|

|

市場調査レポート

商品コード

1415819

ITサービス管理(ITSM)の世界市場:オファリング別(ソリューション、サービス)、展開モデル別、組織規模別、業界別、地域別-2028年までの予測IT Service Management (ITSM) Market by Offering (Solutions (Change & Configuration Management, Operations & Performance Management) and Services), Deployment Model, Organization Size, Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ITサービス管理(ITSM)の世界市場:オファリング別(ソリューション、サービス)、展開モデル別、組織規模別、業界別、地域別-2028年までの予測 |

|

出版日: 2024年01月18日

発行: MarketsandMarkets

ページ情報: 英文 299 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2028年 |

| 基準年 | 2023年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | オファリング別、展開モデル別、組織規模別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

ITSMの市場規模は、2023年の105億米ドルから2028年には221億米ドルに成長すると予測され、予測期間中の年間平均成長率(CAGR)は15.9%になるとみられています。

同市場には、デジタルトランスフォーメーションに向けた政府の取り組みの増加や、プロセスを自動化するAIの登場など、優れた成長機会があります。AI機能を備えたサービス管理ソリューションは、コンテンツに基づいて関連キーワードやメタデータを割り当てることで、画像、テキスト、動画などのデジタル資産のタグ付けを自動化できます。この自動化により、デジタル資産の迅速な識別、分類、検索が可能になります。AIはまた、デジタル資産からメタデータを抽出し、フォレンジック分析を実行し、著作権法のコンプライアンスを確保するのにも役立ちます。

従業員1,000人未満の組織は、中小企業と呼ぶことができます。ITSMは中小企業にコスト削減、拡張性、柔軟性を提供するため、中小企業向け市場の成長が見込まれています。中小企業にとって、クラウドベースの技術は業務効率を改善し、目標とする成果を上げ、より多くの収益をもたらすと思われます。しかし、中小企業は、拡張性、スキル、資金という3つの大きな障害に直面しています。ニーズに合わせてITインフラを柔軟に管理できる従量課金モデルは、これらの問題を解決するソリューションとして中小企業に利用されています。中小企業は大企業との熾烈な競争にさらされているため、競争上の優位性を得るために、中小企業はITSMソリューションを利用しています。これらのソリューションにより、迅速な回答、適切なタイミングでの意思決定、生産性の向上が可能になります。今後、ワークロードをクラウドベース環境に移行する企業が増えるにつれ、ITSMの利用は拡大すると予想されます。

クラウドベースのITSMソリューションでは、サードパーティプロバイダーが管理するリモートサーバー上にITSMソフトウェアを展開します。このモデルは比類のない拡張性、アクセシビリティ、柔軟性を提供し、企業はインターネット接続さえあればどこからでもITSMツールやリソースにアクセスできます。クラウドソリューションは、大規模なオンサイトインフラを必要としないため、資本支出を削減し、従量課金のサブスクリプション・モデルを提供します。クラウドにより、迅速な導入、ワークロードの変化に対応した迅速な拡張性、サービスプロバイダーが管理するシームレスなアップデートが可能になります。

ITおよびITeS分野は、ここ数年で大きく成長しています。ITeS企業は、低下する利益率を安定させるため、インフラ共有、収益保証、ビジネスプロセス、ITアウトソーシング、インフラ削減など、いくつかの戦略を実施しています。これらの行動を確実に実行に移すためには、それを支えるITサービスの有効性を保証することが極めて重要です。ITeS業界では、クラウド管理はビジネスよりも顧客のニーズに主眼を置いた複雑な方法で行われています。ITSMソリューションは、組織のITが全体的な企業戦略に沿ったITガバナンスのレベルまで成熟するのを支援し、それによってビジネス・パフォーマンスがさらに向上します。

当レポートでは、世界のITサービス管理(ITSM)市場について調査し、オファリング別、展開モデル別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム分析

- バリューチェーン分析

- 技術分析

- 価格分析

- ビジネスモデル分析

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 主要な会議とイベント

- ITSM市場の新たな動向

- 主要な利害関係者と購入基準

第6章 ITSM市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 ITSM市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第8章 ITSM市場、展開モデル別

- イントロダクション

- オンプレミス

- クラウド

第9章 ITSM市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 電気通信

- IT・ITES

- 政府・公共部門

- 小売・消費財

- 製造業

- エネルギーと公共事業

- メディアとエンターテイメント

- ヘルスケア

- 教育

- その他

第10章 ITSM市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略/強み

- 収益分析

- 会社の財務指標

- 市場シェア分析

- ITSM市場:ベンダー製品/ブランドの比較

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- SERVICENOW

- BMC SOFTWARE

- BROADCOM

- MANAGEENGINE

- IVANTI

- ZENDESK

- GOTO

- SOLARWINDS

- ATLASSIAN

- OPENTEXT

- SYMPHONYAI SUMMIT

- EFECTE

- その他の企業

- MICROSOFT

- IBM

- IFS

- FRESHWORKS

- EASYVISTA

- ITARIAN

- SYSAID TECHNOLOGIES

- INVGATE

- ALEMBA

- HORNBILL

- NINJAONE

- HALOITSM

- AISERA

- 4ME

- TOPDESK

- TEAMDYNAMIX

第13章 隣接市場および関連市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Offering, Solutions, Services, Organization Size, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The ITSM market size is expected to grow from USD 10.5 billion in 2023 to USD 22.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 15.9% during the forecast period. The market has excellent growth opportunities, such as increasing government initiatives for digital transformation and the emergence of AI to automate processes. Service management solutions with AI capabilities can automate the tagging of digital assets, such as images, text, and videos, by assigning relevant keywords or metadata based on their content. This automation allows for quick digital asset identification, classification, and retrieval. AI also helps extract metadata from digital assets, perform forensic analysis, and ensure compliance with copyright laws.

"By organization size, the SMEs segment to grow at the highest CAGR during the forecast period."

An organization having less than 1,000 employees can be termed an SME. Since ITSM offers SMEs cost savings, scalability, and flexibility, the market for SMEs is anticipated to grow. For SMEs, cloud-based technology will improve business efficiency, targeted results, and more revenues. SMEs, however, confront three significant obstacles: scalability, skills, and funding. Pay-as-you-go models, which provide flexibility in managing their IT infrastructure per their needs, are used by SMEs as a solution to these problems. SMEs are up against fierce competition from larger businesses; therefore, to obtain a competitive advantage, SMEs are using ITSM solutions. These solutions allow for prompt replies, well-timed decisions, and increased productivity. It is anticipated that the use of ITSM will grow in the future as more businesses move their workloads to cloud-based environments.

"By deployment model, the Cloud segment to have a higher market share during the forecast period. "

Cloud-based ITSM solutions involve deploying ITSM software on remote servers maintained by a third-party provider. This model offers unparalleled scalability, accessibility, and flexibility, allowing organizations to access ITSM tools and resources from anywhere with an internet connection. Cloud solutions eliminate the need for extensive on-site infrastructure, reducing capital expenditures and providing a pay-as-you-go subscription model. The cloud enables rapid deployment, quick scalability to accommodate changing workloads, and seamless updates managed by the service provider.

"By vertical, the IT & ITeS segment is projected to record the highest market share during the forecast period."

The IT and ITeS verticals have grown significantly in the last few years. ITeS firms have implemented several strategies to stabilize their declining profit margins, including infrastructure sharing, revenue assurance, business processes, IT outsourcing, and infrastructure reduction. To ensure these actions are practical, it is crucial to guarantee the efficacy of the IT services that support them. In the ITeS industry, cloud management is done in a complex manner where the prime focus is on the customer's needs rather than the business. ITSM solutions are helping organizations' IT to mature to the level of IT governance aligned with the overall corporate strategy, which would further drive business performance.

The breakup of the profiles of the primary participants is below:

- By Company Type: Tier I: 29%, Tier II: 45%, and Tier III: 26%

- By Designation: C-Level Executives: 30%, Director Level: 25%, and *Others: 45%

- By Region: North America: 40%, Europe: 30%, Asia Pacific: 25%, **RoW: 5%

- Others include sales managers, marketing managers, and product managers

*RoW include Middle East & Africa and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the key players operating in the ITSM market are - Dell Technologies (US), Vertiv (US), Schneider Electric (France), IBM (US), Huawei (China), Eaton (Ireland), Rittal (Germany), HPE (US), Silent-Aire (Canada), and Eltek (Norway).

Research coverage:

The market study covers the ITSM market across segments. It aims to estimate the market size and the growth potential across different segments such as offering, deployment model, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall ITSM market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the ITSM market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ITSM market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the ITSM market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ITSM market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ServiceNow, BMC Software, Broadcom, Ivanti, and ManageEngine in the ITSM market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ITSM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 ITSM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF ITSM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION ON GLOBAL ITSM MARKET

- TABLE 3 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- 3.1 OVERVIEW OF RECESSION IMPACT

- FIGURE 9 MAJOR SEGMENTS IN ITSM MARKET

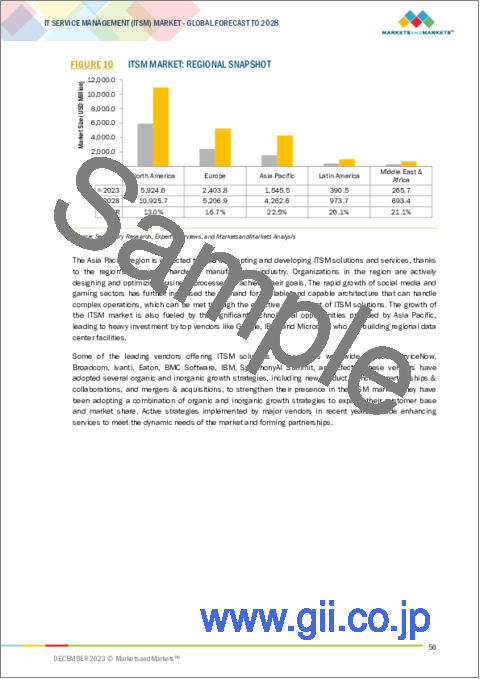

- FIGURE 10 ITSM MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ITSM MARKET

- FIGURE 11 FOCUS ON IMPROVING CUSTOMER EXPERIENCE AND SIMPLIFYING IT OPERATIONS WORKFLOW TO DRIVE MARKET

- 4.2 ITSM MARKET, BY OFFERING

- FIGURE 12 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2028

- 4.3 ITSM MARKET, BY SOLUTION

- FIGURE 13 OPERATIONS & PERFORMANCE MANAGEMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 ITSM MARKET, BY DEPLOYMENT MODEL

- FIGURE 14 CLOUD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 ITSM MARKET, BY ORGANIZATION SIZE

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.6 ITSM MARKET, BY VERTICAL

- FIGURE 16 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- 4.7 ITSM MARKET: REGIONAL SCENARIO

- FIGURE 17 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 ITSM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing shift to cloud-based technologies

- 5.2.1.2 Simplification and synchronization of IT resources

- 5.2.1.3 Automated management of IT processes and policies

- 5.2.1.4 Benefits of agile implementation, easy deployment, and OPEX model

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of technical knowledge and expertise

- 5.2.2.2 Security and privacy concerns for confidential data and business processes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Widespread adoption of BYOD trend and increasing mobile workforce

- 5.2.3.2 Increasing government initiatives for necessary technology usage

- 5.2.3.3 Continuous developments in 5G technology

- 5.2.3.4 Emergence of AI to automate processes

- 5.2.4 CHALLENGES

- 5.2.4.1 Effective workforce management

- 5.2.4.2 Cybersecurity concerns arising out of breaches

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: TECNOLOGICO DE MONTERREY DEPLOYED ITSM SOLUTIONS TO REVOLUTIONIZE USER EXPERIENCE

- 5.3.2 CASE STUDY 2: NEXTIVA DEPLOYED ATLASSIAN'S JIRA SERVICE MANAGEMENT TO ACHIEVE EFFECTIVE SERVICE PROVISION

- 5.3.3 CASE STUDY 3: WILDBERRIES ADOPTED AXIOS ASSIST TO ENHANCE AND OPTIMIZE BUSINESS SUPPORT PROCESS(ES) TO INCREASE REVENUE

- 5.3.4 CASE STUDY 4: TELEFONICA DEPLOYED BMC SOFTWARE'S SOLUTIONS TO ACHIEVE IMPROVED SOFTWARE ASSET MANAGEMENT

- 5.3.5 CASE STUDY 5: ALGAR TECH IMPLEMENTED BROADCOM'S SOLUTIONS TO LEVERAGE ITSM SERVICE PROVISION FOR OPTIMAL PRODUCTION AND BUSINESS GROWTH

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 19 ECOSYSTEM MAP

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Chatops

- 5.6.1.2 Self-service portals

- 5.6.1.3 Artificial intelligence

- 5.6.1.4 Machine learning

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Microservices

- 5.6.2.2 API integrations

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Augmented reality (AR) & virtual reality (VR)

- 5.6.3.2 5G

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS OF ITSM SOLUTIONS

- TABLE 4 INDICATIVE PRICING ANALYSIS OF ITSM SOLUTIONS OFFERED BY KEY PLAYERS

- 5.8 BUSINESS MODEL ANALYSIS

- 5.9 PATENT ANALYSIS

- FIGURE 21 NUMBER OF PATENTS PUBLISHED, 2012-2023

- FIGURE 22 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 5 TOP TEN PATENT OWNERS

- TABLE 6 PATENTS GRANTED TO VENDORS IN ITSM MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 ITSM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 IMPACT OF PORTER'S FIVE FORCES ON ITSM MARKET

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITION RIVALRY

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATIONS, BY REGION

- 5.11.1.1 North America

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.2 Europe

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.3 Asia Pacific

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.4 Rest of the World

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATIONS, BY REGION

- 5.12 KEY CONFERENCES & EVENTS

- TABLE 12 ITSM MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.13 EMERGING TRENDS IN ITSM MARKET

- FIGURE 24 MAJOR YCC TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN ITSM MARKET

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- 5.14.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP VERTICALS

6 ITSM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 27 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2023

- 6.1.1 OFFERINGS: ITSM MARKET DRIVERS

- TABLE 15 ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 16 ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 ITSM SOLUTIONS AID IN COST REDUCTION, TIME SAVING, AND PROCESS AGILITY

- FIGURE 28 OPERATIONS & PERFORMANCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2023

- TABLE 17 ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 18 ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 19 SOLUTIONS: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 SOLUTIONS: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 SERVICE PORTFOLIO MANAGEMENT

- 6.2.2.1 Service catalog management

- 6.2.2.2 Service pipeline management

- 6.2.2.3 Demand management

- 6.2.2.4 Others

- TABLE 21 SERVICE PORTFOLIO MANAGEMENT: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 SERVICE PORTFOLIO MANAGEMENT: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 CONFIGURATION & CHANGE MANAGEMENT

- 6.2.3.1 Configuration management database

- 6.2.3.2 Change control

- 6.2.3.3 Version control

- 6.2.3.4 Others

- TABLE 23 CONFIGURATION & CHANGE MANAGEMENT: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 CONFIGURATION & CHANGE MANAGEMENT: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 SERVICE DESK SOFTWARE

- 6.2.4.1 Incident management

- 6.2.4.2 Problem management

- 6.2.4.3 Service request management

- 6.2.4.4 Knowledge base

- 6.2.4.5 Others

- TABLE 25 SERVICE DESK SOFTWARE: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 SERVICE DESK SOFTWARE: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.5 OPERATIONS & PERFORMANCE MANAGEMENT

- 6.2.5.1 Performance monitoring

- 6.2.5.2 Capacity management

- 6.2.5.3 Event management

- 6.2.5.4 Others

- TABLE 27 OPERATIONS & PERFORMANCE MANAGEMENT: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 OPERATIONS & PERFORMANCE MANAGEMENT: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.6 DASHBOARD, REPORTING, AND ANALYTICS

- TABLE 29 DASHBOARD, REPORTING, AND ANALYTICS: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 DASHBOARD, REPORTING, AND ANALYTICS: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 MANAGED AND PROFESSIONAL SERVICES HELP LEVERAGE ITSM ADOPTION AMONG ENTERPRISES

- FIGURE 29 PROFESSIONAL SERVICES SEGMENT TO LEAD MARKET IN 2023

- TABLE 31 ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 32 ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

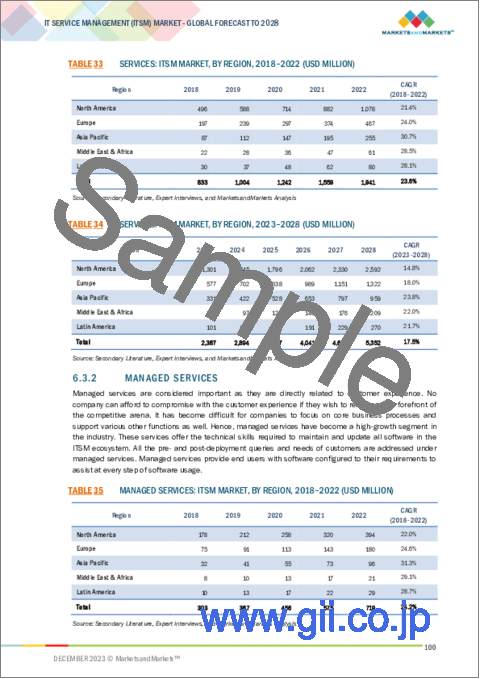

- TABLE 33 SERVICES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 SERVICES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- TABLE 35 MANAGED SERVICES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 MANAGED SERVICES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 PROFESSIONAL SERVICES

- TABLE 37 PROFESSIONAL SERVICES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 PROFESSIONAL SERVICES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3.1 Consulting

- 6.3.3.2 Integration & implementation

- 6.3.3.3 Training, support, and maintenance

7 ITSM MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- FIGURE 30 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2023

- 7.1.1 ORGANIZATION SIZE: ITSM MARKET DRIVERS

- TABLE 39 ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 40 ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 7.2 LARGE ENTERPRISES

- 7.2.1 NEED FOR MANAGEMENT AND OPERATIONAL IMPROVEMENT TO LEAD TO LARGE-SCALE ADOPTION OF ITSM SERVICES

- TABLE 41 LARGE ENTERPRISES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 LARGE ENTERPRISES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SMES

- 7.3.1 SMES GAIN COMPETITIVE ADVANTAGE WITH ITSM ADOPTION, PRACTICE, AND IMPLEMENTATION

- TABLE 43 SMES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 SMES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

8 ITSM MARKET, BY DEPLOYMENT MODEL

- 8.1 INTRODUCTION

- FIGURE 31 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET IN 2023

- 8.1.1 DEPLOYMENT MODELS: ITSM MARKET DRIVERS

- TABLE 45 ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 46 ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 ON-PREMISES CUSTOMIZATION OF ITSM SOLUTIONS TO ACHIEVE PRODUCTION EXCELLENCY AND ENSURE DATA SOVEREIGNTY

- TABLE 47 ON-PREMISES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 ON-PREMISES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 GROWING NEED FOR CLOUD DEPLOYMENT OF ITSM SOLUTIONS FOR RAPID DEVELOPMENT AND SEAMLESS SERVICE PROVISION TO BOOST MARKET

- TABLE 49 CLOUD: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 CLOUD: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

9 ITSM MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 32 IT & ITES VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 9.1.1 VERTICALS: ITSM MARKET DRIVERS

- TABLE 51 ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 52 ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- TABLE 53 BFSI: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 BFSI: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 BFSI: APPLICATION AREAS

- 9.2.1.1 Transaction processing

- 9.2.1.2 Security management

- 9.2.1.3 Compliance management

- 9.2.1.4 Other BFSI applications

- 9.3 TELECOMMUNICATIONS

- TABLE 55 TELECOMMUNICATIONS: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 TELECOMMUNICATIONS: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 TELECOMMUNICATIONS: APPLICATION AREAS

- 9.3.1.1 Network management

- 9.3.1.2 Service provisioning

- 9.3.1.3 Incident management

- 9.3.1.4 Other telecommunication applications

- 9.4 IT & ITES

- TABLE 57 IT & ITES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 IT & ITES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.1 IT & ITES: APPLICATION AREAS

- 9.4.1.1 Service desk support

- 9.4.1.2 Change management

- 9.4.1.3 Application development & maintenance

- 9.4.1.4 Other IT & ITeS applications

- 9.5 GOVERNMENT & PUBLIC SECTOR

- TABLE 59 GOVERNMENT & PUBLIC SECTOR: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 GOVERNMENT & PUBLIC SECTOR: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.1 GOVERNMENT & PUBLIC SECTOR: APPLICATION AREAS

- 9.5.1.1 eGovernment services

- 9.5.1.2 IT infrastructure management

- 9.5.1.3 Security & compliance

- 9.5.1.4 Other government & public sector applications

- 9.6 RETAIL & CONSUMER GOODS

- TABLE 61 RETAIL & CONSUMER GOODS: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 RETAIL & CONSUMER GOODS: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.1 RETAIL & CONSUMER GOODS: APPLICATION AREAS

- 9.6.1.1 eCommerce platform management

- 9.6.1.2 Inventory management systems

- 9.6.1.3 Customer support

- 9.6.1.4 Other retail & consumer goods applications

- 9.7 MANUFACTURING

- TABLE 63 MANUFACTURING: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 MANUFACTURING: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7.1 MANUFACTURING: APPLICATION AREAS

- 9.7.1.1 Manufacturing Execution Systems (MESs)

- 9.7.1.2 Supply chain management

- 9.7.1.3 Quality control systems

- 9.7.1.4 Other manufacturing applications

- 9.8 ENERGY & UTILITIES

- TABLE 65 ENERGY & UTILITIES: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 ENERGY & UTILITIES: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8.1 ENERGY & UTILITIES: APPLICATION AREAS

- 9.8.1.1 Smart grid management

- 9.8.1.2 SCADA systems

- 9.8.1.3 Asset management

- 9.8.1.4 Other energy & utility applications

- 9.9 MEDIA & ENTERTAINMENT

- TABLE 67 MEDIA & ENTERTAINMENT: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 MEDIA & ENTERTAINMENT: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9.1 MEDIA & ENTERTAINMENT: APPLICATION AREAS

- 9.9.1.1 Content Management Systems (CMSs)

- 9.9.1.2 Digital Rights Management (DRM)

- 9.9.1.3 Broadcasting systems

- 9.9.1.4 Other BFSI applications

- 9.10 HEALTHCARE

- TABLE 69 HEALTHCARE: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 HEALTHCARE: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10.1 HEALTHCARE: APPLICATION AREAS

- 9.10.1.1 Electronic Health Records (EHRs)

- 9.10.1.2 Healthcare IT systems management

- 9.10.1.3 Patient care applications

- 9.10.1.4 Other healthcare applications

- 9.11 EDUCATION

- TABLE 71 EDUCATION: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 EDUCATION: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11.1 EDUCATION: APPLICATION AREAS

- 9.11.1.1 Learning Management Systems (LMSs)

- 9.11.1.2 Student Information Systems (SISs)

- 9.11.1.3 Campus IT infrastructure

- 9.11.1.4 Other education applications

- 9.12 OTHER VERTICALS

- TABLE 73 OTHER VERTICALS: ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 OTHER VERTICALS: ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

10 ITSM MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 75 ITSM MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 ITSM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: ITSM MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: ITSM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: ITSM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 US government initiatives toward regulating cloud services such as FedRAMP

- TABLE 91 US: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 92 US: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 93 US: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 94 US: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 High adoption of big data and government digital services offered in Canada

- TABLE 95 CANADA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 96 CANADA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 97 CANADA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 98 CANADA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: ITSM MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 99 EUROPE: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 100 EUROPE: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 102 EUROPE: ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 104 EUROPE: ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 106 EUROPE: ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 108 EUROPE: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 109 EUROPE: ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 110 EUROPE: ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 111 EUROPE: ITSM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 112 EUROPE: ITSM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Extensive initiatives by UK government and European Parliament for servers and data storage products

- TABLE 113 UK: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 114 UK: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 115 UK: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 116 UK: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Industry 4.0, increased digital economy initiatives, high industrial tech spending, and growth in smart cities in Germany

- TABLE 117 GERMANY: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 118 GERMANY: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 119 GERMANY: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 120 GERMANY: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 National investment program to support Digital France Plan for 2025 to encourage companies to expand in country

- TABLE 121 FRANCE: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 122 FRANCE: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 123 FRANCE: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 124 FRANCE: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.6 NETHERLANDS

- 10.3.6.1 Digital transformation with hybrid workspaces to drive need for ITSM foundation in Netherlands

- TABLE 125 NETHERLANDS: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 126 NETHERLANDS: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 127 NETHERLANDS: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 128 NETHERLANDS: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.7 ITALY

- 10.3.7.1 Smart city initiatives and 5G deployment for edge computing solutions in Italy to drive growth

- TABLE 129 ITALY: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 130 ITALY: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 131 ITALY: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 132 ITALY: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 133 REST OF EUROPE: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 134 REST OF EUROPE: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: ITSM MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 137 ASIA PACIFIC: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ITSM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ITSM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Free trade ecosystem and Belt and Road initiatives to increase need for ITSM infrastructure supporting high-density facilities

- TABLE 151 CHINA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 152 CHINA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 153 CHINA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 154 CHINA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Japan's headway into automation, mainly in automotive and industrial robotics, to warrant low latency platforms

- TABLE 155 JAPAN: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 156 JAPAN: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 157 JAPAN: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 158 JAPAN: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Demand for data processing and information interaction with high internet usage

- TABLE 159 AUSTRALIA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 160 AUSTRALIA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 161 AUSTRALIA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 162 AUSTRALIA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.6 SINGAPORE

- 10.4.6.1 Large-scale implementation of best practice frameworks such as ITIL

- TABLE 163 SINGAPORE: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 164 SINGAPORE: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 165 SINGAPORE: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 166 SINGAPORE: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 167 REST OF ASIA PACIFIC: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: ITSM MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 171 MIDDLE EAST & AFRICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: ITSM MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ITSM MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 10.5.3 GCC COUNTRIES (GULF COOPERATION COUNCIL)

- 10.5.3.1 Saudi Arabia

- 10.5.3.1.1 Saudi Vision 2030 initiatives to leverage demand for cloud, ITSM, big data, analytics, and AI/ML

- 10.5.3.1 Saudi Arabia

- TABLE 185 SAUDI ARABIA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 186 SAUDI ARABIA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 187 SAUDI ARABIA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 188 SAUDI ARABIA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.3.2 UAE

- 10.5.3.2.1 High mobile device per user ratio and megaprojects and initiatives in Dubai to spur growth

- 10.5.3.2 UAE

- TABLE 189 UAE: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 190 UAE: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 191 UAE: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 192 UAE: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.3.3 Rest of GCC Countries

- TABLE 193 REST OF GCC COUNTRIES: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 194 REST OF GCC COUNTRIES: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 195 REST OF GCC COUNTRIES: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 196 REST OF GCC COUNTRIES: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 High usage of mobile technologies and colocation facilities in South Africa

- TABLE 197 SOUTH AFRICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 198 SOUTH AFRICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 199 SOUTH AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 200 SOUTH AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.5 REST OF THE MIDDLE EAST & AFRICA

- TABLE 201 REST OF MIDDLE EAST & AFRICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: ITSM MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 205 LATIN AMERICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 206 LATIN AMERICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: ITSM MARKET, BY SOLUTION, 2018-2022 (USD MILLION)

- TABLE 208 LATIN AMERICA: ITSM MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: ITSM MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: ITSM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: ITSM MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 214 LATIN AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: ITSM MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 216 LATIN AMERICA: ITSM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: ITSM MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: ITSM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Latency issues and interest in 5G deployment to attract more cloud players to Brazil

- TABLE 219 BRAZIL: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 220 BRAZIL: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 221 BRAZIL: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 222 BRAZIL: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Increased opportunities for content delivery providers and significant investments from global giants

- TABLE 223 MEXICO: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 224 MEXICO: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 225 MEXICO: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 226 MEXICO: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 227 REST OF LATIN AMERICA: ITSM MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: ITSM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: ITSM MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 231 OVERVIEW OF STRATEGIES ADOPTED BY KEY ITSM VENDORS

- 11.3 REVENUE ANALYSIS

- FIGURE 36 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2022 (USD MILLION)

- 11.4 COMPANY FINANCIAL METRICS

- FIGURE 37 TRADING COMPARABLES, 2023 (EV/EBITDA)

- 11.5 MARKET SHARE ANALYSIS

- FIGURE 38 SHARE OF LEADING COMPANIES IN ITSM MARKET, 2022

- TABLE 232 ITSM MARKET: INTENSITY OF COMPETITION RIVARY

- 11.6 ITSM MARKET: VENDOR PRODUCTS/COMPARISON OF BRANDS

- TABLE 233 VENDOR PRODUCTS/COMPARISON OF BRANDS

- 11.7 COMPANY EVALUATION MATRIX

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 39 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 40 ITSM MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.7.5 COMPANY FOOTPRINT

- TABLE 234 OVERALL GLOBAL COMPANY FOOTPRINT

- TABLE 235 COMPANY OFFERING FOOTPRINT

- TABLE 236 COMPANY VERTICAL FOOTPRINT

- TABLE 237 COMPANY REGION FOOTPRINT

- 11.8 START-UP/SME EVALUATION MATRIX

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 41 START-UP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 42 ITSM MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 238 ITSM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 239 ITSM MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 240 PRODUCT LAUNCHES AND ENHANCEMENTS, 2021-2023

- 11.9.2 DEALS

- TABLE 241 DEALS, 2021-2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.2.1 SERVICENOW

- TABLE 242 SERVICENOW: COMPANY OVERVIEW

- FIGURE 43 SERVICENOW: COMPANY SNAPSHOT

- TABLE 243 SERVICENOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 SERVICENOW: PRODUCT LAUNCHES

- TABLE 245 SERVICENOW: DEALS

- 12.2.2 BMC SOFTWARE

- TABLE 246 BMC SOFTWARE: COMPANY OVERVIEW

- TABLE 247 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 BMC SOFTWARE: PRODUCT LAUNCHES

- TABLE 249 BMC SOFTWARE: DEALS

- 12.2.3 BROADCOM

- TABLE 250 BROADCOM: COMPANY OVERVIEW

- FIGURE 44 BROADCOM: COMPANY SNAPSHOT

- TABLE 251 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 BROADCOM: PRODUCT LAUNCHES

- TABLE 253 BROADCOM: DEALS

- 12.2.4 MANAGEENGINE

- TABLE 254 MANAGEENGINE: COMPANY OVERVIEW

- TABLE 255 MANAGEENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 MANAGEENGINE: PRODUCT LAUNCHES

- TABLE 257 MANAGEENGINE: DEALS

- 12.2.5 IVANTI

- TABLE 258 IVANTI: COMPANY OVERVIEW

- TABLE 259 IVANTI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 IVANTI: PRODUCT LAUNCHES

- TABLE 261 IVANTI: DEALS

- 12.2.6 ZENDESK

- TABLE 262 ZENDESK: COMPANY OVERVIEW

- TABLE 263 ZENDESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 ZENDESK: DEALS

- 12.2.7 GOTO

- TABLE 265 GOTO: COMPANY OVERVIEW

- TABLE 266 GOTO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 GOTO: PRODUCT LAUNCHES

- TABLE 268 GOTO: DEALS

- 12.2.8 SOLARWINDS

- TABLE 269 SOLARWINDS: COMPANY OVERVIEW

- FIGURE 45 SOLARWINDS: COMPANY SNAPSHOT

- TABLE 270 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 SOLARWINDS: PRODUCT LAUNCHES

- TABLE 272 SOLARWINDS: DEALS

- 12.2.9 ATLASSIAN

- TABLE 273 ATLASSIAN: COMPANY OVERVIEW

- FIGURE 46 ATLASSIAN: COMPANY SNAPSHOT

- TABLE 274 ATLASSIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 ATLASSIAN: PRODUCT LAUNCHES

- TABLE 276 ATLASSIAN: DEALS

- 12.2.10 OPENTEXT

- TABLE 277 OPENTEXT: COMPANY OVERVIEW

- FIGURE 47 OPENTEXT: COMPANY SNAPSHOT

- TABLE 278 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.11 SYMPHONYAI SUMMIT

- TABLE 279 SYMPHONYAI SUMMIT: COMPANY OVERVIEW

- TABLE 280 SYMPHONYAI SUMMIT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SYMPHONYAI SUMMIT: PRODUCT LAUNCHES

- TABLE 282 SYMPHONYAI SUMMIT: DEALS

- 12.2.12 EFECTE

- TABLE 283 EFECTE: COMPANY OVERVIEW

- TABLE 284 EFECTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 EFECTE: PRODUCT LAUNCHES

- TABLE 286 EFECTE: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.3 OTHER PLAYERS

- 12.3.1 MICROSOFT

- 12.3.2 IBM

- 12.3.3 IFS

- 12.3.4 FRESHWORKS

- 12.3.5 EASYVISTA

- 12.3.6 ITARIAN

- 12.3.7 SYSAID TECHNOLOGIES

- 12.3.8 INVGATE

- 12.3.9 ALEMBA

- 12.3.10 HORNBILL

- 12.3.11 NINJAONE

- 12.3.12 HALOITSM

- 12.3.13 AISERA

- 12.3.14 4ME

- 12.3.15 TOPDESK

- 12.3.16 TEAMDYNAMIX

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 RELATED MARKETS

- 13.2 CLOUD ITSM MARKET

- TABLE 287 CLOUD ITSM MARKET, BY COMPONENT, 2016-2019 (USD MILLION)

- TABLE 288 CLOUD ITSM MARKET, BY COMPONENT, 2020-2025 (USD MILLION)

- TABLE 289 CLOUD ITSM MARKET, BY ORGANIZATION SIZE, 2016-2019 (USD MILLION)

- TABLE 290 CLOUD ITSM MARKET, BY ORGANIZATION SIZE, 2020-2025 (USD MILLION)

- TABLE 291 CLOUD ITSM MARKET, BY VERTICAL, 2016-2019 (USD MILLION)

- TABLE 292 CLOUD ITSM MARKET, BY VERTICAL, 2020-2025 (USD MILLION)

- TABLE 293 CLOUD ITSM MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 294 CLOUD ITSM MARKET, BY REGION, 2020-2025 (USD MILLION)

- 13.3 CONFIGURATION MANAGEMENT MARKET

- TABLE 295 CONFIGURATION MANAGEMENT MARKET, BY MODULE, 2017-2024 (USD MILLION)

- TABLE 296 CONFIGURATION MANAGEMENT MARKET, BY SYSTEM, 2017-2024 (USD MILLION)

- TABLE 297 CONFIGURATION MANAGEMENT MARKET, BY COMPONENT, 2017-2024 (USD MILLION)

- TABLE 298 CONFIGURATION MANAGEMENT MARKET, BY ENTERPRISE SIZE, 2017-2024 (USD MILLION)

- TABLE 299 CONFIGURATION MANAGEMENT MARKET, BY END-USE VERTICAL, 2017-2024 (USD MILLION)

- TABLE 300 CONFIGURATION MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS