|

|

市場調査レポート

商品コード

1740255

eCOAソリューションの世界市場:モダリティ別、タイプ別、用途別、エンドユーザー別 - 予測(~2030年)Electronic Clinical Outcome Assessment Solutions Market by Modality, Type, Application (Clinical Trial, RWE, Registery), End User - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| eCOAソリューションの世界市場:モダリティ別、タイプ別、用途別、エンドユーザー別 - 予測(~2030年) |

|

出版日: 2025年05月19日

発行: MarketsandMarkets

ページ情報: 英文 344 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のeCOAソリューションの市場規模は、2025年の22億7,000万米ドルから2030年までに47億8,000万米ドルに達すると予測され、予測期間にCAGRで16.1%の成長が見込まれます。

デジタルデータの収集と分析への志向の高まり、経済的なデータ収集ソリューションへのニーズの高まり、医療機関におけるコネクテッドデバイスの統合の増加が、市場の成長促進要因です。一方、患者の健康データは機密性が高いため、強固なセキュリティ対策が必要です。データ漏洩、不正アクセス、サイバーセキュリティの脅威に対する懸念は、予測期間のeCOAソリューションの採用をある程度妨げる可能性があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、製品、展開モデル、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカの、中東・アフリカ |

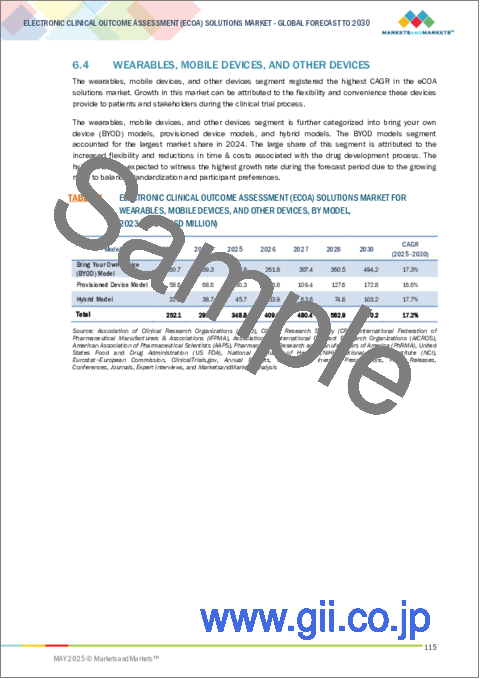

「コンポーネント別では、ハイブリッドモデルが予測期間にeCOAソリューション市場でもっとも高いCAGRで成長する見込みです。」

ハイブリッドモデルは、臨床試験におけるデータ収集にバランスの取れた柔軟なアプローチを提供するため、予測期間にもっとも高いCAGRで成長する見込みです。ハイブリッドモデルは、BYOD(Bring Your Own Device)モデルとプロビジョニングデバイスモデルの両方の要素を組み合わせ、さまざまな選好や試験要件に対応する汎用性の高いソリューションを提供します。ハイブリッドモデルは、参加者の快適さとアクセシビリティに応じて、自分のデバイスまたは試験で提供されるデバイスを使用する選択肢を提供することで、参加者に柔軟性を提供します。この柔軟性により、参加者は自分の技術的選好に沿ったモードを選択できるため、参加への障壁が軽減されます。

「用途別では、臨床試験セグメントが2024年に最大の市場シェアを占めました。」

臨床試験におけるeCOA(Electronic Clinical Outcome Assessment)の台頭は、リアルタイムの取り込みと転記ミスの最小化によって達成されるデータの質の向上、ユーザーフレンドリーなプラットフォームとデータ所有の向上によって促進される患者エンゲージメントの強化、データ収集の合理化と分析の迅速化による試験効率の向上などの無数の利点によるものです。この結果、より質の高い研究、患者満足度の向上、迅速な医薬品開発が実現し、eCOAは臨床研究においてより効率的で患者中心の未来を実現する新たなゴールドスタンダードとして位置づけられています。

「アジア太平洋が予測期間にeCOAソリューション市場でもっとも高い成長率を記録する見込みです。」

医療費の増加、医療インフラの開発、医療部門におけるデジタルソリューションへの需要の高まり、患者人口の増加、患者中心のケアへの注目の高まり、よりよいデータ収集と分析の必要性などの要因が、アジア太平洋におけるeCOAソリューション市場の成長を促進すると予測されます。

当レポートでは、世界のeCOAソリューション市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- eCOAソリューション市場の概要

- アジア太平洋のeCOAソリューション市場:製品別、国別(2024年)

- eCOAソリューション市場:地理的成長機会

- eCOAソリューション市場:地域構成(2025年・2030年)

- eCOAソリューション市場:先進国と新興国

第5章 市場の概要

- イントロダクション

- 市場力学

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 主な産業動向の概要

- 分散型臨床試験の増加

- リアルワールドデータ(RWD)への注目の高まり

- エコシステム分析

- バリューチェーン/サプライチェーン分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 規制情勢

- 規制分析

- 規制機関、政府機関、その他の組織

- ポーターのファイブフォース分析

- 価格分析

- 平均販売価格の動向:地域別

- 参考価格分析:製品別

- ケーススタディ分析

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 顧客のビジネスに影響を与える動向/混乱

- 主なステークホルダーと購入基準

- エンドユーザー分析

- アンメットニーズ

- エンドユーザーの期待

- 収益モデル分析

- サブスクリプションベースモデル

- ペイパースタディモデル

- カスタマイズソリューションモデル

- SaaSモデル

- コンサルティング・統合サービスモデル

- 投資情勢

- 2025年の米国関税の影響 - 概要

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 eCOAソリューション市場:コンポーネント別

- イントロダクション

- ソフトウェア

- サービス

- ウェアラブル、モバイルデバイス、その他のデバイス

- BYOD(Bring Your Own Device)モデル

- プロビジョニングデバイスモデル

- ハイブリッドモデル

第7章 eCOAソリューション市場:製品別

- イントロダクション

- ePRO

- eObsRO

- eClinRO

- ePerfO

第8章 eCOAソリューション市場:展開モデル別

- イントロダクション

- オンプレミスモデル

- ウェブホスト・クラウドベースモデル

- ハイブリッドモデル

第9章 eCOAソリューション市場:用途別

- イントロダクション

- 臨床試験

- 腫瘍

- 感染症

- 神経

- 代謝障害

- 免疫

- 心血管疾患

- 希少疾患・遺伝性疾患

- 精神疾患

- その他の治療領域

- 観察研究・リアルワールドエビデンス(RWE)生成

- 患者管理・登録

- その他の用途

第10章 eCOAソリューション市場:エンドユーザー別

- イントロダクション

- 製薬・バイオテクノロジー企業

- 開発業務受託機関(CRO)

- 政府機関

- 医療技術企業

- 病院・医療機関

- 学術・研究機関

- コンサルティングサービス企業

第11章 eCOAソリューション市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 企業の評価と財務指標

- 財務指標

- 企業の評価

- ブランド/ソフトウェアの比較分析

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- MEDIDATA (DASSAULT SYSTEMES COMPANY)

- IQVIA

- SIGNANT HEALTH

- CLARIO

- ICON PLC

- ORACLE CORPORATION

- MEDABLE INC.

- MERATIVE

- PAREXEL INTERNATIONAL (MA) CORPORATION

- CLIMEDO HEALTH GMBH

- HEALTHENTIA (PRODUCT BY INNOVATION SPRINT SRL)

- VEENA SYSTEMS INC.

- ASSISTEK

- CUREBASE INC.

- CASTOR

- EVIDENTIQ

- Y-PRIME, LLC

- CLINICAL INK

- CLINION

- KAYENTIS

- その他の企業

- TRANSPERFECT

- OBVIOHEALTH USA, INC.

- WCG CLINICAL

- CLINCAPTURE

- CLOUDBYZ

第14章 付録

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 ECOA SOLUTIONS MARKET: IMPACT ANALYSIS

- TABLE 3 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 4 ELECTRONIC CLINICAL OUTCOME ASSESSMENT SOLUTIONS MARKET: ROLE IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 AVERAGE SELLING PRICE OF ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS, BY SOLUTION TYPE (2023)

- TABLE 11 LIST OF PATENTS/PATENT APPLICATIONS IN ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, 2023-2025

- TABLE 12 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 14 KEY BUYING CRITERIA FOR END USERS

- TABLE 15 UNMET NEEDS IN ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET

- TABLE 16 END-USER EXPECTATIONS IN ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET

- TABLE 17 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 19 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 20 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 21 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 22 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR BRING YOUR OWN DEVICE (BYOD) MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 24 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR PROVISIONED DEVICE MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR HYBRID MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 27 ELECTRONIC PATIENT-REPORTED OUTCOMES (EPRO) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 28 ELECTRONIC OBSERVER-REPORTED OUTCOMES (EOBSRO) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 ELECTRONIC CLINICIAN-REPORTED OUTCOMES (ECLINRO) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ELECTRONIC PERFORMANCE-REPORTED OUTCOMES (EPERFO) MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 32 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR ON-PREMISE MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEB-HOSTED & CLOUD-BASED MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR HYBRID MODELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 36 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 37 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR ONCOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR NEUROLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR METABOLIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR IMMUNOLOGY, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CARDIOVASCULAR DISEASES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR RARE DISEASES & GENETIC DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR MENTAL HEALTH DISORDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR OBSERVATIONAL STUDIES & REAL-WORLD EVIDENCE GENERATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR PATIENT MANAGEMENT & REGISTRIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 51 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR GOVERNMENT ORGANIZATIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR MEDTECH COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR HOSPITALS & HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CONSULTING SERVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 67 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 68 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 69 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 70 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 71 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 72 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 73 US: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 74 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 75 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 89 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 91 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 92 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 93 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 94 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 96 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 97 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 98 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 99 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 100 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 101 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 102 UK: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 107 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 108 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 109 FRANCE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 113 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 114 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 116 ITALY: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 118 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 132 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 133 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 134 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 135 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 136 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 137 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 138 JAPAN: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 140 HINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 141 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 142 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 143 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 145 CHINA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 146 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 147 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 148 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 149 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 150 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 151 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 152 INDIA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 161 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 163 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 164 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 165 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 166 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 167 LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 169 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 170 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 171 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 172 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 174 BRAZIL: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 175 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 176 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 177 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 178 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 179 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 180 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 182 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 183 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 184 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 185 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 187 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 198 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 199 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 201 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 202 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2023-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR WEARABLES, MOBILE DEVICES, AND OTHER DEVICES, BY MODEL, 2023-2030 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2023-2030 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET FOR CLINICAL TRIALS, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ECOA SOLUTION VENDORS MARKET, JANUARY 2022-MAY 2025

- TABLE 212 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DEGREE OF COMPETITION

- TABLE 213 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: REGION FOOTPRINT

- TABLE 214 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: COMPONENT FOOTPRINT

- TABLE 215 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DEPLOYMENT MODEL FOOTPRINT

- TABLE 216 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: END USER FOOTPRINT

- TABLE 217 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 218 ELECTRONIC CINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 219 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-MAY 2025

- TABLE 220 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 221 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 222 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 223 MEDIDATA: COMPANY OVERVIEW

- TABLE 224 MEDIDATA: PRODUCTS/SERVICES OFFERED

- TABLE 225 MEDIDATA: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 226 MEDIDATA: DEALS, JANUARY 2022-MAY 2025

- TABLE 227 IQVIA: COMPANY OVERVIEW

- TABLE 228 IQVIA: PRODUCTS/SERVICES OFFERED

- TABLE 229 SIGNANT HEALTH: COMPANY OVERVIEW

- TABLE 230 SIGNANT HEALTH: PRODUCTS/SERVICES OFFERED

- TABLE 231 SIGNANT HEALTH: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 232 SIGNANT HEALTH: DEALS, JANUARY 2022-MAY 2025

- TABLE 233 CLARIO: COMPANY OVERVIEW

- TABLE 234 CLARIO: PRODUCTS/SERVICES OFFERED

- TABLE 235 CLARIO: DEALS, JANUARY 2022-MAY 2025

- TABLE 236 ICON PLC: COMPANY OVERVIEW

- TABLE 237 ICON PLC: PRODUCTS/SERVICES OFFERED

- TABLE 238 ICON PLC: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 239 ICON PLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 240 ORACLE CORPORATION: COMPANY OVERVIEW

- TABLE 241 ORACLE CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 242 ORACLE CORPORATION: PRODUCT/SERVICE ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 243 ORACLE CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 244 MEDABLE INC.: COMPANY OVERVIEW

- TABLE 245 MEDABLE INC.: PRODUCTS/SERVICES OFFERED

- TABLE 246 MEDABLE INC.: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 247 MEDABLE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 248 MERATIVE: COMPANY OVERVIEW

- TABLE 249 MERATIVE: PRODUCTS/SERVICES OFFERED

- TABLE 250 MERATIVE: DEALS, JANUARY 2022-MAY 2025

- TABLE 251 PAREXEL INTERNATIONAL (MA) CORPORATION: COMPANY OVERVIEW

- TABLE 252 PAREXEL INTERNATIONAL (MA) CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 253 PAREXEL INTERNATIONAL (MA) CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 254 PAREXEL INTERNATIONAL (MA) CORPORATION: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 255 CLIMEDO HEALTH GMBH: COMPANY OVERVIEW

- TABLE 256 CLIMEDO HEALTH GMBH: PRODUCTS/SERVICES OFFERED

- TABLE 257 CLIMEDO HEALTH GMBH: DEALS, JANUARY 2022-MAY 2025

- TABLE 258 CLIMEDO HEALTH GMBH: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 259 HEALTHENTIA: COMPANY OVERVIEW

- TABLE 260 HEALTHENTIA: PRODUCTS/SERVICES OFFERED

- TABLE 261 HEALTHENTIA: DEALS, JANUARY 2022-MAY 2025

- TABLE 262 VEENA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 263 VEENA SYSTEMS INC.: PRODUCTS/SERVICES OFFERED

- TABLE 264 VEENA SYSTEMS INC.: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 265 VEENA SYSTEMS INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 266 VEENA SYSTEMS INC.: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 267 ASSISTEK: COMPANY OVERVIEW

- TABLE 268 ASSISTEK: PRODUCTS/SERVICES OFFERED

- TABLE 269 ASSISTEK: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 270 ASSISTEK: DEALS, JANUARY 2022-MAY 2025

- TABLE 271 ASSISTEK: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 272 CUREBASE INC.: COMPANY OVERVIEW

- TABLE 273 CUREBASE INC.: PRODUCTS/SERVICES OFFERED

- TABLE 274 CUREBASE INC: PRODUCT/SERVICE LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 275 CUREBASE INC.: DEALS, JANUARY 2022-MAY 2025

- TABLE 276 CASTOR: COMPANY OVERVIEW

- TABLE 277 CASTOR: PRODUCTS/SERVICES OFFERED

- TABLE 278 CASTOR: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 279 CASTOR: DEALS, JANUARY 2022-MAY 2025

- TABLE 280 EVIDENTIQ: COMPANY OVERVIEW

- TABLE 281 EVIDENTIQ: PRODUCTS/SERVICES OFFERED

- TABLE 282 EVIDENTIQ: DEALS, JANUARY 2022-MAY 2025

- TABLE 283 Y-PRIME, LLC: COMPANY OVERVIEW

- TABLE 284 Y-PRIME, LLC: PRODUCTS/SERVICES OFFERED

- TABLE 285 Y-PRIME, LLC: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 286 Y-PRIME, LLC: DEALS, JANUARY 2022-MAY 2025

- TABLE 287 CLINICAL INK: COMPANY OVERVIEW

- TABLE 288 CLINICAL INK: PRODUCTS/SERVICES OFFERED

- TABLE 289 CLINICAL INK: PRODUCT/SERVICE LAUNCHES & ENHANCEMENTS, JANUARY 2022-MAY 2025

- TABLE 290 CLINICAL INK: DEALS, JANUARY 2022-MAY 2025

- TABLE 291 CLINION: COMPANY OVERVIEW

- TABLE 292 CLINION: PRODUCTS/SERVICES OFFERED

- TABLE 293 CLINION: DEALS, JANUARY 2022-MAY 2025

- TABLE 294 CLINION: OTHER DEVELOPMENTS, JANUARY 2022-MAY 2025

- TABLE 295 KAYENTIS: COMPANY OVERVIEW

- TABLE 296 KAYENTIS: PRODUCTS/SERVICES OFFERED

- TABLE 297 KAYENTIS: DEALS, JANUARY 2022-MAY 2025

- TABLE 298 TRANSPERFECT: COMPANY OVERVIEW

- TABLE 299 OBVIOHEALTH USA, INC.: COMPANY OVERVIEW

- TABLE 300 WCG CLINICAL: COMPANY OVERVIEW

- TABLE 301 CLINCAPTURE: COMPANY OVERVIEW

- TABLE 302 CLOUDBYZ: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY CATEGORY, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 SUPPLY-SIDE MARKET ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: BOTTOM-UP APPROACH

- FIGURE 7 DEMAND-SIDE APPROACH: END-USER SPENDING ON ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS

- FIGURE 8 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: TOP-DOWN APPROACH

- FIGURE 9 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 18 HIGH FOCUS ON R&D FOR CLINICAL TRIALS TO DRIVE MARKET

- FIGURE 19 EPRO SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN JAPAN IN 2024

- FIGURE 20 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC REGION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 INCREASE IN GLOBAL PHARMACEUTICAL R&D SPENDING, 2014-2028

- FIGURE 25 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: ECOSYSTEM ANALYSIS (2024)

- FIGURE 26 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) MARKET: VALUE CHAIN ANALYSIS (2024)

- FIGURE 27 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 TOP PATENT OWNERS & APPLICANTS FOR ECOA SOLUTIONS MARKET, JANUARY 2015-MAY 2025

- FIGURE 29 TOP APPLICANT COUNTRIES/REGIONS FOR ECOA SOLUTION PATENTS, JANUARY 2015-MAY 2025

- FIGURE 30 REVENUE SHIFT IN ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR END USERS

- FIGURE 33 RECENT INVESTMENTS IN ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET

- FIGURE 34 US: CANCER INCIDENCE IN MALES, BY TYPE (2022)

- FIGURE 35 US: CANCER INCIDENCE IN FEMALES, BY TYPE (2022)

- FIGURE 36 ONCOLOGY CLINICAL TRIALS, 2010-2021 (THOUSANDS)

- FIGURE 37 INCREASE IN DIABETES CASES, 2000-2045 (MILLION)

- FIGURE 38 NORTH AMERICA: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET SNAPSHOT

- FIGURE 40 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: REVENUE ANALYSIS OF KEY PLAYERS (2020-2024)

- FIGURE 41 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: MARKET SHARE ANALYSIS (2024)

- FIGURE 42 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: COMPANY FOOTPRINT

- FIGURE 44 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 48 IQVIA: COMPANY SNAPSHOT (2024)

- FIGURE 49 ICON PLC: COMPANY SNAPSHOT (2024)

- FIGURE 50 ORACLE CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 51 VEENA SYSTEMS INC.: COMPANY SNAPSHOT (2024)

The electronic clinical outcome assessment (eCOA) solutions market is projected to reach USD 4.78 billion by 2030 from USD 2.27 billion in 2025, at a CAGR of 16.1% during the forecast period. The growing inclination towards digital data collection and analysis, an escalating need for economic data collection solutions, and the increasing integration of connected devices in healthcare institutions are the factors that will drive the growth of this market. On the other hand, the sensitivity of patient health data requires robust security measures. Concerns about data breaches, unauthorized access, or cybersecurity threats may impede the adoption of eCOA solutions to a certain extent over the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD billion) |

| Segments | Component, Product, Deployment Model, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

"By component, the hybrid model is expected to grow at the highest CAGR in the Electronic Clinical Outcome Assessment (eCOA) Solutions market during the forecast period."

Based on component, the Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into software; services; and wearables, mobile devices, and other devices. The wearables, mobile devices, and other devices segment is further categorized into bring your own device (BYOD) models, provisioned device models, and hybrid models. The hybrid model is expected to grow at the highest CAGR during the forecast period because it offers a balanced and flexible approach to data collection in clinical trials. The hybrid model combines elements of both Bring Your Own Device (BYOD) and provisioned device models, providing a versatile solution that accommodates varying preferences and trial requirements. The hybrid model provides flexibility to participants by offering an option to use their own devices or devices provided by the study, depending on their comfort and accessibility. This flexibility reduces barriers to participation, as participants can choose the mode that aligns with their technological preferences.

"By application, the clinical trials segment accounted for the largest market share in 2024."

Based on application, the Electronic Clinical Outcome Assessment (eCOA) Solutions market is segmented into clinical trials, observational studies & real-world evidence (RWE) generation, patient management & registries, and other applications. The clinical trials segment is expected to hold the largest share in 2024. The rise of eCOA (Electronic Clinical Outcome Assessment) in clinical trials is driven by a myriad of advantages: heightened data quality achieved through real-time capture and minimized transcription errors, enhanced patient engagement facilitated by user-friendly platforms and improved data ownership, and increased trial efficiency through streamlined data collection and accelerated analysis. This results in superior-quality studies, increased patient satisfaction, and expedited drug development, positioning eCOA as the emerging gold standard for a more efficient, patient-centric future in clinical research.

"The Asia Pacific region is expected to register the highest growth rate in the electronic clinical outcome assessment (eCOA) solutions market during the forecast period."

The global electronic clinical outcome assessment (eCOA) solutions market is segmented into five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to register the highest growth rate during the forecast period. Factors such as increasing healthcare expenditure, developing healthcare infrastructure, rising demand for digital solutions in the healthcare sector, large patient population, increasing focus on patient-centric care, and the need for better data collection and analysis are expected to drive the growth of the electronic clinical outcome assessment (eCOA) solutions market in the Asia Pacific.

The break-down of primary participants is as mentioned below:

- By Company Type - Tier 1 (31%), Tier 2 (28%), and Tier 3 (41%)

- By Designation - C-level Executives (31%), Director-level (25%), and Managers (44%)

- By Region - North America (45%), Europe (28%), Asia Pacific (20%), and Latin America (4%), Middle East & Africa (3%)

Key Players

The prominent players in this market are IQVIA (US), Medidata (US), ICON Plc (Ireland), Signant Health (US), Clario (US), Oracle Corporation (US), Medable Inc. (US), Merative (US), Parexel International (MA) Corporation (US), Climedo Health GmbH (Germany), Healthentia (Belgium), Veeva Systems (US), assisTek (US), Curebase Inc. (US), Castor (US), EvidentIQ Group GmbH (Germany), YPrime, LLC (US), Clinical Ink (US), Clinion (US), Kayentis (France), TransPerfect (US), ObvioHealth USA, Inc. (US), WCG Clinical (Germany), ClinCapture (US), and Cloudbyz (US). Players adopted organic as well as inorganic growth strategies such as product launches and enhancements, and investments, partnerships, collaborations, joint ventures, funding, acquisition, expansions, agreements, contracts, and alliances to increase their offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

Research Coverage

- The report studies the electronic clinical outcome assessment (eCOA) solutions market based on component, product, deployment model, application, end user, and region.

- The report analyzes factors (drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the market's opportunities and challenges for stakeholders and details the competitive landscape for market leaders.

- The report studies micro-markets regarding their growth trends, prospects, and contributions to the total electronic clinical outcome assessment (eCOA) solutions market.

- The report forecasts the revenue of market segments concerning five major regions.

Reasons to Buy the Report

The report can help established and new entrants/smaller firms gauge the market's pulse, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers (Increasing R&D expenditure for product development by medtech and pharma-biotech companies, the rising operational costs and regulatory requirements associated with clinical research studies, favorable government support and funding for clinical trials, growing prevalence of chronic diseases and subsequent increase in clinical trials, effective monitoring of clinical data, reduction in overall costs and timelines of clinical trials), restraints (shortage of skilled professionals to develop and operate eCOA solutions, high implementation and maintenance cost, lack of awareness regarding eCOA solutions among end users), opportunities (surging eCOA adoption owing to increasing number of clinical trials in emerging economies, growing outsourcing of clinical trial processes to CROs, gradual shift from manual data interpretation to real-time data analysis, increasing penetration of mobile technology in healthcare industry), and challenges (evolving regulatory landscape and compliance requirements, lack of interoperability & integration, concerns regarding data security & privacy, resistance from traditional healthcare professionals and concerns regarding software reliability) influencing the growth of electronic clinical outcome assessment (eCOA) solutions market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the electronic clinical outcome assessment (eCOA) solutions market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various electronic clinical outcome assessment (eCOA) solutions across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the electronic clinical outcome assessment (eCOA) solutions market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the electronic clinical outcome assessment (eCOA) solutions market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 SECONDARY SOURCES

- 2.2.1 KEY DATA FROM SECONDARY SOURCES

- 2.3 PRIMARY DATA

- 2.3.1 PRIMARY SOURCES

- 2.3.1.1 Key data from primary sources

- 2.3.1.2 Key industry insights

- 2.3.2 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3.1 PRIMARY SOURCES

- 2.4 SECONDARY RESEARCH

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- 2.6 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.7 ASSUMPTIONS

- 2.7.1 MARKET SIZING ASSUMPTIONS

- 2.7.2 STUDY ASSUMPTIONS

- 2.8 LIMITATIONS

- 2.8.1 SCOPE-RELATED LIMITATIONS

- 2.8.2 METHODOLOGY-RELATED LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT AND COUNTRY (2024)

- 4.3 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: REGIONAL MIX, 2025 VS. 2030

- 4.5 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) MARKET: IMPACT ANALYSIS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing R&D expenditure for product development by MedTech and pharma-biotech companies

- 5.3.1.2 Rising operational costs and regulatory requirements associated with clinical research studies

- 5.3.1.3 Favorable government support and funding for clinical trials

- 5.3.1.4 Growing prevalence of chronic diseases & subsequent increase in clinical trials

- 5.3.1.5 Effective monitoring of clinical data

- 5.3.1.6 Reduction in overall costs and timelines of clinical trials

- 5.3.2 RESTRAINTS

- 5.3.2.1 Dearth of skilled professionals to develop and operate eCOA solutions

- 5.3.2.2 High implementation and maintenance costs

- 5.3.2.3 Lack of awareness about eCOA solutions among end users

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Surging eCOA adoption owing to increasing number of clinical trials in emerging economies

- 5.3.3.2 Growing outsourcing of clinical trial processes to CROs

- 5.3.3.3 Gradual shift from manual data interpretation to real-time data analysis

- 5.3.3.4 Growing penetration of mobile technology in healthcare industry

- 5.3.4 CHALLENGES

- 5.3.4.1 Evolving regulatory landscape and compliance requirements

- 5.3.4.2 Concerns regarding data security & privacy

- 5.3.4.3 Lack of interoperability & integration

- 5.3.4.4 Resistance from traditional healthcare professionals and concerns regarding software reliability

- 5.3.1 DRIVERS

- 5.4 INDUSTRY TRENDS

- 5.5 OVERVIEW OF KEY INDUSTRY TRENDS

- 5.5.1 RISING NUMBER OF DECENTRALIZED CLINICAL TRIALS

- 5.5.2 INCREASED FOCUS ON REAL-WORLD DATA (RWD)

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 VALUE/SUPPLY CHAIN ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Machine learning

- 5.8.1.2 Artificial Intelligence

- 5.8.1.3 Internet of Things

- 5.8.1.4 Integrated APIs

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Interactive Voice Response (IVR)

- 5.8.2.2 Data analytics

- 5.8.2.3 Telehealth

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Cloud computing

- 5.8.3.2 Blockchain

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY ANALYSIS

- 5.9.1.1 North America

- 5.9.1.2 Europe

- 5.9.1.3 Asia Pacific

- 5.9.1.4 Latin America

- 5.9.1.5 Middle East & Africa

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATORY ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 THREAT OF SUBSTITUTES

- 5.10.5 THREAT OF NEW ENTRANTS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.11.2 INDICATIVE PRICING ANALYSIS, BY PRODUCT

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 CASE 1: LEADING ACADEMIC MEDICAL CENTER MONITORS NEWLY DIAGNOSED MYELOMA PATIENTS WITH MEDIDATA ECOA

- 5.12.2 CASE 2: SIGNANT'S SCALE MANAGEMENT EXPERTISE FACILITATES ENDPOINT ACCURACY & RELIABILITY IN PSORIATIC ARTHRITIS TRIAL

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 END-USER ANALYSIS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 REVENUE MODEL ANALYSIS

- 5.18.1 SUBSCRIPTION-BASED MODEL

- 5.18.2 PAY-PER-STUDY MODEL

- 5.18.3 CUSTOMIZED SOLUTIONS MODEL

- 5.18.4 SOFTWARE-AS-A-SERVICE (SAAS) MODEL

- 5.18.5 CONSULTING & INTEGRATION SERVICES MODEL

- 5.19 INVESTMENT LANDSCAPE

- 5.20 IMPACT OF 2025 US TARIFF-OVERVIEW

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 ADVANTAGES OF REAL-TIME ANALYSIS AND STREAMLINED DATA COLLECTION TO DRIVE MARKET

- 6.3 SERVICES

- 6.3.1 ABILITY OF ECOA SERVICES TO REDUCE TIME & COSTS OF CLINICAL TRIAL PROCESSES TO BOOST DEMAND

- 6.4 WEARABLES, MOBILE DEVICES, AND OTHER DEVICES

- 6.4.1 BRING YOUR OWN DEVICE (BYOD) MODEL

- 6.4.1.1 Ability of BYOD models to increase flexibility & convenience to drive market

- 6.4.2 PROVISIONED DEVICE MODEL

- 6.4.2.1 Growing need for standardization & control in data collection processes to fuel market

- 6.4.3 HYBRID MODEL

- 6.4.3.1 Ability to increase balance between standardization & participant preferences to boost market

- 6.4.1 BRING YOUR OWN DEVICE (BYOD) MODEL

7 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 ELECTRONIC PATIENT-REPORTED OUTCOMES (EPRO)

- 7.2.1 GROWING EMPHASIS ON PATIENT-CENTRIC HEALTHCARE TO BOOST DEMAND

- 7.3 ELECTRONIC OBSERVER-REPORTED OUTCOMES (EOBSRO)

- 7.3.1 GROWING NEED FOR ACCURATE & RELIABLE DATA COLLECTION TO DRIVE MARKET

- 7.4 ELECTRONIC CLINICIAN-REPORTED OUTCOMES (ECLINRO)

- 7.4.1 RISING EFFICACY & ACCURACY IN CAPTURING CLINICIAN-REPORTED DATA TO PROPEL MARKET

- 7.5 ELECTRONIC PERFORMANCE-REPORTED OUTCOME (EPERFO)

- 7.5.1 INCREASING ACCESSIBILITY & FLEXIBILITY IN CLINICAL TRIAL SETTINGS TO DRIVE MARKET

8 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- 8.2 ON-PREMISE MODELS

- 8.2.1 OPTIMAL CONTROL ON DEPLOYMENT & DATA BACKUP TO FUEL MARKET

- 8.3 WEB-HOSTED & CLOUD-BASED MODELS

- 8.3.1 ENHANCED QUALITY OF CLINICAL TRIALS WITH IMPROVED PRODUCTIVITY TO DRIVE MARKET

- 8.4 HYBRID MODEL

- 8.4.1 ABILITY TO OFFER BALANCED SOLUTIONS TO SUPPORT MARKET GROWTH

9 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CLINICAL TRIALS

- 9.2.1 ONCOLOGY

- 9.2.1.1 Rising incidence of cancer to drive market

- 9.2.2 INFECTIOUS DISEASES

- 9.2.2.1 Growing focus on infectious disease treatment & management to boost demand

- 9.2.3 NEUROLOGY

- 9.2.3.1 Increasing investments in R&D & grants for neurological disorders to drive market

- 9.2.4 METABOLIC DISORDERS

- 9.2.4.1 Rising incidence of autoimmune diseases to fuel uptake

- 9.2.5 IMMUNOLOGY

- 9.2.5.1 Increasing development of immunology drugs to fuel uptake

- 9.2.6 CARDIOVASCULAR DISEASES

- 9.2.6.1 Rising need for efficient collection of outcomes in cardiovascular trials to support market growth

- 9.2.7 RARE DISEASES & GENETIC DISORDERS

- 9.2.7.1 Favorable government support for rare diseases & genetic disorders to boost market

- 9.2.8 MENTAL HEALTH DISORDERS

- 9.2.8.1 Importance of mental health awareness to propel market

- 9.2.9 OTHER THERAPEUTIC AREAS

- 9.2.1 ONCOLOGY

- 9.3 OBSERVATIONAL STUDIES & REAL-WORLD EVIDENCE (RWE) GENERATION

- 9.3.1 INCREASING RECOGNITION OF BENEFITS OF REAL-WORLD EVIDENCE GENERATION TO FUEL MARKET

- 9.4 PATIENT MANAGEMENT & REGISTRIES

- 9.4.1 EVOLVING LANDSCAPE OF PATIENT-CENTRIC HEALTHCARE TO DRIVE MARKET

- 9.5 OTHER APPLICATIONS

10 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 INCREASING R&D EXPENDITURE FOR DRUG DISCOVERY & DEVELOPMENT TO DRIVE MARKET

- 10.3 CONTRACT RESEARCH ORGANIZATIONS (CROS)

- 10.3.1 RISING OUTSOURCING OF CLINICAL TRIAL ACTIVITIES TO CROS TO FUEL MARKET

- 10.4 GOVERNMENT ORGANIZATIONS

- 10.4.1 COLLABORATIONS BETWEEN GOVERNMENT ORGANIZATIONS & CROS FOR RESEARCH TO SUPPORT MARKET GROWTH

- 10.5 MEDTECH COMPANIES

- 10.5.1 INCREASING UTILIZATION OF CLINICAL DATA SOFTWARE SOLUTIONS FOR MEDICAL DEVICE TRIALS TO AID MARKET

- 10.6 HOSPITALS & HEALTHCARE PROVIDERS

- 10.6.1 INTEGRATION INTO HOSPITAL WORKFLOWS TO DRIVE MARKET

- 10.7 ACADEMIC & RESEARCH INSTITUTES

- 10.7.1 FAVORABLE GOVERNMENT SUPPORT FOR CLINICAL RESEARCH TO SUPPORT MARKET GROWTH

- 10.8 CONSULTING SERVICE COMPANIES

- 10.8.1 PROVISION OF STRATEGIC GUIDANCE FOR REGULATORY REQUIREMENTS TO FUEL MARKET

11 ELECTRONIC CLINICAL OUTCOME ASSESSMENT (ECOA) SOLUTIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Rising government funding for pharmaceutical R&D to drive market

- 11.2.3 CANADA

- 11.2.3.1 Increasing number of clinical trials to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increase in R&D expenditure and clinical trials to boost market

- 11.3.3 UK

- 11.3.3.1 Growing investments in drug discovery services to favor market growth

- 11.3.4 FRANCE

- 11.3.4.1 Growing R&D pipeline for oncology trials to drive market

- 11.3.5 ITALY

- 11.3.5.1 Increasing government funds and favorable regulatory scenarios to fuel uptake

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Established clinical trial infrastructure and increased funds for R&D to support growth

- 11.4.3 CHINA

- 11.4.3.1 Low cost of clinical trials and large pharmaceutical R&D base to drive market

- 11.4.4 INDIA

- 11.4.4.1 Growing pharmaceutical industry to fuel uptake of eCOA solutions

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 High demand for clinical trials to boost market

- 11.5.3 MEXICO

- 11.5.3.1 Increasing pharma investments to fuel uptake

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Increasing healthcare investments to support market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ECOA SOLUTION VENDORS MARKET

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Component footprint

- 12.5.5.4 Deployment model footprint

- 12.5.5.5 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 DYNAMIC COMPANIES

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/smes

- 12.6.5.2 Competitive benchmarking of key emerging players/startups

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/SOFTWARE COMPARATIVE ANALYSIS

- 12.8.1 BRAND/SOFTWARE COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MEDIDATA (DASSAULT SYSTEMES COMPANY)

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product/Service launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 IQVIA

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses & competitive threats

- 13.1.3 SIGNANT HEALTH

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product/Service launches & enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 CLARIO

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 ICON PLC

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product/Service launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 ORACLE CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product/Service enhancements

- 13.1.6.3.2 Deals

- 13.1.7 MEDABLE INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product/Service launches & enhancements

- 13.1.7.3.2 Deals

- 13.1.8 MERATIVE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 PAREXEL INTERNATIONAL (MA) CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.10 CLIMEDO HEALTH GMBH

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Other developments

- 13.1.11 HEALTHENTIA (PRODUCT BY INNOVATION SPRINT SRL)

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 VEENA SYSTEMS INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product/Service launches

- 13.1.12.3.2 Deals

- 13.1.12.3.3 Other developments

- 13.1.13 ASSISTEK

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches & enhancements

- 13.1.13.3.2 Deals

- 13.1.13.3.3 Expansions developments

- 13.1.14 CUREBASE INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product/Service launches

- 13.1.14.3.2 Deals

- 13.1.15 CASTOR

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product/Service launches & enhancements

- 13.1.15.3.2 Deals

- 13.1.16 EVIDENTIQ

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 Y-PRIME, LLC

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product/Service launches & enhancements

- 13.1.17.3.2 Deals

- 13.1.18 CLINICAL INK

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Services offered

- 13.1.18.3 Recent developments

- 13.1.18.3.1 Product/Service launches & enhancements

- 13.1.18.3.2 Deals

- 13.1.19 CLINION

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Services offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Deals

- 13.1.19.3.2 Other developments

- 13.1.20 KAYENTIS

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Services offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Deal

- 13.1.1 MEDIDATA (DASSAULT SYSTEMES COMPANY)

- 13.2 OTHER PLAYERS

- 13.2.1 TRANSPERFECT

- 13.2.2 OBVIOHEALTH USA, INC.

- 13.2.3 WCG CLINICAL

- 13.2.4 CLINCAPTURE

- 13.2.5 CLOUDBYZ

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS