|

|

市場調査レポート

商品コード

1720950

持続可能な航空燃料の世界市場:バイオ燃料転換経路別、バイオ燃料混合容量別、エンドユーザー別、燃料タイプ別、航空機タイプ別、地域別 - 2030年までの予測Sustainable Aviation Fuel Market by Fuel type, by Biofuel Conversion Pathways, by biofuel blending capacity, Aircraft type and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 持続可能な航空燃料の世界市場:バイオ燃料転換経路別、バイオ燃料混合容量別、エンドユーザー別、燃料タイプ別、航空機タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月02日

発行: MarketsandMarkets

ページ情報: 英文 340 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

持続可能な航空燃料の市場規模は、2025年に20億6,000万米ドルと推定されます。

同市場は、2030年には256億2,000万米ドルに達し、65.5%のCAGRで拡大すると予測されています。量的には、2025年の3億ガロンから2030年には36億8,000万ガロンに成長すると予測されています。SAFは、農業廃棄物、使用済み食用油、都市固形廃棄物、非食糧バイオマスなどの持続可能なバイオマスから作られます。近年、SAFは、カーボンニュートラルと地球温暖化防止目標を達成するための中心的なソリューションとして浮上しています。規制支援強化の必要性、航空業界によるネットゼロへのコミットメント、SAF製造技術への投資の増加が、この市場の世界の持続可能な成長を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | バイオ燃料転換経路別、バイオ燃料混合容量別、エンドユーザー別、燃料タイプ別、航空機タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

航空機タイプ別では、持続可能な航空燃料市場は商業航空、軍事航空、ビジネス&一般航空、無人航空機(UAV)に分類されます。ビジネス&一般航空セグメントは、持続可能な航空燃料市場で第2位の市場シェアを占めると予測されています。チャーター便、自家用ジェット機、非商用機を対象とするビジネス&一般航空は、カーボンフットプリントへの注目度を高めています。その結果、より環境に優しい運航を求める規制要件や消費者の期待に応えるため、運航会社やメーカーはますますSAFに注目するようになっています。よりクリーンな航空を求める規制上の義務や顧客の期待に応えるため、運航会社やメーカーはSAFをソリューションとして採用しています。ボンバルディア、ガルフストリーム、ダッソーなどの大手ビジネスジェット会社は、自社機のSAF適合性を認証し、運航に組み込むことで、SAFの採用を積極的に推進しています。SAFの最大消費者である民間航空業界の成長により、ビジネス機や一般機の迅速な導入と1フライトあたりの燃料消費量の多さが、予測期間中の同セグメントの成長を後押しすると予測されます。

エンドユーザー別に見ると、観光やビジネス目的の航空旅行の拡大が続いていることから、旅客機セグメントが2025年には最大市場になると推定されます。航空会社は、旅客数の増加と環境要件に対応するため、保有機材を拡大し、より効率的で技術的に優れた旧型機への置き換えを進めています。加えて、新規路線や高頻度運航のニーズが、航空機の購入、整備、機内サービスへの投資を促進しており、これらすべてが旅客機セグメントの市場拡大に寄与しています。さらに、旅客機部門は、規模の経済と、メーカーやサービス・プロバイダーとの長期的な戦略的提携から大きな恩恵を受けています。航空会社は、AI、IoT、高度なアナリティクスの統合など、デジタル化による旅客体験と業務効率の向上にますます注力しています。こうした開発により、旅客機セグメントは航空業界のリーダーとしての地位を維持し、SAF市場の最大シェアに貢献することになります。

欧州は、強固な規制支援、積極的な気候政策、整備された航空インフラにより、第2位の市場を占めると予測されています。欧州連合(EU)は、SAF混合比率の長期的な上昇を義務付けるReFuelEU Aviation提案のような施策を通じて、SAFの支援を先導してきました。さらに、EU排出権取引制度(EU ETS)は、航空会社にさらなる排出量削減を促し、SAFのようなよりクリーンな燃料を使用するよう強制しています。オランダ、フランス、ドイツ、英国はすでにSAF生産工場に投資し、将来の需要に対応するサプライチェーンを構築しています。SkyNRGやNesteといった主要なSAFメーカーの存在も欧州の特徴です。さらに、欧州の航空会社はSAFを燃料として航空機に使用するケースが増えており、民間機や一般機への利用可能性が高まっています。こうした集団的努力とインフラ整備により、2025年の市場シェアは欧州が第2位となります。

当レポートでは、世界の持続可能な航空燃料市場について調査し、バイオ燃料転換経路別、バイオ燃料混合容量別、エンドユーザー別、燃料タイプ別、航空機タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- 関税と規制状況

- 貿易データ

- SAFサプライチェーン要素のコスト貢献

- ボリュームデータ

- 運用データ

- 主要な利害関係者と購入基準

- ケーススタディ

- 主要な会議とイベント

- 技術分析

- 価格分析

- ジェット燃料とSAFの比較

- 投資と資金調達のシナリオ

- AI/生成AIがSAF市場に与える影響

- マクロ経済見通し

- 総所有コスト(TCO)

- ビジネスモデル

- 技術ロードマップ

第6章 業界動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 持続可能な航空燃料市場(バイオ燃料転換経路別)

- イントロダクション

- フィッシャー・トロプシュ(FT)

- 水素化処理エステルおよび脂肪酸(HEFA)

- アルコール・トゥ・ジェット(ATJ)

- 触媒水熱分解ジェット(CHJ)

- 共同処理

第8章 持続可能な航空燃料市場(バイオ燃料混合容量別)

- イントロダクション

- 30%未満

- 30%から50%

- 50%以上

第9章 持続可能な航空燃料市場(エンドユーザー別)

- イントロダクション

- 旅客機

- 政府と軍隊

- 不定期運行事業者

第10章 持続可能な航空燃料市場(燃料タイプ別)

- イントロダクション

- バイオ燃料

- 水素燃料

- パワー・トゥ・リキッド(PTL)

- ガス・トゥ・リキッド(GTL)

第11章 持続可能な航空燃料市場(航空機タイプ別)

- イントロダクション

- 民間航空

- ビジネスおよび一般航空

- 軍用航空

- 無人航空機

第12章 持続可能な航空燃料市場(地域別)

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- インド

- オーストラリア

- 韓国

- 日本

- 中国

- シンガポール

- その他

- 欧州

- PESTLE分析

- ドイツ

- 英国

- フランス

- デンマーク

- フィンランド

- その他

- 中東

- PESTLE分析

- アラブ首長国連邦

- バーレーン

- カタール

- ラテンアメリカ

- PESTLE分析

- ブラジル

- メキシコ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- NESTE

- TOTALENERGIES

- WORLD ENERGY, LLC

- ENI S.P.A

- OMV AKTIENGESELLSCHAFT

- SHELL INTERNATIONAL B.V.

- LANZATECH

- GEVO

- VELOCYS LTD.

- NORTHWEST ADVANCED BIO-FUELS, LLC

- SKYNRG B.V.

- TOPSOE A/S

- AEMETIS, INC.

- WORLD KINECT CORPORATION

- PHILLIPS 66 COMPANY

- ALDER ENERGY, LLC

- MOEVE

- PREEM AB

- BP P.L.C.

- REPSOL

- その他の企業

- ATMOSFAIR GMBH

- SAF PLUS INTERNATIONAL GROUP

- CEMVITA

- DG FUELS, LLC

- WASTEFUEL

- RED ROCK BIOFUELS

- AIR COMPANY HOLDINGS INC

- DIMENSIONAL ENERGY

- VIRENT, INC.

- SGP BIOENERGY HOLDINGS, LLC

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2024

- TABLE 2 KEY ENVIRONMENTAL REGULATIONS DRIVING SAF MARKET

- TABLE 3 REGION-WISE CHALLENGES TO FEEDSTOCK AVAILABILITY

- TABLE 4 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 IMPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 COST CONTRIBUTION OF SAF SUPPLY CHAIN ELEMENTS, 2024 VS. 2030

- TABLE 13 SAF CONSUMPTION VOLUME, BY REGION, 2021-2030

- TABLE 14 SAF OFFTAKE AGREEMENTS PER FUEL PRODUCER, 2013-2025 (MILLION LITERS)

- TABLE 15 SAF OFFTAKE AGREEMENTS PER FUEL PURCHASER, 2013-2025 (MILLION LITERS)

- TABLE 16 IN-SERVICE FACILITIES PRODUCING SAF, BY COUNTRY, 2017-2025 (BILLION LITERS/YEAR)

- TABLE 17 IN-SERVICE FACILITIES PRODUCING SAF, BY COMPANY, 2017-2025 (BILLION LITERS/YEAR)

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 19 KEY BUYING CRITERIA, BY END USER

- TABLE 20 KEY CONFERENCES & EVENTS, 2025

- TABLE 21 AVERAGE SELLING PRICE, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD/GALLON)

- TABLE 22 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/GALLON)

- TABLE 23 INDICATIVE PRICING LEVELS OF SAF, BY KEY PLAYER, 2024 (USD/GALLON)

- TABLE 24 AVERAGE CONSUMPTION AND EMISSIONS OF JET FUEL AND SAF

- TABLE 25 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 26 MAJOR PATENTS FILED, 2021-2025

- TABLE 27 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

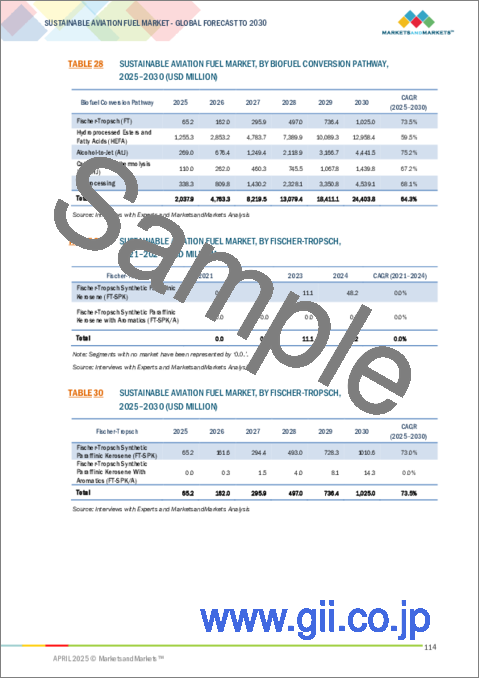

- TABLE 28 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 29 SUSTAINABLE AVIATION FUEL MARKET, BY FISCHER-TROPSCH, 2021-2024 (USD MILLION)

- TABLE 30 SUSTAINABLE AVIATION FUEL MARKET, BY FISCHER-TROPSCH, 2025-2030 (USD MILLION)

- TABLE 31 SUSTAINABLE AVIATION FUEL MARKET, BY HYDROPROCESSED ESTERS AND FATTY ACID, 2021-2024 (USD MILLION)

- TABLE 32 SUSTAINABLE AVIATION FUEL MARKET, BY HYDROPROCESSED ESTERS AND FATTY ACID, 2025-2030 (USD MILLION)

- TABLE 33 SUSTAINABLE AVIATION FUEL MARKET, BY ALCOHOL-TO-JET, 2021-2024 (USD MILLION)

- TABLE 34 SUSTAINABLE AVIATION FUEL MARKET, BY ALCOHOL-TO-JET, 2025-2030 (USD MILLION)

- TABLE 35 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK): OVERVIEW

- TABLE 36 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A): OVERVIEW

- TABLE 37 HYDROPROCESSED ESTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK): OVERVIEW

- TABLE 38 HIGH-HYDROGEN CONTENT SYNTHETIC PARAFFINIC KEROSENE (HHC-SPK): OVERVIEW

- TABLE 39 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (SIP): OVERVIEW

- TABLE 40 ALCOHOL-TO-JET SYNTHETIC PARAFFINIC KEROSENE (ATJ-SPK): OVERVIEW

- TABLE 41 ALCOHOL-TO-JET SYNTHETIC KEROSENE WITH AROMATICS (ATJ-SKA): OVERVIEW

- TABLE 42 CATALYTIC HYDROTHERMOLYSIS JET (CHJ): OVERVIEW

- TABLE 43 CO-PROCESSING: OVERVIEW

- TABLE 44 LIST OF BIOFUEL CONVERSION PATHWAYS UNDER EVALUATION

- TABLE 45 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 46 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 47 SUSTAINABLE AVIATION FUEL MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 48 SUSTAINABLE AVIATION FUEL MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 49 SUSTAINABLE AVIATION FUEL MARKET, BY AIRLINER, 2021-2024 (USD MILLION)

- TABLE 50 SUSTAINABLE AVIATION FUEL MARKET, BY AIRLINER, 2025-2030 (USD MILLION)

- TABLE 51 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 52 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 53 SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 54 SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 55 SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 SAF INITIATIVES UNDERTAKEN IN NORTH AMERICA

- TABLE 58 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 68 US: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 69 US: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 70 US: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 71 US: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 72 CANADA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 73 CANADA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 74 CANADA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 75 CANADA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 76 SAF INITIATIVES UNDERTAKEN IN ASIA PACIFIC

- TABLE 77 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 83 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 87 INDIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 88 INDIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 89 INDIA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 90 INDIA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 91 AUSTRALIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 92 AUSTRALIA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 93 AUSTRALIA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 94 AUSTRALIA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 95 SOUTH KOREA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 96 SOUTH KOREA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 97 SOUTH KOREA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 98 SOUTH KOREA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 99 JAPAN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 100 JAPAN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 101 JAPAN: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 102 JAPAN: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 103 CHINA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 104 CHINA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 105 CHINA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 106 CHINA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 107 SINGAPORE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 108 SINGAPORE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 109 SINGAPORE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 110 SINGAPORE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 115 SAF INITIATIVES UNDERTAKEN IN EUROPE

- TABLE 116 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 119 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 123 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 126 GERMANY: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 127 GERMANY: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 128 GERMANY: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 129 GERMANY: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 130 UK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 131 UK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 132 UK: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 133 UK: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 134 FRANCE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 135 FRANCE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 136 FRANCE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 137 FRANCE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 138 DENMARK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 139 DENMARK: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 140 DENMARK: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 141 DENMARK: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 142 FINLAND: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 143 FINLAND: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 144 FINLAND: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 145 FINLAND: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 148 REST OF EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 149 REST OF EUROPE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 150 SAF INITIATIVES UNDERTAKEN IN MIDDLE EAST

- TABLE 151 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 160 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 161 UAE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 162 UAE: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 163 UAE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION

- TABLE 164 UAE: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 165 BAHRAIN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 166 BAHRAIN: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 167 BAHRAIN: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 168 BAHRAIN: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 169 QATAR: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 170 QATAR: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 171 QATAR: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 172 QATAR: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 173 SAF INITIATIVES UNDERTAKEN IN LATIN AMERICA

- TABLE 174 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 177 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 178 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD MILLION)

- TABLE 179 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY, 2025-2030 (USD MILLION)

- TABLE 180 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 181 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 182 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2021-2024 (USD MILLION)

- TABLE 183 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE, 2025-2030 (USD MILLION)

- TABLE 184 BRAZIL: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 185 BRAZIL: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 186 BRAZIL: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 187 BRAZIL: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 188 MEXICO: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2021-2024 (USD MILLION)

- TABLE 189 MEXICO: SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2025-2030 (USD MILLION)

- TABLE 190 MEXICO: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2021-2024 (USD MILLION)

- TABLE 191 MEXICO: SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY, 2025-2030 (USD MILLION)

- TABLE 192 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 193 SUSTAINABLE AVIATION FUEL MARKET: DEGREE OF COMPETITION

- TABLE 194 BIOFUEL BLENDING CAPACITY FOOTPRINT

- TABLE 195 BIOFUEL CONVERSION PATHWAY FOOTPRINT

- TABLE 196 END USER FOOTPRINT

- TABLE 197 REGION FOOTPRINT

- TABLE 198 DETAILED LIST OF STARTUPS/SMES

- TABLE 199 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING OF STARTUPS/SMES (REGION)

- TABLE 201 SUSTAINABLE AVIATION FUEL MARKET: DEALS, JUNE 2020-APRIL 2025

- TABLE 202 SUSTAINABLE AVIATION FUEL MARKET: OTHER DEVELOPMENTS, JUNE 2020-APRIL 2025

- TABLE 203 NESTE: COMPANY OVERVIEW

- TABLE 204 NESTE: DEALS

- TABLE 205 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 206 TOTALENERGIES: PRODUCTS/SOLUTIONS OFFERED

- TABLE 207 TOTALENERGIES: DEALS

- TABLE 208 TOTALENERGIES: OTHER DEVELOPMENTS

- TABLE 209 WORLD ENERGY, LLC: COMPANY OVERVIEW

- TABLE 210 WORLD ENERGY, LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 211 WORLD ENERGY, LLC: DEALS

- TABLE 212 ENI: COMPANY OVERVIEW

- TABLE 213 ENI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 214 ENI: DEALS

- TABLE 215 ENI: OTHER DEVELOPMENTS

- TABLE 216 OMV AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 217 OMV AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS OFFERED

- TABLE 218 OMV AKTIENGESELLSCHAFT: DEALS

- TABLE 219 OMV AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

- TABLE 220 SHELL: COMPANY OVERVIEW

- TABLE 221 SHELL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 222 SHELL: DEALS

- TABLE 223 LANZATECH: COMPANY OVERVIEW

- TABLE 224 LANZATECH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 225 LANZATECH: DEALS

- TABLE 226 GEVO: COMPANY OVERVIEW

- TABLE 227 GEVO: PRODUCTS/SOLUTIONS OFFERED

- TABLE 228 GEVO: DEALS

- TABLE 229 VELOCYS PLC: COMPANY OVERVIEW

- TABLE 230 VELOCYS PLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 231 VELOCYS PLC: DEALS

- TABLE 232 NORTHWEST ADVANCED BIO-FUELS, LLC: COMPANY OVERVIEW

- TABLE 233 NORTHWEST ADVANCED BIO-FUELS, LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 234 NORTHWEST ADVANCED BIO-FUELS, LLC: DEALS

- TABLE 235 NORTHWEST ADVANCED BIO-FUELS, LLC: OTHER DEVELOPMENTS

- TABLE 236 SKYNRG B.V.: COMPANY OVERVIEW

- TABLE 237 SKYNRG B.V.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 238 SKYNRG B.V.: DEALS

- TABLE 239 TOPSOE A/S: COMPANY OVERVIEW

- TABLE 240 TOPSOE A/S: PRODUCTS/SOLUTIONS OFFERED

- TABLE 241 TOPSOE A/S: DEALS

- TABLE 242 AEMETIS, INC.: COMPANY OVERVIEW

- TABLE 243 AEMETIS, INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 244 AEMETIS, INC.: DEALS

- TABLE 245 WORLD KINECT CORPORATION: COMPANY OVERVIEW

- TABLE 246 WORLD KINECT CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 247 WORLD KINECT CORPORATION: DEALS

- TABLE 248 WORLD KINECT CORPORATION: OTHER DEVELOPMENTS

- TABLE 249 PHILLIPS 66 COMPANY: COMPANY OVERVIEW

- TABLE 250 PHILLIPS 66 COMPANY: PRODUCTS/SOLUTIONS OFFERED

- TABLE 251 PHILLIPS 66 COMPANY: DEALS

- TABLE 252 PHILLIPS 66 COMPANY: OTHER DEVELOPMENTS

- TABLE 253 ALDER ENERGY, LLC: COMPANY OVERVIEW

- TABLE 254 ALDER ENERGY, LLC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 255 ALDER ENERGY, LLC: DEALS

- TABLE 256 ALDER ENERGY, LLC: OTHER DEVELOPMENTS

- TABLE 257 MOEVE: COMPANY OVERVIEW

- TABLE 258 MOEVE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 259 MOEVE: DEALS

- TABLE 260 MOEVE: OTHER DEVELOPMENTS

- TABLE 261 PREEM AB: COMPANY OVERVIEW

- TABLE 262 PREEM AB: PRODUCTS/SOLUTIONS OFFERED

- TABLE 263 PREEM AB: DEALS

- TABLE 264 PREEM AB: OTHER DEVELOPMENTS

- TABLE 265 BP P.L.C.: COMPANY OVERVIEW

- TABLE 266 BP P.L.C.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 267 BP P.L.C.: DEALS

- TABLE 268 BP P.L.C.: OTHER DEVELOPMENTS

- TABLE 269 REPSOL: COMPANY OVERVIEW

- TABLE 270 REPSOL: PRODUCTS/SOLUTIONS OFFERED

- TABLE 271 REPSOL: DEALS

List of Figures

- FIGURE 1 RESEARCH FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 BIOFUEL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET IN 2025

- FIGURE 8 AIRLINER SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 10 INCREASING ADVANCEMENTS IN SAF TECHNOLOGIES TO DRIVE MARKET

- FIGURE 11 AIRLINER SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 COMMERCIAL AVIATION SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 13 BIOFUEL SEGMENT TO LEAD MARKET IN 2025

- FIGURE 14 CANADA TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 SUSTAINABLE AVIATION FUEL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 LIFECYCLE GREENHOUSE EMISSIONS BY SAFS IN GREET

- FIGURE 17 COMPARISON BETWEEN SUPPLY OF AND DEMAND FOR SAF, 2020-2040 (MMT)

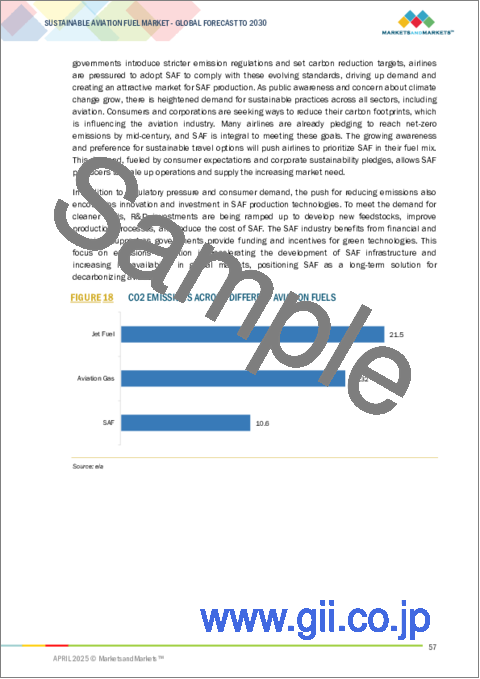

- FIGURE 18 CO2 EMISSIONS ACROSS DIFFERENT AVIATION FUELS

- FIGURE 19 CARBON FOOTPRINT OF GLOBAL AVIATION INDUSTRY ACROSS FOUR SCENARIOS, 2011-2040 (MMT)

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 IMPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 SAF PRODUCTION VOLUME, 2015-2024 (MILLION LITERS)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 26 KEY BUYING CRITERIA, BY END USER

- FIGURE 27 VIRENT'S BIOFORMING PROCESS FLOWCHART

- FIGURE 28 AVERAGE SELLING PRICE, BY BIOFUEL CONVERSION PATHWAY, 2021-2024 (USD/GALLON)

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/GALLON)

- FIGURE 30 VOLUME AND PRICE OF JET FUEL AND SAF, 2021-2030

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 32 IMPACT OF AI/GEN AI

- FIGURE 33 TOTAL COST OF OWNERSHIP (TCO) OF SAF

- FIGURE 34 COMPARISON BETWEEN TCO OF SUSTAINABLE AVIATION FUEL TYPES

- FIGURE 35 BUSINESS MODELS

- FIGURE 36 EVOLUTION OF TECHNOLOGY

- FIGURE 37 TECHNOLOGY ROADMAP (2020-2035)

- FIGURE 38 ETHANOL-TO-JET (ETJ) TECHNOLOGY

- FIGURE 39 ADVANCED GASIFICATION

- FIGURE 40 FT UNICRACKING

- FIGURE 41 SUPPLY CHAIN ANALYSIS

- FIGURE 42 DETAILED ILLUSTRATION OF SAF SUPPLY CHAIN

- FIGURE 43 TOP TEN PATENT APPLICANTS, 2015-2025

- FIGURE 44 HYDROPROCESSED ESTERS AND FATTY ACIDS (HEFA) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 45 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 46 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 47 HYDROPROCESSED ESTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 48 HIGH-HYDROGEN CONTENT SYNTHETIC PARAFFINIC KEROSENE (HHC-SPK) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 49 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (SIP) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 50 ALCOHOL-TO-JET SYNTHETIC PARAFFINIC KEROSENE (ATJ-SPK) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 51 ALCOHOL-TO-JET SYNTHETIC KEROSENE WITH AROMATICS (ATJ-SKA) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 52 CATALYTIC HYDROTHERMOLYSIS JET (CHJ) BIOFUEL CONVERSION PATHWAY: SNAPSHOT

- FIGURE 53 BELOW 30% SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 54 AIRLINER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 55 BIOFUEL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 56 COMMERCIAL AVIATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 57 SUSTAINABLE AVIATION FUEL MARKET: REGIONAL SNAPSHOT

- FIGURE 58 SUSTAINABLE AVIATION FUEL MARKET: SAF INITIATIVES AND MANDATES (BY COUNTRY)

- FIGURE 59 NORTH AMERICA: SAF OFFTAKE AGREEMENTS, 2021-2024 (MILLION LITERS)

- FIGURE 60 NORTH AMERICA: KEY SAF PRODUCERS, FUNDING AGENCIES, KEY SAF PATHWAYS, AND RAW MATERIALS INVOLVED

- FIGURE 61 NORTH AMERICA: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

- FIGURE 62 ASIA PACIFIC: SAF OFFTAKE AGREEMENTS, 2021-2024 (MILLION LITERS)

- FIGURE 63 ASIA PACIFIC: KEY SAF PRODUCERS, FUNDING AGENCIES, KEY SAF PATHWAYS, AND RAW MATERIALS INVOLVED

- FIGURE 64 ASIA PACIFIC: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

- FIGURE 65 EUROPE: SAF OFFTAKE AGREEMENTS, 2021-2024 (MILLION LITERS)

- FIGURE 66 EUROPE: KEY SAF PRODUCERS, FUNDING AGENCIES, KEY SAF PATHWAYS, AND RAW MATERIALS INVOLVED

- FIGURE 67 EUROPE: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

- FIGURE 68 MIDDLE EAST: SAF OFFTAKE AGREEMENTS, 2021-2024 (MILLION LITERS)

- FIGURE 69 MIDDLE EAST: KEY SAF PRODUCERS, FUNDING AGENCIES, KEY SAF PATHWAYS, AND RAW MATERIALS INVOLVED

- FIGURE 70 MIDDLE EAST: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

- FIGURE 71 LATIN AMERICA: SAF OFFTAKE AGREEMENTS, 2021-2024 (MILLION LITERS)

- FIGURE 72 LATIN AMERICA: KEY SAF PRODUCERS, FUNDING AGENCIES, KEY SAF PATHWAYS, AND RAW MATERIALS INVOLVED

- FIGURE 73 LATIN AMERICA: SUSTAINABLE AVIATION FUEL MARKET SNAPSHOT

- FIGURE 74 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 75 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 76 SUSTAINABLE AVIATION FUEL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 77 COMPANY FOOTPRINT

- FIGURE 78 SUSTAINABLE AVIATION FUEL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 79 FINANCIAL METRICS, 2025

- FIGURE 80 VALUATION OF PROMINENT MARKET PLAYERS, 2025 (USD BILLION)

- FIGURE 81 BRAND/PRODUCT COMPARISON

- FIGURE 82 NESTE: COMPANY SNAPSHOT

- FIGURE 83 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 84 ENI: COMPANY SNAPSHOT

- FIGURE 85 OMV AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 86 SHELL: COMPANY SNAPSHOT

- FIGURE 87 LANZATECH: COMPANY SNAPSHOT

- FIGURE 88 GEVO: COMPANY SNAPSHOT

- FIGURE 89 WORLD KINECT CORPORATION: COMPANY SNAPSHOT

- FIGURE 90 PHILLIPS 66 COMPANY: COMPANY SNAPSHOT

- FIGURE 91 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 92 REPSOL: COMPANY SNAPSHOT

The sustainable aviation fuel market is estimated at USD 2.06 billion in 2025. It is projected to reach USD 25.62 billion by 2030, growing at a CAGR of 65.5%. In terms of volume, the market is projected to grow from 0.30 billion gallons in 2025 to 3.68 billion gallons by 2030. SAF is made from sustainable biomass, such as agricultural waste, used cooking oil, municipal solid waste, and non-food biomass. In recent years, SAF has emerged as the central solution to combat carbon neutrality and global climate objectives. The need for enhancing regulatory support, net-zero commitments by the aviation industry, and increased investments in SAF manufacturing technologies drive sustainable growth within this market globally.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Fuel type, Biofuel Conversion Pathways, biofuel blending capacity, Aircraft type and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The business & general aviation segment is estimated to account for the second-largest share in 2025."

Based on aircraft type, the sustainable aviation fuel market is categorized into commercial aviation, military aviation, business & general aviation, and Unmanned Aerial Vehicles (UAVs). The business & general aviation segment is projected to account for the second-largest market share in the sustainable aviation fuel market. Business & general aviation, which covers charter flights, private jets, and non-commercial aircraft, has increased its focus on carbon footprint. As a result, operators and manufacturers are increasingly turning to SAF to meet regulatory requirements and consumer expectations for greener operations. To serve regulatory mandates and customer expectations for cleaner aviation, operators and manufacturers prefer SAF as their solution. Major business jet companies, such as Bombardier, Gulfstream, and Dassault, are actively promoting SAF adoption by certifying their aircraft for SAF compatibility and incorporating it into operations. With the growth of the commercial aviation industry as the largest consumer of SAF, quick uptake and significant per-flight fuel consumption of business and general aircraft are projected to boost the segment's growth during the forecast period.

"The airliner segment is estimated to account for the largest share in 2025."

Based on end user, the airliner segment is estimated to be the largest market by 2025 due to the ongoing expansion of air travel for tourism and business purposes. Airlines are expanding their fleets and replacing older aircraft with more efficient and technologically superior to meet increasing passenger volumes and environmental requirements. In addition, the need for new routes and higher frequencies of flights is fueling investments in aircraft acquisition, maintenance, and onboard services, all of which contribute to the market strength of the airliner segment. Furthermore, the airliner segment benefits significantly from substantial economies of scale and long-term strategic alliances with manufacturers and service providers. Airlines increasingly focus on improving passenger experience and operational efficiency through digitalization, such as integrating AI, IoT, and advanced analytics. With these developments, the airliner segment is set to continue its position as an aviation industry leader, contributing the largest share of the SAF market.

"Europe is estimated to account for the second-largest share in 2025."

Europe is projected to account for the second-largest market due to robust regulatory support, aggressive climate policies, and a well-developed aviation infrastructure. The European Union has been leading the way in supporting SAF through measures like the ReFuelEU Aviation proposal, which requires rising SAF blending ratios over time. Moreover, the EU Emissions Trading System (EU ETS) encourages airlines to lower emissions further, compelling carriers to use cleaner fuel options such as SAF. The Netherlands, France, Germany, and the UK are already investing in SAF production plants and setting up supply chains to cater to future demand. The presence of major SAF producers, such as SkyNRG and Neste, also characterizes Europe. In addition, European airlines are increasingly using SAF in aircraft as fuel, increasing their availability to commercial and general aviation planes. These collective efforts and infrastructure preparedness make Europe the second-largest market share in 2025.

Break-up of Primary Participants' Profiles in Sustainable Aviation Fuel Market

- By Company Type: Tier 1 - 35%; Tier 2 - 54%; and Tier 3 - 20%

- By Designation: Directors - 55%; Managers - 27%; and Others - 18%

- By Region: North America - 40%; Europe - 20%; Asia Pacific - 30%; Latin America - 5%; and Middle East- 4 %

Neste (Finland), Shell (UK), TotalEnergies (France), OMV Group (Austria), and World Energy, LLC (UK) are some of the key players operating in the sustainable aviation fuel market. These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, and Latin America.

Research Coverage

The study covers the sustainable aviation fuel market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on fuel type, aircraft type, biofuel conversion pathway, biofuel blending capacity, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the sustainable aviation fuel market across five key regions: North America, Europe, Asia Pacific, the Middle East, and Latin America. Its scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence sustainable aviation fuel market growth.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, product launches, contracts, expansion, acquisitions, and partnerships associated with the sustainable aviation fuel market.

Reasons to Buy this Report:

This report is a valuable resource for market leaders and newcomers, offering data that closely approximates revenue figures for the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

Insights Covered by the Report

- Analysis of key drivers and factors, such as advancements in feedstock processing and refining technologies, increasing adoption of fuel-efficient aircraft engines, and stringent environmental regulatory mandates

- Market Penetration: Comprehensive information on sustainable aviation fuel solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the sustainable aviation fuel market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the sustainable aviation fuel market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the sustainable aviation fuel market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN SUSTAINABLE AVIATION FUEL MARKET

- 4.2 SUSTAINABLE AVIATION FUEL MARKET, BY END USER

- 4.3 SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE

- 4.4 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

- 4.5 SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in feedstock processing and refining technologies

- 5.2.1.2 Increasing adoption of fuel-efficient aircraft engines

- 5.2.1.3 Stringent environmental regulatory mandates

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost

- 5.2.2.2 Limited feedstock availability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising depletion of fossil fuels

- 5.2.3.2 Growing focus on reducing greenhouse emissions

- 5.2.3.3 Increasing focus on aircraft modernization

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of SAF supply chain with existing jet fuel supply chain

- 5.2.4.2 Lack of sufficient funding for demonstration of SAF technologies

- 5.2.4.3 Infrastructural limitations

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 TARIFF & REGULATORY LANDSCAPE

- 5.5.1 REGULATIONS, BY REGION

- 5.5.2 ORGANIZATIONS INVOLVED IN SAF PROGRAMS

- 5.5.2.1 Sustainable Aviation Fuel User Group (SAFUG)

- 5.5.2.2 CORSIA: International Agreement

- 5.5.2.3 IATA Net Zero Commitment

- 5.5.2.4 Airport Carbon Accreditation

- 5.5.2.5 Clean Skies for Tomorrow

- 5.5.2.6 EU Clean Aviation Joint Undertaking

- 5.5.2.7 European Green Deal

- 5.5.2.8 National Funding Programs

- 5.5.2.9 International Air Transport Association

- 5.5.2.10 Commercial Aviation Alternative Fuels Initiative (CAAFI)

- 5.5.2.11 NORDIC & NISA Initiatives for Sustainable Aviation

- 5.5.2.12 Air Transport Action Group

- 5.5.2.13 International Civil Aviation Organization (ICAO)

- 5.5.2.14 International Renewable Energy Agency

- 5.5.3 TARIFF RELATED TO SAF

- 5.6 TRADE DATA

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 COST CONTRIBUTION OF SAF SUPPLY CHAIN ELEMENTS

- 5.7.1 FACTORS INFLUENCING COST OF SAF

- 5.7.1.1 Improved feedstock yields

- 5.7.1.2 Advanced bio-manufacturing technology

- 5.7.1.3 Increased production of SAF

- 5.7.2 ROLE OF SAF CERTIFICATES, REGISTRIES, AND BOOK AND CLAIM SYSTEMS

- 5.7.2.1 SAF certificates

- 5.7.2.2 SAF registries

- 5.7.2.3 Book and claim systems

- 5.7.1 FACTORS INFLUENCING COST OF SAF

- 5.8 VOLUME DATA

- 5.8.1 SAF CONSUMPTION VOLUME, BY REGION

- 5.8.2 SAF OFFTAKE AGREEMENTS, BY FUEL PRODUCER

- 5.8.3 SAF OFFTAKE AGREEMENTS, BY FUEL PURCHASER

- 5.8.4 SAF PRODUCTION VOLUME

- 5.9 OPERATIONAL DATA

- 5.9.1 PROJECTED CAPACITY OF SAF IN-SERVICE FACILITIES, BY COUNTRY AND COMPANY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDIES

- 5.11.1 ALL NIPPON AIRWAYS (ANA) INCORPORATED NESTE'S SAF TO REDUCE LIFECYCLE GREENHOUSE EMISSIONS

- 5.11.2 UNITED AIRLINES DEMONSTRATED SEAMLESS REPLACEMENT OF TRADITIONAL JET FUEL WITH SAF

- 5.11.3 AIR NEW ZEALAND'S INITIATIVE TRANSFORMED WOODY WASTE INTO SAF

- 5.12 KEY CONFERENCES & EVENTS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Bioforming Process

- 5.13.1.2 Lignocellulosic Biomass Pretreatment Technologies

- 5.13.2 ADJACENT TECHNOLOGIES

- 5.13.2.1 Advanced Feedstock Processing

- 5.13.2.2 Digital Fuel Tracking & Blockchain for Emission Auditing

- 5.13.3 COMPLEMENTARY TECHNOLOGIES

- 5.13.3.1 Carbon Capture and Utilization (CCU)

- 5.13.3.2 Hydrogen Electrolysis

- 5.13.1 KEY TECHNOLOGIES

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE, BY BIOFUEL CONVERSION PATHWAY

- 5.14.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14.3 INDICATIVE PRICING ANALYSIS

- 5.15 COMPARISON BETWEEN JET FUEL AND SAF

- 5.15.1 VOLUME AND PRICE

- 5.15.2 FUEL CONSUMPTION AND EMISSION

- 5.15.3 OPERATIONAL COST AND EFFICIENCY

- 5.15.4 INFRASTRUCTURE REQUIREMENT

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF AI/GENERATIVE AI ON SAF MARKET

- 5.17.1 FEEDSTOCK OPTIMIZATION

- 5.17.2 PROCESS EFFICIENCY AND YIELD IMPROVEMENT

- 5.17.3 PREDICTIVE SUPPLY CHAIN MANAGEMENT

- 5.17.4 LIFECYCLE AND EMISSION MODELING

- 5.17.5 ACCELERATED R&D AND INNOVATION

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

- 5.18.6 LATIN AMERICA

- 5.19 TOTAL COST OF OWNERSHIP (TCO)

- 5.19.1 INTRODUCTION

- 5.20 BUSINESS MODELS

- 5.21 TECHNOLOGY ROADMAP

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ETHANOL-TO-JET (ETJ) TECHNOLOGY

- 6.2.2 ADVANCED GASIFICATION

- 6.2.3 HYDROCRACKING TECHNOLOGY

- 6.2.4 UNICRACKING BY FISCHER-TROPSCH

- 6.2.5 FT CATALYSTS

- 6.2.6 SAF-COMPATIBLE TURBINE GENERATOR

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 INTERNET OF THINGS (IOT) FOR EMISSION MONITORING

- 6.3.2 ARTIFICIAL INTELLIGENCE (AI) FOR FEEDSTOCK OPTIMIZATION

- 6.3.3 DIGITAL TWINS FOR FUEL BLEND EXPERIMENTS

- 6.3.4 COLLABORATIVE INDUSTRY PLATFORMS FOR KNOWLEDGE SHARING

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.4.1 DETAILED ILLUSTRATION OF SAF SUPPLY CHAIN

- 6.5 PATENT ANALYSIS

7 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL CONVERSION PATHWAY

- 7.1 INTRODUCTION

- 7.2 FISCHER-TROPSCH (FT)

- 7.2.1 NEED TO PRODUCE HIGH-QUALITY FUEL FROM ABUNDANT WASTE AND BIOMASS RESOURCES TO DRIVE MARKET

- 7.2.2 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

- 7.2.3 FISCHER-TROPSCH SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

- 7.3 HYDROPROCESSED ESTERS AND FATTY ACIDS (HEFA)

- 7.3.1 AVAILABILITY OF LOW-COST LIPID FEEDSTOCKS AND THEIR PROVEN COMMERCIAL SCALABILITY FOR SAF PRODUCTION TO DRIVE MARKET

- 7.3.2 HYDROPROCESSED ESTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

- 7.3.3 HIGH-HYDROGEN CONTENT SYNTHETIC PARAFFINIC KEROSENE (HHC-SPK)

- 7.3.4 HYDROPROCESSED FERMENTED SUGARS TO SYNTHESIZED ISO-PARAFFINS (HFS-SIP)

- 7.4 ALCOHOL-TO-JET (ATJ)

- 7.4.1 FLEXIBILITY TO USE WIDELY AVAILABLE ALCOHOLS FROM DIVERSE RENEWABLE SOURCES TO DRIVE MARKET

- 7.4.2 ALCOHOL-TO-JET SYNTHETIC PARAFFINIC KEROSENE (ATJ-SPK)

- 7.4.3 ALCOHOL-TO-JET SYNTHETIC KEROSENE WITH AROMATICS (ATJ-SKA)

- 7.5 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

- 7.5.1 FOCUS ON LOW PROCESSING COST TO DRIVE MARKET

- 7.6 CO-PROCESSING

- 7.6.1 EMPHASIS ON COST-EFFECTIVE SAF PRODUCTION TO DRIVE MARKET

8 SUSTAINABLE AVIATION FUEL MARKET, BY BIOFUEL BLENDING CAPACITY

- 8.1 INTRODUCTION

- 8.2 BELOW 30%

- 8.2.1 ADOPTION OF SAF WITHOUT MAJOR MODIFICATIONS TO DRIVE MARKET

- 8.2.2 USE CASE: SK ENERGY'S (SOUTH KOREA) CO-PROCESSING APPROACH TO PRODUCE SAF

- 8.3 30% TO 50%

- 8.3.1 ADVANCEMENTS IN SAF PRODUCTION TECHNOLOGIES TO DRIVE MARKET

- 8.3.2 USE CASE: REPSOL AND VUELING PIONEER SPAIN'S FIRST COMMERCIAL FLIGHT WITH 50% SAF USING HEFA TECHNOLOGY

- 8.4 ABOVE 50%

- 8.4.1 INCREASING R&D IN TECHNOLOGICAL PATHWAYS TO DRIVE MARKET

- 8.4.2 USE CASE: AIRBUS, WITH ROLLS-ROYCE AND NESTE, DEMONSTRATED 100% SAF FLIGHT WITH HEFA FUEL, CUTTING CONTRAIL IMPACT BY 56%

9 SUSTAINABLE AVIATION FUEL MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 AIRLINER

- 9.2.1 GROWING INVESTMENTS IN SUSTAINABLE SOLUTIONS TO DRIVE SEGMENT

- 9.2.2 LARGE AIRLINER

- 9.2.3 MEDIUM AIRLINER

- 9.2.4 SMALL AIRLINER

- 9.3 GOVERNMENT & MILITARY

- 9.3.1 GROWING NEED TO REDUCE GREENHOUSE EMISSIONS AND ACHIEVE LONG-TERM OPERATIONAL RESILIENCE TO DRIVE MARKET

- 9.4 NON-SCHEDULED OPERATOR

- 9.4.1 INCREASING PASSENGER FOCUS ON LOW-CARBON TRAVEL OPTIONS TO DRIVE MARKET

10 SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

- 10.1 INTRODUCTION

- 10.2 BIOFUEL

- 10.2.1 GROWING FOCUS ON REDUCING GREENHOUSE EMISSIONS TO DRIVE MARKET

- 10.3 HYDROGEN FUEL

- 10.3.1 RISE IN GOVERNMENT INVESTMENTS IN HYDROGEN TECHNOLOGIES AND INFRASTRUCTURE TO DRIVE MARKET

- 10.4 POWER-TO-LIQUID (PTL)

- 10.4.1 NEED FOR INCREASED DEEP DECARBONIZATION POTENTIAL TO DRIVE MARKET

- 10.5 GAS-TO-LIQUID (GTL)

- 10.5.1 NEED FOR IMPROVED COMBUSTION EFFICIENCY AND LOW PARTICULATE EMISSIONS TO DRIVE MARKET

11 SUSTAINABLE AVIATION FUEL MARKET, BY AIRCRAFT TYPE

- 11.1 INTRODUCTION

- 11.2 COMMERCIAL AVIATION

- 11.2.1 GROWING E-COMMERCE INDUSTRY AND GLOBAL AIR TRAVEL DEMAND TO DRIVE GROWTH

- 11.2.2 NARROW-BODY AIRCRAFT

- 11.2.3 WIDE-BODY AIRCRAFT

- 11.2.4 REGIONAL TRANSPORT AIRCRAFT

- 11.3 BUSINESS & GENERAL AVIATION

- 11.3.1 EMPHASIS ON CORPORATE SOCIAL RESPONSIBILITY AND HIGH FOCUS ON SUSTAINABILITY TO DRIVE SEGMENT

- 11.3.2 BUSINESS JET

- 11.3.3 LIGHT AIRCRAFT

- 11.3.4 COMMERCIAL HELICOPTER

- 11.4 MILITARY AVIATION

- 11.4.1 HIGH OPERATIONAL DEMAND FOR DIVERSE RANGE OF MISSIONS TO DRIVE SEGMENT

- 11.4.2 FIGHTER AIRCRAFT

- 11.4.3 TRANSPORT AIRCRAFT

- 11.4.4 SPECIAL MISSION AIRCRAFT

- 11.4.5 MILITARY HELICOPTER

- 11.5 UNMANNED AERIAL VEHICLE

- 11.5.1 GROWING FOCUS ON REDUCING ENVIRONMENTAL IMPACT OF PERSISTENT SURVEILLANCE AND INTELLIGENCE MISSIONS TO DRIVE MARKET

12 SUSTAINABLE AVIATION FUEL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 US

- 12.2.2.1 Leveraging federal policy, strategic partnerships, and domestic resources to drive growth

- 12.2.3 CANADA

- 12.2.3.1 Leveraging clean fuel regulations and renewable resources to drive growth

- 12.3 ASIA PACIFIC

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 INDIA

- 12.3.2.1 Need for harnessing indigenous innovation and agricultural abundance to drive growth

- 12.3.3 AUSTRALIA

- 12.3.3.1 Need for leveraging agricultural strengths and technological innovation to drive growth

- 12.3.4 SOUTH KOREA

- 12.3.4.1 Harnessing technological advancements and strategic partnerships to drive growth

- 12.3.5 JAPAN

- 12.3.5.1 Focus on pioneering innovation and policy support to drive growth

- 12.3.6 CHINA

- 12.3.6.1 Emphasis on catalyzing innovation and strategic partnerships to drive growth

- 12.3.7 SINGAPORE

- 12.3.7.1 Global innovation in SAF and need for sustainability through strategic collaborations to drive growth

- 12.3.8 REST OF ASIA PACIFIC

- 12.4 EUROPE

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 GERMANY

- 12.4.2.1 Need for scaling national policy and innovation ecosystems to drive growth

- 12.4.3 UK

- 12.4.3.1 Advancing domestic production, policy support, and feedstock innovation to drive growth

- 12.4.4 FRANCE

- 12.4.4.1 Focus on implementing regulatory targets and industrial integration to drive growth

- 12.4.5 DENMARK

- 12.4.5.1 Need for scaling power-to-liquid pathways and national mandates to drive growth

- 12.4.6 FINLAND

- 12.4.6.1 Demand for harnessing bio-refinery innovation and policy alignment to drive growth

- 12.4.7 REST OF EUROPE

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 UAE

- 12.5.2.1 'Vision 2030' and strategic partnerships to drive growth

- 12.5.3 BAHRAIN

- 12.5.3.1 Government's commitment to sustainability to drive growth

- 12.5.4 QATAR

- 12.5.4.1 Strategic initiatives and collaborations to drive growth

- 12.6 LATIN AMERICA

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 BRAZIL

- 12.6.2.1 Focus on leveraging biofuel expertise to drive growth

- 12.6.3 MEXICO

- 12.6.3.1 Need for harnessing agricultural strength to drive growth

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Blending capacity footprint

- 13.5.5.3 Biofuel conversion pathway footprint

- 13.5.5.4 End user footprint

- 13.5.5.5 Region footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 NESTE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 TOTALENERGIES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 WORLD ENERGY, LLC

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ENI S.P.A

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 OMV AKTIENGESELLSCHAFT

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SHELL INTERNATIONAL B.V.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.7 LANZATECH

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions offered

- 14.1.7.3 Recent developments

- 14.1.8 GEVO

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions offered

- 14.1.8.3 Recent developments

- 14.1.9 VELOCYS LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions offered

- 14.1.9.3 Recent developments

- 14.1.10 NORTHWEST ADVANCED BIO-FUELS, LLC

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Other developments

- 14.1.11 SKYNRG B.V.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions offered

- 14.1.11.3 Recent developments

- 14.1.12 TOPSOE A/S

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions offered

- 14.1.12.3 Recent developments

- 14.1.13 AEMETIS, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions offered

- 14.1.13.3 Recent developments

- 14.1.14 WORLD KINECT CORPORATION

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Other developments

- 14.1.15 PHILLIPS 66 COMPANY

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Other developments

- 14.1.16 ALDER ENERGY, LLC

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Other developments

- 14.1.17 MOEVE

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Other developments

- 14.1.18 PREEM AB

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Other developments

- 14.1.19 BP P.L.C.

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Other developments

- 14.1.20 REPSOL

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions offered

- 14.1.20.3 Recent developments

- 14.1.1 NESTE

- 14.2 OTHER PLAYERS

- 14.2.1 ATMOSFAIR GMBH

- 14.2.2 SAF PLUS INTERNATIONAL GROUP

- 14.2.3 CEMVITA

- 14.2.4 DG FUELS, LLC

- 14.2.5 WASTEFUEL

- 14.2.6 RED ROCK BIOFUELS

- 14.2.7 AIR COMPANY HOLDINGS INC

- 14.2.8 DIMENSIONAL ENERGY

- 14.2.9 VIRENT, INC.

- 14.2.10 SGP BIOENERGY HOLDINGS, LLC

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 ANNEXURE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS