|

|

市場調査レポート

商品コード

1772638

北米のヘルスケアIT市場:ソリューション・サービス別、コンポーネント別、エンドユーザー別、国別 - 2030年までの予測North American Healthcare IT Market by Solution (Provider, Payer(Clinical (EHR, PHM, PACS & VNA, Telehealth, RCM, CDSS), Nonclinical (Analytics, Pharmacy, Interoperability)), Service(Claim, Billing)), End User(Hospital, Payer) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 北米のヘルスケアIT市場:ソリューション・サービス別、コンポーネント別、エンドユーザー別、国別 - 2030年までの予測 |

|

出版日: 2025年07月15日

発行: MarketsandMarkets

ページ情報: 英文 360 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のヘルスケアITの市場規模は、予測期間中に13.9%のCAGRで拡大し、2025年の2,290億5,000万米ドルから2030年には4,390億9,000万米ドルに達すると予測されています。

この市場の成長は、電子カルテ(EHR)、遠隔医療、AIを活用した臨床意思決定支援ツールなど、デジタルヘルスソリューションの採用が増加していることが背景にあります。ヘルスケアコストの削減、患者転帰の改善、業務の合理化に対する圧力の高まりにより、医療提供者や支払者はITインフラに多額の投資を行うようになっています。しかし、データセキュリティに対する懸念の高まりや、高度なヘルスケアITツールの導入に対する医療従事者の消極的な姿勢が、同市場の成長に課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | ソリューション・サービス別、コンポーネント別、エンドユーザー別、国別 |

| 対象地域 | 米国、カナダ |

タイプ別では、医療プロバイダーソリューションセグメントが2024年に最大シェアを占めました。ヘルスケアプロバイダーの間でデジタルヘルスソリューション、特に電子カルテの採用が増加しているのは、ヘルスケアプロバイダーにこれらの技術の導入を促す政府の規制やインセンティブプログラムによるところが大きいです。さらに、病院や診療所では、より良い患者ケア、業務効率の向上、コスト削減に対する需要が高まっています。慢性疾患の増加と高齢化は、拡張性の高いITソリューションの必要性をさらに高めています。

北米のヘルスケアIT市場では、予測期間中、ソフトウェア分野が最も高いCAGRを記録すると予想されています。この成長には、デジタルヘルスソリューションへの急速なシフトが大きく寄与しており、認知度の向上と政府の義務化により、臨床と管理機能の両方に高度なヘルスケアソフトウェアの導入が促進されています。電子カルテ、集団健康管理、高度分析のためのソフトウェアの導入が重視されており、これらのツールはさまざまなヘルスケア環境におけるデータ収集、保存、分析の改善を促進するためです。さらに、人工知能(AI)とモノのインターネット(IoT)をヘルスケアソフトウェアに統合することで、患者ケアの強化、業務効率化、遠隔モニタリングの新たな機会が生まれ、この地域における革新的なソフトウェアソリューションの需要をさらに押し上げています。

米国のヘルスケアIT市場は、予測期間中に最も高いCAGRが見込まれます。この成長の主な原動力は、HITECH法のような連邦政府の義務付けやイニシアチブによって電子カルテ(EHR)や電子医療記録(EMR)の普及が促進されたことです。また、相互運用性、バリュー・ベース・ケア、集団健康管理に対する需要も強く、ヘルスケア分析・管理ソフトウェアの導入が加速しています。さらに、米国の高齢化と慢性疾患の増加により、ヘルスケアプロバイダーはケアコーディネーションと患者管理を強化するITソリューションの導入に動機付けられています。

当レポートでは、北米のヘルスケアIT市場について調査し、ソリューション・サービス別、コンポーネント別、エンドユーザー別、国別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- ポーターのファイブフォース分析

- 規制分析

- サプライチェーン分析

- エコシステム分析

- 特許分析

- 主要な利害関係者と購入基準

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- エンドユーザー分析

- ビジネスモデル分析

- 資金調達シナリオ

第6章 北米のヘルスケアIT市場(ソリューション・サービス別)

- イントロダクション

- ヘルスケア提供者向けソリューション

- ヘルスケア支払者向けソリューション

- HCITアウトソーシングサービス

第7章 ヘルスケアIT市場(コンポーネント別)

- イントロダクション

- サービス

- ソフトウェア

- ハードウェア

第8章 北米のヘルスケアIT市場(エンドユーザー別)

- イントロダクション

- ヘルスケア提供者

- ヘルスケア支払者

- ライフサイエンス産業

第9章 北米のヘルスケアIT市場(国別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- ORACLE

- VERADIGM, INC.(ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.)

- MCKESSON CORPORATION

- KONINKLIJKE PHILIPS N.V.

- OPTUM, INC.(PART OF UNITEDHEALTH GROUP)

- COGNIZANT

- GE HEALTHCARE

- INTERSYSTEMS CORPORATION

- SAS INSTITUTE INC.

- INOVALON

- EPIC SYSTEMS CORPORATION

- ATHENAHEALTH

- INFOR

- DELL INC.

- SALESFORCE INC.

- MERATIVE

- ECLINICALWORKS

- NUANCE COMMUNICATIONS, INC.

- CITIUSTECH INC

- WIPRO

- その他の企業

- MEDEANALYTICS

- CARESTREAM HEALTH

- PRACTICE FUSION, INC.

- SURGICAL INFORMATION SYSTEMS

- MEDECISION

第12章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 RISK ASSESSMENT: NORTH AMERICAN HEALTHCARE IT MARKET

- TABLE 3 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

- TABLE 4 KEY GOVERNMENT INITIATIVES FOR EMR

- TABLE 5 HEALTHCARE RECORDS BREACHED IN US STATES IN 2024

- TABLE 6 KEY CLOUD COMPUTING TOOLS & SAAS IN HCIT MARKET

- TABLE 7 NORTH AMERICAN HEALTHCARE IT MARKET: PORTER'S FIVE FORCES

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICAN HEALTHCARE IT MARKET: REGULATIONS/LAWS

- TABLE 10 NORTH AMERICAN HEALTHCARE IT MARKET: ROLE IN ECOSYSTEM

- TABLE 11 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR NORTH AMERICAN HEALTHCARE IT SOLUTIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 13 KEY BUYING CRITERIA FOR COMPONENTS

- TABLE 14 NORTH AMERICAN HEALTHCARE IT MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 15 UNMET NEEDS IN NORTH AMERICAN HEALTHCARE IT MARKET

- TABLE 16 END-USER EXPECTATIONS IN NORTH HEALTHCARE IT MARKET

- TABLE 17 NORTH AMERICAN HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2023-2030 (USD MILLION)

- TABLE 18 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 19 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDER SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 20 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL HCIT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 21 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL HCIT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 22 ELECTRONIC HEALTH RECORD SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 NORTH AMERICAN HEALTHCARE IT MARKET FOR ELECTRONIC HEALTH RECORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 POPULATION HEALTH MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 25 NORTH AMERICAN HEALTHCARE IT MARKET FOR POPULATION HEALTH MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 NORTH AMERICAN HEALTHCARE IT MARKET FOR SPECIALTY INFORMATION MANAGEMENT SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 27 NORTH AMERICAN HEALTHCARE IT MARKET FOR SPECIALTY INFORMATION MANAGEMENT SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 ONCOLOGY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 29 NORTH AMERICAN HEALTHCARE IT MARKET FOR ONCOLOGY INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 CVIS OFFERED BY KEY MARKET PLAYERS

- TABLE 31 NORTH AMERICAN HEALTHCARE IT MARKET FOR CARDIOVASCULAR INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 NORTH AMERICAN HEALTHCARE IT MARKET FOR OTHER SPECIALTY INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 PACS & VNA OFFERED BY KEY MARKET PLAYERS

- TABLE 34 NORTH AMERICAN HEALTHCARE IT MARKET FOR PACS & VNA, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 MHEALTH APPS OFFERED BY KEY MARKET PLAYERS

- TABLE 36 NORTH AMERICAN HEALTHCARE IT MARKET FOR MOBILE HEALTH APPS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 HCIT INTEGRATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 38 NORTH AMERICAN HEALTHCARE IT MARKET FOR HCIT INTEGRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 TELEHEALTH PLATFORMS OFFERED BY KEY MARKET PLAYERS

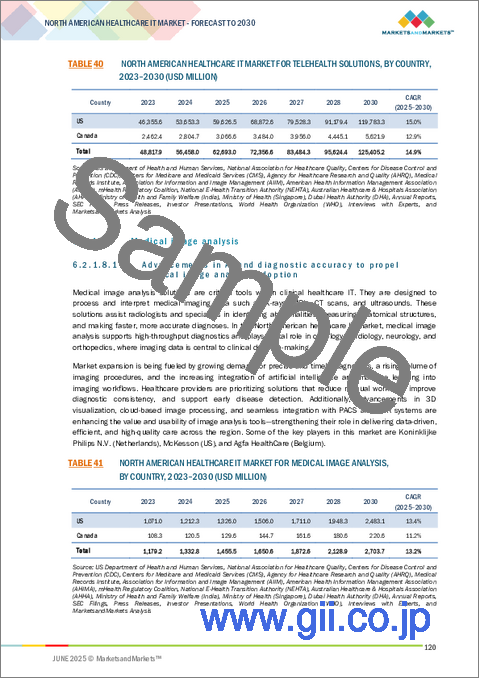

- TABLE 40 NORTH AMERICAN HEALTHCARE IT MARKET FOR TELEHEALTH SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICAL IMAGE ANALYSIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LABORATORY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 43 NORTH AMERICAN HEALTHCARE IT MARKET FOR LABORATORY INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 PRACTICE MANAGEMENT SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 45 NORTH AMERICAN HEALTHCARE IT MARKET FOR PRACTICE MANAGEMENT SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 CDSS OFFERED BY KEY MARKET PLAYERS

- TABLE 47 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL DECISION SUPPORT SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 EPRESCRIBING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 49 NORTH AMERICAN HEALTHCARE IT MARKET FOR EPRESCRIBING SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 RADIOLOGY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 51 NORTH AMERICAN HEALTHCARE IT MARKET FOR RADIOLOGY INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 COMPUTERIZED PHYSICIAN ORDER ENTRY SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 53 NORTH AMERICAN HEALTHCARE IT MARKET FOR COMPUTERIZED PHYSICIAN ORDER ENTRY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 PATIENT REGISTRY SOFTWARE OFFERED BY KEY MARKET PLAYERS/ORGANIZATIONS

- TABLE 55 NORTH AMERICAN HEALTHCARE IT MARKET FOR PATIENT REGISTRY SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 INFECTION SURVEILLANCE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 57 NORTH AMERICAN HEALTHCARE IT MARKET FOR INFECTION SURVEILLANCE SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 RADIATION DOSE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 59 NORTH AMERICAN HEALTHCARE IT MARKET FOR RADIATION DOSE MANAGEMENT, BY COUNTRY, 2023-2030(USD MILLION)

- TABLE 60 NORTH AMERICAN HEALTHCARE IT MARKET FOR NON-CLINICAL HCIT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICAN HEALTHCARE IT MARKET FOR NON-CLINICAL HCIT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 HEALTHCARE ASSET MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 63 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE ASSET MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 REVENUE CYCLE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 65 NORTH AMERICAN HEALTHCARE IT MARKET FOR REVENUE CYCLE MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICAN HEALTHCARE IT MARKET FOR REVENUE CYCLE MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 FRONT-END RCM SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 68 NORTH AMERICAN HEALTHCARE IT MARKET FOR FRONT-END RCM SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 MID-REVENUE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 70 NORTH AMERICAN HEALTHCARE IT MARKET FOR MID-RCM SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 BACK-END RCM SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 72 NORTH AMERICAN HEALTHCARE IT MARKET FOR BACK-END RCM SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICAN HCIT MARKET FOR HEALTHCARE ANALYTICS SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICAN HCIT MARKET FOR HEALTHCARE ANALYTICS SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 CLINICAL ANALYTICS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 76 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL ANALYTICS SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 FINANCIAL ANALYTICS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 78 NORTH AMERICAN HEALTHCARE IT MARKET FOR FINANCIAL ANALYTICS SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICAN HEALTHCARE IT MARKET FOR OPERATIONAL & ADMINISTRATIVE ANALYTICS SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 81 NORTH AMERICAN HEALTHCARE IT MARKET FOR CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 PHARMACY INFORMATION SYSTEMS OFFERED BY KEY MARKET PLAYERS

- TABLE 83 NORTH AMERICAN HEALTHCARE IT MARKET FOR PHARMACY INFORMATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 HEALTHCARE INTEROPERABILITY SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 85 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE INTEROPERABILITY SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 QUALITY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 87 NORTH AMERICAN HEALTHCARE IT MARKET FOR QUALITY MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 SUPPLY CHAIN MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 89 NORTH AMERICAN HEALTHCARE IT MARKET FOR SUPPLY CHAIN MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICAN HEALTHCARE IT MARKET FOR SUPPLY CHAIN MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 PROCUREMENT MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 92 NORTH AMERICAN HEALTHCARE IT MARKET FOR PROCUREMENT MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 INVENTORY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 94 NORTH AMERICAN HEALTHCARE IT MARKET FOR INVENTORY MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 97 ELECTRONIC MEDICATION ADMINISTRATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 98 NORTH AMERICAN HEALTHCARE IT MARKET FOR ELECTRONIC MEDICATION ADMINISTRATION RECORDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 BARCODE MEDICATION ADMINISTRATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 100 NORTH AMERICAN HEALTHCARE IT MARKET FOR BARCODE MEDICATION ADMINISTRATION SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 MEDICATION INVENTORY MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 102 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION INVENTORY MANAGEMENT SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 103 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION ASSURANCE SYSTEMS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 WORKFORCE MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 105 NORTH AMERICAN HEALTHCARE IT MARKET FOR WORKFORCE MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 HEALTHCARE INFORMATION EXCHANGE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 107 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE INFORMATION EXCHANGE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 MEDICAL DOCUMENT MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 109 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICAL DOCUMENT MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYER SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 CLAIMS MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 113 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLAIMS MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 KEY VENDORS OFFERING PHM SOLUTIONS

- TABLE 115 NORTH AMERICAN HEALTHCARE IT MARKET FOR POPULATION HEALTH MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 PHARMACY AUDIT & ANALYSIS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 117 NORTH AMERICAN HEALTHCARE IT MARKET FOR PHARMACY AUDIT & ANALYSIS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 NORTH AMERICAN HEALTHCARE IT MARKET FOR CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS BY HEALTHCARE PAYER SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 NORTH AMERICAN HEALTHCARE IT MARKET FOR FRAUD ANALYTICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 PROVIDER NETWORK MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 121 NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER NETWORK MANAGEMENT SOLUTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 NORTH AMERICAN HEALTHCARE IT MARKET FOR HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 NORTH AMERICAN HEALTHCARE IT MARKET FOR HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 NORTH AMERICAN HEALTHCARE IT MARKET FOR IT INFRASTRUCTURE MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICAN HEALTHCARE IT MARKET FOR PAYER HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 NORTH AMERICAN HEALTHCARE IT MARKET FOR PAYER HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLAIMS MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER NETWORK MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 NORTH AMERICAN HEALTHCARE IT MARKET FOR BILLING & ACCOUNTS MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 NORTH AMERICAN HEALTHCARE IT MARKET FOR FRAUD ANALYTICS SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICAN HEALTHCARE IT MARKET FOR OTHER PAYER HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 NORTH AMERICAN HEALTHCARE IT MARKET FOR REVENUE CYCLE MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICAL DOCUMENT MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICAN HEALTHCARE IT MARKET FOR LABORATORY INFORMATION MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 NORTH AMERICAN HEALTHCARE IT MARKET FOR OTHER PROVIDER HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 NORTH AMERICAN HEALTHCARE IT MARKET FOR OPERATIONAL HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 NORTH AMERICAN HEALTHCARE IT MARKET FOR OPERATIONAL HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 NORTH AMERICAN HEALTHCARE IT MARKET FOR SUPPLY CHAIN MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICAN HEALTHCARE IT MARKET FOR BUSINESS PROCESS MANAGEMENT SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 NORTH AMERICAN HEALTHCARE IT MARKET FOR OTHER OPERATIONAL HCIT OUTSOURCING SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 NORTH AMERICAN HEALTHCARE IT MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 144 SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 145 NORTH AMERICAN HEALTHCARE IT SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 HEALTHCARE IT SOFTWARE OFFERED BY KEY MARKET PLAYERS

- TABLE 147 NORTH AMERICAN HEALTHCARE IT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 NORTH AMERICAN HEALTHCARE IT HARDWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 149 NORTH AMERICAN HEALTHCARE IT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 152 NORTH AMERICAN HEALTHCARE IT MARKET FOR HOSPITALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 153 NORTH AMERICAN HEALTHCARE IT MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 154 NORTH AMERICAN HEALTHCARE IT MARKET FOR HOME HEALTHCARE AGENCIES & ASSISTED LIVING FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 155 NORTH AMERICAN HEALTHCARE IT MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 156 NORTH AMERICAN HEALTHCARE IT MARKET FOR PHARMACIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 157 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 159 NORTH AMERICAN HEALTHCARE IT MARKET FOR PRIVATE PAYERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 160 NORTH AMERICAN HEALTHCARE IT MARKET FOR PUBLIC PAYERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 NORTH AMERICAN HEALTHCARE IT MARKET FOR LIFE SCIENCE INDUSTRY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 162 US: NORTH AMERICAN HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2023-2030 (USD MILLION)

- TABLE 163 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL HCIT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR NON-CLINICAL HCIT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR SPECIALTY INFORMATION MANAGEMENT SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR REVENUE CYCLE MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR SUPPLY CHAIN MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE ANALYTICS SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER HCIT OUTSOURCING SERVICES , BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR PAYER HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR OPERATIONAL HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 US: NORTH AMERICAN HEALTHCARE IT MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 177 US: NORTH AMERICAN HEALTHCARE IT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 178 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 US: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2023-2030 (USD MILLION)

- TABLE 181 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL HCIT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR NON-CLINICAL HCIT SOLUTIONS , BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR SPECIALTY INFORMATION SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR REVENUE CYCLE MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR MEDICATION MANAGEMENT SYSTEMS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR SUPPLY CHAIN MANAGEMENT SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE ANALYTICS SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYER SOLUTIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR PROVIDER HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR PAYER HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR OPERATIONAL HCIT OUTSOURCING SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 195 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 CANADA: NORTH AMERICAN HEALTHCARE IT MARKET FOR HEALTHCARE PAYERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NORTH AMERICAN HEALTHCARE IT MARKET, JANUARY 2022-MAY 2025

- TABLE 199 NORTH AMERICAN HEALTHCARE IT MARKET: DEGREE OF COMPETITION

- TABLE 200 NORTH AMERICAN HEALTHCARE IT MARKET: COUNTRY FOOTPRINT

- TABLE 201 NORTH AMERICAN HEALTHCARE IT MARKET: COMPONENT FOOTPRINT

- TABLE 202 NORTH AMERICAN HEALTHCARE IT MARKET: SOLUTION & SERVICE FOOTPRINT

- TABLE 203 NORTH AMERICAN HEALTHCARE IT MARKET: END-USER FOOTPRINT

- TABLE 204 NORTH AMERICAN HEALTHCARE IT MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 205 NORTH AMERICAN HEALTHCARE IT MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 206 NORTH AMERICAN HEALTHCARE IT MARKET: PRODUCT LAUNCHES, APPROVALS, AND UPGRADES, JANUARY 2022-MAY 2025

- TABLE 207 NORTH AMERICAN HEALTHCARE IT MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 208 NORTH AMERICAN HEALTHCARE IT MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 209 NORTH AMERICAN HEALTHCARE IT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 210 ORACLE: COMPANY OVERVIEW

- TABLE 211 ORACLE: PRODUCTS & SERVICES OFFERED

- TABLE 212 ORACLE: PRODUCT & SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 213 ORACLE: DEALS, JANUARY 2022-MAY 2025

- TABLE 214 VERADIGM, INC.: COMPANY OVERVIEW

- TABLE 215 VERADIGM, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 216 VERADIGM LLC: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 217 VERADIGM, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 218 VERADIGM LLC: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 219 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 220 MCKESSON CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 221 MCKESSON CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 222 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 223 KONINKLIJKE PHILIPS N.V.: PRODUCTS & SERVICES OFFERED

- TABLE 224 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 225 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-MAY 2025

- TABLE 226 KONINKLIJKE PHILIPS N.V.: EXPANSIONS

- TABLE 227 OPTUM, INC.: COMPANY OVERVIEW

- TABLE 228 OPTUM, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 229 OPTUM, INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 230 OPTUM, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 231 COGNIZANT: COMPANY OVERVIEW

- TABLE 232 COGNIZANT: PRODUCTS & SERVICES OFFERED

- TABLE 233 COGNIZANT: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 234 COGNIZANT: DEALS, JANUARY 2022-MAY 2025

- TABLE 235 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 236 GE HEALTHCARE: PRODUCTS & SERVICES OFFERED

- TABLE 237 GE HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 238 GE HEALTHCARE: DEALS, JANUARY 2022-MAY 2025

- TABLE 239 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 240 INTERSYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 241 INTERSYSTEMS CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 242 INTERSYSTEMS CORPORATION: PRODUCT LAUNCHES & UPGRADES, JANUARY 2022-MAY 2025

- TABLE 243 INTERSYSTEMS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 244 SAS INSTITUTE INC.: COMPANY OVERVIEW

- TABLE 245 SAS INSTITUTE INC.: PRODUCTS & SERVICES OFFERED

- TABLE 246 SAS INSTITUTE INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 247 SAS INSTITUTE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 248 INOVALON: COMPANY OVERVIEW

- TABLE 249 INOVALON: PRODUCTS & SERVICES OFFERED

- TABLE 250 INOVALON: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 251 INOVALON: DEALS, JANUARY 2022-MAY 2025

- TABLE 252 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 253 EPIC SYSTEMS CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 254 EPIC SYSTEMS CORPORATION: PRODUCT LAUNCHES & UPGRADES, JANUARY 2022-MAY 2025

- TABLE 255 EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 256 EPIC SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 257 EPIC SYSTEMS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 258 ATHENAHEALTH: COMPANY OVERVIEW

- TABLE 259 ATHENAHEALTH: PRODUCTS & SERVICES OFFERED

- TABLE 260 ATHENAHEALTH: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 261 ATHENAHEALTH: DEALS, JANUARY 2022-MAY 2025

- TABLE 262 ATHENAHEALTH, INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 263 INFOR: COMPANY OVERVIEW

- TABLE 264 INFOR: PRODUCTS & SERVICES OFFERED

- TABLE 265 INFOR: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 266 INFOR: DEALS, JANUARY 2022-MAY 2025

- TABLE 267 DELL INC.: COMPANY OVERVIEW

- TABLE 268 DELL INC.: PRODUCTS & SERVICES OFFERED

- TABLE 269 DELL INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 270 DELL INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 271 SALESFORCE INC.: COMPANY OVERVIEW

- TABLE 272 SALESFORCE INC.: PRODUCTS & SERVICES OFFERED

- TABLE 273 SALESFORCE INC.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 274 SALESFORCE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 275 MERATIVE: COMPANY OVERVIEW

- TABLE 276 MERATIVE: PRODUCTS & SERVICES OFFERED

- TABLE 277 MERATIVE: PRODUCT LAUNCHES & UPGRADES, JANUARY 2022-MAY 2025

- TABLE 278 MERATIVE: DEALS, JANUARY 2022-MAY 2025

- TABLE 279 MERATIVE: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 280 ECLINICALWORKS: COMPANY OVERVIEW

- TABLE 281 ECLINICALWORKS: PRODUCTS & SERVICES OFFERED

- TABLE 282 ECLINICALWORKS: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 283 ECLINICALWORKS: DEALS, JANUARY 2022-MAY 2025

- TABLE 284 NUANCE COMMUNICATIONS, INC.: COMPANY OVERVIEW

- TABLE 285 NUANCE COMMUNICATIONS, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 286 NUANCE COMMUNICATIONS, INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 287 CITIUSTECH INC.: COMPANY OVERVIEW

- TABLE 288 CITIUSTECH INC.: PRODUCTS & SERVICES OFFERED

- TABLE 289 CITIUSTECH INC.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 290 CITIUSTECH INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 291 WIPRO: COMPANY OVERVIEW

- TABLE 292 WIPRO: PRODUCTS & SERVICES OFFERED

- TABLE 293 WIPRO: DEALS, JANUARY 2022-MAY 2025

List of Figures

- FIGURE 1 NORTH AMERICAN HEALTHCARE IT MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 COMPANY REVENUE SHARE ANALYSIS: NORTH AMERICAN HEALTHCARE IT MARKET

- FIGURE 8 BOTTOM-UP APPROACH: NORTH AMERICAN HEALTHCARE IT MARKET

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 NORTH AMERICAN HEALTHCARE IT MARKET, BY SOLUTION & SERVICE, 2025 VS. 2030 (USD BILLION)

- FIGURE 14 NORTH AMERICAN HEALTHCARE IT MARKET FOR CLINICAL HCIT SOLUTIONS MARKET, BY TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 15 NORTH AMERICAN HEALTHCARE IT MARKET FOR NON-CLINICAL HCIT SOLUTIONS, BY TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 16 NORTH AMERICAN HEALTHCARE IT MARKET, BY COMPONENT, 2025 VS. 2030 (USD BILLION)

- FIGURE 17 NORTH AMERICAN HEALTHCARE IT MARKET, BY END USER, 2025 VS. 2030 (USD BILLION)

- FIGURE 18 NORTH AMERICAN HEALTHCARE IT MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 19 NEED TO CONTROL RISING HEALTHCARE EXPENSES AND STRONG ROI FROM HCIT SOLUTIONS TO FUEL NORTH AMERICAN MARKET GROWTH

- FIGURE 20 US TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 HEALTHCARE PROVIDERS AND SERVICES SEGMENTS TO DOMINATE US HEALTHCARE IT MARKET IN 2024

- FIGURE 22 US TO REGISTER HIGHEST GROWTH DURING 2025-2030

- FIGURE 23 NORTH AMERICAN HEALTHCARE IT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 US HEALTHCARE EXPENDITURE, BY SERVICE TYPE, 2023

- FIGURE 25 US HEALTHCARE EXPENDITURE, 2015-2023 (USD TRILLION)

- FIGURE 26 HEALTHCARE SECURITY BREACHES OF 500+ RECORDS, 2009-2024

- FIGURE 27 EVOLUTION OF HEALTHCARE IT IN US

- FIGURE 28 IMPROVEMENTS IN INTEROPERABILITY IN HEALTHCARE SYSTEMS

- FIGURE 29 NORTH AMERICAN HEALTHCARE IT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 NORTH AMERICAN HEALTHCARE IT MARKET: PIPELINE BUSINESS SUPPLY CHAIN ANALYSIS (2024)

- FIGURE 31 NORTH AMERICAN HEALTHCARE IT MARKET: PLATFORM BUSINESS SUPPLY CHAIN ANALYSIS (2024)

- FIGURE 32 NORTH AMERICAN HEALTHCARE IT MARKET: SUPPLY CHAIN ANALYSIS (2024)

- FIGURE 33 NORTH AMERICAN HEALTHCARE IT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 JURISDICTION AND TOP APPLICANT ANALYSIS IN NORTH AMERICAN HEALTHCARE IT SOLUTIONS

- FIGURE 35 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR HEALTHCARE IT MARKET (JANUARY 2015 TO MAY 2025)

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 37 KEY BUYING CRITERIA FOR COMPONENTS

- FIGURE 38 NORTH AMERICAN HEALTHCARE IT MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 39 FUNDING SCENARIO IN NORTH AMERICAN HEALTHCARE IT MARKET

- FIGURE 40 NORTH AMERICAN HEALTHCARE IT MARKET SNAPSHOT

- FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN NORTH AMERICAN HEALTHCARE IT MARKET (2019-2023)

- FIGURE 42 MARKET SHARE ANALYSIS OF KEY PLAYERS IN NORTH AMERICAN HEALTHCARE IT MARKET (2024)

- FIGURE 43 RANKING OF KEY PLAYERS IN NORTH AMERICAN HEALTHCARE IT MARKET, 2024

- FIGURE 44 NORTH AMERICAN HEALTHCARE IT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 NORTH AMERICAN HEALTHCARE IT MARKET: COMPANY FOOTPRINT

- FIGURE 46 NORTH AMERICAN HEALTHCARE IT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 NORTH AMERICAN HEALTHCARE IT MARKET: BRAND/ PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 ORACLE: COMPANY SNAPSHOT (2024)

- FIGURE 51 VERADIGM, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 52 MCKESSON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 53 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 54 UNITEDHEALTH GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 55 COGNIZANT: COMPANY SNAPSHOT (2024)

- FIGURE 56 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 57 DELL INC.: COMPANY SNAPSHOT (2025)

- FIGURE 58 SALESFORCE INC.: COMPANY SNAPSHOT (2024)

- FIGURE 59 WIPRO: COMPANY SNAPSHOT (2025)

The North American healthcare IT market is projected to reach USD 439.09 billion by 2030 from USD 229.05 billion in 2025, at a CAGR of 13.9% during the forecast period. Growth in this market is driven by the rising adoption of digital health solutions, including electronic health records (EHRs), telehealth, and AI-powered clinical decision support tools. Increasing pressure to reduce healthcare costs, improve patient outcomes, and streamline operations has led providers and payers to invest heavily in IT infrastructure. However, increased data security concerns and reluctance among medical professionals to adopt advanced healthcare IT tools are challenging the growth of this market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Solution & Service, Component, End User, and Region |

| Regions covered | US and Canada |

"The healthcare provider solutions segment accounted for the largest share of the North American healthcare IT market in 2024."

Based on type, the healthcare provider solutions segment held the largest share of the market in 2024. The increased adoption of digital health solutions, especially electronic health records, among healthcare providers can be largely attributed to government regulations and incentive programs that encourage healthcare providers to implement these technologies. Additionally, there is a growing demand for better patient care, enhanced operational efficiency, and reduced costs in hospitals and clinics. The rising prevalence of chronic diseases and an aging population are further fueling the need for scalable IT solutions.

"The software segment is expected to grow at the highest CAGR during the forecast period."

The software segment is expected to experience the highest CAGR in the North American healthcare IT market during the forecast period. This growth is largely driven by the rapid shift toward digital health solutions, as increased awareness and government mandates promote the adoption of advanced healthcare software for both clinical and administrative functions. There is a strong emphasis on implementing software for electronic health records, population health management, and advanced analytics, as these tools facilitate improved data collection, storage, and analysis in various healthcare settings. Additionally, the integration of artificial intelligence (AI) and the Internet of Things (IoT) into healthcare software is creating new opportunities for enhanced patient care, operational efficiency, and remote monitoring, which is further boosting the demand for innovative software solutions in the region.

"The US is expected to grow at the highest CAGR during the forecast period."

The US healthcare IT market is expected to experience the highest CAGR during the forecast period. This growth is primarily driven by the widespread adoption of electronic health records (EHRs) and electronic medical records (EMRs), which have been encouraged by federal mandates and initiatives like the HITECH Act. There is also a strong demand for interoperability, value-based care, and population health management, which is accelerating the adoption of healthcare analytics and management software. Additionally, the aging US population and the rising prevalence of chronic diseases are motivating healthcare providers to implement IT solutions that enhance care coordination and patient management.

The breakdown of primary participants is as mentioned below:

- By Company Type: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (40%), Directors (35%), and Others (25%)

- By Country: US (75%) and Canada (25%)

Key players in the North American healthcare IT market

The key players operating in the North American healthcare IT market include Oracle (US), Veradigm, Inc. (US), McKesson Corporation (US), Koninklijke Philips N.V. (Netherlands), Optum, Inc. (US), Cognizant (US), GE Healthcare (US), InterSystems Corporation (US), SAS Institute Inc. (US), Inovalon (US), Epic Systems Corporation (US), athenahealth (US), Infor (US), Dell Inc. (US), Salesforce, Inc. (US), Merative (US),eClinical Works (US), Nuance Communications, Inc. (US), CitiusTech Inc. (US), Wipro (India), MedeAnalytics, Inc. (US), Carestream Health (US), Practice Fusion, Inc. (US), Surgical Information Systems (Georgia), and Medecision (US).

The study includes an in-depth competitive analysis of these key players in the North American healthcare IT market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report provides an analysis of the North American healthcare IT market, estimating the market size and future growth potential across various segments. These segments are categorized by solutions and services, components, end users, and countries. The report also examines key factors influencing market growth, including drivers, restraints, opportunities, and challenges.

Additionally, it evaluates potential opportunities and challenges for stakeholders within the market. The report investigates micromarkets in terms of their growth trends, prospects, and contributions to the overall North American healthcare IT market. It forecasts revenue for different market segments in the North American region.

Lastly, the report includes a competitive analysis of the key players in the market, detailing their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will provide valuable insights for both established companies and new or smaller firms, allowing them to better understand market trends and capture a larger share of the market. Companies that purchase this report can employ one or more of the strategies listed below to enhance their market position.

This report provides insights on:

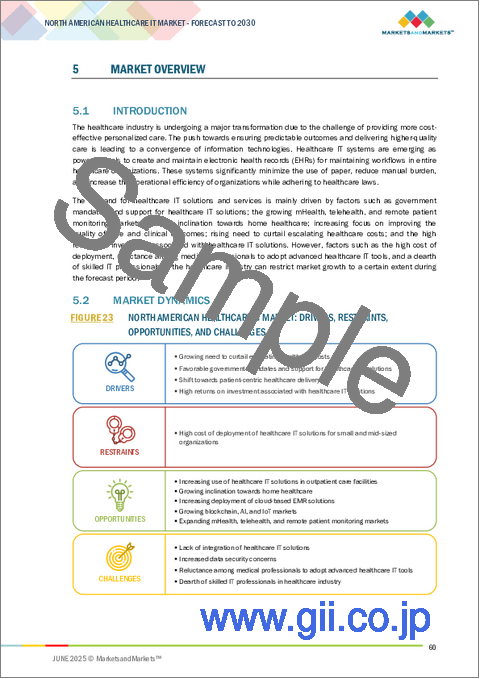

- Analysis of key drivers (growing need to curtail escalating healthcare costs, favorable government mandates and support for healthcare IT solutions, shift towards patient-centric healthcare delivery, and high returns on investment associated with healthcare IT solutions), restraints (high cost of deployment of healthcare IT solutions for small and mid-sized organizations), opportunities (increasing use of healthcare IT solutions in outpatient care facilities; growing inclination towards home healthcare; increasing deployment of cloud-based EMR solutions; growing blockchain, AI, and IoT markets; and expanding mHealth, telehealth, and remote patient monitoring markets), and challenges (lack of integration of healthcare IT solutions, increased data security concerns, reluctance among medical professionals to adopt advanced healthcare IT tools, and dearth of skilled IT professionals in healthcare industry) influencing the growth of the North American healthcare IT market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the North American healthcare IT market.

- Market Development: Comprehensive information on the lucrative emerging markets, solutions & services, components, end users, and countries.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the North American healthcare IT market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the North American healthcare IT market like Oracle (US), Veradigm, Inc. (US), McKesson Corporation (US), Koninklijke Philips N.V. (Netherlands), Optum, Inc. (US), and Cognizant (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 KEY DATA FROM SECONDARY SOURCES

- 2.1.3 PRIMARY DATA

- 2.1.4 KEY DATA FROM PRIMARY SOURCES

- 2.1.5 INSIGHTS FROM PRIMARY EXPERTS

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 NORTH AMERICAN HEALTHCARE IT MARKET OVERVIEW

- 4.2 NORTH AMERICAN HEALTHCARE IT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 US: HEALTHCARE IT MARKET, BY END USER AND COMPONENT (2024)

- 4.4 REGIONAL MIX: NORTH AMERICAN HEALTHCARE IT MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing need to curtail escalating healthcare costs

- 5.2.1.2 Favorable government mandates and support for healthcare IT solutions

- 5.2.1.3 Shift toward patient-centric healthcare delivery

- 5.2.1.4 High returns on investments associated with healthcare IT solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of deployment of healthcare IT solutions for small and mid-sized organizations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of healthcare IT solutions in outpatient care facilities

- 5.2.3.2 Growing inclination towards home healthcare

- 5.2.3.3 Increasing deployment of cloud-based EMR solutions

- 5.2.3.4 Growing blockchain, AI, and IoT markets

- 5.2.3.5 Expanding mHealth, telehealth, and remote patient monitoring markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of integration of healthcare IT solutions

- 5.2.4.2 Increased data security concerns

- 5.2.4.3 Reluctance among medical professionals to adopt advanced healthcare IT tools

- 5.2.4.4 Dearth of skilled IT professionals in healthcare industry

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 EVOLUTION OF HEALTHCARE INFORMATION TECHNOLOGY IN US

- 5.3.2 INTEROPERABILITY AND INTEGRATED CARE MODELS

- 5.3.3 CLOUD-BASED IT SOLUTIONS

- 5.3.4 CLOUD COMPUTING

- 5.3.5 SMART ON FHIR

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Big data analytics

- 5.4.1.2 Artificial intelligence (AI) and machine learning (ML)

- 5.4.1.3 Business intelligence (BI) tools

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Natural language processing (NLP)

- 5.4.2.2 Blockchain technology

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Cloud computing

- 5.4.3.2 Internet of Things (IoT)

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.6 REGULATORY ANALYSIS

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2 REGULATORY LANDSCAPE

- 5.6.2.1 North America

- 5.6.2.1.1 US

- 5.6.2.1.2 Canada

- 5.6.2.1 North America

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR NORTH AMERICAN HEALTHCARE IT SOLUTIONS

- 5.9.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: RADIATION DOSE MANAGEMENT - FOCUS ON REDUCING RADIATION DOSE

- 5.13.2 CASE STUDY 2: VNA & PACS - EFFORTLESS INTEGRATION AND INSTANT DATA ACCESS PROVIDED BY SYNAPPS VNA

- 5.13.3 CASE STUDY 3: HEALTH INFORMATION EXCHANGE - HEALTHINFONET AND ORION HEALTH COLLABORATE FOR RAPID DELIVERY OF HIE SERVICES TO PATIENTS AND HEALTHCARE PROVIDERS

- 5.14 END-USER ANALYSIS

- 5.14.1 UNMET NEEDS

- 5.14.2 END-USER EXPECTATIONS

- 5.15 BUSINESS MODEL ANALYSIS

- 5.15.1 SOFTWARE LICENSING MODEL

- 5.15.2 SOFTWARE-AS-A-SERVICE (SAAS) MODEL

- 5.15.3 HARDWARE-SOFTWARE BUNDLE

- 5.15.4 PAY-PER-USE MODEL

- 5.15.5 FREEMIUM MODEL

- 5.15.6 DATA-AS-A-SERVICE (DAAS) MODEL

- 5.16 FUNDING SCENARIO

6 NORTH AMERICAN HEALTHCARE IT MARKET, BY SOLUTION & SERVICE

- 6.1 INTRODUCTION

- 6.2 HEALTHCARE PROVIDER SOLUTIONS

- 6.2.1 CLINICAL HCIT SOLUTIONS

- 6.2.1.1 Electronic health records

- 6.2.1.1.1 Increasing demand for EHRs to drive growth

- 6.2.1.2 Population health management

- 6.2.1.2.1 Aggregation and collation advantages to boost adoption

- 6.2.1.3 Specialty information management systems

- 6.2.1.3.1 Oncology information systems

- 6.2.1.3.1.1 Enhanced oncology outcomes through integrated information systems to drive growth

- 6.2.1.3.2 Cardiovascular information systems

- 6.2.1.3.2.1 Transforming cardiovascular workflows through intelligent information systems to drive market

- 6.2.1.3.3 Other specialty information systems

- 6.2.1.3.1 Oncology information systems

- 6.2.1.4 PACS & VNA

- 6.2.1.4.1 Expansion in imaging procedure volumes set to drive higher demand

- 6.2.1.5 Mobile health applications

- 6.2.1.5.1 Rising demand for remote monitoring and self-care tools to accelerate mHealth application adoption

- 6.2.1.6 HCIT integration

- 6.2.1.6.1 Expanding need for interoperability and streamlined data exchange to drive HCIT integration growth

- 6.2.1.7 Telehealth solutions

- 6.2.1.7.1 Growing demand for virtual care and access expansion to fuel telehealth solutions market

- 6.2.1.8 Medical image analysis

- 6.2.1.8.1 Advancements in AI and diagnostic accuracy to propel medical image analysis adoption

- 6.2.1.9 Laboratory information systems

- 6.2.1.9.1 Emphasis on diagnostic efficiency and workflow automation to drive LIS adoption

- 6.2.1.10 Practice management systems

- 6.2.1.10.1 Operational efficiency and revenue optimization to boost practice management systems adoption

- 6.2.1.11 Clinical decision support systems

- 6.2.1.11.1 Growing focus on evidence-based care and diagnostic accuracy

- 6.2.1.12 ePrescribing solutions

- 6.2.1.12.1 Drive for medication safety and workflow optimization to fuel ePrescribing solutions adoption

- 6.2.1.13 Radiology information systems

- 6.2.1.13.1 Need for streamlined imaging workflows and accurate reporting to enhance radiology solutions

- 6.2.1.14 Computerized physician order entry

- 6.2.1.14.1 Emphasis on reducing medication errors and enhancing clinical accuracy to drive CPOE system adoption

- 6.2.1.15 Patient registry software

- 6.2.1.15.1 Rising focus on outcome tracking and population health to boost patient registry software adoption

- 6.2.1.16 Infection surveillance

- 6.2.1.16.1 Potential to minimize financial and human impact of infections to support adoption

- 6.2.1.17 Radiation dose management

- 6.2.1.17.1 Regulatory pressures and patient safety initiatives to drive radiation dose management solutions

- 6.2.1.1 Electronic health records

- 6.2.2 NON-CLINICAL HCIT SOLUTIONS

- 6.2.2.1 Healthcare asset management solutions

- 6.2.2.1.1 Emphasis on cost control and equipment efficiency to boost market

- 6.2.2.2 Revenue cycle management solutions

- 6.2.2.2.1 Front-end RCM Solutions

- 6.2.2.2.1.1 Patient experience and pre-visit accuracy to drive front-end RCM adoption

- 6.2.2.2.2 Mid-RCM solutions

- 6.2.2.2.2.1 Operational accuracy and coding compliance to fuel mid-RCM investments

- 6.2.2.2.3 Back-end RCM solutions

- 6.2.2.2.3.1 Automation and analytics to enhance efficiency in back-end RCM processes

- 6.2.2.2.1 Front-end RCM Solutions

- 6.2.2.3 Healthcare analytics

- 6.2.2.3.1 Clinical analytics solutions

- 6.2.2.3.1.1 Demand for data-driven decision-making to propel adoption of healthcare analytics solutions

- 6.2.2.3.2 Financial analytics solutions

- 6.2.2.3.2.1 Enhancing revenue integrity and strategic planning with financial analytics to support market

- 6.2.2.3.3 Operational & administrative analytics solutions

- 6.2.2.3.3.1 Streamlining healthcare operations through data-driven efficiency to fuel growth

- 6.2.2.3.1 Clinical analytics solutions

- 6.2.2.4 Customer relationship management solutions

- 6.2.2.4.1 Rising demand for patient-centric engagement to drive CRM adoption in healthcare

- 6.2.2.5 Pharmacy information systems

- 6.2.2.5.1 Automation and medication safety efforts to accelerate adoption of pharmacy information systems

- 6.2.2.6 Healthcare interoperability solutions

- 6.2.2.6.1 Drive for connected care and data fluidity to drive healthcare interoperability solutions

- 6.2.2.7 Healthcare quality management solutions

- 6.2.2.7.1 Emphasis on performance improvement and compliance to boost healthcare quality management solutions

- 6.2.2.8 Supply chain management solutions

- 6.2.2.8.1 Procurement management solutions

- 6.2.2.8.1.1 Digitization of purchasing processes to enhance procurement efficiency

- 6.2.2.8.2 Inventory management solutions

- 6.2.2.8.2.1 Real-time tracking and automation to drive inventory optimization

- 6.2.2.8.1 Procurement management solutions

- 6.2.2.9 Medication management solutions

- 6.2.2.9.1 Electronic medication administration records

- 6.2.2.9.1.1 Ability to enhance accuracy and accountability in drug administration to drive growth

- 6.2.2.9.2 Barcode medication administration systems

- 6.2.2.9.2.1 Ability to drive error reduction through verification technology to boost demand

- 6.2.2.9.3 Medication inventory management systems

- 6.2.2.9.3.1 Advantages such as real-time visibility and control over pharmaceutical supplies to fuel growth

- 6.2.2.9.4 Medication assurance systems

- 6.2.2.9.4.1 Strengthening compliance and traceability across medication lifecycle to drive growth

- 6.2.2.9.1 Electronic medication administration records

- 6.2.2.10 Workforce management solutions

- 6.2.2.10.1 Need for operational efficiency and staff optimization to drive workforce management solutions market

- 6.2.2.11 Healthcare information exchange

- 6.2.2.11.1 Expanding need for care coordination to accelerate healthcare information exchange adoption

- 6.2.2.12 Medical document management solutions

- 6.2.2.12.1 Digitization and compliance needs to fuel demand for medical document management solutions

- 6.2.2.1 Healthcare asset management solutions

- 6.2.1 CLINICAL HCIT SOLUTIONS

- 6.3 HEALTHCARE PAYER SOLUTIONS

- 6.3.1 CLAIMS MANAGEMENT SOLUTIONS

- 6.3.1.1 Automation and accuracy needs to strengthen market for claims management solutions

- 6.3.2 POPULATION HEALTH MANAGEMENT SOLUTIONS

- 6.3.2.1 Data-driven care strategies to empower payer-led population health initiatives

- 6.3.3 PHARMACY AUDIT & ANALYSIS

- 6.3.3.1 Enhanced cost control and compliance through pharmacy audit tools to support growth

- 6.3.4 CUSTOMER RELATIONSHIP MANAGEMENT SOLUTIONS

- 6.3.4.1 Personalized engagement models to reshape member experience

- 6.3.5 FRAUD ANALYTICS

- 6.3.5.1 Combating healthcare fraud through predictive and real-time analytics to boost market

- 6.3.6 PROVIDER NETWORK MANAGEMENT SOLUTIONS

- 6.3.6.1 Optimizing network performance through digital provider management solutions to fuel adoption

- 6.3.1 CLAIMS MANAGEMENT SOLUTIONS

- 6.4 HCIT OUTSOURCING SERVICES

- 6.4.1 IT INFRASTRUCTURE MANAGEMENT SERVICES

- 6.4.1.1 Modernizing legacy systems and ensuring business continuity through IT infrastructure outsourcing to drive growth

- 6.4.2 PAYER HCIT OUTSOURCING SERVICES

- 6.4.2.1 Claims management services

- 6.4.2.1.1 Streamlining claims processing to improve payer efficiency

- 6.4.2.2 Provider network management services

- 6.4.2.2.1 Ensuring network efficiency and regulatory compliance through outsourcing to fuel growth

- 6.4.2.3 Billing & accounts management services

- 6.4.2.3.1 Outsourcing revenue operations to improve accuracy and reduce overheads

- 6.4.2.4 Fraud analytics services

- 6.4.2.4.1 Need for better fraud management to ensure demand

- 6.4.2.5 Other payer HCIT outsourcing services

- 6.4.2.1 Claims management services

- 6.4.3 PROVIDER HCIT OUTSOURCING SERVICES

- 6.4.3.1 Revenue cycle management services

- 6.4.3.1.1 Optimizing financial performance through outsourced revenue cycle operations too drive market

- 6.4.3.2 Medical document management services

- 6.4.3.2.1 Streamlining clinical documentation through outsourced solutions to fuel growth

- 6.4.3.3 Laboratory information management services

- 6.4.3.3.1 Enhancing lab efficiency and accuracy through outsourced information management to drive demand

- 6.4.3.4 Other provider HCIT outsourcing services

- 6.4.3.1 Revenue cycle management services

- 6.4.4 OPERATIONAL HCIT OUTSOURCING SERVICES

- 6.4.4.1 Supply chain management services

- 6.4.4.1.1 Optimizing resource utilization through outsourced supply chain operations to fuel market

- 6.4.4.2 Business process management services

- 6.4.4.2.1 Need for automating operational processes to drive adoption

- 6.4.4.3 Other operational HCIT outsourcing services

- 6.4.4.1 Supply chain management services

- 6.4.1 IT INFRASTRUCTURE MANAGEMENT SERVICES

7 HEALTHCARE IT MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SERVICES

- 7.2.1 INTRODUCTION OF COMPLEX SOFTWARE TO DRIVE DEMAND FOR SERVICES

- 7.3 SOFTWARE

- 7.3.1 SHIFT TO WEB/CLOUD-BASED MODELS TO SUPPORT GROWTH

- 7.4 HARDWARE

- 7.4.1 NEED FOR FREQUENT HARDWARE UPGRADES TO DRIVE MARKET GROWTH

8 NORTH AMERICAN HEALTHCARE IT MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS

- 8.2.1.1 Large-scale HCIT adoption driven by EHR mandates and infrastructure modernization in US to boost market

- 8.2.2 AMBULATORY CARE CENTERS

- 8.2.2.1 Shifting care delivery models to bolster demand for scalable, cloud-based IT solutions

- 8.2.3 HOME HEALTHCARE AGENCIES & ASSISTED LIVING FACILITIES

- 8.2.3.1 Growing need for long-term home care to drive market growth

- 8.2.4 DIAGNOSTIC & IMAGING CENTERS

- 8.2.4.1 Rising imaging volumes and AI integration to drive IT adoption in diagnostic facilities

- 8.2.5 PHARMACIES

- 8.2.5.1 Retail and institutional pharmacies to drive IT demand for workflow automation and compliance

- 8.2.1 HOSPITALS

- 8.3 HEALTHCARE PAYERS

- 8.3.1 PRIVATE PAYERS

- 8.3.1.1 Growing competition and member expectations to accelerate IT modernization

- 8.3.2 PUBLIC PAYERS

- 8.3.2.1 Government programs covering tens of millions to fuel IT adoption

- 8.3.1 PRIVATE PAYERS

- 8.4 LIFE SCIENCE INDUSTRY

9 NORTH AMERICAN HEALTHCARE IT MARKET, BY COUNTRY

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Widespread EHR adoption and interoperability to drive US healthcare IT advancements

- 9.2.3 CANADA

- 9.2.3.1 Government investment in health infrastructure and prevalence of digital solutions such as EHRs

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN NORTH AMERICAN HEALTHCARE IT MARKET

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.4.1 RANKING OF KEY MARKET PLAYERS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Country footprint

- 10.5.5.3 Component footprint

- 10.5.5.4 Solution & service footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startup/SME players

- 10.6.5.2 Competitive benchmarking of key emerging players/startups

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES, APPROVALS, AND UPGRADES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ORACLE

- 11.1.1.1 Business overview

- 11.1.1.2 Products & services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product & service launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 VERADIGM, INC. (ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.)

- 11.1.2.1 Business overview

- 11.1.2.2 Products & services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.3 MCKESSON CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products & services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.4 KONINKLIJKE PHILIPS N.V.

- 11.1.4.1 Business overview

- 11.1.4.2 Products & services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 OPTUM, INC. (PART OF UNITEDHEALTH GROUP)

- 11.1.5.1 Business overview

- 11.1.5.2 Products & services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 COGNIZANT

- 11.1.6.1 Business overview

- 11.1.6.2 Products & services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses & competitive threats

- 11.1.7 GE HEALTHCARE

- 11.1.7.1 Business overview

- 11.1.7.2 Products & services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Other developments

- 11.1.8 INTERSYSTEMS CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products & services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & upgrades

- 11.1.8.3.2 Deals

- 11.1.9 SAS INSTITUTE INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products & services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 INOVALON

- 11.1.10.1 Business overview

- 11.1.10.2 Products & services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 EPIC SYSTEMS CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products & services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & upgrades

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Expansions

- 11.1.11.3.4 Other developments

- 11.1.12 ATHENAHEALTH

- 11.1.12.1 Business overview

- 11.1.12.2 Products & services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches & enhancements

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Other developments

- 11.1.13 INFOR

- 11.1.13.1 Business overview

- 11.1.13.2 Products & services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Deals

- 11.1.14 DELL INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products & services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.14.3.2 Deals

- 11.1.14.4 MnM view

- 11.1.14.4.1 Right to win

- 11.1.14.4.2 Strategic choices

- 11.1.14.4.3 Weaknesses & competitive threats

- 11.1.15 SALESFORCE INC.

- 11.1.15.1 Business overview

- 11.1.15.2 Products & services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & approvals

- 11.1.15.3.2 Deals

- 11.1.16 MERATIVE

- 11.1.16.1 Business overview

- 11.1.16.2 Products & services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches & upgrades

- 11.1.16.3.2 Deals

- 11.1.16.3.3 Other developments

- 11.1.17 ECLINICALWORKS

- 11.1.17.1 Business overview

- 11.1.17.2 Products & services offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product upgrades

- 11.1.17.3.2 Deals

- 11.1.18 NUANCE COMMUNICATIONS, INC.

- 11.1.18.1 Business overview

- 11.1.18.2 Products & services offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Deals

- 11.1.19 CITIUSTECH INC

- 11.1.19.1 Business overview

- 11.1.19.2 Products & services offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product launches

- 11.1.19.3.2 Deals

- 11.1.20 WIPRO

- 11.1.20.1 Business overview

- 11.1.20.2 Products & services offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Deals

- 11.1.1 ORACLE

- 11.2 OTHER PLAYERS

- 11.2.1 MEDEANALYTICS

- 11.2.2 CARESTREAM HEALTH

- 11.2.3 PRACTICE FUSION, INC.

- 11.2.4 SURGICAL INFORMATION SYSTEMS

- 11.2.5 MEDECISION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS