|

|

市場調査レポート

商品コード

1558956

サステナブルタイヤの世界市場:材料タイプ別、推進タイプ別、構造別、車両タイプ別、地域別 - 予測(~2029年)Sustainable Tire Market by Material Type (Rubber, Sustainable Carbon Black, Silica), Propulsion Type (Internal Combustion Engine, Electric Vehicles), Structure (Radial, Bias), Vehicle (Passenger, Commercial), & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| サステナブルタイヤの世界市場:材料タイプ別、推進タイプ別、構造別、車両タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年09月16日

発行: MarketsandMarkets

ページ情報: 英文 225 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

サステナブルタイヤの市場規模は、2024年の1億2,000万米ドルから、予測期間中はCAGR 27.3%で推移し、2029年には3億9,000万米ドルに達すると予測されています。

タイヤは非生分解性であると同時に、その不適切な管理に多くの環境問題が潜んでいます。このため、EPRの遵守が非常に重要になっています。EPRは、地方自治体の廃棄物管理部門の負担を軽減し、環境に配慮した取り組みを奨励・促進するものです。さらに、世界のカーボンニュートラルという目標は、グリーンタイヤ素材の動きをさらに刺激すると思われます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル), 数量 (キロトン) |

| セグメント | 材料タイプ・推進タイプ・車両タイプ・構造・販売チャネル・地域別 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

"2023年、材料タイプ別ではシリカが数量ベースで最大の市場シェアを占める"

シリカは、タイヤ性能の向上と環境負荷の低減に役立つため、サステナブルタイヤ市場において最大の規模を維持すると予想されます。シリカはタイヤ、より具体的にはエネルギー効率の高いグリーンタイヤの生産に不可欠な成分のひとつであり、転がり抵抗を大幅に低減し、燃料消費量を削減し、CO2排出量を削減します。シリカは厳しい規制要件とグリーン製品に対する消費者の要求の両方を達成するための重要な材料のひとつです。

"電気自動車は予測期間中、金額ベースで2番目に大きな推進タイプになると予想される"

政府と消費者が持続可能性と二酸化炭素削減への関心を高める中で、EVの普及率も高まっており、EVの特殊な特性に最適な特殊タイヤが求められています。EVは従来の内燃機関車に比べてトルクと重量が大きいため、最高のバッテリー性能を発揮するために転がり抵抗の低いタイヤが必要になりますが、内燃機関車用タイヤよりも耐摩耗性が高く、ハンドリングに優れている必要があります。このため、性能要件を満たすのに不可欠な、先進シリカやサステイナブルカーボンブラックなどのタイヤ材料の開発が進んでいます。

"乗用車は予測期間中、金額ベースで2番目に大きな車両タイプになると予想される"

乗用車は走行台数が多く、グリーン製品に対する消費者の需要が高まっていることから、乗用車の部門が金額ベースで2番目に大きな車両タイプになると予想されます。世界の自動車市場はグリーン化を続けており、乗用車メーカーとタイヤメーカーは持続可能な素材を製品に含めることにますます力を入れています。また、消費者の間でも乗用車用エコタイヤへの需要が高まっています。通常、こうしたタイヤは転がり抵抗を減らして燃費を向上させる先進素材で作られているため、二酸化炭素の排出量が少ないです。消費者が環境への関心は自動車にもおよび、需要が高まる見通しです。また、規制当局の圧力や政府のグリーン技術へのインセンティブによっても乗用車部門におけるサステナブルタイヤ材料の価値が高まっています。

当レポートでは、世界のサステナブルタイヤの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サステナブルタイヤ材料市場における生成AIの影響

- 業界動向

- 顧客の事業に影響を与える動向/ディスラプション

- サプライチェーン分析

- 投資情勢と資金調達シナリオ

- 価格分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済見通し

- ケーススタディ分析

第6章 サステナブルタイヤ材料市場:材料タイプ別

- ゴム

- サステナブルカーボンブラック

- シリカ

- その他

- バイオベースオイル

- リサイクルポリエステル&ナイロン

- リグニン

第7章 サステナブルタイヤ材料市場:推進タイプ別

- 内燃機関車

- 電気自動車

第8章 サステナブルタイヤ材料市場:車両タイプ別

- 乗用車

- 商用車

第9章 サステナブルタイヤ材料市場:構造別

- ラジアル

- バイアス

第10章 サステナブルタイヤ材料市場:販売チャネル別

- OEM

- アフターマーケット

第11章 サステナブルタイヤ材料市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第12章 競合情勢

- 主要企業の戦略/有力企業

- 市場シェア分析

- 収益分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- EVONIK INDUSTRIES AG

- SOLVAY

- BIRLA CARBON

- ORION

- GRP LTD.

- GENAN HOLDING A/S

- LEHIGH TECHNOLOGIES, INC.

- CABOT CORPORATION

- PPG INDUSTRIES, INC.

- JIANGXI BLACK CAT CARBON BLACK CO., LTD.

- その他の企業

- LDC CO., LTD.

- MONOLITH INC.

- CONTEC

- BLACK BEAR CARBON B.V.

- SNR RECLAMATIONS PVT. LTD.

- CAPITAL CARBON

- PYRUM INNOVATIONS AG

- ORIGIN MATERIALS

- TINNA RUBBER & INFRASTRUCTURE LTD.

- HI-GREEN CARBON LTD.

- SAPPHIRE RECLAIM RUBBER PVT. LTD.

- ENVIGAS

- TOKAI CARBON CB LTD.

第14章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF SUSTAINABLE TIRE MATERIALS, BY REGION, 2020-2023 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY MATERIAL TYPE, 2020-2023 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE, 2020-2023 (USD/KG)

- TABLE 4 SUSTAINABLE TIRE MATERIALS MARKET: ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN SUSTAINABLE TIRE MATERIALS MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN SUSTAINABLE TIRE MATERIALS MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN SUSTAINABLE TIRE MATERIALS MARKET

- TABLE 8 SUSTAINABLE TIRE MATERIALS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 SUSTAINABLE TIRE MATERIALS MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 SUSTAINABLE TIRE MATERIALS MARKET: LIST OF MAJOR PATENTS, 2022-2024

- TABLE 11 SUSTAINABLE TIRE MATERIALS MARKET: LIST OF KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 12 TARIFF RELATED TO SUSTAINABLE TIRE MATERIALS MARKET

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LIST OF REGULATIONS FOR SUSTAINABLE TIRE MATERIALS

- TABLE 19 SUSTAINABLE TIRE MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PROPULSION TYPES

- TABLE 21 KEY BUYING CRITERIA FOR PROPULSION TYPES

- TABLE 22 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018-2025

- TABLE 23 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 24 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 25 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 26 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 27 SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 28 SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 29 SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 30 SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 31 SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 32 SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 33 SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 34 SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 35 SUSTAINABLE TIRE MATERIALS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 SUSTAINABLE TIRE MATERIALS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 SUSTAINABLE TIRE MATERIALS MARKET, BY REGION, 2020-2023 (TON)

- TABLE 38 SUSTAINABLE TIRE MATERIALS MARKET, BY REGION, 2024-2029 (TON)

- TABLE 39 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 40 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 41 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 42 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (TON)

- TABLE 43 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 44 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 45 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 46 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 47 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 48 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 49 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 51 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 52 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 55 CHINA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 56 CHINA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 57 JAPAN: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 58 JAPAN: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 59 INDIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 60 INDIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 61 SOUTH KOREA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 62 SOUTH KOREA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 68 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (TON)

- TABLE 69 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 71 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 72 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 73 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 81 US: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 82 US: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 83 CANADA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 84 CANADA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 85 MEXICO: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 86 MEXICO: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 87 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 90 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (TON)

- TABLE 91 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 94 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 95 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 96 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 97 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 98 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 100 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 101 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 102 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 103 GERMANY: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 104 GERMANY: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 105 ITALY: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 106 ITALY: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 107 FRANCE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 108 FRANCE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 109 UK: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 110 UK: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 111 SPAIN: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 112 SPAIN: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 113 RUSSIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 114 RUSSIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 115 REST OF EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 116 REST OF EUROPE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 120 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (TON)

- TABLE 121 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 124 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 125 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 133 SAUDI ARABIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 134 SAUDI ARABIA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 135 UAE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 136 UAE: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 137 REST OF GCC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 138 REST OF GCC: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 139 SOUTH AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 140 SOUTH AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 143 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 144 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 145 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 146 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY COUNTRY, 2024-2029 (TON)

- TABLE 147 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (USD MILLION)

- TABLE 148 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (USD MILLION)

- TABLE 149 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2020-2023 (TON)

- TABLE 150 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE, 2024-2029 (TON)

- TABLE 151 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2020-2023 (USD MILLION)

- TABLE 152 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE, 2024-2029 (USD MILLION)

- TABLE 153 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2020-2023 (USD MILLION)

- TABLE 154 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE, 2024-2029 (USD MILLION)

- TABLE 155 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 156 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 157 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 158 SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 159 BRAZIL: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 160 BRAZIL: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 161 ARGENTINA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 162 ARGENTINA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2020-2023 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE, 2024-2029 (USD MILLION)

- TABLE 165 OVERVIEW OF STRATEGIES ADOPTED BY KEY SUSTAINABLE TIRE MATERIALS MANUFACTURERS

- TABLE 166 SUSTAINABLE TIRE MATERIALS MARKET: DEGREE OF COMPETITION

- TABLE 167 SUSTAINABLE TIRE MATERIALS MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 168 SUSTAINABLE TIRE MATERIALS MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 169 SUSTAINABLE TIRE MATERIALS MARKET: PROPULSION TYPE FOOTPRINT

- TABLE 170 SUSTAINABLE TIRE MATERIALS MARKET: REGION FOOTPRINT

- TABLE 171 SUSTAINABLE TIRE MATERIALS MARKET: KEY STARTUPS/SMES

- TABLE 172 SUSTAINABLE TIRE MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 173 SUSTAINABLE TIRE MATERIALS MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 174 SUSTAINABLE TIRE MATERIALS MARKET: DEALS, JANUARY 2020-JULY 2024

- TABLE 175 SUSTAINABLE TIRE MATERIALS MARKET: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 176 SUSTAINABLE TIRE MATERIALS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2024

- TABLE 177 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 178 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 EVONIK INDUSTRIES AG: DEALS, JANUARY 2020-JULY 2024

- TABLE 180 EVONIK INDUSTRIES AG: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 181 EVONIK INDUSTRIES AG: OTHERS, JANUARY 2020-JULY 2024

- TABLE 182 SOLVAY: COMPANY OVERVIEW

- TABLE 183 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 SOLVAY: DEALS, JANUARY 2020-JULY 2024

- TABLE 185 SOLVAY: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 186 SOLVAY: OTHERS, JANUARY 2020-JULY 2024

- TABLE 187 BIRLA CARBON: COMPANY OVERVIEW

- TABLE 188 BIRLA CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 BIRLA CARBON: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 190 BIRLA CARBON: DEALS, JANUARY 2020-JULY 2024

- TABLE 191 BIRLA CARBON: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 192 BIRLA CARBON: OTHERS, JANUARY 2020-JULY 2024

- TABLE 193 ORION: COMPANY OVERVIEW

- TABLE 194 ORION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ORION: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 196 ORION: DEALS, JANUARY 2020-JULY 2024

- TABLE 197 ORION: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 198 ORION: OTHERS, JANUARY 2020-JULY 2024

- TABLE 199 GRP LTD.: COMPANY OVERVIEW

- TABLE 200 GRP LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 GENAN HOLDING A/S: COMPANY OVERVIEW

- TABLE 202 GENAN HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 GENAN HOLDING A/S: OTHERS, JANUARY 2020-JULY 2024

- TABLE 204 LEHIGH TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 205 LEHIGH TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 207 CABOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 CABOT CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 209 CABOT CORPORATION: DEALS, JANUARY 2020-JULY 2024

- TABLE 210 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 211 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 PPG INDUSTRIES, INC.: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 213 JIANGXI BLACK CAT CARBON BLACK CO., LTD.: COMPANY OVERVIEW

- TABLE 214 JIANGXI BLACK CAT CARBON BLACK CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 LDC CO., LTD.: COMPANY OVERVIEW

- TABLE 216 MONOLITH INC.: COMPANY OVERVIEW

- TABLE 217 CONTEC: COMPANY OVERVIEW

- TABLE 218 BLACK BEAR CARBON B.V.: COMPANY OVERVIEW

- TABLE 219 SNR RECLAMATIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 220 CAPITAL CARBON: COMPANY OVERVIEW

- TABLE 221 PYRUM INNOVATIONS AG: COMPANY OVERVIEW

- TABLE 222 ORIGIN MATERIALS: COMPANY OVERVIEW

- TABLE 223 TINNA RUBBER & INFRASTRUCTURE LTD.: COMPANY OVERVIEW

- TABLE 224 HI-GREEN CARBON LTD.: COMPANY OVERVIEW

- TABLE 225 SAPPHIRE RECLAIM RUBBER PVT. LTD.: COMPANY OVERVIEW

- TABLE 226 ENVIGAS: COMPANY OVERVIEW

- TABLE 227 TOKAI CARBON CB LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SUSTAINABLE TIRE MATERIALS MARKET SEGMENTATION

- FIGURE 2 SUSTAINABLE TIRE MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 SUSTAINABLE TIRE MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 8 RUBBER MATERIAL TYPE SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2029

- FIGURE 9 INTERNAL COMBUSTION ENGINE VEHICLE PROPULSION TYPE TO LEAD MARKET BETWEEN 2024 AND 2029

- FIGURE 10 RADIAL STRUCTURE SEGMENT TO LEAD MARKET BETWEEN 2024 AND 2029

- FIGURE 11 COMMERCIAL VEHICLE TYPE SEGMENT TO LEAD MARKET BETWEEN 2024 AND 2029

- FIGURE 12 OEM SALES CHANNEL SEGMENT TO LEAD MARKET BETWEEN 2024 AND 2029

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 INCREASING NUMBER OF ECO-FRIENDLY TIRE SOLUTIONS, ENVIRONMENTAL REGULATIONS, AND CONSUMER AWARENESS TO DRIVE MARKET

- FIGURE 15 RUBBER TO BE FASTEST-GROWING MATERIAL TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 COMMERCIAL VEHICLES TO BE FASTER-GROWING VEHICLE TYPE DURING FORECAST PERIOD

- FIGURE 17 ELECTRIC VEHICLES TO BE FASTER-GROWING PROPULSION TYPE DURING FORECAST PERIOD

- FIGURE 18 RADIAL TO BE FASTER-GROWING STRUCTURE SEGMENT DURING FORECAST PERIOD

- FIGURE 19 OEMS TO BE FASTER-GROWING SALES CHANNEL DURING FORECAST PERIOD

- FIGURE 20 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SUSTAINABLE TIRE MATERIALS MARKET

- FIGURE 22 CHEMICAL COMPANIES EMBRACING AI ACROSS VARIOUS BUSINESS AREAS

- FIGURE 23 USE OF GENERATIVE AI IN SUSTAINABLE TIRE MATERIALS MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 OVERVIEW OF SUSTAINABLE TIRE MATERIALS MARKET VALUE CHAIN

- FIGURE 26 INVESTMENT & FUNDING SCENARIO: SUSTAINABLE TIRE MATERIALS MARKET

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SUSTAINABLE TIRE MATERIALS, BY REGION

- FIGURE 28 SUSTAINABLE TIRE MATERIALS MARKET: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE

- FIGURE 29 NUMBER OF PATENTS GRANTED, 2014-2023

- FIGURE 30 SUSTAINABLE TIRE MATERIALS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 31 PATENT ANALYSIS FOR SUSTAINABLE TIRE MATERIALS, BY JURISDICTION, 2014-2023

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 33 IMPORTS OF HS CODE 400110- COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 34 EXPORTS OF IMPORTS OF HS CODE 400110- COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS: SUSTAINABLE TIRE MATERIALS MARKET

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PROPULSION TYPES

- FIGURE 37 KEY BUYING CRITERIA FOR PROPULSION TYPES

- FIGURE 38 RUBBER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 INTERNAL COMBUSTION ENGINE VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 COMMERCIAL VEHICLES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 41 RADIAL STRUCTURE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 OEMS SALES CHANNEL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: SUSTAINABLE TIRE MATERIALS MARKET SNAPSHOT

- FIGURE 45 NORTH AMERICA: SUSTAINABLE TIRE MATERIALS MARKET SNAPSHOT

- FIGURE 46 EUROPE: SUSTAINABLE TIRE MATERIALS MARKET SNAPSHOT

- FIGURE 47 SUSTAINABLE TIRE MATERIALS MARKET: SHARE OF KEY PLAYERS

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 49 SUSTAINABLE TIRE MATERIALS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 SUSTAINABLE TIRE MATERIALS MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 51 SUSTAINABLE TIRE MATERIALS MARKET: OVERALL COMPANY FOOTPRINT

- FIGURE 52 SUSTAINABLE TIRE MATERIALS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2023

- FIGURE 53 EV/EBITDA OF KEY VENDORS

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 55 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 56 SOLVAY: COMPANY SNAPSHOT

- FIGURE 57 BIRLA CARBON: COMPANY SNAPSHOT

- FIGURE 58 ORION: COMPANY SNAPSHOT

- FIGURE 59 GRP LTD.: COMPANY SNAPSHOT

- FIGURE 60 GENAN HOLDING A/S: COMPANY SNAPSHOT

- FIGURE 61 LEHIGH TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 62 CABOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 64 JIANGXI BLACK CAT CARBON BLACK CO., LTD.: COMPANY SNAPSHOT

The sustainable tire market is USD 0.12 billion in 2024 and is projected to reach USD 0.39 billion by 2029, at a CAGR of 27.3%. Tires are non-biodegradable and at the same time have a number of environmental problems lying in their improper management. This makes the adherence to EPR very crucial. EPR is basically a framework policy advancing the notion that the producer is responsible for the product 'from cradle to grave', related to proper waste management and disposal. It encourages and promotes green practices with reduced burden on the waste management departments of local governments. Moreover, the ambition of global carbon neutrality will further inspire the movement of green tire materials. The 2015 Paris Agreement has the objective of keeping the increase in global average temperature well below 2°C, while trying to limit it to net-zero emissions. Here, the European Union has set an objective to be climate-neutral by 2050 and was for the first time, as cited in the European Climate Law. Net zero emissions no later than 2070 was pledged in India. Not later than in 2050, the United States committed to net-zero emissions from its operations through the newly launched Net-Zero Government Initiative at COP26. Other drivers include the corporate sustenance initiatives that push for the use of sustenance tire materials, whereby several companies set very aggressive goals in the general strategies intended to reduce their footprints. For example, the ambition set by Apollo Tires is carbon neutrality by 2050, with interim targets in place; LPWA intends to ensure a reduction in emission intensity by 25% through Scope 1 and Scope 2 by 2026 against the 2020 baseline.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion / Million), Volume (Kiloton) |

| Segments | Material Type, Propulsion Type, Vehicle Type, Structure, Sales Channel, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America, |

Goodyear Tire & Rubber Company targets to deliver 100% sustainable materials and maintenance-free tires by 2030, thus making a commitment to drive a sea change in manufacturing and sustainability processes related to tire manufacturing. CEAT is also working towards halving its environmental footprint by 30% come 2030, majorly focusing on sustainable production practices and reducing carbon footprint. These, therefore, are the great drivers in demand for innovation toward environmentally friendly solutions in the sustainable tire market. Advanced tire materials are now being developed to help companies realize their targets of becoming carbon-neutral and improve their environmental performance, thus underscoring growth in the sustainable tire market.

"Silica, by material type, accounts for the largest market share in terms of volume in 2023."

Silica is expected to retain the largest volume in the sustainable tire market because it helps improve tire performance and reduces environmental impact. Silica has been one of the essential components in the production of tires-more specifically, energy-efficient "green tires"-reducing rolling resistance drastically and hence fuel consumption, with resultant lower CO2 emissions. It thus earmarks silica as one of the key materials in the achievement of both strict regulatory requirements and consumer demand for "green" products. Silica started gaining dominance because of the wide reach of HDS technology in the marketplace. HDS technology, with finer dispersion within the rubber matrix, lends improved tire performance in terms of grip, durability, and overall efficiency. This is where the many tire property improvements in relation to wet traction and wear resistance-without performance trade-offs-make silica quite indispensable in the goal of tire manufacturers striving to come up with high-performance, sustainable tires.

This will undoubtedly increase the demand for silica in tire manufacturing, cementing its place as the largest material by volume in the sustainable tire market.

"Electric Vehicles is expected to be the second largest propulsion type for sustainable tire market during the forecast period, in terms of value."

EVs will represent the second-largest propulsion type by value in the sustainable tire market, as the world is accelerating toward electrification and EVs present special needs to tires. While governments and consumers raise their focus on sustainability and carbon reduction, so does the adoption rate of EVs demanding special tires that would work best with the peculiar characteristics of these vehicles. EVs will need lower rolling resistance tires to achieve the best battery performance but be more resistant and have better handling than ICE vehicle tires because of the higher torque and weight of an EV compared to traditional ICE vehicle applications. This is leading to increasing development of tire materials such as advanced silica and sustainable carbon black, critical to meet performance requirement demands. As the EV market grows, so will the value contribution associated with the sustainable tire tailored for such electric vehicles, placing EVs second in value contribution within the propulsion type segment of the sustainable tire market.

"Passenger Vehicles is expected to be the second largest vehicle type for sustainable tire market during the forecast period, in terms of value."

With high volumes of passenger vehicles on the road and growing consumer demand for green products, it is expected that passenger vehicles will be the second-biggest type of vehicle by value in the sustainable tire market. The global automotive market continues to turn green, and passenger vehicle manufacturers and tire makers are increasingly focusing on including sustainable materials in their products. The demands for eco-friendly tires in passenger cars have also been on the rise among consumers. Normally, such tires are made with advanced material that reduces the rolling resistance and enhances fuel efficiency; therefore, they release less carbon. As consumers emerge wanting to align value concerns on the environment with vehicles, this segment is bound to experience heightened demand for materials that make sustainable tires. Besides, there are manufacturers who have been forced by regulatory pressure as well as government incentives towards green technologies to inculcate sustainability into their processes hence making tire materials more valuable in the passenger car market that are sustainable. Already a trendsetter when it comes to electric and hybrid pass automobile segments where other than standard compounds are required making it certainly possible for these figures to sharply rise.

"Bias tires are expected to be the second largest structure for sustainable tire market during the forecast period, in terms of value."

The bias tires segment is projected to continue holding the second-largest value share of the sustainable tire market, due to its wide applications in some vehicle segments. Though radials dominate the market, bias tires have an extremely solid nature under harsh conditions-where there is a question of critical durability, puncture resistance, and loads. The situation is usable in the agricultural, construction, and some of the commercial cars sectors. Bias tires have a number of layers of fabric laid at an angle to one another to achieve a cross-ply structure, thus providing extraordinary sidewall strength for this tire to work under very coarse conditions with heavy loads. With sectors like agriculture and construction growing and leaning more towards green solutions, demands for green materials in bias tires grow too.

"Aftermarket are expected to be the second largest sales channel for sustainable tire market during the forecast period, in terms of value."

By sales channel, the aftermarket is likely to occupy the second-largest value share in the sustainable tire market. This may be attributed to the rise in demand for environmentally sustainable and high-performance replacement tires. The preference toward green tire options rises as consumers and businesses replace worn-out tires and develop a sense of responsibility toward their environment. One trend in these areas with strict environmental regulations is that the practiced sustainability is not because people there prefer it but sometimes even are required to. Contrarily, automotive owners have always looked out for pocket-friendly and durable tire solutions while wanting to be environmentally responsible in the aftermarket. Such sustainable tire as low rolling resistance rubber compounds or eco-friendly silica attract indeed a wide range of customers who wish to reduce their fuel use and carbon emissions. Moreover, its variance in this segment by different types of cars that are needing different types of tires marks a significant route for sustainable tire. The manufacturers make a range of the green tire for fulfilling the new market demand for the aftermarket. Development in this region for sustainable tire comes out of a compliance approach that emphasizes enhancing the longevity of the tire lifecycle, vehicle performance, and emission regulation; therefore, it is becoming a critical aftermarket segment.

"Based on region, North America was the second largest market for sustainable adhesives in 2023."

North America is the second-largest region in the sustainable tire market, owing to a number of contributing factors. Robust growth in the automotive industry, coupled with rising environmental regulations, drives the demand for sustainable tire. In the U.S. and Canada, the mounting pressure from government departments on auto-manufacturers and tire manufacturers to cut down CO2 emissions and enhance fuel efficiency has compelled companies to switch to sustainable materials in tire manufacturing. In addition, North America comprises major tire manufacturers and automobile companies investing a huge amount in research and development to attain sustainability goals, such as minimizing not only environmental impacts of products but also innovating for better tire performance, durability, and safety with sustainable materials like silica, bio-based rubber, and recycled carbon black. The well-established infrastructure of the region in terms of automotive production, coupled with high consumer awareness and demand for eco-friendly products, further strengthens this market. In view of tightening regulations and growing consumer preference for 'green' products, the contribution or role of North America in the global sustainable tire market can hardly be low.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-Level - 25%, Director Level - 15%, and Others - 60%

- By Region: North America - 25%, Europe -35%, Asia Pacific - 30%, Middle East & Africa - 5%, and South America-5%

The key players in this market are Evonik Industries AG (Germany), Solvay (Belgium), Cabot Corporation (US), Birla Carbon (India), Orion (Luxembourg), GRP LTD (India), GENAN HOLDING A/S (Denmark), Lehigh Technologies, Inc., (US), PPG Industries, Inc. (US), Jiangxi black cat carbon black Co., Ltd (China) etc.

Research Coverage

This report segments the market for the sustainable adhesives market on the basis of material type, vehicle type, propulsion type, structure, sales channel and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and partnerhsips associated with the market for the sustainable tire market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the sustainable tire market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: Stricter environmental regulations and carbon neutrality goals along with corporate sustainability goals.

- Market Penetration: Comprehensive information on the sustainable tire market offered by top players in the global sustainable tire market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the sustainable tire market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the sustainable tire across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global sustainable tire market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the sustainable tire market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key primary participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

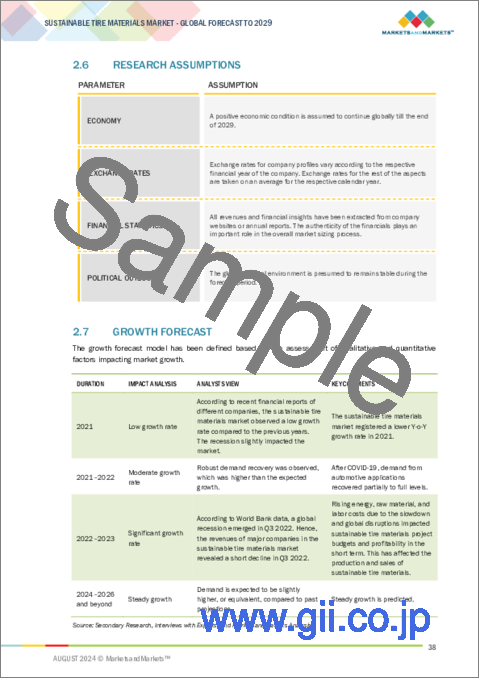

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUSTAINABLE TIRE MATERIALS MARKET

- 4.2 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE

- 4.3 SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE

- 4.4 SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE

- 4.5 SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE

- 4.6 SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL

- 4.7 SUSTAINABLE TIRE MATERIALS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stricter environmental regulations and carbon neutrality goals

- 5.2.1.2 Corporate sustainability goals

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited raw material availability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising consumer awareness along with government support and incentives

- 5.2.4 CHALLENGES

- 5.2.4.1 High production costs

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON SUSTAINABLE TIRE MATERIALS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 TRANSFORMATIVE IMPACT OF GENERATIVE AI ON SUSTAINABLE TIRE MATERIALS MARKET

- 5.4 INDUSTRY TRENDS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 SUPPLY CHAIN ANALYSIS

RAW MATERIAL SUPPLIERS

PROCESSING & REFINEMENT

MANUFACTURERS

DISTRIBUTION & LOGISTICS

END-OF-LIFE MANAGEMENT

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8.2 AVERAGE SELLING PRICE TREND, BY MATERIAL TYPE

- 5.8.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS GRANTED WORLDWIDE, 2014-2023

- 5.11.3 PATENT PUBLICATION TRENDS

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS OF PATENTS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP COMPANIES/APPLICANTS

- 5.11.8 LIST OF MAJOR PATENTS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO FOR HS CODE 400110

- 5.12.2 EXPORT SCENARIO FOR HS CODE 400110

- 5.13 KEY CONFERENCES AND EVENTS

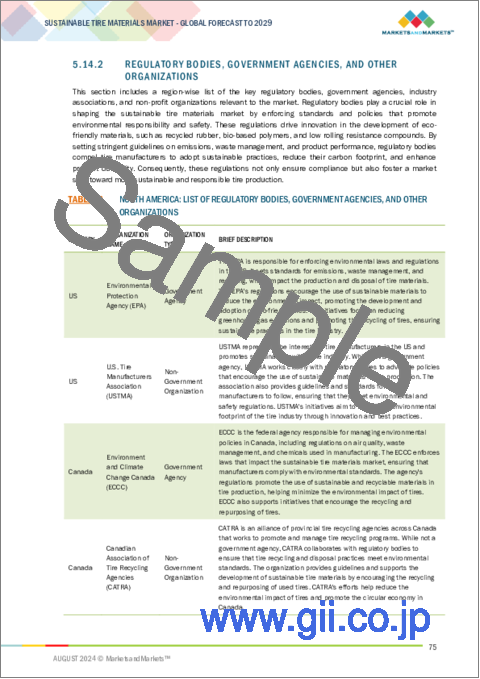

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF AND REGULATIONS RELATED TO SUSTAINABLE TIRE MATERIALS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATIONS RELATED TO SUSTAINABLE TIRE MATERIALS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 THREAT OF NEW ENTRANTS

- 5.15.3 THREAT OF SUBSTITUTES

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 INNOVATIVE PYROLYSIS FOR SUSTAINABLE TIRE PRODUCTION: CONTEC'S RECOVERED CARBON BLACK REVOLUTION

- 5.18.2 REVOLUTIONIZING TIRE TECHNOLOGY: EVONIK'S SILICA/SILANE- SYSTEM FOR HIGH-PERFORMANCE GREEN TIRESGRA

- 5.18.3 TRANSFORMING TIRE DISPOSAL: SUSTAINABLE APPROACH TO END-OF-LIFE TIRES IN MEXICO

6 SUSTAINABLE TIRE MATERIALS MARKET, BY MATERIAL TYPE

- 6.1 INTRODUCTION

- 6.2 RUBBER

- 6.2.1 LOWER CARBON EMISSIONS, AND UTILIZATION OF RENEWABLE RESOURCES TO DRIVE MARKET

- 6.3 SUSTAINABLE CARBON BLACK

- 6.3.1 DURABILITY, AND RESISTANCE TO WEAR AND UV DEGRADATION TO PROPEL MARKET

- 6.4 SILICA

- 6.4.1 LOWER ENVIRONMENTAL IMPACT AND ENHANCED TIRE PERFORMANCE TO BOOST MARKET

- 6.5 OTHER MATERIAL TYPES

- 6.5.1 BIO-BASED OILS

- 6.5.2 RECYCLED POLYESTER & NYLON

- 6.5.3 LIGNIN

7 SUSTAINABLE TIRE MATERIALS MARKET, BY PROPULSION TYPE

- 7.1 INTRODUCTION

- 7.2 INTERNAL COMBUSTION ENGINE VEHICLES

- 7.2.1 REDUCED USE OF NON-RENEWABLE RESOURCES AND MINIMAL ENVIRONMENTAL FOOTPRINT TO DRIVE MARKET

- 7.3 ELECTRIC VEHICLES

- 7.3.1 MEETING SPECIFIC REQUIREMENTS AND ENVIRONMENTAL BENEFITS TO DRIVE MARKET

8 SUSTAINABLE TIRE MATERIALS MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER VEHICLES

- 8.2.1 DEMAND FOR ECO-FRIENDLY SOLUTIONS AND ADHERENCE TO STRINGENT REGULATIONS TO DRIVE MARKET

- 8.3 COMMERCIAL VEHICLES

- 8.3.1 MEETING DEMANDING PERFORMANCE REQUIREMENTS WHILE MINIMIZING ENVIRONMENTAL DAMAGE TO BOOST MARKET

9 SUSTAINABLE TIRE MATERIALS MARKET, BY STRUCTURE

- 9.1 INTRODUCTION

- 9.2 RADIAL

- 9.2.1 INCORPORATION OF SUSTAINABLE MATERIALS PROVIDING PERFORMANCE BENEFITS TO DRIVE MARKET

- 9.3 BIAS

- 9.3.1 DEMAND FOR OFF-ROAD AND INDUSTRIAL APPLICATIONS TO BOOST MARKET

10 SUSTAINABLE TIRE MATERIALS MARKET, BY SALES CHANNEL

- 10.1 INTRODUCTION

- 10.2 OEMS

- 10.2.1 INCREASING DEMAND FOR SUSTAINABLE MATERIALS IN VEHICLES TO BOOST MARKET

- 10.3 AFTERMARKET

- 10.3.1 INCREASING CONSUMER AWARENESS AND PREFERENCE FOR ENVIRONMENTALLY FRIENDLY PRODUCTS TO FUEL MARKET GROWTH

11 SUSTAINABLE TIRE MATERIALS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Substantial tire production and sales volume, combined with commitment to lowering emissions, to drive demand

- 11.2.2 JAPAN

- 11.2.2.1 Emphasis of personal and corporate environmental goals for sustainability to boost market

- 11.2.3 INDIA

- 11.2.3.1 Presence of large numbers of tire manufacturers to lead to market growth

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Robust growth in eco-friendly vehicle exports and development of innovative and sustainable tire materials to propel market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Robust tire market and focus on sustainable practices to drive market

- 11.3.2 CANADA

- 11.3.2.1 Implementation of tire recycling programs to responsibly manage and recycle scrap tires to drive market

- 11.3.3 MEXICO

- 11.3.3.1 Growth of automotive and tire industries to propel market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Strong environmental goals and leadership in global automotive industry to propel market

- 11.4.2 ITALY

- 11.4.2.1 Stringent carbon neutrality goals and investments in eco-friendly technologies to drive market

- 11.4.3 FRANCE

- 11.4.3.1 Rise in innovative technologies and significant investments to boost market

- 11.4.4 UK

- 11.4.4.1 Strong automotive sector and emphasis on sustainability and carbon reduction to drive market

- 11.4.5 SPAIN

- 11.4.5.1 Strategic investments in carbon neutrality and robust automotive manufacturing capabilities to boost market

- 11.4.6 RUSSIA

- 11.4.6.1 Increasing domestic tire production and growing automotive sector to support market growth

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 SAUDI ARABIA

- 11.5.1.1 Increase in automobile manufacturing industries and strategic partnerships to propel market

- 11.5.2 UAE

- 11.5.2.1 Shift toward EVs and growing emphasis on reducing carbon emissions to drive market

- 11.5.3 REST OF GCC COUNTRIES

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Investments in technologies enhancing sustainability of tire production to drive market

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.5.1 SAUDI ARABIA

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Significant investments, government incentives, and ambitious climate targets to boost market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growing automotive production and commitment to net-zero emissions drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.5.1 EVONIK INDUSTRIES

- 12.5.2 SOLVAY

- 12.5.3 CABOT CORPORATION

- 12.5.4 BIRLA CARBON

- 12.5.5 ORION

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.6.5.1 Company footprint: Key players

- 12.6.5.2 Material type footprint

- 12.6.5.3 Vehicle type footprint

- 12.6.5.4 Propulsion type footprint

- 12.6.5.5 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES

- 12.7.5.1 Competitive benchmarking of key startups/SMEs

- 12.7.6 VALUATION AND FINANCIAL METRICS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

- 12.8.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 EVONIK INDUSTRIES AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SOLVAY

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 BIRLA CARBON

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.3.4 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 ORION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Others

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 GRP LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 GENAN HOLDING A/S

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Others

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 LEHIGH TECHNOLOGIES, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Right to win

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 CABOT CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 PPG INDUSTRIES, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Expansions

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 JIANGXI BLACK CAT CARBON BLACK CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.10.3.1 Right to win

- 13.1.10.3.2 Strategic choices

- 13.1.10.3.3 Weaknesses and competitive threats

- 13.1.1 EVONIK INDUSTRIES AG

- 13.2 OTHER PLAYERS

- 13.2.1 LDC CO., LTD.

- 13.2.2 MONOLITH INC.

- 13.2.3 CONTEC

- 13.2.4 BLACK BEAR CARBON B.V.

- 13.2.5 SNR RECLAMATIONS PVT. LTD.

- 13.2.6 CAPITAL CARBON

- 13.2.7 PYRUM INNOVATIONS AG

- 13.2.8 ORIGIN MATERIALS

- 13.2.9 TINNA RUBBER & INFRASTRUCTURE LTD.

- 13.2.10 HI-GREEN CARBON LTD.

- 13.2.11 SAPPHIRE RECLAIM RUBBER PVT. LTD.

- 13.2.12 ENVIGAS

- 13.2.13 TOKAI CARBON CB LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS