|

|

市場調査レポート

商品コード

1773186

4D画像レーダーの世界市場 (~2030年):距離 (短距離・中距離・長距離)・用途 (ADAS・セキュリティ&監視・患者診断&モニタリング)・エンドユーザー (自動車・航空宇宙&防衛・ヘルスケア・工業) 別4D Imaging Radar Market by Range (Short-Range, Medium-Range, Long-Range), Application (ADAS, Security & Surveillance, Patient Diagnostic & Monitoring), End User (Automotive, Aerospace & Defense, Healthcare, Industrial) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 4D画像レーダーの世界市場 (~2030年):距離 (短距離・中距離・長距離)・用途 (ADAS・セキュリティ&監視・患者診断&モニタリング)・エンドユーザー (自動車・航空宇宙&防衛・ヘルスケア・工業) 別 |

|

出版日: 2025年07月03日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

4D画像レーダーの市場規模は、2025年の3億9,280万米ドルから、予測期間中は25.2%のCAGR推移し、2030年には12億690万米ドルに達すると予測されています。

この市場は、レーダーがマルチセンサーシステムに組み込まれる動きが進んでいることによって牽引されています。これにより、自動運転車における物体の検出、追跡、意思決定の精度が向上しています。センサーフュージョン技術の進歩は、特に霧や暗闇といった厳しい環境下で従来型センサーが機能しにくい状況でも信頼性の高い性能を提供することで、道路安全性を大幅に向上させています。さらに、インテリジェントトランスポートシステム (ITS) への規制面での支援や投資の増加も導入を加速させており、4D画像レーダーは、より安全な移動手段を実現するうえで必要とされる高精度かつ高信頼性を提供する技術として注目されています。さらに、4D画像レーダーがより安全なモビリティソリューションに必要な精度と信頼性を提供するため、規制当局の支援とインテリジェント交通システムへの投資が増加し、導入が加速しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 距離・用途・エンドユーザー・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・その他の地域 |

"用途別では、セキュリティ&監視の部門が予測期間中に最も高いCAGRを示す見通し"

4D画像レーダーは、複雑で変化の激しい環境においても物体の検出・追跡・分類を高精度で行える性能により、セキュリティおよび監視用途で急速に採用が進んでいます。このレーダーは、霧・雨・雪・完全な暗闇といった視界不良の条件下でも安定して動作するため、24時間365日の監視に最適です。その応用範囲は、国境警備、防衛基地、発電所、空港、データセンターなどの重要インフラの周辺警備にまで及び、早期の脅威検知と状況把握が求められる場面で特に効果を発揮します。さらに、都市部ではスマートシティの監視ネットワークに統合され、交通パターンの監視、不審な動きの特定、イベント時の群衆管理などに活用されています。また、パトロール車両や無人地上/航空車両 (UGV/UAV) などの移動型監視システムにも搭載されており、戦術的・緊急時の運用中にもリアルタイムの状況認識を提供します。正確な位置情報と動きのデータに基づく物体追跡が可能なため、警備担当者による迅速かつ正確な意思決定を可能にします。加えて、テロ、越境侵入、重要インフラへの攻撃などの世界的な安全保障リスクの高まりを受け、各国政府や民間セクターが次世代監視技術への投資を拡大していることも、この分野の成長を後押ししています。

”アジア太平洋地域は予測期間中に高いCAGRを記録する見込み"

アジア太平洋地域では、自動車産業の急速な拡大と自動運転技術への積極的な投資を背景に、4D画像レーダー市場が力強い成長を見せています。たとえば、日本のToyota、韓国のHyundai (現代) 、中国のBYDやNIOといった主要自動車製造業者は、車両の安全性や状況認識、自動運転機能の強化を目的に、4D画像レーダーの導入を進めています。特に、BYDが電気自動車に高度運転支援システム (ADAS) を導入し、政府がクリーンかつスマートな移動手段を後押しする政策を展開している例は、レーダー技術への移行を象徴しています。また、インドの自動車市場も成長著しく、スマートカーや安全機能に対する消費者の関心の高まりから、ACCや自動緊急ブレーキといった機能に対応するために、4Dレーダーの導入が進んでいます。この動きは、中間層の拡大や可処分所得の上昇にも支えられており、ADAS搭載車がより多くの層に普及しやすくなっています。さらに、地域内のスマートシティ構想では、インテリジェントな交通管理システムの導入が進められており、4D画像レーダーは車車間・路車間通信、群衆検知、事故防止といった機能を担う重要技術となっています。こうした安全性を義務付ける規制環境は、公共・民間交通システムにおけるレーダーセンサー需要の拡大を促進しています。

当レポートでは、世界の4D画像レーダーの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客の事業に影響を与える動向と混乱

- 投資と資金調達のシナリオ

- 技術分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025-2026年の主な会議とイベント

- 規制状況

- AIの影響

第6章 2025年の米国関税

- 主要関税率

- 国/地域への影響

- 米国

- 欧州

- アジア太平洋

- エンドユーザー産業への影響

第7章 4D画像レーダー市場:距離別

- 短距離

- 中距離

- 長距離

第8章 4D画像レーダー市場:用途別

- ADAS

- セキュリティ・監視

- その他

第9章 4D画像レーダー市場:エンドユーザー別

- 自動車

- 航空宇宙および防衛

- その他

第10章 4D画像レーダー市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- 世界のその他の地域

- マクロ経済見通し

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:4D画像レーダーSOC製造業者

- 企業評価マトリックス:4D画像レーダー装置製造業者

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- TEXAS INSTRUMENTS INCORPORATED

- NXP SEMICONDUCTORS

- INFINEON TECHNOLOGIES AG

- ROBERT BOSCH GMBH

- MOBILEYE

- VAYYAR

- UHNDER

- ARBE

- THALES

- CONTINENTAL AG

- MAGNA INTERNATIONAL INC.

- AINSTEIN

- CUBTEK INC.

- その他の企業

- AMBARELLA INTERNATIONAL LP

- GREENERWAVE

- APTIV

- ELBIT SYSTEMS LTD.

- VALEO

- SENSRAD

- ECHODYNE CORP.

- CONQUERI

- ALTOS RADAR

- RENESAS ELECTRONICS CORPORATION

- SMART RADAR SYSTEM INC.

- MUYE MICROELECTRONICS

- BITSENSING INC

- CALTERAH SEMICONDUCTOR TECHNOLOGY (SHANGHAI) CO., LTD.

第13章 付録

List of Tables

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 INDICATIVE PRICING OF 4D IMAGING RADAR CHIPS OFFERED BY KEY PLAYERS (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF 4D IMAGING RADAR CHIPS, BY REGION, 2021-2024 (USD)

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 6 KEY BUYING CRITERIA, BY END USER

- TABLE 7 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 PATENT ANALYSIS

- TABLE 10 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 STANDARDS AND REGULATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 4D IMAGING RADAR MARKET, BY RANGE, 2023-2024 (USD MILLION)

- TABLE 18 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 19 SHORT RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 20 SHORT RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 MEDIUM RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 22 MEDIUM RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 LONG RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 24 LONG RANGE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 26 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 ADAS: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 28 ADAS: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 29 ADAS: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 30 ADAS: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 SECURITY & SURVEILLANCE: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 32 SECURITY & SURVEILLANCE: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 33 SECURITY & SURVEILLANCE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 34 SECURITY & SURVEILLANCE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 OTHER APPLICATIONS: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 38 OTHER APPLICATIONS: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 40 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 41 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY VALUE AND VOLUME, 2023-2024

- TABLE 42 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY VALUE AND VOLUME, 2025-2030

- TABLE 43 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 44 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 45 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 46 AUTOMOTIVE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 AEROSPACE & DEFENSE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 48 AEROSPACE & DEFENSE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 AEROSPACE & DEFENSE: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 50 AEROSPACE & DEFENSE: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 OTHER END USERS: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 52 OTHER END USERS: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 OTHER END USERS: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 54 OTHER END USERS: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 56 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY COUNTRY, 2023-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY RANGE, 2023-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 65 US: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 66 US: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 US: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 68 US: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 69 CANADA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 CANADA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 71 MEXICO: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 MEXICO: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: 4D IMAGING RADAR MARKET, BY COUNTRY, 2023-2024 (USD MILLION)

- TABLE 74 EUROPE: 4D IMAGING RADAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: 4D IMAGING RADAR MARKET, BY RANGE, 2023-2024 (USD MILLION)

- TABLE 76 EUROPE: 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 78 EUROPE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 80 EUROPE: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 GERMANY: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 82 GERMANY: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 83 GERMANY: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 84 GERMANY: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 UK: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 86 UK: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 UK: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 88 UK: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 89 FRANCE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 90 FRANCE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 FRANCE: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 92 FRANCE: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 ITALY: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 94 ITALY: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 95 ITALY: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 96 ITALY: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 98 REST OF EUROPE: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 100 REST OF EUROPE: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY COUNTRY, 2023-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY RANGE, 2023-2024 (USD MILLION)

- TABLE 104 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 CHINA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 110 CHINA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111 CHINA: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 112 CHINA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 JAPAN: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 114 JAPAN: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 JAPAN: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 116 JAPAN: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 SOUTH KOREA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 118 SOUTH KOREA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 SOUTH KOREA: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 120 SOUTH KOREA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 INDIA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 INDIA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 127 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY REGION, 2023-2024 (USD MILLION)

- TABLE 128 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY RANGE, 2023-2024 (USD MILLION)

- TABLE 130 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 131 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 132 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 134 REST OF THE WORLD: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2023-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: 4D IMAGING RADAR MARKET, BY END USER, 2023-2024 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 SOUTH AMERICA: 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 SOUTH AMERICA: 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 142 4D IMAGING RADAR MARKET: DEGREE OF COMPETITION

- TABLE 143 REGION FOOTPRINT

- TABLE 144 RANGE FOOTPRINT

- TABLE 145 APPLICATION FOOTPRINT

- TABLE 146 END USER FOOTPRINT

- TABLE 147 LIST OF START-UPS/SMES

- TABLE 148 COMPETITIVE BENCHMARKING OF START-UPS/SMES, 2025

- TABLE 149 4D IMAGING RADAR MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2025

- TABLE 150 4D IMAGING RADAR MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 151 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 152 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS OFFERED

- TABLE 153 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 154 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 155 TEXAS INSTRUMENTS INCORPORATED: EXPANSIONS

- TABLE 156 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 157 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 158 NXP SEMICONDUCTORS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 159 NXP SEMICONDUCTORS: DEALS

- TABLE 160 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 161 INFINEON TECHNOLOGIES AG: PRODUCTS OFFERED

- TABLE 162 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 163 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 164 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 165 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 166 MOBILEYE: COMPANY OVERVIEW

- TABLE 167 MOBILEYE: PRODUCTS OFFERED

- TABLE 168 MOBILEYE: DEALS

- TABLE 169 VAYYAR: COMPANY OVERVIEW

- TABLE 170 VAYYAR: PRODUCTS OFFERED

- TABLE 171 VAYYAR: DEALS

- TABLE 172 UHNDER: COMPANY OVERVIEW

- TABLE 173 UHNDER: PRODUCTS OFFERED

- TABLE 174 UHNDER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 175 UHNDER: DEALS

- TABLE 176 ARBE: COMPANY OVERVIEW

- TABLE 177 ARBE: PRODUCTS OFFERED

- TABLE 178 ARBE: DEALS

- TABLE 179 THALES: COMPANY OVERVIEW

- TABLE 180 THALES: PRODUCTS OFFERED

- TABLE 181 THALES: DEALS

- TABLE 182 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 183 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 184 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 185 CONTINENTAL AG: DEALS

- TABLE 186 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 187 MAGNA INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 188 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 189 AINSTEIN: COMPANY OVERVIEW

- TABLE 190 AINSTEIN: PRODUCTS OFFERED

- TABLE 191 CUBTEK INC.: COMPANY OVERVIEW

- TABLE 192 CUBTEK INC.: PRODUCTS OFFERED

- TABLE 193 AMBARELLA INTERNATIONAL LP: COMPANY OVERVIEW

- TABLE 194 GREENERWAVE: COMPANY OVERVIEW

- TABLE 195 APTIV: COMPANY OVERVIEW

- TABLE 196 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 197 VALEO: COMPANY OVERVIEW

- TABLE 198 SENSRAD: COMPANY OVERVIEW

- TABLE 199 ECHODYNE CORP.: COMPANY OVERVIEW

- TABLE 200 CONQUERI: COMPANY OVERVIEW

- TABLE 201 ALTOS RADAR: COMPANY OVERVIEW

- TABLE 202 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 203 SMART RADAR SYSTEM INC.: COMPANY OVERVIEW

- TABLE 204 MUYE MICROELECTRONICS: COMPANY OVERVIEW

- TABLE 205 BITSENSING INC: COMPANY OVERVIEW

- TABLE 206 CALTERAH SEMICONDUCTOR TECHNOLOGY (SHANGHAI) CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 4D IMAGING RADAR MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW

- FIGURE 4 REVENUE GENERATED FROM SALES OF 4D IMAGING RADARS IN 2024

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SHORT RANGE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 9 SECURITY & SURVEILLANCE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 SURGE IN DEMAND FOR 4D IMAGING RADAR SOCS FROM AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- FIGURE 13 LONG RANGE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 ADAS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 15 AUTOMOTIVE SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 16 EUROPE TO BE LARGEST MARKET FOR 4D IMAGING RADARS DURING FORECAST PERIOD

- FIGURE 17 ITALY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 4D IMAGING RADAR MARKET DYNAMICS

- FIGURE 19 IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 VALUE CHAIN ANALYSIS

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF 4D IMAGING RADAR CHIPS, BY REGION, 2023-2024 (USD)

- FIGURE 26 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN 4D IMAGING RADAR MARKET

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 30 KEY BUYING CRITERIA, BY END USER

- FIGURE 31 IMPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 8526-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 PATENT ANALYSIS

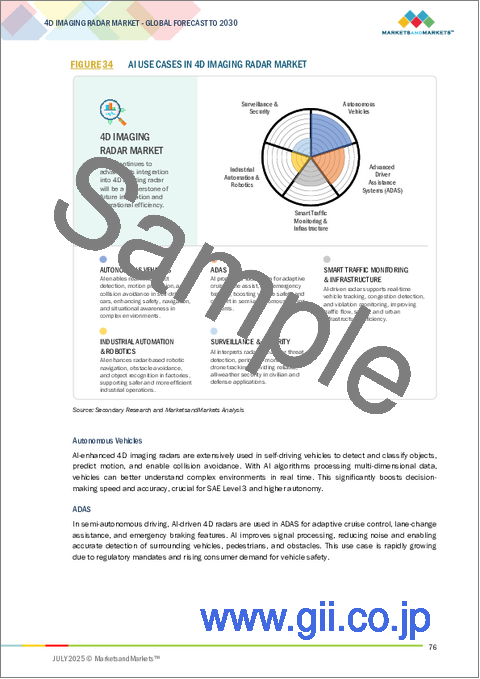

- FIGURE 34 AI USE CASES IN 4D IMAGING RADAR MARKET

- FIGURE 35 4D IMAGING RADAR MARKET, BY RANGE, 2025-2030 (USD MILLION)

- FIGURE 36 4D IMAGING RADAR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- FIGURE 37 4D IMAGING RADAR MARKET, BY END USER, 2025-2030 (USD MILLION)

- FIGURE 38 4D IMAGING RADAR MARKET, BY REGION, 2025-2030 (USD MILLION)

- FIGURE 39 NORTH AMERICA: 4D IMAGING RADAR MARKET SNAPSHOT

- FIGURE 40 EUROPE: 4D IMAGING RADAR MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: 4D IMAGING RADAR MARKET SNAPSHOT

- FIGURE 42 REST OF THE WORLD: 4D IMAGING RADAR MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2022-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 45 COMPANY VALUATION (USD BILLION)

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 47 BRAND COMPARISON

- FIGURE 48 COMPANY EVALUATION MATRIX (4D IMAGING RADAR SOC MANUFACTURERS), 2024

- FIGURE 49 COMPANY EVALUATION MATRIX (4D IMAGING RADAR DEVICE MANUFACTURERS), 2024

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 52 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 53 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 54 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 56 MOBILEYE: COMPANY SNAPSHOT

- FIGURE 57 ARBE: COMPANY SNAPSHOT

- FIGURE 58 THALES: COMPANY SNAPSHOT

- FIGURE 59 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 60 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

The 4D imaging radar market is estimated to be USD 392.8 million in 2025 and is estimated to reach USD 1,206.9 million by 2030, at a CAGR of 25.2% between 2025 and 2030. The market is driven by the growing integration of radar into multi-sensor systems, which enhances object detection, tracking, and decision-making in autonomous vehicles. Advancements in sensor fusion are significantly improving road safety by providing reliable performance in challenging conditions like fog or darkness, where traditional sensors may fail. Additionally, increasing regulatory support and investments in intelligent transport systems are accelerating adoption, as 4D imaging radar delivers the precision and reliability needed for safer mobility solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Range, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"Security & surveillance application to register highest CAGR during the forecast period."

4D imaging radar is increasingly being adopted across a broad spectrum of security and surveillance applications due to its superior ability to detect, track, and classify objects in complex and dynamic environments. 4D imaging radar operates reliably in poor visibility conditions such as fog, rain, snow, or complete darkness, making it ideal for 24/7 monitoring. It is used in perimeter security for border control, defense bases, and critical infrastructure such as power stations, airports, and data centers, where early threat detection and situational awareness are crucial. In urban environments, it is integrated into smart city surveillance networks to monitor traffic patterns, identify suspicious activities, and manage crowd control during events. Furthermore, mobile surveillance systems, including those in patrol vehicles and unmanned ground or aerial vehicles (UGVs/UAVs), use 4D radar to maintain real-time awareness during tactical or emergency operations. Its ability to track objects with precise location and motion data enables faster and more accurate decision-making for security personnel. Rising global security concerns, including terrorism, cross-border intrusions, and increasing incidents of critical infrastructure attacks, are prompting governments and private sectors to invest heavily in next-generation surveillance technologies.

"Asia Pacific is expected to witness high CAGR in 4D imaging radar market during the forecast period."

The Asia Pacific region is experiencing robust growth in the 4D imaging radar market, primarily due to the rapid expansion of its automotive sector and increasing investments in autonomous driving technologies. Leading automakers such as Toyota (Japan), Hyundai (South Korea), BYD(China), and NIO (China) are actively incorporating 4D imaging radar in their vehicles to enhance safety, situational awareness, and automated driving capabilities. For instance, BYD's integration of advanced driver-assistance systems (ADAS) in its electric vehicles, backed by government policies promoting clean and intelligent mobility, exemplifies the shift toward radar-based solutions. Additionally, India's growing automotive market, with rising consumer demand for smart vehicles and safety features, is pushing manufacturers to adopt 4D radar for features like Adaptive Cruise Control and Automatic Emergency Braking. This is further supported by a growing middle-class population and increasing disposable income, making ADAS-equipped vehicles more accessible. Furthermore, smart city projects across the region aim to incorporate intelligent traffic management systems, where 4D imaging radar is critical in enabling vehicle-to-infrastructure communication, crowd detection, and accident prevention. This regulatory environment not only mandates safety but also stimulates demand for radar sensors in both public and private transportation systems.

Extensive primary interviews were conducted with key industry experts in the 4D imaging radar market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-20%, Tier 2-35%, and Tier 3-45%

- By Designation: Managers-20%, Directors-30%, and Others-50%

- By Region: North America-30%, Europe-20%, Asia Pacific-40%, and RoW-10%

The report profiles key players in the 4D imaging radar market with their respective market ranking analysis. Prominent players profiled in this report are Texas Instruments Incorporated (US), NXP Semiconductors (Netherlands), Infineon Technologies AG (Germany), Robert Bosch GmbH (Germany), Mobileye (Israel), Vayyar (Israel), Uhnder (US), Arbe (Israel), Thales (France), Continental AG (Germany), Magna International Inc. (Canada), Ainstein (US), and CUBTEK INC. (Taiwan), among others.

Apart from this, Ambarella International LP. (US), Greenerwave (France), Aptiv (US), Elbit Systems Ltd. (Israel), Valeo (France), Sensrad (Sweden), Echodyne Corp. (US), Conqueri (US), Altos Radar (US), Renesas Electronics Corporation (Japan), Smart Radar System Inc. (South Korea), Muye Microelectronics (China), bitsensing Inc. (South Korea), and Calterah Semiconductor Technology (Shanghai) Co., Ltd. (China) are among the few other companies in the 4D imaging radar market.

Research Coverage:

This research report categorizes the 4D imaging radar market based on range, application, end user, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the 4D imaging radar market and forecasts the same till 2030. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the 4D imaging radar ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall 4D imaging radar market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for Autonomous driving and advanced driver assistance systems (ADAS), Rising need for safety and smart sensing in industrial and infrastructure applications, Limitations of LiDAR and camera systems in harsh environments, and advancements in radar technology) influencing the growth of the 4D imaging radar market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 4D imaging radar market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the 4D imaging radar market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the 4D imaging radar market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Texas Instruments Incorporated (US), NXP Semiconductors (Netherlands), Infineon Technologies AG (Germany), Robert Bosch GmbH (Germany), and Mobileye (Israel), in the 4D imaging radar market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interviewees

- 2.1.3.2 Breakdown of primary interviews

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (supply side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (demand side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 4D IMAGING RADAR MARKET

- 4.2 4D IMAGING RADAR MARKET, BY RANGE

- 4.3 4D IMAGING RADAR MARKET, BY APPLICATION

- 4.4 4D IMAGING RADAR MARKET, BY END USER

- 4.5 4D IMAGING RADAR MARKET, BY REGION

- 4.6 4D IMAGING RADAR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for ADAS and autonomous driving features

- 5.2.1.2 Innovations in radar technology

- 5.2.1.3 Need for smart sensing in industrial and infrastructure applications

- 5.2.1.4 Limitations of optical and laser-based perception technologies in extreme environments

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of 4D imaging radar systems

- 5.2.2.2 Complexity of data processing and integration with existing systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of 4D imaging radar into multi-sensor systems

- 5.2.3.2 Heightened demand for privacy-preserving sensing technologies

- 5.2.3.3 Adoption of 4D imaging radar in healthcare and assisted living

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical constraints and high-power consumption

- 5.2.4.2 Regulatory and standardization challenges

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 MIMO radar

- 5.8.1.2 Millimeter-wave technology

- 5.8.1.3 Advanced signal processing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Sensor fusion system

- 5.8.2.2 Edge AI and embedded processing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 LiDAR

- 5.8.3.2 Camera-based vision system

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 UHNDER AND BITSENSING DEVELOP 4D IMAGING RADAR SYSTEM TO IMPROVE VEHICLE SAFETY

- 5.11.2 ARBE DESIGNS ULTRA-HIGH-RESOLUTION IMAGING RADAR CHIPSET TO ENHANCE PERFORMANCE

- 5.11.3 MAGNA AND FISKER DEVELOP INDUSTRY-SPECIFIC ADAS FEATURES TO PROVIDE EXCELLENT DRIVING EXPERIENCE

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8526)

- 5.12.2 EXPORT SCENARIO (HS CODE 8526)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS AND REGULATIONS

- 5.16 IMPACT OF AI

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI ON 4D IMAGING RADAR MARKET

- 5.16.3 TOP USE CASES AND MARKET POTENTIAL

6 US 2025 TARIFF

- 6.1 INTRODUCTION

- 6.2 KEY TARIFF RATES

- 6.3 IMPACT ON COUNTRY/REGION

- 6.3.1 US

- 6.3.2 EUROPE

- 6.3.3 ASIA PACIFIC

- 6.4 IMPACT ON END-USE INDUSTRIES

7 4D IMAGING RADAR MARKET, BY RANGE

- 7.1 INTRODUCTION

- 7.2 SHORT RANGE

- 7.2.1 RAPID GROWTH OF AUTONOMOUS AND SEMI-AUTONOMOUS VEHICLES TO DRIVE MARKET

- 7.3 MEDIUM RANGE

- 7.3.1 NEED FOR ENHANCED SAFETY AND AUTOMATION IN AUTOMOTIVE AND DEFENSE APPLICATIONS TO DRIVE MARKET

- 7.4 LONG RANGE

- 7.4.1 GLOBAL PUSH FOR HIGHER LEVELS OF VEHICLE AUTOMATION AND STRINGENT SAFETY REGULATIONS TO DRIVE MARKET

8 4D IMAGING RADAR MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 ADAS

- 8.2.1 GROWING INCLINATION TOWARD SAFER, SMARTER VEHICLES TO DRIVE MARKET

- 8.3 SECURITY & SURVEILLANCE

- 8.3.1 RISING INVESTMENTS IN SURVEILLANCE TECHNOLOGIES DUE TO EVOLVING GLOBAL THREAT TO DRIVE MARKET

- 8.4 OTHER APPLICATIONS

9 4D IMAGING RADAR MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 ELEVATED DEMAND FOR ENHANCED SAFETY FEATURES IN VEHICLES TO DRIVE MARKET

- 9.3 AEROSPACE & DEFENSE

- 9.3.1 RISE IN AIR TRAFFIC VOLUME AND INCREASED COMPLEXITY OF MODERN WARFARE TO DRIVE MARKET

- 9.4 OTHER END USERS

10 4D IMAGING RADAR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Heightened demand for ADAS and autonomous vehicles to drive market

- 10.2.3 CANADA

- 10.2.3.1 Rigorous development of autonomous driving technologies to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Rapidly evolving automotive manufacturing industry to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Surge in defense spending and export activities to drive market

- 10.3.3 UK

- 10.3.3.1 Substantial government investments in defense technology and AI integration to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Strategic emphasis on internal security and military modernization to drive market

- 10.3.5 ITALY

- 10.3.5.1 Space-based radar investments and ground-level safety needs to drive market

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Predominance of electric vehicle and autonomous driving segments to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Robust automotive industry and susceptibility to natural disasters to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Government's strong focus on smart mobility and traffic safety to drive market

- 10.4.5 INDIA

- 10.4.5.1 Government-backed initiatives and push for electric mobility to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST & AFRICA

- 10.5.2.1 Increasing need for enhanced border surveillance and defense modernization to drive market

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Expanding vehicle production and urban tech investments to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: 4D IMAGING RADAR SOC MANUFACTURERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.8 COMPANY EVALUATION MATRIX: 4D IMAGING RADAR DEVICE MANUFACTURERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Range footprint

- 11.8.5.4 Application footprint

- 11.8.5.5 End user footprint

- 11.9 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2025

- 11.9.5.1 List of start-ups/SMEs

- 11.9.5.2 Competitive benchmarking of start-ups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- 11.10.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TEXAS INSTRUMENTS INCORPORATED

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches/developments

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 NXP SEMICONDUCTORS

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches/developments

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 INFINEON TECHNOLOGIES AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches/developments

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 ROBERT BOSCH GMBH

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses/Competitive threats

- 12.1.5 MOBILEYE

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 VAYYAR

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 UHNDER

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.7.3.2 Deals

- 12.1.8 ARBE

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 THALES

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 CONTINENTAL AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches/developments

- 12.1.10.3.2 Deals

- 12.1.11 MAGNA INTERNATIONAL INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 AINSTEIN

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 CUBTEK INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.1 TEXAS INSTRUMENTS INCORPORATED

- 12.2 OTHER PLAYERS

- 12.2.1 AMBARELLA INTERNATIONAL LP

- 12.2.2 GREENERWAVE

- 12.2.3 APTIV

- 12.2.4 ELBIT SYSTEMS LTD.

- 12.2.5 VALEO

- 12.2.6 SENSRAD

- 12.2.7 ECHODYNE CORP.

- 12.2.8 CONQUERI

- 12.2.9 ALTOS RADAR

- 12.2.10 RENESAS ELECTRONICS CORPORATION

- 12.2.11 SMART RADAR SYSTEM INC.

- 12.2.12 MUYE MICROELECTRONICS

- 12.2.13 BITSENSING INC

- 12.2.14 CALTERAH SEMICONDUCTOR TECHNOLOGY (SHANGHAI) CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS