|

|

市場調査レポート

商品コード

1396472

工場内物流の世界市場:製品別、場所別、産業別-2028年までの予測In-Plant Logistics Market by Product (Robots, ASRS, Conveyors & Sortation Systems, Cranes, AGVs, WMS, RTLS), Location (Receiving & Delivery Docks, Assembly/Production Lines, Storage Facilities, Packaging Workstations), Industry - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 工場内物流の世界市場:製品別、場所別、産業別-2028年までの予測 |

|

出版日: 2023年12月11日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2023年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント別 | 製品別、場所別、産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

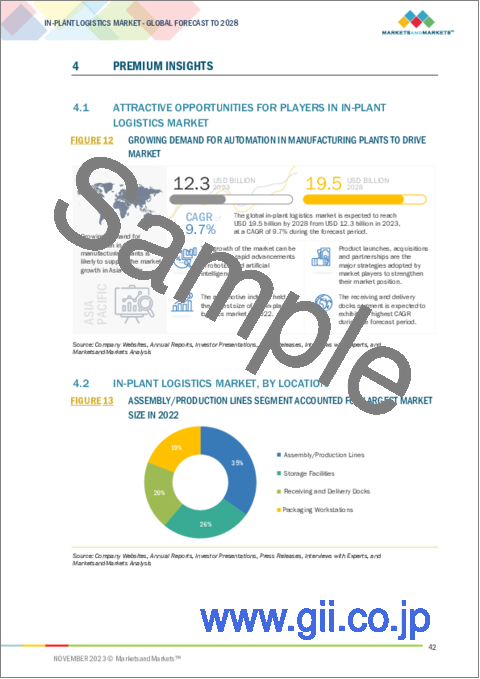

工場内物流の市場規模は、2023年には123億米ドル規模になると予測され、9.7%のCAGRで拡大し、2028年には195億米ドルに達すると予測されています。

工場内物流ソリューションに対する需要の高まりは、製造業、自動車、エレクトロニクスなど、さまざまな業界に浸透しています。産業界は、業務効率を高めコストを削減するために、合理化されたマテリアルフロー、効率的な在庫管理、最適化された生産プロセスの必要性を認識しています。同時に、自動化と技術の進歩は、市場情勢の形成に極めて重要な役割を果たしています。自動搬送車(AGV)、ロボット工学、リアルタイム追跡システム、高度なマテリアルハンドリング機器の統合は、工場内ロジスティクスを変革し、かつてないレベルの精度、柔軟性、拡張性を提供しています。業界の需要と技術革新の相乗効果により、工場内物流は、現代の製造業とサプライチェーン・マネジメントのダイナミックな情勢の中で競争力を維持しようと努力する企業にとって重要な要素となっています。

コンベアと仕分けシステムは、製造施設、配送センター、倉庫内での商品輸送にシームレスで自動化されたソリューションを提供します。合理化された高速マテリアルフローに対する需要の高まりは、正確な仕分けと注文処理の必要性と相まって、様々な産業でコンベア・仕分けシステムの採用を強化しています。センサーベースの仕分けやリアルタイムの追跡などの先進技術の統合により、操作の可視性と精度が向上し、工場内物流の最適化に不可欠なシステムとなっています。業界情勢がリーンで俊敏なサプライチェーンオペレーションをますます優先させる中、コンベア・仕分けシステムは、工場内ロジスティクスの生産性と全体的な効率を高める上で重要な役割を果たす、基幹技術として台頭しています。

金属・重機械産業は、大型で重い部品の生産と移動を伴うため、専門的なロジスティクス・ソリューションが必要となります。天井クレーン、自動マテリアルハンドリングシステム、リアルタイムトラッキングなどの高度な工場内ロジスティクス技術の統合は、製造施設内での材料のスムーズで安全な流れを確保するために不可欠となります。精密さ、安全性、最適化された生産工程を重視する姿勢は、工場内物流ソリューションの能力と密接に合致しており、金属・重機械セクターにおける全体的な業務効率の強化に不可欠なものとなっています。業界の進化と近代化が進むにつれて、洗練された工場内物流技術に対する需要は拡大し、このダイナミックな市場情勢においてそのシェアを確固たるものにすると予想されます。

欧州の製造業は、自動車、航空宇宙、製薬、その他多様なセクターにまたがっており、生産プロセスを最適化するために効率的な工場内物流が重視されています。この地域の持続可能性への取り組みと厳格な品質基準は、マテリアルハンドリングにおける精度と制御の必要性をさらに際立たせています。さらに、自動化、ロボット工学、リアルタイムの追跡システムなどの先進技術の採用に対する欧州の積極的なアプローチは、工場内ロジスティクス革新の最前線に位置しています。欧州の産業が引き続き業務効率と市場の需要への対応力を優先するにつれて、工場内物流市場の繁栄が予想され、この地域はこのダイナミックな産業分野の全体的な成長と進化に大きく貢献することになります。

当レポートでは、世界の工場内物流市場について調査し、製品別、場所別、産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- 生態系/市場マップ

- 技術分析

- 特許分析

- 貿易分析

- 2023年~2025年の主要な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 工場内物流に関わるサービス

- イントロダクション

- 工場内倉庫保管

- ラインフィード

- パッキング

- その他

第7章 工場内物流市場、製品別

- イントロダクション

- ロボット

- 自動保管および検索システム(ASRS)

- コンベヤと仕分けシステム

- クレーン

- 無人搬送車(AGVS)

- 倉庫管理システム(WMS)

- リアルタイム位置情報システム(RTLS)

第8章 工場内物流市場、場所別

- イントロダクション

- 受け取りおよび配送ドック

- 組立/生産ライン

- 貯蔵施設

- パッキングワークステーション

第9章 工場内物流市場、産業別

- イントロダクション

- 自動車

- 金属・重機械

- 食品・飲料

- ヘルスケア

- 半導体・エレクトロニクス

- 航空

- その他

第10章 工場内物流市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 上位企業の収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- DAIFUKU CO., LTD.

- JBT

- KION GROUP AG

- KUKA AG

- TOYOTA INDUSTRIES CORPORATION

- HYSTER-YALE MATERIALS HANDLING, INC.

- SSI SCHAEFER

- BEUMER GROUP

- HONEYWELL INTERNATIONAL INC.

- MURATA MACHINERY, LTD.

- その他の企業

- ADDVERB TECHNOLOGIES LIMITED

- AUTOMATION LOGISTICS CORPORATION

- AUTOCRIB

- AVANCON SA

- FERRETTO GROUP S.P.A.

- GRABIT

- HANEL GMBH & CO. KG

- INVATA INTRALOGISTICS

- MIAS

- INVIA ROBOTICS, INC.

- SENCORPWHITE, INC

- VIASTORE SYSTEMS GMBH

- VIDMAR

- WESTFALIA TECHNOLOGIES, INC.

- WITRON LOGISTIK+INFORMATIK GMBH

第13章 隣接市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Location, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

The in-plant logistics market is estimated to be worth USD 12.3 billion in 2023 and is projected to reach USD 19.5 billion by 2028 at a CAGR of 9.7% during the forecast period. The escalating demand for in-plant logistics solutions is pervasive across various industries, including manufacturing, automotive, electronics, and more. Industries are recognizing the need for streamlined material flow, efficient inventory management, and optimized production processes to enhance operational efficiency and reduce costs. Simultaneously, advancements in automation and technology play a pivotal role in shaping the market landscape. The integration of automated guided vehicles (AGVs), robotics, real-time tracking systems, and sophisticated material handling equipment is transforming in-plant logistics, providing unprecedented levels of precision, flexibility, and scalability. This synergy between industry demand and technological innovation positions in-plant logistics as a critical component for businesses striving to stay competitive in the dynamic landscape of modern manufacturing and supply chain management.

"Conveyors & Sortation Systems to hold the second largest share of in-plant logistics market in 2022."

Conveyor and sortation systems offer a seamless and automated solution for transporting goods within manufacturing facilities, distribution centers, and warehouses. The escalating demand for streamlined and high-speed material flow, coupled with the need for accurate sorting and order processing, has intensified the adoption of conveyor and sortation systems across various industries. The integration of advanced technologies, such as sensor-based sorting and real-time tracking, enhances operational visibility and precision, making these systems indispensable for optimizing in-plant logistics. As industries increasingly prioritize lean and agile supply chain operations, conveyor and sortation systems emerge as a cornerstone technology, playing a crucial role in enhancing productivity and overall efficiency within the in-plant logistics landscape.

"Metals & Heavy Machinery industry to hold the second largest share of in-plant logistics market in 2022."

The Metals and heavy Machinery industry involves the production and movement of large and heavy components, necessitating specialized logistics solutions. The integration of advanced in-plant logistics technologies, such as overhead cranes, automated material handling systems, and real-time tracking, becomes imperative to ensure the smooth and safe flow of materials within manufacturing facilities. The emphasis on precision, safety, and optimized production processes aligns closely with the capabilities of in-plant logistics solutions, making them integral for enhancing overall operational efficiency in the Metals and heavy Machinery sector. As the industry continues to evolve and modernize, the demand for sophisticated in-plant logistics technologies is expected to grow, solidifying its prominent share in this dynamic market landscape.

"Europe to hold the second largest market share of in-plant logistics market in 2022."

The European manufacturing landscape, spanning automotive, aerospace, pharmaceuticals, and other diverse sectors, places a premium on efficient in-plant logistics to optimize production processes. The region's commitment to sustainability and stringent quality standards further accentuates the need for precision and control in material handling. Additionally, Europe's proactive approach toward adopting advanced technologies, such as automation, robotics, and real-time tracking systems, positions it at the forefront of in-plant logistics innovation. As industries in Europe continue to prioritize operational efficiency and responsiveness to market demands, the in-plant logistics market is anticipated to thrive, making the region a key contributor to the overall growth and evolution of this dynamic industry segment.

The break-up of the profiles of primary participants:

- By Company Type - Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation - C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region - North America - 30%, Europe - 25%, Asia Pacific - 35%, and Rest of the World - 10%

Major players in the in-plant logistics market are Daifuku Co., Ltd. (Japan), JBT (US), KION GROUP AG (Germany), KUKA AG (Germany), and Toyota Industries Corporation (Japan).

Research Coverage

The report segments the in-plant logistics market by product, location, industry, and region. The report also comprehensively reviews drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall in-plant logistics market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for in-plant logistics solutions in various industries, Continuous advancements in automation and technology, and strong focus on lean manufacturing and sustainability initiatives are driving the market), restraints (High cost related to deployment and maintenance of In-plant logistics system, Inadequate technical expertise to manage system operations are hindering the growth of the market), opportunities (Integration of emerging technologies such as AI, Industry4.0, and IoT with In-plant logistics system, Substantial industrial growth in emerging economies), and challenges (Production and revenue losses attributed to unwanted equipment downtime, Technical challenges related to sensing elements) influencing the growth of the in-plant logistics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the in-plant logistics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the in-plant logistics market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the in-plant logistics market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Daifuku Co., Ltd. (Japan), JBT (US), KION GROUP AG (Germany), KUKA AG (Germany), and Toyota Industries Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 IN-PLANT LOGISTICS MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 IN-PLANT LOGISTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM AGV BUSINESS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON IN-PLANT LOGISTICS MARKET

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 IN-PLANT LOGISTICS MARKET, 2019-2028 (USD MILLION)

- FIGURE 8 CRANES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 9 ASSEMBLY/PRODUCTION LINES SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2023 TO 2028

- FIGURE 10 AUTOMOTIVE SEGMENT CAPTURED LARGEST MARKET SIZE IN 2022

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IN-PLANT LOGISTICS MARKET

- FIGURE 12 GROWING DEMAND FOR AUTOMATION IN MANUFACTURING PLANTS TO DRIVE MARKET

- 4.2 IN-PLANT LOGISTICS MARKET, BY LOCATION

- FIGURE 13 ASSEMBLY/PRODUCTION LINES SEGMENT ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- 4.3 IN-PLANT LOGISTICS MARKET, BY PRODUCT

- FIGURE 14 CRANES SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.4 IN-PLANT LOGISTICS MARKET, BY INDUSTRY

- FIGURE 15 AUTOMOTIVE SEGMENT TO COMMAND LARGEST MARKET SHARE IN 2023

- 4.5 IN-PLANT LOGISTICS MARKET, BY REGION

- FIGURE 16 IN-PLANT LOGISTICS MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 IN-PLANT LOGISTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for efficient supply chain processes in various industries

- 5.2.1.2 Strong focus on lean manufacturing and sustainability initiatives

- FIGURE 18 ANALYSIS OF IMPACT OF DRIVERS ON IN-PLANT LOGISTICS MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs related to deployment and maintenance of in-plant logistics systems

- 5.2.2.2 Need for technically sound experts to operate in-plant logistics solutions

- FIGURE 19 ANALYSIS OF IMPACT OF RESTRAINTS ON IN-PLANT LOGISTICS MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of emerging technologies such as AI, Industry 4.0, and IoT with in-plant logistics systems

- 5.2.3.2 Substantial industrial growth in emerging economies

- FIGURE 20 ANALYSIS OF IMPACT OF OPPORTUNITIES ON IN-PLANT LOGISTICS MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Risk of production and revenue losses due to unwanted equipment downtime

- 5.2.4.2 Technical challenges related to sensing elements

- FIGURE 21 ANALYSIS OF IMPACT OF CHALLENGES ON IN-PLANT LOGISTICS MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (ASP) OF AUTOMATED STORAGE AND RETRIEVAL SYSTEMS (ASRS) OFFERED BY KEY PLAYERS, BY TYPE

- FIGURE 23 AVERAGE PROJECT COST OF DIFFERENT TYPES OF ASRS, BY COMPANY

- TABLE 1 AVERAGE PROJECT COST OF DIFFERENT TYPES OF ASRS, BY COMPANY (USD)

- 5.4.2 ASP OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

- FIGURE 24 ASP OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

- TABLE 2 ASP OF COLLABORATIVE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD

- 5.4.3 AVERAGE SELLING PRICE TREND

- TABLE 3 ASP OF AUTOMATED GUIDED VEHICLES (AGVS), BY TYPE

- TABLE 4 ASP OF AGVS, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE OF AGVS, 2019-2028

- TABLE 5 ASP OF SORTATION SYSTEMS, BY TYPE

- TABLE 6 ASP OF CONVEYOR SYSTEMS, BY BELT WIDTH

- TABLE 7 ASP OF CRANES, BY TYPE

- TABLE 8 PRICING OF WAREHOUSE MANAGEMENT SYSTEMS

- TABLE 9 ASP OF RTLS TAGS, BY TECHNOLOGY

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 26 IN-PLANT LOGISTICS MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 27 IN-PLANT LOGISTICS MARKET: ECOSYSTEM ANALYSIS

- TABLE 10 IN-PLANT LOGISTICS MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 WEARABLE TECHNOLOGY

- 5.7.2 PREDICTIVE ANALYTICS

- 5.7.3 MACHINE LEARNING PLATFORMS

- 5.7.4 DIGITAL TWIN MODEL BUILDER

- 5.7.5 VOICE RECOGNITION TECHNOLOGY

- 5.7.6 5G

- 5.7.7 IOT

- 5.7.8 INDUSTRY 4.0

- 5.7.9 ROBOTIC PROCESS AUTOMATION

- 5.8 PATENT ANALYSIS

- FIGURE 28 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 11 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 29 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- TABLE 12 LIST OF PATENTS RELATED TO IN-PLANT LOGISTICS MARKET

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- FIGURE 30 IMPORT DATA FOR HS CODE 8428, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.9.2 EXPORT SCENARIO

- FIGURE 31 EXPORT DATA FOR HS CODE 8428, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2025

- TABLE 13 IN-PLANT LOGISTICS MARKET: CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- TABLE 14 DEMATIC PROVIDED REITAN DISTRIBUTION WITH HIGH-PERFORMANCE AUTOMATED SOLUTION FOR INCREASED DELIVERY FREQUENCY AND SERVICE LEVELS

- TABLE 15 TRANSBOTICS OFFERED CUSTOM-ENGINEERED AGVS TO FOOD AND BEVERAGE INDUSTRY CLIENT

- TABLE 16 VOLKSWAGEN AUTOEUROPA DEPLOYED RTLS TO MANAGE MOVING ASSETS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 STANDARDS AND REGULATIONS RELATED TO IN-PLANT LOGISTICS MARKET

- 5.12.3 SAFETY STANDARDS FOR ASRS

- TABLE 21 SAFETY STANDARDS FOR ASRS

- 5.12.4 SAFETY STANDARDS FOR AGVS

- TABLE 22 SAFETY STANDARDS FOR AGVS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 IMPACT OF PORTER'S FIVE FORCES ON RTLS MARKET, 2022

- FIGURE 32 RTLS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 THREAT OF SUBSTITUTES

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- 5.14.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

6 SERVICES INVOLVED IN IN-PLANT LOGISTICS

- 6.1 INTRODUCTION

- 6.2 IN-PLANT WAREHOUSING

- 6.3 LINE-FEED FEEDING

- 6.4 PACKING

- 6.5 OTHER SERVICES

7 IN-PLANT LOGISTICS MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- FIGURE 35 IN-PLANT LOGISTICS MARKET, BY PRODUCT

- FIGURE 36 CRANES SEGMENT TO HOLD LARGEST SHARE OF IN-PLANT LOGISTICS MARKET DURING FORECAST PERIOD

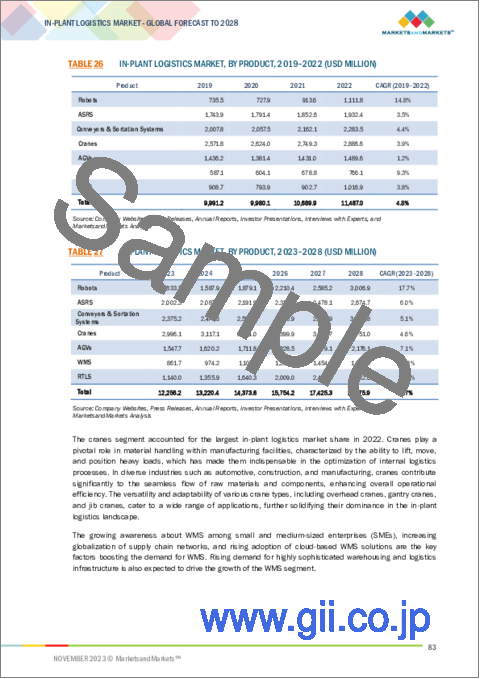

- TABLE 26 IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 27 IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 7.2 ROBOTS

- TABLE 28 ROBOTS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 29 ROBOTS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 30 ROBOTS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 ROBOTS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 ROBOTS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 33 ROBOTS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1 COLLABORATIVE ROBOTS

- 7.2.1.1 Ability to work alongside humans safely and efficiently to drive adoption of cobots in-plant logistics operations

- 7.2.2 AUTONOMOUS MOBILE ROBOTS (AMRS)

- 7.2.2.1 Ability to navigate dynamically changing environments with minimum errors to propel adoption of autonomous mobile robots

- TABLE 34 AMRS: IN-PLANT LOGISTICS MARKET, 2019-2022 (THOUSAND UNITS)

- TABLE 35 AMRS: IN-PLANT LOGISTICS MARKET, 2023-2028 (THOUSAND UNITS)

- 7.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM (ASRS)

- TABLE 36 ASRS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 37 ASRS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 38 ASRS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 ASRS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 37 UNIT LOAD SEGMENT TO ACCOUNT FOR LARGEST SHARE OF IN-PLANT LOGISTICS MARKET FOR ASRS DURING FORECAST PERIOD

- TABLE 40 ASRS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 41 ASRS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3.1 UNIT LOAD

- 7.3.1.1 Ability to store large quantities of goods in small spaces to drive segmental growth

- 7.3.2 MINI LOAD

- 7.3.2.1 Ability to fit into space-constrained facilities to propel demand for mini-load ASRS

- 7.3.3 VERTICAL LIFT MODULE (VLM)

- 7.3.3.1 Rising adoption of VLM ASRS in order picking, kitting, and inventory storage applications to drive segment

- 7.3.4 CAROUSEL

- 7.3.4.1 Vertical carousel

- 7.3.4.1.1 Ability to optimize floor space to boost demand for vertical carousel ASRS

- 7.3.4.2 Horizontal carousel

- 7.3.4.2.1 Potential to ensure consistent and long-term operational safety to spur adoption of horizontal carousel ASRS

- 7.3.4.1 Vertical carousel

- 7.3.5 MID LOAD

- 7.3.5.1 Low installation footprint to propel demand for mid-load ASRS in multiple applications

- 7.4 CONVEYORS & SORTATION SYSTEMS

- 7.4.1 BELT CONVEYORS

- 7.4.1.1 Need to transport various items quickly over long distances to speed up adoption of belt conveyors

- 7.4.2 ROLLER CONVEYORS

- 7.4.2.1 Easy integration with other material handling equipment to accelerate adoption of roller conveyors

- 7.4.3 OVERHEAD CONVEYORS

- 7.4.3.1 Ability to optimize floor space in industrial settings to spur demand for overhead conveyors

- 7.4.4 SCREW CONVEYORS

- 7.4.4.1 Rising demand from food & beverages and chemical industries to substantiate segmental growth

- TABLE 42 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 43 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 44 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 47 CONVEYORS & SORTATION SYSTEMS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.4.1 BELT CONVEYORS

- 7.5 CRANES

- 7.5.1 NEED TO REDUCE LOAD DAMAGE AND INJURIES IN VARIOUS INDUSTRIES TO FUEL DEMAND FOR CRANES

- FIGURE 38 AUTOMOTIVE SEGMENT TO HOLD LARGEST SHARE OF IN-PLANT LOGISTICS MARKET FOR CRANES DURING FORECAST PERIOD

- TABLE 48 CRANES: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 49 CRANES: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 50 CRANES: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 CRANES: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 AUTOMATED GUIDED VEHICLES (AGVS)

- TABLE 52 AGVS: IN-PLANT LOGISTICS MARKET, 2019-2022 (THOUSAND UNITS)

- TABLE 53 AGVS: IN-PLANT LOGISTICS MARKET, 2023-2028 (THOUSAND UNITS)

- TABLE 54 AGVS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 55 AGVS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 56 AGVS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 AGVS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 AGVS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 59 AGVS: IN-PLANT LOGISTICS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.6.1 TOW VEHICLES

- 7.6.1.1 Heavy load-carrying capacity to boost uptake of tow vehicles

- 7.6.2 UNIT LOAD CARRIERS

- 7.6.2.1 Suitability to handle large volumes of load to contribute to demand for unit load carriers

- 7.6.3 PALLET TRUCKS

- 7.6.3.1 Rising focus on streamlining material handling to induce demand for pallet trucks

- 7.6.4 ASSEMBLY LINE VEHICLES

- 7.6.4.1 Flexibility of parallel operations in manufacturing offered by assembly line vehicles to drive segment

- 7.6.5 FORKLIFT TRUCKS

- 7.6.5.1 Increasing adoption of forklift trucks in floor-to-floor and floor-to-racking operations to drive segment

- 7.6.6 OTHER TYPES

- TABLE 60 LIST OF MAJOR AGV VENDORS

- 7.6.7 AUTOMATIC GUIDED VEHICLES (AGV) MARKET, BY NAVIGATION TECHNOLOGY

- TABLE 61 AGVS: IN-PLANT LOGISTICS MARKET, BY NAVIGATION TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 62 AGVS: IN-PLANT LOGISTICS MARKET, BY NAVIGATION TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.6.7.1 Laser guidance

- 7.6.7.1.1 High level of positioning accuracy and obstacle-free navigation facilitated by laser-guided AGVs to drive market

- 7.6.7.2 Magnetic guidance

- 7.6.7.2.1 Ability to operate without interruptions and human intervention to drive demand for magnetic-guided AGVs

- 7.6.7.3 Inductive guidance

- 7.6.7.3.1 Suitability in harsh environments to accelerate demand for inductive guided systems

- 7.6.7.4 Optical tape guidance

- 7.6.7.4.1 Flexibility offered over other AGVs to contribute to segmental growth

- 7.6.7.5 Vision guidance

- 7.6.7.5.1 Reliability and maneuverability offered in dynamic environments to augment demand for vision-guided vehicles

- 7.6.7.6 Other navigation technologies

- 7.6.7.1 Laser guidance

- 7.7 WAREHOUSE MANAGEMENT SYSTEMS (WMS)

- TABLE 63 WMS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 64 WMS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 65 WMS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 WMS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7.1 WAREHOUSE MANAGEMENT SYSTEMS (WMS) MARKET, BY DEPLOYMENT TYPE

- 7.7.1.1 On premises

- 7.7.1.1.1 Need for better control over data flow and sensitive information sharing to boost adoption of in-premises WMS

- 7.7.1.2 Cloud

- 7.7.1.2.1 Scalability, flexibility, and mobility offered by cloud-based WMS to drive market

- 7.7.1.1 On premises

- TABLE 67 WMS: IN-PLANT LOGISTICS MARKET, BY DEPLOYMENT TYPE, 2019-2022 (USD MILLION)

- TABLE 68 WMS: IN-PLANT LOGISTICS MARKET, BY DEPLOYMENT TYPE, 2023-2028 (USD MILLION)

- 7.8 REAL-TIME LOCATION SYSTEMS (RTLS)

- 7.8.1 ABILITY TO PROVIDE REAL-TIME INFORMATION ON ASSET LOCATION TO FUEL DEMAND FOR RTLS IN IN-PLANT LOGISTICS OPERATIONS

- TABLE 69 RTLS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 70 RTLS: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 71 RTLS: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 RTLS: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 IN-PLANT LOGISTICS MARKET, BY LOCATION

- 8.1 INTRODUCTION

- FIGURE 39 ASSEMBLY/PRODUCTION LINES SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- TABLE 73 IN-PLANT LOGISTICS MARKET, BY LOCATION, 2019-2022 (USD MILLION)

- TABLE 74 IN-PLANT LOGISTICS MARKET, BY LOCATION, 2023-2028 (USD MILLION)

- 8.2 RECEIVING AND DELIVERY DOCKS

- 8.2.1 NEED FOR TIMELY MATERIAL MOVEMENT IN DOCKS TO BOOST DEPLOYMENT OF IN-PLANT LOGISTICS SOLUTIONS

- 8.3 ASSEMBLY/PRODUCTION LINES

- 8.3.1 NEED TO ENSURE EFFICIENT FLOW OF MATERIALS AND COMPONENTS IN PRODUCTION LINES TO DRIVE MARKET

- 8.4 STORAGE FACILITIES

- 8.4.1 NEED TO OPTIMIZE SPACE UTILIZATION IN STORAGE FACILITIES TO BOOST ADOPTION OF IN-PLANT LOGISTICS SOLUTIONS

- 8.5 PACKAGING WORKSTATIONS

- 8.5.1 NEED TO OPTIMIZE EFFICIENCY AND REDUCE ERRORS TO BOOST ADOPTION OF IN-PLANT LOGISTICS SOLUTIONS

9 IN-PLANT LOGISTICS MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 40 IN-PLANT LOGISTICS MARKET, BY INDUSTRY

- FIGURE 41 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2023 TO 2028

- TABLE 75 IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 76 IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.2 AUTOMOTIVE

- 9.2.1 NEED TO MANAGE COMPLEX AND DYNAMIC AUTOMOTIVE SUPPLY CHAINS TO FUEL ADOPTION OF IN-PLANT LOGISTICS SOLUTIONS

- TABLE 77 AUTOMOTIVE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 78 AUTOMOTIVE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.3 METALS & HEAVY MACHINERY

- 9.3.1 RISING FOCUS ON EASING WORKFLOW IN METALS & HEAVY MACHINERY INDUSTRIES TO DRIVE SEGMENT

- FIGURE 42 RTLS SEGMENT TO REGISTER HIGHEST CAGR IN MARKET FOR METALS & HEAVY MACHINERY INDUSTRY DURING FORECAST PERIOD

- TABLE 79 METALS & HEAVY MACHINERY: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 80 METALS & HEAVY MACHINERY: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.4 FOOD & BEVERAGES

- 9.4.1 INCREASING FOCUS ON TRACEABILITY AND COMPLIANCE IN FOOD & BEVERAGES INDUSTRY TO PROPEL MARKET

- TABLE 81 FOOD & BEVERAGES: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 82 FOOD & BEVERAGES: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.5 HEALTHCARE

- 9.5.1 RISING EMPHASIS ON RISK AND CONTAMINATION REDUCTION TO SPUR ADOPTION OF IN-PLANT LOGISTICS SYSTEMS IN HEALTHCARE

- FIGURE 43 CRANES SEGMENT TO ACCOUNT FOR LARGEST SIZE OF IN-PLANT LOGISTICS MARKET FOR HEALTHCARE INDUSTRY IN 2023

- TABLE 83 HEALTHCARE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 84 HEALTHCARE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.6 SEMICONDUCTOR & ELECTRONICS

- 9.6.1 GROWING NEED FOR ACCURACY IN SEMICONDUCTOR AND ELECTRONICS MANUFACTURING TO PROPEL MARKET

- TABLE 85 SEMICONDUCTOR & ELECTRONICS: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 86 SEMICONDUCTOR & ELECTRONICS: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.7 AVIATION

- 9.7.1 GROWING REQUIREMENT FOR SYSTEMATIC MANUFACTURING AND ASSEMBLY OPERATIONS IN AVIATION INDUSTRY TO DRIVE MARKET

- FIGURE 44 CRANES TO ACCOUNT FOR LARGEST SIZE OF IN-PLANT LOGISTICS MARKET FOR AVIATION INDUSTRY FROM 2023 TO 2028

- TABLE 87 AVIATION: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 88 AVIATION: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- 9.8 OTHER INDUSTRIES

- TABLE 89 OTHER INDUSTRIES: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 90 OTHER INDUSTRIES: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

10 IN-PLANT LOGISTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 45 CHINA TO REGISTER HIGHEST CAGR IN IN-PLANT LOGISTICS MARKET FROM 2023 TO 2028

- TABLE 91 IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 46 NORTH AMERICA: IN-PLANT LOGISTICS MARKET SNAPSHOT

- TABLE 93 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Presence of robust manufacturing sector to boost market growth

- 10.2.3 CANADA

- 10.2.3.1 Expanding automotive industry to contribute to market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rapid industrial development to foster market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- FIGURE 47 EUROPE: IN-PLANT LOGISTICS MARKET SNAPSHOT

- TABLE 99 EUROPE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 100 EUROPE: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 102 EUROPE: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 EUROPE: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Presence of strong industrial base to create conducive environment for market growth

- 10.3.3 UK

- 10.3.3.1 Increasing investments in automation and robotics to propel market

- 10.3.4 FRANCE

- 10.3.4.1 Rising emphasis on sustainability in manufacturing to boost adoption of in-plant logistics solutions

- 10.3.5 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 48 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET SNAPSHOT

- TABLE 105 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: IN-PLANT LOGISTICS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Expanding automotive, electronics, and manufacturing verticals to create opportunities for in-plant logistics solution providers

- 10.4.3 JAPAN

- 10.4.3.1 Thriving manufacturing sector to boost market growth

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Focus on increasing share of robotics and automation in manufacturing and warehousing facilities to drive market

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 ROW: RECESSION IMPACT

- TABLE 111 ROW: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 112 ROW: IN-PLANT LOGISTICS MARKET, BY PRODUCT, 2023-2028 (USD MILLION)

- TABLE 113 ROW: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 114 ROW: IN-PLANT LOGISTICS MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 115 ROW: IN-PLANT LOGISTICS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 ROW: IN-PLANT LOGISTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Rising adoption of advanced technologies and sustainability practices to boost market growth

- 10.5.3 GCC

- 10.5.3.1 Booming manufacturing industries to create opportunities for market players

- 10.5.4 AFRICA & REST OF MIDDLE EAST

- 10.5.4.1 Inflow of investments from major global economies to boost market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 117 OVERVIEW OF STRATEGIES ADOPTED BY IN-PLANT LOGISTICS VENDORS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- FIGURE 49 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN AGV MARKET

- FIGURE 50 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN ASRS MARKET

- 11.4 MARKET SHARE ANALYSIS

- TABLE 118 AGV MARKET: DEGREE OF COMPETITION, 2022

- FIGURE 51 AGV MARKET: INDUSTRY CONCENTRATION

- TABLE 119 ASRS MARKET: DEGREE OF COMPETITION, 2022

- FIGURE 52 ASRS MARKET: INDUSTRY CONCENTRATION

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 53 AGV MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 54 ASRS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- TABLE 120 COMPANY FOOTPRINT

- TABLE 121 PRODUCT: COMPANY FOOTPRINT

- TABLE 122 INDUSTRY: COMPANY FOOTPRINT

- TABLE 123 REGION: COMPANY FOOTPRINT

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 55 AGV MARKET (GLOBAL): START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 56 ASRS MARKET (GLOBAL): START-UP/SME EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 124 IN-PLANT LOGISTICS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 125 IN-PLANT LOGISTICS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 126 IN-PLANT LOGISTICS MARKET: PRODUCT LAUNCHES, 2021-2022

- TABLE 127 IN-PLANT LOGISTICS MARKET: DEALS, 2020-2022

- TABLE 128 IN-PLANT LOGISTICS MARKET: OTHERS, 2022

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 DAIFUKU CO., LTD.

- TABLE 129 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- FIGURE 57 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- TABLE 130 DAIFUKU CO., LTD.: PRODUCTS OFFERED

- TABLE 131 DAIFUKU CO., LTD.: DEALS

- TABLE 132 DAIFUKU CO., LTD.: OTHERS

- 12.1.2 JBT

- TABLE 133 JBT: COMPANY OVERVIEW

- FIGURE 58 JBT: COMPANY SNAPSHOT

- TABLE 134 JBT: PRODUCTS OFFERED

- TABLE 135 JBT: PRODUCT LAUNCHES

- 12.1.3 KION GROUP AG

- TABLE 136 KION GROUP AG: COMPANY OVERVIEW

- FIGURE 59 KION GROUP AG: COMPANY SNAPSHOT

- TABLE 137 KION GROUP AG: PRODUCTS OFFERED

- TABLE 138 KION GROUP AG: PRODUCT LAUNCHES

- TABLE 139 KION GROUP AG: DEALS

- TABLE 140 KION GROUP AG: OTHERS

- 12.1.4 KUKA AG

- TABLE 141 KUKA AG: COMPANY OVERVIEW

- FIGURE 60 KUKA AG: COMPANY SNAPSHOT

- TABLE 142 KUKA AG: PRODUCTS OFFERED

- TABLE 143 KUKA: PRODUCT LAUNCHES

- TABLE 144 KUKA AG: DEALS

- TABLE 145 KUKA AG: OTHERS

- 12.1.5 TOYOTA INDUSTRIES CORPORATION

- TABLE 146 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- FIGURE 61 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- TABLE 147 TOYOTA INDUSTRIES CORPORATION: PRODUCTS OFFERED

- TABLE 148 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES

- TABLE 149 TOYOTA INDUSTRIES CORPORATION: DEALS

- TABLE 150 TOYOTA INDUSTRIES CORPORATION: OTHERS

- 12.1.6 HYSTER-YALE MATERIALS HANDLING, INC.

- TABLE 151 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY OVERVIEW

- FIGURE 62 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY SNAPSHOT

- TABLE 152 HYSTER-YALE MATERIALS HANDLING, INC.: PRODUCTS OFFERED

- TABLE 153 HYSTER-YALE MATERIALS HANDLING, INC.: PRODUCT LAUNCHES

- TABLE 154 HYSTER-YALE MATERIALS HANDLING, INC.: OTHERS

- 12.1.7 SSI SCHAEFER

- TABLE 155 SSI SCHAEFER: COMPANY OVERVIEW

- TABLE 156 SSI SCHAEFER: PRODUCTS OFFERED

- TABLE 157 SSI SCHAEFER: OTHERS

- 12.1.8 BEUMER GROUP

- TABLE 158 BEUMER GROUP: COMPANY OVERVIEW

- TABLE 159 BEUMER GROUP: PRODUCTS OFFERED

- TABLE 160 BEUMER GROUP: PRODUCT LAUNCHES

- TABLE 161 BEUMER GROUP: DEALS

- TABLE 162 BEUMER GROUP: OTHERS

- 12.1.9 HONEYWELL INTERNATIONAL INC.

- TABLE 163 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 164 HONEYWELL INTERNATIONAL: PRODUCTS OFFERED

- TABLE 165 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- 12.1.10 MURATA MACHINERY, LTD.

- TABLE 166 MURATA MACHINERY, LTD.: COMPANY OVERVIEW

- TABLE 167 MURATA MACHINERY, LTD.: PRODUCTS OFFERED

- TABLE 168 MURATA MACHINERY, LTD.: DEALS

- TABLE 169 MURATA MACHINERY, LTD.: OTHERS

- 12.2 OTHER PLAYERS

- 12.2.1 ADDVERB TECHNOLOGIES LIMITED

- TABLE 170 ADDVERB TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- 12.2.2 AUTOMATION LOGISTICS CORPORATION

- TABLE 171 AUTOMATION LOGISTICS CORPORATION: COMPANY OVERVIEW

- 12.2.3 AUTOCRIB

- TABLE 172 AUTOCRIB: COMPANY OVERVIEW

- 12.2.4 AVANCON SA

- TABLE 173 AVANCON SA: COMPANY OVERVIEW

- 12.2.5 FERRETTO GROUP S.P.A.

- TABLE 174 FERRETTO GROUP S.P.A.: COMPANY OVERVIEW

- 12.2.6 GRABIT

- TABLE 175 GRABIT: COMPANY OVERVIEW

- 12.2.7 HANEL GMBH & CO. KG

- TABLE 176 HANEL GMBH & CO. KG: COMPANY OVERVIEW

- 12.2.8 INVATA INTRALOGISTICS

- TABLE 177 INVATA INTRALOGISTICS: COMPANY OVERVIEW

- 12.2.9 MIAS

- TABLE 178 MIAS: COMPANY OVERVIEW

- 12.2.10 INVIA ROBOTICS, INC.

- TABLE 179 INVIA ROBOTICS, INC.: COMPANY OVERVIEW

- 12.2.11 SENCORPWHITE, INC

- TABLE 180 SENCORPWHITE, INC: COMPANY OVERVIEW

- 12.2.12 VIASTORE SYSTEMS GMBH

- TABLE 181 VIASTORE SYSTEMS GMBH: COMPANY OVERVIEW

- 12.2.13 VIDMAR

- TABLE 182 VIDMAR: COMPANY OVERVIEW

- 12.2.14 WESTFALIA TECHNOLOGIES, INC.

- TABLE 183 WESTFALIA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 12.2.15 WITRON LOGISTIK + INFORMATIK GMBH

- TABLE 184 WITRON LOGISTIK + INFORMATIK GMBH: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 ADJACENT MARKET

- 13.1 RFID MARKET

- 13.2 INTRODUCTION

- FIGURE 64 RFID MARKET, BY OFFERING

- TABLE 185 RFID MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- FIGURE 65 TAGS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF RFID MARKET IN 2023

- TABLE 186 RFID MARKET, BY OFFERING, 2023-2032 (USD MILLION)

- 13.3 TAGS

- 13.3.1 RISING USE OF TAGS TO IDENTIFY, TRACK, AND LOCATE ASSETS IN REAL TIME TO FUEL MARKET GROWTH

- 13.4 READERS

- 13.4.1 GROWING ADOPTION OF RFID READERS IN LOGISTICS AND SUPPLY CHAIN APPLICATIONS TO FOSTER MARKET GROWTH

- 13.4.2 FIXED READERS

- 13.4.3 HANDHELD READERS

- 13.5 SOFTWARE AND SERVICES

- 13.5.1 INCREASING ADOPTION OF CLOUD-BASED DATA STORAGE SOLUTIONS TO DRIVE MARKET

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS