|

|

市場調査レポート

商品コード

1812620

サステナブル接着剤の世界市場:タイプ別、原材料別、最終用途産業別、地域別 - 予測(~2030年)Sustainable Adhesives Market by Type, Raw Material, End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| サステナブル接着剤の世界市場:タイプ別、原材料別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2025年09月11日

発行: MarketsandMarkets

ページ情報: 英文 303 Pages

納期: 即納可能

|

概要

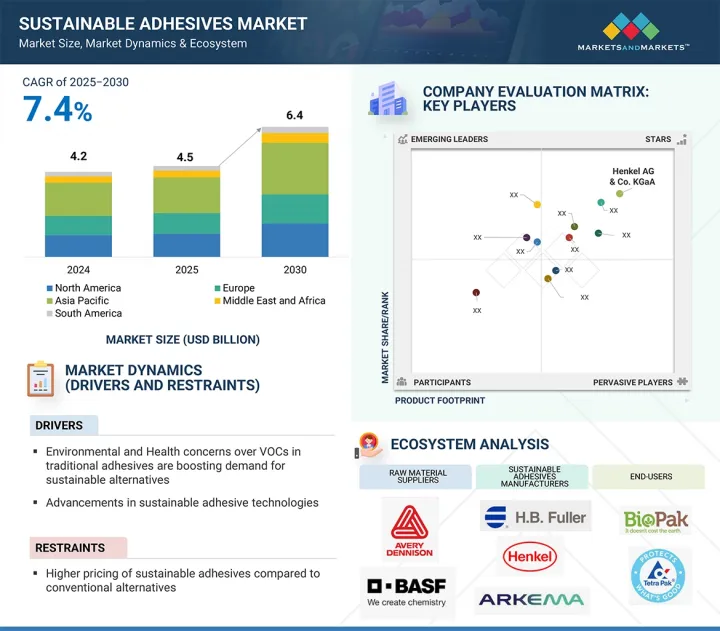

世界のサステナブル接着剤の市場規模は、2025年の45億米ドルから2030年までに64億米ドルに達すると予測され、予測期間にCAGRで7.4%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル、キロトン |

| セグメント | サービス、技術、最終用途産業、地域 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

サステナブル接着剤市場の主な成長促進要因は、従来の接着剤に含まれるVOCがもたらす環境・健康被害に対する意識の高まりです。VOC排出は大気汚染、健康問題、環境リスクの主因であり、産業界はより安全で環境にやさしい代替品を求めるようになっています。このような意識は、欧州のREACHや米国のEPA規制などの、VOCレベルの低減を義務付け、持続可能かつできるかぎり環境にやさしい材料の使用を促進する、各地域の規制枠組みによって後押しされています。技術の進歩により、バイオベースの水性でリサイクル可能な粘着剤の製法が改良され、高い性能を維持しながら、持続可能な粘着剤が容易に適用できるようになっています。

さらに、包装、自動車、建設、家具などの産業は、企業や顧客の持続可能性目標を支持するためにサステナブル接着剤を採用しています。規制圧力、技術の進歩、環境意識の高まりが組み合わさり、インク・接着剤産業では、性能損失のない持続可能なソリューションへのシフトが大幅に加速しており、サステナブル接着剤はあらゆる部門で好まれる選択肢となっています。

「リサイクル可能な接着剤が数量ベースで最大の市場シェアを占めるとみられます。」

リサイクル可能な接着剤は、世界的な循環経済目標に沿い、製品寿命の終わりに材料の分離と回収を容易にする持続可能な接着ソリューションを提供するため、リサイクル可能な接着剤市場で最大のタイプセグメントとなります。これらの接着剤は、使用中に強力な性能を維持する一方で、熱、湿気、化学的トリガーなどの特定の条件下では剥離できるように設計されており、プラスチック、金属、ガラス、紙などの基材の効率的なリサイクルを促進します。厳しい環境規制や企業の持続可能性目標を達成するため、包装産業、電子、自動車部門では、こうした接着剤の採用が増加しています。環境にやさしい製品に対する消費者の需要の高まりは、リサイクル不可能な材料や拡大生産者責任(EPR)プログラムを禁止する政策もあり、その採用を加速させています。さらに、接着剤の製法の進歩により、汎用性、自動製造への適合性、費用対効果が向上し、市場での優位性がさらに高まっています。このような規制の後押し、技術革新、業界の採用の組み合わせが、主導的地位を確実なものにしています。

「水性セグメントが数量ベースでサステナブル接着剤市場における最大の原材料セグメントでした。」

水性原材料は、揮発性有機化合物(VOC)排出が少なく、環境に対する影響が少なく、有害化学品に関する厳しい世界の規制に準拠しているため、サステナブル接着剤市場で最大のシェアを占めると予測されます。これらの接着剤は、溶剤の代わりに水をキャリアとして使用するため、火災の危険性や職場の健康リスクを最小化しながら、メーカーとエンドユーザーの双方にとってより安全なものとなっています。その汎用性により、環境にやさしい接着ソリューションへの需要が急速に高まっている包装、木工、自動車、建設などの多様な産業での応用が可能です。技術の進歩により性能が向上し、溶剤系の代替品に匹敵する耐久性、速い硬化、高い接着強度が実現されています。さらに、環境にやさしい製品に対する消費者の選好の高まりと、企業による持続可能な製造法の採用の増加は、水性接着剤の需要をさらに強化し、サステナブル接着剤市場で好まれる選択肢としています。

「包装が金額ベースでサステナブル接着剤市場でもっとも急成長する最終用途産業セグメントとなります。」

食品・飲料、eコマース、消費財の各部門で環境にやさしいリサイクル可能な包装ソリューションの需要が急増していることから、包装産業はサステナブル接着剤の最終用途部門として急成長すると予測されます。環境規制の高まりや、ブランドのプラスチック廃棄物を削減する取り組みが、紙、段ボール、堆肥化可能なフィルムに適合するバイオベースの水性かつ無溶剤の接着剤製法へとメーカーを後押ししています。さらに、オンライン小売の急成長が、段ボール箱や軟包装向けの強力で軽量かつ持続可能な接着ソリューションへのニーズを促進しています。このシフトは、グリーン包装に対する消費者の選好や、世界的なブランドによる循環型経済原則の採用によってさらに後押しされ、包装用途におけるサステナブル接着剤の使用を加速させています。

当レポートでは、世界のサステナブル接着剤市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- サステナブル接着剤市場の企業にとって魅力的な機会

- サステナブル接着剤市場:タイプ別

- サステナブル接着剤市場:原材料別

- サステナブル接着剤市場:最終用途産業別

- サステナブル接着剤市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サステナブル接着剤市場における生成AIの影響

- イントロダクション

- さまざまな事業分野でAIを導入する化学企業

- サステナブル接着剤市場における生成AIの活用

- サステナブル接着剤市場における生成AIの影響

第6章 産業動向

- イントロダクション

- カスタマービジネスに影響を与える動向/混乱

- サプライチェーン分析

- サステナブル接着剤市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 北米

- 欧州

- アジア太平洋

- 最終用途産業に対する影響

- 投資と資金調達のシナリオ

- 価格設定の分析

- 平均販売価格の動向:地域別

- 平均販売価格の動向:原材料別

- 主要企業の平均販売価格の動向:原材料別

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 調査手法

- 特許取得件数(2015年~2024年)

- 考察

- 法的地位

- 管轄分析

- 主な出願者

- サステナブル接着剤に関する主要特許

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- サステナブル接着剤に関する関税

- 規制機関、政府機関、その他の組織

- サステナブル接着剤に関する規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

- ケーススタディ分析

- BOSTIK、高性能サステナブル接着剤ソリューションを開発

- 接着剤はベビーフードメーカーがラベルを効率的に更新することに役立つ

- HENKEL、KRATON、DOWが接着剤のカーボンフットプリント削減に向け提携

第7章 サステナブル接着剤市場:タイプ別

- イントロダクション

- リサイクル可能な接着剤

- 再生可能な接着剤

- 再パルプ化可能な接着剤

- 生分解性接着剤

- グリーン接着剤

- その他のタイプ

- ホットメルト接着剤

- UV硬化型接着剤

- 無溶剤接着剤

第8章 サステナブル接着剤市場:原材料別

- イントロダクション

- 水性

- 植物性

- EVA系

- アクリル系

- その他の原材料

- 動物性

- バイオベースポリウレタン

第9章 サステナブル接着剤市場:最終用途産業別

- イントロダクション

- 包装

- 木工

- 医療

- 消費財

- 建設

- 自動車

- その他の最終用途産業

- 電子

- テキスタイル

- 再生可能エネルギー

第10章 サステナブル接着剤市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- アルゼンチン

- ブラジル

- その他の南米

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年1月~2025年7月

- 市場シェア分析

- 収益分析(2021年~2025年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- BASF

- HENKEL AG & CO. KGAA

- H.B. FULLER COMPANY

- JOWAT SE

- DOW

- DUPONT

- ARKEMA

- AVERY DENNISON CORPORATION

- PARAMELT B.V.

- SYNTHOS

- ARTIENCE CO., LTD.

- SIKA AG

- 3M

- その他の企業

- ARTIMELT AG

- FOLLMANN GMBH & CO. KG

- LD DAVIS

- EMSLAND GROUP

- ECOSYNTHETIX INC

- WEISS CHEMIE+TECHNIK GMBH & CO. KG

- SELLEYS

- AVEBE

- MASTER BOND

- KLEIBERIT SE & CO. KG

- THE COMPOUND COMPANY

- U.S. ADHESIVES, INC.

- FRANKLIN INTERNATIONAL

- PREMIER STARCH PRODUCTS PVT. LTD

- C.B. ADHESIVES LTD