise in demand for poultry meat to drive market

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Growing pet culture in country to augment demand

- 13.4.6 INDONESIA

- 13.4.6.1 High demand for feed due to growing poultry sector to drive market

- 13.4.7 THAILAND

- 13.4.7.1 Expansion of poultry meat export sector to drive market

- 13.4.8 VIETNAM

- 13.4.8.1 Goal to meet domestic feed demand by 2030 to support use of natural and functional additives

- 13.4.9 MALAYSIA

- 13.4.9.1 Rise in demand for animal meat to fuel market growth

- 13.4.10 PHILIPPINES

- 13.4.10.1 Key players launching new products to showcase market demand

- 13.4.11 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 LATIN AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Increase in livestock population and export opportunities to fuel market growth

- 13.5.2 ARGENTINA

- 13.5.2.1 Export pork opportunity to drive market

- 13.5.3 MEXICO

- 13.5.3.1 Expansions by key players in country to exhibit market demand

- 13.5.4 COLOMBIA

- 13.5.4.1 Rise in per capita pork consumption to emphasize need for quality feed to support higher production levels

- 13.5.5 VENEZUELA

- 13.5.5.1 Poultry production's more than doubling since 2018 to signal rise in demand for advanced feed additives

- 13.5.6 REST OF LATIN AMERICA

- 13.5.1 BRAZIL

- 13.6 REST OF THE WORLD (ROW)

- 13.6.1 AFRICA

- 13.6.1.1 Rise in disease incidences and growth of poultry sector to drive demand

- 13.6.1.2 South Africa

- 13.6.1.2.1 Preventive animal health strategies to increase reliance on functional feed additives

- 13.6.1.3 Egypt

- 13.6.1.3.1 Shift toward sustainable production to accelerate adoption of innovative feed solutions

- 13.6.2 REST OF AFRICA

- 13.6.3 MIDDLE EAST

- 13.6.3.1 Growth in livestock population and demand for dairy products to drive market

- 13.6.3.2 Turkiye

- 13.6.3.2.1 Disease threats like avian influenza to push producers toward immunity-boosting nutritional strategies

- 13.6.3.3 Israel

- 13.6.3.3.1 Advanced dairy genetics and intensive herd management to increase reliance on nutritional optimization tools

- 13.6.3.4 Iraq

- 13.6.3.4.1 Government support for domestic livestock producers to drive market demand

- 13.6.3.5 Rest of Middle East

- 13.6.1 AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.4.1 MARKET RANKING ANALYSIS

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.5.1 COMPANY VALUATION

- 14.5.2 EV/EBITDA

- 14.6 BRAND COMPARISON ANALYSIS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Type footprint

- 14.7.5.4 Livestock footprint

- 14.7.5.5 Form footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 CARGILL, INCORPORATED

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 ARCHER DANIELS MIDLAND (ADM) COMPANY

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 EVONIK INDUSTRIES AG

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 BASF SE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent development

- 15.1.5.3.1 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 NOVONESIS GROUP

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.7 NUTRECO

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Expansions

- 15.1.7.4 MnM view

- 15.1.8 LALLEMAND INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.4 MnM view

- 15.1.9 BENTOLI

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.4 MnM view

- 15.1.10 ALLTECH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.10.4 MnM view

- 15.1.11 PETROLIAM NASIONAL BERHAD (PETRONAS)

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.4 MnM view

- 15.1.12 ADISSEO

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Expansions

- 15.1.12.4 MnM view

- 15.1.13 KEMIN INDUSTRIES, INC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.13.3.2 Deals

- 15.1.13.3.3 Expansions

- 15.1.13.4 MnM view

- 15.1.14 LAND O'LAKES, INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 MnM view

- 15.1.15 NOVUS INTERNATIONAL, INC.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Deals

- 15.1.15.3.3 Other developments

- 15.1.15.4 MnM view

- 15.1.1 CARGILL, INCORPORATED

- 15.2 OTHER PLAYERS

- 15.2.1 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.4 MnM view

- 15.2.2 GLOBAL NUTRITION INTERNATIONAL

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.4 MnM view

- 15.2.3 VOLAC INTERNATIONAL LTD.

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Expansions

- 15.2.3.3.2 Other developments

- 15.2.3.4 MnM view

- 15.2.4 NUTREX

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.4 MnM view

- 15.2.5 IMPEXTRACO NV

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.4 MnM view

- 15.2.6 INNOVAD

- 15.2.7 TEX BIOSCIENCES (P) LTD.

- 15.2.8 CENTAFARM SRL

- 15.2.9 NUQO FEED ADDITIVES

- 15.2.10 PALITAL FEED ADDITIVES B.V.

- 15.2.1 NEOSPARK DRUGS AND CHEMICALS PRIVATE LIMITED

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATIONS

- 16.3 FEED ADDITIVES MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.4 COMPOUND FEED MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS